GM is successful.

- JaxsonRaineposted 12 years ago

0

GM posted $7.6 billion in profits for 2011! This is, of course, all thanks to the bailout.

Although, a couple of things come to mind.

1a - Obama gets credit for bailing out GM. Workers took pay cuts, and floundering plants were closed, and this is the saving grace of the auto industry.

1b - Romney/Bain purchase controlling interest in a failing company, cut pay, and close floundering plants, and he is a demon, American-hating, vulture-capitalist.

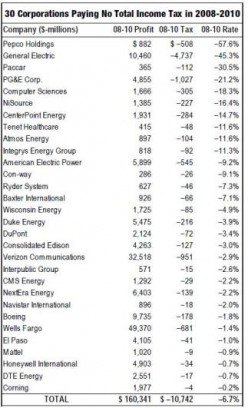

2a - GE paid an effective tax rate averaging 20.9% over the last three years. They aren't paying enough, and our budget problems are due to companies like GE, and rich people, not paying their fair share.

2b - GM paid... err... got back $76 million in taxes... meaning their effective tax rate was -0.05%. But, GE is proof that the bailout is a success. Oh, and low taxes are bad, unless its for a company the government bailed out."GE paid an effective tax rate averaging 20.9% over the last three years. They aren't paying enough, and our budget problems are due to companies like GE, and rich people, not paying their fair share."

I don't know what GE's tax rate averaged over the past three years was, but here's a Fortune Magazine article that says its tax rate for 2010 was 7%. Can you cite a source for your statement? The article also points out that GE's rate is significantly lower than its major competitors and that GE has been quite aggressive in taking advantage of various loopholes.

Bain has been called a vulture capitalist firm for good reason because it took over successful companies loaded them up with debt, paid Bain huge sums, ran them into bankruptcy and then plundered the pension funds and laid off long service employees. Hardly a job creation operation. Romney likes to cite his success at Staples. It's true that Staples has been successful, opening many new stores and hiring plenty of people. What Mittens doesn't mention is that Staples has put hundreds of small stationery and office supply stores out of business, destroying more jobs than created by Staples.

"GM posted $7.6 billion in profits for 2011! This is, of course, all thanks to the bailout."

The bailout saved GM (and Chrysler) and their suppliers from going out of business. Important also is the nearly complete change in management and tough decisions (elimination of Oldsmobile, Saturn, Saab and Hummer) and sacrifices by employees. An estimated 1 million jobs were saved as a result of the bailout. Romney's plan for a bankruptcy and no bailout would not likely to have worked because financing required to keep GM going was not available from banks or other investors.

Your analysis is partially correct but far from objective.Sadly, when I research and post the truth, it usually goes unnoticed on these forums. You can find the info here, page 82.

http://www.sec.gov/Archives/edgar/data/ … 9/d10k.htm

GE, excluding GE Capital Services, averaged 20.9% over the last 3 years, and paid ~17% this last year.

GE Capital Services has averaged 23% for the last 3 years.

Again, just like the GE articles in the news, articles about Bain have been mostly based on interviews, not facts. I've posted about Bain's record but nobody ever responded. They left companies with more profit, more employees, more assets.

They didn't raid anybody. Yes, some companies failed, like the typewriter manufacturing union that wouldn't agree to a pay-cut, or the steel plant that managed to stay afloat longer than competitors in the field, until new management approved a $1 billion construction project and that debt helped drive them under(wasn't under Bain).Bain had many successes for Bain and some for the companies they acquired with borrowed money. The successes for Bain were frequently not successes for the companies and employees thay took over.

Your figures on GE differ substantially from many news reports. Apparently the NY Times misinterpreted GE numbers but I've seen nothing that says GE's taxes averaged 20 percent for the past three years. The GE reports you linked are not susceptible to interpretation by anyone but a tax accountant.Can you support your claims?

Hopefully something more than a news article... do you have any primary sources?

Everything I've looked at(and it takes some work) shows companies being more successful under Bain than previously.There is a good reason for that. My figures come from the proper sources. Almost every news report comes form the NY Times article, which was bad research.

No, what I linked is very clear. They state their effective tax rate. Open it up, scroll down to page 82, and look at the chart titled "GE Pre-Tax Earnings from Continuing Operations"

The last line of the chart is "GE effective tax rate, excluding GECS earnings"

The numbers from that line are 16.8% 21.8% 24.2%

Do you know of a company that would have a hard time surviving if it were given billions of dollars, forgiven its debt, and exempted from taxes?

