Why would people be against lower taxes on thier income?

More than 400 millionaires and billionaires asks Congress not to pass a bill that "further exacerbates inequality." It also says the tax bill should not add to the country's debt.

Republicans are “saying we can’t afford to spend money, but we can afford to give rich people a huge tax break. This makes no sense,” Crandall said.

What do you think?

The creation of the individual and corporate income taxes was largely motivated by concerns about equity. At the turn of the twentieth century, the federal government relied on regressive tariffs and

excise taxes for most of its financing. Progressive Democrats and Republicans rallied around the new income tax and the required three-quarters of the states quickly ratified the amendment enabling the new legislation. Initially, the individual income tax was a 1% levy on the incomes of the wealthy, with a 6% surtax on the super-rich. U.S. entry into World War I vastly increased federal revenue needs and the top income tax rate rose to 77% in 1918.

For its first thirty years, the income tax remained a “class tax,” affecting only a small sliver of the population with very high incomes. World War II again increased the federal government’s revenue needs and the innovation of payroll tax withholding made the income tax into a “mass tax,” affecting most working people in the country. Nonetheless, the income tax has remained progressive: It claims a much larger share of income from those at the top than at the bottom. https://www.urban.org/research/publicat … ull_reportThere is a line on the 1040 to pay extra to help the deficit/debt. They are always welcome to use that line.

Of course, there's always the possibility that they understand what the liberals don't; that we cannot forever live on credit.I'm not good on taxes, but if do pay extra to help deficit- is that a tax-deductable item?

LOL Darned if I know! The US govt. cannot be a non-profitable charity (not when it returns "profits" to "stockholders") so probably not.

I don't know. But, you could earn a % on your tax return by leaving it with the IRS for a year, or till whenever you want your return plus interest earned. I haven't done that for years so I don't know what % you could earn now, but I did earn 15%-16% on my returns when I did that.

I am happy to pay a proportional amount of tax. An attitude I find equally rare in my conservative and liberal friends, but someone needs to pay for police, roads, disaster relief and so forth.

What I object to is when tax benefits that should apply to all people being given only to the super wealthy. If Donald trump can write off part of his charitable donations I want that same benefit. If Donald Trump can write of mortgage interest, I want that same benefit.

If no one has a benefit I can live with that because we are all sharing that burden. And it would simplify the tax code which sure is needed and should be a bipartisan goal. But if it is taken only from poorer people and kept for rich ones, that is unfair.But what is "a proportional amount"? 70%? 80? That's what we charge some people.

But you can write off your charitable donations. Or take the standard deduction, which is designed to include such deductions in small amounts. If yours is great, then itemize. Same for mortgage interest; I benefit more from taking the standard deduction now and so have "lost" that particular one, but gained when all is said and done.

Would it be fair to give tax breaks proportional to the amount of taxes paid? The more you pay, the greater the tax break? That seems most reasonable to me.What seems proportional varies between people, but I believe in public services so I realize that means I will help pay for them. I don't feel that what I pay now is unreasonable overall, although I would rather it was spent differently.

Trumps tax plan removes both of the benefits I named and currently claim but retains it for very wealthy people--that being my point. I oppose that.

I think the code should be simplified so you just pay the appropriate amount based on a calculation of various factors, with no need to make specific claim-backs/breaks for people who are simply salaried workers."Trumps tax plan removes both of the benefits I named and currently claim but retains it for very wealthy people--that being my point. I oppose that."

But that's not true, or at best merely a side affect. Should you, a poor person, have a mortgage payment large enough you can deduct it, too.

Here's another for you: you, a salaried employee with health insurance as a part of your compensation, may deduct not only the portion that you pay, but don't pay taxes on that part of your total compensation that the company pays for your insurance. I don't get insurance, so have to purchase it myself but cannot deduct the price...unless it crosses some enormous amount I'm expected to pay for health care before deducting any. Never HAS made sense to me.

I'm with you - let's just eliminate any deductions not directly tied to the cost of doing business. No mortgage interest, no health care, no IRA contributions, nothing at all. If it's worth spending your money on there is no reason to require your neighbor to help you defray the cost.

You keep on about the proportional amount as if the tax code is sticking it to the rich when it is not. Nobody mentioned 70 -80% other than you. Your made-up exaggerated figures to prove your point is useless.

Currently: House version is the top rate at 39.6 percent and the Senate with the top rate at 38.5 percent. Trump tweeted “Cut top rate to 35%"

"The Senate version of the legislation would actually increase taxes for some 13.8 million U.S. households earning less than $200,000 a year. ... the biggest differences in the two bills that have emerged: the House bill allows homeowners to deduct up to $10,000 in property taxes while the Senate proposal unveiled by GOP leaders last week eliminates the entire deduction. ... A key feature of both bills is a reduction in the corporate tax rate from 35 percent to 20 percent." - https://www.washingtonpost.com/politics … ccee24c8f6

W, your repeated past posts on how overburdened with taxes the 1% are is so utterly ridiculous.

