What should be done about the economic crisis in Europe and the U.S.?

Economists Agree: Solutions Are Elusive

By EDUARDO PORTER

Published: April 23, 2013

"Last week the International Monetary Fund hosted a conference of some of the world’s top macroeconomists to assess how the most intense crisis to have shaken the industrialized economies since the Great Depression has changed the profession’s collective understanding of how the world economy works."

http://www.nytimes.com/2013/04/24/busin … s&_r=0- JaxsonRaineposted 12 years ago

0

Ooh, ooh, pick me!

Let's create an environment where businesses aren't crushed by regulations, laws, and taxes... and, and, AND! assurances that they aren't going to face huge regulations, laws, and taxes the next time we change POTUS or control of Congress.

Like your link said Ralph, the cat is scared to move. While it is scared to move, we introduce Obamacare, which makes it even more uncertain about how safe it is to come down. Maybe we should help it, instead of adding more uncertainty? The first thing that should be done is to stop referring to the outstanding bonds of fiat currency economies as "debt," and acting like sovereign nations are broke. When you can create your own currency out of thin air, then pay your obligations with that paper, that isn't "debt" in any real sense of the word. Next, governments should apply that knowledge, and stop factoring debt into their budget decisions. The true limit on government deficit spending is not debt, but inflation. And it follows that government spending should increase, with the goal of 100% employment.

The Eurozone is a different case - those countries that foolishly ceded monetary sovereignity to the European Central Bank are actually in debt, because they have to borrow euros - and pay interest - just to have currency to use. Eurozone countries are more like American states in that respect - they cannot create currency, so they have to stick to an actual budget. The euro should be abandoned ASAP.

There. Problem solved.So wait, you're arguing not that these countries have not spent too much but have spent too little? I wonder how much spending we actually need considering the spending we've seen so far has been unprecedented. What would be an appropriate level, do you think?

What makes you think we need less government spending?

An appropriate level of government spending depends on what they spend it on. What I would shoot for is 100% employment, which would just mean giving the currently unemployed simple government jobs. The cost would be small compared to the benefits.Government spending has done nothing but increase for the past 100 year or so, with no substantial economic improvement. This is because the more government spends the more money is being taken away from the productive side of the economy. The government can create tons of employment tomorrow, but would be taking productive capacity away from the private sector to do so. Just give everyone the job of digging holes and filling them back up again and you have full employment but no production and no growth. Moreover, the government cannot possibly create a productive job seeing as if was productive, the market would be doing it anyway.

You don't think our economy has advanced over the past 100 years? Seriously?

Also - putting the unemployed to work does not take productive capacity away from the private sector, because the private sector was not using that labor to begin with. That's why we call them "unemployed." Like you said (and I agree with this), if there was more money to be made by employing that unused labor, the private sector would already be doing it. But they aren't.In certain sectors, perhaps, but not widespread and no where near as fast as it was where the government largely kept their hands off the economy in the 19th century.

But where does the government get the money to pay these people? By taxing, naturally taking productive capacity away from the economy. And you admit it: there is no productivity to be had out of this labour. That means we need to restore productive capacity to the market by reducing taxation and spending. To disagree with this is to commit cognitive dissonance.+1

You get it, and you say it well. Nice.The government gets the money to pay these people by creating new dollars. We have a fiat currency, and it costs nothing to do so.

Also, you don't WANT production out of these government jobs. That doesn't mean they won't be useful (like picking up litter or fixing potholes), but "production" means putting a product on the shelves for consumption. You don't increase production, then hope for new demand, because that doesn't work. But the increased demand will naturally lead to an increase in production. And if any more labor is needed by the private sector to meet that new demand, they should have no trouble enticing labor over from those minimum-wage government jobs.Which then causes price inflation, destroying the consumer's purchasing power and mitigating any short-term benefit. Inflation is but a more sinister form of taxation.

Production is fixing potholes and picking up litter, it is the creation of product and service, i.e. the end that humanity strives to meet through jobs. If the resources were not there, for whatever reason, to sustain those jobs in the market they're not going to be there in government jobs without taking them from somewhere else, whether that be through taxation or inflation.

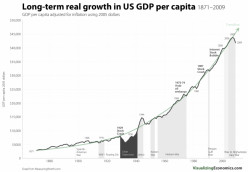

"Government spending has done nothing but increase for the past 100 year or so, with no substantial economic improvement."

There has been considerable economic improvement in the U.S. during the past 100 years.

You guys really ought to do a Google search and to do a little checking before making such off the wall statements.

http://visualizingeconomics.com/blog/20 … -1871-2009 Long Term Growth in GDP per Capita 1871-2009

You should try reading before you criticize others Ralph. It wasn't a statement about our economic growth, it was a statement about the effect of government spending on our growth.

Perhaps that's what he meant to say, but it's not what he said. And if that's what he meant to say, it's no more than an unsupported libertarian assertion.

No, it's what he said. It was a single thought, otherwise it would have been separated.