My analysis is completely correct. Any inference you make to other candidates is your own. My point is the hypocrisy from people blaming Bain for doing what the government did, and people saying GE should pay more when GM pays nothing.It won't be long before the bailout money is returned and GM is paying taxes. I live in Michigan, and Romney's position against the bail out was not well received here.

GE is one of the most aggressive pursuer of tax loopholes among major companies. One of the biggest and most unjustified loopholes is allowing them to avoid US taxes on earnings in other countries. I don't have specific information about GE, but it's undeniable that many companies use artificial, unrealistic transfer prices in order to minimize profits subject to U.S. corporate taxes. GM spends millions each year on tax avoidance lawyers and accountants.GM's tax breaks could last over a decade. As for paying back the bailout money, they won't do a very good job of that if they take their non-taxed money and give it to all their workers as profit-sharing.

GM is also going to have to deal with the failure of the Volt, which wasn't represented in 2011 financials.

Disregarding that, they are still freeloading off of the backs of Americans, while claiming $7 billion in profits(thanks to Obama). Everybody that talks about taxes being too low for the rich and corporations like GE should be outraged that GM is getting money back on their taxes.Please quit putting innacurate information up on this forum. Slightly different from the false picture you painted. If you want to establish credibility here you should try to be more factual. Here's what Bloomberg Business Week had to say about GE's taxes:

"In December, President Barack Obama started negotiating with Republicans to extend unemployment benefits in exchange for tax cuts, and that's when the tax commandos sprang into action. Washington's specialty boutiques and its giant lobby shops pressed for retroactive renewal of numerous corporate tax breaks that had expired. Nearly all were reinstated as part of a compromise measure that Congress passed on Dec. 16, a bit of nifty legislative footwork that saved companies about $43 billion in 2011 and 2012 taxes.

"One of the biggest beneficiaries was General Electric (GE), which won the right to continue deferring tax on income from overseas financing deals. That includes some earnings that GE Capital, a finance unit that kicked in about a third of the parent company's $150 billion in revenue last year, derives from loans to overseas buyers of GE equipment. "There was an awful lot of lobbying going on," says Kenneth Kies, managing director of the Federal Policy Group, a former chief of staff of the Joint Committee on Taxation and one of GE's many outside lobbyists. Right after the midterm elections, "Democrats didn't know which way was up and Republicans didn't yet have control of the House."

"Now the tax-break industry is gearing up for a bigger confrontation. As Congress debates a possible tax code overhaul, companies such as GE may be wary of trading benefits they have in the current system for a lower statutory rate. Win or lose, Kies says, the battle to reshape the tax code "probably would create a lot of new business" for lobbyists.

"GE likely will throw some serious money around. The diversified conglomerate spent $4.18 million last year—more than any U.S. company or trade association, according to data compiled by Bloomberg News—on outside lobbyists to preserve favorable tax treatment for its earnings and to win breaks that benefit its renewable-energy business. "The $4 million is just the tip of the iceberg," says James Thurber, who teaches courses on lobbying at American University in Washington. He says disclosure laws use a narrow definition of lobbying that excludes many ways companies influence policy.

"All that lobbying has helped GE lower its effective tax rate. According to company filings, GE's consolidated tax rate from 2005 through 2009 was 11.6 percent, including state, local, and foreign taxes. That's well below the 35 percent top federal tax rate for U.S. corporations and the 30.5 percent average for companies in the Standard & Poor's 500-stock index.

"Losses at GE Capital stemming from the financial crisis helped the parent company lower its tax rate for several years. Still, GE's average rate before the crisis, from 2002-07, was 17.5 percent—higher than now, but below the mid- to high-20 percent range that many large U.S. companies paid in the same period.

"GE's preferential tax treatment forces other taxpayers to pick up the tab for health-care programs, national defense, and the rest of the federal budget, says Dean Baker, co-director of the Center for Economic Policy and Research, a left-leaning think tank. "No one thinks that tax incentives are being dished out based on their merit," he says. "This encourages disrespect for the tax code." Baker adds that it's "very hard to tell a struggling small business why they should be honest and pay their taxes when the big companies are hiring lobbyists to get out of their tax liability."

The break that was renewed in December, formally known as the active finance exception, allows GE and other manufacturers such as Caterpillar (CAT) to finance overseas customers' purchases of big-ticket items, creating jobs back home and increasing U.S. exports. The provision also allows it to compete with banks outside the U.S. by deferring U.S. tax on earnings from such financing activities."Deferred taxes are still taxes that are paid by the company, they just aren't paid immediately. GE is constantly paying old deferred tax.

