Thanks to Trump, government borrowing leaps to $1 trillion this year

- promisemposted 7 years ago

0

Trump's new tax law that deeply slashes taxes on rich people and large corporations will force an 84 percent increase in government borrowing this year to nearly $1 trillion.

https://www.washingtonpost.com/news/won … 3d92970ec3

As a fiscal conservative and former Republican, I'm appalled once again at the total corruption of the Republican party and its principles. The party serves only the rich to the detriment of our country.

How can anyone support the GOP and Donald Trump while claiming to be a conservative?Odd. All the projections I've seen are that it will increase the national debt by 1.5T in 10 years: that doesn't fit very well with 1T in the first year.

But whether it's an accurate guess or not, seems that we badly need to cut spending, doesn't it?

(Was there a reason that the tax cut for the middle class wasn't included in the reasons for additional debt?)The article refers to borrowing in a single year. The total increase in borrowing is $426 billion. To your point, it begs the questions of whether the debt estimates were too low.

To my point, do you think the tax law is fiscally responsible if the national debt skyrockets?

Yes, there is a reason that I didn't mention the middle class. Their tax benefit isn't meaningful.

The $50,000 to $75,000 range will see an average tax change of $870.

Millionaires on average will get an extra $69,660 boost. Those with less than $10,000 will get an extra $10 to play with.

"To my point, do you think the tax law is fiscally responsible if the national debt skyrockets?"

Possibly. Don't forget, we're not operating under Trump's budget, but that of Obama. Let's see what next year's budget (and actual spending) is before we make the call that a tax cut was fiscally irresponsible. As well as what actual tax receipts this year are.

"Millionaires on average will get an extra $69,660 boost. Those with less than $10,000 will get an extra $10 to play with.

So 10000 millionaires get an extra $70,000. And 100 million middle class wage earners gets 1,000. Which one adds more to the debt? (Hint: one is measured in the millions and the other in the billions. And it isn't the millionaires that are in the billions.)

(not that I believe that 70,000 figure; the median millionaire has 1.6M in wealth and earns $250,000 on the average. Even if their tax bill is cut in half (it wasn't) then they DID owe $140,000, or 56% in federal taxes. Didn't happen. And the earner with 10,000 income got exactly zero as they didn't owe anything anyway.)

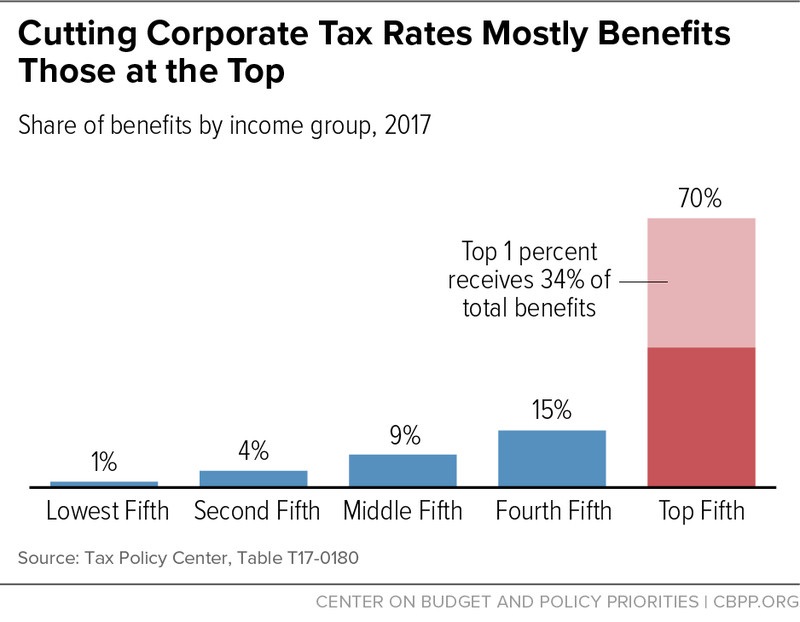

I'm pretty skeptical of anything written in the Washington Post and generally try to avoid it as a news source. The CBPP appears to have a reasonably diverse board of directors -- though I'd have to put in significant due diligence to dispel biases. With the top 1 percent receiving 34% of total benefits, I have a feeling that our corruption problems will only deepen. More laws will serve profiteers rather than the American people, leaving us deeper in debt with a weaker dollar. I see a lot of argument lately that the Fed can print all the money it wants and that we can never go broke as a country. While that may be true in a way, if we have dollars being printed willy-nilly, we'll be lucky if they are worth the cost of the paper.

Related Discussions

- 119

One Big Beautiful Bill or a Ball of BS?

by Willowarbor 2 months ago

On Tuesday, Trump lauded a House budget blueprint that may enable Congress to pass much of his legislative agenda in what he called “ONE BIG BEAUTIFUL BILL.” That budget, which passed a committee vote and could hit the House floor as soon as next week, lays out targets for legislation that would...

- 15

Trump vs. Harris . . . economic plan, deficit, and debt.

by tsmog 12 months ago

How the Plans of Kamala Harris and Donald Trump Could Affect the Deficit by Investopedia (Sept 17, 2024)https://www.investopedia.com/trump-harr … on-8710401The bottom line . . ."According to separate analyses by nonpartisan think tank the Committee for a Responsible Federal Budget and...

- 41

Biden Proposed Tax Hikes for 2025

by Ken Burgess 2 months ago

Details and Analysis of President Biden’s Fiscal Year 2025 Budget Proposalhttps://taxfoundation.org/research/all/ … proposals/The Biden Tax Hike Will Likely Exceed $7 Trillion https://gop-waysandmeans.house.gov/the- … -trillion/Biden Tax Resource...

- 1071

Thinking about how to vote in 2024? I Am!

by tsmog 14 months ago

We all know it will be party-line loyalty for most voters. According to Pew Research, six percent of voters for the 2022 elections crossed party lines. For the mythical independent voter, it is a binary choice for the President. We are fortunate to be able to assess two Presidents based on criteria...

- 142

What is your opinion of President Obama, the President, not the man?

by Jack Lee 8 years ago

It has been almost a year since he left office. Though he seems to stick around DC and make his comments occasionally about policies...The question I have for all is this - what is your opinion of this President in his 8 years in office...?Overall, has he been good or bad for America?Please use...

- 31

The Trump Purges: Retribution or Necessity

by ga anderson 7 months ago

Instead of getting a morning chuckle, this one opened a whole can of confirmation bias. And that's not a good thing. Amid all of the headlines about Pres. Trump's deep state/retribution 'purges', I stumbled across a new O'keefe 'undercover' film. My perception of O'keefe isn't positive, but...