Oh no! Wall Street's surging! Call in Romney!

So Nasdaq and the Dow Jones Industrial Average both hit new records today, based on stronger than expected employment news.

The sky is obviously falling, the economy still s#ks.

And of course it's all Obama's fault.

Yessir,

There's only one man -- a skilled business turner-arounder and state executive -- who can save our free market and get our country (and the world) out of this economic morass.

Stay tuned as Barack Hussein (codeword for communist) Obama's inglorious one term presidency comes to a screeching halt.

Thank GOD for Romney.

I've had as much of this gloom and doom as I can stand!

http://www.washingtonpost.com/business/ … _comboNE_bYes, MM, sadly things are looking grim

Did I say that? The American economy has clearly been stifled during the Obama 'socialist' regime. Unemployment is rising and the economy is contracting. You all obviously need Romney. He will help reverse the fortunes and bring y'all back to where you where in 2008. When America had hope and was doing well.

Did I say that? The American economy has clearly been stifled during the Obama 'socialist' regime. Unemployment is rising and the economy is contracting. You all obviously need Romney. He will help reverse the fortunes and bring y'all back to where you where in 2008. When America had hope and was doing well.

This is clearly an inflationary bubble.

Key interest rates have been set by the highly-politicized Federal Reserve Bank at 0% --- yes, that's right: 0% -- for about 4 years -- yes, that's right: 3 years.

That literally means that people have been borrowing money at 0% interest rates for 3 years.

Of COURSE the economy is going to look good. Hell, I'm shocked it has taken this long!

The crash is coming. Buy gold and silver.The Brits have been borrowing money at 0% interest for the last three years, our economy doesn't look good though. Why the difference (I'm not asking you because I want you to substantiate your point, I'm asking because I don't know) I agree with you on one thing though. Buy gold and silver.

I'm not familiar with the specifics of the British Economy, nor am I acquainted with the specifics of the US economy.

But loose interest rates lead to more long-term investments.

A bust will surely follow.

On a citizenry level:

Do you know one single person who has borrowed money at 0% in the last 3 years?

Do you know anyone who actually qualified for the 0% interest "teaser rates" on all those new cars?

Do you know anyone who has been successfully able to refi their house in a straight refi (not government loan modification) to take advantage of these oh-so-low rates?

Do you know anyone whose bank has reset their credit cared APR lower due to these historic low rates set by the Fed?

Cuz if you do, I would sure like to meet them!

And note on the buy gold and silver advice. You do realize gold and silver have to be turned back into CASH to buy anything at the grocery store or gas station. And guess what? They're not appreciating in value so you'll be losing money.

So maybe save a step and just stockpiling cash would be smarter?

Just a thought.It appears that Evan may not comprehend how commodities actually work but you seem to not understand money and banking on an even more fundamental level. I would recommend a little reading.

MM was asking about citizenry, UCV. Before mocking, answer the question, who do you know that has benefited from these low interest rates?

The Fed rate of 0% isn't a consumer rate - it is part of the American banking system. That is the answer. The interest rates set by the Federal Reserve are not consumer rates but rather rates available for banks to borrow from each other and from the Fed. Consumer and Commercial rates are always higher.

Which is precisely why I said a little reading would be good. before delving into how Britain handles its consumer and commercial banking I would need to do some reading.Then MM does not need to do a little more reading on this topic. On a citizenry

level there are no advantages, pretty much.When the operational costs of borrowing money go down other interest rates also go down. The current rate on a home mortgage is lower than when my parents bought their first home in 1962. There is an advantage. And since when does the citizen not work for a bank, commercial enterprise or business benefit from their employers better position. Since when does the consumer not benefit? When businesses do better everyone does better. It is when the state grows that we all do a little worse everyday. The state cannot grow but at our expense.

NO. THIS IS INCORRECT

ARGH!!

When a bank is able to borrow money for free, it proceeds to spend it like it was free. Thus, it proceeds to mal-invest the money.

Then, resource prices increase dramatically in a short period because the new investors AND the normal consumers are spending money in an un-natural way. The long-term ventures end up costing more than they were supposed to and the bust ensues.

This is ABCT 101.

EVERY BANK.

Oh, and I got a car at 0% interest last year.

OH yeah! UCV TOTALLY got me on THIS one!!! I have NO idea how commodities work!!!

Oh ... wait... I made some $200 buying silver with little more than my pocket change over the last few years.

Here's gold:

If only I had heard of the Austrian School of Economics in 2000!!! I woulda been filthy rich.And if you buy that gold now, do you expect the price to continue rising?

From what I hear it's at or pretty close to its peak.

Or perhaps with commodities the plan is buy high sell high? That's for you, UCV just so you know I'm being a smartass not engaging in a genuine economics debate with Evan.

That's for you, UCV just so you know I'm being a smartass not engaging in a genuine economics debate with Evan.Enjoy poverty, MM.

If you would like to understand money better, check out my hubs.No thanks.

BTW, Evan: that's self promotion. I'm only mentioning it because HP seems to be getting tougher about that. It seems best to keep mum..Tell you what, Evan.