You say I am the one not putting up accurate information, when I put up SEC finanacials, and you choose instead to put up false(I proved it false) information, without a source.

So, what is it I'm not telling the truth about?Here's what Bloomberg said:

"According to company filings, GE's consolidated tax rate from 2005 through 2009 was 11.6 percent, including state, local, and foreign taxes. That's well below the 35 percent top federal tax rate for U.S. corporations and the 30.5 percent average for companies in the Standard & Poor's 500-stock index."

As I recall you said GE's tax rate was nearly double the 11.6% figure cited by Bloomberg. And you posted some impenetrable forms filed by GE. GE has long had a reputation for sleaze dating back to the corporate pimping scandal in the 1950s.

GE spends millions on tax loophole lobbying and on tax avoidance lawyers and accountants.1 - I stated their tax rate for the past 3 years. 2009, 2010, 2011. Why are you comparing that to 2005-2009? We can talk about that if you want, but where did I lie?

2 - I posted very clear instructions for you to see yourself. Page 82, first chart, fourth line. I even quoted directly from it. It's not an 'impenetrable form'. The fact is, official financial filings are slightly more reliable(forgive the sarcasm) than news articles.

3 - Loopholes are only called loopholes when you talk about somebody you don't like. When a family of 3 makes $20k, and gets a $5k return, they use 'loopholes' too.Another GE scandal--

Aug 2009

Today, GE was fined $50 million by the SEC for committing accounting fraud. The fraud goes back to 2002 and 2003 relating to the reporting of sales that hadn't taken place and the inflation of company profits. The total amount that GE was to have falsified was $995 million which means that the penalty equaled only 5.24% of the fraud committed. That penalty is like a processing fee or a sales tax rather than an actual penalty.

In theory, the fraud helped stop the decline in GE's stock price, which resulted in the doubling of the market capitalization from 2002 to 2007. It was a well known secret that GE utilized cookie jar accounting and other more questionable methods to smooth out their earnings. Such methods were not in conformity with GAAP accounting rules. However, since it was so common among companies at the time the practice was easily overlooked.

And another one--

Pentagon Disciplines G.E. For Role in Bribe Scandal

By RICHARD W. STEVENSON

Published: June 03, 1992

Sign In to E-Mail

Print

"In a harsh rebuke to one of the nation's largest military contractors, the Pentagon has suspended the General Electric Company's aircraft-engine division from receiving new Government orders because of the company's role in a bribery scandal involving a top Israeli general.

"The action indefinitely bars the division, one of two primary suppliers of military jet engines, from renewing existing Government contracts and from being awarded new contracts. In imposing the suspension late Monday, the Pentagon's Defense Logistics Agency said it was considering whether to expand the sanctions to cover all of General Electric. The company, the Pentagon's third-largest supplier last year, with sales of $4.9 billion, provides the military everything from light bulbs to radar."Here's a very recent report from Huffington Post which paints a quite different picture than the bad fish you've been selling.

February 28,2012

"General Electric again finds itself the focus of a politically-charged battle over corporate taxes.

"A new analysis of the mega-corporation's tax filings shows that 2.3 percent of GE's pre-tax profits have gone to the federal government since 2002. That bears repeating: GE has paid an average tax rate of just 2.3 percent over the past decade, according to an analysis by the non-profit advocacy group Citizens for Tax Justice.

"If you'll think back to your high school math classes, you'll recall that 2.3 percent is less than 35 percent. That means GE is paying well below the top marginal corporate tax rate of 35 percent -- the same tax rate that business leaders, politicians and conservative commentators have repeatedly deplored as high enough to impede economic growth."

Funny that I haven't found a single published article on GE's taxes that comes remotely close to the 20% figure you're pushing. GE needs a better PR department apparently.Yes, American media is stupid.

CfTJ study - Firstly, they don't count deferred taxes as taxes paid. This is stupid, because GE is responsible in paying its deferred taxes. Secondly, they average GE's tax rate between GE Capital Services and GE(non CS) each year, and then average the averages. This is bad practice. The correct way is to average GECS's rates each year, then average GE's rates each year, then average those averages. The reason is because GECS's taxes include tremendous amounts of profit and loss that are realized in different years, so their rates can swing from 100-200% to -100%. If you average the rates though, then you find the real effective tax they pay.

