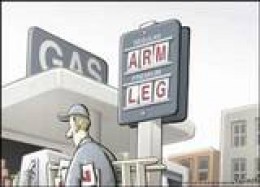

I just heard that it is very probable that the gas will go up to $5.00 a gallon

I just heard that it is very probable that the gas will go up to $5.00 a gallon in the near...

future in the United States; do you think it will happen? And why is it going up that much?

I've heard the same supposition. I don't think that the price of gasoline will get that high here in America simply because the economy is so fragile and most people simply cannot afford to pay for it at $5/gallon. You may recall in 2008 that gasoline (at least, in my part of the country) got up to around $4/gallon. I believe that was the trigger domino for the collapse of other areas of the economy in the fall of that year. As the saying goes, people had to rob Peter to pay Paul. Something had to give and it did. As to why the price might go that high, I will give you the convenient, textbook answer. It will probably be blamed on tremendous demand by China and, secondarily, India. Who knows? Personally, I believe that the American economy will be trembling once the price averages between $3.50-$4.00/gallon.

In Canada the price of gas has averaged over $5 /gallon for more than two years. In Western Europe gas prices are $6-$7/ gallon and have been for several years. The United States has always been able to keep the prices lower mostly because of lower fuel taxes. Those days are coming to an end, unfortunately, and the financial adjustment to the new reality for the average American will be severe.

The US prices could well surpass $5 in 2011 and will almost certainly by 2012. The demand for oil by China,in the coming years, will put enormous upward pressure on the price of oil. The United States is the largest importer and user of oil in the world. As domestic supplies dwindle the reliance on imported oil rises and the competition for a shrinking world oil inventory drives prices ever higher.

This, unfortunately, only explains the rise in oil prices and the pressures on domestic gas prices. The other side of that discussion deals with federal and state gas taxes which are currently very low when compared to Canada and Europe. The price of gas in the US will also be driven higher by the huge increases in federal and state gas taxes that will, because of the crippling debt the nation and the states face, have the potential to rise to frightening levels.

Hate to sound so negative but we all need to be prepared for what may be coming our way.It may, or it may not. If people clearly knew that gas was going to increase in cost by that much, wouldn't wealthy people be investing in crude oil commodities? The truth is that we just don't know. OPEC, severe weather conditions, political disputes, gas taxes, and many other forces impact prices. While it looks probable that prices will climb over the next year, I don't know that anybody could clearly state that gas prices will nearly double in that short a period. If they could foretell what gas prices were, they would be investing in commodities. People talk about walking the walk. When it comes to gas prices, follow the money. Where are wealthy people in the know putting their money? I don't see an abnormally large increase in crude oil commodity activity. Consequently, I don't think anybody really knows what gas prices will really do. That being said, it's pretty likely that they will continue to climb to some extent. I agree with point2make on several issues. Gas prices are typically higher in many other countries, and China's fuel demands may well have an impact on prices. Only time will tell, but I'm certainly not banking on gas prices increasing by that much in one year.

I think it has the potential to go up over $5.00 a gallon, The two main factors that will influence it are supply and demand the price of the purchasing currency (if the country where it is not being exported is not pegged to the buying currency).

Just for information: The price of petrol where I live (Qatar) is roungly around 80 cents per gallon. The price never seems to change, in fact the price is engraved in metal on the edge of the pump!- Mr Tindleposted 13 years ago

0

I think that it is definitely possible that we could be paying $5.00 a gallon on average in the next several years. There are 2 main reasons for why this could happen.

China and other developing nations are growing and as a result using allot more energy.

Probably even more important though is the fact that the Federal Reserve is printing tons of money and the Federal Government of the U.S. is still running huge budget deficits. This leads to a devaluation of the purchasing power of the dollar especially for things like gas which rely on imported crude oil in order to be manufactured. Thank you so much guys for giving me such detailed answers, gas and gas prices is not something I have ever been interested in before, therefore I do not have much knowledge on the subject and I rarely watch the news. Now I understand better! And I will hope that it doesn't happen!

Yes its highly likely, given that the USD is just being printed to sustain the economy. Eventually hyper inflation will set in because the dollar is backed by nothing, just monopoly money really.

Not only will gas go up , but everything will go up. Interesting times ahead.I think it will happen. The world is changing. China and other countries in the eastern is growing very quick and they need more oil. There is a limit on oil on the earth and that will make the price higher and higher even in United States.

The last time the price of gas spiked up to almost $4 per gallon Exxon recorded the highest profit ever recorded by a corporation.... EVER.... in the history of humanity. It is all about greed.

See the documentary "the corporation"

Related Discussions

- 70

$5.00's a gallon of gas?

by qwark 13 years ago

Energy money RULES!Those who are dedicated to destroying the American economy KNOW that this is the way to bring us down...and they are doing it!The economy, being as it is today, if a barrel of "crude" rises to $180.00 - $190.00's, and gas rises to $5.00's a gallon, the cost of living...

- 16

How people are reacting to Gas prices

by derekcaulfield 15 years ago

I know gas prices are pretty here in the states at the minute, saying that if broke it down , england would cost about 8-9 dollars a gallon and ireland about $7 maybe $6 more even . So $4 aint bad when you count this. I know the other countries go by the litre rather then the gallon. Some...

- 38

Gas prices down

by Doug Hughes 12 years ago

When gas prices were going up, Wingnuts were tripping over each other in a rush to blame the president. Even though he had nothing to do with it.President Obama ordered a release of strategic reserves. Prices have dropped over 50 cents per gallon in Florida.What do we hear now?

- 39

Rising gas prices to wipe out the tax cuts for many Americans.

by Randy Godwin 5 years ago

Gas prices are soaring as usual under Republican leadership. This will hurt middle and lower classes more than it does those who got the lions' share of the tax cuts. Not only do we have to repay the Chinese for the money we borrowed , we now have to pay higher prices for fuel. I hope those wanted...

- 22

A liberal's take on gas prices:

by Holle Abee 12 years ago

http://www.realclearpolitics.com/video/ … _bush.htmlBush gas at $3 a gallon bad! Obama gas at $5 a gallon okay and not his fault. Got it.

- 14

Are you planning on hoarding on gasoline before the prices go up even further?

by ptosis 13 years ago

Are you planning on hoarding on gasoline before the prices go up even further?Volatility in gasoline prices: Give your prediction of peak gasoline prices for March 2011Last week I filled up tank @ $3.12 and in 7 days it's now $3.25. The prediciton was a peak price of $3.24. I predict $4 in March...