If Ron Paul becomes POTUS I will personally engage you as my financial advisor.'How about this:

If I can show you that Ron Paul predicted the Housing Bubble 5 years in advance AND also pinpointed Freddie and Fannie as culprits, will you take my advice?

Or how about if I show you that the Austrian School of Economics has consistently predicted almost every major Economic even in the 20th century years in advance?

Will you listen to me then?

No?

I won't waste my time showing you these predictions unless you say yes.

Mighty Mom: who are you going to listen to? The people who have been wrong consistently for 90 years? Or the people who have been right consistently for the past century?

If silver were currently priced in it historical ratio with the price of gold you would be even wealthier. Silver and gold are not the only commodities. There must always be a buyer. Timing is even more important because commodities are even more volatile than stocks. I understand your love of Austrian School Economics - I share your enthusiasm, however, booms are the unnatural state of a price and we are currently in a precious metals boom. The bust will come.

The bust will come with the demise of the dollar.

The only thing supporting the dollar now is the train wreck that is the Euro and the complete and justifiable cynicism about the Yuan.

Absolutely, what economy actually has ever run on gold alone. Paper money was the fuel the American economy was waiting for in the 19th century. I agree that going off a precious metals backed currency system has been problematic and I agree that the Federal Reserve system has been mismanaged and in some instances run amok.

I may agree with the criticism of fiat currency but gold is not the answer besides gold has an ascribed value just as paper chits. One cannot eat, drink or sleep in gold. Gold makes pretty but expensive bullets. A collapse of the dollar is not guaranteed and it would be a better use of time, money and effort to lay in store-able food and water, learn to garden, raise chickens and trap rabbits than to trade gold.

If the dollar actually collapses the global economy will not be far behind and who will buy your gold then.They might not *buy* your gold, but they might let you exchange it for food.

Sure. That's why I do recommend having a little gold and silver around in case of temporary economic collapse.

But the time to buy that is not now - that's something you should have laid in a long time ago and it shouldn't be more than you can carry.

By the way, for that use, silver coins make more sense than gold. Even a tenth ounce gold coin is way too much to pay for lunch. A silver dime might be just about right. A gold coin might buy you safe passage.. if there is anywhere safe to go.

Finally, although they cost a little bit more, for U.S. coins I recommend the older "Mercury" dimes. If you have the newer Roosevelts, people will have to look closely to be sure they are silver. A few rolls of those Mercury dimes could carry you through a temporary upset in world order.

Realistically, though, if something like that happens, most of us will be dead fairly quickly, from starvation or at the hands of our pillaging neighbors. Neither silver nor gold will stop a hungry mob.I thought the Democratic Republics of the Northeast were paradise and here you say that you fear your pillaging neighbors. Ironically, here in the Republican mid-west, I can only imagine Hoosiers(residents of the state of Indiana - the names origin and meaning lost in "antiquity") pulling together and pulling the plow. I plan on trapping the hundreds of rabbits in my suburban Indianapolis neighborhood, filling my yard with chickens and potatoes, walking to the reservoir with my fishing pole and shooting the squirrels that like the walnuts in my trees.

Wondering how good gold tastes.It isn't poisonous, but it has little nutritional value.

I live in a rural area and would expect to survive a small disruption for the same reasons you state. Until the mobs arrive from the cities, that is..The cities, by that do you mean "urban" people - isn't that conservative speak for blacks, are you betraying your secret "Republicanism" by implying black people ... wow, too fun and way too easy.

The cities of the Northeast are the most Democrat and the most liberal and yet it is these loving, compassionate, noble, sainted Democrats you fear most. Awesome.

When one is fed by the state, the collapse thereof is worse than disastrous. I would panic too if I lived in the worker's paradise.

Here is the thing, if the American economy collapses what country produces sufficient surplus food to feed all the hungry around the world who are currently fed from America's farm land? It is no small thing to be an economy of over $15 trillion dollars - that is roughly equivalent to the whole of the EU. It won't be a pretty world - because when the US goes down it will take Europe with it.

Yes, it had also occurred to me that there could be some kind of global domino effect - if one regional economy collapses, then the others will go down too. Not a nice thought.

Consider yourself blessed, when Europe crashes there will be a Britain.

This royal throne of kings, this sceptred isle,

This earth of majesty, this seat of Mars,

This other Eden, demi-paradise,

This fortress built by Nature for herself

Against infection and the hand of war,

This happy breed of men, this little world,

This precious stone set in the silver sea,

Which serves it in the office of a wall

Or as a moat defensive to a house,

Against the envy of less happier lands,--

This blessed plot, this earth, this realm, this England.

I am going to have to fend off the Democrats who have come to rely on the state for their heat, water, full bellies, decision making, etc.... A population dependent upon the state for its survival will not survive if the state does not survive.

(by the way the down side to living in Britania is that if the zombie apocalypse begins there it will be easy to contain and sanitize - sorry)We have plenty of people dependent on the state for their survival in Britain - whether they're on a pension or are on disability benefit/jobseekers' allowance/whatever.

