Ben Stein Calls For Higher Taxes

- Sooner28posted 12 years ago

0

http://gawker.com/5953010/ben-stein-tel … o-damn-low

The Simpson/Bowles commission also calls for a mix of spending cuts and higher taxes to tackle the deficit.

Whether you agree with the methods of what is cut and exactly what line taxes should be raised, there is no denying people on the right and left are both calling for higher taxes.I read a report the other day from the CBO, the gist was we cut and tax now and risk a downturn, or we wait and depending on how long we wait we could be in real trouble(Greece)..I thought, off the top of my head, why not give gentle relief and cuts along the way, be straight up about that with the American people, and when the economy rebounds add a little more, etc....I would rather suffer a little now and know there will be a tomorrow, but that's just my two cents? (mispelled purposefully,lol)

Ben Stein is correct once in a while. I had dealings with his father, Herb Stein, when he was research director of the C.E.D. (Committee for Economic Development, a non-partisan public policy think tank supported by major U.S. corporations). He later became chairman of Nixon's Council of Economic Advisers and affiliated with the American Enterprise Institute.

CED http://en.wikipedia.org/wiki/Committee_ … evelopment

- JaxsonRaineposted 12 years ago

0

Or...

We could get 15 million more Americans working, which would raise revenues.Economic growth will increase revenues. There is no question about that. If the economy recovers, and absolutely NOTHING changes (no new spending, tax increases or decrease), the deficit will be dealt with just by the stronger economy over time.

Taxes give a base to exactly how much can be collected though. Even if your economic growth is incredible, a 5% tax on all income being the highest will starve the government of revenue.And a higher tax will starve the economy of growth.

Raising taxes is not the solution.

Corporate taxes need to come DOWN. We aren't competitive. Not even close.

Personal taxes need to come DOWN. Millions of businesses pay at the personal rates, and the 35% tax rate for those businesses starts at just $388,000. It's ridiculous. You have all these businesses paying 35%, where in other countries they can pay 25%, 20%, 15%, or less.

Most importantly, we have to invite multinational companies to invest in America. It's such a simple concept, there is no reason not to do it. Why do we want to tell people 'Well, if you want to bring that money your business made in Germany, and invest it here... We're going to have to take 10, 15, 20% of it away from you first. Of course, you can just invest it all in Germany and we won't take anything!'Our affective corporate tax rate is the second lowest in the world.

http://www.cbsnews.com/8301-505123_162- … the-world/

http://www.cbpp.org/cms/index.cfm?fa=view&id=3806 Approximately 2.5% of small businesses file under the personal income level, and many of those "businesses" are not so small figures.

If the final paragraph is defending a territorial tax system, that is sure to cost American jobs. If I can make profits overseas and not pay any taxes on it at all, or I can make profits here and pay taxes on it, which one am I gonna do?Ugh. No. No. No. No no no no no no no no no no no no no no no no no.

That is the stupidest yardstick I have ever seen. Did you know our corporate tax rate, compared to mangoes produced, is the lowest in the world?

Taxes as a percentage of GDP is a horrible, ridiculous, illogical way to look at taxes. It doesn't even look at the actual tax rates corporations pay.

Our corporations pay, on average, 29% of all their pre-tax profits. The OECD average is 20%. That is the ONLY way to look at tax rates. You have to look at TAX RATES.

2.5% of businesses is still a lot of businesses, and directly would affect a lot of employees.

Lastly, no. Almost every other developed nation has a territorial tax system, and they haven't lost all of their jobs. It is estimated that $1.4 TRILLION dollars every year are held out of the economy because of our tax system. That money would be invested in America... that's almost 10% GDP growth.

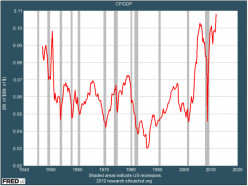

We PUNISH multinational companies, not for being multinational, but solely for the act of bringing the profits they are making overseas anyway, into America.GPD is used as a measure because, "Some economists argue that tax collection relative to gross domestic product is the more relevant measure. That's because different accounting rules around the world mean what's counted as income in one country isn't counted in another, making comparisons of tax rates misleading."

