Why we need unions and what it means for the US to not have them.

That has to be the best and clearest definition of the trickle down effect!

I agree. Only I would add, "and be sufficiently grateful for it....or you don't Luv your country."

- JaxsonRaineposted 13 years ago

0

Yeah, only one thing would make it better...

If it were correct.But it is! How else do you explain the feeble idea that the best way to make the poor better off is to give more to the rich?

Don't forget that I come from a country whose leader at one time publicly espoused trickle down!Lowering the tax rate on someone is not 'giving them more'. It's 'taking away less'.

When you earn money, it is yours. If the government taxes you, they are taking it away. They don't give you money by allowing you to keep it.

Now that we have that out of the way, the whole idea of 'trickle down doesn't work' is flawed on different levels.

Fundamentally, if the government takes away all of everybody's earnings, nobody will have anything, and there would be no private sector. So, by increasing taxes toward 100%, you will inevitably approach 0 private-sector hiring. You can't dispute that.

Additionally, the whole argument that trickle-down doesn't work is stupid because we haven't really changed corporate tax rates in about 25 years, but everyone acts like they were dropped drastically and it made no difference.Dream on.

Like I said, we tried trickle down and we're still paying the price. It isn't about taxing people more, it's about taxing them the same, everybody, not giving huge tax breaks to the rich whilst putting the tax screws on the middle classes and the poor.We never lowered taxes on CORPORATIONS. You know, the entities that hire people.

As far as taxing everybody the same, that's ridiculous.

Bottom 50% pay 1.85%. Top 1% pay 24%.

The top 1% make 17% of the money and pay 37% of the taxes. By definition, they pay over double their fair share.

How is paying 24% not paying as much as paying 1.85?"We never lowered taxes on CORPORATIONS. You know, the entities that hire people."

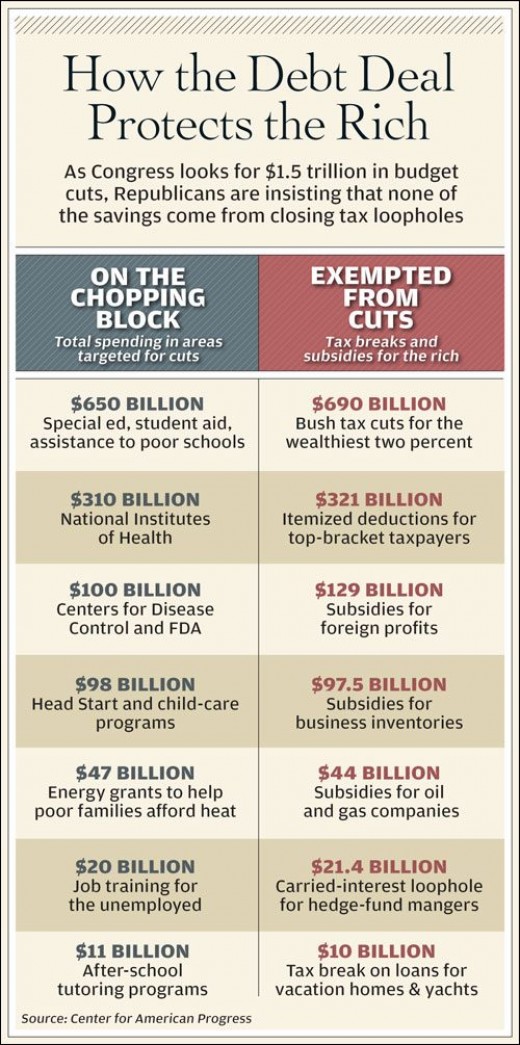

Maybe, but we sure created a lot of loopholes and subsidies which lowered the actual effective rate if not the nominal rate.

True. The U.S. doesn't collect enough taxes to pay for the public services that everybody wants and needs--education, roads, SS, Medicare, Medicaide, defense (war, actually)and so forth. The GOP likes to cut taxes, especially on the rich, but they aren't very good at following through on cutting expenses, especially the billions wasted by the Department of Defense.

Do you think that the bottom 50% of Americans should pay more than 1.85% income taxes?

Did you know that for every tank of gas you buy...$14.00 of it is because of wall street speculators? Do you consider that a tax?

Gas in 1995 was $1.19 a gal. I paid $3.69 yesterday...what is that?

How about when we pay our phone bill, electric bill, real estate, heat, buy clothes, car payments, toilet paper, lawn-mowers, etc etc etc etc. It's all taxed.

And don't forget FICA--that's 7.65% right off the top.....on small incomes 1.85% in Fed is all we can afford!

And yet: Mitt pays tax at 14%, and he made 45 mil in 2 years....you OK with that?The reason gas is so expensive is because of OPEC, they engage in price fixing. It's not because of Wall Street(Are you saying that Wall Street is responsible for worldwide gas prices?) Even with that though, we could get our gas prices back down if we just took advantage of our natural resources here at home, and create a lot of jobs while we're at it too.

Yes, we have sales tax. Funny thing, everyone pays the same sales tax.

Yes, people pay FICA and all that too. But, want to hear something REALLY funny about the 1.85% figure? It doesn't include any refundable credits. A family of 3 or more that makes under ~40,000 will actually get money back, aka a negative tax rate. But those numbers aren't included in that figure I gave.

Also, Mitt pays more taxes than just his 14%. He also has to pay taxes on the corporate side. Just like how a self-employed person pays taxes on their business income, then they pay taxes on 'paying themselves' from their business income.

But keep imagining that the rich somehow aren't paying their fair share, even though the top 1% covers almost 40% of the burden.And how much of the countries wealth do the top 1% have?

The top 1% earn about 17% of the income and pay about 37% of the taxes. Dollar for dollar earned, they pay more than double taxes than the bottom 99%, let alone the bottom 50%.

No, how much of the countries wealth do they have? That is not the same as income.

The top one per cent own 42.7% of the countries wealth.Looking at wealth when talking about income tax is completely irrelevant.

The bottom 50% have almost 0 net wealth because they get themselves under huge mortgages and credit card debts.

Are you proposing a wealth tax?Why is looking at unearned income when talking about income tax irrelevant?

What is so sacred about unearned income that it either shouldn't be taxed at all or taxed at a lower rate than earned income?

I bet you haven't a good word for those at the bottom of the heap living off unearned income but isn't it strange how defensive you become when those at the top live off unearned income.

To my mind they are worse than those at the bottom living off unearned income, at least they put the money back into circulation quickly.Unearned income is not the same thing as wealth. You were talking about wealth, not income.

When I say the top 1% earn 17% of the income, that includes unearned income.

The wealthy do much more for the economy. Poor people don't provide jobs. Without jobs there would be no circulation.The wealthy only provide jobs where it will make them even wealthier. Without the poor there would be much greater circulation.

So, blame the rich for getting rich off of providing jobs for other people?

Poor people never provide jobs, the rich do, but the rich are evil because they only pay 24% taxes and the poor pay less than 2%.But you've already admitted to the poor paying 9% sales tax!

No, not even close. You don't seem to actually read what I write.

I said IF the poor spent ALL of their money on items that are subject to sales tax, that would be what they would pay.

When in actuality, most expenses aren't subject to sales tax.

Here's something from Wikipedia, I haven't fact checked it.

http://en.wikipedia.org/wiki/File:Avera … 50_States_(2007).gif

So you can add on an extra 2% to the bottom 50% for sales tax compared to the top 1%.

But, you also have to subtract all refundable credits for the bottom 50%, because a large number of that group actually has a negative tax rate that isn't counted. A married couple with one child can make up to ~35,000 dollars and still have a negative income tax rate.