And if you want to say government spending has helped, then it's up to you to prove that it has.I'm wondering if 'proof' goes beyond presenting GDP numbers, that were never intended to represent the economic welfare of a nation in the first place. As government spending is factored into it, naturally GDP will go up when government spending increases. That doesn't say anything about the productive capacity of the economy.

GDP for a given year is a direct measure of the extent to which the "productive capacity of the economy" was realized. Lately, GDP has been significantly below the productive capacity of the economy due to the slow recovery from the deepest recession since the thirties.

At what point does the POTUS start to get the blame for the slow recovery?

Any time now, along with the morons who control the House.

If Republicans had not thrown up every roadblock they could to try to sabotage the president, we'd all be better off. He's not a magician. I think he walked right into this sequester fiasco, but it was in response to absolute refusal to cooperate among the Republicans for no good reason.

Do you refer to the sequester that was his idea?

Democrats do the same thing to republicans. That's standard politics. I'm not saying that I condone standard politics, but it is what it is. The POTUS needs to take responsibility. That's part of leadership.

I do; I am aware that someone in his administration cooked it up and that he bought into it as a way to avoid the "fiscal cliff," and I think he way underestimated the Republicans' willingness to sabotage the American people to get to him. He walked right into it, and I think it was probably the dumbest thing he's ever done. But it is a result of dealing with a Congress that is willing to take us down to take him down. Bad marks for him for his naive approach; worse marks for Congress for the worst possible intent.

The sequester? That's the big roadblock? Oh, it's the sequester again, a product of the Obama administration. Excuse. Excuse. Excuse. Excuse. Excuese. That's all we hear from many democrats about Obama. Face it, he's a failure. Give me Bush, Clinton, Reagan, or even Carter for that matter. I'd take any of them over Obama, and that's not a partisan statement. I'll take any other democrat or republican who was president over Obama.

"a product of the Obama administration." It's hard to have a rational discussion unless both parties are willing to be honest. The sequester is a product of the Obama administration and the Republican controlled House of Representatives. President Obama didn't impose the sequester unilaterally. He agreed to it only after the Tea Party refused to come to the budget party. You are full of unsupported personal opinions which don't advance the discussion beyone tis and taint.

I hear this all the time albeit from Democrats, please explain why the Republicans would want to sabotage the American people? What do you think they would gain from that?

That is what I meant but I didn't make that as clear as I should have. Obviously there has been some economic advancement, but "not widespread and no where near as fast as it was where the government largely kept their hands off the economy in the 19th century." as I said in a subsequent reply.

In support I present: 'Economic cycles before the Fed', a collection of articles on what the economy was like before the Fed enabled outrageous government spending:

http://www.libertyclassroom.com/panics/Kind of a crackpot source you're leaning on there. If there is one thing Austrians aren't good at, it's coming up with actual evidence to support their theories. I don't want to get into another endless debate with an Austrian disciple, but I will say two things: one, no matter how much research you do, you cannot go back in time and hypothesize what things would have been like had such and such variables been different, and call that "evidence." Two, it's pointless to try, because we have a system in place already, and it isn't going to change anytime soon.

Although Austrians are not empiricists, there is surely a correlation to be made regarding how exactly crashes are caused and what gets the economy moving again. This is not imagining what they would be like if things were different - it's ascribing causes to results. This is the evidence we present along with praxeological deductions that prove the interventionists wrong.

But you don't need to address all that because . . . that's the way it is, so deal with it, slave. The Federal Reserve and the fractional reserve banking system are fraudulent and wealth-stealing. That sounds like something worth fighting against, myself.

What absolute twaddle!

For productive read profitable and you will see how false your claim is.

Local government in Manchester is creating a lot of needed and productive jobs - apprentices aren't very profitable short term though so business does not tend to offer them too often, unless they are heavily backed by government money.

Government doesn't take money and then hide it away under its collective mattress, it spends it again and spends much in the private sector.

Think of defence spending, most suppliers are in the private sector. Dole money, most of it is spent on local services. Health care, all those privately produced drugs and medical equipment.

There is plenty that needs doing beyond digging holes and filling them back up again. Do you know how many of the Victorian reservoirs and sewage systems were built? No? They were funded by government to provide work for the unemployed.Productive is profitable. When you're making profit in the market, that is a sign the good or service you are providing is in demand and productive. If there isn't a way to make hiring everybody profitable, no amount of stimulus or wealth sharing is going to make it productive.

Think of what happens when government steals money: the private sector has less purchasing power to spend in the economy. They would have otherwise been spending it on services, sewage systems, drugs etc. It makes it an odd policy from people that usually argue that the economy has not got enough "aggregate demand".

Either way, by spending or inflating, government spending is simply shifting money around. Those jobs that are created by local government in Manchester necessarily take jobs from somewhere else. You cannot create something out of nothing."Either way, by spending or inflating, government spending is simply shifting money around. Those jobs that are created by local government in Manchester necessarily take jobs from somewhere else. You cannot create something out of nothing."

