How Much Is "My Fair Share"?

- HuntersWhittposted 13 years ago

0

For the purposes of this discussion, let's assume that I am part of the 1%. What percentage of my income do you feel is my "fair share", and how did you come up with that number?

Apparently, taking $0.24 of every dollar you make, while we take less than $0.02 of every dollar half of Americans make, isn't you pulling your weight.

Lol, it's ridiculous. Legalized theft, nothing more.The same as everyone else - what could be more fair than that?

Practicality demands more, but that doesn't make it fair - just workable.Wasn't Obama just talking about equality? How is it treating two people equally to treat them differently?

But then by that logic, we'd have to ask the lower end of the spectrum, the ones who don't pay a federal income tax, to start kicking in also. How would you handle that?It would be impossible as those people already depend on benefits to live. Taxing benefits is a shell game, they money was never really theirs to begin with.

Haha. So it is wrong to tax people on money that we give them, that never really was theirs.

But perfectly OK to tax people on money that they earn, that always really was theirs.I did not say it was wrong, I said it was pointless. The second you did it you would need to increase the benefit to subsistence levels again. So nothing would be achieved.

I don't know what you mean by that.

I answered your question. My opinion is what it is.It means that you shouldn't make something dependent on being taken care of.

Providing free food and money to people, and not even asking them to pay taxes, gives them benefits without feeling they are having to pay for them.

Give them a little money to cover the taxes, charge them taxes, and if they blow the money, cut off their benefits. Teach them a little sacrifice and responsibility.So, as I asked psycheskinner, what percentage do you think is fair?

I don't think it's fair to tax any income at all. Corporate taxes are wrong too. Everything should be sales tax(because in the end, that's the effect of every tax. Doing sales tax is just the most efficient way of handling it).

So what would you put a sales tax on, and how much would it be?

It would most likely need to be 10-15 percent to support the current programs.

Our government spends a lot of money, people don't realize it.

$12 trillion in consumer spending. $3.79 trillion in government spending.

31.5% tax to extract $3.79 trillion.I have not checked it out thoroughly, but I think that is the gist of "Fair Tax" proposal to revamp the U.S. tax system.

. And it proposes a 23% national sales tax - and the abolition of all income taxes.

GASo would you have any exclusions for the tax (i.e. food, produce, services, etc), and how would you justify such a large tax increase on the poor?

Income taxes(personal and corporate) are already priced into the prices of goods and services.

Changing the time when those taxes are taking out won't make a difference.

No exclusions. If compromise is required, I would rather just give everyone a prebate.

Probably on everything. Consumer spending is something like $12 trillion, 10% ought to do it(of course this would require entitlement reform and drastic spending cuts).

I think sales tax is a very good option too--as it tends to place a higher tax burden on the wealthy as a natural consequence of their greater spending behavior.

While the wealthy do have a higher spending potential, the lower end of the bracket constantly spends a higher percentage of their income. With that being said, how would you justify a 10-15% price increase on people who are already struggling to make it; and how would you cope with the increased demand for public assistance from people who the sales tax would "push over the edge"?

That's why I say it can't work; you can't take what isn't there. Therefore, the rich must pay more if we wish to have a country.

There is very often a difference between what is "fair" and what is "workable". Life isn't fair and the tax structure can't be either.No, the rich don't necessarily have to pay more "if we wish to have a country"

Our leaders need to practice fiscal responsibility "if we wish to have a country"

You are right about life not being fair - as in - we can't always have it just because we want it.

Trillions were billions first, and billions were hundreds of millions first, and hundreds of millions were... etc.

As the old saying goes, "if you watch the pennies - the dollars will take care of themselves"

Everyone talks as if trillion and hundred billion dollar answers are the only way, but what about starting with scrutinizing those paltry "million dollar" expenditures first.

Fiscal responsibility! Without it there will never be a "fair" tax structure, or enough taxes.

"Taxing the rich" is just patronizing pablum for the masses.

GAUsing that line of reasoning the country need have no income at all. The poorest cannot contribute any taxes without starving (whereupon they cannot contribute then either) which you are claiming applies to the rich as well.