If you are really interested in the truth(you haven't shown yourself to be, putting down my sources and calling my research bad fish), I would be happy to go over it with you. A little respect would be nice, however.

The government will get its bailout money back when it sells the GM stock it received as part of the bailout. You are talking like a Toyota owner and stockholder.

They can be as successful as they want. No government agency has the authority to blow my money like that.

Apparently they do...

GM paid out profit sharing bonus checks up to $7,000 to its employees, while paying no taxes, and while share price(which = how much of the loan will get paid back) falls.NO, they don't. This is the kind of crap that is creating militias in our country.

GE has been a bad actor for as long as I can remember. For years the company dumped PCBs into the Hudson River and fought tooth and nail against lawsuits to get them to clean up their mess.

And in the 1950s there was a huge GE scandal involving providing prostitutes to government purchasing representatives in order to get military business.

I'll go back and look, but I don't recall that you explained how you got the 20% tax figure for the three years you cited. Please list the taxes paid for each of the three years and explain your calculation. The 11% figure cited by Bloomberg is considerably lower.Ok, you're really going off topic here.

Really?

Really?

Fine, I'll do it again.

http://www.sec.gov/Archives/edgar/data/ … 9/d10k.htm

From page 82 of my source:

2009 - 24.2% effective tax rate

2010 - 21.8% effective tax rate

2011 - 16.8% effective tax rate

24.2 + 21.8 + 16.8 = 62.8 / 3 = 20.93% average effective tax rate.Your source is a 203 page 10k report not an IRS tax document. I note that the profit numbers you cited from page 82 of the 10k report exclude profits from GE Capital. If the GE Capital profits were included GE's tax rate would be lower. I don't see why GE Capital's profits should be excluded from the calculations. Beyond that, I'm don't know enough about 10k reports to reconcile the differences between the figures from the report and the various independent analyses which conclude that GE's tax rate is closer to 10% than the 20% figure you cite. Just about every published article I've seen claims GE's tax rate is much lower than what you are claiming and much much lower than the nominal 35% US corporate tax rate before loopholes. It's pretty clear that GE's rate is among the lowest of major U.S. corporations. Oil companies also get a huge depletion allowance tax break despite their record profits year after year. They also spending huge amounts campaigning and lobbying to retain or increase their tax breaks.

Companies don't make their tax documents public. 10k reports are their official financials.

I have explained this. They list GE and GECS income and taxes separately. Consolidating them makes the financial picture less clear due to the fact that losses and gains are realized in different years. It wouldn't make sense to include the income from GECS without also including the tax paid on GECS, but I've posted both sets for you.

I told you as well, GE's tax rate averaged 20.9% for 2008,2009,2010(I had the years wrong before as I was looking at the wrong 10k). GECS's tax rate averaged

23% for 2008,2009,2010.

I explained the reason those reports are off. Some of them weren't based on 10k forms, but based on misinterpreted data from investor sheets. The others average tax rates from GE and GECS together each year, then average those rates together. The only true way to average tax rates across years is to total revenues and total taxes paid, and you have to do it for GE first, GECS separately, and then average the two if you wish.

For instance, 2010 GECS paid something like -40% taxes, but the year previous paid 152% taxes. Again, this is because of how gains and losses don't go together like they do with regular business. Irresponsible researchers just look at the -40% and average that against the 17%.

Apparently there is more than one way to calculate corporate profits and taxes. The figures above for 2008-2010 are from the Citizens for Tax Justice. I'm not a tax accountant but I'm suspicious of the figures you cite. Virtually all the media has been carrying stories saying that GE's tax rate has been considerably lower than the 20% that you are citing. Perhaps the difference is that the profits that you are using are U.S. profits only, and those by the media and fair tax people are world wide profits. At any rate your conclusions are quite wrong. The unpatriated profits/transfer pricing loophole is recognized by nearly everyone.Yes, there is more than one way.

What these people are doing is averaging GE's rate this year, with GECS's rate this year.

The problem though, is GECS has the issue of profits and losses being realized in different years, among other things, so you can't look at GECS one year at a time.

You can verify those figures yourself, but you obviously don't care to. You should learn that it's not always best to depend on the media for the truth.Listen, I have provided for you primary source data for you to verify, but you are unwilling to do so. Instead, you declare that I am wrong with third party sources.

