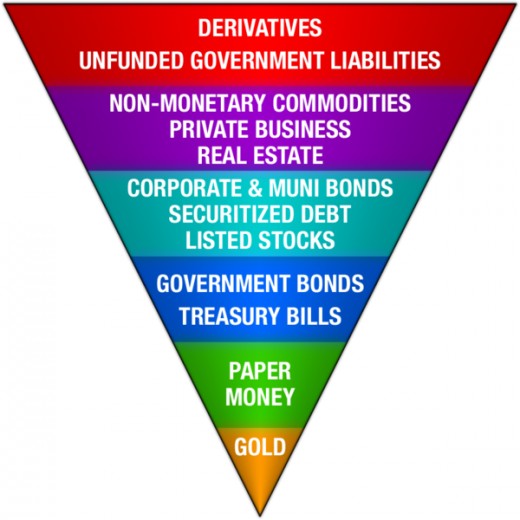

Exter's Inverted Pyramid

John Exter

The Builder of the Great Inverted Monetary Pyramid

John Exter, was a former Federal Reserve Board Governor; who became famous for his explanation of how credit is created.His analysis, known as Exter's Pyramid, although largely ignored today, still forms the best conceptual model for understanding the source of the Credit Crunch; and its solution.

Exter's Inverted Pyramid Scheme

A Bottom-Up Strategy for the creation of credit

Credit and hence banking is nothing more than a regulated Pyramid Scheme. The Federal Reserve is the major player in this scheme.

Gold forms the base of Exter's Pyramid. Since Gold is relatively fixed in supply; it must be leveraged first by the Central Bank and then subsequent layers of the capital market's institutions that create credit. Chairman Bernanke may say that Gold is not Money; but it is fair to say that Money is a derivative of Gold, created by leverage.

Applying Exter's Pyramid to the last credit cycle, one can see how a pyramid of credit (debt) was built through leverage from the narrow monetary base of Gold. When the bubble burst, the inverted pyramid collapsed in on itself; as subsequent layers of credit got liquidated and abandoned. Investors flocked to Treasury Bonds and Gold, which were both viewed as real money.

Quantitative Easing, was the attempt by the Federal Reserve to force the creation of more credit; by the injection of Reserves into the banking system. By doing this, the Federal Reserve has increased the level of Reserves relative to Gold. Gold is therefore more valuable in monetary terms; and will remain so until the financial institutions have regained the faith of investors, so that they are happy to own credit instruments rather than Gold. For this faith to be restored, credit must go into economic activity that creates real economic need for money. Once this real economic need is certain, investors will be more inclined to own assets that have a call on income streams derived from this activity; rather than Gold that produces no income.

Links

- How can Ben Bernanke the Builder fix it?

Ever since the June FOMC Meeting minutes were published, analysts and financial markets have been trying to predict what the Federal Reserve will do at its next meeting. The broken transmission mechanism between the Federal Reserve and the real econo - Valuing the Bernanke Put

Commentators talk about the Bernanke Put. What does it mean in monetary terms; and what is its value?