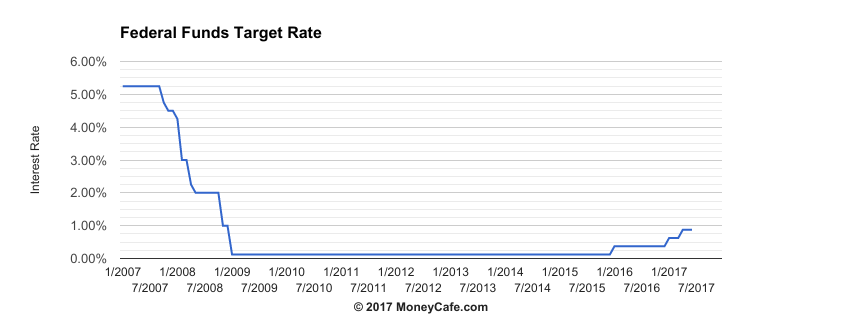

Federal Reserve just raised the fund rate by .25% to 1.0%

What do you think of this? Do you agree? what should the Fed fund rate be?

My personal opinion is that the rate has been kept too low for too long.

We need to raise the rate back up to about 3 or 4 percent in line with traditional rates...Do you listen to the analysts on corporate media? I'm guessing you do.

The Fed has raised the interest rate four times now since Trump was democratically elected president, despite declining inflation. If the Fed keeps on poking the bubbles they created there is going to be a crash, soon. That's what Alan Greenspan created computer programming to do.

Every stock market crash since the late 70's, early 80's has been orchestrated by computer programming. The crash of '87 was all because of computer programs. Then the crash of 2001 and 2008, it was the computer trading programs.

Could you imagine the Fed crashing the economy to blame it on Trump's policies? It wouldn't be anymore his fault then any other president.

Added: I'm not saying a crash is a bad thing, because then we could go back to the gold standard, which is the Feds end game plan after soaking up as much free money as they can first.The Fed's proposed “balance sheet reduction” would remove $4.5 TRILLION in artificial stimulus that has been used as life support for markets since 2008. They should have let the system crash then before the bubbles got as big as they are now, it would have been softer.

I'm no expert, but I think it is wise to prepare for a worst case scenario. I would be amiss if I didn't say so and could end up feeling bad if I didn't.You are right. By delaying the crash, we are just setting up a bigger crash. The current bubble cannot last.

Jack, I think the rate went from 1.0 to 1.25. That's still pretty low even though there's been four increases in the past two years. The economy is strong (statistically). I have no problem with it. CDs will do well. My mortgage will cost a little more, which is not fun.

If they followed this up with a campaign to save $$ for a rainy day, that might help too. With the dramatic changes in the workplace they are forecasting for the 2020s, folks need to start investing and saving.<"Could you imagine the Fed crashing the economy to blame it on Trump's policies? It wouldn't be anymore his fault then any other president.">

So, the Federal Reserve IS an independent entity with no one in the federal government controlling it? Not even the president? This situation is what Thomas Jefferson and James Madison were leery of.

" … Some founding fathers, including Thomas Jefferson and James Madison, believed that the bank was unconstitutional.

By 1811, Madison was in the White House. The Bank of the United States closed down. Until, at least, Madison realized how hard it was to fight the War of 1812 without a national bank to fund the government. The Second Bank of the United States was founded in 1816. It lasted a little longer — until it crashed against the same distrust of centralized financial authority that undermined the first. The populist Andrew Jackson managed its demise in 1836.

On the other hand:

"Running an economy without a central bank empowered to issue paper money caused more than a few problems in late 19th-century America. For example, the supply of dollars was tied to private banks’ holdings of government bonds. That would have been fine if the need for dollars was fixed over time. But one overarching lesson of financial history is that that’s not the case. In times of financial panic, for example, everybody wants cash at the same time (that’s what happened in fall 2008)."