Plus the population is over 60 million and is squashed in very densely. Not a lot of scope for people to set up their own self-sufficient farming communities, even assuming they had the ability/wish to do so.

The only thing we've got going for us is our climate, which is mostly quite pleasant and easy to grow vegetables in (not now though - we've got six inches of snow at the moment where I live, which is very unusual).

LOL, that one went right over my head - you'll have to explain.Britain is a tidy little island - if you all turn into zombies because the island was quarantined after the zombie outbreak it will be easy to clean up the mess with a couple of nukes - sorry but humanity must survive. And zombies are troublesome.

It almost sounds like Britain already has a state sponsored zombie problem - much like the problem with urban people (read black) to which Pcunix has alluded.

Gold's value is determined by the market, whereas a sheet of paper's value is determined by tyrants.

Can I buy that bumper sticker at Ronpaulista.com?

When bellies are empty gold is too expensive. A real world collapse will also collapse the value of gold. It will be the knowledge of the mundane that will be most valuable - I am currently cultivating friendships with moonshiners, car mechanics and farmers.

Blame everyone else for the overspending and greedy mismanagement of your economy huh !

Blame everyone else for the overspending and greedy mismanagement of your economy huh !

The dollar is dead as the world exchange currency, it is only still up at all through the heavy support of the Yuan and the puppy dog obeisance of the Euro.

Buy gold buddy, it is still at a low price against what it will be shortly ! or send me your dollars and I will put them into the safe and appreciating Yuan for you

There is a coming collapse in China's banking sector. It won't be apparent because it will be hushed up. The age of the internet is proving to be very hard for the Central Committee of the Chinese Communist Party to manage. Information gets out and the paper screen behind which the real state of the Chinese economy hides will be puled away.

I agree the dollar is finished and with it so is America. The disastrous term of Ben Bernanke at the Federal Reserve coupled with the historically bad Barrack Obama, worst President ever, and the pusillanimous, pathetic Republicans have permanently sunk the dollar. With the sinking dollar all that is left is the Deutch Mark - oops I mean the Euro.

The only country doing the right things, internally, for their economy is the Germans. Yet our President treats Angela Merkel like garbage when she may very well be the savior of Europe and the mother of the Fourth Reich.That's what my other half has been calling the EU for years.

I think that is one reason why Great Britain hasn't joined the Euro - that and there is still hope for you Brits. If the Germans had actually dominated the EU and driven all of its decisions I wonder if Greece and Portugal would have been admitted. Now the Eurozone has no choice but to bend to German policy positions. France is in trouble with its central bank and banking system invested in rescuing Greece. Belgium(and therefore Netherlands and Luxembourg) is itself in a financial crisis with it banks teetering. Italy, the third largest economy in the Eurozone, is almost as far gone as Spain. Spain, having mismanaged everything including their culture by ceding great swaths of it to Muslim "invaders," will totter on because they survive Franco, didn't they.

It is a mess from which only Germany, some of the Vilnius 11 and, hopefully, Great Britain will emerge with anything near their pre-crisis economic power. Slovenia is gone - but they were the sick man anyway. Turkey will have to be pushed out of NATO because Erdogon is destroying the last vestiges of Atraturk's secular atate.

Europe is a mess. We aren't much better. Russia is turning toward chaos as the populations falls out of love with Putin. China is on the rise with bogus finances and real bullets. India isn't sure if it wants to be a capitalist system or a giant bureaucratic hodge podge....

"THERE IS NOTHING NEW UNDER THE SUN"

You never seem to know when I'm kidding.

Does this make it any clearer for you?

I got my car at a 0% rate.

So... yes. Me.

... that was easy.

Either way, "buying cars at 0% interest" isn't what causes a boom and bust. It's when thousands of banks see "borrowing money indefinitely has no consequences" that they lend out money to business ventures.

They compound because consumers are still buying resources. A bust will follow.

MM: you can argue with me all you want. I'm right. Just as sure as a ball will fall back to earth, a bust will come in the next 5 or 6 years.Why do people ask questions, and then when they get the answer they are looking for, they don't proceed to say "oh yeah, look at that!"

For the same reason why not a single Bain-basher, Romney-is-a-corporate-looter type has commented on my analysis of Romney's work at Bain either on these forums or on another forum on a debate website.

When the truth doesn't agree with your claims, it's simplest to ignore it.

STOCKPILING CASH WOULD BE SMARTER THAN OWNING GOLD!??!?!

BE YE DAFT?!

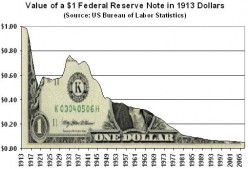

Gold Value measured in dollars over the past 12 years:

Dollar value relative to other commodities and currencies over the past 100 years:

Ugh, why bother arguing? Go ahead and believe in your false prophets.

I'll stick with 6,000 years of history.No. I think both ideas are ridiculous if practiced on any kind of widespread basis.

People who have hoarded money have lost wealth.

It's a fact

People hoarded gold have had their wealth at least stay stable.

