One Big Beautiful Bill or a Ball of BS?

On Tuesday, Trump lauded a House budget blueprint that may enable Congress to pass much of his legislative agenda in what he called “ONE BIG BEAUTIFUL BILL.” That budget, which passed a committee vote and could hit the House floor as soon as next week, lays out targets for legislation that would extend tax cuts and increase the federal deficit. It would also almost certainly make major cuts to programs that serve the poor.

The Cuts

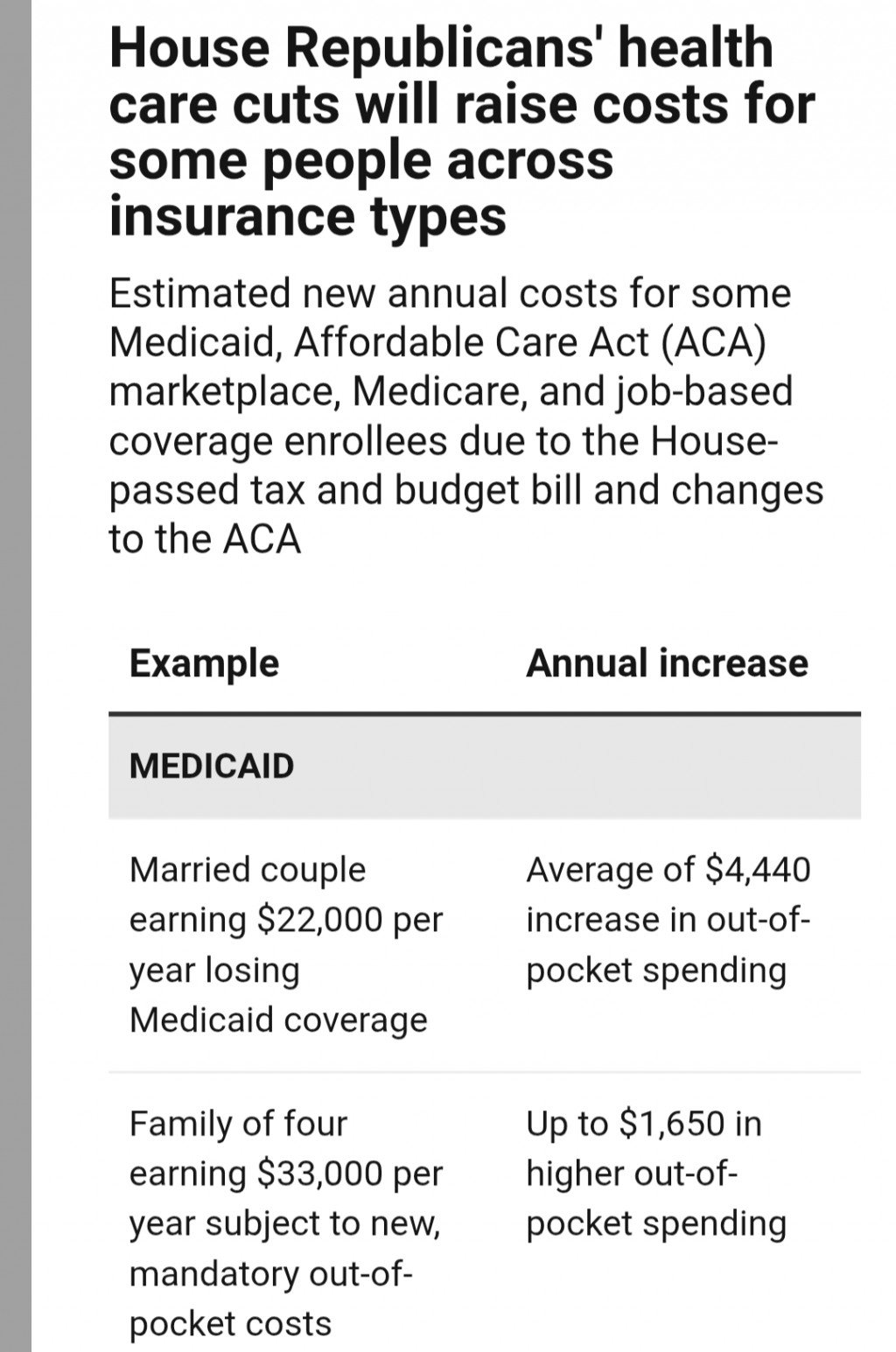

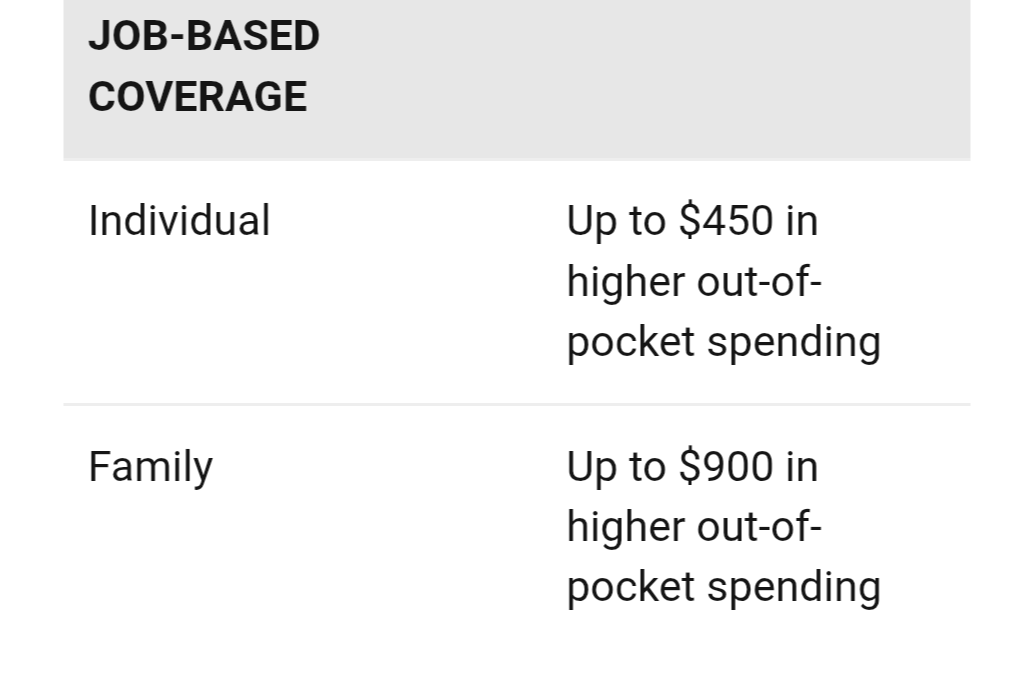

Medicaid is likely to be the largest target for cuts to achieve the $880 billion in budget savings set out in the legislation.

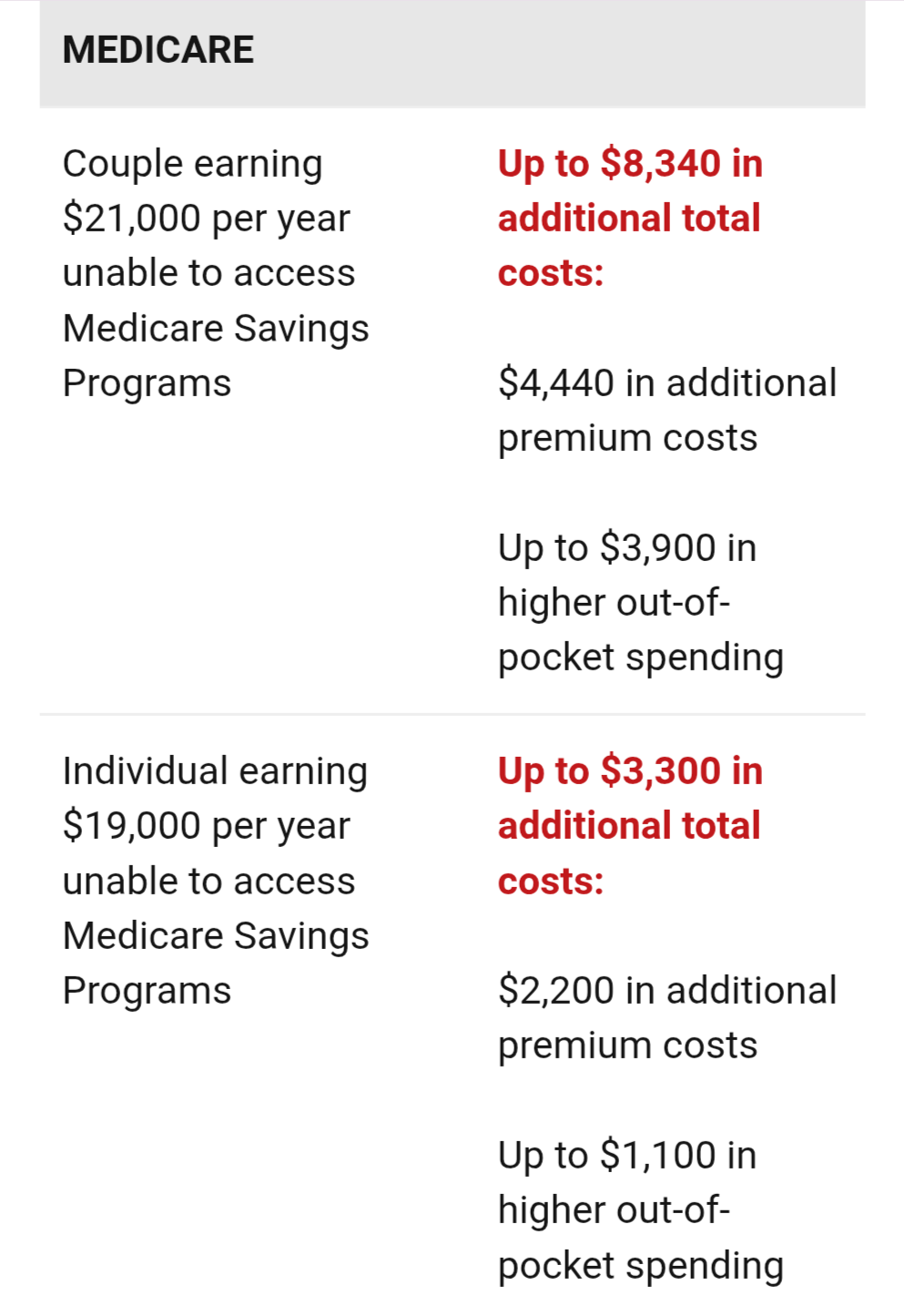

But the committee also has the ability to include cuts to Medicare, and may also be able to find some savings by reversing Biden-era regulations.

Education and Work Force

Cut by at least $330 billion...

The instructions could require cuts to nearly half of all spending on programs the committee can consider.

The biggest category of spending for the committee is school nutrition programs. The budget document also suggested some cuts to school breakfasts, and to lunch programs for schools that serve low-income children.

Agriculture

Cut by at least $230 billion

The bulk of the spending overseen by the committee is on food benefits through the Supplemental Nutrition Assistance Program, and most of the rest is on farm programs like crop insurance. If the cuts hit the programs overseen by the committee equally, it would amount to a 13 percent cut. If they were directed to SNAP alone, that would amount to a 21 percent cut.

Spending increases:

The budget also includes a small amount of increased spending, primarily focused on border security and the military.

The largest spending item:

Tax cuts

Up to $4.5 trillion in tax reductions

Extending $4 trillion in expiring tax cuts passed during the first Trump administration represents the biggest policy priority in the bill, both in emphasis and dollars.

The budget would allow the tax-writing Ways and Means committee to decrease federal revenue by as much as $4.5 trillion over a decade, an allowance that may mean new tax cuts, too.

