Affordable Healthcare

With 11 days until it takes effect, it would be a little bit helpful if there were some clear details.

http://www.nytimes.com/2013/09/18/busin … 1&_r=0

This article really concerns me since my cancer medications are expensive and the money we can put aside to help pay out of pocket costs was limited to $2,000 starting last year.Hello Tireless. I can see why you are concerned about the cost of your medication. There are many solutions under Obamacare that are designed for the financially challenged.

If I may, please allow me to make a few observations. First, I do not think Hubpages is the best place to look for answers. How the ACA affects you will depend on your particular circumstances, the state in which you live, and medical factors known only to you.

In states with Democratic governors, you will likely find a lot of information about Obamacare at state level web sites. You might benefit from calling the California Department of Insurance, Consumer Communications Bureau, Consumer Hotline at (800) 927-4357 (inside California).

On the other hand, for quotes and information regarding policies that are specific to your location and circumstances you might try http://www.healthcare.com/insurance/online-quotes/

Secondly, October 1, 2013 is the target date for each state to open their insurance exchanges to the public. New policies purchased on the exchanges will go into effect January 1, 2014. There are "essential benefits" specified by the ACA in all policies. They include coverage for doctors' visits and ER visits; hospitalization; maternity and newborn care; mental health and substance abuse services; lab services; prescription drugs; chronic disease management; and preventive services. Plans will differ in how these services are packaged and priced with each assigned a category from the basic "bronze" to the high-end "platinum." Furthermore, premiums will vary among the participating insurance companies and they may be lowered by subsidies for low-income earners.

Finally, the NY Times article that triggered your concerns is NOT California specific and it mentions your state only once. "Oregon, Virginia, Connecticut and other states plan to cover more than 97 percent of drugs," it says. "While others like Maryland, Colorado and California plan to cover 54 to 84 percent, according to an analysis by Avalere Health, a consulting firm. Patients can lobby for an exception if they can demonstrate that a drug not covered by their plan is medically necessary." Not much help to you, is it? {1}

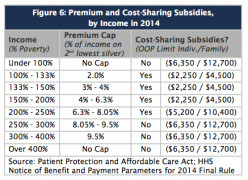

You seem to be most interested in out-of-pocket limits that will apply to you. The Huffingtonpost reported the annual out-of-pocket limit for individuals in California is $6,400, while noting low-income folks may see as low as $2,250. "However, policies will pay 100% once this limit is reached," it said. {2} You might want to verify that this is correct.

Primarily, I would be aggressive in my efforts to learn. I would not wait for the information to come to me.

Please, Tireless, let me know if you think I can help you in any way.

{1} http://www.nytimes.com/2013/09/18/busin … 1&_r=0

{2}

http://www.huffingtonpost.com/2013/05/1 … 65286.htmlI imagine most if not all states will have a website up and running. I know Idaho will (or is at least is supposed to) and you can't get much more Republican.

Hey there Wilderness. Howzit goin’?

I do not know much about Idaho, I admit, but I do know the Republican governor issued an executive order banning all state departments, agencies, and employees from assisting in the implementation of Obamacare within the state. His order reads in part, “No executive branch department, agency, institution or employee of the State shall establish or amend any program or promulgate any rule to implement any provisions of the PPACA.” {1} I do not expect Idahoans will find much helpful information on official state supported web sites.

I also know that Idaho has declined to establish a state run insurance exchange thus leaving it to the federal government to create one for them. Perhaps it is the federal effort that you expect to be up and running on Oct. 1.

Fortunately, the Idaho Librarian Association has taken up the task of informing citizens about the provisions of the ACA. Librarians in the state are gearing up to help patrons learn about the law and how they can access policies and subsidies on the insurance exchange created by the federal government. {2}

It was nice hearing from you, Wilderness. Thank you for your contribution about Idaho.

{1} http://gov.idaho.gov/mediacenter/execor … 11_03.html

{2} http://www.idahoreporter.com/2013/libra … -in-idaho/I didn't see a date on that first link, but the rhetoric sounds a little old. Idaho spent a lot of money and effort fighting the whole thing, but seems to have decided to go along with the inevitable.