It won't work. While I fully support the idea that we are overspending and that spending needs to be cut drastically, it won't stop the rich from needing to pay more the the poor or even middle class. Or what I (in my poverty) call the middle class.At least have everyone pay the same percentage. The rich will still pay FAR more, but that has some resemblance to fairness.

"Using that line of reasoning the country need have no income at all. The poorest cannot contribute any taxes without starving (whereupon they cannot contribute then either) which you are claiming applies to the rich as well.

"

I admit I am confused - I don't understand you point (above)

Why do you say that with fiscal responsibility our country would need no income?

What are you saying that I am saying applies to the rich as well? Fiscal responsibility?

Why do you think the rich should pay more? Just because they can?

How much more? What ever is needed?

Is there a ceiling to how much more they should pay - even if there is no ceiling to how much more the government could/would spend?

Do you believe that if the rich did pay more our country's money problems would be solved?

Taking one of the Democrat mantras about Bush destroying the budget surplus Clinton left him, (at least on paper), wouldn't it be more fair to tax the Republicans more, instead of the rich? After all it is the Republicans fault we are in this bind isn't it?

So...

Why do you think the rich should pay more? Why shouldn't we just tax Republicans more?

GA

Trying to use the government to create a fair society is a fallacy in itself, life isn't fair and never will be and anyone who says otherwise is up to something! The left has always used high minded rhetoric to disguise there true agenda of class warfare and envy. When you use fuzzy expressions like "fairness", as a basis of policy, you're being deceptive and utopianistic.

Fairness is hard to determine, you could have a room full of poeple, none of which would agree on what is fair. To invite the government to decide on what is fair, is to invite tyranny. The reason for this is the government would require vast amounts of power to be given the latitude to make these types of value judgements binding on national policy. Maybe this is what the left wants, an elite group making decisions for the benighted masses! The Constitution never mentions the term fairness, it does mention equality one time but only equality under the law.While I certainly agree that life is, by no means, "fair", I think we can all agree that there is at least a quantifiable spectrum of "fair" when it comes to things like tax policy. For instance, no one would argue that a 100% income tax would be "unfair", and once you agree on the concept, all that's left is finding a number we can all deal with.

The point of the question is too get a feel for just how much people think the wealthy should be required to pay.

Your fair share (I assume you are referring to your fair tax rate) is whatever the Congress decides. Marginal income tax rates have been as high as, I recall, 90 percent in the U.S. down to a low of 35% as a result of the Bush tax cuts. Of course, the long term capital gains tax rate is only 15% and the "carried interest" tax rate enjoyed by hedge fund operators is lower also. The currant tax code is as full of unjustified holes as Gypsy Rose Lee's stockings.

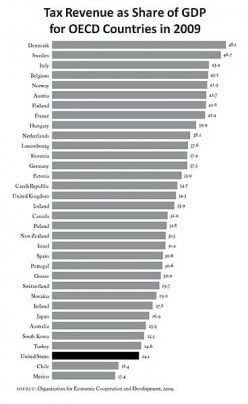

As you can see from this chart tax rates in the U.S. are among the lowest of industrialized countries.

http://en.wikipedia.org/wiki/File:Tax_R … n_2009.jpg

Sorry Ralph, that's not a chart of tax rates. Do you know what a tax rate is?

No, that's a chart showing what percentage of our GDP comes from tax revenue. Ralph must have accidentally linked the wrong picture, he meant to link one showing a comparison of Tax rates.

The left loves to use that particular yardstick... revenue as a % of GDP. As if it means anything...

Like I said, I think that was just an accident. He was talking about tax rates, and I think he probably just linked the wrong URL by accident, I've done that before.

No, he's done it before. Ralph won't have an open discussion with me. He's completely hypocritical and irrational. He will say that Source X is perfectly fine, unless you show him that it says something he doesn't agree with, then Source X is, and always has been, hogwash.

Don't we measure spending as a % of GDP?

You can, but it doesn't mean much. You can measure spending as a % of new automobile sales... there are an infinite number of useless yardsticks.

