Using Commodities to Lower Volatility

Lowering Portfolio Volatility

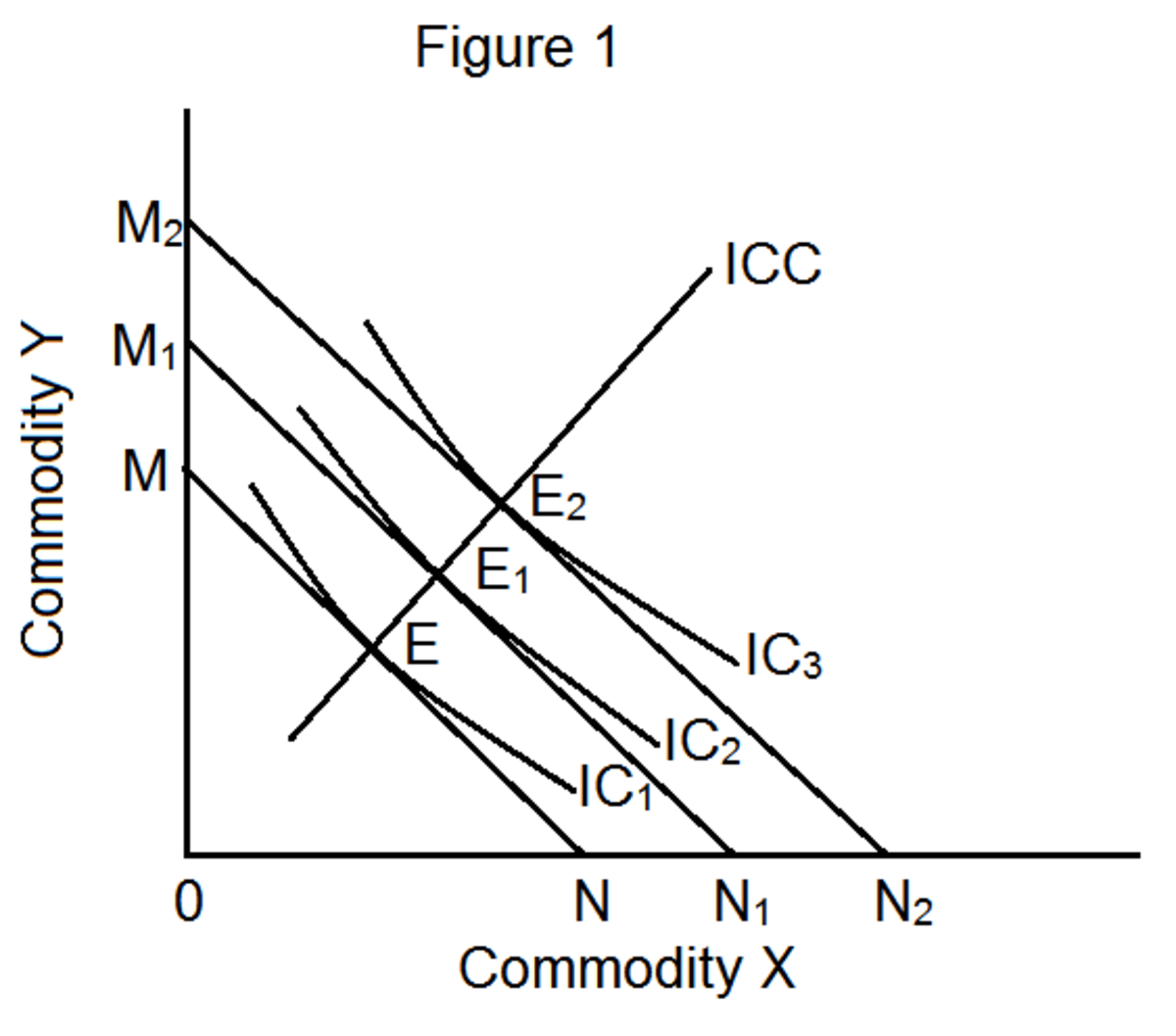

In the course of building a long term investment portfolio, the focus should be based on not just returns...but risk adjusted returns. The premise behind a multi asset portfolio is the combining of multiple asset classes in which each produces a positive long term return, but are not always highly correlated can produce more consistent longer term returns...while offering a lower overall degree of portfolio volatility. One of these asset classes is the commodities market.

Commodities independently have historically been more volatile than stocks with a higher standard deviation of returns over the last 40 plus years. Since 1970, US large cap equities have posted a standard deviation of 17.63 versus 24.29 in the GSCI commodity index. However, when combined as a component in an overall asset allocation...they can serve an important role. All too often investors chase after the most recent top performing assets. Using commodities as an example, the last 5 years have been less favorable as the US and most of the developed world has seen a somewhat anemic economic recovery from the 2008 recession. Yet, if we were to examine average returns of the broad based commodities market in comparison to the US large cap stock market, we find that the average returns are not much different. During the period of 1970 thru 2013…US large cap equities posted average annual returns of 10.41%, while commodities posted average annual returns of 9.21%.