2009 when Obama took office gas was $1.89, guess you did not want to admit that LMC

Just to accurate here, SS is 7.5 % but now is only 5.5%

Yes I am OK Mitt paid 15% on the $200 million risk he took. LMC, would you let him take a tax credit if he lost all $200 Million and became broke? What do you risk LMC? Why should you get something when you risk nothing.I don't risk....I work!

And my kids teacher works. And the nurses at the hospital work.

And they should not be paying more out of their lives than ole money-bags Romney.

I'm positive they pay at a higher rate....and they're not gambling with other people's money.LMC,

twists twist twist, like you did last summer. Sorry get carried away with that song but it actually addresses the point. You don't risk, nothing ventured nothing gained. You work, you get paid for your work or do you do it for free. Your positive they pay a higher rate because you are all knowing and all wise, we bow at your feet, we cannot deal with your wisdom. Of course most nurses pay more of a percentage than Romney but I guess we will not mention that.

And you continue to miss the point that he is not gambling with other people's money, every dime that he is risking his own personal money. Once more you take the risk you to can make that money. And no matter how much you complain in a matter how much you spin it that the factThey pay at a higher rate because what Leona Helmsley said was true: Only the little people pay taxes. She just got caught and made an example of ala Martha Stewart. You think insider trading has stopped? please.

For some people enough is never enough. They always have to have more more more. And they will do anything to keep it that way.Once more change the story to something that has nothing to do with the subject at had. Keep up those left moves.

By the way, be accurate about things please. She said "only the little people should pay taxes" You left out a few words that changed the meaning of what she said. She felt she was a woman of posture and should not have to pay taxes. I guess you forgot how she treated the middleclass people who worked for her

When you live somewhere--you owe it.

YOU didn't make the roads, provide the schools, the beautiful parks, the military, etc etc.

Those with wealth get the best this country has to offer, and no one stops them--they live like kings and queens.

Buffet is right....They have been coddled way too long.

For, as Leona Helmsley said: "Only the little people pay taxes."

And the rich skim off the top.Only the little people pay taxes?

The average American in the bottom 50% pays 1.85% taxes. The average 1%-er pays 24%. Is 1.85 more than 24?Max Keiser

Tax payers built the net. They give away their content freely. They blow billions on an IPO. But only Zuck and a few VC's get paid.Those figures don't sound rught. They obviously don't include SS tax, sales tax, property taxes. Our tax system is one of the most regressive in the world.

Lol. So if Wiz posts a picture that says the top 1% pay 19% taxes, you call it facts.

If I provide a direct source where you can check out the data, showing that two years later the top 1% pay 24% taxes, you say it's wrong?

I have an idea Ralph. Since I have provided source after source after source, time and time again, how about you provide a source showing that I'm wrong?

I mean a real source too. Not a news story, not a blog post. Some kind of actual study into tax rates, preferably from a government agency.Tell me if I'm wrong if your figures included ALL taxes. All taxes should be included in making conclusions about the fairness or regressivity of taxes. Seems to me you specialize in citing obscure figures and drawing misleading, unwarranted conclusions.

No, my figures don't include all taxes. My figures are from federal taxes based on IRS reports. My figures show the federal tax rate(with some notes).

The bottom 50% paying 1.85 is a generous figure, as it doesn't count any refundable credits. Almost any head of household of married couple with at least 1 dependent will actually have a negative tax rate in the bottom 50%, but in these reports they get reported as having a positive tax rate.

Citing the federal income tax rate isn't obscure, nor is it misleading. I told you, you are welcome to look for something showing the total impact of state/local/FICA taxes across all income levels, but you seem more concerned with insisting(with no evidence) that I'm wrong and you're right and rich people are evil.

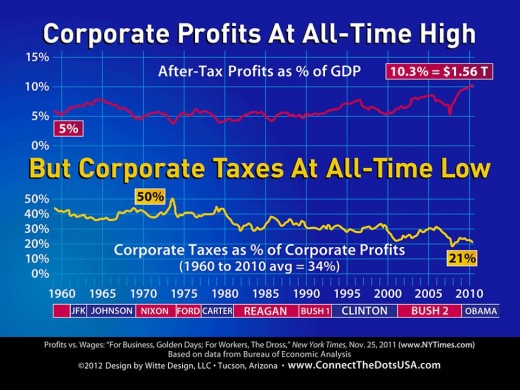

1st image - Ok, corporations pay 20% taxes on their pre-tax profits, after having paid taxes on the money they pay to their employees. Unless you are in the top 1%, you aren't paying anywhere near that much, so why complain? Do you want to punish corporations more for doing well and hiring people?

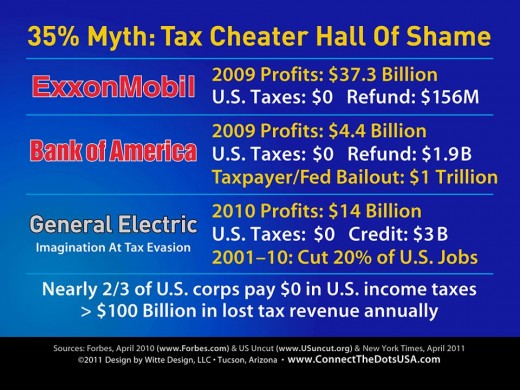

2nd image - I already know that the part about GE is wrong, and I've proven that(although you never did reply to that thread I made even though you said you would look at the facts). Do you have anything to say about that?

Bank of America I agree with. Companies bailed out by the government get stupid benefits. GM is getting a total of $45 billion off of their taxes over the next decade. The bailouts rewarded corporations for going bankrupt.

Exxon paid 15 billion in income taxes in 2009, that's 47% of their pre-tax earnings.

http://www.sec.gov/Archives/edgar/data/ … toc94192_9

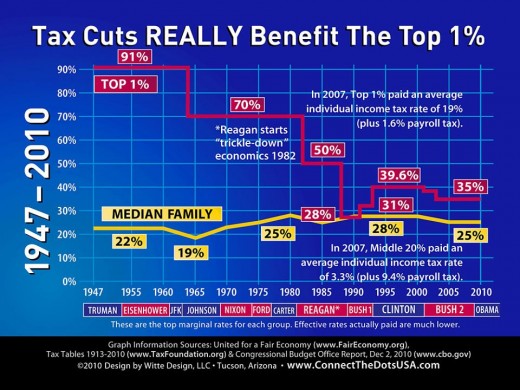

3rd image actually proves my point, that the rich pay high taxes and the poor don't. The chart admits that the yellow line is marginal rates and effective rates are much lower. It puts the top 1% at 20% and the middle 20% at 3.3%. So, are the rich not paying enough for only paying 20%?

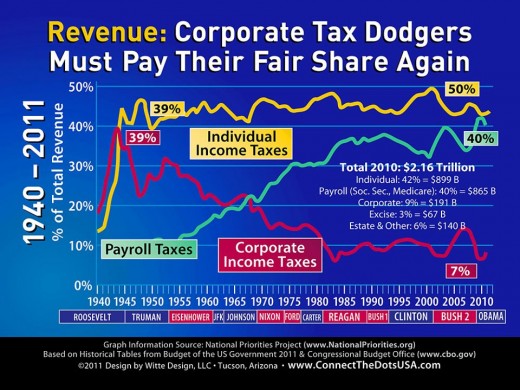

4th image - What's the point? Corporations are paying much more out in payroll taxes than in income taxes? That's good, it means they are employing people. Looking at corporate taxes as a % of tax revenue doesn't say anything about the % they are paying as a tax rate. It's a stupid % to look at.