We measure spending in $, mostly.Spending as a percentage of GDP can be a good benchmark for certain economic trends, but it really wouldn't apply to this discussion- at least not as it pertains to what we've discussed so far.

Why not? It's the most basic way to compare taxes among countries which have quite different tax systems--e.g., value added taxes, sales taxes, inheritance taxes, etc. which would not be included in a comparison of marginal income tax rates. My understanding is that the comparison of taxes as a % of GDP captures all taxes. One thing that it may not capture is the non-compliance percentage (Secret Swiss, Cayman Islands, Bermuda).

True, but this discussion is about individual tax rates, not the revenue generated.

Because, it still says nothing about the tax RATES that people are paying.

The US has the highest corporate tax rates, yet one of the lowest corporate tax revenue/GDP rates. Even if we taxed corporations at 100%, we wouldn't top the list of revenue as % of GDP.That's because of all the unjustified loopholes and subsidies.

No, if we took 100% of every dollar of corporate profit, with no loopholes and subsidies, we still wouldn't top the list. It's because our corporate activity to GDP level is different from other countries.

We are a wealthier, consumer nation. More of our money funnels to the workers, compared to the corporations. Since the corporations only have a small chunk of the money, even if we took all their profit, it would still not be as big of a % of GDP as you would get by taking all the corporate profits in other countries.

Hmmm, this conversation is about the fair share of taxes, which is the governments revenue...The fiscal talks about our out of control spending will be balanced by revenues and cuts...we measure spending as a % of GDP therefore, why should we not measure revenue as a % of GDP?

How much the country needs? How much can pay?

If the country produce an amount, what percentage is for its needs?

That is out of my capacity. I say good bye.Yes, but we were discussing rates, not the actual dollar amounts.

I don't understand, could you elaborate?

We're discussing what percentage of the money someone earns is taxed. The chart Ralph posted is looking at total taxes collected, which doesn't tell you what tax rates people are paying.

The question was: For the purposes of this discussion, let's assume that I am part of the 1%. What percentage of my income do you feel is my "fair share", and how did you come up with that number?

Oh okay, sorry I jumped in when things broadened...well, it seems the rate has been set at just under 37% for the top 1%, by those much smarter than myself...however, my opinion is that a flat tax would be a fair system, closing all loopholes etc that allow the wealthiest of society to escape paying, but allowing those of middle and lower incomes to have deductions that help them send their children to college and invest in retirement programs, etc.

So how would you answer the criticism that, forcing the wealthy to pay higher taxes is a penalty on success?

I believe to whom much is given, much is required...Honestly, I believe that it is not a penalty but a civil responsibility to share in our successes and help others to be successful, improving our country exponentially, being a part of something greater than ones self, building a country that is successful, showing a humanity that is its own reward...I believe we are all in this together and should do whatever it takes to create the greatest country own earth, to be a beacon to the world, to care for our brothers and sisters more than dollars and jets and diamonds...It should not be concieved as a penalty but an honor, a compliment of ones success. As a culture we only see reward for success in dollars...we se worth in dollars, that's sad

Do you believe in forcing your beliefs on others?

No, I don't.

So do you support laws that force the wealthy to support the poor? Call it their civic duty, but they aren't being given the choice.And the poor are not being given the choice to stop being poor

Nobody is forcing them to be poor.

I'm asking if you support forcing the wealthy to pay for the poor?Not true Jaxson, if you are born poor you will stay poor, you will not receive the education and opportunities to do otherwise...I am speaking of the POOR, not the financially challenged

Who is forcing a poor person to stay poor? Forcing is an action, so who is doing what to force them to stay poor?

Also, answer my question please.Suzie is born into a poor family, her father runs off, no child support, mom waits tables at the waffle house, suzie goes to school hungry and tired often, she doesn't go to college she repeats her mothers life...Poor people most often can not climb out of the ditch without help..help with food, help with education or training, without social programs to help the Suzies of the world what will become of them? The system itself forces the poor to remain poor, even with help the jobs do not pay enough to an uneducated mother to ever climb over the hump, so she works two jobs and loses her food benefit, not added income for the family, does this answer your question or do I misunderstand the question?