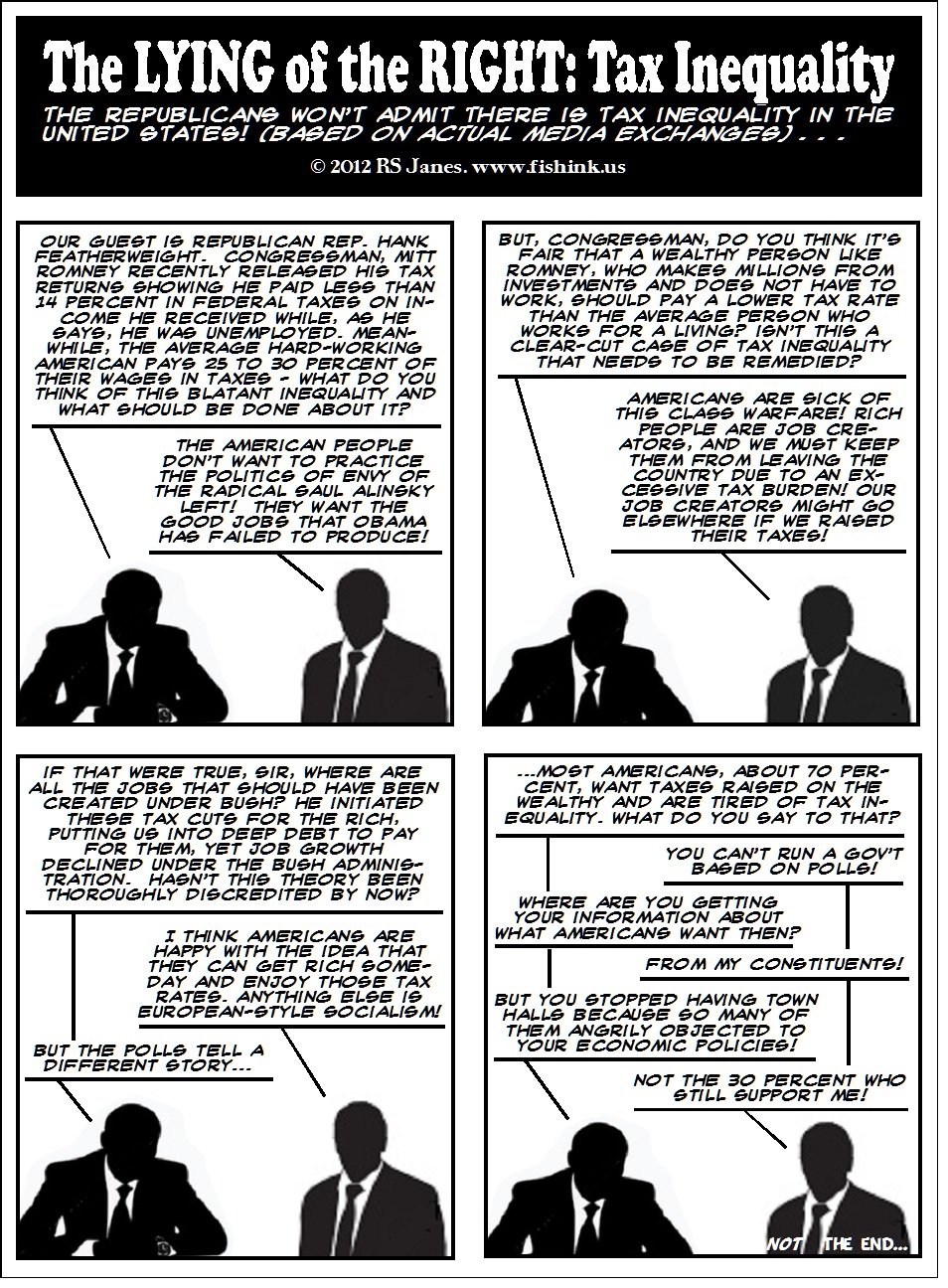

Mitt Romney Made Nearly $22 Million in 2010, Paid Less Than 14 Percent in Taxes It would of been 11% if he had took advantage of of the loopholes but he wanted to appear fair for election year tax return disclosure - something Donnie has never done. In 2015, Americans paid an average of 20% of their income in federal taxes.

I already know your weak answer of total money versus percentage. We've been round and round this one. You never convinced me you were of the right opinion, and neither does the majority of people (68%) in this country agree with you. So just stop it.