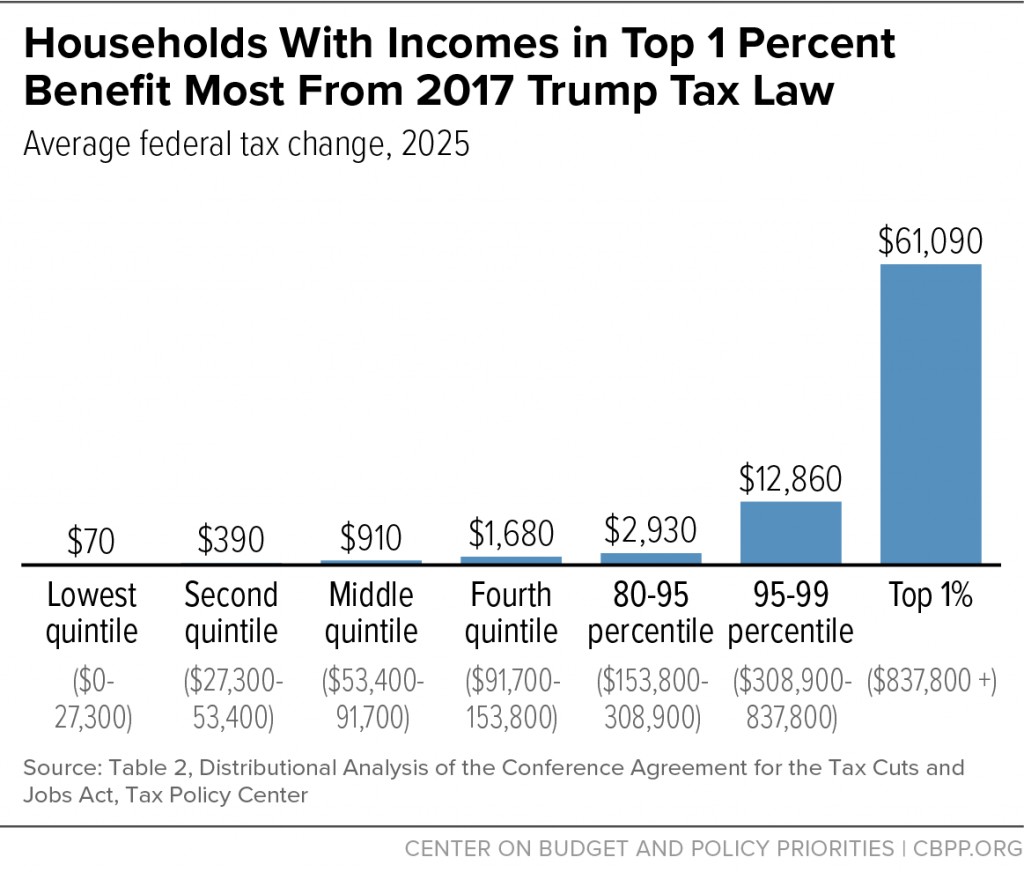

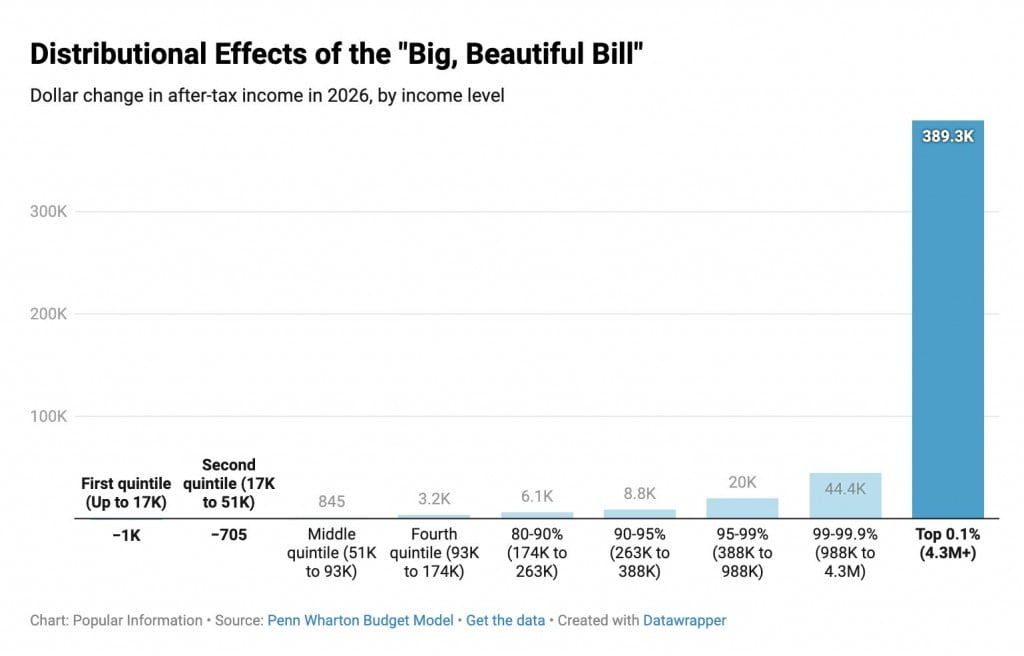

The tax cut extension benefits the wealthiest taxpayers the most, in raw dollars and as a share of their income.

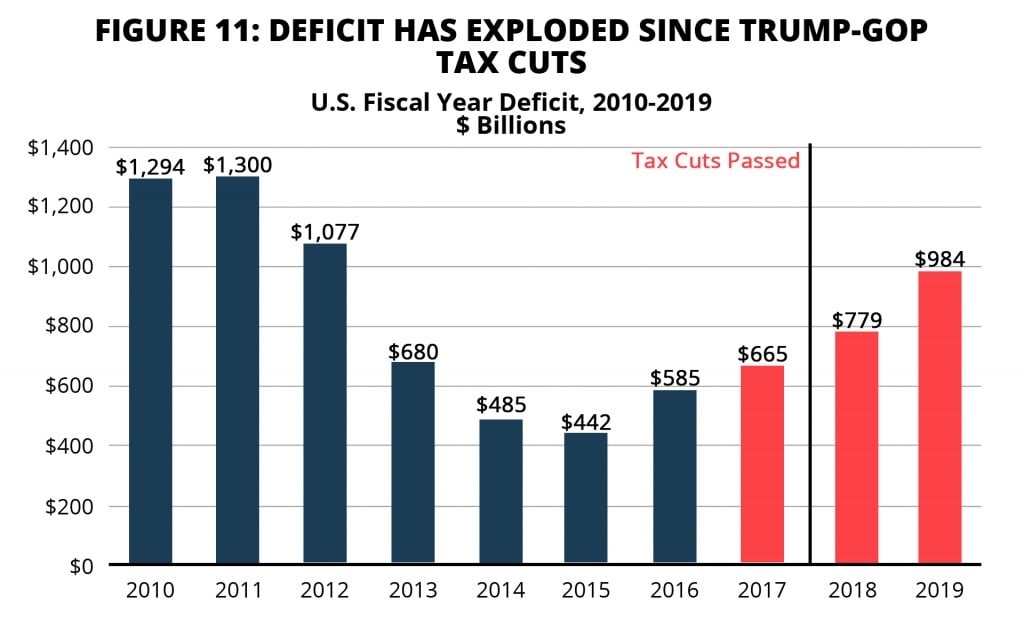

Deficits and debt

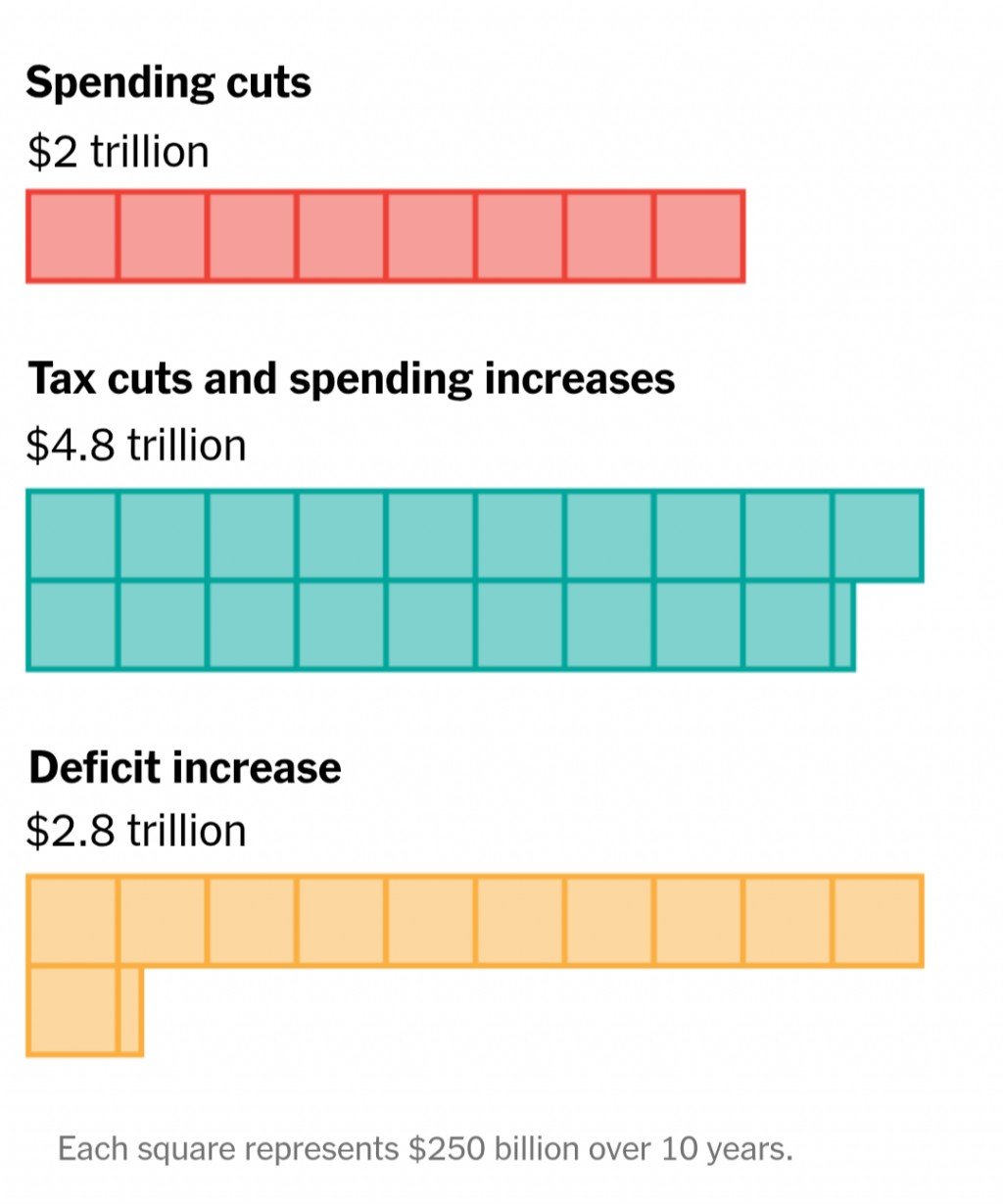

Because the tax cuts and spending increases significantly outweigh the spending cuts in the budget, it would directly add $2.8 trillion to deficits over the next 10 years. (It could ultimately add an estimated $3.4 trillion to the national debt because of the costs associated with increased borrowing.) Tables released with the House bill assume aggressive economic growth that would help cover the bulk of this increase, but budget experts say the assumptions are unrealistic.

Also included in the bill: a $4 trillion increase to the debt limit.

For me, This budget plan reflects a stark betrayal of Trump’s campaign promises to protect families who struggle financially while providing tax windfalls for the wealthy...“For me, This budget plan reflects a stark betrayal of Trump’s campaign promises to protect families who struggle financially while providing tax windfalls for the wealthy...”

We could all have seen this months before Trumps election without looking. Many of the dupes that voted for him will feel the pain as this budget will adversely affect them. It will be no less than what they deserve. The only sad part is that innocents will be within the blast radius.

So much for the BS of the Republicans being the fiscally responsible party…..Doge running around indiscriminately slashing at programs and agencies is all in service of making this ludicrous budget seem palatable to people. I think it will fail in this form. Republicans are already quivering in their boots to bring this garbage to their constituents. We will see what they will be able to get over on the American people . The resistance is growing though.

The resistance is growing though.

Cheer me up, where do you see resistance?Well we have some Republicans voicing concerns, going on record opposing the drastic cuts to Medicaid. And in the last few days there has been quite a backlash at Town Halls in Republican districts. The representatives are being blindsided by angry constituents that are spilling over into overflow rooms. Lots of heated exchanges concerning Musk's role, Trump's overreach and broken promises.

Rep. Rich McCormick (R-Ga.) faced a large and testy audience at a town hall on Thursday, with Reps. Cliff Bentz (R-Ore.), Stephanie Bice (R-Okla.) and Scott Fitzgerald (R-Wis.) also getting heated questioning.

Swing-district Reps. David Schweikert (R-Ariz.), Ken Calvert (R-Calif.), Scott Perry (R-Pa.), Tom Kean Jr. (R-N.J.), Mike Lawler (R-N.Y.), Ryan Mackenzie (R-Pa.) and Bryan Steil (R-Wis.) all had demonstrations outside their offices.

A lot of folks saying we didn't vote for THIS

https://www.nbcnews.com/politics/congre … rcna193164

https://www.newsweek.com/republicans-ra … al-2034011

Adding to with what I have read recently

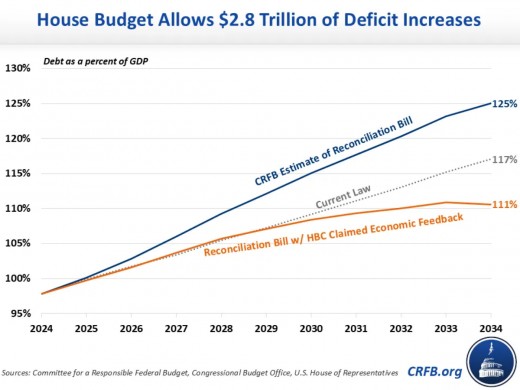

House Budget Allows At Least $2.8 Trillion of Deficit Increases by The Committee for a Responsible Federal Budget (Feb 21, 2025)

https://www.crfb.org/blogs/house-budget … -increases

"The House of Representatives will soon consider a budget resolution for Fiscal Year (FY) 2025, which was reported favorably out of the House Budget Committee on February 13. The budget’s reconciliation instructions pave the way for a bill that could add at least $2.8 trillion to deficits through FY 2034, or $3.4 to $4 trillion of debt including interest costs.

In this piece, we explain that:

** The marked-up House budget allows lawmakers to add at least $2.8 trillion to deficits through FY 2034 or $3.4 trillion including interest.