The state is now advertising the web site on TV and newspaper, and there have been several newspaper articles including a long one today. The web site won't be available until required, though - Oct. 1 - and while I expect it to provide information I do not expect to see advice there.Wilderness, you are correct.

Governor Otter did back-peddle on his executive order. He later vetoed a bill aimed at blocking an insurance exchange and did set up a state exchange.

Thank you for the correction.

I don't see that he really had any choice. Like so much else we see today, it was nothing more than grandstanding.

My problem is being middle class.

Wall Street Journal says 10 days before this is set to go into effect that government reports computer programs are not working correctly.

This is getting scarier by the day. I completely agree something has to be done.

The official site is Health.gov.

From there - you can access the Kaiser Foundation calculator that will allow you to estimate your premium, benefits and potential subsidy.

In my opinion, the bill is ill-conceived and doomed to fail.In my opinion, the bill is neither ill conceived nor is it doomed to fail. Many Americans are working to make the bill succeed and many others are working harder to obstruct its implementation. Meanwhile, Obamacare continues to move forward and it has already begun to fulfill many of its objectives.

I fear your wrong but have no choice but to pray your right about it not being a failure, as I have a loved one for whom it is quite literally critical that care go uninterrupted. Either that or I must hope it doesn't get going at all, but that's not looking likely.

My friend, I am touched by your plight and your fear for a loved one. I also join with you and with your prayers that your fears are unfounded.

Quill, Obamacare might appear to be moving forward on the surface, but if you pay close attention, you'll find it's stalling out.

Are you aware that Obama pushed back the employer-side mandate to 2015? Do you know why? Because he's buying time. He knows slapping the employers with that mandate has already caused numerous companies to lay off workers or reduce their hours to keep from paying.

Do you realize that Obamacare is NOT supported by the wealthy at all? They remain untouched because they already have their Cadillac plans. No skin off their teeth.

Sadly, this bill rides on the backs of those least likely to be able to afford it. The lower-middle income class.

What Obamacare says in essence is that come January 1, if you don't have insurance - go out and buy it. That's your option. The employer mandate is off the table for another year - so you're on your own.

Do you also understand that there is a group of near-poverty line people who will be under the mandate to buy a policy, but they will not qualify for a subsidy? This is the group (in states that did not expand Medicaid) that extend from 100% to 140% of the poverty line. These people are out of luck.

This is conceivably the worst bill passed by this administration. This bill - and its subsequent failure - will be what determines Obama's legacy, because it bears his name.

It's all getting ready to fall apart. Remember you were informed of that, Quill.Good to see you, Howard. I see we continue to disagree on some Obamacare issues but that's all right. If our perceptions differ, our opinions are likely to follow. Let's talk progress.

It is strange that you would assume I am not paying close attention. I do not see any signs of the measure "stalling out." It is easy for anyone to adopt this position if they down play the bill's progress. Everyone inside the Beltway knows that there are areas in the bill that need to be tweaked and everyone there also knows there is no hope to revise the bill in this congress. There are reported bugs in the insurance exchange software too but this does not mean the bill is not good for the country.

I do not see any signs of the measure "stalling out." It is easy for anyone to adopt this position if they down play the bill's progress. Everyone inside the Beltway knows that there are areas in the bill that need to be tweaked and everyone there also knows there is no hope to revise the bill in this congress. There are reported bugs in the insurance exchange software too but this does not mean the bill is not good for the country.

Gauging the rate of progress for the bill is in the eye of the beholder. Avik Roy, certainly not a fan of Obamacare, observed in Forbes about a month ago, "We should make one thing clear. The law isn't going to 'collapse unto itself'' or any such thing that conservatives appear to pine for. For every missed deadline or White House waiver, there are nine aspects of Obamacare that are being implemented as we speak." {1}

This reality may be frustrating to those who oppose the bill but there is progress despite their opposition. In fact, Mr. Roy points out that 11% of the bill's deadlines are being obstructed by congress. {2}

In the meantime, let us focus on the facts. Predicting failure is like praying. It is great if that makes you feel good but it does not mean the outcome will change. If Obamacare, fully implemented and funded, fails then you will have won bragging rights. If it is repealed, you lose out because we will never know how much of a benefit it would have been for the millions of uninsured Americans.

