Tax the rich more so they pay their fair share

- Nick Lucasposted 14 years ago

0

I don’t understand this concept that Obama and many liberals keep clinging to…..So allow me to make it simple. If everyone is taxed at say 10% people who make more do pay more as 10% of a greater amount is more……example 10% of 100 = 10 10% 1000 = 100…easy to follow?

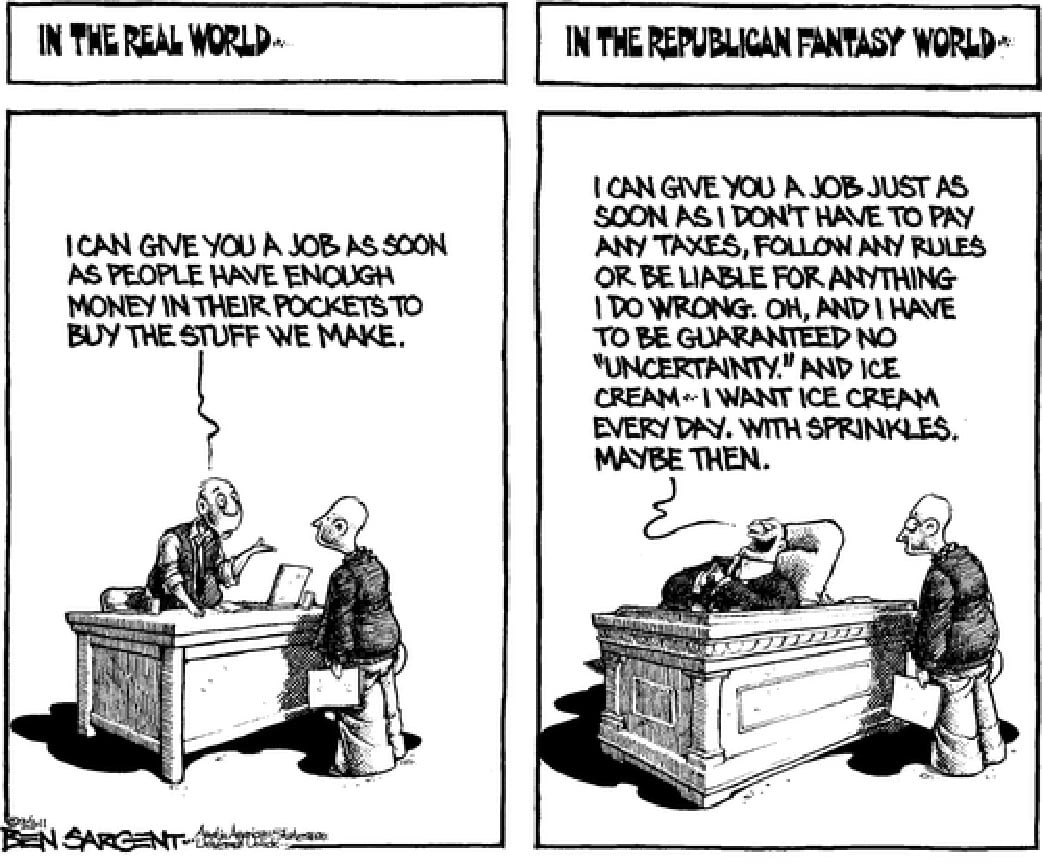

Here's why taxing the rich to make them pay 'their fair share' is idiotic no matter how good it sounds. Ever get a job from a poor man?

<snipped-promotional link>tobey - 10% is more than fair across the board. Unless, of course, you'd rather continue to pay 15-30% depending upon your income. Poor people generally don't pay taxes, so there's no issue there.

Here, here. Nick Lucas for president. At least somebody gets it.

I take you have no understanding of the loopholes the rich have access to, that other people do not have access, which grants them the ability to lessen their tax rates to lower percentages than those who are living in the middle class?

Taxing the rich at a higher rate(like Warren Buffet said) has a better chance of the rich paying more, simply because they have access to resources others don't.

Buffet recently talked about it in the article many made noise about. He was taxed at 17% vs the middle class being taxed at 30% or more.

So, how exactly are the rich paying their fair share?

Edit: Before you claim I'm liberal or anything else. Keep your labels to yourself. I have no political side.buffet is an idiot who hasnt paid his full taxes in 10 years so he is a hypocrit.......I agree the tax code should be changed and no loop holes but a flat tax for all no matter what you make

I am not an economics major nor do I have a degree in it, however, from what I've heard, a flat tax isn't feasible.

As for Buffet being an idiot and hypocrite? An idiot, far from it. A hypocrite? I would say that the man knows what he has done and been able to get away with, but as he gets older, it's weighing on his conscience, because he is seeing that the population of citizens is getting worse and his associates(upper 1%) continue to not care.On the face of it a flat rate for all appears fair but with a bit of thought it is anything but.

Those at the bottom of the pile who at present are not paying tax would suffer severe hardship if they were to lose 10% of their income whereas those at the top of the pile wouldn't even notice the loss of 10%.So make the ones on top pay for the ones on the bottom, yeah, that's fair.

Well it's a damn sight fairer than making the ones at the bottom pay for the ones at the top as it is now.

The ones at the bottom don't pay anything, you said so yourself. If you're just rattling to hear yourself rattle then keep on rattling.

Keep up! The proposition was that everybody should be taxed equally.

Because rich people don't have "income" in the form of a pay check. People like Buffet make their money through investments whose gains and dividends are raxed as "capital gains". The reason for the different rates is to encourage investment of which every American with a 401k, stock holdings, or a.home has taken advantage of and benefitted from. Buffet on the other hand has been in court fighting his company's tax bills going back to 2002, and there us nothing stopping him from taking his oay in the forn of a paycheck or of contributing his money to the treasury.

BS. If he is the CEO then he makes a paycheck.

If he gets a paycheck then he's taxed at a higher rate than his secretary, but you have no idea how Buffet is compensated, so you can't call BS.

According to Buffet, he wasn't taxed higher than some of the people he works with. So, you're wrong yet again.

he is talking about one type of pay...that is if its true and I know it is not......but he would be taxed more on the earnings per share he received....

And, what exactly would be the deductions he is allowed? vs others?

Again, he has access to more loopholes than those who are below his earnings, and knows many different ways, which other people are not privy to, so as to drop his percentage.

So, with that said, even if the taxes were hiked, the rich wouldn't really incur any hardship, unless the tax code was reformed making it so loopholes were closed to all, not just the rich.