** As a result of this debt increase, debt held by the public would reach 125 percent of Gross Domestic Product (GDP) by FY 2034, compared with 117 percent under current law.

** Deficits under the House budget would average 6.8 percent of GDP over the decade, compared with 5.8 percent under current law.

This entire rant is built on speculation, assumptions, and worst-case scenario predictions without actual evidence. First, Trump has been in office for only a month, and none of these proposed changes have been enacted. A House budget blueprint is not the same as actual legislation, and Congress still has to negotiate and pass any spending plans. Claiming that this budget is a "betrayal" of Trump's promises is premature at best and disingenuous at worst.

The claim that Medicaid will face massive cuts is based on a general budget outline, not finalized policy. The reality is that budget plans often suggest potential savings, but that doesn't mean every proposed cut will happen as written. Similarly, the claim that school nutrition programs will be slashed is another assumption. There’s a huge difference between suggesting budget adjustments and gutting essential services. The idea that Trump’s administration is going after low-income school lunches is an emotional appeal rather than a factual argument.

The tax cuts argument is also misleading. Tax relief is a fundamental part of Trump’s economic plan, designed to stimulate growth and benefit businesses and workers alike. The notion that tax cuts only benefit the wealthy ignores how they impact job creation, wages, and investment. Moreover, projections about deficits and debt are based on economic models that often fail to account for the positive effects of economic expansion. Trump’s policies in his first term led to significant economic growth, and similar strategies are being pursued again.

This entire critique assumes that Trump's supporters didn’t expect him to pursue these policies. That’s simply not true. His base elected him precisely because they wanted tax cuts, stronger border security, and economic policies that prioritize growth over government handouts. Jumping to conclusions about what will happen a decade from now while ignoring the full legislative process is nothing more than political fearmongering. Let’s deal with actual results, not doomsday predictions. Your OP offers no soucres.Do you take issue with the data presented by Willow? Being factual and looking at the big picture, only you are saying that it is "emotional". Prove that the information she presented is incorrect before an attack on its content. Why is it wrong beyond your just saying so?

Doesn't everyone (take issue with the "data")? Does anyone, even you and Willow, actually believe that Trump will reduce income twice what he reduced spending, after making such an issue of cutting our deficit?

Where is your evidence to refute it or is just more of YOUR OPINION?

My opinion? I merely asked if anyone could believe the fairy story, with no indication that it was not true.

How about you? Do you actually think Trump has that in mind? I mean yes, TDS may be strong, but it doesn't take a genius to understand that it won't work...and regardless of TDS Trump is not stupid."How about you? Do you actually think Trump has that in mind? I mean yes, TDS may be strong, but it doesn't take a genius to understand that it won't work...and regardless of TDS Trump is not stupid."

I don't trust anything Trump says. Trump is stupid in my opinion. I am going to trust the New York Times data over fabrications from Trump and the Right.

"Do you take issue with the data presented by Willow? Being factual and looking at the big picture, only you are saying that it is "emotional". Prove that the information she presented is incorrect before an attack on its content. Why is it wrong beyond your just saying so?" Cred

I take issue when statistics are quoted without a source or when someone presents them as their own view. I have no problem with opinions on a given subject or sourced data that can be critiqued, especially when it comes to budget predictions. Not all economists are created equal—history has shown that many left-leaning economists predicted Biden would have a stellar economy, and we’ve seen how that turned out. I don’t need to prove anything—that’s Willow’s job. I didn’t attack her view; I debated it and presented a different perspective. You ask, “Why is it wrong beyond your just saying so?” Well, why is hers right just because she said so? It’s clear that Willow and I have very different mindsets, and frankly, it seems you align much more closely with her perspective, as shown by the analogy I just shared.https://www.nytimes.com/interactive/202 … print.html

Sharlee, you have to excuse me for favoring the information as presented by the "Grey Lady", New York Times, a professional and credible source of journalism, over the contrary opinions of Wilderness and yourself, which you can't or won't substantiate. Her "say so" is more correct than yours because it is supported by a reputable journalistic source, where's yours?

Beware, there may well be a formidable pay wall between you and the article.

I am satisfied with the direction the economy was taking during the Biden term and identify what negatives there were to the term of his predecessor. But, again that is just my opinion

And, yes, I share her perspectives in this matter and see Trump as a total fraud.

So, where's the beef, Sharlee?You may have been satisfied with falling real incomes, with inflation going back up, with a gradual (or sometimes quick) decrease in our standard of living under Biden.

Most of us were not."Sharlee, you have to excuse me for favoring the information as presented by the "Grey Lady", New York Times, a professional and credible source of journalism, over the contrary opinions of Wilderness and yourself, which you can't or won't substantiate." Cred

Where are you going with this? Talk about a diversion... I never questioned the author's credibility as a journalist. The article was an NYT op-ed—keyword, 'op-ed.' I simply debated the viewpoint. and lacked sources. Keyword debated.

Here is my comment regarding the article--- I take issue when statistics are quoted without a source or when someone presents them as their own view. I have no problem with opinions on a given subject or source data that can be critiqued, especially when it comes to budget predictions. Not all economists are created equal—history has shown that many left-leaning economists predicted Biden would have a stellar economy, and we’ve seen how that turned out. Sharlee

I have no beef--- In my view, some here have come to not respect any form of debate where others share their views that conflict. My re[ly to Willows OP was nothing but a very, actually lightweight debate. It is hard to communicate with the leftists here on HPs. Just my view, but some don't want to debate. This is very, how can I even say this, odd.

What happened to no tax on tips and no tax on social security? Did I miss something or those things didn't make it into the budget?

Odd?

This is not an opinion piece where am I missing that it was labeled as such?

https://www.nytimes.com/interactive/202 … print.html

You are certainly welcome to debate the points raised in the article. Certainly welcome to provide anything that refutes those points.Could you add sources that dictate facts? I am not interested in the predictions represented. This is why the piece is an OP. It represents views, of what could come from economists. The article you posted presents a perspective on what COULD happen if the House successfully passes the proposed bill containing Trump's agenda, but it doesn’t reflect any form of reality that has or will fully come to fruition.

It's essentially speculative, outlining the potential provisions and consequences, an 'if come". The article provides an analysis based on current discussions, views, and proposed plans, but until the bill passes and is enacted, it remains a prediction or outlook on what might come to be. And as I mentioned we saw all these types of predictions in Bidens first weeks, and before each of his legislation was passed--- we all know how off the predictions were. That is those that followed predictions.What source do you find acceptable?

The First source from the New York times, did not offer predictions it simply outlined what was in the bill. Which coincides with every other source I've seen .

Since when do we not follow the predictions of experts?When one presents nothing but what could happen, on a bill that no one has seen, that is called predicting. When one predicts they share their opinion. The NYT posts a large majority of OP's.

I visited your thread, I joined in and critiqued then debated the NYT article.--- Here is my first post, in which my context indicates I sharing my view. ----

This entire rant is built on speculation, assumptions, and worst-case scenario predictions without actual evidence. First, Trump has been in office for only a month, and none of these proposed changes have been enacted. A House budget blueprint is not the same as actual legislation, and Congress still has to negotiate and pass any spending plans. Claiming that this budget is a "betrayal" of Trump's promises is premature at best and disingenuous at worst.

The claim that Medicaid will face massive cuts is based on a general budget outline, not a finalized policy. The reality is that budget plans often suggest potential savings, but that doesn't mean every proposed cut will happen as written. Similarly, the claim that school nutrition programs will be slashed is another assumption. There’s a huge difference between suggesting budget adjustments and gutting essential services. The idea that Trump’s administration is going after low-income school lunches is an emotional appeal rather than a factual argument.

The tax cuts argument is also misleading. Tax relief is a fundamental part of Trump’s economic plan, designed to stimulate growth and benefit businesses and workers alike. The notion that tax cuts only benefit the wealthy ignores how they impact job creation, wages, and investment. Moreover, projections about deficits and debt are based on economic models that often fail to account for the positive effects of economic expansion. Trump’s policies in his first term led to significant economic growth, and similar strategies are being pursued again.

This entire critique assumes that Trump's supporters didn’t expect him to pursue these policies. That’s simply not true. His base elected him precisely because they wanted tax cuts, stronger border security, and economic policies that prioritized growth over government handouts. Jumping to conclusions about what will happen a decade from now while ignoring the full legislative process is nothing more than political fearmongering. Let’s deal with actual results, not doomsday predictions. Your OP offers no soucres.

You have yet to offer any sources that would indicate facts. yes, predictions were given, nothing more. It did offer what was being again predicted to be in the bill. As of February 23, 2025, President Donald Trump's proposed "big, beautiful bill" has not yet been formally introduced to Congress or the public. The authors were working with pure speculation. Which is fine in an OP. I did no more or less than debate their article. As my very first comment indicates.

This is a political forum, when a thread is posted on any given subject it is up for debate or agreement. Hey, Cred took the article as factual, as he shared in a reply.

Regarding The New York Times or any news outlet—if an opinion piece (OP) in The New York Times is not a source itself, the author cannot simply say, "The NYT is my source" as a defense. The NYT publishes a range of opinions, many of which are not fact-based but instead rely on personal interpretation, speculation, or ideology.

The article you posted was ultimately an opinion piece, speculating on what might be in the "Big Bill" and throwing out possible scenarios of what could happen. It was a hit piece—a “Hey, everybody, look what could happen!” piece, meant to stir up panic and get people wringing their hands.What organization would provide an accurate analysis in your opinion

CONGRESS after the bill is presented. Maybe we wait for that... Or maybe just do what the NYT did write a hip piece.

Congress relies on the CBO though... As, I believe, none of them are economists. Sadly, many of them aren't very educated at all.

Trump's tax scheme didn't really work out very well during his first term though did it? It really failed to deliver on its promises. Why would we do something again that didn't work the first time?

I disagree, I did great under Trump's taxes. I will keep it that simple. You see how simple it can be to just disagree with another's view.

You must be in the top 10%?

"Evidence suggests that the TCJA's corporate tax changes failed to produce the promised investment or wage increases for the majority of U.S. workers. The benefits of the tax changes disproportionately favored high-income households and profitable corporations. Claims made by the Trump administration that the average household would see a substantial increase in income did not materialize. Research indicates that earnings did not significantly change for workers in the bottom 90% of the income distribution, while those in the top 10% saw increase.

The TCJA's business tax changes have permanently reduced federal revenues. Claims that the tax plan would pay for itself have not been substantiated. Studies indicate that increases in economic activity only offset a small fraction of the revenue loss attributable to the tax cut.

CBO Finds TCJA Expirations Would Boost The Economy. (2024). https://taxpolicycenter.org/daily-deduc … st-economyThe Tax Cuts and Jobs Act (TCJA) of 2017 introduced significant changes to the U.S. tax system during President Donald Trump's tenure. Here's a detailed overview of its impacts, supported by key sources: Yes, I am in the top 10% due to hard work, and thriving well in my ventures.

1. Tax Reductions Across Income Groups:

General Impact: Approximately 65% of households received a tax cut in 2018, averaging about $1,260. Conversely, around 6% experienced a tax increase.

TAXPOLICYCENTER.ORG

Middle-Income Households: Those earning between $48,000 and $86,000 saw an average tax reduction of $800.

TAXPOLICYCENTER.ORG

High-Income Households: The top 1% of earners, with incomes over $733,000, benefited from an average tax cut of $33,000.

TAXPOLICYCENTER.ORG

2. Corporate Tax Rate Reduction:

Rate Change: The TCJA permanently lowered the corporate tax rate from 35% to 21%.

TAXPOLICYCENTER.ORG

Investment Response: Initial analyses indicated a modest increase in business investments post-enactment. However, studies suggest that the TCJA's corporate tax cuts did not lead to significant wage growth for workers, with benefits largely accruing to shareholders and top executives.

AMERICANPROGRESS.ORG

3. Economic Growth and Employment:

GDP Growth: The U.S. economy experienced a growth rate of 2.9% in 2018, up from 2.4% in 2017. This uptick is partially attributed to the TCJA's stimulus effects.

TAXPOLICYCENTER.ORG

Unemployment Rates: The unemployment rate declined to a 50-year low of 3.5% in 2019, reflecting a robust labor market during this period.

4. Federal Deficit and National Debt:

Deficit Increase: The TCJA significantly impacted federal revenues. The Congressional Budget Office (CBO) projected that the act would increase the total deficit by about $1.9 trillion over the 2018–2028 period.

CBO.GOV

Long-Term Debt Projections: In 2024, the CBO projected that extending the TCJA's individual tax cuts beyond their scheduled expiration would further increase deficits by approximately $4 trillion over the subsequent decade.

TAXPOLICYCENTER.ORG

5. Small Business and Middle-Class Effects:

Pass-Through Entities: The TCJA introduced a 20% deduction for qualified business income from pass-through entities (e.g., sole proprietorships, partnerships, S corporations). This provision aimed to reduce the tax burden on small business owners.

TAXPOLICYCENTER.ORG

Middle-Class Benefits: While middle-income taxpayers received tax cuts, analyses indicate that higher-income households benefited more significantly, both in absolute terms and as a percentage of after-tax income.