It's a fact.

I'll stick with history. You go trust your false prophets.

If you actually knew anything about the history of gold, you'd know that it is a sucker buy right now.

Not necessarily. The entire EU is in danger of going bust. The US debt load will become unsustainable at our current pace within 10-20 years. The entire global economy could be thoroughly thrashed.

Gold is only a sucker buy if you think the global economy is going to do better in the future than it is right now.I think I know quite a bit more about gold than you do by virtue of previous employment and involvement.

Gold is a sucker bet right now. There are plenty of suckers who will be fleeced.

I'm not against owning some gold and silver, but you should have bought it at much lower price. It has NEVER been a good investment - you can make money with it, but that's speculating, not investing. You want to trade in gold, fine. If you think it is a hedge against inflation, you have the wrong timing.Not a hedge against inflation. A hedge against the stupidity of governments worldwide. Certainly you know more than gold than I do, without knowing anything about me. Another one of these crystal-ball types?

The EU is a mess, worse than the US... governments need to fix their budgets or we're going to see much worse.Good points. While I'm not speculating on Rogers' reasons for buying gold, I can't help but notice there are a lot of people that buy gold because they think that somehow it will be a good thing to have (a) if the economy totally collapses, or (b) there's some sort of massive destruction doomsday scenario. And I see a couple of problems with that.

First, while you say you're buying gold, it's not like you really are. Is it in your hot little hands? Of course not. You're buying a piece of paper that says that somewhere someone has gold that belongs to you. In that sense, it's really no 'safer' than buying stocks or making real estate investments in Florida swampland.

And, of course, even if you had that gold in your hot little hands, what good is it? As is pointed out elsewhere in this thread, in the real world, people don't use gold. Think you can walk into the corner grocery and pick up some milk and eggs with it? Of course not. You've got to turn it into dollars or euros or whatever your local currency is in order to use it.

Which means if we were to find ourselves in the Great Depression Part 2 or some sort of doomsday scenario came to pass, you would have put your money into something that you don't actually have and couldn't use if you did (despite the love that people have for gold, when you get right down to it, it's not a very useful metal. It's too soft for most applications. It's only valuable because people *say* it is), and would have to hope that someone would buy it. Except who would have the money for it? In those situations, people who have money are likely to be looking for things like food, shelter, and the basic necessities of life - they're not going to be buying nonsense like gold. Who would be buying gold? The people that have LOTS of money - and they're only going to buy at bargain basement prices. And they'll be able to, because they've been hoarding money.I don't actually care if you guys take my advice. I really don't.

But China disagrees with you all.

http://www.forbes.com/sites/gordonchang … s-of-gold/And yet, if you actually READ that article..

Oh, never mind. Buy gold, Evan. And don't forget to leave yourself enough cash to put a big bet down on Ron Paul winning the Presidency. Between that and your gold, you are going to be RICH!I'm not going to be rich, I'm merely going to hold on to my wealth.

I don't know which part of the article you don't think I read...

was it: "“The only choice to hedge risks is to hold hard currency—gold.” He also said it was smart strategy to buy on market dips. Analysts naturally jumped on his comment as proof that China, the world’s fifth-largest holder of the metal, is in the market for more."

or: "A better explanation for the gold-buying binge of Chinese citizens is that they are using the shiny commodity as an inflation hedge,"

Or just the simple fact that the Chinese have decided that holding gold is better than holding dollars?Umm, all of it..

Don't forget to bet on Paul! 25/1 still! And that's just to be the nominee - it's 50/1 against him becoming POTUS!What's funny about those statistics is that you seem to think that your data discredit my data.

If he's 1-25 to get the R nomination, but 1/50 to get the Presidency...

... then that means that he has a 50:50 chance against Obama.

You're agreeing that he's tied with Obama.Sure, Evan - that's exactly how it works..

Buy up that gold. I understand tulip bulbs are due for a big comeback also.I guess that "division" is too much to ask of some people.

Pcunix, it's always astonishing to hear you demand more public expenditures for education when you're unable to recognize the statistics are saying what I'm saying.

If Ron Paul is 1/25 for being the R candidate;

and he is 1/50 for being the President;

then he must be a 1/2 chance for beating Obama.

1 / 25 * 1 / 2 = 1/50

R nom Beat Oba total to get to white house.

Or, using percentages:

4% chance of beating the other Rs time a 50% chance of beating Obama = 2% overall.

Ron Paul can beat Obama - it's 50-50. His biggest concern is getting the R nomination.

I'm sorry your 4th grade teacher never taught you this. She probably had tenure, health care, and a $50k/year salary, so why bother being the best of the best?

"That literally means that people have been borrowing money at 0% interest rates for 3 years."