Suzie has been taught for her whole life that education and work are not what feeds her. As a result she holds herself in poverty and any and all help we give won't (typically) make any difference. Most poor could work themselves out of abject poverty (although never becoming rich or probably even middle class) but will not make the effort.

A good part of the problem, as I see it, is that we don't help the poor to support themselves. Instead we help them to become ever more dependent on handouts. We don't move them out of the slums, we don't educate them (partially because education is a two way street and most poor won't accept education), we don't even try to change the entitlement mentality and instill some pride in their own accomplishments. We just feed and house them, calling it "help" while they sink further into the morass of attitudes that cause poverty.'We just feed and house them, calling it "help"....'

I see or hear some variation on this statement quite often. I am not aware of any government program for the able-bodied where they are "fed and housed" unconditionally and without time limit. Can you please tell me what programs do this?Ask yourself how long a young mother that produces another child every couple of years can receive food stamps and/or housing. Do you really think that we will let either her OR her children starve?

Yes, the feds put in rules for limiting that amount of time one can draw these things, but it hasn't worked in practice and won't. What if we did follow them? What will happen when that young uneducated woman without a shred of work ethic but with 4 young kids is suddenly thrown on her own?http://feedingamerica.org/how-we-fight- … ities.aspx

This is just one program. I don't have the time or motivation to post a bunch of others. Excerpt: "The average length of time a new participant stays on the program is 8 to 10 months."

Yes, people with an entitlement mentality do exist, but most of the people using the program use it temporarily while they get back on their feet. I am not in favor of limiting programs that help people just because some people abuse it.Skimming through it, I like it. There is just a couple of points that raise my attention.

Average length of stay is 8-10 months, but what's the maximum?

2/3 of the recipients are children, not able bodied, which is exactly what I said - the welfare mama makes a career out of it.

A limit of $2,000 of assets. That's stupid in the extreme - requiring someone that has been injured or laid off to spend a lifetime's worth of savings (money+"things" like homes and cars) before getting help to get back on their feet is cruel and unnecessary. Plus, it creates poverty - what we're trying to avoid!

Wilderness, I was that mom, I did climb out, I did get help and an education while raising two daughters alone, and the proudest day ever was walking into those offices and thanking them for their help and telling them I would no longer be requiring assistance. I am all for strict regulations because there is abuse of the system to be sure, but there is plenty of abuse at the top from those receiving corporate welfare, living off the backs of the working poor.

I'm sorry, but that's just simply not true. There are plenty of examples of people who have started with nothing and gone on to achieve great success.

You live in a different world than most of us. You sound like a Romneyite or Ayn Randian. The Horatio Alger myth died in this country with Ronald Reagan. Since Reagan we've achieved (in your mind, at least) unprecedented inequality of wealth and income in this country.

Really? Because what I think I sound like is someone who busted his ass in High School, worked hard to get into college, and then busted my ass working my way through college. What I didn't do was sit around and complain about my situation. I didn't blame others because they were more successful than I was.

Now while there are those who would love to live in an idyllic world where everyone has everything they ever wanted, anyone over the age of five knows that that just isn't going to happen.

As for your assertion that I "live in a different world than most of us", on that point, you are entirely correct. I live in a world where hard work and dedication are prerequisites for success; a world where anyone willing to put forth the necessary effort can achieve anything.

It's a world where a poor girl from Mississippi, who was so poor she had to wear clothes made out of potato sacks, can grow up to become a multi-billionaire, and one of the most influential people on the planet (Oprah).

It's a world where a single mother, living on welfare, doesn't just accept the circumstances of her life, instead she spends hours, every day, working- writing a story. She went on to sell more books than J.R.R. Tolkien and Charles Dickens combined, all while becoming a billionaire.

Yes, it's apparently a much "different world".You could easily have written Romney's speech writing off the 48 percent "takers."

There are SOME outliers, but it is the exception and not the rule...

What percentage of your current society will start off with nothing and go on to achieve great success?

