How Do Inflation Affect an Economy?

Introduction

Inflation is one of the greatest challenges or threats for any economy. Since the trends of economic conditions never remain constant, many economic issues may arise like inflation, deflation, stagnation, price raising etc. Inflation is a common economic issue which effects widely irrespective of developed or developing countries. Since the nature of one economy is different to other economy, economists have different opinions about inflation. Simply inflation is a condition in which the demand for every commodity reaches in its peak. Similarly, the price level and the money supply in the economy will also be too large. In such a case there will be many impacts throughout the economy on its different matters. Normally to cure the burden of inflation, the governments or central banks may intervene in the economy by using tools like fiscal policy and monetary policy etc. Any way here this hub is aimed to explain about the effects on an economy due to inflation.

Inflation As a Gain and As a Loss

When you analyze any economy, you can observe that inflation creates gain for some sectors of the economy while some sectors suffer losses. These two discrepant things are happening because of many reasons. The changes in money value is an important reason. When the money value changes, someone will gain and someone will suffer losses from their economic activity. Normally during inflation, the value of money will decrease and the money supply will increase. Suppose if a fixed income earning person doing work during inflation, he cannot earn much in real terms. So, a fixed income earner suffers losses during inflation. Similarly debtors will gain from inflation. In short, inflation creates both gain and losses for different sectors of the economy. Each of the effects of inflation on various sections of the society is explained below.