{1} http://www.forbes.com/sites/theapotheca … deadlines/

{2} Ibid.Hi again, Howard. Golly, I wish I had the mental agility to make assumptions and then to declare those assumptions are facts.

I do not so let’s look at the employer mandate.

I do not so let’s look at the employer mandate.

You seem to know why the President delayed the employer mandate but you do not reveal how you came by the knowledge or how reliable it is. Please share that with us if you can. Otherwise, we are left wondering if you are relying on facts or opinions. I hope you have considered that there might have been other reasons for the delay beside the one you claim but have yet to support.

Without seeing supporting data, it is difficult to buy into the claim that the “mandate has already caused numerous companies to lay off workers or reduce their hours to keep from paying.” I would love to see some figures that quantify these “numerous companies” since I can not find any. Especially since only 5% of all businesses with more than 50 employees are affected in the first place. The other 95% already provide healthcare insurance to their employees and are not subject to the mandate. {1}

Another applicable fact deserves to be weighed as well. Early this year, the congress discovered that the language in the proposed Immigration Reform Bill conflicted with the language in the ACA. As drafted, the wording in the proposed immigration law provide an unintended incentive to hire a newly legalized immigrant rather than a US citizen. Delaying the employer mandate eliminated this incentive until the wording in both bills can be reconciled. {2}

So, Howard, there may be a lot of reasons why the employer mandate was delayed. Reasons to be researched and not assumed. Reasons that may, or may not, support your crash and burn predictions for Obamacare.

I feel for the half-million Americans who will be uninsured next year because of the delay. According to the CBO, “About half of the 1 million workers who would have gained employer-sponsored coverage next year will now obtain insurance through the exchanges or via public programs including Medicaid.” The other half will go without insurance coverage and that is a sad fact in the wealthiest country in the world.

I respect your concerns about the ACA, Howard, as much as I respect our friendship. I make a sincere effort to understand your points of view. It is my experience that opinions and assumptions not supported by facts often have no value. I do not presume my conclusions are flawless nor my facts indisputable. I encourage factual challenges to both.

Have a good night, Howard. I am looking forward to tomorrow.

{1} http://www.washingtontimes.com/news/201 … asury-del/

{2} http://washingtonexaminer.com/obamacare … le/2534563Hi Howard.

Do you realize everyone already knows that the wealthy do not support Obamacare or the needy? It is the pattern in this country for the wealthy to find a way not to pay while the poor have no money to pay. The working class always ends up paying for both of them. So let us look at your unrelated claim about Medicaid.

You wrote:

“There is a group of near-poverty line people who will be under the mandate to buy a policy, but they will not qualify for a subsidy? This is the group (in states that did not expand Medicaid) that extend from 100% to 140% of the poverty line. These people are out of luck.”

It seems your 140% should read 133% and they are “out of luck” only because their state government decided on its own NOT to expand Medicaid participation. In other words, this group is not part of an Obamacare discussion but part of a dialog about state Medicaid expansion. {1}

In fact, Howard, every household below 400% of the poverty line, or $45,960, is eligible for some financial assistance when they buy policies from state exchanges. {2}

{2}

Finally, my friend, let’s talk about your predicting Obamacare will fail without offering any convincing evidence that the ACA, fully funded and implemented, can not achieve its goals.

You wrote:

“ This is conceivably the worst bill passed by this administration. This bill - and its subsequent failure - will be what determines Obama's legacy, because it bears his name. It's all getting ready to fall apart. Remember you were informed of that, Quill.”

