Do Profit-Maximizing Credit Unions Destroy Value?

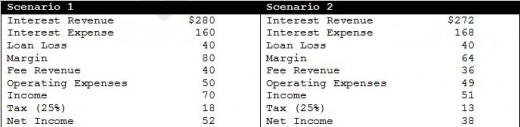

To explore whether profit-maximization is a good strategy to follow for a tax paying, for-profit credit union (e.g., a Canadian credit union), we'll set up two hypothetical credit union scenarios.

Credit union 1 is managed to maximize profit so interest margin is maximized, fee revenue is maximized, operating expenses are managed, the credit union pays tax on its profits and then distributes patronage to members based on the final profitability of the credit union for that year (Assume Assets = $4,000)

Credit union 2 is managed to sustain a sufficient proportion of capital to assets to support anticipated future growth, interest margin is not maximized, fee revenue is not maximized, operating expenses are managed, the credit union pays tax on its profits (albeit lower profits than the Scenario 1 credit union above) and does not distribute patronage. The view at this credit union is that patronage has already been more efficiently delivered through more favourable interest rates and product pricing to members who use the credit union's products and services. (Again, assume Assets = $4,000).

To allow us to do some calculations, let’s assume that the regulator dictates that the credit union must maintain a level of capital of 8% of assets (8% * $4,000 = $320). If we assume that Scenario 1 credit union plans to grow 8% next year, they would need to add another $26 of capital to maintain capital at 8% of assets. If we assume Scenario 2 credit union will grow 12% because of its favourable product pricing then it will need $38 of additional capital.

Even though these are very simplified and contrived examples, looking at the summary calculations at the bottom of this article, we can see that, all else being equal, Scenario 1 credit union destroys $5 of value through profit maximization and the ensuing excess taxation that results. Maximizing revenues and profit and then returning patronage (dividends) to members after the fact has led to income before tax being higher than necessary and therefore tax is higher than necessary. As well, in Scenario 1, only $26 of Net Income was required to sustain capital so there is $26 of excess profit that the credit union Board must decide what to do with. As explored in a previous post, one wonders if credit union suppliers (e.g., management and employees) would be tempted to claim this excess $26 as some sort of "profit share"?

The Scenario 2 credit union provided better loan interest rates, better deposit rates, and lower fees to its members, paid sustainable amounts to credit union suppliers all the while maintaining a sustainable level of capital and minimizing value destruction through taxation.

The point here is that profit maximization is not the correct strategy for a credit union.

“If you think like your competitor you are not really thinking at all” – John Scully

Credit unions have learned over time to think like banks and other financial institutions. They’ve done this through comparing themselves to banks as competitors but also because they have a regulatory regime that demands it. Measures like ROA, efficiency, ROE, RAROC, etc., and regulatory stakeholders like the deposit guarantee corporations drive credit unions down a path of thinking like banks. These types of measures and regulatory pressures may be relevant to shareholders who provide capital to banks and to the financial analysts that serve those capital providers but, based on the example above, they may take credit union management and directors’ eye off the ball. They can be distractions because they measure aspects that may be irrelevant to credit unions (or at least less relevant than they are for banks).

The correct measures for a credit union may prove to be a flip-flop of traditional bank measures. For example, instead of trying to drive efficiency toward 0, perhaps the benchmark should be something close to 1. Scenario 2 above has the worst efficiency of the two scenarios but we’ve already shown it to be the superior outcome in terms of value delivered. And, perhaps ROA should be targeted close to 0 instead of trying to drive it above 1 because that would mean the credit union did not over-extract loan interest from the credit union owners and then have to pay more tax than necessary and wrestle with patronage allocation quandaries (not to mention the credit union wouldn't have provided the best prices possible to its members as customers).

Again, Scenario 2 above has the worst ROA of the two scenarios but we’ve identified it as the more desirable outcome for the credit union's members. Even if the Scenario 1 credit union pays out some or all of the excess profit as patronage which would reduce its corporate tax bill, the members would then be paying tax on the patronage payment so Scenario 2 is the truly superior value generator for the membership.

Think about the perversity of charging “too much” loan interest to a member (interest which is not tax deductible for the member) and then paying back the excess “profit” from that interest to that member as patronage which the member now has to pay tax on. There is no question that value is destroyed for that member. And, if the credit union decides to pay some of that excess to employees as "profit share", the picture only worsens for the credit unions' members.

So, how does a credit union determine the “right” amount of profit? The right amount can be estimated as:

π = { [Assetst0] * g * k } / (1 – T)

where:

π = required annual profit to ensure adequate growth of capital to support expected growth in assets

Assetst0 = credit union assets at time 0

g = expected or desired growth rate in assets for the upcoming year

k = minimum capital requirements as a percentage of assets

T = the tax rate applicable to the credit union for the level of profits anticipated

The above equation suggests that there is only one right amount for the credit union. Of course, credit unions deal with many uncertainties in a given year so it will be important to use the outcome of the above equation as an estimate. Varying the various aspects of the equation would provide insights into the sensitivity of the outcome to the various inputs. We won't explore a sensitivity analysis here -- we only want to raise the notion of sensitivity analysis being a prudent practice when using the above equation.

Profit-maximization is not the correct strategy for a credit union; value-maximization to the credit unions' members is the only possible correct strategy.