Effects of Inflation

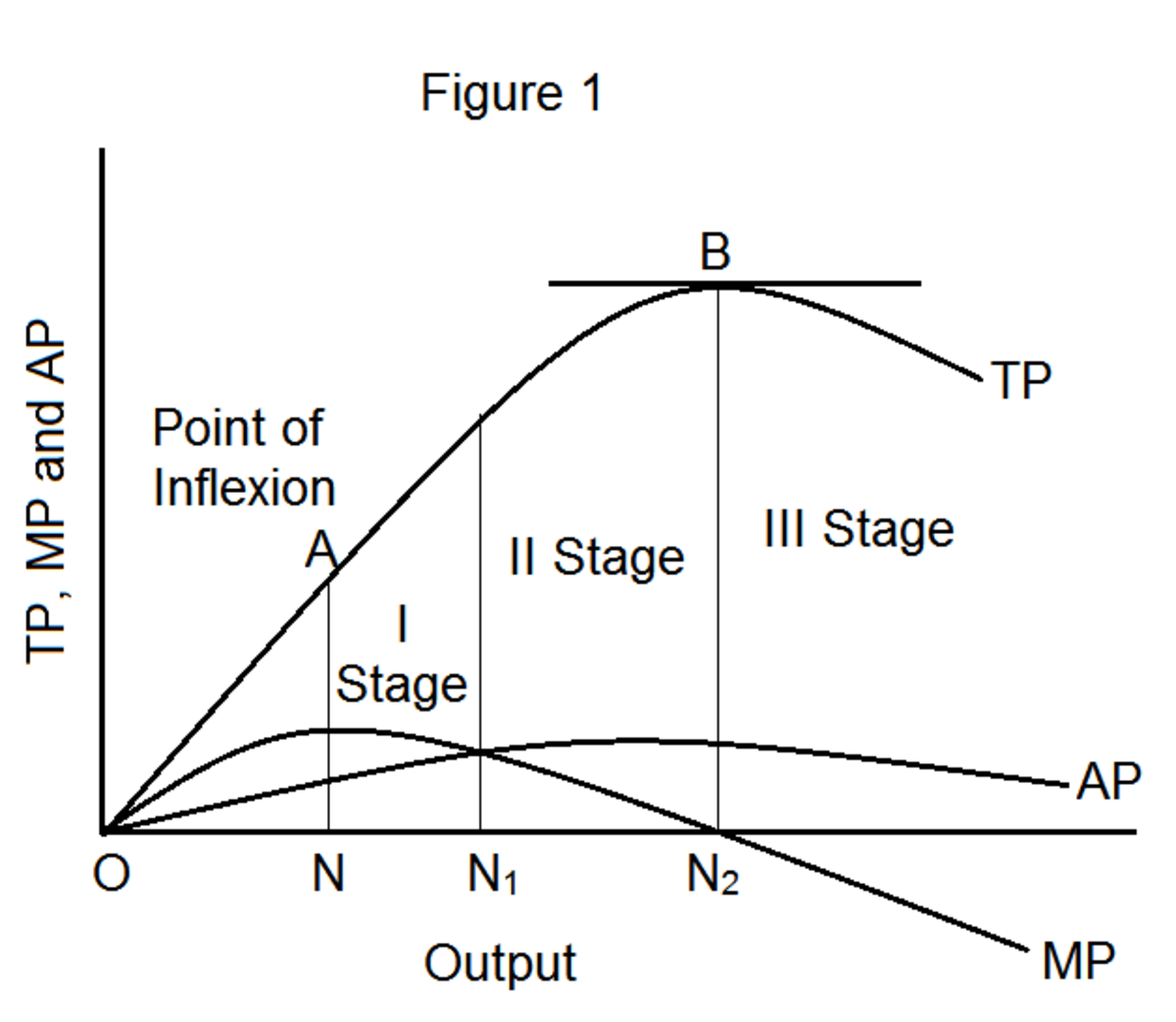

Inflation may affect differently in many ways against various parts of an economy such as wage earners, fixed income earners, debtors and creditors, tax payers etc. Following words is very briefly explained each of them.

a) Salaried Persons / Fixed Income Earners

Salaried income groups like professionals will suffer losses due to inflation. Since their income is fixed the price level will be much higher. Further these groups never earn income additionally during inflation. So, their income in real terms (in purchasing power terms) will decline. Which means their purchasing power may decline than their earlier purchasing power. This is because, the price level is larger and they can’t meet their wants with the income that they earned in lower real values. So, fixed income groups will suffer losses from inflation.

b) Wage Earners

Normally daily wage earners will suffer losses from inflation. There is the possibility for increasing the wage rate when there are strong trade unions. Trade unions will argue for wage raises as respect to the increasing of price level and standard of living. But even though the wage rate increases, there will be an indirect and negative effect on wage earners. Their purchasing power or real wage will never increases just due to increase in money wage rate. This is because of the price raising. So, higher price level always creates burden on wage earners even they earn higher wages than they earned before inflation in monetary terms.

c) Debtors and Creditors

In the case of debtors, they can gain from inflation while creditors suffer losses. This is very interesting fact to observe. Suppose a debtor or a borrower repays the debt during inflation, they will pay the loan amount at lower amount in terms real value or in the value of goods and services. This is because the money value will be less during inflation. On the opposite side creditors suffer losses during inflation since; the creditors lend money before the inflation at a higher value. When creditor receives the repayments as the same amount, the money value will be lower. In short debtors will make gain from inflation and creditors will suffer losses from inflation.

d) Investors and Savers

Generally people are investing in different securities, bonds, shares etc. Share holders will gain during inflation, because the return on shares is not fixed but varying with profits which the companies made. During inflation companies will gain more profits because of the increase in aggregate demand. On the other hand, securities like bonds, debentures etc will earn fixed income to the investor. During inflation, the investors get a fixed return as they earned before inflation. But since the value of money and purchasing power diminishes, those investors will suffer losses when they invest in fixed income earning securities.

