Tips for Reducing A Home Mortgage and Home Mortgage Interest

Whether you make money or not on your own home will often be driven by how hard you negotiate the home purchase, limiting the length of time over which you repay and the amount of interest your pay on your home mortgage.

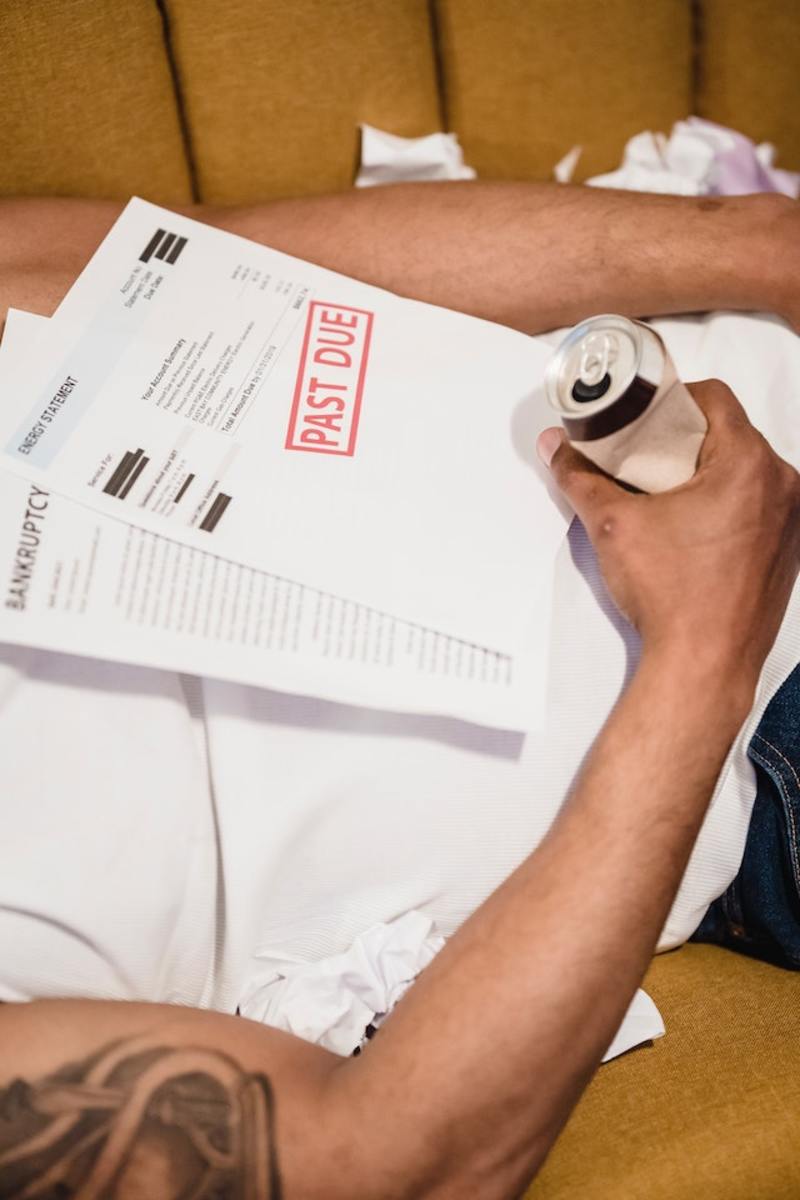

But when buying a home, we often forget about the capital gain and instead fall in love with a property and reason goes out the door. Emotion takes over rational behavior which is part of the reason we extend ourselves financially with a mortgage and take on more debt than is necessary.

Its frightening how much extra we’ll pay in interest over the term of a home loan by paying just $20,000 extra on a home loan.

When buying a home, its best to try to keep a dispassionate view and be ready to walk away if the price spirals up higher than you anticipate or the vendor won’t meet your maximum price.

Interest Cost of an Extra $20,000 Loan

Term of the $20,000 Loan

| Interest @ 5% per annum

| Interest @ 6% per annum

|

|---|---|---|

25 years

| $15,076

| $18,658

|

30 years

| $18,650

| $23,168

|

Interest Cost of a $20,000 Loan

Try to Eliminate Emotion from the Negotiation - Tips

However, that’s easier said than done, and I have “fallen” for a home and paid more than I should have so consequently have had a higher mortgage than I wanted.

When considering a mortgage, it’s important not to straddle yourself with too much debt so that you have to scrimp and save every cent to repay the mortgage. It cripples you emotionally and places an enormous financial burden on the household. There are some tips below.

It's very helpful (when in a partnership) if you've identified who is the saver and who is the spender in the household. Or, if you've identified one person as being more clinical in their approach to purchases, then let that person take charge of the negotiations.

Best, if you are the emotional one, to stay well clear when negotiations are taking place because a seasoned sales professional will quickly identify the weakness and exploit it. Then you may find yourselves spending more than you want and having a higher debt.

The Pre-Purchase Phase

- Look closely at the impact of servicing the home mortgage on your household finances.

- Re-do your household budget to include the cost of servicing the debt.

- It costs more to own a home than it does to rent so don’t ignore those extra costs such as maintenance, local body fees, home owners insurance etc.

- Shop around for a good mortgage provider with low rates and the best borrowing terms. An extra 1% has a major impact on the cost of the loan and therefore the length of time you will be straddled with the repayments. There is more information and a useful table, Home Mortgage - What Impact Does 1% have.

- If you are relying on two incomes to pay the mortgage, look at the worst case scenario – having to pay the mortgage on one income.

- Consider taking life insurance or home mortgage insurance if dependents are reliant upon the income to pay the mortgage.

- Don’t borrow any more than you need to. Look at ways of buying a smaller home, buying in a less expensive suburb, an apartment or buying a home unit rather than a house.

- Many purchasers, especially if buying a first home, want to buy in the suburb where they were bought up. It's unlikely you will be able to afford that area, especially if it is an expensive area and/or it houses the best schools. Don’t even try to stretch yourself to do it – purchase in a more affordable area.

Managing the Home Mortgage and Reducing the Home Mortgage Interest You Pay

Tips once you have the purchased your property and have a home mortgage:

- Repay more than the required minimum as even a small increase in the minimum repayments will reduce the term over which you repay your home mortgage.

- When you receive a pay rise, use some of it to increase your regular mortgage repayments.

- Make fortnightly repayments (instead of monthly).

- Do pay lump sums off your principal from time to time as your income allows, e.g. if you receive a bonus.

- Resist the temptation to increase your mortgage and use the extra borrowings to treat yourself to a trip or to help cover living costs beyond your income.

- Likewise, in times of property price increases, resist the temptation to increase your mortgage against the increasing equity in your home using the released money to treat yourself.

- Do not fall into the trap, after paying off your mortgage, of rewarding yourself by buying a bigger, newer home or moving to a more expensive suburb unless that is part of your overall financial plan.

Live to work not work to live

Once you have a home loan its prudent to eliminate it as soon as possible. Having said that don't put too much strain on your finances and ignore the fun part of life. Let’s face it, none of us want to live to work.

Better to have a life balance and enjoy some champagne from time to time.

And finally......

This hub is copyright travelespresso. Do not copy.

Writers' love feedback so please leave a comment, rate and/or pass this article onto others. Thank you.