Why am I not convinced by your words? I am sorry, Howard, but I am reading rhetoric without substance. I did not find one single fact in your entire post that proves Obamacare can not possibly succeed; not one fact that proves Obamacare is the “worst bill passed by this administration;” and not one fact that proves “It's all getting ready to fall apart." I thank you for the hamburger but where is the beef?

Yet, I am sure, you are convinced that it will fail. Therefore, you must have proof, not opinions mind you, but proof that it will not succeed. I would be grateful if you would share your proof with all of us. It is the only way anyone can evaluate your conclusions.

I admit that there is always the possibility that Obamacare may fail before it is repealed. As for your prediction, however, if you have no proof then I would agree you should push for repeal. Otherwise, you might have to consume some crow if Obamacare achieves most the goals it set out to accomplish.

{1} http://www.obamacarewatch.org/primer/ex … -subsidies

{2} http://www.washingtonpost.com/blogs/won … obamacare/I appreciate your opinion, Quill, but I don't think you're really looking at what's happening. Your opinion that Obama's employer mandate delay had nothing to do with employers reducing hours or laying off isn't supported by the evidence.

http://news.investors.com/politics-obam … s-jobs.htm

Furthermore, your nice chart that shows caps on out-of-pocket expenses is moot because Obama delayed implementing that cap as well.

http://www.forbes.com/sites/theapotheca … ntil-2015/

Plus, don't send people to an insurance site for reliable information. The government site is health.gov and they're using the Kaiser Foundation calculator as being the most accurate.

I understand your wanting the ACA to fly - but I think you're basing your opinion on desire and emotions - not on what's happening right now.G’day Howard.

C’mon Howard. Look at your “evidence.” It is a clerical search that resulted in a "List Of Cuts To Work Hours, Jobs." You are attempting to support your own incredible claims with data that the author openly admits is inconclusive. “The list doesn't begin to provide an actual accounting,” he says.

It turns out you not only do not know why the employer mandate was delayed but the reason you stated is totally implausible. It seems it is you, and not me, who are not really looking at what is happening!

The White House delayed the mandate after it assimilated the concerns received from the business sector. It became apparent that companies did not have enough time to comply with the newly drafted regulations by Jan. 1, 2014. {1}

Following the announcement, a chorus of affirmations emerged from the business sector from employer groups and business lobbyist who had been working with ACA agencies to roll out the new law. A featured TheHill.com headline on July 4, 2013 read, “Mounting pressure, looming deadline led to surprise employer mandate delay.” {2}

Ben Goad at TheHill observed, “The Obama administration’s bombshell decision to hold off on penalties for employers that don’t provide insurance to their workers came under fierce pressure from business groups, who warned that unresolved questions would cause havoc.”

Judith Thorman, senior vice president of government relations and public policy at the International Franchise Association, stated publicly that the issue for employers focused on the uncertainty due to unreleased regulations programmed to take effect in only six months. Business complained regularly that more time was needed to implement the necessary reporting to the Internal Revenue Service. She acknowledged White House Senior Adviser Valerie Jarrett’s role by saying, “Valerie Jarrett has met with many, many business groups, and I suspect that is why she was the face of this decision.”

Ms. Jarrett spoke about the decision to delay the mandate. “We have heard the concern that the reporting called for under the law about each worker’s access to and enrollment in health insurance requires new data collection systems and coordination…We will convene employers, insurers, and experts to propose a smarter system and, in the interim, suspend reporting for 2014.”

Michelle Neblett, director for labor and workforce policy for the National Restaurant Association, recounted more than a year of meetings in which her group pushed for streamlined reporting requirements.

In addition, Neil Trautwein, VP of the National Retail Federation praised the government’s proactive process for getting direct input from businesses. He said there was no defining moment during discussions when the administration suddenly decided to delay the mandate’s timing. He believes it was a “long running process decision.”

Yvette Fontenot, who was associated with Affordable Care Act issues, also confirms “There was a tremendous amount of outreach on both sides to see what’s doable.”

All of these observers reveal the behind-the-scenes dynamics and together they contradict you. Their statements prove you actually did not know the reason for the White House delay of the employer mandate after all. In addition, the flaky reason you offered as part of your claim also turns out to be both false and undeniably improbable.