Similarly there will be a trend in the economy among savers to deposit money with bank. Because holding of money with in hand is not a reasonable idea during inflation since the money value decreases. Further to reduce the problem of inflation, the central bank may increase interest rate on deposits as a part of monetary policy to reduce the money supply in the economy. In short, depositors may have tendency to keep money with banks instead of holding as liquid cash within hand during inflation.

a) Farmers

Generally farmers are making more benefits during inflation because of the price rising of commodities. They will earn more money greater than their cost on farming. So, the farmers can earn more than their expected sales earnings. But when there is middleman between farmers and the market, it may reduce the possible gain for the farmers.

b) Property Owners

Property owners will make gain from inflation by utilizing the increasing of price level. Here also property owners will earn higher value than they expected value for their property.

c) Businessman

Businessman will gain from inflation. They can enjoy the ultimate benefits of inflation. Since, the aggregate demand is higher, businessman can make more profits. Further inflation or boom is the peak in business cycle which is favorable for business activities. So, business class will earn more profits during inflation.

d) Tax Payers

Normally, a taxpayer makes gain from inflation. Because they will pay fixed tax regularly (if tax is a fixed percentage to the income). So, tax as the liability, tax payer will gain from inflation. This is because of that, the tax payers will pay only lesser amount in terms of the real value to the government.

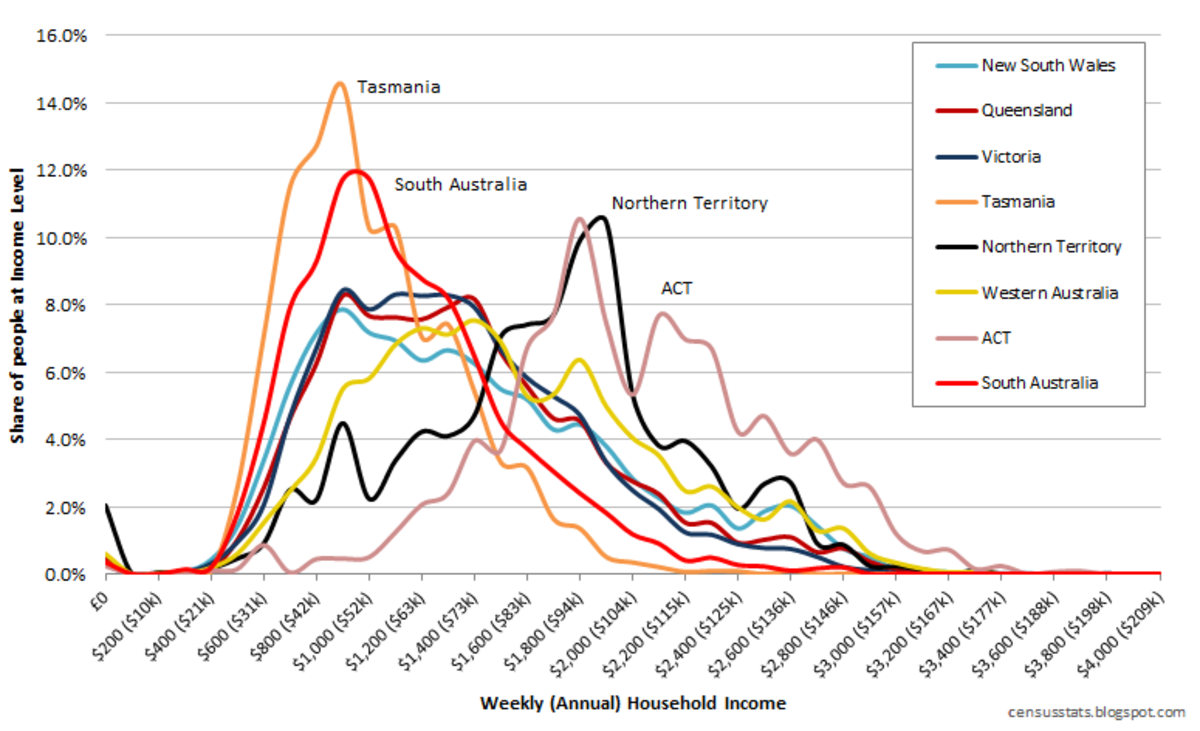

How Inflation Affect Richer and Poor People

Inflation will badly affect people particularly the poor people. At the same time it never makes more burdens on richer section of the society. Inflation increases the price level, So increasing of general price level will be a great threaten to the poor people while richer section can adjust it. So, inflation will affect poor and richer people differently.