I don't think it's fair that the rich have access to the loopholes that other people don't have access to, just like you don't think taxing them higher would be fair.

Again, the flat tax isn't feasible and why not? Because of what John said- it would create hardship on those who are not paying now and the rich wouldn't notice anything, plus keep more of their money(which doesn't translate into jobs(creation) or increased economy. The rich would probably invest more in the stock market, but that contributes only to Wall Street and not Main Street.Cas,

First, Warren admits he gets no paycheck. Second, show me one loophole he has access to that everyone else does not have access to.

*sigh* Capital fains is taxed at 17%. The top tax rate on INCOME is 36%. So obviously if you income is from capital gains you're taxed at a lower rate as in Buffet's case, and his secretary that derives her income from payroll is taxed at a maximum of 36% depending on her pay. So I am right as usual and you well ...

You're leaving out deductions Ladylove. Please do try to argue with some sense.

What do deductions have to do with anything? We're talking about maximum tax rates not individual returns. In general the rich like Buffet get the majority of their compensation from sources other than a paycheck which lowers their tax rate. Do you deny this or do you have some other point you're failing to make?

hey cag do you know the difference between tax avoidance and tax evasion? that is under the IRC

I understand capital gains and other ways of payment quite well which is why all three of my corps were s corps........but what im saying is it is not right to tax anyone or any thing more than another

Warren Buffet is a hypocrite and an ass. There is no mechanism preventing him, or any other like minded liberal whiner, from paying more in taxes. His position is, I don't steal only because the law says don't. Or I drive 55 only because the law says drive 55. He could pay the 30% if he wants there is nothing stopping him, except him.

Besides that, he is also lying. His companies, the ones he owns, pay taxes. He is speaking specifically about one income stream. He is not counting all the other sources of money in his life that entail more taxes than the 17%

The wealthiest portion of society pays a disproportional percentage of all taxes - disproportional to their numbers and disproportional to their income.

BUT SO WHAT?? What the hell is a fair share? Since when does what someone else earns become my business? Since when do we believe it is the job of the government to FORCE a level income field? I make more money than some people I know - should they have the government come and seize my "excess" and award to to them?

If I were an aboriginal living on the edge of privation should I demand that the government FORCE food out of your mouth and into mine? Where does liberty end and tyranny begin? When one believes it is the job of government to tear one man down and build another man up, where is liberty?

I have grown tired of the envy and avarice that so fills the heads of liberals that when they look at their fellow citizen they see money signs. Perhaps the best thing we could do is take every thing owned and earned by everyone who makes more money than me and give it to me. That should solve everything, shouldn't it.

The GOVERNMENT as the ultimate arbiter of right and wrong, fair and unfair, moral and immoral. Robbery, plunder, piracy is the way to make America better.John have you looked at that profile picture of yours, mate? If I was you, I would shy away from any discussion of piracy.

Oh, better far to live and die

Under the brave black flag I fly,

Than play a sanctimonious part,

With a pirate head and a pirate heart.

Away to the cheating world go you,

Where pirates all are well-to-do;

But I’ll be true to the song I sing,

And live and die a Pirate King.

For I am a Pirate King!

And it is, it is a glorious thing

To be a Pirate King!

For I am a Pirate King!

When I sally forth to seek my prey

I help myself in a royal way.

I sink a few more ships, it’s true,

Than a well-bred monarch ought to do;

But many a king on a first-class throne,

If he wants to call his crown his own,

Must manage somehow to get through

More dirty work than ever I do,

For I am a Pirate King!

And it is, it is a glorious thing

To be a Pirate King!

So Rasputin was so hard to kill he lasted well into the 21st century. Is this true John? No wonder you have issues with Stalin, killer of the goose that laid the golden egg.

Just goes to show that absurdity is available where ever one looks, not just in politics

Loopholes that the rich have access to?

51% of Americans pay no income tax.

Talk about loopholes!I was going to write a reply but you covered it very well.

- Holmes221bposted 14 years ago

0

The rich paying more makes perfect sense to me. There was a time, when the richest paid 80%, yet they were still rich. Now, they pay 36% and Obama only wants to increase it to 39%. This is only what Clinton did in the '90s. Of course the rich object to paying an extra 3%, which in reality, they would not notice at all.

yeah they will....it is not fare and as a former IRS employee and someone who worked with venture capitalist in the private sector I can say they will higher 3% less.

- Holmes221bposted 14 years ago

0

There is a false idea, that by not taxing the richest 1% too highly, then their money will filter down to those below, and will be used to create jobs. In fact though, the rich just spend their money on bigger yachts, and employ cheap immigrant labour, and pay accountants to save them millions. It really isn't fair, when hard-working class people are losing their jobs and homes on a huge scale. Wealth doesn't filter down to the poor, it remains with the rich. America considers itself a Christian nation, yet this form of economics cannot be described as being Christian at all. The only hope the new homeless families are given, as the rich banks, who caused the economic downturn in the first place and have now repossessed their homes, whilst the bankers continue to receive their huge bonuses, is that it is easier for a camel to pass through the eye of a needle than for a rich man to enter the kingdom of heaven. Not much comfort, when you are living on the streets.

That of course is a false notion. What do you think the rich do with their money, keep it in their mattress? They invest it! Even putting it in the bank, who then lends it to other businesses or homeowners means that money is putting people to work, creating jobs and demand for goods and services.

Clue: Poor people don't hire workers!

The problem isn't that we don't tax the rich enough, the problem is we don't have enough rich people! Taxing the rich less and eliminating regulations will help create more rich people.I take it you are rich. Well good luck to you!

Lol! Hardly! But I'd like to have the opportunity to become rich, wouldn't you? That could be a lot easier if government was less of a burden.

I think a lot of the confusion between American ideas of social economy and British ones, comes down to the class system. It seems to me, as an outsider that the American class system is based on money. And people, whatever their position in life seem to have respect for people with money. So, not to question the fact that the rich get a lot of breaks, which the poor obviously don't seems fair, and part of the free enterprise economic system.

The British, although having a class system, it is one more based on blood, i.e. whether it is blue or red, and whether you have an upper class accent or a regional one. Someone of an upper class background, is still upper class, even if they haven't a penny to their name. And someone who is rich, but comes from working class stock is still working class, because of their lack of breeding. Not that the old upper class now have much power.

Also, after the war, the working class gained a lot from the Welfare State, which is considered a right for everyone, whatever their background. It seems though that the Welfare State is considered a bad thing in the US. Perhaps this is why it is the richest country in the world, yet does not see fit to have a National Health Service.