You claimed:

“Do you know why? Because he's buying time. He knows slapping the employers with that mandate has already caused numerous companies to lay off workers or reduce their hours to keep from paying.”

He’s buying time? This statement is creative fantasy on your part. Having made it up yourself, you can’t even prove it is true. In fact, analysis by the Rand Organization after the announcement found the one-year delay in the employer mandate will have relatively few consequences, primarily resulting in a relatively small one-year drop in revenue. {3}

In addition, the impact of companies laying off workers is not significant enough to affect the functionality and the implementation of the ACA much less to contribute to the decision to delay the mandate. Less than 0.2 % of all businesses have less than 50 employees and do not already offer insurance to their employees. Because their number is so small, how they shuffle their employees means nothing to the overall progress and success of the bill.

I hope you enjoy your day, Howard, and you get to follow your bliss.

{1} http://thinkprogress.org/health/2013/08 … al-effect/

{2} http://thehill.com/blogs/regwatch/healt … date-delay

{3} http://www.rand.org/pubs/research_reports/RR411.htmlGood morning, Quill,

Thank you for the wonderful cheerleading routine. While you put on a great show, you fail to defend your points, which are, frankly, a bit unclear.

You’ve cited “employer reporting” concerns as the reason for the pushback, and, sure, that’s the main Democrat talking point. What you, and your sources, fail to explain is how four and a half years is not enough time to iron out reporting methodology.

Are you aware that IRS policies change annually and the reporting changes are implemented by the start of the next fiscal year? You’re telling me four and a half years is not enough time? Perhaps, you should starting wondering about the bill if four and half years is not enough time to get it ready to roll out.

I claimed Obama was buying time, and you’ve presented nothing to show otherwise. In fact, Jarrett’s own words that they will “propose a smarter system,” backs my claim that the system currently called for in the bill – is a failure.

I’m sure the reporting aspect IS bad – what isn’t bad about this bill? But, they’ve had plenty of time to enact a reasonable reporting system.

Mort Zuckerman from the McLaughlin Group said, “Part-time employment is going to grow from 25 percent of the workforce to close to 50 percent of the workforce in part because of the problems of healthcare obligations.”

Do you honestly think the White House is unaware of these types of sentiments? Do you think the slams by the AFL-CIO are falling on deaf ears? When the nation’s largest labor organization - an organization that originally supported the ACA – says ACA fees will “…drive the costs of collectively bargained, union administration plan, and other plans that cover unionized workers to unsupportable levels…,” do you think the White House is unaware of the sentiment?

This Administration is not going to come out and admit that what the AFL-CIO and those like Zuckerman are saying is behind the mandate pushback. They’re going to point to some trivial part of the bill – a part that (by all accounts, given the manpower and resources) should be a quick and easy fix.

While I appreciate the fact that there are those, such as yourself, that believe every word issued by an administration you so obviously support, I find it sad that you’re choosing to buy into talking points instead of thinking for yourself.

As a business owner, I will tell you unequivocally that this bill will fail. It is fiscally unsound. It is not fixable.Hi Howard.

Are strawman arguments and red herrings all that you have?

Examine your statement and you will see your strawman “not enough time to iron out reporting methodology” does not address my point that your “employer lay offs” is not the only reason behind the delay as you claimed. Slick how you ignore the public statements of members in employer groups and business lobbyist because their public testimony proves you were wrong.

You also wrote:

“I claimed Obama was buying time, and you’ve presented nothing to show otherwise.”

Excuse me, Howard, but this fallacy is called “Shifting the Burden of Proof.”

“Shifting the Burden of Proof. (See also Argument from Ignorance) A fallacy that challenges opponents to disprove a claim, rather than asking the person making the claim to defend his/her own argument.” {1}

You made the original false claim as the only reason for the delay and, therefore, you are the one who needs to prove it is true. I quoted dozens of employer groups and other business lobbyist telling you the reasons behind the announced delay. You ignore them because they prove you were wrong. You would not have asked me to disprove your false claim if you had sufficient proof yourself. You dodge the issue because you can not defend it with any facts.