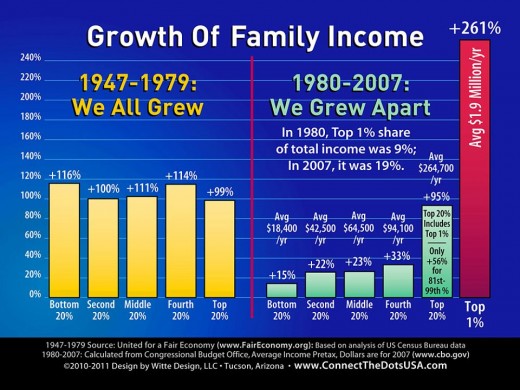

5th image - Yes, the internet and other modern advances has brought fame and fortune within the reach of everyone. Many people have made a lot of money by starting their own companies. Before the 80's, how much harder do you think it was to start a business that could reach out across the entire world for customers? This is a tribute to the opportunity we all have access to. I'd have to check the Census data to see if they are right about the figures in the first portion of the chart, but really, it just shows that EVERYONE is getting more and more, on average, no matter what group they are in.Thanks for taking the time to analyze the images, Jaxson, though your cherry-picked interpretation is not the way I view that information—nevertheless, I appreciate your acknowledgement and agreements with some of the data.

I'm curious about how you might view and interpret the following video on the difference between people and corporations . . . if you would be so kind?

http://youtu.be/bQ9Pr4iT-QMI don't have sound.

Why won't you actually discuss anything? You can't say anything about my analysis except that you don't agree?

You don't agree that Exxon paid 17 billion in taxes, even though I linked to the SEC filing that said they do?

What about GE? Have you looked at that?I don't agree because I don't trust the company to be honest and transparent about their real profits, moreover, it also conflicts with other assessments of their profit/paid tax ratio:

ExxonMobil Makes $41 Billion, But Pays Estimated 17.6% Tax Rate, Lower Than Most Taxpayers

http://thinkprogress.org/climate/2012/0 … ot-romney/

Wrt GE, I missed your post on "your proof" but I'm still influenced by the Citizen's For Tax Justice conclusion on GE, but I'd be happy to peruse your "proof" if you don't mind providing it yet again.

Meanwhile, here is the CTJ article that uses a decade of data: http://www.ctj.org/taxjusticedigest/arc … ectric.phpOne of the biggest loopholes for international companies like Exxon and GE is that un-repatriated profits in other countries are not subject to U.S. taxes. This means that with a few accounting tricks a manufacturing company like GE can use phony transfer pricing to book the profits in another country and avoid a U.S. tax liability. And of course Exxon and other oil companies have enjoyed a 15%? depletion allowance for many years even though their reserves have grown rather than being depleted and regardless of how much profit they make.

It's so discouraging, Ralph. Petty resentments over food stamps and total denial of economic injustice. They want a feudal system back where serfs have to do their bidding and like it . . . or die.

What is "economic justice", how do you define it? As for the feudal system that is what you are living under with your insistence on defending Obama's indefensible Marxist socialist policies. I prefer freedom to serfdom, capitalism to Marxism and prosperity to the stench of failure under which we are currently subjected to under Obama.

Wait. You don't agree with Exxon's SEC filing, but you agree with somebody's analysis that they paid no taxes, which would have to be made either by making it up, or by analyzing Exxon's SEC filing.

Think progress links to thinkprogress which links to thinkprogress as their source. Where do you think they are getting their information? The only place to see financial information on a company is in their... wait for it... financial filings.

TP claims they paid no income taxes, but I linked to you showing where they did. You show me some real data proving that they paid nothing.

Seriously, anybody can write an article on the internet. TP uses themselves as a source. I provided the SEC filings for you, but you believe an unsourced claim on the internet over official figures...

http://hubpages.com/forum/topic/98395

But I'm sure you'll just say that the SEC filings are wrong, and CTJ's analysis based on the SEC filings is right.

CTJ can't even copy figures from an SEC filing correctly. Give me a break.Well Jaxson, I don't want to say I mistrust you, so I will defer to a more creditable source that you may or may not find acceptable wrt Exxon-Mobil . . . and certainly more palatable than the SEC document you posted that Exxon may or may not have lied in—and that you believe (as a true believer ) as you tout the Company Line . . .

The source is the Washington Post using Exxon-Mobil's data, but in a Reader's Digest version . . .

Here's the article: http://www.washingtonpost.com/business/ … story.html

GE to follow as time permits.Thanks for the article. The oil industry is one I don't know too much about as far as tax deductions and breaks go, but the 17% figure is pretty close to what I saw in their 2009 filings.

I can't really say whether or not I agree with the tax breaks they get, because I don't know the requirements or impacts of them.

http://www.bluegrasspundit.com/2011/06/ … ostly.html

Perhaps instead of being the Food Stamp President --- Obama should be hired as the Micky Ds President. Besides they need another clown.Food Stamp Resentment—how predictable and petty!

You still got nuttin'!What is "Food Stamp Resentment" a new medical condition covered by Obamacare? WOW -- the problem with your reply is that it fails to refute anything. Hence, you obviously agree that Obama's economic policies have resulted in increasing the use of food stamps by over 80 percent. Quite an impressive achievement. 46 million Americans on food stamps...what a legacy!

By Allison Linn

"More than 35,000 people who had income of more than $200,000 in 2009 paid no federal income taxes that year, according to a new report from the Internal Revenue Service.

The non-taxpayers were among the top 3 percent of all earners with more than $200,000 in "expanded income," which includes adjusted gross income plus other less common sources of income such as tax-exempt interest or foreign income.

The number of wealthy people who paid no federal income taxes rose between 2007 and 2009, thanks in part to new tax credits, according to the report."

http://lifeinc.today.msnbc.msn.com/_new … bills?lite

Tax credits are NOT just for low incomes!Ah LMC, can't wait to read why that IRS report is wrong!

Hello John -- IRS are just cops or perhaps they are more like the Gestapo. Regardless, I think it is great that 35,000 of the so-called wealthy didn't pay income taxes. They certainly paid all other taxes due such as capital gains taxes. As for the report being "wrong" I can't imagine the IRS screwing that up too. But I thought the definition of rich according to Obama was $250,000. And that is for an individual. However, what is wrong (I didn't want to disappoint you) is the taxation of individual labor. I find it curious that liberals/progressives/marxist socialists always complain about workers rights and the need for UNIONS (which is what the original intent of the question was founded), but yet leftists have no problem with a government taxing LABOR. The very thing Jefferson and all the Founding Fathers were against -- taxing the fruits of our labor! It was a founding principle.

Freedom to enjoy the fruits of our labor is a fundamental inalienable right and yet most Americans are seeking ways to tax everyone "fairly". I would say that it is "fairly" wrong and ignorant.

So let me get this straight -- people want Unions for the purpose of getting better paying jobs so that they can pay more in taxes to a government many claims represent the rich. That my friend is a brilliant strategy. One in which I'm certain similar thoughts were a cause of the failure of the Roman Empire and British Empire.So you're pleased that the rich can take all the benefits of living in a prosperous society without actually paying for it! The tax system is all ready regressive enough with the weight of taxation being most heavy on those that can least afford it.

Of course if everybody paid their fair share of taxes, it would mean smaller tax bills for the ones who aren't evading their tax liabilities.8/10ths of 1% of those making 200,000 or more paid no taxes. That's not a fair sample of the rich.

Also, go look at WHY they didn't pay taxes. The same 'loopholes' are available to you.

The bottom 50% pay almost no taxes at all, while the top 1% pay more than double their fair share.Who said they didn't pay for the benefits? And who exactly is responsible for their "prosperous" living -- government? No, the individual is responsible. The INDIVIDUAL made American society prosperous NOT government. What do you think the atom of society is? There is NO "society" without the individual. And in the US Constitution I see not any discussion or mention of societal rights, social justice or any of your Marxist socialist propaganda propensities that disembowel individual rights.

But I noticed that you failed to address the FACT that 48 percent of Americans pay NO INCOME TAX. Apparently that is perfectly legitimate for average Americans avoiding income taxes according to you?