Whilst social mobility may be easier in the US, there seems little consideration for the poor in society. It seems Americans either are able to provide for themsleves, or they go to the wall, and there are few that really care.By jove Holmes, I don't think you got it.

We dont have a national health system because our government was not given the power to create one but each state can and some have. The American system strives to spread power broadly across the population to avoid tyranny.

Same with addressing the issues of the poor. Constitutionally the states can each address tjis in their own way and whichever state does so more efficiently and cost effectively would be copied. I might add, the American people are extremely compassionate and generous having given 295 billion to charities. The government on the other hand tends to take our money and create a dependent class that they can count on for votes.good point....I know I personally give a nice portion of what I make every month to charity and do not need big gov to do it for me

@ladylove

"The Center on Philanthropy at Indiana University and Google partnered in early 2007 to estimate how much of the charitable giving by households in the U.S. focuses on the needs of the poor. This analysis finds that less than one-third of the money individuals gave to nonprofits in 2005 was focused on the needs of the economically disadvantaged. Of the $250 billion in donations, less than $78 billion explicitly targeted those in need.

Only 8 percent of households' donated dollars were reported as contributions to help meet basic needs--providing food, shelter or other necessities. An additional estimated 23 percent of total giving from all sources went to programs specifically intended to help people of low income--either providing other direct benefits (such as medical treatment and scholarships) or through initiatives creating opportunity and empowerment (such as literacy and job training programs)"

You need to look closer at your stats before posting them. The above was from the same organization that produced the 250 billion dollar report.Does that change the fact that 250 Billion was donated?

It does when most of the "donated" money goes to fund political causes. Not really charity is it?

250 Billion given to charity, so yeah, it is charitable.

Thanks for your valuable contribution.

Where did it say the money went to political causes? I didn't see that. Campaign contributions aren't tax deductible and wouldnt count as a charitable deduction. In addition many more dollars are donated to help the poor and not reported, in churches, collection jars in stores, concerts that ask for can goods etc. By the way, where is the measure of efficency on how much government collects and disperses to the poor?

It's in the break down of the sub sectors... which are largely quasi political organizations acting under the guises of churches. There were also donations to the government listed among the 250 billion. In addition, the 250 billion did not list tax-deductible as a requisite for being called a donation. There are several organizations listed among the receivers that don't enjoy tax-free status.

Churches are indeed included among the 250 billion as well as the in the calculations on contributions to the poor. Unfortunately, the study also include the overhead of these organizations, so the actual help going to the poor is actually much lower.

So that would leave 172 billion dollars that went into jars in stores? Ok.

The numbers for voluntarism are even more abysmal btw. My point is, relying on the "kindness" of Americans to help the poor will result in the poor not getting help. To suggest otherwise is either posturing or ignorance. If we were better people, maybe. But we, as a country, are not.

The government doesn't do a good job of it either, as there are still starving people on the street. But at least it is making an effort that the population, as a whole, would not.Okay, so you give the government credot for trying without even making an effort to quantify just what it is they've done. By the way I don't buy the results of that study. Something doesnt add up.

For example in Jan 2010 the us government gave 90 million to Haiti after the quake us corporations ponyed up another 43 million and the numbers were much higher for the tsunamis in Japan and indonesia. Who's to say the donations wouldn't be greater if people and corporations could keep more of our money.If you don't buy it, then you shouldn't have used it as an example.

I wasn't arguing the effectiveness of the government. I didn't quantify what they did because it wasn't what I was arguing.

I'm sure their numbers would be abysmal too. They would just be slightly less abysmal.

And neither of course do they spend much beyond essentials.

Tax the high earners and give it to the low earners and watch the economy boom as the money works its way quickly back to the high earners.So you don't believe in private property rights?

Of course he doesn't, well, not rich peoples property anyway.

Because you want to take property (money) and give it to someone else.

Money isn't property, it's a handy form of barter, owned by the government and lent out for purposes of commerce.

Its property, come to my house and take it, you will find very quickly that the law considers it property.

But look how quickly the government will change its value,even make some of it illegal at the drop of a hat?

John....Just curious...what is your stance on firearms?

I like living in the UK where the chances of me even seeing a gun,let alone being shot with one are very remote indeed.

I like you living in the UK too, do you think you could find Obama a little place there?

I think it would be great if Obama decided to come and live in the UK, as he seems the most educated president the US has ever had.

Yeah, he's the smartest, you can have him to add to the intelligence of Britain. Good luck.

john - I didnt know you are in the UK....that would explain our differences in opinion.......what is right one place isnt right in another.....I have known many people from the UK and discussed the differences ....great people and sounds like a nice place...thank you for your honest answer

I think you'll find that what's right in one place is right everywhere, just perceptions of right differ.

well....for example where I am from if it wasnt for having a firearm I woul;d have been shot on 7 occassions....thats what I mean.....then again I was working unofficially for the man but all the same haha

But only because the other guy had a gun. How did having a gun stop you from being shot anyway? Was it big enough to hide behind?

People don't usually shoot if there is a chance they will get shot. Its called equality.

exactly....thank you .....the fact that I could pull my own fast enough so if they shot me they would also be shot...plus I had a higher caliber weapon......and I learned saying things like go ahead and shoot makes them pause and rethink...until your in the "game" as we called it you cant understand...I am happy I made it out and that I was on the right side helping those who couldnt help themselves and can live peacefully now knowing I made a difference after all as edmund burke said in 1780 "the only thing neccessary for the triumph of evil is for good men to do nothing"

You are correct, poor people tend to spend unwisely, causing them to stay poor.

But when the cheapest is all you can afford then buying unwisely is not a choice, its an essential.

Save money and get the best, it isn't hard to do. Have a little pride in yourself and see how far you can go. Quit holding the hand out. I'm talking in the general sense not you personally.

One needs surplus income to save, even to take advantage of bulk buy offers.

Not excuses,reasons,or do you really believe it is possible to save when your outgoings exactly match your income?

That's the unwise spending I am talking about. If you spend more or equal to what you are earning you will always be poor. Deep thoughts by Jack Handy.

Strewth, you don't get it do you? If the smallest, cheapest, loaf of bread is the best you can afford, how do you save from that?

Forget it, you will always have an excuse to take from someone who has. Its not your fault I guess, its your breeding.

Lost for an answer! Never mind, bring on the personal insults.

I wasn't trying to insult you, I was referring to Holmes who said that in Britain its all about breeding. I apologize if I offended you. Yes, that was sincere.