Irrelevant references to IRS policies…Strawman.

I am sorry, Howard” but “propose a smarter system,” refers to employer reporting methods and does not imply the mandate or the entire bill is a failure.

What “Mort Zuckerman from the McLaughlin Group” says is another unsupported opposition talking point that does not prove it will actually happen.

You have not proven your claim is true. There is a big difference between anecdotes and genuine facts.

Most of your last post consists of red herrings that are off topic.

Being a businessman does not make you an oracle. In your final pompous, unsupported pontification you said:

“I will tell you unequivocally that this bill will fail. It is fiscally unsound. It is not fixable.”

If you are correct…

Where are your numbers that prove the bill will fail?

Where are your calculations that the bill is fiscally unsound?

Where are the official assessments showing the ACA fully funded and implemented can not be tweaked?

Where, Howard, is your proof? I read only self-righteous blather and, further, your anecdotes are far from being genuine evidence.

Independent analysts have calculated that 92% of non-elderly Americans will be insured by 2017. {2}

“The Estimated Budgetary Impact of the ACA’s Coverage Provisions Has Changed Little on a Year-by-Year Basis Since March 2010” ~ CBO May 1, 2013 {3}

“The projected cost of the ACA’s insurance coverage provisions for 2014 through 2019 has declined $49B during the past three years…

“Taking the coverage provisions and other provisions together, CBO and JCT have estimated that the ACA will reduce deficits over the next 10 years and in the subsequent decade…” [Emphasis added.]

All aspects of the ACA are expected to reduce federal budget deficits $109 B over the 2013–2022 period. {4}

The CBO and JCT have crunched the numbers, Howard. Have you?

Stay well, Howard.

{1} http://utminers.utep.edu/omwilliamson/E … lacies.htm

{2} http://www.cbo.gov/sites/default/files/ … rage_2.pdf

{3} http://www.cbo.gov/publication/44176

{4} http://www.cbo.gov/publication/43471Hi Quill,

You wrote,

You made the original false claim as the only reason for the delay and, therefore, you are the one who needs to prove it is true. I quoted dozens of employer groups and other business lobbyist telling you the reasons behind the announced delay. You ignore them because they prove you were wrong.

First, that is incorrect. I never said “only,” that is your term, and your intent is to back my argument in a corner. That attempt failed.

You also wrote:

You would not have asked me to disprove your false claim if you had sufficient proof yourself. You dodge the issue because you can not defend it with any facts.

Would anyone really ask someone else to defend their “false claim?” I find this kind of fustian tiring and intellectually dishonest. You found pro-ACA sources that claim there are other reasons why the Administration pushed back the mandate, but you failed to offer anything of substance to refute that four years should be sufficient for anyone to hone reporting issues.

You wrote,

I am sorry, Howard” but “propose a smarter system,” refers to employer reporting methods and does not imply the mandate or the entire bill is a failure.

Quill, I gotta tell you – I don’t have a good feeling about your ability to discuss a subject without twisting another’s words and meaning.

I assert that the bill is a failure due to many factors, I simply pointed to the pushback as evidence that it’s failing.

I don’t have a lot of time to play games with you, Quill. You’re using this Administration’s talking points to make your case and that’s akin to someone claiming the Bible is the truth – because the Bible says so.

Some of us look past the political rhetoric to what’s underneath. Some of us are experienced in business and have seen fiscal messes before. Some of us recognize the red flags.

You can tell me until you’re blue in the face that I’m not proving my claims, and while that might make you feel better – it won’t change what’s happening.

Time will prove my claim, my friend.

Wait and see.Hello Howard.

You are the one who made the claims:

”I will tell you unequivocally that this bill will fail. It is fiscally unsound. It is not fixable.”

After plowing through all of your rhetoric and anecdotes…

You have not provided numbers that prove the bill will fail!

You have not provided calculations that prove the bill is fiscally unsound!