TAXPOLICYCENTER.ORG

6. Long-Term Considerations:

Expiration of Individual Tax Provisions: Many individual tax benefits under the TCJA are set to expire after 2025, potentially leading to tax increases for individuals if not extended.

TAXPOLICYCENTER.ORG

Corporate Tax Provisions: In contrast, the reduction in the corporate tax rate is a permanent change, continuing to influence federal revenues and business taxation.

TAXPOLICYCENTER.ORG

In summary, the TCJA provided tax relief across various income levels, with more substantial benefits for higher-income individuals and corporations. While it stimulated short-term economic growth and reduced unemployment, it also contributed to increased federal deficits and raised concerns about long-term fiscal sustainability.

Less have a look at the 1 percenters

The top 1% benefited more from the Tax Cuts and Jobs Act (TCJA) primarily because they earn significantly more money, pay higher absolute amounts in taxes, and disproportionately benefit from certain tax provisions. Since the U.S. tax system is progressive, high earners already pay a larger share of taxes. When tax rates were reduced across the board, they naturally saw greater savings in dollar amounts, even if the percentage reductions were similar for all taxpayers. One of the biggest changes under the TCJA was the reduction of the top individual income tax rate from 39.6% to 37%, which resulted in direct tax savings for wealthy individuals. Since their taxable income is much higher, even a small percentage cut meant tens of thousands of dollars in savings.

Another major factor was the corporate tax reduction from 35% to 21%. The wealthy benefited the most from this change because they own a majority of corporate stocks, meaning their investment returns increased. Additionally, the TCJA introduced a 20% deduction for pass-through business income, which applies to entities like LLCs and S-corporations. Many high-income individuals operate businesses structured in this way, allowing them to shield more of their income from taxation compared to wage earners. The tax law also left capital gains and dividend taxes unchanged, which was significant since investment income is a major source of wealth for the top 1%. Unlike wages, which are taxed at higher rates, capital gains are taxed at lower rates, allowing wealthier individuals to keep more of their earnings.

Another major advantage for high earners came from the estate tax exemption, which doubled under the TCJA. This meant that individuals could pass down up to $11.18 million tax-free ($22.36 million for married couples), allowing the wealthiest Americans to preserve more generational wealth. The absolute dollar effect also played a role—while middle-class taxpayers saw average tax savings of $800 to $1,500 per year, high earners saved tens of thousands simply because their tax liability was much greater to begin with. Even if a middle-class worker and a millionaire received the same 2% tax cut, the millionaire’s savings would be dramatically higher in dollar terms.

Although the wealthy gained the most under the TCJA, supporters argue that lower corporate taxes and business incentives led to job growth, wage increases, and economic expansion, benefiting the broader economy. Critics, however, contend that much of the benefit went to stock buybacks rather than higher wages for workers. While the tax cuts provided relief across various income levels, they ultimately had a more substantial impact on high earners due to the structure of the tax system and the nature of their income sources. Would you like a breakdown of how the tax cuts impacted specific income groups?I feel I also made mine. I went into detail about why the top 1% and top 10% did a bit better but were treated fairly under Trump's taxes. I posted the good the bad, and the ugly on Trump's taxes. Just facts. It is easy to say one did better than another--- but it is also important to know the whys of it.

Its about arithmetic, Sharlee not opinion. Is the breakout that was presented what Trump would prefer be the outcome of the legislative process? Whether he gets his wish or not is speculation, but he made it clear that that what was presented in the Times was his preference.

And it certainly is not mine,....

"On Tuesday, President Trump lauded a House budget blueprint that would enable Congress to pass much of his legislative agenda in what he called “ONE BIG BEAUTIFUL BILL.” That budget, which passed a committee vote and could hit the House floor as soon as next week, lays out targets for legislation that would extend tax cuts and increase the federal deficit. It would also almost certainly make major cuts to programs that serve the poor."

Seems pretty clear cut to me, did I miss something?Yes, you missed me just joining in and giving my view of an article. And it seems some are not willing to just leave it at that --- LOL Ya know liberals just can't take rejection of their views. That is not my problem. I took time to debate what I read. Hey, I guess those who don't care for my view, could keep it simple --- Just say ---"I don't like your view".

No one can do the asthmatic until we see the numbers. No one has seen the bill. We can assume all over the place, but why do that? All about ringing hands... We think differently I don't wring my hands until I find a fact that would get me to wringing my hands.

Trump's big ugly bill will raise taxes on poor Americans and raise costs for the rest of the working class, while disproportionately helping the richest Americans.

This isn't a budget bill. It's a wealth transfer.

This is what an oligarchy looks like.

Tax on tips? Still there.

Tax on overtime? Still there.

Tax on Social Security benefits? Still there.

AND...ALMOST 13 MILLION people will lose health care to give billionaires another tax break.The claim that Trump's proposed “Big Beautiful Bill” is a “big ugly bill” designed to raise taxes on the poor and benefit the wealthy misrepresents the bill's actual provisions. Contrary to the assertion that taxes on tips, overtime, and Social Security benefits remain, the bill explicitly proposes eliminating federal taxes on tips and overtime pay, a move that would directly benefit millions of working-class Americans, particularly in service industries and among law enforcement officers, nurses, and hourly laborers. Additionally, while it does not entirely eliminate taxes on Social Security benefits, it introduces an extra $4,000 deduction for seniors over 65, offering some tax relief to retirees rather than targeting them for higher taxes. These are not the actions of a bill aimed at harming the working class.

Labeling the bill a “wealth transfer” and evidence of “oligarchy” ignores the broader scope of its tax relief measures and frames the debate in misleading terms. While the wealthiest Americans may also see tax benefits, just as they did under the 2017 Tax Cuts and Jobs Act, the idea that only the rich benefit is false. According to analyses of past Trump-era tax policy, over 80% of Americans received some form of tax cut, and similar patterns are likely under this proposal, especially with new provisions targeted at wage earners.

On May 18, the House Budget Committee advanced a budget reconciliation bill to meet spending targets aimed at funding President Trump’s domestic priorities, that includes significant changes to the Medicaid program. The Congressional Budget Office (CBO) estimates that the bill would decrease the federal deficit by more than the $880 billion over 10 years that was called for by the budget resolution passed by Congress in April. CBO preliminary estimates show that the Medicaid provisions would reduce the deficit by $625 billion over ten years and increase the number of people without health insurance by at least 7.6 million by 2034. https://www.kff.org/tracking-the-medica … hatgpt.com

Trump’s “Big Beautiful Bill” offers clear tax relief to workers in the form of eliminating taxes on tips and overtime and reducing the burden on seniors. While legitimate concerns may exist about healthcare funding or debt impact, the sweeping claim that this is purely a handout to billionaires while punishing the working class does not hold up under factual scrutiny. The bill contains targeted relief aimed specifically at middle- and lower-income Americans, exactly the opposite of what critics are alleging.Social security tax cuts have absolutely not been included in this budget bill.

Can I ask folks, how much this bill will increases the national debt and deficit?

"The bill contains targeted relief aimed specifically at middle- and lower-income Americans, exactly the opposite of what critics are alleging.

What is that relief exactly?I haven't seen any analysis that shows a benefit for the middle and lower class>. The benefits are absolutely skewed toward top earners.

In terms of medicaid, having millions of people with no coverage is a benefit? How? How will their needs be dealt with?

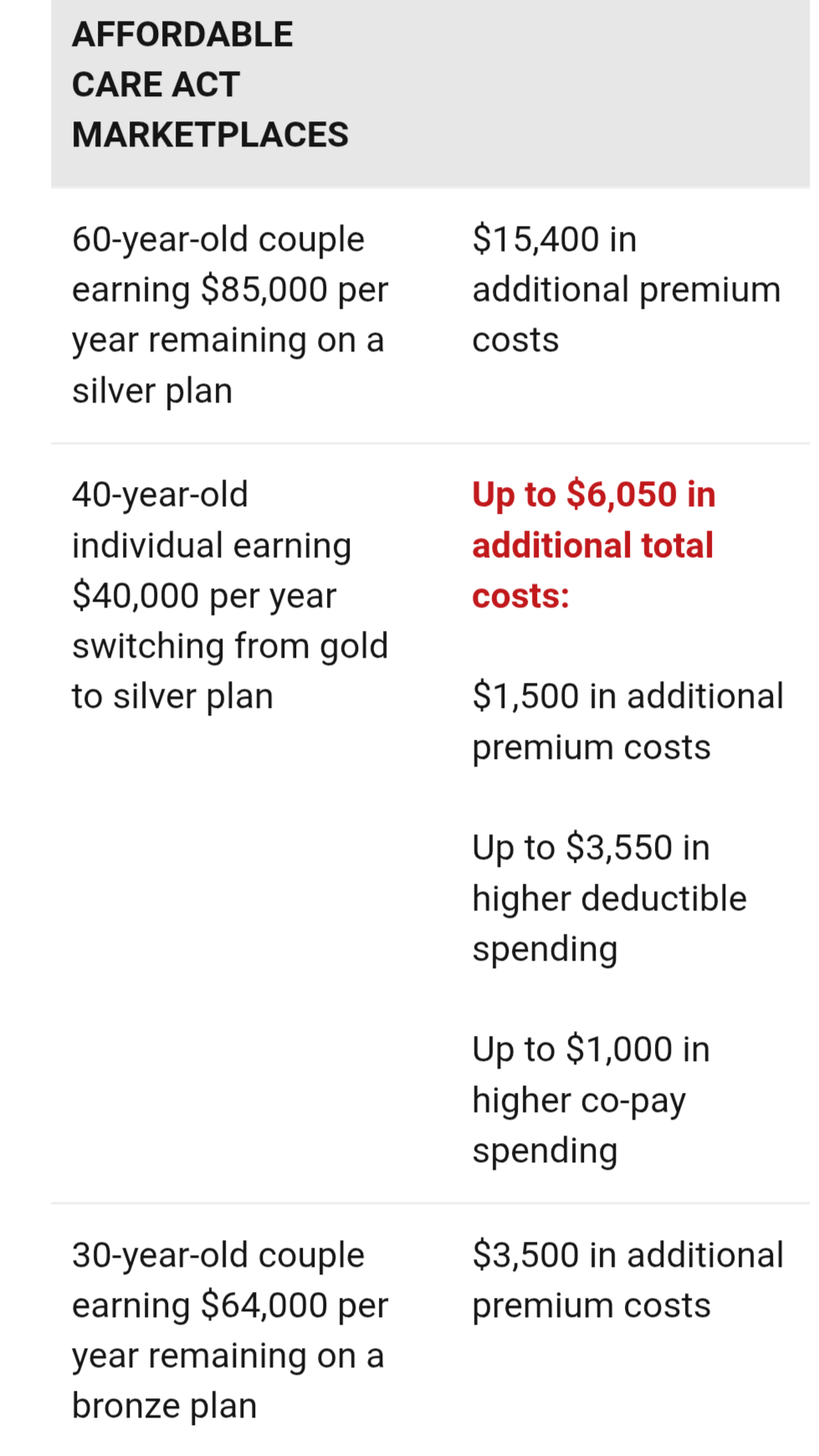

Also, what has not been mentioned is the fact that millions more are expected to lose coverage as a result of codified changes to the Affordable Care Act and the failure to extend ACA subsidies.

Aside from Maga talking points, which non partisan tax or economic organizations are supporting this bill as a benefit to the country?

Trump says this tax bill will help all Americans but literally every study say low earners would pay the price.Top earners are top taxpayers, paying the most tax. They absolutely should get the bulk of the benefits - anything else is just more wealth distribution you complained about.

You've skirted the question. Why should a higher income earner get to keep more of what they make versus the lower income earner?

"This isn't a budget bill. It's a wealth transfer."

You mean that the wealth transfer, using socialistic principles, that has been going on for decades now is finally going to be reversed and the people that earned and own the wealth get to keep a little more of it?

How can anyone be upset about that...except those that demand someone else pay for their wants and needs.Under what kind of logic makes it okay that people who make millions per year get to keep more of that income and people who make under $50,000 a year don't get to keep more of their income?

Under what kind of logic makes it okay to take 70% of what one person earns and zero from another, then giving that 70% to give to the one not paying taxes?

How about we each pay a fixed amount, all buying the same thing (citizenship) and paying the same thing for it? You want "fair" - that's as fair as you can get.

Tax on overtime, tips?