If you ever decide you want to know the real story, I'd be happy to explain it to you.As I pointed out, I'm pretty sure the difference is attributable to the difference in what is included in profits on the GE reports and the reports on GE profits and taxes by other analysts. Thus, the "primary source data" is misleading. I strongly suspect that the profit figures in the reports you linked do not include world wide profits of which the portions from outside the US are not taxable in the U.S. So, when you start out with a lower profit figure the tax percentage is lower than it would be on GE'

s total profits. This is why there is so much discussion about the unfairness of the current system due to the un-patriated profits loophole. Moreover, the loophole is even bigger than it appears because of the use of phony transfer prices in order to report the profits in whatever country will minimize tax liability. This also creates a side effect of providing an incentive to create jobs in other countries rather than in the United States, another reason to reform the corporate tax law.No, it includes worldwide operations. The reports also state foreign taxes paid, and when you total US and foreign taxes the rate usually ends up around 39%.

But, you aren't even willing to verify information in these reports if I give you the page number, paragraph number, line number, and word number. You don't care about the truth, you just want to call me a liar when you have the information right in front of you.

GM sucks. And this is coming from a kid who's dad worked for GM, and who grew up in the motor city and passed a GM plant every day on my way to school. My entire family drives foreign cars because our GM cars broke down repeatedly.

I'll attest to that. American made, generally speaking, = crap.

I'm driving a 1999 Volvo S70 with 190,000 miles on it, and the engine still revs and shifts better than the last new Ford I was in.Seriously, it's that good. Pressing on the gas pedal is like... smearing soft butter onto a warm bagel.

Hahaha, I prefer cream cheese. I drive a 2001 Toyota Avalon with almost 100,000 miles on it and it's never had any issues besides needing the battery replaced this past month. I'm going to drive that car until the day it dies for good.

It's how I drive cars for cheap.

I bought a 1996 Honda Accord with 191k on it for $4,000. I drove it for two years, and sold it for $3,000.

Took that $3,000 and bought the Volvo. In two years, I'll sell it for about $2,000.

My monthly payment comes out to about $40/month that way.Ah, I accidentally quoted the 2010 filing instead of 2011.

2011 GE was 38.3%.

http://investing.businessweek.com/resea … mType=10-K

GECS was 12%.

Total average 25%.

That's baloney. Volvo has had a quite poor repair and durability record. Toyota's is quite good, however, except for the sudden acceleration issue.

Actually, Volvo can be very good as long as you take care of it. There was a wagon with over 500,000 miles with original engine/tranny at a dealership in WA a bit ago.

There is a high-mileage club for Volvo, Irv Gordon has 2.4 million miles on his.

You have no reason to think I am a liar, yet you are utterly convinced.

Related Discussions

- 126

Trump said at the first debate that it is good business not to pay taxes, do you

by Shyron E Shenko 7 years ago

Trump said at the first debate that it is good business not to pay taxes, do you agree with him?At the same time he is talking about the Military shrinking. Maybe he doesn’t know that taxes pay for the Military. Taxes also pay our infrastructure, schools, police…etc.

- 64

The Republican Lie on Tax Cuts

by kerryg 13 years ago

Republicans have repeated the lie that tax cuts are always good for the economy so often that all of Washington seems absolutely convinced that it's true. The conventional wisdom is so established on this that all a Republican has to say is, "Everyone knows you don't raise taxes in the middle...

- 17

What Is A "Fair Share" Relative To Taxes?

by ga anderson 8 years ago

Much is heard of a demand that corporations and the wealthy pay their "fair share" of taxes, but I have heard little of what that share should be.With only a single restriction; that the discussion is about legal tax actions, what should that "fair share" be?One could say that...

- 49

Are all these new taxes true???

by SparklingJewel 13 years ago

"It takes twenty years to build a reputation and five minutes to lose it. If you think about that, you will do things differently"-Warren Buffett In just six months, on January 1, 2011, the largest tax hikes in the history of America will take effect.They will hit families and small...

- 173

France's 75% tax rate

by karl 10 years ago

How many French millionaires will your country take?http://www.bloomberg.com/news/2013-12-2 … e-tax.htmlHow long do you think it will be before Frances economy will be on the big slide downwards?

- 8

To tax or not to tax, that is the question...

by SparklingJewel 12 years ago

I don't claim to be a big financial, economics know it all (how could anyone, frankly, but the link here is a conservative version of the current presidents tax creation scenario for next yearcan anyone that monitors similar information from the liberals post a comparison for us all to learn...