Evan ???Which people have been borrowing at 0%? Oh! I forgot New York banksters are people, too. They are the only ones who've been borrowing at 0%. Ordinary folks have been LENDING at 0% or close to it which is what money market funds are paying. Moreover, the banksters and Freddie Mac have been makeing it hard for people to refinance their home mortgages at record low rates. Freddie Mac has been betting against refinancing at lower rates. That is, it is profiting by preventing people whose homes are under water from refinancing their mortgages at the current record low rates. They are currently under investigation for a conflict of interest and possible fraud. As you are aware, Gingrich has profited from his longstanding "consulting" relationship with Freddie and Fannie.One of your heroes, Barnie Frank, has been diddling in a long relationship with Fannie Mae. Barry got huge campaign contributions from those Democrat run and protected Fannie Mae and Freddie Mac. When GWB approached Congress to reform mortgage lending it was Democrats like Maxine Waters, Chris Dodd and Barnie Frank who fought to keep the status quo. You are kvetching about Gingrich getting a pittance from an institution run by Democrats and protected by Democrats to the tune of Billions in bailouts and hundreds of millions in perks and bonuses.

It is fine that the Democrats who ran FM/FM into the ground and the mortgage industry and mortgage loans with them to receive millions in bonuses but let an entrepreneur approach a company to advise them on a better direction he better not be a Republican and he better not get paid. Some times I wonder how much manure liberals can swallow as long as there is a (D) printed after the purveyors name.More misinformation.

Freddie CEO:

"Refinancing is Freddie Mac's bread and butter in today's marketplace. Mortgage refinances represented an estimated 78 percent of our single-family purchase volume in 2011 and 80 percent in 2009 and 2010. In the last three years, we refinanced about $930 billion in mortgages – helping nearly 4.3 million American families lower thhttp://www.freddiemac.com/news/blog/ed_haldeman/20120131_refinancing_is_freddies_bread_and_butter_today.html?intcmp=FM12012020-1EPBeir payments or shorten their mortgage terms."It was amazing to see you turn "they're lending at 0% interest rates" into "I hate Gingrich".

That was pretty epic.

Deeds, you're a Keynesian, so you actually want NEGATIVE interest rates. Having a discussion about this with you is largely moot.

The discussion summarized:

Deeds "more lending leads to better life! inflate inflate inflate!"

Me "No, the Cantillion Effect is well documented, and there will be a burst. This short term political trick will end in millions of people having a decreased standard of living".

Will you review the results when the unemployment figures are revised next week to an even less rosy level?

Don't you have questions about the unemployment figures being compiled by those most likely to benefit from a more positive outlook?

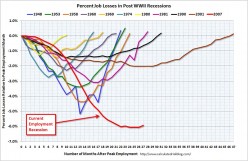

There is ample evidence that the universe of jobs has contracted and distorted the unemployment rate. The percentage of working age people actually employed is at an 30 year low. Youth unemployment has not been higher since the compiling of that data.

Perhaps the stock market is responding to the possibility of another round of Fed Reserve debt monetizing.

Since when is an unemployment rate over 5% good? After all the average unemployment rate since 1983 has been 2 points lower than the current rate - even during the various recessions that occurred in the intervening years.

Ironic the only time there has been such a protracted period of economic hardship in the country since 1900 has been while a Democrat occupied the White House. Barry-Jimmy-FDR - awesome track record.The unemployment numbers are not accurate. If you have been following my articles and shows, I said this was going to happen. First several months ago, about 1 million people were not counted in order to drop the numbers. This month it is 2.8 million people. Add them back in and lets see where the unemployment numbers are. Next, how is it that there are almost 400,000 new job claims per week and unemployment go down. Even the CBO reports say Obama's numbers are not accurate. Notice too absent from the report, unemployed veterans, the ones Obama ask 5 billion dollars to help find jobs. I could go on by showing a state by state breakdown not supporting the Fed number.

One of the most telling statistics is that only 63.7% of working age people are in the labor force. This is the lowest participation rate in decades. Once women entered the labor force that number steadily climbed to a high in the late 1990s early 2000s.

But payroll figures increased. That's why Wall Street reacted as it did.

But the GOP will try to do something to make things worse again. They will justify it to themselves as "greater good".That's exactly why Obama told Congress today "Don't muck this up."

One of these days he will figure out that only reverse psychology works with the toddler mentality GOP.

Whatever he tells them to do they will do the opposite. Especially if it harms Americans.You should look at my analysis of the employment rate MM. It's a load of bull. We have 21% more non-working adults, percentage-wise based on the workforce-age population, than we did in 2008.

Wall Street isn't reacting to 4-year old numbers, however.

Markets are manipulated. There are big players with their own agendas. Everything else is traders, investors, and speculators just riding the waves. The markets don't reflect reality, they reflect the agenda.

Trust me, most traders know when they are getting a load of bull, but they also know that the market will act like the bull is true. If they go against it they will lose.

2.6 million less jobs in Jan than Dec. That's the reality. It's only reported 'seasonally adjusted'(and SA isn't consistent) to make things look better than they are. The job rate isn't getting better. Look at the percentages, it's stagnating.

8.5% unemployment is awesome. Wish we could have had that during the 90s and early 200s we had to struggle along with unemployment rates in the 4-5-6 range -- horrors. When the Republicans ran Congress unemployment rates were low - regardless of which party was in the White House - history repeats?

No argument here.