You DO realize there is more than one tax in this country? And that when all added up the rich may well pay that 70% figure of their income in various taxes?

Of course the majority doesn't agree - to agree would mean recognition that they aren't paying their fair share and their taxes would rise if they stop dinging the rich for their all their wants. But outside of that neither you nor anyone else has ever given a reasonable, moral reason for charging one person more than another for the same product. It's all about greed, isn't it - you want more than you can afford so will demand someone else pay for what you want but don't want to pay for.Where did you get that 70% figure? Got a link to you (_!_) ?

Product? We are not talking products, this is not a retail situation. Get with the program.Hm, that's interesting because Warren Buffet showed he paid a smaller percentage in tax than his secretary, and he doesn't take part in tax evasion. So unless you have some evidence I'm assuming that's not true. A few family trusts and an off shore account and near 0% is achievable.

Yep - he paid a smaller percentage. But 1,000 (pick your figure) times what she paid, and for the exact same thing in return. Reasonable? Only if the assumption is made that what the wealthy earn actually belongs to someone else.

Hi psycheskinner, I see that Wilderness has answered you, but this "percentage" tax rate perspective is a pet peeve of mine. My thinking is that it is the actual dollars paid that matter more than percentages.

And my Google quest to learn more about the reality of Buffet's statement, (whose facts have not been denied), lead me to a very interesting Politico "debunking" article - that couldn't debunk it.

I have a question for you personally... do you feel the "percentage" perspective of tax payments is more valid than the reality of tax monies paid? I don't mean that as a challenge to your perspective, (although I do disagree if that is your perspective), but as a serious question for you to consider after digesting a few additional facts.

I hope you will check out this link; Does a secretary pay higher taxes than a millionaire?, because rather than rate the statement true or false, it offers several very practical perspectives with which to consider that question.

Here are a few 'for instances'

Warren Buffet does pay 1000's of times, (as Wilderness noted) - if not millions of times, (there is no public record of what dollar amount his secretary actually paid - but Mr. Buffet paid about $7 million in 2010), more actual dollars into the treasury than his secretary.

Apparently the top 10% of income earners pay over 71% of all Federal income tax monies, and 51% percent of all tax filers pay no income tax, (the article didn't mention the folks that get refunds).

Now, if Politico's facts can be accepted, would that affect your opinion of the importance of a "percentage" as the most important parameter for "who pays what taxes" discussions?

Or... is it just the most "debatable" way to claim the "rich" aren't paying their fair share?

*Note: I realize this will come off as a challenge to your statement, but it was honestly intended only as a question to you. So to be fair I will take your quote and this response to open a new thread for all to participate.

GA

Related Discussions

- 54

A "Fair Tax' System vs. Our, (U.S.), Progressive Income Tax Structure

by ga anderson 8 years ago

First, a little housekeeping;Recent comments by Wilderness and Live to Learn prompted me to refer to an old thread by My Esoteric.The motivating comments related to what a "Fair" taxation structure should be.I now believe that out current 'progressive' income tax structure is one that at...

- 17

What Is A "Fair Share" Relative To Taxes?

by ga anderson 10 years ago

Much is heard of a demand that corporations and the wealthy pay their "fair share" of taxes, but I have heard little of what that share should be.With only a single restriction; that the discussion is about legal tax actions, what should that "fair share" be?One could say that...

- 5

"Romney's Theory of the Taker Class and Why it Matters"

by PrettyPanther 13 years ago

Ezra Klein explains how Mitt Romney 1) is wrong about the 47% being a "taker" class and 2) how the rich are using this lie to justify further tax cuts for the rich while cutting services to the poor.". . . Romney is arguing that about 47 percent of the country is a "taker...

- 28

Trump's tax plan: Trickle Down Economics: Give your opinion

by ptosis 8 years ago

yea or nea? Are you HAPPY! that the richest .01% get less taxes? I mean - they did earn it didn't they?Do they just work harder? Is everybody else just stupid and lazy? Hard work will only get you so far if circumstances aren’t amenable. Do you believe that “If you’re still poor at 35, you deserve...

- 4

If you have a job, is it fair that you may not pay Federal Income Tax?

by Judy Specht 13 years ago

If you have a job, is it fair that you may not pay Federal Income Tax?Forty nine percent of people in US don't pay Fed Income Tax because they don't make "enough", Warren Buffet says he doesn't pay as much as his secretary. Whats a fair share and who should pay it.

- 19

Middle class screw job, MAGA = Winning? Taxes plan

by ptosis 8 years ago

Tell Congress: Tax reform should help working families, not millionaires!https://petitions.signforgood.com/prote … orgood.com Want a new house? If you're in a big city or a blue state, you'd be screwed. It limits the mortgage tax deduction of $500,000 for new home purchases....