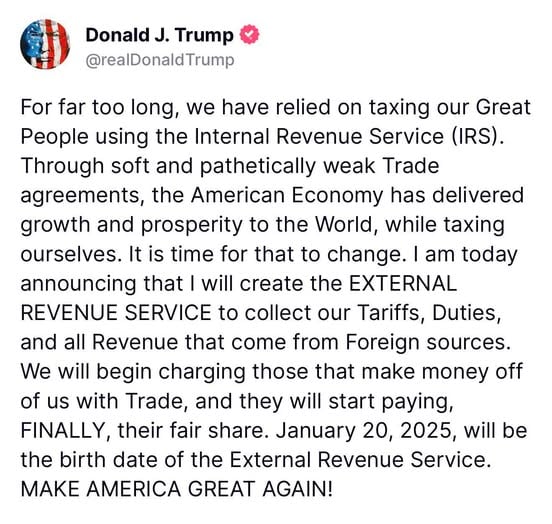

External Revenue Service Not Internal But External

Donald Trump's announcement to establish an External Revenue Service (ERS) is, in my view, a forward-thinking and progressive approach to governance. The concept of shifting the financial burden from American taxpayers to foreign entities benefiting from trade with the U.S. demonstrates a clear focus on putting Americans first. His idea of creating a new agency to handle tariffs and other foreign revenues is not only innovative but also a bold step in rethinking how the country generates and manages income.

I believe this kind of thinking outside the box is exactly what we need in leadership. Instead of sticking to outdated systems, Trump is proposing solutions that prioritize the American economy and work to ensure fairness in international trade. While no specific leader for the ERS has been announced yet, I’m confident that Trump’s administration will select someone capable of carrying out this vision effectively. This is the type of leadership that challenges the status quo and aims to create real results for the American people.Who are they collecting the tariff from? Exactly?

It's obvious that people still don't understand how tariffs work.

And of course he says this new agency will be created on day one...he really must be suffering mentally to believe that could ever happen.

My biggest question though, does it happen before or after all cost of living items are cut? People sure have seemed to forgotten about that. He's got his followers looking here not there.Wouldn't that be creating more bureaucracy furthering the deep state? Isn't that the type of waste that Musk and Ramaswamy have promised to eliminate?

I'm not sure what you're getting at. Why would allocating funds generated from tariffs be considered wasteful, especially if they are directed to an agency that could manage the funds effectively, track tariff revenue, and assess whether the tariffs are truly benefiting the country? I think it works well with the concept of what DOGE. The concept of external revenue earned from tariffs could keep a better watch on the funds coming in from tariffs and how they are spent.

Thus far--- In the United States, tariff revenue is collected by U.S. Customs and Border Protection (CBP), a division of the Department of Homeland Security. The money collected from tariffs, which are taxes imposed on imported goods, is deposited into the U.S. Treasury’s general fund. It is not earmarked for any specific purpose, so it becomes part of the broader federal revenue.

While there are no specific agencies assigned to track tariff money separately, Congress decides how to allocate funds through the annual budgeting process. This means that tariff revenue could be used to fund various federal programs or initiatives, depending on the priorities set in the federal budget.

There are occasional calls in Congress for better oversight on how tariff revenues are used, with some suggesting that a dedicated agency or accounting system should be established to ensure that these funds are effectively contributing to economic goals, like reducing the trade deficit or supporting domestic industries.

This is going too far. I have to jump in on this one. For supporters of this 'idea,' you're tripping all over your previous statements.

You (generic, of course) have ignored multiple explanations of who actually pays the tariffs—the consumer, and defended them as negotiating tactics. The latter can squeak through as a legitimate possibility (probability?), but there are no alternate facts about who pays the real money collected.

Since there is the real possibility that all of Pres. Trump's tariff blasts are simply tactics—many international leaders are reacting, folks give him a pass on the 'who pays' contradiction.

But now, he's talking about collecting tariffs from foreign countries, and you guys applauded him for thinking out of the box. How do you get around the words "foreign sources"?

But the worst words came next: ". . . pay Finally their fair share."