Do you support the laws that force the poor to support the wealthy?When they recklessly and unashamedly shirk their civic duties in the callous pursuit of profit?

Why shouldn't she? Isn't that what we are all doing when put forth our arguments in the forums? Are your beliefs more valid than Tammy's? if so, why?

No, I don't believe in forcing my beliefs on others. I think it is morally 'correct' to donate money to help those who are less fortunate, but I don't believe in forcing that belief on others. If I vote for a law that forcefully takes their money to give to the less fortunate, then I am trying to force my beliefs.

Putting forward arguments on a forum(should be, at least) presenting logical arguments for others to consider. It's not forcing at all, it's more of an invitation and joint-learning session. That kind of conversation doesn't happen often though.No, I don't believe in forcing my beliefs on others. I think it is morally 'correct' to donate money to help those who are less fortunate, but I don't believe in forcing that belief on others. If I vote for a law that forcefully takes their money to give to the less fortunate, then I am trying to force my beliefs.

Putting forward arguments on a forum(should be, at least) presenting logical arguments for others to consider. It's not forcing at all, it's more of an invitation and joint-learning session. That kind of conversation doesn't happen often though.

This isn't about being morally correct or otherwise- this is about paying taxation, which is your civic duty and, morally?, should be proportionate to your earnings. And before you come back with some daft, manufactured, spin, percentage which has been half baked in some dodgy accountants office- think about this- the poor do not have the ability to take advantage of every loop hole which has been cleverly crafted into the system of taxation- nor do they have some well paid lobbyist to ensure that their interests are served. So whenever you vote for a law that forcefully takes money from the poor in order to serve the interests of the *most* well off amongst us- then you are trying to force your beliefs on others. At least recognise that.

There you go, a joint learning session! Logical and yours for the consideration.

It's called a civilized Christian, Jewish, Hindu or Muslim community obligation..

Lucky you, being part of the 1%, it’s an exclusive club. A lot of people would like to pay those taxes; living in a society is expensive, who receive more benefits should pay more. Everybody work hard; people who earn a million at a year do not work 50 times harder than other people who earn fifty thousand. Who can pay more is, what a coincidence, who gets more benefits of being part of that expensive society. Living in a jungle is cheaper, live with no-state is cheaper, but if you live without interaction with the Governments of countries, you cannot make a fortune. People who earn fifty thousand at a year do not work two times harder than other people who earn twenty-five thousand, and old people still need medical attention; kids need high quality education, all kids, poor and rich, or your country won’t last half a century; wars are expensive, and veteran soldiers need expensive psychiatric treatment; and so on.

We all pay tax. The wealthy pay more as it doesn't take food out of their mouths like it does for minimum wage workers. I am fine with that.

I'm fine with stealing money from rich people, they can afford to be stolen from.

They already pay more than 12 times as much per dollar as half of Americans. More than 12 times what an equal share would be...So how do you determine the cut off? I know several people who make over six figures a year, but who still live paycheck to paycheck. Should there be some kind of DTI analysis that effects your tax rate?

Of course not. A doctor making 8k a month with 4k in loan payments is much richer than someone with 4k of income and no student loan, so they should pay more!!!

I have no idea how loans work into calculating income and would consider that a different issue to the general idea of whether those with higher income, all other things being equal, should pay a greater share.

So, I'll pose the same question: what percentage would you consider fair?

I'm really just trying to get a feel for what people think the "fair share" should be; it's been a popular buzzword for the last year or so, yet when I ask people what it actually means, it's hard to get a response. The forum here on HubPages, so far, seems to be more politically literate (if at times a bit eccentric), so I figured I'd ask here.I would think 50% should be the maximum. I think if the current rate was applied uniformly without loopholes, shelters and silver spoon funds it would be about right.

Would you still allow for deductions, or just a flat 50% period?

I think whatever rate is applies should be without any exemptions, credits, exceptions etc of any kind.

If we did that lowering the rate might well become possible as people could not evade tax.

Of course you are. Why should Paul complain that Peter is being robbed?

GAI am much closer in income to Peter than to Paul. And I have no complaints. Some people genuinely accept their role of supporting civic structures and services.