No, I'm not lost for an answer. In the US we have this thing called welfare, if you make below a certain amount of money then you qualify for it. In other words we give poor people money to buy food, it works and I don't think anyone disagrees with helping the poor. But at some point we expect you to better yourself and rise above your situation. That's where you and I part ways, you don't expect them to do any better you expect others to pay their way.

Flaming eck, talk about jumping to conclusions,if it was an Olympic sport you would be a gold medallist!

How on earth do you conclude that I don't expect them to do better?

Don't you realise that the best way to keep people in poverty is to give them a poverty level income, whether it is earnt or a benefit! Some benefit!

"Doesn't the restaurant on the next block have a dumpster out back?"

Scrooge MacDuck

In a perfect world you may be right. There is no perfect world. Less regulation only allows the rich a better chance to economically oppress those less fortunate. You CANNOT remove the human factor of greed from those who feel they are owed everything.

Greed? You mean like those who think others should pay their way? No I'm sure you mean the greed of the rich, class warfare wont work this time.

Class warfare is right! Corporations pay a LOWER tax rate on income than middle class workers. Most corporations gain the majority of their income through capital gains which is taxed at an even lower rate. They also have access to tax breaks, loopholes, and incentives that the rest of us don't get. Meanwhile, the GOP is making an all out effort across the country to strip workers bargaining rights and repeal the minimum wage. Government monies bought them out of the hole they dug themselves into, AND NOW, they have trillions in liquidity that they sit on, while 14 million people are unemployed. Corporate earnings are at record levels, but the middle class wages have been stagnate for 30 years. Multinational corporations set up shop in foreign nations which affects jobs here, and can only do so because our trade agreements favor foreign nations over American citizens.

Now lets talk about America's dirty little secret. People always bring up the FACT that nearly 50% of Americans don't pay FEDERAL income taxes. This is true. However, they do pay a payroll tax (Social Security). The payroll tax has a cap on it, so anyone who makes more than 150,000 annually doesn't pay it at all! They also pay property taxes, state taxes, and in some cases, if they have anything, estate taxes. And like everyone else they are expected to pay for insurance on their cars, keep medical insurance, and home insurance as well. Then pay their mortgage, feed their family, and pay for utilities. The problem is, that 45 million of these people now sit in a position of poverty. The national poverty position states that anyone making 20,000 annually or less is impoverished. When you have done all these things with less than 20,000 a year, then you can complain.

Yet still, you complain about corporate tax increases and class warfare. It's comparable to one country bombing another and then complaining when they fight back with small arms fire. IT'S PATHETIC!!!!!!!!!!!!!!!!!! Don't just listen to the GOP (corporate lackeys) spin on things and condemn. Get all the facts, and then look up the definitions of morality, compassion, and greed. THEN TAKE A LONG LOOK IN THE MIRROR!!!

Amen. Income disparity has grown since Reagan to the point where Americans are losing their faith in our democratic, capitalistic system. The warfare is one way--the greedy Wall Street banksters and corporate CEOs against the poor and disappearing middle class.Capital gains is a double tax. In order to have money to invest you would have had to earn it only then could you risk it for a gain where you would again owe a tax. By the way you can only write off a loss of 3000 per year.

Corporations don't pay taxes, their customers do. In fact their customers pay all of their costs including those imposed upon them by government regulation.

No one is stripping unions of anything. Yes public service unions are being asked to give up some bargining rights granted to them over the years by politicians who weren't protecting the rights of the taxpayers! Public service unions shouldn't even be legal.

Corporations are sitting on cash because of fear of what government is going to impose on them. This is a direct result of Obama policies. Yes companies are given incentive to move overseas by our own government regulation! Case in point NLRB fight to prevent Boring from moving to SC. The raid on Gibson guitar, and Fords plans to open a factory in India. All a result of liberal policy and union protectionism.

Yes there's a max on what you pay into SS but there is also a max.on what you get paid out and its based on what you put in. Raising the contribution means the payout will rise. Remember, its YOUR money, a forced savings and investment scheme.I agree with you that some workers in the public sector could give up SOME of the bargaining rights they have. But the bill shoved through the state legislature in Ohio cancels ALL of their rights. And why should public service unions be illegal? Police, firemen, and teachers have no right to protection against bad policies? I disagree. Now I do feel that some things go way beyond common sense. Such as tenure for teachers. But at the same time, why should they be asked to give things up and not ask anything from wealthier people or corporations?

I don't buy it that corporations won't invest because of regulations and certainly not because of Obama's policies. They faced more stringent regulation under Clinton's administration, yet they invested heavily during that time. Also, the restructuring of financial regulation that was formed within the Obama administration, (due to the financial collapse brought on by the Bush policies of lack of regulation), haven't even been implemented yet. I do agree that corporations are sitting on cash from fear, but it has more to do with the political instability in Washington. The level of partisan politics at this time is VERY, VERY extreme. It doesn't leave a promising outlook for ANY long term policies to be put in place that would give investors a sense of stability.

As to SS, people constantly complain that it is unstable and will go bankrupt if it isn't reformed. Reform IS needed in medicare to an extent, but SS only needs one reform. MONIES BROUGHT IN FROM THE PAYROLL TAX SHOULD ONLY BE USED FOR SS!!! If we keep the politicians from putting their grubby little hands on it, it would sustain itself.

Don't mistake me. Democrats are just as guilty as the GOP. Democrats are the insurance and drug company lackeys as the GOP belong to the oil companies and banks. Both parties put party and self interests above American interests. I personally believe that until we get people into government who are more interested in governing than they are politics, our country is in a long ride down the #@itter. Pardon the expression. Money and politics = lack of governing!

I know I'm in the top 7% income bracket and I pay a hell of a lot in taxes.

I dont need to pay anymore. I would like to know how to get those loopholes!! If they are legal, then techinically they aren't loopholes! I do not admonish ANYONE who can save by doing it legally. If the laws need to change to make things better for everyone, I'm all for that even it means more out of my pocket. I know most do not share this sentiment, but the way I see it, the more money out there = more money in my pocket (eventually).Yes equally, lets say I make 30,000 a year, tax 10% that's 3000 divided by 12 is 250 a month. Divide that by 30 it comes out to 8 dollars a day. Bring your lunch to work and don't eat at Mickey D's. Now, everybody pays and now its fair.

Not so fast, RepairGuy.

Now you're hurting the economy by not buying your lunch from an employer who is putting the disenfranchised (used to be teenagers, now it's displaced executives and PhDs) to work.They can still eat there if they choose, I was just showing how easy it is to save money. Besides rich people will go because the drive-thru lines will be shorter.