What the hell, that's a Democrat mantra. You folks (including me on this one) jump all over the Left when they say it, but now, it's thinking outside the box?

I have to add a caveat. I am responding based on the OP, but it doesn't matter if it's true; the responses to it are real, and that was the point.

For a bit of red meat, I think Pres. Trump's tariff statements are negotiating tactics, and the public responses from most of the nations mentioned seem positive for us. I think his 'tactics' are working, but that's a long way from supporting his Truth Social statement.

GAI see where you're coming from, and I understand the concern about how President Trump’s new idea for an External Revenue Department might be perceived. I think it’s important to consider the context behind his statements. First, while it’s true that consumers often bear the brunt of tariffs through higher prices, the goal of such measures is typically to encourage more favorable trade agreements and address unfair practices by foreign countries. It’s also worth noting that tariffs can serve as a negotiation tactic, as you've mentioned, and if the result is better trade deals for the U.S., then they might be justified in the long run.

Regarding the idea of collecting tariffs from foreign countries through a new department, I think it’s a creative approach to hold countries accountable for fair trade practices. The "foreign sources" part might sound contradictory to the typical rhetoric about taxes and tariffs, but I see it as a new way of ensuring that those who benefit from access to U.S. markets are contributing more fairly, especially when other nations have been less stringent about trade imbalances.

As for the phrase “pay their fair share,” I agree it’s often a left-wing talking point, but in this context, it could be more about ensuring that global trade benefits the U.S. economy rather than penalizing American consumers. This isn’t necessarily about redistribution; it’s about leveling the playing field.

In terms of the proposed new agencies, I believe this could be a positive step in improving transparency and accountability, particularly if the agencies are designed to track tariff collections more efficiently and ensure that they’re used to support U.S. interests. I do think it's important that these agencies, if created, are implemented with careful oversight to ensure they aren’t just bureaucratic red tape but are genuinely serving the national interest. So, while I understand your skepticism, I also think there’s potential for this idea to create a more structured and transparent approach to trade policy.Regarding the idea of collecting tariffs from foreign countries through a new department, ..

But the tariffs are not paid by the foreign country.... Not in any manner whatsoever.The United States receives tariffs as taxes on goods and services imported into the country from other countries. The process begins with the U.S. Customs and Border Protection (CBP), the agency responsible for collecting these tariffs at ports of entry when goods arrive. The entity importing the goods, known as the "importer of record," is required to pay the tariff. Upon arrival, the importer files a declaration with CBP that includes details about the type, value, and origin of the goods. Based on this information, tariffs are calculated using the Harmonized Tariff Schedule (HTS), which outlines the applicable rates depending on the product and its country of origin.

Once calculated, the importer pays the tariffs as part of the customs clearance process. These tariffs are typically a percentage of the value of the goods, but some are assessed based on weight, quantity, or other measures. After collection, the revenue is deposited into the U.S. Treasury, where it helps fund government operations and programs.

When President Trump says he will impose tariffs, I understand it to mean that he plans to place taxes on certain imported goods and services from other countries. The goal behind this is usually to protect American industries by making imported goods more expensive, which encourages people to buy domestic products instead. It’s also a way to address what he sees as unfair trade practices, like subsidies to foreign industries or intellectual property theft. In some cases, tariffs are used as leverage in trade negotiations to push other countries toward more favorable agreements for the U.S. While tariffs do generate revenue for the government, I think their primary purpose under Trump’s approach is to support American jobs and reduce the trade deficit by discouraging imports and boosting domestic production.

I say the 'consumer' always pays the costs of tariffs. Even if an importer absorbs the extra cost it still means the consumer will pay more than they would if the product costs didn't include tariff costs.

If an explanation doesn't accommodate that truth it's not even a rationalization it's an excuse.

GAConsider one example, the Auto Industry...

If Chinese brands are allowed to compete in America tariff free, whether made in China or Mexico, within a few years the only remaining Auto manufacturer left in America would be Tesla.

Stellantis is nearly done for, GM has more debt than it can manage without getting billions diverted to it from the government (like the Biden Administration and before that the Obama Administration did for it) and Ford is in a bind as well.