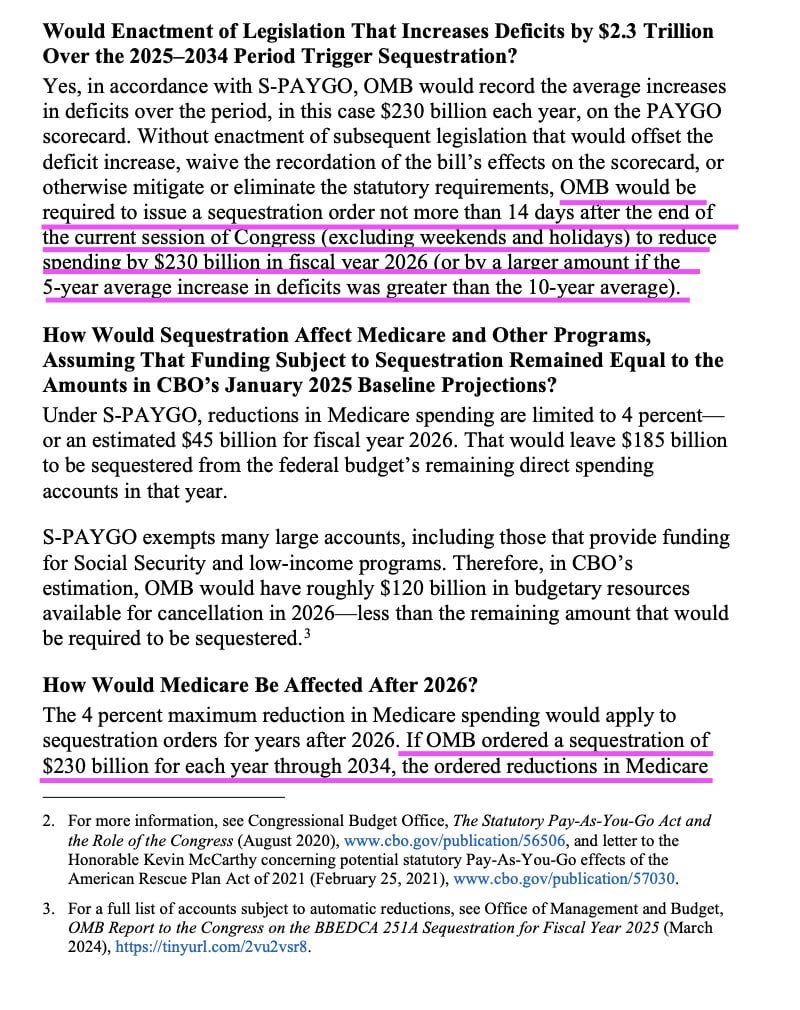

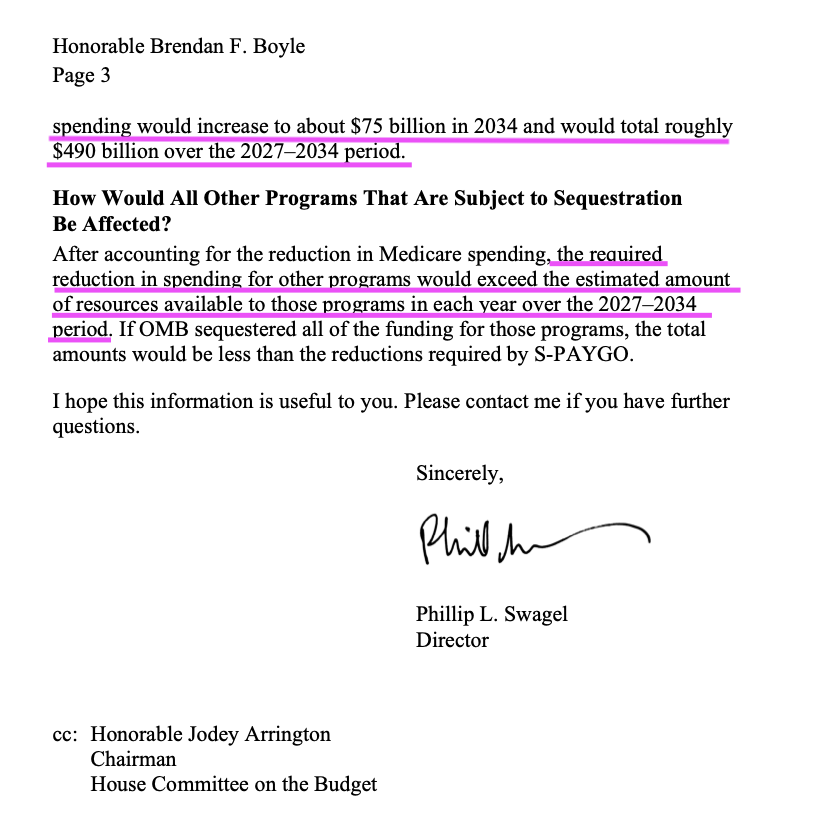

https://x.com/maddenifico/status/1924462280441282586CBO Confirms GOP Budget Bill Triggers Medicare Cuts...

According to the CBO, the bill's addition to the deficit would trigger a process known as sequestration under the Statutory Pay‑As‑You‑Go Act of 2010.

Unless lawmakers offset the deficit impact of the Republican bill or agree to waive the PAYGO requirements—which the GOP measure does not do—the Office of Management and Budget (OMB) "would be required to issue a sequestration order not more than 14 days after the end of the current session of Congress (excluding weekends and holidays) to reduce spending by $230 billion in fiscal year 2026," the CBO said.

Under PAYGO, automatic Medicare cuts are capped at 4%. The CBO estimates that the Republican legislation would trigger roughly $45 billion in Medicare cuts in 2026 and a total of $490 billion in cuts to the program between 2027 and 2034...

This is what Republicans do best, right? pay for massive tax breaks for billionaires by going after programs families rely on the most: Medicaid, food assistance, and now Medicare.

https://democrats-budget.house.gov/news … 20Betrayal

https://www.yahoo.com/news/top-house-de … 15926.html"

Estimated budgetary effects of a bill to provide for reconciliation pursuant to title II of H. Con. Res. 14., the One Big Beautiful Bill Act, as ordered reported by the House Committee on the Budget on May 18, 2025. CBO HAS NOT reviewed the legislation for effects on spending subject to appropriation and has not yet completed estimates of the effects of interactions among titles of the legislation. " CBO

https://www.cbo.gov/publication/61420?u … hatgpt.com

Perhaps it is wiser to wait and see the bottom line, and not make a prediction on the bottom line.

CBO Limitations / Misses

Economic Forecasting Errors:

Like all forecasters, the CBO struggles to accurately predict recessions, booms, or unexpected geopolitical events. For example:

It underestimated the strength of the recovery after the 2008 crash.

It overestimated economic growth and productivity in several 10-year outlooks, especially post-2014. Their record is not what it was.

Example--- The Congressional Budget Office (CBO) did not predict that Biden’s legislation would lead to 9% inflation. While the CBO warned that massive spending, especially from the American Rescue Plan Act—could increase demand and raise inflation somewhat, it did not foresee the historic spike that peaked at 9.1% in mid-2022.Deleted

You need to repost a link as the one you left is 'Page Not Found'.

The first paragraph of this letter really says everything that matters at this stage. You seem to be jumping ahead and focusing on parts of the letter that don’t carry real weight until the bill has actually gone through the full legislative process and is signed by the president.

"Dear Ranking Member Boyle:

Today the Congressional Budget Office transmitted an estimate of the

budgetary effects of the 2025 reconciliation bill, as ordered reported by the

House Committee on the Budget on May 18, 2025.

"1 CBO has not yet

completed estimates of the effects of interactions among the titles of the

legislation. "

It sounds to me like the CBO is being very cautious in its response, simply laying out the process without making any firm predictions because the bill hasn’t been passed yet. They’ve provided a partial estimate of the budget impact, but they admit that their analysis isn’t complete, specifically, they haven’t factored in how different parts of the bill might interact with each other. What they are doing is explaining how the Statutory Pay-As-You-Go Act works, and what would happen if the bill added $2.3 trillion to the deficit over 10 years. In that case, the law would require sequestration, automatic spending cuts, to offset the deficit increase. But even then, it’s not up to the CBO to enforce that; it’s the Office of Management and Budget (OMB) that makes that call. So essentially, the CBO isn’t saying the bill will cause this outcome; they’re just outlining the consequences if it does. That’s why this statement feels more procedural than predictive.You've skipped over the triggering of paygo. In what estimation does this bill NOT create the deficit needed to trigger the act?

Because of the size of the deficits, because of the paygo act, that would trigger sequestration of Medicare, and it would total over $500 billion. The official figure that CBO confirms is $535 billion in cuts to Medicare.

https://www.cbo.gov/system/files/2025-0 … -PAYGO.pdf

It is the deficit created by this bill that triggers the cuts to Medicare... This isn't a CBO prediction. This is the reality of PAYGO

Unless lawmakers offset the deficit impact of the Republican bill or agree to waive the PAYGO requirements—which the GOP measure does not do—the Office of Management and Budget "would be required to issue a sequestration order not more than 14 days after the end of the current session of Congress (excluding weekends and holidays) to reduce spending by $230 billion in fiscal year 2026," the CBO said.

Under PAYGO, automatic Medicare cuts are capped at 4%. The CBO estimates that the Republican legislation would trigger roughly $45 billion in Medicare cuts in 2026 and a total of $490 billion in cuts to the program between 2027 and 2034..

It really is no wonder that they are doing their talk/negotiations in the middle of the night LOL

This is the GOP’s fiscal hypocrisy on full display. After exploding the deficit with billionaire tax cuts, now they’re using their own PAYGO rules to slash billions from Medicare. Working-class seniors will pay the price for handouts to the wealthy. This isn’t budget discipline. it’s class warfare.

The House just passed the grotesque bloated bill in a 215-214 vote. It will defund Medicaid and Medicare while decreasing taxes mainly for the uber wealthy and corporations. It will also expand our deficit and increase our national debt by trillions of dollars. On to the Senate...where hopefully this thing gets dismantled.

The budget bill really does expose Trump’s ‘working-class party’ rhetoric as phony.I think this points out the huge difference between MAGA and the Biden sycophants. Many MAGA followers are unhappy with this too but are not afraid to comment on that.

When Bidens rulers passed the so-called inflation reduction act, which was actually a climate change bill that would increase prices, none of the leftists on this forum bothered to point out anything wrong with the bill, just like they would not point out the fact that Biden was suffering from dementia or Kamala Harris was drunk at her apperances and unable to answer basic questions.

Here’s a detailed factual breakdown of key provisions from the 2025 "One Big Beautiful Bill" (H.R. 1), based on its text and official summaries:

1. Tax Relief and Economic Growth

Permanent Tax Cuts

The bill extends and makes permanent many of the tax cuts originally enacted in the 2017 Tax Cuts and Jobs Act. This includes keeping individual and corporate tax rates lowered through 2028 and beyond. The bill also permanently increases the standard deduction by $1,000 for single filers, heads of household, and married couples filing jointly. These cuts aim to increase taxpayers’ take-home pay and incentivize investment.

New Tax Deductions for Workers

A notable feature is the introduction of a tax deduction for tips and overtime pay, which is designed to reduce the taxable income of workers who earn these types of compensation, effectively increasing their net income.

Child Tax Credit Expansion

The child tax credit is raised to $2,500 per child and extended through 2028. This aims to provide families with additional financial relief to support child-rearing expenses.

Increase in SALT Deduction Cap

The bill raises the state and local tax (SALT) deduction cap from $10,000 to $40,000, but this applies only to taxpayers earning under $500,000 annually. This benefits residents in states with higher local taxes by allowing them to deduct more of those payments on their federal returns.

MAGA Savings Accounts

The bill creates “Money Accounts for Growth and Investment” (MAGA accounts), which provide $1,000 per child to families, encouraging savings and long-term investment, aiming to build wealth from a young age.

2. Healthcare Reforms

Medicaid Work Requirements

For Medicaid recipients with incomes above the federal poverty line, the bill imposes work or community engagement requirements as a condition of continued eligibility. This policy intends to encourage employment and reduce long-term dependency on government benefits.

Restrictions on Gender-Affirming Care

The bill prohibits Medicaid from covering gender-affirming medical treatments, including hormone therapy and surgeries, for people of all ages. This marks a significant shift in Medicaid coverage related to transgender healthcare.

Federal Funding Ban on Abortion Services

Federal funding is barred from clinics providing abortion services, including Planned Parenthood, directing funds toward other healthcare services and priorities instead.

3. Border Security and Defense

Border Wall Funding

The legislation allocates approximately $46.5 billion for the construction and modernization of border barriers, focusing on strengthening physical security infrastructure along the U.S.-Mexico border.

Immigration Enforcement Funding

It provides an additional $5 billion for Customs and Border Protection (CBP) facilities and about $4.1 billion to hire more Border Patrol and CBP officers, aiming to improve enforcement capacity.

Advanced Missile Defense Investment

The bill dedicates $25 billion toward an advanced missile defense system, colloquially known as the “Golden Dome,” designed to enhance the United States' ability to defend against missile threats.

4. Education and Workforce Development

Expanded Pell Grant Eligibility

The bill broadens access to Pell Grants by increasing eligibility and introducing Workforce Pell Grants that target trade school students and vocational training programs, supporting skills development for in-demand jobs.

Student Loan Policy Changes

It replaces previous student loan forgiveness programs with stricter repayment plans aimed at fiscal responsibility, focusing on more sustainable management of student debt.

5. Fiscal Policy and Government Spending

National Debt Ceiling Increase

The bill raises the national debt ceiling by $4 trillion to avoid default and ensure uninterrupted government funding.

Defense Spending Boost

An additional $150 billion is allocated to defense, targeting modernization of military capabilities and national security enhancements.

Nonprofit Oversight

The legislation authorizes the U.S. Treasury to revoke tax-exempt status from nonprofit organizations found to be supporting terrorism, tightening oversight and accountability for charitable entities.