As to your point regarding taxation being unfair because it impacts the poor more is precisely my point. Before 1912 there was no income tax or other taxes for that matter. And even after that until the IRS poor and middle class didn't pay voluntary income taxes.

And to your tax evasion claim -- since the tax returns were from the IRS, it is obvious those 35,000 people did not EVADE taxes. That is illegal. However, what is legal is tax AVOIDANCE which if you cannot understand the difference then you should have your life controlled by government bureaucrats. But please leave me out of your pathetic desires to receive your sustenance from government. Thanks John.Why do you harp on about the unfairness of income tax? It's probably the most fair tax we pay, unlike sales taxes, fuel taxes and all the other taxes we have to pay and which incidentally hit the less well off much harder than the wealthy.

Sales tax, fuel tax, etc... are equal taxes. Everyone pays the same rate. The rich pay more and travel more though, so they pay much more in those taxes.

Are you mad at the government for charging you between $0.50 and $1/gallon of gas in taxes?Erm, my government charges me a lot more tax on gas than that, or they would do if I owned a car!

The point is that if you've got $10 in your pocket the tax on that gas will hit you a lot harder than the guy with $1000 in his pocket.Yeah, it can hurt more, but it's not unfair for everyone to pay the same percentage.

The rich end up paying a lot more sales tax and gas tax than everyone else. Heck, even flying a small aircraft you can burn between 5-10 gallons per hour.

So as a percentage, everyone pays the same. As a total amount, the wealthy pay much much more.

Where is the imbalance?No, as a percentage the rich pay considerably less. You know, $10 out of $10 is one hundred per cent, $10 out of $100 is 10%.

Ok, you want to talk about percentage of income?

A poor person could spend ALL of their money buying things that are subjected to sales tax(which they don't do), then they would pay an average of ~9% of their income on tax. Add to that 1.85%(not really that high) federal income tax.Not so in the UK where VAT is 20% on a lot of things, even 5% on fuel and that 5% really hits the poor spending a large part of their money on heating during the winter.

What in the name of all that is holy does the UK's VAT have to do with US taxes? We kind of are talking about the US here.

I thought we were talking about tax and wage inequality!

Exactly. But why would do people insist on higher taxes, when the rich often pay more in taxes in one year than most people will make in a life time.

But to the point, is it fair that people that do not pay income taxes (48% of Americans), but receive the exact same amount of national defense as someone that paid $100 million in taxes?

The point is simply that government ensures that you have the same opportunity to develop an idea or business and are protected by the same laws and property rights as someone who is rich. But the government does not and cannot ensure the outcome.

And where do you live if your government is charging more in gas taxes -- socialist Europe? It couldn't possibly be the United States.He lives in the UK I believe. James May said it best:

[Announcing the nominations for the Top Gear Life Time Achievement Award] Ken Livingstone, for deciding that if you earn a living and pay tax, and spend some of what's left on a car, and then pay Value Added Tax on that, and then buy some Road Fund License Tax to put the car on road, and then pay Fuel Duty Tax on the fuel, and Value Added Tax on that Fuel Duty Tax, you should then pay £25 - TAX - to drive into the centre of the Capital.

"I think it is great that 35,000 of the so-called wealthy didn't pay income taxes. They certainly paid all other taxes due such as capital gains taxes."

FYI capital gains taxes are income taxes. They are included as income and paid when taxes are due every April 15. Taxes are used to pay for the government services that Americans expect and enjoy--public schools, roads, police, courts, national defense and so forth.Hello Ralph -- FYI capital gains taxes are NOT income taxes, hence the term "capital gain" which is intended to distinguish them from other taxes.

Also, not to strain your intellectual capacity for the day -- but, "income taxes" do NOT fund anything other than the interest on debt. Those things called "school taxes" fund schools. Gasoline taxes fund road use, allegedly.

And your statement "government services that Americans expect and enjoy" sets me apart from you -- I don't EXPECT a damn thing from government other than national defense and protecting our constitutional rights -- which they are constitutionally obligated to do. All the other "services" are not mentioned in the Constitution. All those things you mentioned are essentially state issues.Maybe you should quit using the public roads and highways which were built by taxpayer's money. Capital gains are a form of income and the taxes on them are paid to the IRS on the same forms at the same time. They are combined with wages and dividends and other income to determine the amount of taxes owed.

LMC -- That is great news! 35,000 Americans freed from bondage that can be added to the other 48 percent of Americans not paying income taxes. And at least all the poor are not getting all the benefits.

Only a righty would call feeding their family and paying bills a "benefit".

That's a necessity....and low incomes have no money for anything else.

And, as Ronnie Reagan said: The prices are high because of ever increasing profits!

These rich people have to have more, so we can have less.Are you smoking crack? What does paying bills have to do with taxation. Corporations do not tax you -- governments do. Reagan never said such a thing that I'm aware of. Profits do not increase costs. Competition, cost of raw materials and taxes determine costs. And just because a "rich" guy has 10 pies does not mean that you don't get any pies. Simply learn how to bake pies. Money is the same way. Merely because someone makes $5 million doesn't mean that there is $5 million less for you.

Please use your critical thinking skills instead of emotionally driven political ideological propaganda.Corporations do not tax you! And you accuse LMC of smoking crack!

Did you know that you pay Microsoft for every new computer you buy even if it has no Microsoft product on it?

Did you not realise that employers tax every employee? Or do you really believe that they pay you every penny that you earn?John: are you intentionally trying to irritate me? Companies DO NOT TAX EMPLOYEES and they don't tax their own products as that would be stupid. Now generally when I come across a tragically dumb ignorant bastard, I express my opinion unequivocally!! However in your case I will refrain.

To begin with Businesses collect taxes imposed by the government. ONLY GOVERNMENTS have the legal right to lay and collect taxes. You'll find that in the Constitution. You may have heard of that little document, unless of course you attended a public school. Companies are forced by the government to collect income and social security taxes as part of being given the wonderful opportunity to engage in business in such a free wonderful country. You see John, companies would much prefer NOT collecting taxes for the government because it costs MONEY that the government does not reimburse.

And yes I do think you are in a crack induced haze of incredible ignorance. But I think you fit in well into the Obama administration -- as they too have NO clue what the hell in going on in business or the economy. Have great night! Best regards Grant HoustonSo you're telling me that after materials and machinery costs and other overheads employers pay their employees every penny that they've earned!

That they don't keep a bit back to finance their own lifestyle!Yes. It is called a "competitive market place" in which corporations compete for talent/human capital. The more specialized or critically important the skill set the higher the value placed on that job. For instance -- anyone can dig a ditch with a shovel, but not everyone can effectively, safely and efficiently operate heavy equipment to the ditch. Hence, the more valuable the machine operator.

The only cost not incurred by the employer is the FICA whereupon it is claimed the employer pays half and you pay half of the total 14+%. But that is a cost to business forced upon business by government tax policy. You do actually pay that tax by the fact that your wages are minus that 7+%. However, that's an issue to bring to your congressional reps.

Obviously you have never started or operated your own business, which is fine, however you lack a rudimentary understanding of business and economics. The principle on hiring is typically an individual running a business has experience in the various aspects of that business and knows what they have been paid in the past and understand the value associated with driving revenue. An employee takes a job knowing before hand what their pay and benefits are. They freely and without duress, agree to the pay and conditions of the job description.

Legitimate Employers don't troll the streets kidnapping workers and forcing them at gun point to work -- you have that confused with drug and prostitution rings and the Chinese government.

If you had your own company would you pay your secretary and the janitor the same amount of money you make?That of course totally misses the point that I was making, which was "do corporations tax their workers" not do they pay them all the same.