American made vehicles dominated the global market a decade ago (kinda)... ten years from now it would not surprise me if they all were out of business.

Same is going on in Germany, they cannot compete with the cheaper Chinese vehicles, Tesla, and their own EU laws which are making gas vehicles all but illegal to manufacture/sell in the EU in the near future.

Same can be said for just about anything complex made in America.

What is left of America's manufacturing/industrial base can be wiped out today by Chinese (and other foreign companies) production if there are not strong tariffs put in place to protect what remains... and encourage new businesses to be developed within our borders.

China has played this game against America for decades, and due to that, they were able to make themselves into the world's Industrial center today.

Its long past due we took care of America first...

Made in America means American jobs (well... if we stop bringing in millions of migrants a year to do those jobs).I think you took a wrong turn. My comments haven't been a verdict on tariffs, they were very specifically (as noted) addressed to the craziness of accepting and praising the content of the Truth Social post.

Relative to this audience, I think all know who pays the tariffs, yet support the idea of a new bureaucracy to collect funds they know are imaginary. There are no foreign sources paying tariffs or duties (my certainty on duties is iffy).

GAWhile it's true that tariffs and duties are typically paid by the importer of goods, not by foreign governments directly, the economic burden of tariffs can ultimately fall on foreign exporters. In practice, when the U.S. imposes tariffs on foreign goods, the cost is often passed along to the U.S. importer, who may then raise prices for consumers. However, in some cases, foreign exporters may choose to absorb part of the tariff to remain competitive in the U.S. market.

In essence, while foreign governments or businesses aren't directly paying tariffs to the U.S. government, they do bear the financial impact of tariffs, either by adjusting their prices or losing market share.

I agree that consumers often end up shouldering the costs of tariffs in one way or another, whether through higher prices or reduced quality.

However, I think it’s worth considering the bigger picture. Tariffs can also serve as a tool to protect domestic industries and jobs, which could lead to long-term benefits for consumers. For instance, if tariffs encourage companies to produce goods domestically, it might create more stable employment and reduce reliance on imports for essential items. While the immediate costs to consumers are undeniable, there’s another side to the coin where the overall economy and national security might benefit in the long run. What do you think about balancing those trade-offs?Do you really think the American people have an appetite to pay more for just about everything?

Just my view

It's obvious that no one wants higher prices, but I think it’s important to consider the broader picture. While the prospect of higher costs might seem daunting in the short term, Trump's tariff plan could potentially yield positive outcomes in a couple of ways. First, it could encourage the growth of American industries by incentivizing domestic production, thus creating jobs and reducing dependency on foreign goods.

Second, it may lead to a more balanced trade policy, where the U.S. could leverage tariffs to negotiate better deals with other countries, potentially leading to fairer trade terms and more favorable economic conditions in the long run. We have very poor trade deals, and it’s well past time to negotiate better trade terms.

Tariffs are our best tool for ensuring that we get fairer deals that benefit American workers and industries. I am willing to put in a bit of a fight to obtain a fair playing field regarding tariffs. I also feel that Trump will be wise enough to do what is best when negotiating trade and placing tariffs. I certainly could be wrong, but these approaches could ultimately lead to stronger and more sustainable economic conditions for the country.

As mentioned to Ken, my comment wasn't a verdict on the use of tariffs.

There is always another side of the coin. Relative to tariffs, I can look at them issue by issue and form different opinions for each one.

A lot of economists think they're more harmful than helpful and there is a valid argument that using them to protect an industry is usually a mistake. "Usually" is the keyword. National Security and National economics are too broad to say 'always.'

GAI do agree with your sentiment, particularly in acknowledging that there is always another side to every issue, especially something as complex as tariffs. It’s true that many economists argue tariffs can be more harmful than helpful in certain situations, particularly when they lead to higher costs for consumers or disrupt global supply chains. History does show that, in some cases, tariffs have resulted in trade wars and economic downturns.