I support the bill, it's not perfect, what bill ever is. Based on what Trump promised during his 2024 campaign, focusing on strong border security, rebuilding the military, boosting economic growth, and supporting families, the "One Big Beautiful Bill" seems to align with many of those priorities. The bill’s significant investment in defense and border security reflects the emphasis on protecting the country and controlling immigration. Expanding Pell Grants and introducing workforce-focused education initiatives also support economic opportunity, which fits with the campaign’s messaging about job growth and empowering Americans.And the additions to the debt and deficit? The impact of millions losing medicaid, ACA coverage? Snap?

The Affordable Care Act (ACA) has not been repealed by Trump’s new bill. However, the bill includes significant cuts to Medicaid, which was expanded under the ACA. These changes could reduce the number of people who receive health coverage, particularly through Medicaid.

The bill introduces new work requirements for Medicaid recipients and increases eligibility verification frequency, which may lead to loss of coverage for some individuals who do not meet the new criteria.

SNAP (Supplemental Nutrition Assistance Program) is also not eliminated, but the bill proposes budget cuts over the next decade.

Under the "One Big Beautiful Bill Act," sweeping changes are proposed for Medicaid, introducing mandatory work requirements for certain adult recipients. Here’s a clear summary of what those changes include:

Work Requirement Overview

Beginning in 2026, adults aged 19 to 64 who are enrolled in Medicaid under the ACA expansion, primarily low-income, childless adults, must engage in a minimum of 80 hours per month in activities such as:

Employment

Job training

Education

Volunteering or community service

Participants must report their compliance twice each year. Failure to meet the requirement or properly report activities can result in the loss of Medicaid coverage.

Exemptions from Requirements

The following groups are exempt from the work requirements:

Individuals under age 19

Pregnant women and those receiving postpartum care

Seniors (typically those 65 and older)

Disabled individuals

Primary caregivers for dependents or disabled family members

Veterans

State Implementation and Oversight

States will be required to set up systems to enforce and monitor the new work requirement rules. They must also handle exemptions and determine which beneficiaries are subject to the mandates. The federal government will oversee state compliance with these new obligations.

Projected Impact

The new requirements are expected to result in millions losing coverage over time, either due to non-compliance or difficulties with reporting. Previous attempts to implement similar mandates at the state level have led to unintended coverage losses tied more to paperwork burdens than actual failure to work.

Additional Changes

Beginning in Fiscal Year 2028, states must redetermine eligibility for Medicaid recipients under the ACA every six months. This rule aims to keep Medicaid rolls limited to individuals who remain eligible, but it also adds to the administrative load on both beneficiaries and state agencies.

These changes reflect a policy shift toward linking public assistance to employment and civic participation. I argue it encourages independence and personal responsibility, while opponents caution about the risk of cutting off essential healthcare for vulnerable populations.

Medicaid has been abused for decades. And our government has done nothing until now.So there will be no impact in terms of throwing people off of medicaid, the ACA because of lack of expansion. Snap? I mean what will happen to the uninsured when they're sick? Or when people are hungry because they no longer have snap benefits?

Those who do not meet the criteria will lose Medicare. You do realize there are tons of medicare abuses?

No one is going to lose their coverage under the Affordable Care Act (ACA) itself. The ACA remains in place and continues to provide health insurance options. However, the Medicaid part linked to the ACA could be affected for some people if they don’t meet new eligibility requirements that states may implement.

So, while people won’t be “thrown off” the ACA or lose their ACA coverage, some might lose Medicaid coverage if they don’t qualify under these updated rules. The key point is that losing Medicaid coverage does not mean losing the ACA marketplace coverage; they could still buy insurance through the ACA exchanges, possibly with subsidies.

In other words, Medicaid eligibility can change based on new state rules, but ACA protections and coverage options remain intact for everyone.

SNAP is not going away because of President Trump’s new bill, but the legislation does include significant changes that could reduce benefits for many recipients. One of the main proposals in the bill is to expand work requirements. Currently, able-bodied adults aged 18 to 49 must work or participate in work-related activities to maintain their SNAP benefits. The new bill would extend these work requirements to include individuals aged 50 to 64, as well as parents with children aged 7 and older. If recipients fail to meet these requirements, they risk losing their benefits.It's pure and simple. I read the new bill requirements, of course, the liberal media is preaching doomsday a la Dickensian England. Trump is trimming the excess fat of the government. He is doing what he promised. The government is not a parent.

They can say what they will about Trump’s “big beautiful bill,” but it’s about time we saw a piece of legislation that takes a serious shot at both protecting proven tax cuts and reining in wasteful government spending. This bill may not be perfect, few big reforms are, but it reflects a fiscally responsible approach that many Americans have been asking for.

The continuation of tax cuts that helped families and small businesses weather tough economic times isn’t just smart policy, it’s common sense. What’s even more encouraging is that this bill doesn’t just spend, it pulls back money from bloated programs and federal agencies that have long been criticized for inefficiency and abuse. That’s not just trimming fat; it’s listening to years of concerns from watchdogs and taxpayers alike.

Let’s be honest: Trump was elected on a controversial platform, and he won, in large part, because voters were tired of the status quo. If we truly believe in democratic outcomes, then yes, he deserves a shot to implement what he promised. This bill might ruffle feathers, but that’s often what real reform looks like. At the very least, it’s a step in the direction of a leaner, more accountable government, something we need now more than ever.Protecting proven tax cuts for who? Every single analysis shows that this bill is heavily skewed to the top few percent in terms of income.

The budget bill passed by the House, does not expand the Affordable Care Act. In fact, it's projected to significantly reduce health insurance coverage. ...

https://www.cnbc.com/2025/05/23/big-bea … rts%20say.

Medicaid abusers? Are there studies or data that they have pointed to in terms of backing up those types of claims. I certainly can give my own examples of people who work sparsely, their reasons for it, while receiving both Medicaid and snap.

I am certain that my trump loving neighbor will lose his benefits as he is an abled bodied man capable of working 40 + hours per week. Why does he work less than part-time? Well he has an adult daughter living there who can't be left alone for more than a few hours at a time due to her capacity... I wonder how many out there have a similar situation? Or they have memaw and peepaw's hospice beds set up at home?

Also, I'm sure you've looked at States who did implement their own increased work requirements for Medicaid and I believe every single one of them reversed those policies. They didn't really work to plan.

But again, I don't think anyone has really answered but the impact will be of millions who could potentially be without insurance? The impact on hospitals? Rural hospitals particularly that will go under.

In the realm of healthcare fraud, isn't it most often the providers themselves, including doctors and other medical professionals, who are the primary culprits??Yes, your statement is factually accurate: the Affordable Care Act (ACA) is not being expanded, but it is also not being fully repealed.

The "One Big Beautiful Bill," recently passed by the House, includes significant changes to Medicaid, a key component of the ACA

No one is going to lose their coverage under the Affordable Care Act (ACA) itself. The ACA remains in place and continues to provide health insurance options. However, the Medicaid part linked to the ACA could be affected for some people if they don’t meet new eligibility requirements that states may implement.

So, while people won’t be “thrown off” the ACA or lose their ACA coverage, some might lose Medicaid coverage if they don’t qualify under these updated rules. The key point is that losing Medicaid coverage does not mean losing the ACA marketplace coverage; they could still buy insurance through the ACA exchanges, possibly with subsidies.

You’ve actually made my point Ideally, your Trump-supporting neighbor, who is able-bodied and fully capable of working full-time, will no longer qualify for benefits under the new rules. That’s the intent behind these changes: to ensure assistance goes only to those truly in need, not to those who can support themselves but choose not to.

Grampa and Grandma are covered under Medicare for hospice care.

Once enrolled, Medicare's hospice benefit covers a comprehensive range of services related to your terminal illness, such as:

Medicare

Doctor and nursing services

Pain relief and symptom management medications

Medical equipment and supplies

Physical and occupational therapy

Speech-language pathology services

Social work services

Dietary counseling

Grief and loss counseling for you and your family

Short-term inpatient care for pain and symptom management

Inpatient respite care to provide relief for your caregiverBecause the premium tax credits are not being renewed under this bill, ACA coverage will become unaffordable for millions.

"You’ve actually made my point Ideally, your Trump-supporting neighbor, who is able-bodied and fully capable of working full-time, will no longer qualify for benefits under the new rules.

I guess he can always lock his daughter in a room, right?Changes must be made...

Changes are coming whether we are ready or not...

We are in the midst of massive disruption... we are moving from the Industrial Age... and the Information Age... while still being in both... entering into the AI age... or the AGI age if you prefer...

The old ways of training for a trade or profession and going to work for someone in a factory for 25 years or being a doctor... much of what we have grown up considering career fields and lifelong professions is being disrupted... moreso today in the "white collar" jobs than the "blue collar".

Most of the "blue collar" fields where humans can be replaced with computers or robots have suffered this transition already...

Now they are replacing doctors, accountants, managers... "white collar" jobs with AI today... teledoc... melio...

Soon the truck drivers and the travel industry will be hit... as Cabs, Trucks, and Planes are controlled by FSD AI. Before you know it they will make most travel illegal if not FSD AI controlled.

We have had 30 years of sellout politicians making themselves rich as they kick these problems down the road for the next elected stooge to deal with...

Trump... and by extension Gabbard, Kennedy, Musk, etc. are trying to deal with a BROKE economic system where we are spending MORE on interest on our debt... than on our Defense Budget...

Think on that... we waste more per year on Defense (wars) than the entire rest of the world combined... the entire world, ALL other nations, do not spend close to what America does on Defense...

And we are now spending more on our INTEREST on the National Debt... than we do on Defense... or ALL of our other government funded programs (IE Medicaid and Social Security)...

We got problems... not even tough love can solve them...I see nothing wrong with the bill at all. Trump is just trimming excess fat. I believe that people should work for their keep. If people want food, they should be able to afford it themselves. If people are poor, they shouldn't have children to bring them into the world where the latter has a hellish existence. People are poor in America because of irresponsible behavior & choices. The American taxpayer shouldn't have to foot the bill. We pay more than enough taxes already.

You're exactly right, and I couldn’t agree more with the urgency behind your words. We are living through a seismic shift, not just in technology but in how our entire economic system functions, and the political class has done nothing but enrich themselves while letting it all unravel. The disruption isn’t coming, it’s already here. AI and automation are rewriting the rules of employment, and like you pointed out, the white-collar sector is now feeling the same squeeze that decimated blue-collar jobs years ago. What's truly maddening is how our leaders, on both sides, have ignored the writing on the wall for decades.

They kept printing money, outsourcing industry, and pretending that debt doesn’t matter. Now we’re spending more on interest than national defense, and somehow still funding endless wars and bloated bureaucracy, while everyday Americans are just trying to keep their heads above water. I agree with you, figures like Trump, Kennedy, and Musk at least seem willing to name the problem and stop kicking the can. The system isn’t just broken, it's rigged, and unless we face that head-on, the future will be decided for us by the same elites who created this mess.This is one of the reasons that I, a Democrat, voted for Trump. I was getting wary of the inane leftist nonsense that the Democrats who are becoming more communistic was preaching. Because of the Democrats, welfare has become an industry with my hard earned tax dollars going to people who don't want to help themselves but live off others' dimes. As a result of the Great Society, poor people are given privileges which made them lazier. I say that welfare should be cut 90-95%.

The Biden Administration pushed things so far...

That most people are happy today with merely the stoppage of adding millions of migrants onto Social Security + Health + Housing every year...

Funny how that works...Unauthorized immigrants are not eligible for Medicare or Social Security retirement benefits....Undocumented immigrants are not eligible for Medicaid or CHIP, and only some lawfully present immigrants qualify subject to eligibility restrictions...

Honest debate cannot start with fiction.Yeah... that... honest ... factual...

Elon Musk, Antonio Gracias and the DOGE team recently exposed how rampant immigration fraud and government corruption became under the Biden administration. Specifically, they showed how aliens “getting” asylum can receive work authorization and, with it, an automatic Social Security number, which enables them to obtain driver’s licenses, commit voter fraud and receive other benefits.

Under the Biden administration, so many employment documents were issued to immigration parolees (without congressional authorization), asylum applicants and other temporary aliens that DHS could not keep up with renewing the authorizations.

To “solve” the problem, Biden’s DHS finalized a rule in December 2024 to permanently increase the automatic extension period for expiring employment authorization from six months to 18 months.

That is, DHS chose to automatically extend work authorization without ever considering whether the aliens should continue to have it.

According to one chart (shown by DOGE’s Gracias at a recent Wisconsin town hall), 270,000 new aliens were issued Social Security numbers in FY2021. That number rose to 590,000 in FY22, 964,000 in FY23, and approximately 2.1 million in FY24.

According to Gracias, the Social Security Administration automatically mails aliens Social Security numbers—without requiring them to prove their identity or complete an interview. Gracias says “The defaults in the system from Social Security to all the benefit programs have been set to max inclusion, max pay for these people. And minimum collection.”

During its investigations, DOGE found 1.3 million aliens who were already receiving Medicaid. They also found among the millions a subset who were registered to vote—and some who did indeed vote.

https://www.heritage.org/border-securit … he-iceberg

DOGE has uncovered Social Security Administration files indicating that millions of migrants were recently added to the benefits program.

There are millions of non-citizens who were recently given Social Security numbers, many of them were set to receive 'max' benefits, which the DOGE worker said was the 'default' output under the previous administration.