I donate money to charity, including the funding of things I think taxes should cover like bullet proof vests for police and food for people in need. So in a way, yes I have.

No. Not in a way. Not at all.

Donating to charity doesn't relieve the tax burden. If it's your role to support civic expenses, then why don't you step up to the plate and fulfill that role more than is absolutely minimally required of you?

If government spending didn't go down, but your tax rate went down, would you pay the lower tax rate, or would you still pay the same amount that you paid this year?I think you question is illogical as it is not actually possible to pay more tax than you are asked for. But I do pay more for civic services than I am asked for because I oppose letting police get shoot and killed etc.

It is possible. Many states have a voluntary fund, and the federal government has one too. You can donate as much as you want.

You can also decline to declare deductions. You're not required to itemize, for instance.If you mean the check off options at the end of the tax return, yes I do that. I don't count that as tax as it is a donation.

Actually, believe it or not, you can make "donations" (for lack of a better word) to the US Treasury.

Yes, but like other donations, that is not tax.

How much more is finally "enough"? And how long can it go on before there is little of nothing to take? This is not about the welfare of any group of people...it is about politicians using American taxpayer revenue to buy and sustain power over people...plain and simple. In its most basic form...it is tyranny. ~WB

"And how long can it go on before there is little of nothing to take? "

You mean how long can taking from the middle class and the poor before there is a revolution? The inequality of wealth and income has been growing steadily since Reagan to the point where many are losing faith in our democratic free enterprise system.

Person 1 pays $100,000 in taxes.

Person 2 gets $2,000 for free.

The laws change, and Person 1 pays $95,000 in taxes.

Person 2 gets $1,500 for free.

FOR SHAME! THAT HORRIBLE RICH PERSON!

The RICH are STILL being unfairly taken from.36.9% is what I think I last read, for the top 1%

What is "fair" is defined by our "democratically" elected legislators based on what's needed to implement the laws they have passed and the wars they have declared and on comparisons with other civilized countries. Unfortunately our democracy is imperfect because it's influenced too much by billionaires like David Koch, hedge fund operators, oil companies, coal companies, electric power companies Wall Street bankers, Big Pharma, health care insurance companies, gun manufacturers, et al which results in grinding the faces of the poor and filling the coffers of the billionaire inside traders like Steven Cohen of SAC Capital.

http://www.businessweek.com/articles/20 … even-cohen- PrettyPantherposted 13 years ago

0

I support forcing the wealthy to pay more in taxes so that the poor (the working poor, the temporarily poor, the disabled, the disadvantaged elderly, etc.) can have a decent life. In our society, a decent life means adequate housing in a safe neighborhood, healthy food, medical and dental care, and enough money to pay for clothing, transportation, food, a few extras like a cell phone or internet access, and a little entertainment. Why do I support this? To me, it is simple. We all contribute to the culture and community that we have made for ourselves. Some get paid a massive amount of money for doing almost nothing, while others get paid a pittance for doing jobs that expose them to dangerous elements or chemicals, or wear down their bodies with hard physical labor. Each job or role that we play is a part of the whole: we should be thankful for janitors, food service workers, retail clerks, hotel maids, and every single person who does a job that we as a society need to have done and does it for very little pay. I consider the guy we pay $12/hour (a lot of money here by the way; most people only pay $8/hour) to help us build fences on our farm just as important as the accountant who does our taxes for a whole lot more. And both of them are just as important as Donald Trump or Michael Moore or any other 1%-er.

I cannot understand the argument that a CEO of a bank that we bailed out who gets paid $10 million dollars should not pay a higher percentage of his wages (i.e., contribute more money to the whole) than a teacher who makes $40,000. He/she is not worth 250 times more than a teacher; his salary is that high because the system has been rigged in favor of the CEO over the teacher. I'm not saying the CEO did not work hard to get there; but then you cannot say that the teacher didn't work hard to get there, either. The CEO gets paid more, but I do not believe his contribution to society is "worth" more. Having the wealthy pay more in taxes is one way we can level out how we value each individual's contribution to the whole.