In other words, after deducting the expenses of employing somebody, do they then pay the remainder to the worker, or do they keep some of it for themselves.

Why would an employer pay its employees every penny of its profits?

Again, that wasn't the question, but I'm not repeating it again as you obviously have no intention of addressing it.

You asked if employers paid employees every penny they earned. I assumed you meant all the employers' profits, because employees earn their wage, and they get paid their wage. Sorry that I misunderstood.

How does an employer not pay you the money that you earn? If I agree to work for $15/hr, and I get paid $15/hr, then I am getting paid every penny that I earn. How is the employer taxing me?Agreeing to work for a wage and what you earn are not the same. What you earn is the value of what you produce less costs. What you get paid is usually considerably less.

No, you are talking about the net value of your production. Who says an employee is entitled to 100% of the net value of his production? That has nothing to do with earning.

Earn: to receive as return for effort and especially for work done or services rendered.

If you earn $15/hr, then you earn $15/hr. It doesn't matter what you produce, that's what you and the employer agreed to. An employer has no obligation to give you 100% of the net value of your production. He is absolutely entitled to make a profit, expand the business, save up operating capital, etc... It's his business.So, government taxing people and giving them the benefit of that taxation is evil.

Employers making a profit off the workers and giving them no benefit in return is exemplary!What in the world are you talking about?

An employer not giving an employee 100% of his production value isn't taxing. You are saying an employer is immoral for making a profit?

Employers do give workers a benefit. It's called a job. Wages, benefits, and all that. Both parties benefit. Or do you think the workers would be better off without a job?I'm talking about something straight forward and simple.

Government taking money for services to the tax payer - bad.

Employer taking a profit off the worker and giving nothing in return - good!Government taking a portion of your earnings = taxes. Not all taxes are bad.

An employer doesn't take a portion of your earnings.

I already showed that an employer provides a benefit to his workers. A JOB!

BTW, still waiting to hear all about how the industrial revolution lowered life expectancy.Don't be impatient! Some of us are not married to our keyboards and have other things to do.

Right, I forget. You always have time to post a quick jab with no content, but for real replies I have to wait

The first link I posted, econlib? Yeah, it says life expectancy rose. I still don't get why you are claiming otherwise.http://www.bbc.co.uk/history/british/vi … s_01.shtml

http://www.bbc.co.uk/learningzone/clips … s/145.html

http://www.historyatfreeston.co.uk/fbec … lution.htm

" On the eve of the Industrial Revolution Britain was a highly developed, commercialised, sophisticated economy in which a large proportion of the labour force was engaged in non-agricultural activities, and in which the quality of life as measured by the consumption of non-essentials and life expectancy was as high as could be expected anywhere on this planet."

http://histories.cambridge.org/extract? … 820363A002

http://www.localhistories.org/19thcent.html

Note the average age of death about half way down-

http://www.historyhome.co.uk/peel/p-health/pubheal.htm

and then for interest look at-

http://www.historyhome.co.uk/peel/p-health/man1844.htm.

I can't find any of the many written works that I would like you to see on-line, but the preceding should give you a taste."Life expectancy at birth - in the high 30s in 1837 - had crept up to 48 by 1901."

So... life expectancy went up... and somehow that is an argument that it went down?

I don't have sound, but even with child labor children were living past 5 years old, and living past 30 years old. I'm not saying everything was hunky dory, I'm saying that innovation ends up benefiting the whole.

Life expectancy for some was low, but the population as a whole, again, benefited. Pointing out some examples doesn't illustrate the general trend.

Right, and that compares before and after... how? (Hint, it doesn't)

What are you using this link for?

Yes, I see what your point is. Your point is that some aspects of the industrial revolution brought the life expectancy down for some people for a short period of time.

My point is that the population as a whole DURING enjoyed a higher life expectancy, and the population as a whole AFTER enjoyed a MUCH higher life expectancy.

Why don't we have such horrible death rates at factories anymore?

Innovation.My point is that the industrial revolution brought the life expectancy down for many people and not for a short time for them, they only had one life.

If you mean by the population as a whole the wealthy and the middle classes then I'd have to agree with you, if you meant by the population as a whole, everybody, then history proves you wrong.

And why don't we have such horrible death rates any more? That's an easy one to answer, Trade Unions and Government.

Here's Reagan saying it:

http://www.youtube.com/watch?v=uJDhS4oUm0M

Please respond without personal attacks. Thank you. No--I don't do drugs.LMC -- Reagan was a liberal democrat when he made the statement, just as you are today. He changed his viewpoint 180 degrees because he learned that increased taxation, decreases incentive to produce. Furthermore, I lack the ability to see what value this has relative to the topic. Unions have destroyed themselves, by destroying corporations via bankruptcy. There is a correlation between fair compensation and pricing oneself out of the market. Unions have destroyed private corporations as well as the state and the federal government. Unions are parasites that have proven a propensity to kill the host that supports them.

Where then does that $5 million come from?

The money fairy?

Strange how much effect on the economy trade unions have asking for a few bob more but the man at the top with his millions has no effect at all!That's right. There is a DIRECT effect from tax cuts for the rich, and the decline of a country.

Money out = less services, OR, the $$ has to come from somewhere else...lower incomes. Decline of quality of life, or decline of middle class.

Lose/Lose.Regrettably You have a painfully obvious deficiency in your education. This is not a zero sum game. Show me the "DIRECT" correlation with tax cuts for the rich and the decline of the country. You cannot -- because there is no such data supporting your claim.

However, there is a correlation with "higher" taxation relative to economic performance, whereupon in the 1930s taxes were raised incomes and profits fell -- hence that little nagging problem called the Great Depression.

There is also something in econ called the Laffer Curve that shows optimum tax rate levels generate the most revenue, whereupon as tax rates rise government revenue declines. Hence, LOWER taxes lead to HIGHER tax revenues.

And son, if you are defining "quality of life" on the basis of what you get from the government you are a pathetic failure who represents the quintessential reason for Americas decline. And it too, represents the primary reason as to how a Marxist socialist, like Obama, could be elected President of the US.

You lack the most elementary understanding of government, the US Constitution, the function and role of the federal government relative to the States. And finally you haven't the slightest idea of what drives business and economic growth. And it is precisely your lack of education that has created your "Lose/Lose" proposition.LDM, you just have to be rude, insulting and aggressive in your posts, don't you?

Your arrogant convictions and behaviors (implying that only you know how economics really work and that others are all wrong in their viewpoints) is a telling sign that you're actually insecure and compelled to bully others to prove (to yourself) that you are right.

Stop the aggressive attacks on people and just argue the points . . . then see a therapist!

Ok, 8/10ths of 1% of those 200,000+ returns paid no taxes. Did you look at the reasons? Taxes already paid, Interest paid, and Charitable deductions account for most of it, as well as medical expenses and casualty/theft losses.

Now that you know the main reasons, are you against any of these particular deductions?

Personally, I think we need a major overhaul of the tax code, but I'm not against deductions for some kinds of losses.

12 charts that will make your blood boil:

http://www.motherjones.com/politics/201 … der-charts

and a comment:

"When I was young, this country built things, there were unions to protect workers and make sure they had decent wages. After Reagan became President, things started to change. Alan Greenspan, the Ayn Rand, disciple, became powerful, and the American worker started to be viewed as a parasite. Now, many years later, people cannot get jobs, Teachers are viewed as the haves (that is just crazy) and this country is unrecognizable.

The people who aren't viewed as parasites, are the ones that brought this country down. They took sub prime mortgages, wrapped them all together, and sold them as AAA. They shipped jobs to countries where they could enslave the workers. These are the true parasites. They have their master (money) and they don't care how they hurt this country to get it.