'The defaults in the system, from Social Security to all of the benefit programs have been set to max inclusion, max pay for these people, and minimum collection,' Gracias said of the recent migrant enrollees.

'We found 1.3 million of them already on Medicaid, as an example,' he continued.

https://www.dailymail.co.uk/news/articl … urity.html

Gmwilliams? I used to feel that way when I was initially living in New York City so many years ago. I was barely scraping by in a basement apartment the size of a closet inasmuch as high taxes were eating up my paychecks from my job. At the time, I felt that too many people were getting free rides on the taxpayers' dime. Would you believe that I later found out that the state of New York was providing social welfare benefits to illegal aliens? That's so not cool.

Later on, I discovered that the way that tax dollars were being spent on the needy was much more elaborate than I had thought insofar as it caused me to reassess my stance on social welfare. For example, the reason that taxes are so high in our nation, especially in New York and California, is because there are people receiving large tax exemptions that they shouldn't be receiving and that is reducing the amount of revenue coming into the Federal government. And, no, I'm not talking about the top 10 percent income earners that some people have complained about on this discussion thread. I'm talking about the Church of Scientology and satanic cults.

It turns out that the Church of Scientology is receiving an I.R.S. 501(c)(3) exemption from paying taxes. I thought that that tax loophole was only for real churches. The Church of Scientology doesn't worship any god. They have committed a number of human-rights violations, so they should not be getting that tax exemption.

Satanic cults are also receiving a full exemption from paying taxes under I.R.S 501(c)(3). That's completely crazy. And these people are dangerous and volatile. These sinister organizations should not be getting out of paying taxes under any circumstances. In my opinion, the Republicans should be going after them and the Church of Scientology instead of after Medicaid recipients with this One Big, Beautiful Bill of theirs.Correction. Actually, the statutory code for the religious tax exemption is IRC Section 501(c)(3). Sorry for the bloop and blunder.

“It turns out that the Church of Scientology is receiving an I.R.S. 501(c)(3) exemption from paying taxes. I thought that that tax loophole was only for real churches. The Church of Scientology doesn't worship any god. They have committed a number of human-rights violations, so they should not be getting that tax exemption.”

So what is a real church, Shadow?

One man’s church is another man’s cult. I could easily call the Christian Right and its political advocacy a cult today, would I be so far off from the mark?But don't you think it's rather bizarre that the Church of Scientology doesn't really worship anything and yet they receive tax exemptions as though they were a religious institution? I can't wrap my brain around that. I know that Leah Remini has a lot of unpleasant things to say about the Church of Scientology.

Yeah, Scientology was bizarre and was BS. I was almost caught up in it while living in Southern California during the mid-seventies, as the choice of the “stars”.

The reality though is what is the qualifications for being considered a “church” and being tax exempt? What and who is to be worshipped? Are satan worshippers part of the idea of freedom of religion? Who is to say who is to be worshipped and who or what is not? What about that Bob Jones University in South Carolina for example, how much political advocacy is allowed before they cease being a “church”?

This all can be very subjective, the amount of infusion in to politics challenges us all to keep up with the Joneses. How much meddling in politics did we get from Falwell or Pat Robinson disguised as religious institutions?

the exemption has certain requirements, they are not supposed to be involved in political advocacy and we don’t really know as to the worship of which gods or gods apply, or even Satan, himself.

Iowa constituent: "People will die" because of Republicans' cuts to Medicaid.

Joni Ernst: "Well, we all are going to die."

Holy sh*t. This woman needs to be sent back to castrating hogs....

LOL and they always say this kind of stuff with the largest crucifix around their neck.. like please tell me more about your Christian values.

https://x.com/dabbs346/status/1928441971460202894"LOL and THEY always say this kind of stuff with the largest crucifix around their neck.. like please tell me more about your Christian values." Willow

Wait a minute. Joni Ernst made a comment, blunt, maybe poorly timed, and without full context, hard to judge fairly. But to leap from that one sentence to insulting her personally and then turning it into an attack on all Christians is way out of line.

She's one individual. Her views, her tone, her choice of words, that’s on her. But pointing to a crucifix and mocking Christian values as if one person speaks for an entire faith? That’s not only unfair, it’s the same kind of broad-brush thinking people claim to stand against.

We’re all individuals. Christians, like everyone else, are not a monolith. To act like wearing a cross makes someone a hypocrite the moment they say something you don’t like, is just stereotyping with extra steps.

Speaking at a town hall in Butler County, Iowa, on Friday, Sen. Joni Ernst, an Iowa Republican was explaining how the bill would affect Medicaid eligibility when one audience member yelled out that individuals who lost coverage because of the cuts could die.

While outrage at Ernst’s glib comment was immediate, on Saturday, the senator doubled down with a sarcastic response shared on Instagram.

“I made an incorrect assumption that everyone in the auditorium understood that, yes, we are all going to perish from this earth,” she said in a video filmed in what appeared to be a cemetery. “So I apologize, and I’m really, really glad that I did not have to bring up the subject of the tooth fairy as well.”

She then added: “For those that would like to see eternal and everlasting life, I encourage you to embrace my Lord and savior Jesus Christ.”

In Iowa, about 1 in 5 residents are covered by Medicaid, including half of all nursing home residents, according to estimates from the nonprofit health policy research organization KFF.

Fake christians are awful people.House GOP ‘big, beautiful bill’ would increase the deficit by $2.4 trillion, CBO says

House Republicans’ sweeping tax and spending cuts package would increase the deficit by $2.4 trillion over the next decade, according to the Congressional Budget Office’s analysis of the bill that GOP lawmakers narrowly approved last month.

The highly anticipated score, which was released Wednesday, could complicate Senate Majority Leader John Thune’s task of crafting a version of the legislation that his divided conference would approve. Several GOP senators have already expressed concern about the House package’s potential impact to the deficit and want to make deeper spending cuts, while others are wary of the major reductions to the nation’s safety net – particularly Medicaid – in the House bill.