You are unable to provide any official assessments showing the ACA fully funded and implemented can not be tweaked!

Yes, Howard, you have failed to prove your claims. This is about all your readers and I need to know. You treat your opinions as if they are genuine facts. They are not. You treat your opinions as if they are superior to the opinions of others. They are not. You have no choice but to hope that time bails you out.

My best wishes, Howard.

It's a prediction, Quill, and I stand firmly behind it.

I offered my reasoning, but that failed to appease you. You directed readers to commercial insurance sites and I redirected them to the government site and the calculator used by Health.gov. I asked readers to use the calculator and see for themselves. I linked you to the article stating when Obama waived the out-of-pocket cap.

You're not paying attention, Quill, but that's your right. Of course my prediction is my opinion, but it's an opinion based on solid fiscal practices that I've used throughout my career.

No one has to prove an opinion, Quill, although I've thoroughly explained why I made the prediction. You engaged in "the Bible's true because the Bible says it's true."

Now, I'm going to make another prediction. I predict that when the ACA shells, you're going to blame its failure on conservatives enacting roadblocks. I predict you will miss the bigger picture that the bill wasn't fiscally sound. I also predict that you will not understand that conservative lawmakers who opposed the bill did so because the constituency that elected them - asked them to.Take a look, Quill.

http://www.youtube.com/watch?v=Q4dX0i5Nn68

That I will be fined for not having health care is not acceptable to me.

Nor should it be for anyone in a free country.

Yet, it is for so many.

Why?So, if you break your leg, you were just planning on paying out-of-pocket? Or were you just going to let the hospital foot the bill (lol i maed a joak) because they're legally-obligated to help you?

Either way, that's pretty stupid.I pay for my own health care.

already.

- but, if I cannot afford it, I do not want to be fined. I'll just pay cash and get the cash discount. If healthcare insurance was lower for all, we could all afford it just fine.If we all did the same - and we kicked the insurance industry to the curb - health care would be much more affordable.

As it is - the ACA is in bed with AIG and Big Pharma.Healthcare would indeed be cheaper without insurance. What is the profit margin of those companies? 6-7% on a long term, multi year basis? That's what the cost would fall by, plus a little more as providers won't have to hire special people to deal with it

More important than that small decrease in costs, would be the gain in care itself without an insurance company second guessing the doctors in an effort to have a better bottom line..I think it would actually fall closer to 50%, but that's just a guess. Their reported profit margin does not indicate what they pay their CEOs, sales reps, and their overhead, all of which must be paid for by consumers who purchase a policy or pay a fine for not being able to do so.

I also agree on the insurance company second-guessing the doctors.A very poor guess if you think medical insurance companies are showing a 50% profit margin.

Income minus costs (including CEO salaries, sales rep salaries, and payments to doctors) is profit. So yes, the profit margin includes deductions for CEO salaries.I don't think they're showing a 50% profit margin, I'm estimating the savings patients would see if we kicked the insurance companies to the curb and cut out the middle man.

We still have to pay what they deem "overhead," which is subtracted from their gross receipts as a cost of doing business. But the entire amount gets paid for through premiums, co-pays and deductibles.

As a comparison, my business is construction. If I charge a client $10,000 to build a porch expansion on a stem wall, the materials might cost $5,000, the excavator I sub out might be $1,500 and my crew's wages might be $2,500, bringing my costs to $9,000. I tack on 10% and that $1,000 goes to pay my salary, minus things that are deductible, like fuel, depreciated use of my truck and equipment. When it's all said and done I can claim I only made $750 dollars - or 7.5% profit.

But - the customer STILL had to pay twice as much as what the actual materials would cost.

Same thing with healthcare. A doctor's bill might be only $1,000, but in order to pay the insurance company that has a large building with utilities, taxes, company automobiles and employees to pay, that insurer is going to set the cost for the medical procedure at $2,000 - or more. After paying overhead, the insurer can claim that they only realized a 7% profit.