At one time, when a person invested in a company, they had a general idea what that company was about. They made something. A person could decide if the product was of sufficient quality, and desirability, to back. That is no longer so."- JaxsonRaineposted 13 years ago

0

Those who can't discuss facts of their own accord, post other peoples' charts.

When I say something of my own accord, you ask for facts!

Make up your mind.

You mean like this?:

[1]http://www.ctj.org/taxjusticedigest/archive/2012/02/press_release_general_electric.php

[2]http://www.sec.gov/Archives/edgar/data/40545/000119312511047479/d10k.htm

[3]http://www.ge.com/ar2007/pdf/ge_ar2007_full_book.pdf

[4]http://www.ge.com/files/usa/en/ar2004/pdfs/ge_2004_form10ka.pdf

[5]http://www.sec.gov/Archives/edgar/data/40545/000004054502000012/f10k.txt

*******************

t'weren't me....Actually, yes, that's exactly what I mean. Being able to back up what you are saying with sources is key to having a meaningful discussion.

You just didn't like the charts I linked?

Or what? You implied that I can't discuss on my own, so I need other peoples charts to do so....now you say use charts to back up what you say!

Make up your mind.

How are these charts not relevant to the discussion?

http://www.motherjones.com/politics/201 … der-chartsCharts aren't primary data. Charts are somebody else saying what the primary data is. I'm saying you should look at the data and leave the charts.

There have been a lot of charts posted, and I've shown many of them to be either wrong, or misrepresenting information.

If you want to discuss them, we can discuss them, but you haven't put forth much effort to actually discuss things. I can provide primary data, and you dismiss it or change the subject.

Do you want to discuss those charts?No--this is not a classroom, it's a discussion forum. When did you become forum leader?

Can't I discuss as is natural for me?

And changing the subject is allowed...as is dismissing things.

You should not bother with me if I am not to your liking. In fact, join the club.

You may not see it, but you dismiss me by forcing me to play your way. Im not you.I know, my way is unreasonable. I ask people to have an open mind and look at primary data instead of secondary/tertiary/worse sources. I'm just telling you that if you want to actually discuss any particular point, I'll discuss it with you.

But you have a tendency, when I present primary data, to dismiss it and take the side of a secondary source, even if that source claims to be using the primary data.

It's fine, if you don't want to discuss, just keep posting what you're posting, but you're not going to learn and grow if you don't open yourself up to consider other viewpoints.I don't consider you to have an open mind. Not in the least, actually.

You shouldn't demand it of others.You don't think I'm open minded because when I see the Census say wages are going up, and you post a graph saying they are going down, I don't believe your graph.

I call it logic. The primary source should always be trusted over a secondary source.No, because if I see your name on a thread...I know what you are going to say!

Obama is bad

Corporations are good

poor people are lucky

No one has it bad but the rich

You support Romney

All your "facts" lead to this. That is not open minded.Obama has been bad for our economy. There is no doubt about it.

So was Bush. There is no doubt about it.

Corporations aren't evil by necessity, and they pay more than their fair share of taxes, just like rich people. But you don't think 24% compared to 2% is fair.

I support Romney because America is in a horrible place with double-digit unemployment, and we need someone who understands the free market.

You think I'm closed minded because I don't agree with you.SIGH!!!

You are closed minded because you only see things your way!

You see what you want to see and nothing else!

It's like clock-work.

And I'm the same. But I don't expect others to be any other than who they are.

And don't think I've ever told someone how they should respond.

Authoritarian Complex. Conservatives suffer from it.No, I've changed my opinions on a lot of things.

But there is no changing my opinion on whether or not the rich pay more taxes than the poor. The data is there. 24 is more than 2. There's no two ways about it.

There is no changing my opinion on whether or not GE pays income taxes. The data is there. 23% is more than 0. There are no two ways about it.

There is no changing my opinion that wages are increasing. The data is there. 14,000 is more than 12,000. There's no two ways about it.

When it comes to the facts, it's not about opinion.

There are a lot of issues that have to do with opinion, and I like to discuss them. But whether or not wages are going up or down... the data is there and there is no way you can look at a line that is going up and say it is going down.

The oil and gas industry evolved its tax breaks from the risks involved with exploration and drilling. Too often the potential to drill a dry hole was the outcome draining money out of the companies and causing them to shy away from risks. The same thing happens with contractor companies capable of making military weapons but having no real market for them otherwise. The government must subsidize their efforts to keep them in the game. Too often, I think we look too literally at the numbers and not the contrasts. Obviously the oil and gas industry of today works with big financial numbers so the impact of those references....billions of dollars creates visions of enormous profits. That may or may not be true. If a company employing sound accounting principles targets a bottom line net of 5% after all is said and done, then 5% is 5%....it matters little if the measure is in hundreds, millions, or billions because the relative nature of the 5% is that it is representative proportionally to what was invested upfront to get to that bottomline. It also is indicative of the amount of capitalization the corportion will need to target such a profit again in the coming year. Amazingly, far too many Americans believe that if the government can get by with borrowing 42 cents out of every dollar that it spends, then surely a big corporation can adopt the same principles. Those who have tried are long since bankrupt. Certainly our elected officials can take away the tax breaks but they run the risk of stagnating the exploration process in the aftermath. These factors must be weighed. WB

Good post Wayne. It's just like people who blame insurance companies for health care costs, when they operate on the same kind of ~5% profit margin.

Big corporations are big because they provide products or services(and jobs) for the rest of us. We should help them succeed, not demonize them for their success.They've gotten their best profits under Obama...why don't you praise him?

Despite those self same insurance companies employing accountants and every trick under the sun to keep their profits down!

You make corporations sound so altruistic, they aren't bothered about providing jobs, do you really think that if they could make their money employing two men and a boy they would employ twenty men?What are they doing to keep their profits down? Can you provide proof?

We have the IRS to keep them in check. The IRS is very serious about getting all the money they are entitled, do you think it's so easy to cheat the IRS, especially if you are a large corporation?

Besides, all it takes is 1 good person to bring the hammer down on a cheating company. My brother reported money laundering activities in a large multinational corporation.

Lastly, innovation in efficiency is a good thing. If we hadn't been constantly innovating since the dark ages, we would still have a vast majority of the population working on providing food, clothes, and other basic goods and services.Instead we have hoards of people who are either unemployed or under employed!

Good move!Yeah, we have high unemployment right now.

Are you really going to say that things were better in the dark ages than now?No,just pointing out that all the innovation is not so wonderful for some people.

That as all ways with progress there are some winners and some losersInnovation has nothing to do with our current situation.

Yes, with progress there are always jobs being phased out, but like I said, that's a good thing. Otherwise you'd probably be an apprentice for a blacksmith or farmer and struggle to survive the winter half the time.As a blacksmiths apprentice I hardly think I'd struggle to survive the winter, probably be grateful for the reduced heat!

Most blacksmiths and farmers lived to a ripe old age, often for as long, or longer than modern man.Right, with a life expectancy of 30, you would have had a much better chance in Medieval Britain. Never mind that you would have less than a 50% chance of even surviving to be old enough to become an apprentice.

Yeah, those were great times.Who mentioned medieval Britain?

Pre industrial revolution life expectancy was much higher than post industrial revolution until well into the 20th century.Well, the further back you go, the less innovation mankind had. You act like it's a bad thing, so life should have been better in the past.

During the industrial revolution, life expectancy rose.

" On the other hand, according to historians E. A. Wrigley and Roger S. Schofield, between 1781 and 1851, life expectancy at birth rose from thirty-five years to forty years, a 15 percent increase."

http://www.econlib.org/library/Enc/Indu … iving.html

"During the Industrial Revolution, the life expectancy of children increased dramatically. The percentage of the children born in London who died before the age of five decreased from 74.5% in 1730–1749 to 31.8% in 1810–1829."

http://en.wikipedia.org/wiki/Industrial_RevolutionOh well if Wikipedia says that I'm wrong I'll just have to throw away the last twenty years of research.