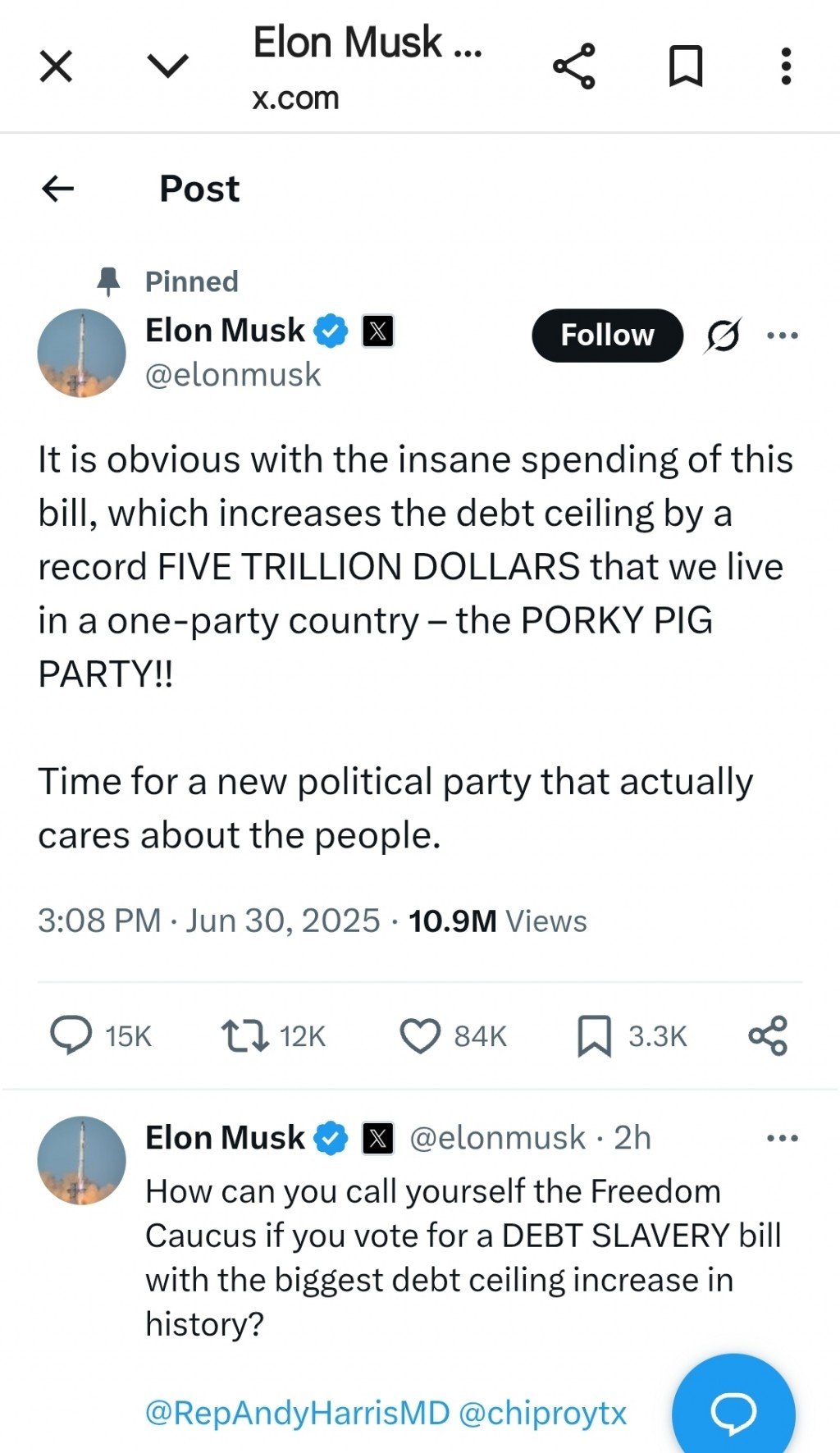

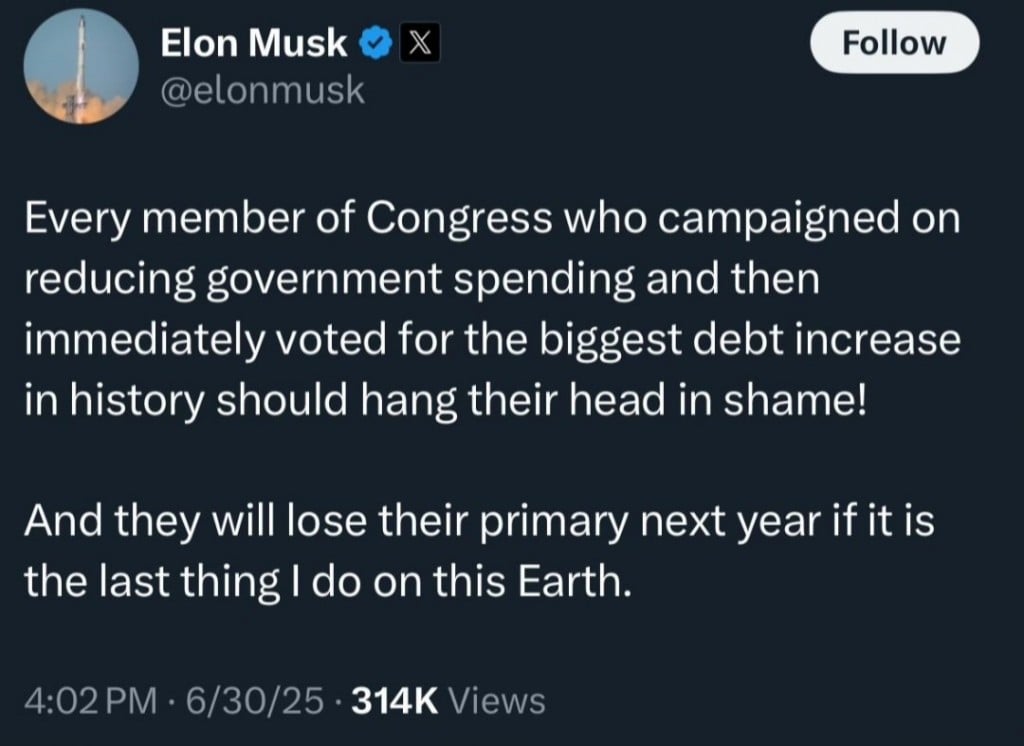

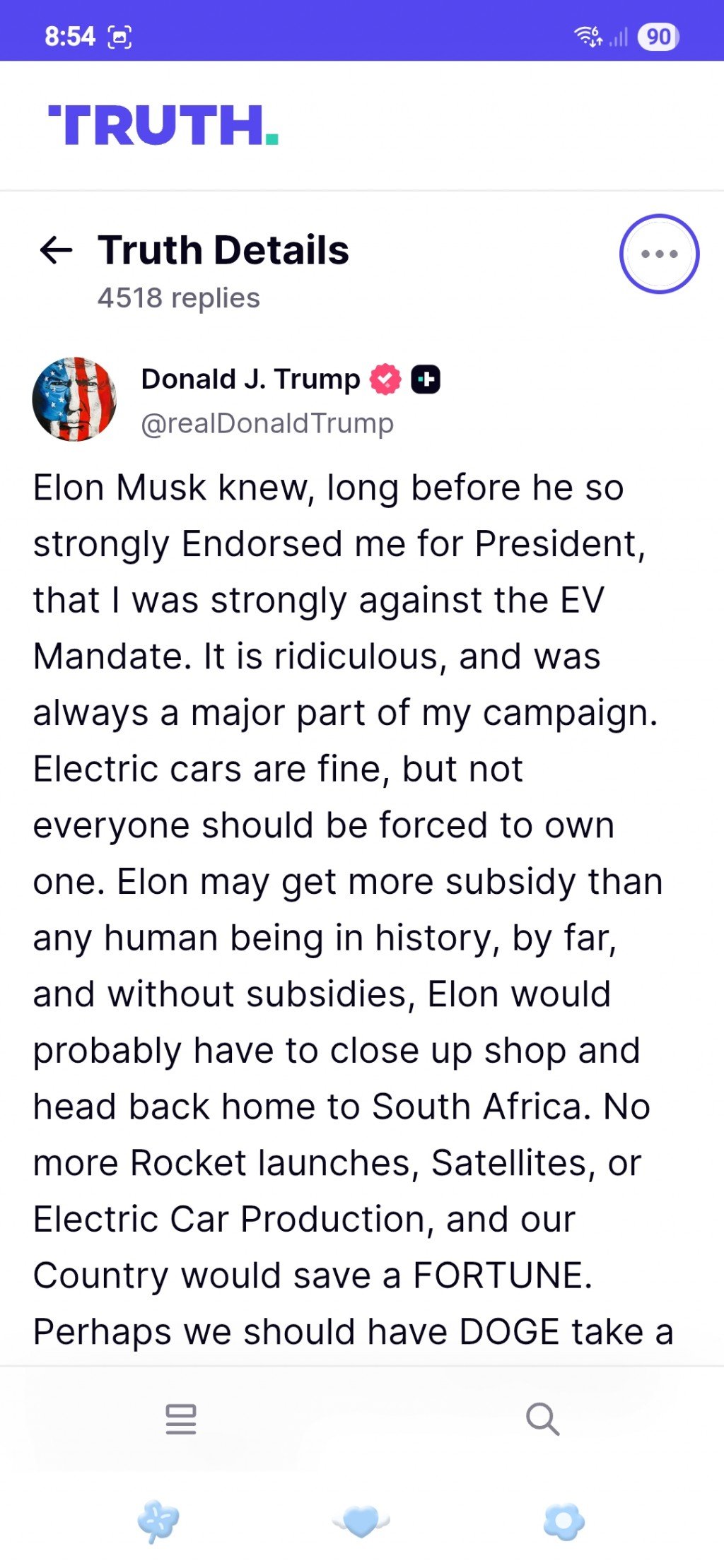

The analysis also adds ammunition to billionaire Elon Musk’s attacks on the package, which he wrote on X Tuesday would bankrupt America. The posts follow an interview with CBS Sunday Morning, in which Musk said will increase the deficit and undermine the work of his Department of Government Efficiency.

Trump and House GOP leaders have already sought to undercut the CBO’s projections, arguing that nonpartisan agency has missed the mark in the past and that its analyses don’t properly account for the economic growth that would result from the tax breaks. They have made similar claims about estimates from independent groups that also project a big hit to the deficit.I honestly question the common sense on both sides of the aisle when it comes to this bill. Democrats are loudly objecting to the spending cuts, especially regarding programs like Medicaid, and in the next breath, they’re screaming about the cost of the bill. That makes no sense at all. Meanwhile, some Republicans are pushing for even deeper cuts based on CBO projections that the bill will increase the national debt. The irony is, the bill does make significant cuts already, yet neither side seems to be approaching this rationally.

Democrats appear unwilling to accept any reductions in social programs, while many Republicans are quick to criticize the spending without clearly outlining what they'd cut instead. Meanwhile, both parties have allowed a slew of pork projects to sneak into the bill, many of them added by Republicans. It’s become so politicized that it’s hard to even follow the logic behind the final draft.

At this point, we have to ask: is there anything left that can be cut without undermining the basic functioning of the government or harming vulnerable populations? Cuts to Medicaid right now seem unwise, as they’re already relatively restrained. But to make the bill more fiscally responsible, maybe we should take a serious look at bloated defense spending, outdated subsidies, or unnecessary federal contracts. The conversation needs to shift from partisanship to pragmatism, because the debt won’t care which party caused it.

I’ve read the bill, and it definitely needs a lot of work. There’s room for cuts in several areas—just trimming a bit from military and immigration spending and cutting the pork projects would make it more manageable. Honestly, as a nation, we can’t afford luxuries like the Golden Dome missile system right now. It’s a great idea in theory, but sadly, we’re no longer the nation we once were financially. We need to be more realistic about our priorities.This isn't a bipartisan bill. So I don't think Democrats have added anything to it, have they? Pork would be Republican pork. I do agree with you on trimming the defense budget and money being thrown at immigration before reforms are passed through Congress.

Well of course it is...

Medicare is a target as Senate GOP faces megabill math issues

"Senate Republicans are eyeing possible Medicare provisions to help offset the cost of their megabill as they try to appease budget hawks who want more spending cuts embedded in the legislation...."

Oh yes and they'll call it "waste fraud and abuse", won't they? Anything to get those texts benefits to the wealthy... It's getting ugly folks.

https://www.politico.com/news/2025/06/0 … s-00389537"Anything to get those texts benefits to the wealthy..."

And to everyone else paying taxes as well. Why is it that the rest of the equation is always left out by those of the left? Are they trying to convince us all that a lie is true? That only the rich, those paying the vast bulk of our needs, are the only ones going to benefit?I understand the frustration with how the left often simplifies the tax debate by focusing only on the wealthy. The reality is that taxpayers across all income levels, including the middle class, contribute a significant share toward funding government programs. But ultimately, the wealthy do contribute more to government coffers, not just through income taxes, but also through capital gains, corporate taxes, investment taxes, property taxes, and even sales taxes on high-end goods. Their businesses also generate jobs, payroll taxes, and economic activity that feeds into local and federal revenues.

It’s not just about “the rich” benefiting; the full picture involves how taxes and spending impact everyone. Leaving out that context distorts the conversation and stops us from having an honest discussion about fairness and responsibility. I can't understand a mindset that does not grasp the very basics of how wealth creation and taxation actually work.

How did our society become so dumbed down?"How did our society become so dumbed down?"

We simply can't afford the tax cut that's being pushed forward though? The current Administration is pushing us to live beyond our means. Maybe this rift between Elon and Trump will finally bring that home to more people?Yes, it is encouraging the country to live beyond its means. As bad as those onibus bills that were full of pork for liberal causes that were passed during the Biden and Obama times, dont you think?

In my view, our society has become increasingly dumbed down, and my recent conversation with Dan helped highlight some of the reasons I feel that way. Regarding the tax cuts, I strongly disagree with any proposal to end them. I believe doing so would hurt the country, especially given the challenges we're facing right now. The key point is timing, I think keeping the current tax rates is necessary to help us through this volatile period.

We're in a tough and uncertain time. Raising taxes now could put more pressure on families, businesses, and the economy as a whole. The current rates provide some breathing room, which can help maintain stability until things settle down.

As for the back and forth between Elon Musk and his critics, I see it as childish and unprofessional. It damages both sides’ reputations. I doubt this exchange will have any real impact in the long run, but Elon definitely took a hit on X. Personally, I lost some respect for him. If what he’s implying is true, I have to question his morals.I don't think we need to raise taxes but it is very clear that we simply cannot afford to pass these tax cuts. The impact on the deficit and the debt would be huge. Tax cuts don't pay for themselves. Past cuts have led to ever widening budget deficits and lower revenue, not the reverse. Extending the tax cuts is just irresponsible. The government can't cut, slash and carve things up to offset a plan that drastically reduces revenue. The 2017 TCJA did not pay for itself and the deficit widened... Why are we expecting any different this time?

Let's remember...

"Donald Trump left office with the largest budget deficit in terms of raw dollar amount in peacetime American history, and a national debt exceeding 100% of GDP for the first time since World War II. "

https://manhattan.institute/article/tru … d-deficitsJust my view, Trump’s first-term tax cuts were a gamble on growth, and while COVID derailed the results, the groundwork was there. Now, with the economy in a stronger position, keeping those tax cuts is once again a bet that growth will outpace the loss in revenue. If the country really takes off, through business investment, job creation, and smart energy and trade policies, it could work. But it’s still a gamble that depends on serious growth and keeping spending in check. Without both, the deficit could continue to grow. I voted for change, and knew Trump was a gambler. I would be completely against what Democrats suggest, hitting the rich. This rubs me the wrong way, I am a total capitalist.

The “tinkle down” theory has been discredited since Ronald Reagan. Who is going to buy that today?

People on Medicare, Medicaid, ACA marketplace plans, AND with job-based health insurance (over 50% of Americans) will ALL see prices rise if Republicans' budget bill becomes law...

https://www.americanprogress.org/articl … insurance/Willowarbor? Everyone on this forum? I know that this is a little bit off topic. However, there's a major concern that our DiscoverHubPages articles are being plagiarized over on the Owlcation site. There's information about it on the discussion forum for "HP/TAG mining content from Discover." I needed to let you all know about it.

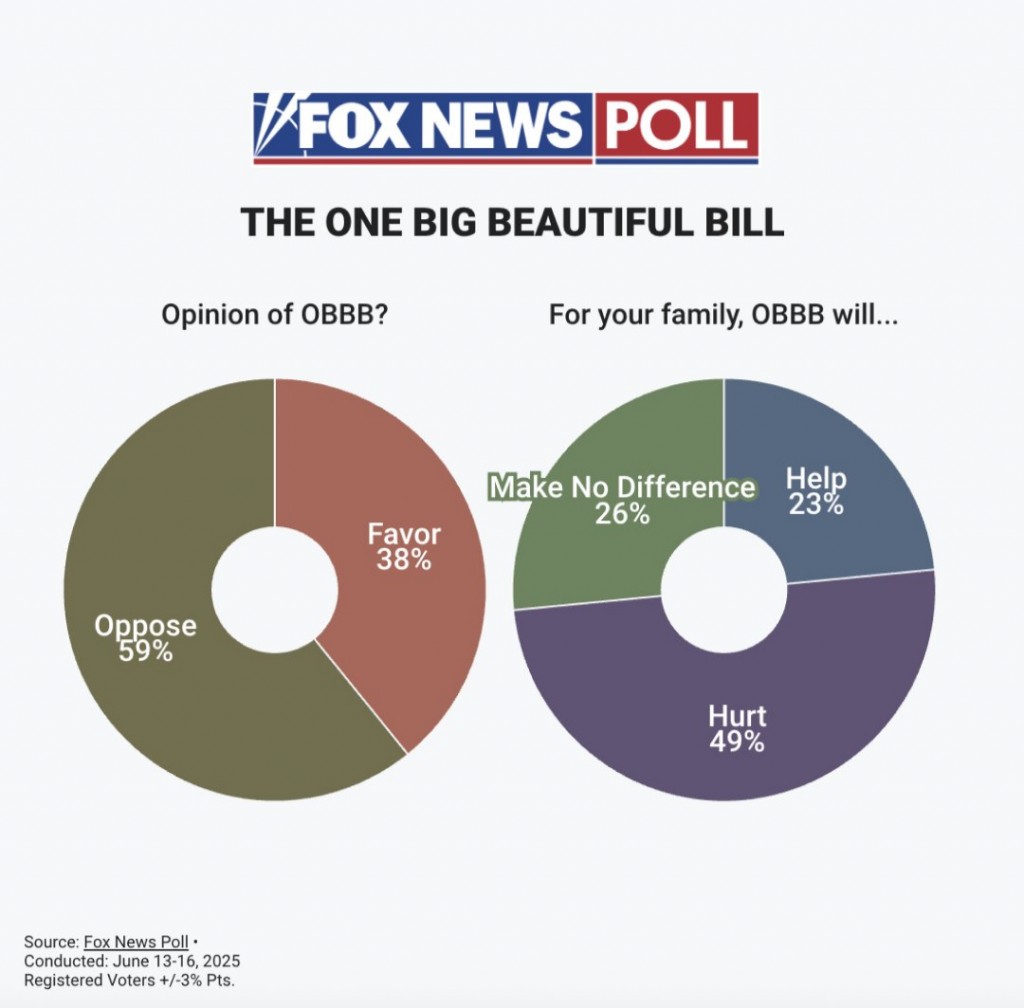

Trump’s “Big Beautiful Bill” is a total and complete disaster, every part of it. No wonder a majority of Americans oppose it in poll after poll. So many maga's about to lose their Medicaid.

Update on OBBB--- we are coming to the wire.

The Senate is currently wrapped up in a "vote‑a‑rama" on President Trump’s massive “One Big, Beautiful Bill” — a marathon of amendment votes that kicked off Monday morning (June 30). Senators are debating and voting on numerous changes, especially targeting Medicaid cuts, energy tax credits, food stamps, and border provisions, before moving to a final passage vote today.

All day: Senators are offering unlimited amendments—Democrats aiming to highlight GOP differences, while Republicans push through key tax and spending changes

.Tonight: After finishing the amendment votes, the Senate will hold a final up‑or‑down vote on passage, likely late Monday or into early Tuesday.