We are also still below the average in terms of ACTUAL rates also. http://money.cnn.com/2012/03/27/pf/taxe … /index.htm

The multinational companies aren't being punished. They could not have built their businesses and have the strong base they do without living in a country like the United States, with a stable government and infrastructure. No cheap labor in countries without strong governments if you don't have a stable business base.

http://businessfinancemag.com/article/t … -jobs-0717

http://www.americanprogressaction.org/i … -u-s-jobs/We could tax corporations at 100%, and still not have as high of a %of GDP as some countries.

It's irrelevant. It doesn't tell you a thing about what they actually pay.

Ok... if you really think it's a good idea to say 'Invest in that country for free, we're going to charge you to invest here'...I also cited the CNN article showing our corporate tax rates, not as a % of GDP, are still below average.

Uh... no.

We have the highest marginal rate.

When you look at effective rates, we also have the highest. The little line in your article isn't comparing to the effective tax rates for the OECD. We average 29%, the OECD averages 20%(not 31% as the article states).

Do you know what that sounds like?

It sounds like saying "We are desperate for jobs, for investment in our country, but we want you to PAY for the PRIVILEGE of being part of the American economy".And that is absolutely correct, Corporate profit margins are at an all time high, the US has the biggest consumer base in the world with a struggling underclass if people want to participate in the best market place for corporations in the world than they should pay for it and we can use that payment to help those struggling. Don't give me the victimized corporation spiel because it's completely untrue Sooner's GDP measure is a good scale and the profit margins show very clearly that corporations are not being overtaxed there is no better market for a corporation to be in.

If every country should be responsible for their own well being to the utmost extent possible (which is a widely held assumption), and the only reason these companies even have the possibility to exist is because the United States is a stable, relatively educated society with many overconsumers, their profits overseas that could not have been built without starting in the United States should not be tax free. Workers, police, courts, and infrastructure are not provided by the corporation.

Some of their profits can then go to providing educational opportunities for future workers, who will then provide the technical skill and tenacity that doesn't exist anywhere else (at least for now). If trends continue going the way they are now, the lower skilled jobs will naturally go overseas, and the ones requiring more education will end up being taken by Americans (unless we continue our trek of favoring missiles over people).

Are we supposed to look at a corporation as some kind of abstract entity that is borderless and should have a race to the bottom in determining where to do business? Is there no sense of obligation to the communities they live in to help those who are less fortunate?Listen. All business expenses are passed onto the consumer anyway. Increasing taxes is really increasing the cost of the goods or services.

This is exactly why we shouldn't even have corporate tax rates. All taxes are paid by the consumer, so all taxes should be based on consumption. That way, corporations would have no obstacle, tax-wise, to come into America, and invest in America.

I'm sorry Sooner, you are simply ignoring reality. 23 million unemployed or underemployed... we should be doing EVERYTHING we can to attract jobs. It would be better to eliminate corporate taxes(which only pay something like 8% of our spending), and get Americans employed again. As the economy improves, then increase some taxes(corporate or consumption) gradually.You do realize that corporations who make money overseas are allowed to deduct expenses on their US tax returns without actually having to first bring the profits back right?

Also, if a company pays the corporate tax in one country, that corporation only has to pay the difference when they bring the money here. It isn't like they are paying the full tax rate for both countries.

I actually completely agree that their should be no income tax for anyone on anything. However, its not like the corporations are getting screwed. They just want something to complain about.

Joe Biden said it wouldn't work, he said it didn't work under Kennedy or Reagan. If crazy Joe says it you have to believe it.

Binders

They will have to emigrate to China where the jobs are if Romney is elected.

- JaxsonRaineposted 12 years ago

0

... ok.

So, we are desperate for jobs, but we want to make corporations pay more to create jobs here than they need to pay to create jobs in other countries.

If your business was struggling, and let's assume you make the best version of the product you sell, would you send out ads to all your regular customers and say 'We really need to move some inventory, but we don't want to lower prices, because you need to PAY for the PRIVILEGE of buying our products'?

Or... would you try to ATTRACT customers?