FROM https://www.washingtonpost.com/news/won … d4aa0bb160"Alexander Hamilton, the first Treasury secretary, believed a national bank would stabilize the new government’s shaky credit and support a stronger economy — and was an absolute necessity to exercise the new republic’s constitutional powers." From the above link.

And he trusted the Federal Reserve with the power it was given?

How can we get the fund rate to stay low or do anything about it whatsoever if we decide a low fund rate is better in the short or long term?

…. and yes it might be short term.

and what is a" fund rate"?

Its called a funds rate:

"An increase in the federal funds rate can affect mortgage rates if the increase sparks a rise in the 10-year Treasury rate that mortgages and bonds follow, notes CNBC. However, this doesn't always happen, and mortgage rates sometimes remain stable even after a federal funds hike."

https://www.reference.com/business-fina … rQuestions

https://www.reference.com/history/purpo … rQuestions"The Federal Reserve is considered an independent central bank, as it does not receive funding appropriated by Congress, and policy decisions do not have to be approved by anyone in either the legislative or executive branches of government.

Any decisions made by the Federal Reserve also do not require Presidential approval.

However, the Federal Reserve does operate within the government.

While the Federal Reserve is the central bank of the United States, there are 12 different regional Federal Reserve Banks. These banks were established by Congress and are considered the operations of the United States banking system. The regional Federal Reserve Banks are similar in structure to private organizations, but are still considered a part of the government.

The regional banks also have the ability to issue shares of stock to different member banks as a condition of membership in the Reserve Bank System. This stock cannot be sold or traded, and it cannot be used as security for obtaining a loan."

FROM https://www.reference.com/business-fina … rQuestions… our (People's) power is very tied up with who we vote for.

Republicans won all of the Special Elections despite all the 'hate Trump' rhetoric. Laughing my Ossoff!

This is going to be very interesting to see what happens in 9 days if Illinois can not come through with a budget for a third straight year. The Fed will rate the state junk. It is the most bananaish State. They are $15 trillion plus in debt.

* http://www.zerohedge.com/news/2017-06-2 … ase-crisis

They are going to have to make massive budget cuts? Seniors will suffer the most. Maybe they will pass a law like Oregon did, and kill the old with a mental illness by starvation and dehydration.

They will have to raise taxes? Property owners will get screwed. I don't know what the heck they are going to do. I feel for the people.

Related Discussions

- 20

Should the Federal Reserve be Abolished - Can it be Reformed?

by ga anderson 11 years ago

Here is what the Federal Reserve describes as its charter:" The Federal Reserve System, often referred to as the Federal Reserve or simply "the Fed," is the central bank of the United States. It was created by the Congress to provide the nation with a safer, more flexible, and more...

- 18

End The Federal Reserve - End Of Problem

by Wesman Todd Shaw 14 years ago

It's all so simple, really, and a wicked man stated long, long ago that it never mattered who a king was - so long as he controlled the currency - he was lord and master.http://auditthefedphonebomb.com/bailout … rillion-2/

- 265

The federal reserve wants a North American Union

by Gary Anderson 16 years ago

This guy is or was high up in the Fed. The fed is a PRIVATE bank, despite the lie on their website. The fed is owned by private stock and the US government owns none of that private stock. http://www.frbatlanta.org/publica/eco-r … hriszt.pdf

- 28

Trump was prophetic when he said this...

by Jack Lee 6 years ago

He said on Oct. 30, 2018 -If you want your stocks to go down, I suggest you vote Democrat...

- 5

When was the Federal Reserve established and by whom?

by platinumOwl4 14 years ago

When was the Federal Reserve established and by whom?Can we identify all of the member of the federal reserve and its founders?

- 15

Money : The Federal Reserve of the United States of America.

by J Zod 7 years ago

The Federal Reserve is a private institution.They have rigged the financial system in favor of the government and the banks The Fed has made the American Dollar useless..Do we really work for free? or Do we work for the banks? Are we under financial bondage?