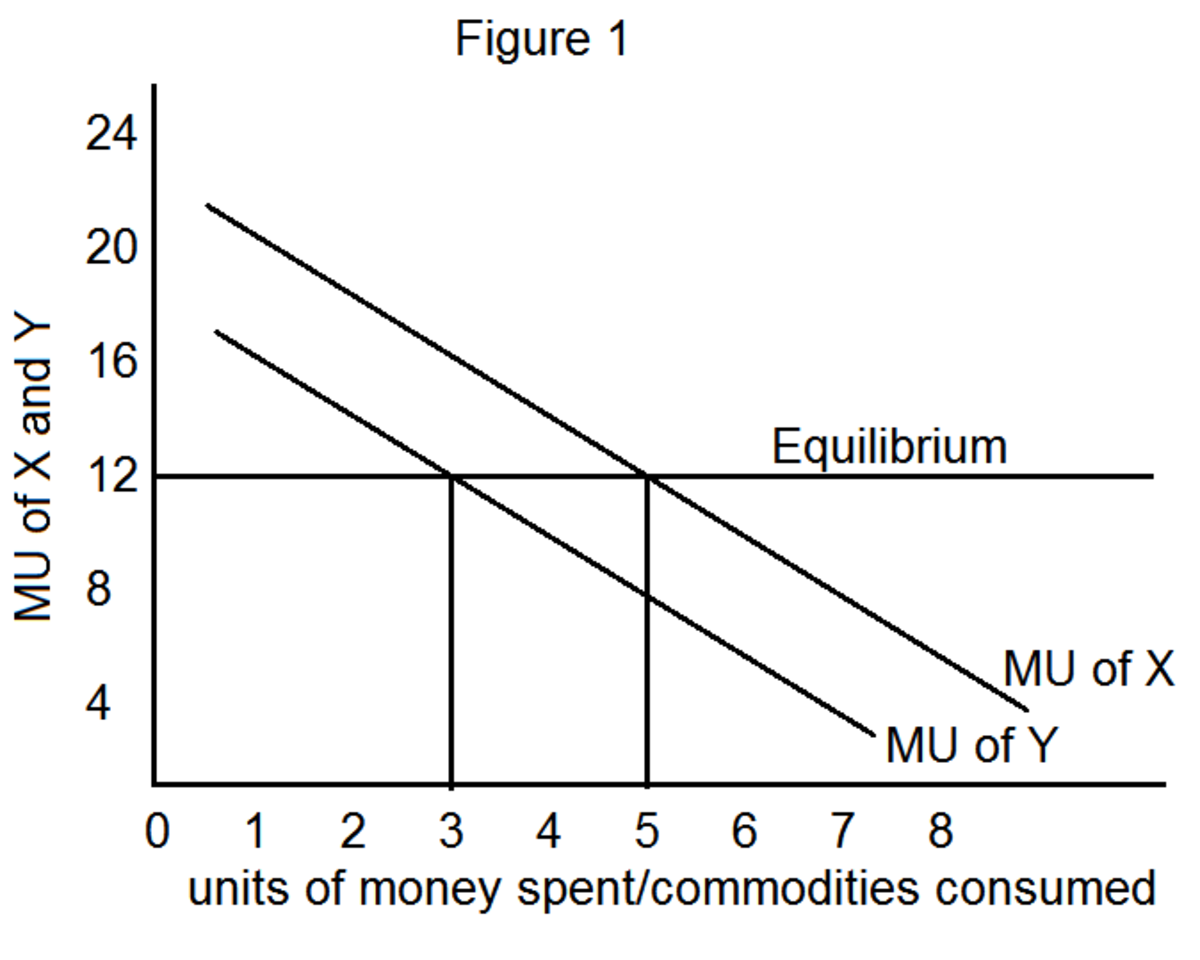

What is important to note by looking at the following chart on is the individual year over year returns. What we find is that in many years in which stocks suffered...commodities offered a cushion to portfolio returns. In many years the inverse was also true. During periods of extraordinary deflationary panics such as 1929 or 2008, asset classes often become highly correlated. However, we also find that in years like 2002 as the tech bubble had imploded and the US was recovering from the events of Sept 11th...commodities offered a substantial reduction in overall portfolio volatility.

It is also important to recognize that a proper investment asset allocation is defined by multiple asset classes and sub-asset classes of satellite investments to compliment core holdings like US large cap stocks. Commodity holdings are just one such holding. As a result of the high volatility that accompanies a broad basket of commodity holdings, investors should likely limit exposure in the commodities markets to a reasonable percentage of their portfolio holdings. Investors who utilize the aid of a financial advisor should consult with them before incorporating new holdings into their longer term investment strategy.