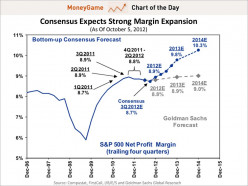

I just... I can't... oh well.Again ignoring the facts, if companies do not want to invest in America it's not because we have a high tax rate we have the second lowest in the world and it is not because it won't be profitable because the facts show very clearly IT'S MORE PROFITABLE THAN EVER BEFORE AND GETTING EVEN BETTER EVERY DAY now if we have the best profit margins IN AMERICAN HISTORY, the second lowest effective tax rate in the world and the biggest consumer base in the world and you still think that corporations aren't investing in America because of the taxes then your view is completely out of sync with all the facts the main reason corporations are not investing here at the moment is because we just had a GLOBAL financial crisis and investment money is hard to find.

The facts speak for themselves.

You can't attract money that doesn't exist all you will accomplish is reducing the amount of money raised by taxation, market confidence is rising steadily and once it gets good enough investors will start investing in THE MOST PROFITABLE MARKET IN THE WORLD AT THE MOST PROFITABLE TIME IN IT'S HISTORY.

P.S. I don't know how to bold text on this so I capitalized.We DO NOT have the second lowest tax rate in the world.

That taxes/GDP figure means NOTHING.

If you start a business in America, you're going to pay an effective rate between 29-39%. If you invest elsewhere in the OECD, you're going to pay a rate between 15-25%.

That rate means NOTHING to a business. The only figure that means ANYTHING is the ACTUAL EFFECTIVE RATE THEY WILL PAY, and the US ranks #1 for that.

Again, we could tax 100% of corporate profits, and still not be listed #1 by your measure. Do you understand now how it doesn't mean anything?

If you can't accept that, there is no point in continuing. You go ahead and use your measure, which ignores the tax rates that corporations actually pay... how in the world you think it is more relevant than the effective tax rates...If you want to dismiss the effective tax rate ranked as a valid method by a wide array of institutions including the CRS then fine the point does not really revolve around it, even looking at the actually paid rates the US ranks below countries like the UK, Japan and Canada. (page 5 figure 2)

http://www.treasury.gov/resource-center … 2-2012.pdf

The point is as noted Corporations have never had profit margins this good in American history there has never ever been more financial incentive to invest in the US and yet it isn't happening which to someone who stops to think for half a second would suggest another cause which is simply after the crash investment money is scarce. I SAY AGAIN THERE HAS NEVER BEEN MORE FINANCIAL INCENTIVE TO INVEST IN THE US, IT HAS NEVER EVER BEEN MORE PROFITABLE AND THAT IS EXPECTED TO CONTINUE IMPROVING.

Think about it.

hi

You use [b]text then use the same b with a slash at the beginning.

Related Discussions

- 41

Romney and Territorial Tax

by Mtbailz 12 years ago

There has been debate about taxes lately which has consisted of the normal "they should go up" or "they should go down", but there has been an underlying debate about Romney's new tax policy. The idea would be based on territorial taxes which would mean multinational...

- 106

Socialism and high taxes are not equivalent

by Josak 11 years ago

One of the greatest criticisms leveled at socialist and perceived socialist nations is their high taxes, usually reinforced with the example of France and it's high tax rates under a newly elected socialist government.Let's examine that claim factually, a quick analysis will prove it false.For...

- 81

Romney's tax returns:

by Holle Abee 12 years ago

McCain released two years of tax returns. Reagan released one. Romney has released two. It wasn't a big deal with McCain and Reagan. Why is it now?http://factcheck.org/2012/07/romney-and … precedent/

- 27

Mitt Admits Companies are Dodging Taxes

by Sooner28 12 years ago

"I'm going to champion small business. We've got to make it easier for small businesses. Big business is doing fine in many places -– they get the loans they need, they can deal with all the regulation. They know how to find ways to get through the tax code, save money by putting various...

- 17

What Is A "Fair Share" Relative To Taxes?

by ga anderson 8 years ago

Much is heard of a demand that corporations and the wealthy pay their "fair share" of taxes, but I have heard little of what that share should be.With only a single restriction; that the discussion is about legal tax actions, what should that "fair share" be?One could say that...

- 68

Obama's Debt Plan- 3 Dollars in Taxes For Every Dollar Cut

by lady_love158 13 years ago

http://m.washingtontimes.com/news/2011/ … increases/Really, and people think this guy is a genius? Why does he insist on making ideological proposals that even his own party wont support? This president is beyond inept and incompetent, he's moronic!