Hehehehe.... now that's gonna annoy a bunch of people in here. May the truth set us all giggling.

If we would just make it mandatory that anyone making less that $75,000 a year had to move to Canada we'd have no problem other than slightly elevated illegal immigration.

Better make that $150,000 instead. If you don't as soon as those earning $75000 find out that they are at the bottom of the heap and can't afford the things everyone else can they will demand that the rich support them.

Of course, if you make it $150,000 the same scenario occurs. Pretty soon only Warren Buffet (paying the bills with voluntary taxation) and Bill Gates are left."they will demand that the rich support them."

That's pure baloney.

Poor people pay taxes. A greater percentage, in fact, than the wealthy. And they pay them in the most challenging ways possible, at the time of the transaction when it is not possible to have lawyers, lobbyists and the people paid to make one look right and just around to smooth over the discomfort.

No they don't. Poor people pay 7.5% (FICA) and then take 3 times that amount back in charity, leaving a net payment of less than 0.

The great unwashed middle class, however, is another story.Wrong again! Poor people pay sales tax, car registration fees, turnpike tolls, real estate taxes, cigarette and liquor taxes, etc, etc.

As for charity. Try Impact Investing. Has good potential to mute all concerns as long as the teeter-totter of opportunity goes up and down for both sides. Can I have a shot of GIIN.org?

So funny. Nothing wrong with a wealthy man as long as he doesn't talk honestly about being dishonest about how he got to be in his very place of excess. Weird free marketeerism.

What of sales taxes, where so much more is paid by those who are otherwise in the toilet bowl of the rich? FICA is Social Security. The question is why don't the rich pay that all across their earnings? All in all it amounts to the fact that people pay taxes for different reasons. Those on the bottom don't get many ways around their required fees.

Sorry. Oregon doesn't have such a thing and I tend to forget.

Sure they do - they're called "kids". Produced in all too many cases solely for the resulting additional "income" and you and I will provide Mom.

FICA is Social Security. The question is why don't the rich pay that all across their earnings?

That's a good question. What's fair about a a person making $1 million/year paying .075% FICA tax and someone making $100,000/year paying 7.5%?Would you then give them a great deal more per month after retirement or just use all that "free" money to give to someone else that hadn't contributed enough to provide for themselves?

Most of the time it seems that "fair" simply means "Give me what you have because I want more."But who gives the money to the rich in the first place?

The world isn't full of billionaires by birth, even if it was they wouldn't remain so for long employing thousands of people out of the kindness of their own hearts and paying them out of their own wallets.You talk about the rich like they are aliens from another planet. Most of them are just smart people that worked hard.

Social Security is a form of social insurance, not an investment program. It is designed to provide a minimum income in retirement for everyone sufficient to prevent starvation and mass begging in the streets, income for orphan children and a minimum income for people who become totally and permanently disabled. Some people live til age 90 and get back more than they contributed. Some die soon after retiring and get next to nothing back. The people who make a million $ per year have plenty of investment opportunities which provide them a handsome return. Expecting them to contribute to this social insurance program the same percentage of their income as those with lower earnings strikes me as reasonable. Moreover, thanks to loopholes, tax rates paid by the rich in most cases currently are lower than those paid by middle and lower income Americans thanks to regressive sales and property taxes. As you've no doubt seen Warren Buffett's secretary's tax rate is double his tax rate. Do you think that's fair?

Maybe we should not tax the rich more but we need a tax system in America where everyone has to pay a fair share based on income and holdings. That is the only way taxes would ever be fair.

"Fair". Do the rich get an extra army to protect them? Or more roads to drive on? Or do they get an extra public park the public is barred from?

About all I can see they get extra is the opportunity to support more strangers.Well, yeah, kinda, but they do pay for that stuff out of their own pocket. Wish I were them. Just a joke.

The rich are protected by the "majesty of the law":

France on the Majesty of Law

The law, in its majestic equality, forbids the rich as well as the poor to sleep under bridges, to beg in the streets, and to steal bread. That is one of the good effects of the Revolution.

–Anatole France, Le Lys rouge ch. vii (1894) (S.H. transl.)

Does it strike you fair that desparate unemployed indigent people are sent to jail for stealing food while there have been practically no criminal charges against the Banksters who plunged the world into the deepest recession since the 30s with their toxic no-doc, subprime mortgage derivatives sold to naive, unsuspecting investors around the world?

As they say in Spain, "The law is a mad dog that bites only the poor."Protected from what? Certainly not from those that legally steal from them in the name of "fairness"!

Of course, I should realize that two wrongs will make a right, particularly when the second wrong is committed by only a very few while all (the rich) must suffer for it. My oversight.Well it's easily sorted, just let the wealthy cover their employees from the cradle to the grave and then you can let them off paying any tax at all.

Absolutely. And while we're at it make the minimum wage $100 per hour so that the employees can afford the taxes to run the country while still being able to buy all the luxuries they want.

We'll also have to legislate all product prices as well, of course, (to prevent the rich from making undue profits) but that's all right - we'll simply become a form of communism instead of capitalism. That's the "fair" way, although it never seems to work very well.Get with the real world.

Here they pay $8.00 an hr and no benefits.

Here, your pay doesn't keep up with the cost of living....not even close.

Here, a job that our grandfathers had, and which could support a family...nicely, is a thing of the past.

Here, we are penalized for making a mistake on a checking or debit transaction....or simply paying a bill because you have no choice.

I pay more to my bank than a billionaire...I'm subsidizing his services, you might say.

Here, kids go hungry because their parents must choose between gas, food or heat.

Here, seniors are worried sick about all this "reform" talk, since they're already on fixed incomes......the cost goes up, but the income doesn't....

****

And Evan, if 51% of American pay no federal income tax, that means 51% of Americans earn less than $45,000 a year.

And 400 people have more than that 51% COMBINED. Now--you can cry for those 400.....NOT ME.

I say Pay Up.

If making Russsshhhhhhhh get by on 47 instead of 49 MILLION, will save stress on poor seniors, families and kids, I say tuff noogies Poor Poor Russssshhhhh. His "sacrifice" of an x-tra 2 mil won't even put a dent in that big fat mouth of his.You know, LMC, there are many reasons for the things you complain about. If you live in an area where top pay is $8, there is a reason for that and the answer isn't to complain and demand that employers pay more. I guarantee that there are few areas outside the slums where that is true; move if you have to, but do something besides demand that others support you. (Not you personally, understand, but someone in that fix).

