Stop Tax Cheats : petition

https://actionnetwork.org/letters/tell- … tax-cheats

The Treasury Department has opened up a public comment period, which closes Monday, August 7. We need your help today to demand that big corporations pay their fair share of taxes.

Submit a comment directly to the Treasury Department to defend the “earnings stripping” rule, which ends one type of manipulative financial arrangement used by multinational corporations―like Pfizer―to dodge taxes.

I want corporations to pay their fair share of taxes so we have the resources needed to invest in rebuilding our roads and bridges, making college affordable, researching new medical cures, and ensuring a secure retirement for seniors. These investments will help working families and make our economy stronger.

That's why I support the current "earnings stripping" rule, which is designed to discourage U.S. firms from doing an inversion. That’s when a U.S. corporation buys a foreign company in order to change its address, usually to a tax haven, to dodge U.S. taxes. The rule ended one type of manipulative financial arrangement multinational corporations use in an inversion to dodge taxes.

When a U.S. company inverts the new foreign parent company shouldn't be able to load up its American subsidiaries with unnecessary debt to take a tax deduction to reduce its U.S. taxes. It's outrageous that they can get a tax deduction here while shifting their profits to a low-tax country and avoid even more U.S. taxes. Thankfully, the existing rule stops this scam. I urge you to maintain the current "earnings stripping" rule.

https://taxmaks.wordpress.com/2013/01/2 … ing-rules/

The U.S. earnings “stripped out” in the form of interest payments on the debt would result in the erosion of the U.S. tax base because the U.S. subsidiary would receive a U.S. tax deduction that reduces its U.S. taxable income and the interest paid to the foreign-based parent corporation may not be subject to U.S. withholding tax (or subject to a reduced rate) under various income tax treaties.

As usual, that "fair share" goes undefined somehow. Would you care to expand on what a "fair share" is, bearing in mind that we have nearly the highest corporate tax rate in the world, and that that money being taxed will be taxed again when it goes to the owners - effectively taxing the owners of the corporation twice on the same income?

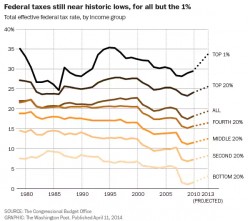

"Highest corporate tax rate in the world" is a typical Fox News propaganda claim. The reality is that our actual tax rate is comparable to other countries.

https://www.cbpp.org/research/federal-t … -countriesHaven't we had this discussion in a slightly different form, comparing taxes on the rich from decades ago to current? And finding that the actual amount being paid was lower then than it is now?

But the comment was nearly the highest, and it wasn't limited to only a comparison between 7 countries.

https://taxfoundation.org/us-has-highes … -rate-oecdThat link does not show the effective rates. It simply states that we have the highest statutory rate. The actual rates are much lower after the various credits, deductions and accounting tricks.

The same is true of personal rates. They are near historic lows, at least going back to the 1970s.

Odd - what I'm reading is that the rich are paying more than ever before. Effective, that is, not top rate. Perhaps it has something to do with half the country paying nothing, lowering the average far below normal while putting all the onus of supporting the country on the "rich"?

Maybe we ought to be looking at taxes taken in as a percentage of GDP? And who is paying them?

No, I do not wish to define fair share. Pehaps you know more than I do and you can explain it to me! I'm not a corporate tax expert like yourself are.

Leaves the statement kind of empty, then, doesn't it? After all, corporations are already paying at least double their "fair share"...if we define "fair share" as half what they're paying.

Thanks for bringing this to our attention. No use asking wilderness to define 'fair share'. As far as he is concerned, we are stealing from him via taxes - LoL!

Then "Fair Share" must be like porn... you can't define it, but you will know it when you see it. ;-)

Why is that such a hard question for folks that demand it?

Could it be compared to asking how much water it takes to properly fill a pool - you don't know, but keep pouring it in and you will say "when", (aka "fair share"), when you think it is filled to the proper level?

GAThere is not standard by which to set it, so it becomes arbitrary and a matter of opinion. It's also increasing controlled by whoever spends the most money on campaign contributions.

Finally, an honest answer. Especially the "matter of opinion" part. At least your answer establishes a baseline that must be determined before any "fair share" conversation can have any validity.

GAAgreed. Claims and petitions to demand "fair share" from others (why is it never demanding that the speaker be required to pay a "fair share?"

should be accompanied by a figure.

should be accompanied by a figure.

Come, sign the petition to make corporations pay 100% of profits!

Corporations should pay 75% of whatever they take in!

Or whatever the speaker thinks is "fair" - this way the petition isn't being given a different meaning by everyone that signs it.

Related Discussions

- 17

What Is A "Fair Share" Relative To Taxes?

by ga anderson 10 years ago

Much is heard of a demand that corporations and the wealthy pay their "fair share" of taxes, but I have heard little of what that share should be.With only a single restriction; that the discussion is about legal tax actions, what should that "fair share" be?One could say that...

- 55

Would you support a flat 15% income tax?

by Alex J. Reissig 13 years ago

Would you support a flat 15% income tax?Would you support a flat 15% income tax in this country? Other than a personal deduction (possibly in the neighborhood of 25k per individual/50k per couple) there would be no deductions.

- 19

Middle class screw job, MAGA = Winning? Taxes plan

by ptosis 8 years ago

Tell Congress: Tax reform should help working families, not millionaires!https://petitions.signforgood.com/prote … orgood.com Want a new house? If you're in a big city or a blue state, you'd be screwed. It limits the mortgage tax deduction of $500,000 for new home purchases....

- 53

What Does It Mean for The Wealthy to Pay Their Fair Share of Taxes?

by Scott Belford 5 months ago

This topic has come up recently across several forums, so I though I would start on specifically for this subject.The question comes up when mainly Democrats and some Independents complain that the wealthy do not pay their fair share in taxes. The rebuttal ranges from they already do to why should...

- 330

Why raising taxes on corporations is BAD

by Nickny79 16 years ago

Issue: Why raising taxes on corporations is BAD economics and does NOT serve any social justice:1. when gov't raises taxes on corps., corps. don't pay more money, CONSUMERS do with increased prices that account for the increased cost of doing business. 2. when gov't raises taxes...

- 29

A New Clue About What A "Fair Share" Is For Wealthy Folks

by ga anderson 4 years ago

I haven't heard any politician or political operative ever answer the question of what is the `fair share' of taxes that they think the wealthy should pay. No one ever says. We just get the Buffet argument. Quickly willing to define what isn't a fair share, but only a hmm . . . when asked about...