I don't understand why some people are so concerned with "fairness" when it comes to taxes, yet ignore "fairness" when it comes to the powerful using their wealth and influence to game the system to increase their already obscene wealth.

This question of how much is "my fair share" can never be resolved by throwing out numbers because there is no right answer. However, we can embrace a philosophy that values all contributions to our society and recognizes that money is only part of it. Money is just a means to an end, and it is beyond me why some people get so upset about the wealthy paying more. The wealthy will still have more than adequate housing and all those other basics I mentioned earlier plus plenty of money left over for extravagance.Who determines what qualifies as "adequate housing"? By what scale do we judge how much us "enough" for one person to have?

I just said above it isn't possible for everyone to agree on numbers and I'm not going to waste my time on that.

Edited to add: that is why we have elections, for the people to elect those who they believe will most closely reflect their values.

1% which would be applicable to your gross income.

this tax would be the same for all 100% of the citizens of the nation.

no deductions, no modifications.

simple, adequate, and fairly charged.Have you by any chance done any math on that number? I like it in theory, but I'd be curious to see what kind of revenue we'd be talking about.

my plan requires 1% from everyone including all businesses that process any payment transferes through these clearing houses.

current income tax system deleted when this is required.

we can pay off the debt in 3 years if we eliminate 50% of the imports at the same time.

by eliminating 50% of the imports, we put 90% of the unemployed back to work. Thus we have more revenue earned because the clearing house numbers would then grow by 15% to 20%.How are you planning to eliminate 50% of imports?

It's not hard to do - simply raise import dues, fees and taxes. The trick is to do it without losing 100% of our exports at the same time - impossible to do. Most countries take a dim view of such protectionism (including the US) and will quickly retaliate.

Yeah, I'm not really one to be negative, but raising tariffs to the point where you could cut 50% of all imports would trigger a round of retaliatory tariffs that would make Smoot-Hawley seem down right pleasant.

I do like the idea of a flat gross earnings tax though.I like the idea of a flat tax on net earnings/profits, too. Deduction for each member of the house, and maybe a bottom limit (under $20,000=no tax?) but that's it.

I've seen numbers, though, that indicate it would take a pretty high tax - numbers vary around 15-25%. Don't know that I agree, but I haven't run the numbers, either.

Related Discussions

- 14

Why should the wealthy pay more in taxes?

by Billy Hicks 13 years ago

Why should the wealthy pay more in taxes?I posed a question this morning asking what people thought the "fair share" should be for wealthy Americans; specifically, what percentage they should pay in taxes, and I've gotten some interesting responses. Now I'll pose the flip side to that...

- 115

Historical data on taxing the rich

by ptosis 8 years ago

federal income tax rates history, During the eight years of the Eisenhower presidency, from 1953 to 1961, the top marginal rate was 91 percent. (It was 92 percent the year he came into office.)What does it mean, though? For the duration of Eisenhower’s presidency, that rate affected individuals...

- 17

What Is A "Fair Share" Relative To Taxes?

by ga anderson 10 years ago

Much is heard of a demand that corporations and the wealthy pay their "fair share" of taxes, but I have heard little of what that share should be.With only a single restriction; that the discussion is about legal tax actions, what should that "fair share" be?One could say that...

- 8

Would you be willing to pay more taxes if you trusted the government to spend it

by kashannkilson 14 years ago

Would you be willing to pay more taxes if you trusted the government to spend it appropriately?

- 9

How much is my "fair share"?

by Billy Hicks 13 years ago

How much is my "fair share"?With all of the "Tax the wealthy" rhetoric out there this election cycle, I want an idea of what people think a "fair" tax rate would be for the wealthy. I don't want partisan talking points, or unsubstantiated allegations (from either...

- 170

Tax the rich more so they pay their fair share

by Nick Lucas 14 years ago

I don’t understand this concept that Obama and many liberals keep clinging to…..So allow me to make it simple. If everyone is taxed at say 10% people who make more do pay more as 10% of a greater amount is more……example 10% of 100 = 10 10% 1000...