If we could somehow rewind the economic clock to the go-go '90s and skip right over 2007-2011 and land here like Dorothy in Oz we'd all be hubbing from our yachts and private islands.

Reality bites. Or Bytes, in the case of our hubber pal.The Obama Depression isn't finished. It is likely to gain renewed vigor when he is re-elected in November as a lame duck and all the anger he hints at when the blamer-in-chief petulantly targets a sector of the economy to vilify is freed from any electoral constraint to ravage the last few productive vestiges of a once great country.

Time to lay in those survival supplies kidlings.

No, payroll figures decreased by 2.6 million jobs. Don't by into the political crap.

Wallstreet reacts the way it does because it's just a big game. There are a few large players that make things move, and lots of small investors that just ride the waves. The markets aren't an accurate representation of things."Payroll figures increased"

I find it odd that one DOL report says just that, but another DOL report for the same month of January 2012 says the opposite. So did the CBO this week in a report. Not to mention all the states unemployment numbers do not support that the rate went down or even support the number of new jobs the DOL is claiming. Gee did the President not just say in the SOTU that manufacturing is down. Did the CPI last month not report wholesale and manufacturing were down? Sorry, way to many reports contradict the jobs reportHere's something interesting.

From Dec. 07 to Jan. 08, 2% of all jobs were lost(due to seasonality). That statistic was Seasonally Adjusted to be an increase of 40,000.

Under Obama, from this Dec. to this Jan, 2% of all jobs were lost, and that was Seasonally Adjusted to be an increase of 243,000.

Of course, it could also be noted that each of those Democratic presidents inherited an economy that had already tanked, and in the case of FDR & Clinton, who you forgot to mention, the economy improved during their terms in office. Carter admittedly had no such luck, and it's too early to pass judgement on Obama's final results.

The economy under FDR reached it nadir and languished there. It took twenty years - most of which was while FDR was President - for the Stock Market to regain its level from before the crash. FDR ran against Hoover's policies but once elected expanded and extrapolated on those policies - that should remind you of Barrack Obama. The recession that you say Clinton inherited was over before the 4th quarter of 1992 - it did not follow him into office.(just because a political animal says - "Its the economy, stupid" doesn't mean it is)

Every protracted economic down turn in the 20th and now 21st centuries has corresponded with a Democrat Congress. The worst also included a Democrat in the White House. There have been numerous recessions since the end of WWII, this is the longest one - by far.

http://en.wikipedia.org/wiki/List_of_re … on_onwards

We are in the most languid recover since the Great Depression. It will take a decade of growth in excess of 3% per year to bring back the jobs that Democrats have killed with their anti-business rhetoric and over regulation and down right stupid moves - like destroying the Gulf Oil industry because oil drilling is scary.

The Blamer-in-Chief has no one to thank for the thousands of jobs that have been destroyed in every industry he decides to attack but himself. He has attacked the employers of thousands of hard working Americans - that is just brilliant. Insurance companies, banks, pharmaceutical companies, jet aircraft manufacturers and operators, oil companies(that goes way beyond Exxon) have all been the target of his hateful commentary and name calling.

Like most liberals he does not comprehend that businesses are made up of thousands of people. Liberals mocked Romney when he said, "Corporations are people." They are - Wal-Mart Corporation is made up of 2.1 million people - if you destroy the corporation you harm those people. But that is what liberals in the White House and Congress do - destroy the lively hood of people.

Good luck with the whole, Democrats inherited malarkey. Americans are starting to wake up to the fact that the only thing liberals know how to expand is poverty.

Don't get too excited yet. According to CNBC, 1.2 million unemployed people have stopped looking for jobs, so they're not figured in the unemployment numbers:

http://www.realclearpolitics.com/video/ … r_low.htmlThat's according to CNBC though, Habee. Is the report factual?

Actually it is 2.8 million that did not get counted yet they still collect unemployment

Dow Jones measured in gold prices:

Translation? When measured in dollars, things go up (because there are more dollars to exchange), when measured in gold, we're poorer (despite the small amount of increase in gold supply)

Oh my, I am laughing quite hard right now. Thanks, Mighty, for the laugh and dose of altered reality! Oh, for the good old days, right?

Oh yeah, y'all need a new Bush. Life was so much better then. Hell, he didn't make mistakes.

You are so astute, Hollie.

I'm surprised there haven't been more comparisons drawn between Bush and Romney. Now that Rick Perry (Bush on steroids) is out of the race, Romney is actually sounding more and more like W every day. I think he is rapidly losing articulation and devolving into malapropism!

Billybuc!How are ya friend?

How nice to see you venturing into the viper pit (aka politics forum) with us!

I am doing well Mighty; thought I'd give it a whirl and see if I can't stir it up a bit.

, Romney is actually sounding more and more like W every day.

When you stick your hand up someone's bum (sorry to be crude) and then work their mouth, they speak with the same accent. I look at our ( I use that term loosely) PM. His puppet master is bi-lingual.Righteo. That is quite the visual

Speaking of the good old pre HOPE days of 2000-2008, don't you miss Bush and his lapdog Tony? I sure do!! What a fine pair.