You talk about your grandfathers job making a good living wage, but you don't mention that he worked hard for 50 hours per week while Mom raised a garden, sewed the children's clothes and entertainment was a weekly community songfest. No big screen TV, a single old car if even that, no cellphones for every family member, no eating out, no satellite TV, no 2000 sq. ft. home and no computers. Take away all the luxuries that have somehow become necessities, spend some effort on making do with what you have and you can live, not on $8, but on far less than most people recognize.

Yes, you are penalized for spending money you don't have; take the time and effort to KNOW what you have and it won't happen. This is nothing new, except that banks will usually "loan" you the money rather than return a check or charge when you haven't bothered to keep a balance. If you are paying your bank anything at all it is either because you have the wrong bank or depend on them for loans when you spend money you don't have.

Yes, there are poor people everywhere in America who are having a very, very hard time with the necessities through no fault of their own. But it isn't the 50% of the people that live off the rest of the country by demanding that someone else do the work to support them and their luxuries.But I didn't think the rich made up 50% of the population!

Certainly they demand that somebody else do the work to support them and their luxuries, but not 50%.(shrugs) Latest figures seem to indicate that around 50% of the people pay all the taxes; the other 50% live off of them, very often through charity and subsidies. Even without direct charity they still get roads, police, infrastructure, etc. at someone else's cost.

GE didn't pay taxes last year.

And just because somebody doesn't pay federal income taxes doesn't mean that they are living off the people who do pay taxes. Nearly everyone pays sales taxes and most people pay property taxes directly on their homes or indirectly in their rent. People who are involuntarily unemployed temporarily due to layoff or permanently because or disability don't pay much federal income tax. You appear to me to assume the worst about the poor, the unemployed and the disabled. Do you consider yourself a Christian?? You don't like government programs to help the poor. Are you opposed to charity as well? Your opinions are quite cynical.I know GE didn't pay taxes. Our politicians, in an effort to accomplish social change through the tax code, gave them a bye.

I am also aware that most people pay taxes, but "most" simply means over half. A truly huge number get more charity from the govt. (read other taxpayers) than they pay in all forms of taxes combined and thus actually pay nothing.

No, I do not assume the worst about the poor, unemployed and disabled. I do recognize, however, that a great many are there because they want to be. Or because they won't put out the effort necessary to change their status in life - same thing as far as I'm concerned.

Yes, those temporarily "down on their luck" have my sympathy and I don't mind helping. Ditto for those disabled. Ditto again for kids. It is those that simply refuse to actually work for their survival and demand that society give more and more luxuries to them that raise my ire. Or those that WILL work and support themselves but demand the same luxuries that others have. Did you know part of your cell phone bill is a tax to buy cell phones for those that won't afford them? Since when is a cell phone a necessity of life? I have no desire to purchase luxuries for anyone and highly resent it when I am forced to do so by law.

No, I do not subscribe to the mythologies of Christianity. Are you indicating that if I at least pay lip service to the idea that I can then demand that I determine how much I can steal from those that have more than I do? Or are you promoting that tired old idea that only gullible people, listening to the VIP's of the church covered in gold leaf, are able to behave morally?Anybody who buys fool and clothing and pays rent pays taxes. That covers most everybody.

I don't know anybody who "refuses to work." I deal with unemployed people in my part-time job and I've encountered very few who would not prefer to be working if they could find a job. You seem to be suspicious of people who are unemployed through no fault of their own. Come to Michigan and you will soon realize that there are many more people looking for work than there are available jobs. In order to preserve some jobs GM, Ford and Chrysler are now hiring new non-skilled employees at $15 per hour instead of $30 per hour and the lines of applicants are quite long for the few available jobs.You need to read a little more carefully. I clearly stated that they pay taxes but that many also take back more than that in charity. The net result is a negative transfer of money from the person to the government; they paid nothing.

You may not see it, but there are many in this country that refuse to work. Moms that have chosen to have 10 or 12 children and have intentionally put themselves in a position where it isn't possible. Semi-disabled that find it difficult to work but possible. Multi generational families that have never worked a day in their collective lives.

My son, while living with me and going to college, went with a single mom (two children) that also went to college and worked 40 hours on the side. Grants loans and her income did not cover the bills; daycare was too expensive. She asked welfare for a few hundred a month to help out there but was refused. Instead she was advised to quit her job, whereupon welfare would pay for the schooling, housing, daycare and living expenses. She refused. That is the person I have no problem helping, and in fact took her into my own home and supported her and her kids while she went to school. Our welfare system is much to blame for this kind of thing; it has become all too fashionable to give without requiring effort on the recipients part."You need to read a little more carefully. I clearly stated that they pay taxes but that many also take back more than that in charity. The net result is a negative transfer of money from the person to the government; they paid nothing."

Can you document that assertion? I suppose it would be true for people drawing a SS disability pension or for orphans drawing SS benefits. But so what? Some people with serious health problems draw more Medicare benefits that they have put in. That wouldn't be hard considering what one trip to a hospital emergency room or a few days in an ECU cost. Again, so what? Health care costs are a much bigger problem than your focus which points a blaming finger at what you apparently believe are lazy parasites.

How come you aren't working BTW?Ralph, I suppose I could, but won't, at least in public. My information is from people I know personally (but I don't believe are unusual) and I won't divulge their names, etc.

However, one of them was a family of 6, earning around 25,000 per year. No withheld income taxes, either state or federal, but $4,000+ "refund" each year from the feds alone. Food stamps of over $3600 per year and free medical care for the kids. Free school lunch and breakfasts. Subsidized college education. With an $1200 mortgage ($1000 per year taxes) and a car payment it doesn't leave much to pay sales tax on but they still managed to buy a 2400 sq ft brand new home via a co-signer.

Another is a deadbeat Mom (child is taken care of by someone else, with govt picking up the tab) that hasn't worked for 6 months steady in her 30+ years of life. Survives by sponging off of friends and supplying them with food stamps and sex. Been in rehab twice at govt. expense and gets free or nearly free meds for various health issues. With no income at all she pays no taxes of any kind, and even sales tax can't come to $50 a year.

A third is disabled and could never hold a full time job. He watches kids (for free) every day, though, including two infants. He will undoubtedly receive full disability in the near future even though he could write on HP, stuff envelopes, or whatever for some income.

I just don't think this kind of thing is uncommon at all and it is the very thing that so irritates me. It is far too easy to get that free money from Uncle Sam that everyone in the world deserves.

And don't get me started on the freebies that illegal aliens get, including welfare programs, because it's the same thing. Sponge off the American public - it's all free!! Except that you and I pay for it all.I work in the construction trades where layoffs are a fact of life. At the end of the last job the expectation was to be off for 2 or 3 weeks but delays in starting the new job have stretched it into several months.