You provided no source.

I provided two. If you want me to be more specific:

Mabel C. Buer, Health, Wealth and Population in the Early Days of the Industrial Revolution, London: George Routledge & Sons, 1926, page 30 ISBN 0-415-38218-1

Fogel, Robert W. (2004). The Escape from Hunger and Premature Death, 1700-2100. London: Cambridge University Press. ISBN 0-521-80878-2.

E. A. Wrigley and Roger S. Schofield Population History of England.

Your turn. Where do you get your data that the industrial revolution lowered life expectancy?From a more in depth study of primary documents.

Whilst it is true that life expectancy for some did increase, for many factory workers and miners it fell drastically, some trades having an average life expectancy of less than 20 years!

Chronic overcrowding in insanitary living conditions took its toll on life as well. Four families living in one small damp cellar must have really cranked up the life expectancy!

Disease, such as cholera were rampant and deadly, sweeping through over crowed living conditions like, well, the plague! Often caused by drinking water supplies contaminated by raw sewage, very few actually had access to toilets, making use of the streets.

Read the first link that you posted,it's quite a good one and doesn't make everything so cut and dried as you seem to think!

Guilty until proven innocent, right? Evil until proven good?

No, just realistic. If you want to believe that corporations are dedicated to the common wealth, dream on, don't let me stop you.

No, corporations are mostly driven by greed. Greed is the most common, universal motivational factor. It drives people to invent new products and services. People want those products and services, so both parties benefit.

In a free market, anytime there is trade going on, both parties benefit.

BTW...Romney is Bush on steroids, and Obama has been great for America.

How is Romney Bush on steroids? Because he's an R?

Have you looked at Romney's plans in detail?Less taxes for rich people. More spending on military. Destroy the ACA...War with Iran.

and NO--I don't want detail. I want No More Republican Horror. 8 years was ENOUGH.You don't want detail. Because Romney is an R you don't want to know what he has to say. Because he's an R he is wrong. Gotcha.

Did you not hear the last part? Told you you only hear what you want to hear...

8 years was enough.Yes, I heard that. 8 years was enough. You think that Romney is Bush because they both have an R.

Are all D's the same too?Romney is Bush because his policies are the same...only heightened. MORE tax cuts for the rich....MORE spending on military....More gutting of social programs....more privitizing America...more bennies for corporations....more oil and gas subsidies...bye bye alternatives...

And who was Romney admiring the other day? Dick Cheney.

And I wish all D's were the same...then they would be unified and stand with Obama.

So--why don't you tell me how Romney is different than Bush.You know Romney is Bush without ever looking at his ideas on the big issues?

You don't want to know his plans, but you want me to tell them to you?

Thanks for DODGING my question 3 times....even though you are quick to criticize me!

LOL! Romneye doesn't have any plans—other than lowering taxes on the rich and I hate to even think about what he might do with foreign policy.

He's going to cut taxes on everyone equally, except corporations. We need to be competitive on the international market for corporate rates, and we aren't right now.

Romney does have plans, you should read them sometime.

Confronting China is a big one. They've been cheating on their currency for far too long. We can have a lot more manufacturing if we don't have to compete with their deflated currency.

The Absurdity of Mitt Romney’s Education Plan

http://bigthink.com/praxis/the-absurdit … ation-planNews Flash to Craptalist Dupes. . .

Bank of America, which last fall announced plans to lay off 30,000 workers, is about to go on a hiring spree—overseas.

America’s second-largest bank is relocating its business-support operations to the Philippines, according to a high-ranking Filipino government official recently quoted in the Filipino press. The move, which includes a portion of the bank’s customer service unit, comes less than three years after Bank of America received a $45 billion federal bailout."There is not a single state in the US where a minimum wage worker can afford a 2 bedroom apt working a 40 hour week." http://pic.twitter.com/DNOMhq7v

Sure was possible when I was coming up!

My grandfathers were both factory workers, and raised families on that income!

THIS is proof positive better than any bunch of numbers.

The reality of life is the teacher.

Kids today are getting SCR*WED. and it's all because people have to have more and more profits at the top. Period.Yup, a pic on twitter is proof positive.

1 - The rental market is inflated due to increased demand from the housing crisis. A lot of people can't afford a house or don't have the credit for it, so they have to rent, so even though housing prices right now are low, rental prices are high. That's why someone can rent out a 2-bedroom home for $900 when their mortgage payment might only be $200.

2 - Minimum wage in AZ will get a single person $1200/month after taxes. Found 2-bedroom apartments for as low as $400/month in Phoenix. You can pay that with that income and get by. Your chart suggests that one would need to earn $2100/month after tax to afford a $400/month apartment.

Busted.

More Ronald Reagan!

http://www.youtube.com/watch?feature=pl … n28oayX31Y

did he just say "the torture of imprisonment"?....wow!

without unions, we're not free!

R's fell far from the man they claim as hero.Tut tut, these people who get impatient when they don't get an instant reply!

Still I suppose it's one rule for them and another for us

You were on and replying, when I reminded you of something you seemed to have missed.

Like I said, you love to make jabs that have nothing to do with content.You have missed something too...twice. Here's try #3:

How is Romney different than Bush?Nah, I've replied to that.

You specifically told me that you don't want to know what Romney's stances are on the issues, because he is an R.

So did you change your mind, or are you automatically going to disagree with every position, even if you agree with it, because he is an R?No I didn't. I said 8 years was enough, and Romney is Bush on steroids. I'm waiting for you to show me I'm wrong.

You can't, because he is.How is what he is proposing any different?

LMC,

He has not made any real proposals, just generalizations, You made the claim he will be Bush on steriods. Show us howA good poker player never bets the house when all they have are geralizations! If you do, there's no telling what surprises await you. More of Bush? God help us all, it didnt' work then, and it won't work now.

Webster G Tarpley

"Must defeat unionbuster Walker in Wisconsin Tuesday or US will face fascist nightmare under Mitt Romney Mitch Daniels as per Bilderberg"

He said the 1st day in office he would have a massive tax cut. Bush policies!

Repub policies. Over and Over and Over again. And what does it yield? Lower quality of life in America. At least Obama's cuts targeted those under 250 mil.

R Money wants more cuts for HIMSELF! You need to read his proposals....

He wants more tax cuts for upper incomes. look it up.Have you? Are you still falling for the Bush cuts were for the wealthy?

Like the gas tax Obama put in place in his first 30 days in office, wanted to raise taxes on small businesses just last week, now looking to tax retirement systems at 18%, he is looking to eliminate middles class tax breaks on mortgages, employer benefits and more. Yeah he is so for the middle class. He has you so snowed you cannot see anythingYes, I read RMoney's proposals...I'm not going back to twitter weeks, maybe months, to find it!!

I posted it on a thread here somewhere.....but you can google. Just google it!Not for me to prove, you said it, show us. thing is you cannot. If you read Romney's proposals, you are the only one. He has given generalizations on what he is going to do, but nothing specific.

No--I cannot google!! YOU can. Scared to find out?

- JaxsonRaineposted 13 years ago

0

It's been fun guys, but Im too busy to post much anymore.

At least the truth had a minor victory in Wiz finally looking at corporate taxes objectively.

Seriously, if we all stopped mindlessly cheering for our party, and had some real dialogue, we would be able to learn a lot.

Please, do yourselves a favor. Stop believing everything you read online. Track down the primary data, as people often lie when they report what it 'says'.And yet, Jaxson, when I fed you the primary data you refused to believe it because I couldn't show it you on-line and you reckoned your on-line references were inarguable!

I'd say to you "stop believing everything you read on-line" and stop dealing in sound bites.