However, it’s also important to recognize that tariffs can be useful tools when used strategically. That said, the question then becomes: Have Americans taken a gamble on a man who gambles? If so, all that remains is for us to figure out the odds—how much risk are we willing to take in the pursuit of potential rewards?

I think we are passing each other as we circle."Have Americans taken a gamble on a man who gambles? If so, all that remains is for us to figure out the odds—how much risk are we willing to take in the pursuit of potential rewards?"

That is a good description. It works for me.

GA

Yup, its a complicated issue... self made by the greed of the elites... who knew they could make themselves unbelievably rich draining away the America's Industry and moving it to China.

We all can probably tell stories about how in the 1980s our health insurance covered almost everything, wages were good, and the future looked bright.

Fast forward 40 years or so, and many jobs are paying the same wage as back then, or less... health insurance covers nothing, without you coming up with the other half out-of-pocket, and the future (for America/Americans) looks scarier than it ever has.

There are no 'easy fixes' when you are now spending ONE TRILLION dollars a year (and growing) on the INTEREST of your National debt, and you are spending TWO TRILLION more each year to run the government than you take in.

Hard choices are coming up... Hard times are ahead.

Its just a matter of how badly are we going to pay for the incredible idiocy that got us here... none worse than what we have seen in the last 4 years.

Not all bad... Just my view

Trump's proposed idea for an External Revenue Department could potentially benefit the U.S. by offering a more transparent and accountable way to manage tariff revenue and trade-related finances. From what I understand, the goal would be to improve how trade policies are carried out and ensure that foreign countries are contributing fairly, especially when it comes to tariffs.

One major benefit I see is improved accountability and transparency—a new agency could track how tariff revenue is collected and spent, making sure it's used efficiently to strengthen the economy. This would allow us to have a clearer picture of the impact tariffs are having on U.S. industries and consumers, which could help in trade negotiations and ensure better deals for the country.

A focus on fair trade could help address issues like trade imbalances or unfair practices from other nations. If the department could manage and allocate tariff funds more efficiently, it might fund programs that directly benefit U.S. industries and infrastructure.

I think the plan has the potential to make the U.S. more self-sufficient in trade and improve accountability, which could ultimately benefit the American people. However, like any new initiative, it would require careful planning to make sure it works as intended.Not sure about anyone else here but I'm not interested in paying more for every item that comes into this country and then pretending like it's a good idea to create another government agency to manage that money which is actually my money... I think I'd rather just have my money. You know for all those higher grocery prices that everyone has conveniently forgotten about...

I think this is a brilliant idea.

President Donald Trump has always been America First.

These tariffs are a way to keep out foreign imports on many items that could can easily be manufactured by American companies. The demand will be there and it will be an opportunity for American manufacturers to have better competition.

Foreign countries around the world place tariffs on American goods imported into their country. China and some countries in Europe are pretty bad.

We need to understand that many countries provide their companies with subsidies so they can sell their products cheaper in the United States and grab a bigger market share from American companies who do not have subsidies when they sell their products abroad.

Tariffs are an economic tool and nothing more. It makes countries pay attention to what you are saying and provides a way to help American companies grow and expand.

I don't see a downside to this.The importer pays the tariff and passes the cost a long to the consumer. The foreign country does not pay any tariff.

The phrase "tariff on foreign countries" is a euphemism because it oversimplifies and misrepresents how tariffs function. While tariffs are often described as a tax on goods from foreign nations, they don’t directly tax those countries or their governments. Instead, the financial burden falls on importers—typically businesses in the imposing country—and is ultimately passed on to consumers through higher prices.

However, increasing tariffs can still harm the targeted country’s economy. Tariffs make foreign goods more expensive in the imposing country, reducing their competitiveness and demand. This decline in demand can shrink export revenues for the targeted nation, leading to economic ripple effects such as lower production, job losses, and slower growth. Supply chain disruptions further exacerbate the issue, as tariffs raise costs and complicate global trade networks. In some cases, the targeted country may retaliate with its own tariffs, escalating trade tensions and creating broader economic harm. Additionally, tariffs can destabilize the targeted country’s economy by devaluing its currency and deterring foreign investment.