It's just a way of crunching numbers. If the insurance company wants to lower its profit margin, it can host a massive party for staff (like AIG has done by renting islands to the tune of 3 million dollars), which comes out of the profit margin. Then, they can say that they only showed a 5% profit for that year.

That's how it works. They reinvest the profits or increase expenditures to keep from showing a larger profit margin. Because that means more money to the IRS and less to play with.

At any rate - without the insurance company padding the bill, I'm estimating the cost would be about half what it is now.Gotcha, and you are correct.

The only problem is who will verify the charges if not insurance companies? Certainly, consumers are not competent to check the validity and amount of everything being charged on their hospital bill. (Neither is the insurance company, but a combination of the two is).That's a good point and I don't have a good answer. Some sort of oversight, as you say, would be needed.

Me neither, and I wonder how good of job they do anyway. Many years ago (30+) I used to have the hospital send me the bills and I would fill out the insurance for and forward them to the insurance co. I do not recall EVER seeing the insurance question a charge although I do remember alerting them to some charges that were for procedures never done.

Just wondering, but is adding new rules mid game (January ) helpful?

A fiscal mess is what happens to a person whose employer does not provide insurance. I am very happy that these people will soon have health insurance that a working class person can actually afford.

And that includes freelance writers. The insurance options up until now have been utterly unaffordable for one person, let alone for someone with a family.I think you're in for a surprise, Psycheskinner. But I hope you will be one of the fortunate few.

Best guess at this point, with the websites still not open, is that I'll get insurance for around $300 per month. If I cut out a few groceries that becomes affordable.

Unfortunately the newspaper tells me that many states (maybe including mine) will have an out of pocket limit of a little over $5,000 for my family of two. Very quickly taking the cost of health care OUT of any possible meaning of the world "affordable".That's an out-of-pocket limit that does not include premiums, so tack an additional $3,300 to the $5,000 per year tab.

But, that's actually looking on the rosy side of things. Because, there is not limit. Not at present anyway. Obama waived it.

https://www.wsws.org/en/articles/2013/0 … l-a14.html

The "unaffordable" just got even MORE unaffordable.

This President will not be remembered kindly in the annals of history.That's correct, somewhere around $8500 per year for health care for 2 people. That is NOT affordable to a great many people today.

Throw in the inevitable other costs not directly related to health care - time off work, travel to doctor/hospital, ambulance/emergency air travel, extra child care, a new nighty for the little girl going in for minor surgery and the cost escalates to a figure very few people can actually afford if paying for it themselves.

Related Discussions

- 152

Obamacare increase the avability of healthcare in what ways?

by Judy Specht 9 years ago

I have been listening to how the government has a billion dollars for getting people to sign up for the Affordable Healthcare Act. Would that money have been better spent training more doctors and building new hospitals? New Jersey has closed how many community hospitals in the last few...

- 296

FREE HEALTHCARE OR AFFORDABLE HEALTHCARE

by vshining 16 years ago

We all know affordable healthcare in America do not exist and it's sad because America is suppose to be the land of the plenty, but yet we have people dying because they can't afford healthcare.I appreciate the President for wanting to help the poor and middle class people that can’t afford...

- 7

How is the Affordable Healthcare Act known as "Obamacare" actually raising healt

by Sue B. 11 years ago

How is the Affordable Healthcare Act known as "Obamacare" actually raising healthcare costs?I have been hearing those arguing against the Affordable Healthcare Act state over and over again that this act is raising healthcare costs. I have not found how the act is directly...

- 16

Affordable Healthcare

by Glen Rix 7 years ago

As a British citizen who has benefited throughout my life from health care provided by the State by means of the collection of income tax, I can’t figure out why affordable healthcare is such a big issue in American politics. The U.K. National Health Service may be struggling a little at present...

- 75

Obama Care and State Exchanges

by Mike Russo 12 years ago

How is your state doing with Obama Care State Exchanges? Read this article about how the California State Exchange is going to help lower premium costs.http://thinkprogress.org/health/2013/05 … ng-points/

- 91

ObamaCare

by edita 13 years ago

Do you think ObamaCare is constitutional? Why?