Commodities as an asset class can be a bit more difficult to own outright. It is unadvisable that investors begin to trade in futures contracts around the commodity complex, unless this is something with which they have had significant experience. In most cases it is much more suitable to utilize a mutual fund or an ETF which diversifies across a broad range of futures contracts. Unfortunately, due to the structure of many commodity products in the ETF product space, they often report tax liability on a K-1 rather than a 1099. This is irrelevant for retirement accounts, and does not increase liability...but may delay income tax returns for non-retirement accounts, as K1’s tend to be issued later and often close to the tax deadline. In the event that an investor wishes to avoid the K1 filings, there are a number of open-ended traditional mutual funds that have broadly diversified commodity holdings. As in any mutual fund, expenses should be monitored as well portfolio holdings to ensure the fund achieves a truly diversified set of commodity holdings consistent with the benchmark. Below is a breakdown of the year over year comparison between US Large Cap Equities and the GSCI Commodity Index.

Multi Decade Historical Returns

Year

| Large Cap Stocks

| Commodities

|

|---|---|---|

1970

| 3.95%

| 15.11%

|

1971

| 14.31%

| 21.08%

|

1972

| 19.02%

| 42.44%

|

1973

| -14.68%

| 75.01%

|

1974

| -26.48%

| 39.54%

|

1975

| 37.22%

| -17.22%

|

1976

| 23.92%

| -11.89%

|

1977

| -7.15%

| 10.37%

|

1978

| 6.56%

| 31.60%

|

1979

| 18.61%

| 33.80%

|

1980

| 32.49%

| 11.10%

|

1981

| -4.90%

| -23.01%

|

1982

| 21.55%

| 11.56%

|

1983

| 22.55%

| 16.56%

|

1984

| 6.25%

| 1.05%

|

1985

| 31.74%

| 10.02%

|

1986

| 18.67%

| 2.06%

|

1987

| 5.26%

| 23.77%

|

1988

| 16.59%

| 27.93%

|

1989

| 31.67%

| 38.29%

|

1990

| -3.10%

| 29.07%

|

1991

| 30.46%

| -6.14%

|

1992

| 7.65%

| 4.44%

|

1993

| 10.08%

| -12.33%

|

1994

| 1.32%

| 5.31%

|

1995

| 37.57%

| 20.35%

|

1996

| 22.96%

| 33.91%

|

1997

| 33.38%

| -14.06%

|

1998

| 28.58%

| -35.75%

|

1999

| 21.04%

| 40.90%

|

2000

| 9.09%

| 49.77%

|

2001

| -11.88%

| -31.94%

|

2002

| -22.10%

| 32.08%

|

2003

| 28.69%

| 20.72%

|

2004

| 10.87%

| 17.72%

|

2005

| 4.89%

| 25.55%

|

2006

| 15.79%

| -15.10%

|

2007

| 5.50%

| 32.68%

|

2008

| -36.99%

| -46.49%

|

2009

| 26.45%

| 13.47%

|

2010

| 15.05%

| 9.04%

|

2011

| 2.12%

| -1.18%

|

2012

| 15.98%

| 0.06%

|

2013

| 32.41%

| 1.21%

|

Suggested Reading

- Understanding The Long/Short Strategy

The single most important factor in a successful long term asset allocation investment strategy is the ability to maintain a low correlation between asset classes. In order for the notion of an asset allocation to work, a portfolio must be actively.. - The Best Ways to Pay for College

There is an old saying when it comes to saving for education. Either save a lot of money or don’t save anything at all. However, don’t fall in between the two strategies. The cost of education has gone up dramatically over the last several... - Living Benefit Annuities…Buyer Beware

As a result of two major market panics in the last two decades, the use of variable annuities as a solution to the financial needs of the consumer has increased. These products have been marketed and re-marketed in various different formats with... - The Benefits of Master Limited Partnerships

A Master Limited Partnership (MLP) is a partnership which has the ability to trade on a public securities exchange. There are two core components which are the Limited Partner and the General Partner. The Limited partner is the investor who puts up.. - How Government Programs Increase Costs

Many of us look at the cost of things we need to buy and often get frustrated with how expensive certain aspects of the cost of living have increased. Yet often we really don’t take the time to try to understand the root cause of exactly why... - Should We Return To The Gold Standard ???

The discussion of monetary policy is a complicated one with many aspects that are often misunderstood by the general public. The discussion of the Gold Standard in recent years has been brought back to the forefront by some in American politics,... - Money Creation & The Impact of Debt & Deficits

Everyone one of us just about every day reaches in our pocket and removes some money to purchase something. We receive money for our labor, whether self-employed or paid by an employer. Yet, many of us have very little understanding of exactly where. - The US Housing Crisis...How it Happened

One of the most impactful recessions in US history began with the linchpin of the inflated US housing collapse which culminated in 2008. This has been one of the most discussed topics in recent years, as it has had a profound economic impact on both. - Understanding Medicare Benefits

Health care is an area of major political and economic debate, and many of these laws may be substantially altered in light of potential legislative changes, coupled with the enormous fiscal challenges the current programs like Medicare & Medicai - National Income Disparity...A Look Behind the Number...

Over the years there has been an ongoing discussion about the growing income disparity in the United States. This discussion has been particularly emphasized when compared to the income distribution of other parts of the world. While it’s true...