The phrase "tariff on foreign countries" misleads by implying that the foreign government or nation directly pays the cost, when in reality, tariffs create a complex chain of economic consequences that affect both sides. While the targeted country experiences significant harm, the imposing country also suffers from higher prices, reduced consumer choice, and the risks of retaliatory actions, making the phrase an oversimplification of the broader impact."they don’t directly tax those countries or their governments. Instead, the financial burden falls on importers—typically businesses in the imposing country—and is ultimately passed on to consumers through higher prices."

And what is the result? Less foreign goods on the market to compete with American products. The vast majority of the countries pay no tariffs on the goods they send to the United States, so they benefit as well.

When the price of foreign goods increases consumers will then purchase more American products for a lower cost.

Again, America and American industry benefits.Again, America and American industry benefits.

And when American industry does not exist currently to replace what's coming in quickly? For example the multitude of car components that come in from various countries to be assembled here.... It is extremely shortsighted and simplistic to think that manufacturing of that sort is just going to appear on American soil quickly and out of thin air...Quickly? No. It will take months to years to rebuild our manufacturing base. In the meantime we pay higher prices.

But what is the alternative? Continue down the road of importing everything we use? Depend on inimical countries for our needs and wants?The American public would not tolerate inflation due to covid... We are not a patient people. We are not a reasonable people. The idea that higher costs for everything will be accepted by the American people is laughable. The majority of the folks who voted for trump, will be looking for lower grocery prices next week and he will suffer the consequences if he does not produce. It's really very simple.

Perhaps you should reconsider your comment and clarify that you’re expressing your own perspective rather than speaking for all Americans as impatient or intolerant people. It seems presumptive to claim insight into the thoughts and feelings of hundreds of millions of individuals. It’s reasonable to assume that citizens who voted for Trump supported some or all of his agenda and ideas. From my perspective, I don’t believe many of his supporters expected his bold, transformative policies to be achieved overnight.

Of course they expect changes overnight... That's what he promised and that's what they voted for. Too much waffling on this forum. Folks need to be reminded of their previous posts and stance. It's interesting that all the daily complaining and bemoaning inflation has disappeared as Trump's inauguration Day nears.

https://apnews.com/article/ap-votecast- … e57a74f198I believe many of our complaints have lessened because we feel that the person we support worked incredibly hard in his last term, and brought about positive change, and we are hopeful that he can do it again. I think we see and trust our economy will get better with a many that solves problems not makes them.

Some prefer never facing the root of a problem, and smacking a bandaid on it. It is just the easiest route to take.

While it’s true that rebuilding American industry to replace imported goods cannot happen overnight, the argument that it’s "shortsighted and simplistic" to pursue this goal overlooks the broader economic strategy behind such policies. Tariffs are not solely about instant replacement; they are about creating long-term incentives for investment in domestic manufacturing. By making imports more expensive, tariffs encourage businesses to reconsider where they source materials and manufacture goods. It’s a gradual process aimed at fostering resilience and reducing reliance on foreign supply chains.

The status quo has provided stagnant growth in the US. Trump hopes to solve that and move beyond the status quo. As I said his plan would create a two-edged sword. Hopefully, negotiations will prove to be successful and he will create a fair playing field. I do think foreign as well as US business owners realize Trump means what he said, and is ready for a fight.Good luck getting the backing of the everyday American who is simply tired of paying $5 for a dozen eggs to accept additional costs on anything . They were promised a bevy of giveaways and it's time for him to produce. Again, the average American couldn't accept the reality of inflation related covid, they most certainly won't buy any narrative of "suffer now" for something down the road they can't see. Americans want more money in their pockets and they want it now. Biden paid the price of many Americans lack of understanding of basic economics and Trump will suffer a similar fate.

We had no choice under Biden did we? Guess one could say we will have no choice under Trump. You are very correct Americans seem to hold the economy at the top of the list.

We will see what shakes out under Trump. I will not predict, as you do. I supported Trump's agenda, if it fails, in four years I will be once again looking for another candidate to support. I have a good feeling that Trump will work like hell to bring about positive change.