Yes, I could find other work and get off of unemployment, but jobs in my field are hard to find for a 61 year old worker. I would have to take a big pay cut and start anew in some different field - or I can wait until my company starts work again, whereupon the new job will last me until retirement. I choose the latter and will use the insurance program already paid for until it does.Wasn't the massive STIMULUS PACKAGE all about rescuing the building trades and the infrastructure- and just about everything and everyone else???? Wha' happen?

Why you no like?

What happened to the laser focus? Given the recent "jobs" bill he meant a 1939 Buck Rogers ray gun with the fusee stuck in the end.

Most doesn't mean "over half." It means nearly everyone.

Sorry - you can't redefied the meaning of words in the middle of the debate:

most

[mohst] Show IPA

adjective, superl. of much or many with more as compar.

1.

in the greatest quantity, amount, measure, degree, or number: to win the most votes.

2.

in the majority of instances: Most operations are successful.

3.

greatest, as in size or extent: the most talent.

"greatest quantity" or "majority" both mean over half. Not nearly all; over half.Play all you want with words. Nearly everyone pays taxes.

No, you're right. We should just continue to let the rich sponge off the poor!

I would love you to tell me where you think these people get the money they so generously share with their employees.If you don't already know, they generally get it from those very same employees buying their products. Along with others, of course. Why - did you think they got it by legal theft? By requiring the poor people to donate money into their bank accounts to do with as they wish?

Nearly right, they get it off their employees making the products, not buying them.

The rich are "suffering?" All the way to the bank Up is down, white is black in your mind.

As you say. And it is "fair" to take whatever you have the power to take.

Have you considered that you are most likely "rich" by my standards? Particularly by my current standards of income (unemployed)? Do I then have the right to take whatever I want from you simply because you can afford more than I can?

You just don't get it, Ralph, any more than John (above) does. That someone works hard, saves and makes good financial decisions doesn't give you or anyone else the right to take what they have because you didn't do those things. Nor do your claims that a few of the "rich" got that way through illegal methods mean that all the rich did it that way. That those horrible banksters generally followed the law and desires of our politicians doesn't mean than anyone making more than a million a year (or whatever number is currently in vogue) is a scoundrel and thief, fit only to be robbed.No, you don't get it. The "rich" get rich by taking off the poor. The really rich don't get to be really rich by hard work, well not their own hard work any way, they get rich off the hard work of others.

It's not that the poor have the "right" to take off the rich but that the rich have an obligation to pay their way, just as everybody else does.Have you ever been in management, John? I've worked both white and blue collar; of the two blue is often easier. Muscles may ache at the end of the blue collar day, but I never laid awake all night trying to figure out how to work that shovel. I never ground my teeth to the point of needing a root canal. I never put in unpaid 70 hour weeks. I've done all three in management - it can be very hard work indeed.

Yes, the rich need to pay their way (and some do not). But paying their way does not mean that it is somehow "fair" that it cost them 1,000 times what anyone else pays for exactly the same services. While I actually do agree that it is necessary to maintain our country that doesn't make it fair.Oh get real, I'm not talking about middle management, they're screwed along with everybody else.

I'm talking of the Bill Gates, the Warren Buffet's, the Koch Brothers of this world who get rich off the backs of others and are no better than the few scroungers at the other end of the spectrum, who take and give nothing back unless there is some thing in it for them.

Where do you get the idea that it costs them a thousand times what it costs other men?

You're unemployed! You must really hate yourself having to live off the taxes paid by other people!

Why don't you get a job instead of scrounging off others?You are correct in that I'm not happy. Not for drawing unemployment (an insurance program bought and paid for by my employer) though - I just want to support myself. So far I've done it not by demanding that others feed me or house me but by drawing on retirement funds that I have saved over 40 years and which I now pay taxes on. My retirement years will be fairly poor, but I do still hold my head high.

How about you? When the unthinkable hits and you can't work will you simply demand food stamps, housing subsidies and whatever other welfare you can dig out of your neighbors? Or will you suck it in, give up some of what you have and support yourself?

Thankfully, a job is in the making and as soon as construction starts so do I.Thanks to the inept ideologues in our government, the crooks in Wall Street, and various others, there are currently 14 millions in your shoes many of whom are not fortunate to have savings to draw on. Not to mention the recent college graduates who can't find jobs.

As I've worked for most of my life in fairly low paid jobs, paid taxes and other contributions I won't demand anything but I'll happily accept a return on the investment I have made in my old age.

Very true, some of them inherited their money from their hard working parents or grandparents. Detroit is full of Henry Ford heirs and trust fund babies whose parents made money when the US auto companies were booming.

The benefits you so despise result from laws passed by our elected representatives. If you don't agree you should vote and work for representatives more amenable to your retromingent viewpoint. And if you lose you have no cause to denigrate people who benefit from unemployment compensation, Social Security, Medicare, Welfare, public education, etc. without paying taxes equal to the CEOs, hedge fund operators and Banksters for whom you apparently have more sympathy than the poor people of this country whose jobs have been shipped to Mexico, China, Bangladesh and India.

As Nixon or Reagan said, "There are bird dogs and kennel dogs." Which one are you? Seems to me you've been duped by the Koch brothers, et al, into taking positions against your own interest.Whether or not it is in my best interest I don't take from others against their will. Poor or not (and I've spent a good deal of time wondering where my kids next meal was to come from) I've never been on welfare. Unemployment yes - I have no problem using the insurance program my employers bought for me. Same thing for SS - I and my employer have both paid for my retirement.

The rich are "protected from what?" From being prosecuted for money they have stolen from the public, their stockholders, their customers and their employees. Haven't you noticed that there have been virtually no prosecutions of the NY Banksters whos dishonest dealings plunged the world into a deep recession? Some of the banks have been required to pay billions in fines but without anybody being prosecuted let alone sentenced to prison.

Lord help the rich if the Tea Baggers figure out that they are being screwed and turn on the rich pupeteers like the Koch brothers, and other dark figures behind the curtains.

Flat, No loopholes. Personal or corporate

How about no corporate taxes, since corporations do not pay taxes they collect them. Other than that, a plain flat tax has been proposed and liberals dismiss it as regressive. Wrap your brain around that.

ahahaha!!

"Conservatives are not generally opposed to taxes on principle either. They have no problem taxing the American people to fund bloated defense budgets, US military adventures around the world, the CIA, FBI, and anything related to law enforcement or homeland security, faith-based welfare programs, educational vouchers, abstinence-education programs, the war on drugs, and various conservative pork projects."

