Do you think we are already in a recession?

Do you think we are already in a recession?

Some data seems to indicate we are already in a recession in 2016. What do you think?

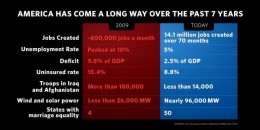

Not in the traditional sense, Jack. The numbers are not there. But what's happening is that the economy is growing, but not overall real employment. That's permanent. So we are in a workers' recession.

While there will be an uptick for seasonal hiring (Amazon is on a hiring craze out here right now), companies can now get cheap labor in all professions. They are much more efficient in all areas. Employees have become like inventory...keep it low.

We have a glut of labor and it will take years to thin out. That 55 year old machinist who lost his job is probably not getting back at the same hourly rate. Just a fact of life now. Purchasing power has been affected, but you never hear it reported in that way.What about recent indicators that tax revenues are down all around various cities and States...? also, the price of oil is down near $45 per barrel... Remember recession usually shows up months later when they revised the GDP after the fact.

Jack, you are correct. I guess I'm saying is that the definition of recession has changed. And this alludes to what Tamara stated. The metrics are there, but economists have raised the bar.

Yes, because in the United States, real unemployment is 1/6 of the population, not the official 5%. They changed the definition to exclude people who gave up looking and not counting those who worked one four hour shift a week.

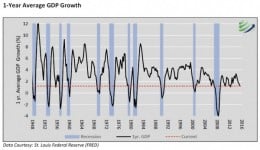

Economists measure a recession as being two consecutive quarters of negative GDP. To my knowledge no economist would could consider the key performance indicators of today to be anything close to a recession.

The stock market is at record highs, unemployment is 4.9%, interest rates are still low for home buyers, gas prices are at or near $2 per gallon around the country, foreclosures are not on the rise....However...."Perception is reality"

If someone doesn't {feel} good about the economy especially where they are. It doesn't matter to them what the "traditional KPIs" used to measure our economy state. I personally know people who have not lost their jobs and even have gotten raises, own new car/home and take vacations every year who still say the economy is in the toilet!

Whenever people don't feel positive about the future it effects their present. Having lived through several recessions to where we are today I'd say this is no comparison to those times.

What I think is happening is the nation is going through a major transitional change. Just as we went from agricultural age to the industrial age. We're in the midst of yet another major shift.

The uncertainty about the future and the longing for a known past where a high school grad could get a job at the steel mill making good money and have a job for life are forever gone.

Oddly enough the Labor Department’s Bureau of Labor Statistics (BLS) reported that there were a record 5.9 million unfilled job openings in America as of the end of July. Business owners can’t find the "skilled workers" qualified to fill the jobs they have available.

The number of job openings for {professional and business services and for health and education services have reached new highs} in recent years. The number of job openings in manufacturing and construction, by contrast, remain below their levels of a decade ago. This lends more support for the idea that openings are going unfilled because workers don’t have the right skills.

Factory work has evolved over the past 15 years or so as companies have invested in {advanced machinery requiring new skill sets}. Many workers who were laid off in recent decades – as technology, globalization and recession {wiped out lower-skilled jobs} – don’t have the skills to do today’s jobs.

Lower skilled mfg. jobs are being outsourced to other countries with lower pay scales to increase profits and keep product prices down.

The fed raises interest rates when inflation rises in order to slow down an overheated economy! The interest rates are low because inflation is low. People are saving more money these days maybe due to fear of job loss.You make some good points but you are missing the real story. The economy is broken and the stats do not reflect current reality. The stock market is artificially propped up by a near zero interest rate. The unemployment rate is more like 12% - U6.

Jack what I'm saying is the measurements we've always used in the past do not indicate that we are in a recession!

Suddenly we throw out those and come up with different ways of measuring...etc

When (inflation is low) so are interest rates!Yes, it is time for a new economics model-

http://hubpages.com/education/A-New-Eco … tric-Model

Also, interest rate is near zero because of artificial control by the Fed. reserve. Even with low inflation, the interest rate should be higher.Traditionally the feds only raise interest rates when inflation is high or there is a ton of spending by consumers. Higher interest rates discourage borrowing and encourage saving. If people (spend any less now) we'd fall back into a recession!

No we are in a "recovery" bubble.

What is a "recovery" bubble you ask?

It is when an artificial economic stability combined with near ideal conditions create an economy that appears to be doing ok, but is in reality, just waiting for conditions to change for the bottom to fall out.

What is creating the current stability? The 0% interest the FedRes is sustaining until after the election, the depressed gas/oil prices, the government jobs created/supported by an unsustainable budget based on Trillions added to the national debt yearly. Etc. Etc.

When the Fed decides to hike up interest rates, and gas prices start going back up, and the government cuts back a couple hundred thousand jobs then the real economic stagnation will settle in.The feds won't raise interest rates unless inflation rises, personal spending increases dramatically from an overheated economy. Interest rates are raised to encourage saving! As of now people are saving and spending less.

Higher rates hurt us.

Related Discussions

- 8177

What are the Great Things President Joe Biden Has Done While President

by Scott Belford 5 months ago

This is, of course, an open question since he has just started his four years, but since the RINO Party is already saying defeating Covid and growing the economy is a disaster, I thought I would start a thread that proves them wrong.I just listed two things he has done:- Got America well on its way...

- 2

How are Inflation, recession, and high interest rates are characterized in econo

by Arvind Babajee 8 years ago

How are Inflation, recession, and high interest rates are characterized in economics events?

- 137

Inflation, what is up with that?

by Scott Belford 10 months ago

There is good inflation and their is bad inflation. What we experienced from 2009 - 2021 was the good type of inflation, between 1 and 3% a year. What we are experiencing now between 5 and 9% inflation is bad inflation. What we experienced in the 1980s, 10 to 15% inflation is...

- 18

Is a double-dip recession happening now in the US?

by Ralph Deeds 13 years ago

Floyd Norris, NYT chief financial writer thinks so.It has been three decades since the United States suffered a recession that followed on the heels of the previous one. But it could be happening again. The unrelenting negative economic news of the past two weeks has painted a picture of a United...

- 6

Sears has 20,000 job openings in the country

by mm77 15 years ago

According to CNNMoney Sears has over 20,000 job openings from cashiers to vice presidentshttp://jobnewspost.com/retailjobs/sears … b-openings

- 119

Oh no! Wall Street's surging! Call in Romney!

by Susan Reid 13 years ago

So Nasdaq and the Dow Jones Industrial Average both hit new records today, based on stronger than expected employment news.The sky is obviously falling, the economy still s#ks.And of course it's all Obama's fault.Yessir,There's only one man -- a skilled business turner-arounder and state executive...