I agree, that would most likely be the scenario. I am on board with Trump's plan regarding tariffs to create a fairer playing field. The time has come. we have been taken advantage of.

Over decades, the U.S. found itself at a disadvantage with unfair tariffs due to a combination of historical trade policies, global economic dynamics, and strategic decisions made during periods of rebuilding and alliance-building. After World War II, the U.S. championed free trade and economic recovery in Europe and Asia, often accepting trade terms that allowed allies to impose higher tariffs or other barriers on U.S. goods while enjoying low tariffs on their exports to the U.S. This approach was designed to foster global stability and economic growth, particularly through initiatives like the General Agreement on Tariffs and Trade the establishment of the World Trade Organization.

However, as global economies grew and became competitive, many nations maintained protectionist policies, including subsidies and tariffs, that benefited their industries at the expense of American manufacturers and exporters. Over time, this created significant trade imbalances, with U.S. industries struggling to compete unevenly.

It is time to create a fair-paying feeling. Even at the expense of hurting other nations' feelings LOL

And American manufacturing benefits. American companies are able to regain market share from foreign imports. It's an excellent idea.

Lol... Tell me about it when your costs go up. There is no appetite in the country for increased costs whatsoever. Most folks have voted in Trump to reduce their grocery costs... He's got a few days to do that or face the wrath. Tick tock. The clock on his many promises is ticking.

Sorry folks, you can't complain about your egg prices for the last 3 years and then all of a sudden it doesn't matter to you anymore...There is no appetite for other nations to see their costs increase either, and tariffs remain a two-edged sword. That said, MAGA can prioritize whatever we choose, whether it’s supporting Trump’s policies or not—tariffs are and were a significant part of his agenda. It’s presumptive to assume you can predict what citizens feel because individuality plays a major role in our party. As you pointed out, the Republican Party has different factions, but one thing we can agree on is that we don’t adhere to groupthink.

Tariffs don't increase costs for the foreign country.

I have tried to explain that Tariffs pose a great cost to other nations. Their business as well as their people suffer under many variables. You are stuck on a euphemism. You don't seem to comprehend what increasing tariffs could do to a nation's economy. Again

The phrase "tariff on foreign countries" is a euphemism because it oversimplifies and misrepresents how tariffs function. While tariffs are often described as a tax on goods from foreign nations, they don’t directly tax those countries or their governments. Instead, the financial burden falls on importers—typically businesses in the imposing country—and is ultimately passed on to consumers through higher prices.

However, increasing tariffs can still harm the targeted country’s economy. Tariffs make foreign goods more expensive in the imposing country, reducing their competitiveness and demand. This decline in demand can shrink export revenues for the targeted nation, leading to economic ripple effects such as lower production, job losses, and slower growth. Supply chain disruptions further exacerbate the issue, as tariffs raise costs and complicate global trade networks. In some cases, the targeted country may retaliate with its own tariffs, escalating trade tensions and creating broader economic harm. Additionally, tariffs can destabilize the targeted country’s economy by devaluing its currency and deterring foreign investment.

The phrase "tariff on foreign countries" misleads by implying that the foreign government or nation directly pays the cost, when in reality, tariffs create a complex chain of economic consequences that affect both sides. While the targeted country experiences significant harm, the imposing country also suffers from higher prices, reduced consumer choice, and the risks of retaliatory actions, making the phrase an oversimplification of the broader impact.

There is no appetite for other nations to see their costs increase either, and tariffs remain a two-edged sword.

Explain how tariffs increase the costs for the foreign country as you claim above...I believe that happens because companies pass along the cost of the tariffs to the country they are importing goods from.

copy and paste a thrid time --- sort of time to say believe what you please.

again ---- I have tried to explain that Tariffs pose a great cost to other nations. Their business as well as their people suffer under many variables. You are stuck on a euphemism. You don't seem to comprehend what increasing tariffs could do to a nation's economy.