BINGO.

The Flat Tax Is Not Flat and the FairTax Is Not Fair

http://www.lewrockwell.com/vance/vance168.htmlRegardless of what this article says, the flat tax is flat across the board. And corporations should not be treated as 'individuals'.

- Home Girlposted 14 years ago

0

Every human being - rich or poor, has to be entitled to education and health. Tax cannot be avoided, nor eliminated. Unnecessary stress can. May be we should stop blaming each other and government, and go instead to some European countries, like Sweeden, for example, and learn a thing or two from them. What do you think?

The rich are the ones who provide most of the jobs. Microsoft and other large companies employ many people. If we tax the rich more, they will be force to start cutting jobs. I dont agree with taxing the rich more.

Why will they be forced to cut jobs?

They don't pay people out of their own capital you know!

Surely raising taxes would force them to employ more people to keep their income up.

They get to be rich because they employ people and not despite their employing people.

We could learn a lot from Sweden. However, it's smaller than many of our states so what works there may not work here. Also, there population and ethos is more homogeneous than ours.

CEOs who rose through the ranks by kissing ass and who never had an original thought in their lives are paying themselves as if they were Bill Gates, Steve Jobs or Henry Ford. The ratio between corporate officer pay and the pay of ordinary workers has skyrocketed in recent years thanks to "pay for performance" theory which was supposed to align CEO pay with the interests of the company's stockholders. But the result was that they fudged the books, leveraged their company's balance sheets in order to produce phony or risky profits. When that wasn't enough to satisfy their greed they just back dated their stock options. The Banksters were even more evil. They created toxic subprime mortgage derivatives and sold them all to unsuspecting and dumb investors all over the world. Some even created derivatives which were designed to fail and bet against them. This is well known, but there have been few criminal prosecutions.

"The law, in its majestic equality, forbids the rich as well as the poor to sleep under bridges, to beg in the streets, and to steal bread." Anatole France,

"The law is a mad dog that bites only the poor." Old Spanish saying.just a reminder that 51% of the US doesn't pay ANY income tax

Just a reminder, they pay sales tax, car registration fees, turnpike tolls, park entrance fees, real estate tax and payroll tax (assuming your 51% figure is correct).

I haven't read the whole way through all of these posts, but has anyone defined 'rich' here? Or 'fair'?

When I work full-time, I fall into the category that pays in the highest tax bracket, 36% or whatever that is now. With state and local taxes, I end up paying about 50% in taxes, overall. I work 60-80 very stressful hours a week to make that money, including holidays, weekends and during my childrens' school and life activities. I also had to be a corporation to protect my assets in case of a lawsuit which statistics say I will have before retirement. I pay corporate and personal tax at a high rate.

In this country, I also paid nearly $180,000 for my education which I am paying back with interest of about 5% to the government. My monthly payments are about another 10% of my income. (I will not add in the other 20% that goes to malpractice and overhead because that is not going to the government.)

Also, please note that all of those magical deductions don't 'count' for us. We are in that in-between category where the deductions don't apply. I don't deduct the student loan interest, medical expenses or any of the things that everyone assumes we get to deduct. Maybe our mortgage interest counts, but not much else.

I do not grumble about paying my taxes as I grew up poor (and have now moved my mother in with me and gotten her off of welfare) and know that there are some people who are truly going to be helped to make a better life with those dollars. I also value national security (even if I don't agree that that's what the military is always allocated for), education and the infrastructure that comes from the tax dollars.

I guess my point is not to pigeon-hole everyone in that 'rich' category. We (my, husband and lots of people like us) are struggling to get money into our retirements since we didn't start earning any money until after medical school and residency, more than a full decade after our peers. We have not taken a vacation and have bought only one new car in the last dozen years as we are trying to catch up.

That 'extra' 3% that we wouldn't feel would actually be what we had set aside for our childrens' education, for which we are also very behind.

For my 60-80 hour weeks, we live pretty modestly without a lot to show for our efforts.

Obviously, we are not poor. I do not expect anyone to feel sorry for us or think we aren't grateful for what we have- we know we are better off than many, many citizens of this same country. But, the assumption that we are rich, selfish and hiding our money, not wanting to pay our fair share really bothers me.

Just a different point of view...

eta: And don't get me started on the lady who was complaining to a friend on her iphone which she had dialed with her beautifully manicured nails that our cafeteria didn't take food stamps...because that's another issue altogether.Good point about the definition of rich. Most small businessmen and farmers would fall in that category because of assets whether they are making a profit or not. For the large corporations, if they are taxed at a much higher rate or more regulations are placed upon them they will simply move out of the U.S. where they can pay lower wages and don't have to adhere to EPA standards, etc. Kind of like biting the hand that feeds you!

Related Discussions

- 53

What Does It Mean for The Wealthy to Pay Their Fair Share of Taxes?

by Scott Belford 6 months ago

This topic has come up recently across several forums, so I though I would start on specifically for this subject.The question comes up when mainly Democrats and some Independents complain that the wealthy do not pay their fair share in taxes. The rebuttal ranges from they already do to why should...

- 21

Greece and the U.S. have some things in common

by promisem 10 years ago

1) Their governments are heavily influenced by multibillionaires.2) Those billionaires hide their assets and underpay taxes.3) Both governments spend more than than receive anyway to appease the lower classes.4) Both countries are heavily in debt.Agree or disagree?

- 35

What Defense Can Justify An Estate Tax?

by ga anderson 10 years ago

You work hard to build a fortune that you can pass on to your kids, or otherwise distribute however you desire on your passing. It is your money. Shouldn't you be able to do whatever you want with it, within our legal boundaries of course?What business does the government have taxing your estate...

- 129

Redistribution of Wealth is Perfectly Fine

by Kathryn L Hill 11 years ago

Right?

- 17

What Is A "Fair Share" Relative To Taxes?

by ga anderson 10 years ago

Much is heard of a demand that corporations and the wealthy pay their "fair share" of taxes, but I have heard little of what that share should be.With only a single restriction; that the discussion is about legal tax actions, what should that "fair share" be?One could say that...

- 115

Historical data on taxing the rich

by ptosis 8 years ago

federal income tax rates history, During the eight years of the Eisenhower presidency, from 1953 to 1961, the top marginal rate was 91 percent. (It was 92 percent the year he came into office.)What does it mean, though? For the duration of Eisenhower’s presidency, that rate affected individuals...