Whoa! Just got this on my twitter:

"On Meet the Press today, @neeratanden asked @KevinMaddenDC to name one way Romney differed from George W. Bush. He couldn't do it."DC Debbie

If you thought Bush's tax cuts worked, vote for Romney.- Onusonusposted 13 years ago

0

In my state the Boeing corporation has been threatening to leave because the power hungry unions are constantly demanding more money. Most of the workers are happy with their wages but they are intimidated by union bullies into striking.

What'd the CEO make? You telling me he can't take less, so the workers can have more?

And if he gets so much: why should the unions not fight for more?

They always blame the bottom and cut from the bottom....top goes on like cream to a spoon.

Is the ceo making 500 times the workers? Take it from him!No LMC, lay off, the poor chap only makes $10.94 million a year, he must really struggle to get by.

Why am I not surprised?

And people actually think this is OK......

It's totally disgusting and un-American! Tom Jefferson said labor was way more important than wealth...

People have forgotten our roots and eat at the tree of Money. Their eyes are green and can't see straight anymore.Here, play with this, it'll get your mad up. A surprise, the lowest CEO to worker ratio is Warren Buffet at 10:1!

http://www.payscale.com/ceo-income/fortune-50It's laughable. Totally outrageously laughable.

Anyone who says the top class needs more tax breaks is a Pirate.

avast ye, matee.....let's see some walk the plank! harrrrrr

Would that be this?

http://www.seattlepi.com/business/artic … 881788.php

Of the Few

By the Few

For the Few

F

E

W......

World

Economic

ForumGas prices have nothing to do with prez...unless you use them for political demonization....which you R's are good at.

Romney blamed Obama for high gas prices, then when they went down, the Repub media machine said low gas prices were a bad thing.

make up your minds on the smears, will ya?Oh please, nobody said that it was bad when prices go down, and oh yeah notice how much they have plummeted, that 20 cents has really saved us. Middle-class America is no longer in economic turmoil, the budget is balanced, the national debt eliminated, all for that 20 cents drop over the last 45 days. Of course since president has nothing to do with gas prices, I guess when Obama said he was going to allow those thousand gas wells to be drilled and immediately after is one the gas prices start to go down, yeah you're right the president cannot influence anything.

Oh yes they did...Fox did.

Just like they are now promoting that Obama himself engineered the Birther story..so he could get affirmative action votes or something. Racist AND dumb!

And they were for an individual mandate before Obama used it. For the Simpson-Bowles solutions before Obama supported it.

LOVED war until Obama got elected.

Your candidate blamed Obama for the high price of gas....he's either ill-informed or a rapscallion.

I vote he's both.LMC,

Fox has never said what you are claiming. I think you are thinking of a recent Madow show where she made those claims but could not prove it

I knew the race card would be played by you. Typical left response.

Obama is responsible for the high prices of gas. He over turned the EO from Bush that drove gas prices down, so naturally gas prices rose. Obama said he wanted $5 per gallon gas, his regulations have driven up costs, it is you that is ill informedRussssshhhhhhh said:

Obama pretended that he was born in Kenya (yes, you have that right), so he could take advantage of affirmative action programs that are allegedly offered to people from Africa.

Mike Huckabee said almost the same thing, that Obama said he was born in Kenya “to present himself as an internationally themed author.”

http://www.addictinginfo.org/2012/05/20 … ama-kenya/

Huckabee...another talk radio head......very odd how so many of them do it. Very odd.

Huckabee was on fox....and clearchannell is owned by Bain capital...clearchannell is daddy to all these rabid right radio shows.

Quell surpreeze.

unions are just another "middle man" scheme to fleece the pay of hard workers (such as in dues) to line the pockets of those in power and keep the workers enslaved to the power elites' whims

corruption needs to be the issue, not whether unions are good or badNoam Chomski

"The mass media inculcates an unquestioning acceptance of capitalist values and ideas."Of course it does, as does so much else in life.

I think it has more to do with how we run our economic system...our money

as Ron Paul is promoting, stop printing excess money that causes inflation when it has no backing...adhere to the natural laws of supply and demand in the free market...and his biggest point, get the Federal Reserve out of the way that manipulates it all, as well as much of Wall Street speculation

unions can be just one more manipulator of the people and their hard earned money to line the pocket of "middle men" and global elitestsWell I guess Wisconsin has the right Idea. The people did speak there. At least on the subject of Public Sector Unions.

Money and corporations spoke louder than the people and will continue to do so as long as the sheep do as they are told by lobbyist and media.

Highway Robbery and immorality on a grand scale.

It's really breath-taking. And the fact that people defend it even more so.

WOW...have we strayed from the ideals of this country! We are not recognizable any more.

The richest 400 families in America paid a tax rate of 11.6% last year.

We need Jaxson to tell us how the IRS and Reuters are not to be trusted

"We hear a lot of fulminations about the menace of redistribution and the threat to "wealth creators." It's worth remembering that the wealthiest have been winning the distributional fights. Worth remembering too that the promise implied by the phrase "American dream" was not that a lucky few would gain staggering success, but that the broad many could, with reasonable effort, gain comfort and security: the "best poor man's country in the world" in an 18th century phrase."

Frum, a former Bush speech writer!

Another egg-head: (I LOVE them)

http://www.youtube.com/watch?feature=pl … zMpjCSUuWkviolence of union thugs against union workers

http://www.righttoworkcommittee.org/FUV … px?pid=1bnJust more lies and deceitful misinformation bought and paid for by the real corporate thugs called ALEC, Sparkling Jewel.

Coke, Pepsi, Kraft, McDonald's, Wendy's, Intuit, Reed-Elsevier, and others have dropped their membership in the American Legislative Exchange Council (ALEC).

Is it any wonder why they want to keep us all under minimum wage?

http://www.sourcewatch.org/index.php?ti … _Committee

Do your homework before you believe the propaganda and hype.

Click here to tell other firms bankrolling ALEC to do the same: http://salsa.democracyinaction.org/o/63 … _KEY=10002

Related Discussions

- 119

What is the truth about minimum wage?

by SparklingJewel 12 years ago

here is one "perspective of facts"...anyone have another as well put together source of a "different perspective of facts" ?Seriously, just like the economy and how it is run, or how businesses are run, or how laws are perceived, or how judges judge for that matter...there are...

- 42

Is minimum wage beneficial to the US economy?

by Robert Erich 13 years ago

With the continual outsourcing of jobs to other countries, the struggling national economy, and the unrealistic ability for everyone to earn a college degree, should minimum wage be eliminated?Just something that I have been thinking about and I would love to get your opinions on.

- 375

Is it Time to Abolish the Minimum Wage?

by awesome77 14 years ago

The minimum wage is a joke and I think it should be abolished. Let the market system determine what the wages should be!I know, some of you will scream and holler, but as a former retail business owner, it undermines the market system for wages.

- 129

One More Time - How to Justify A "Living Wage" Demand

by ga anderson 6 years ago

I think most of the previous "Living Wage" discussions might have been before hard sun's joining of these forums.So I grabbed one of his comments to drag him into the discussion:I think a wage should be tied to the value of the work performed. But... because of our human nature, I do...

- 76

Almost half of Americans work in low wage jobs.

by Eastward 5 years ago

CBS News reports that the Brookings Institution [1] found, "America's unemployment rate is at a half-century low, but it also has a job-quality problem that affects nearly half the population, with a study finding 44% of U.S. workers are employed in low-wage jobs that pay median annual wages...

- 421

Let's raise the minimum wage to $45 an hour!

by Barefootfae 12 years ago

Once again there is a call to raise the minimum wage.Now....common sense and a little education will tell you that when you raise the minimum wage, prices go up to compensate. Also, you stand the chance of having a nice little spike in unemployment from the smaller businesses that can no longer...