The phrase "tariff on foreign countries" is a euphemism because it oversimplifies and misrepresents how tariffs function. While tariffs are often described as a tax on goods from foreign nations, they don’t directly tax those countries or their governments. Instead, the financial burden falls on importers—typically businesses in the imposing country—and is ultimately passed on to consumers through higher prices.

However, increasing tariffs can still harm the targeted country’s economy. Tariffs make foreign goods more expensive in the imposing country, reducing their competitiveness and demand. This decline in demand can shrink export revenues for the targeted nation, leading to economic ripple effects such as lower production, job losses, and slower growth. Supply chain disruptions further exacerbate the issue, as tariffs raise costs and complicate global trade networks. In some cases, the targeted country may retaliate with its own tariffs, escalating trade tensions and creating broader economic harm. Additionally, tariffs can destabilize the targeted country’s economy by devaluing its currency and deterring foreign investment.

The phrase "tariff on foreign countries" misleads by implying that the foreign government or nation directly pays the cost, when in reality, tariffs create a complex chain of economic consequences that affect both sides. While the targeted country experiences significant harm, the imposing country also suffers from higher prices, reduced consumer choice, and the risks of retaliatory actions, making the phrase an oversimplification of the broader impact.

What Trump supporters believe and expect....

"The economy and immigration were top issues for Trump supporters. Just as it was in 2020, the economy was the most important issue for Trump voters this year. In a September survey, 93% said it was very important to their vote."

Economy Most Important Issue to 2024 Presidential Vote...

"The economy ranks as the most important of 22 issues that U.S. registered voters say will influence their choice for president.."

https://news.gallup.com/poll/651719/eco … -vote.aspx

Like I said... Tick Tock. Stop the Greenland nonsense, stop the external revenue nonsense, stop the look here not there distractions.... It's about the eggs.

https://www.pewresearch.org/short-reads … nd-expect/I don't think many Trump supporters would disagree that we prioritize two issues above all else: the economy and immigration. These are areas where most of us believe Biden has failed, leading to significant problems related to both.

What's your point?

"Pay their fair share." What? Like the top 1% in US?

Related Discussions

- 71

Why does the Right now support Welfare Payments - I Don't Understand

by Scott Belford 7 years ago

President Trump starts a trade war with the rest of the world say such wars are good for America. Everybody of intelligence tells him he is wrong. Now that reality is hitting Americans and American producers with huge loses, as expected and predicted, Trump wants to spend $12 billion to...

- 102

Tarriffs:Trump, a father of a new Golden Age or is it a Golden Shower?

by Credence2 9 months ago

Once again, the great stone head is now calling himself a scholar of economics. He tells us now that the economic turnaround would now "take time", while on the campaign trail he was telling us that it would occur overnight. On March 13th, there will be an assessment of the inflation...

- 29

Mexico, Canada, and the EU hit with new steel and aluminum tariff

by Ralph Schwartz 7 years ago

The President announced today that America will levy tariffs on steel and aluminum to the EU, Mexico, and Canada tonight - retaliatory measures are already being drafted against the country and the stock market is tenuous at best. Commerce Secretary Wilbur Ross said trade talks with the...

- 15

President Donald Trump's Tariffs are working

by Readmikenow 4 months ago

From the left-leaning Fortune Magazine."Trump is bringing in enough revenue from tariffs to cut deficits by $4 trillion over the next decade, CBO saysPresident Donald Trump’s hike in tariffs is projected to generate enough revenue to cut federal deficits by $4 trillion over the next decade,...

- 50

Tariffs Here We Come

by Willowarbor 13 months ago

Nov 25 (Reuters) - U.S. President-elect Donald Trump on Monday pledged a 25% tariff on all products from Mexico and Canada from his first day in office, and an additional 10% tariff on goods from China, citing illegal immigration and the trade of illicit drugs."On January 20th, as one of my...

- 11

Why Trump Loves Tariffs So Much.

by Mike Russo 8 weeks ago

To understand why Trump loves tariffs, we have to go back to the 1970's. In that period we had big cars with big gas guzzling engines and everybody was happy. The price of gasoline was very low and affordable by all and then the OAPEC oil embargo hit.**The 1970s oil embargo was a geopolitical...