Not looking like this topic is going to pick up steam. I can never tell what's going to stick in people's craw and draw out the extremists...

We'll see.Oh, it picked up steam for sure...as soon as you mentioned Bush steam came out of my ears.

Bush and the poodle, do I miss them....emmm. We still have a poodle Mcomplex, bankers etc.etc.) However, I think that Cam the flam and Obama are very different people, thank florence!! I definitely prefer Obama.

It will pick up steam, the opposition just have to plan their retaliation. I mean, after all, they can honestly jump on the way Obama has destroyed the economy, unemployment is on the up. They have so much to jump on. Right?

The big boys and the banks. They borrow for zero interest and lend it out for 3 to 6 percent or who knows higher.

Exactly, the big boys and the banks are the only ones to benefit from 0 rates of interest. Not the citizenry.

Except with lowered (not zero) rates on their mortgages. Which is great if you have a job and can pay your mortgage.

Mortgages are cheap now for those who can afford a mortgage. They have said they are going keep zero interest to 2014. This probably indicates that they

expect the economy to be bad at least 'til then, and if they can maintain the US dollar as the world's reserve currency.Do you think Knol, that the US dollar will be maintained as the world's reserve?

It is what the whole Iran drama is all about. No one trades oil in anything but dollars or euros or else.

See Iraq and Libya. Iran was trading in other currencies and had the nerve to set up their oil market. Now these Iran oil sanctions are causing other countries like China, India, maybe Japan and South Korea and some others to have to trade in gold or their own currencies. Exactly what the US does not want. Go figure. Thus it is now war with every word.

America is ruined if countries stop using the dollar.

War to stop it and world depression. No war to stop it and American depression. Which will it be is any body's guess.In effect then, the US is acting against their own interests. If these sanctions are causing some of the BRIC and other asian countries to use gold for the transactions, it is counter productive to US ambitions? I think they are all FOOLS.

"I think they are all FOOLS." There seems to be no overestimating the lunacy of the US managing ruling class these last ten years. Now the European Union has voted for Iran oil sanctions, which only hurts them and may bring down the union since many European countries need Iran's oil. Great for the US, get rid of the Euro. But the US now has official pentagon policy right out of a James Bond movie, "Full Spectrum Dominance" of the world.

I also think they are all DEVIOUS. The conditions are ripe for world war III. Do I sound paranoid? I can't help but think there is some (other) agenda here, one which we have not truly considered. Or maybe we have. Either way, the ruling class do not believe that THEY will be in the line of fire, hunger or desperation, when the world becomes even more insane than it is now.

Underground cities....or bunkers, where Cheney went to manage 9/11

- JaxsonRaineposted 13 years ago

0

Unfortunately, the information we are getting about jobs isn't reliable. 'Seasonal adjustment' is just a way of presenting bad news as good news.

2.68 million jobs lost from December to January, but that is 'seasonally adjusted' to 243,000 jobs created.

Also, the stock markets aren't a true indication of the strength of the economy. Stocks and foreign exchange have a tendency to be inversely related... i.e. when the internal markets go up, the dollar usually weakens. Look pals, I hope the economy does improve - soon. If Obama's plans work, I won't be eager to change metaphorical horses in the middle of the metaphorical stream. What hits hubby and me hardest, on a personal level, is the housing market and home values.

I agree, housing market and values are way down. But Romney wants more homes to go into foreclosure, purchased by investors, and rented out. I see that as the rich getting richer when values go up. Makes more sense to me, if the folks in the homes now, worked out new mortgage arrangements, helping them keep their homes. As you know in our area of the country many landlords are slum lords that were bringing down property values before the bubble burst. Most home owners increase a neighborhoods home values, where landlords are notorious for letting the properties get run down, bringing all the neighborhood home values down..

Hi MM,

I've been staying off the political forums, if I have to see one more R debate I'll die of boredom. I like the reverse psychology idea with Congress. I can't believe Romney sang America The Beautiful in his desperation. Why would we elect a corporate raider who looks like a Ken doll? And do all the R men need blonde wives? Is it one of the requirements to have a blond staring at you adoringly when she probably can't stand you? Then Santorum stands with his family, who look so bored to be there. I'm sick of seeing Planned Parenthood demonized too. They provide pap smears and breast exams many women cannot afford. Abortions account for 2% of what they do. Even Mrs.Santorum backed off her hubby's story of how she almost died giving birth to their last child, and at first she said to save the child. Then she says she "got her mind back" and realized "who would be there to care for my other three children if I died." I can't stand any man who would be proud to say he'd let his wife die to have yet another child. He's a moron.Hi Jean,

Blonde adoring wife.

It's on page 19 paragraph 5 of the GOP Candidate's Playbook.

Agree, with Perry and Cain gone, the the campaign isn't fun to watch anymore. It is interesting to watch the reluctant Romneyites suddenly standing up for him, tho. It's almost like "We don't really like him and can't really warm up to him but by gosh we're gonna fight anyone who says anything bad about old Mitt."

I'm pretty upset with Komen, too.

Although my personal experience with the organization had already dropped the Komen "brand" down a few notches in my book before this news hit.

They won't even be honest about what they did and why they did it.You mean like this, formerly pro-life, power couple?

Here we go again! Didn't we just watch a bubble burst about 3 years ago now?? I can't understand why they keep 'inflating' them - is it to keep the masses under control? Content? Subdued? The 'Masses' know they are still starving to death, can't get a job, can't get a loan, and can't get a house. They know their kids can't either. It's so annoying that politicians and the powers that be think they can say it and therefore - it is. American has to keep an eye on her arrogance or take the road of the Greek and the Roman Empires. Wall Street still has the same criminals running it as it ever had. While I agree that Obama is obamanible, Romney ain't getting voted president anytime in this lifetime. No way, no how. Unfortunately, the lack of quality candidates on the gop ticket is serving Obama up his second term in office! He should thank them!

Bubbles are inflated because people don't understand how economies work and people like Alan Greenspan and Ben Bernanke serve the Federal Reserve not the economy. Ever expanding bubbles resemble real economic growth though they are a profound threat there to. The housing bubble has not fully deflated and if left to the mechanisms of the market would be much closer to reaching an equilibrium price than it will be with more government intervention that is sure to delay the actual, real world end to the Obama Depression.

Much like the FDR Depression, this one is being extended by the constant tinkering and tampering. The borrowing, inflating and spending are not helping. In 2007 when Bear Sterns was about to die my son said they were discussing what the government should do - he answered his liberal teacher with, "Let it burn." Wise beyond his years.

If "let it burn" had been the position of the Bush Administration in 2007 we would be on the other side of the Obama Depression by now. We are not in a recovery. We are in a distorted economy. Recoveries are not so anemic.

The Post-Depression Boom lasted into the 1950s despite high taxes Eisenhower maintained to pay the WWII debt.

The Post-Carter Boom continued until the collapse of the housing bubble.

The Post-Obama Boom will not come because this is our last year with a semblance of economic liberty. The inevitable re-election of Obama will insulate the daffy liberals from enacting, through extra constitutional means, so many onerous regulations and rules that what ever hope may remain for the economy will be dashed to pieces on the rock of Barry's anti-Americanism.I agree 100%. I'm a definite advocate of the 'let it burn' philosophy! How can the USA say it hates socialism in one breath - and hand money out to failing companies in the other. AND - to companies that managed to rob themselves blind - and the general public! I also wonder why they use the exact same tactics that failed so miserably in the 30's? A road traveled always ends at the same location, yes?..no?...lol

I watched Market Watch this a.m. on New England Cable News.....seems that the Eatern seaboard is doing quite well! Businesses are very optomistic...in fact they work WITH gvt to create jobs...and one of them was voted best in the country to work at...an investment firm!

Yup...they have imagination and courage. Not doom and gloom. So, if'n youse wanna catch up, better drop the GOP loser mentality!

America is on the mend....with or without you.Yes . . . thanks Chrismylove. I was following this snowball of vitriol and pessimism and NOW my glass is half full and the sun is shining. It is 7:45 PM here in Hawaii and for the first Christmas in years, tourism flourished.

Related Discussions

- 12

Do you think we are already in a recession?

by Jack Lee 9 years ago

Do you think we are already in a recession?Some data seems to indicate we are already in a recession in 2016. What do you think?

- 68

Controversial CBO Report - Last step into Political Bizzaro World

by ga anderson 11 years ago

The gist of the new Congressional Budget Office, (CBO), report on the effects of Obamacare on the U.S. economy is that it will cause a reduction in works hours equivalent to about 2 million jobs by 2017.Here is just one link from a Washington Post story: http://www.washingtonpost.com/blogs/plu...

- 7

"A Slow but Steady Climb to Prosperity" by Alan Blinder

by Ralph Deeds 13 years ago

"...Two indisputable economic facts are highly relevant to the current campaign. First, more than four years after the frightening financial panic and deep recession triggered by the collapse of Lehman Brothers in September 2008, the U.S. economy is still not healthy. Second, however, the...

- 18

Is a double-dip recession happening now in the US?

by Ralph Deeds 14 years ago

Floyd Norris, NYT chief financial writer thinks so.It has been three decades since the United States suffered a recession that followed on the heels of the previous one. But it could be happening again. The unrelenting negative economic news of the past two weeks has painted a picture of a United...

- 24

In what ways is Mitt Romney worse than George W. Bush?

by peanutroaster 13 years ago

In what ways is Mitt Romney worse than George W. Bush?I'll start off the discussion with a few observations: 1. He actually profits from shipping jobs to China. 2. No one in his family ever served in the armed forces and he's doesn't even appear to care about veterans. I could go...

- 22

Unemployment Report Beats 18-Year Low. 3.8% Trump's economy roars on.

by Sharlee 7 years ago

My question - President Trump was well known for this statement. "You will get sick of winning." Are you sick of winning? Trump's economy once again this month beats projected unemployment numbers... 18 year low. ...