Not so when the economy is in recession. Unemployed workers and resources are put back to work on useful, needed jobs and projects. The equation is C (consumption)+I (investment)+ G (government expenditures)=GNPTo some degree. While government does provide some productive work (infrastructure, military, etc.) the large majority of expenditures produces nothing that anyone needs or wants. Paperwork and new laws are not something people hang on their wall or eat. It's not even good entertainment.

Have you never considered how much government spends on paper?

All from private suppliers and manufacturers.Government services are provided by virtue of votes by our elected federal, state and local representatives. The military and infrastructure are two of many useful services. Others include the courts, law enforcement, environmental protection, drug regulation, parks and recreation, not to mention public schools. Your view of the role of government is that of a radical libertarian.

I'd like you to give me some examples where the military is productive.

In order to pay the workers you need to take it from already productive sources, necessarily taking purchasing power away from people and businesses, and therefore the ability to create jobs. If the productive capacity is not there, there can be no creation of jobs.

If the demand is not there then there can be no creation of jobs.

Get people into work by any means and increase the demand.... and necessarily take the productive capacity away from the economy. Rob Peter to pay Paul. It's amazing how popular dumb ideas are.

OK, as you've established that I'm dumb, how about sharing your wisdom with us mere mortals and tell us how to fix the economy?

Don't forget though that we are in a recession and loads of people don't even have enough money for their day to day needs let alone spare money for none essentials.No, the ideas you subscribe to are dumb. Many an intelligent person has subscribed to dumb ideas.

As to how I would fix the economy, I have touched upon that in the other mini-thread below.

What productive capacity? Corporations are sitting on trillions of dollars of capital rather than investing it in expansion or salaries for workers whose incomes have flatlined.

This is not even remotely true - it is a gross oversimplification, and only useful to illustrate the production/consumption dynamic at the econ 101 level (at a bad college, at that). "Purchasing power" is not a barter-level thing in the real world. You are suggesting a zero-sum game, where 100% of production is consumed by the producers, but in the real world, we have savings, population growth, increases in productivity, interest, and a host of other things that render your scenario obsolete.

If those "productive sources" spent 100% of what they earned, the economy would be in better shape, but they don't. They save quite a bit of it. China, Japan, and Saudi Arabia, for instance, sock away hundreds of billions every year, and those dollars never get spent. Where do they fit into your simplistic explanation?Well, in a free market, savings have an impact on futures, i.e. savings encourage the economy to produce in order to convince consumers to part with their cash. In that sense, saving is productive.

On the other hand, nations that choose to hoard money are aggressive and distort the market. This fact makes a great case for the legalisation of the competing currency.Actually, savings don't work that way at all. There is no finite pile of capital that is affected by the supply and demand of credit. That's pure fantasy. In the real world, the supply of capital is limited only by demand. Even in the rare case where there aren't enough bank reserves to cover new loans, banks can always borrow new reserves from the Fed's discount window, and the Fed always obliges. So no matter what, loanable funds are available, and the interest rate always follows the overnight rate, which is set by the Fed through bond auctions.

If you bothered to look into it, you would find no correlations that back up your theories. Savings don't correlate to anything except savings, and savings is money not being spent.

Government expenditures provide additional demand and jobs. In a recession, the money comes from borrowing. This increases "G" in the equation resulting in a net increase in GNP, demand and jobs.

In a recession markets that may normally be profitable and productive cease to be so and some suppliers will not weather that recession, reducing demand in other markets.

Government stimulus can help companies to weather that recession and even raise the economy out of recession.

Firstly, the government does not steal money but when it levies taxes that money all goes back into the economy, plus a bit extra. In a recession businesses rarely spend money on infrastructure and they cut back on the amount they spend on labour, look how a recession ramps up the unemployment figures.

You don't get it do you? Those jobs created in Manchester do not take jobs from anywhere else. They exist because private companies don't have the confidence to create those jobs but backed by local government they do have the confidence to create them.

What do you think will happen when the recession ends and the demand for skilled labour increases?

If you had your way that pool of skilled labour would have shrunk, even disappeared completely, with government intervention that pool of skilled labour is kept up to size.Do you think businesses cut back on labour just because they get the willies? For whatever reason, these businesses do not have the means to hire the workers, and they're not going to be able to until they are more productive, efficient and therefore making more money. You could just go ahead and give the business money, but you need to take it from somewhere else to do it, which only exacerbates the problem. Where does this 'extra' come from? Through counterfeiting? You can do it through inflation, thus destroying the public's purchasing power, but this is not a fix.

I think the only way to to get out of this recession any time soon is to stop the stimulus and money-printing to allow the economy to fix the fundamental problems that the misappropriation of resources caused in the first place (through the central-bank created housing bubble in the 2000s).No. businesses cut back on labour because there isn't sufficient demand for their product or service.

However productive and efficient a workforce maybe if there is no demand for their product then there is no job for them.

You can use tax revenue to stimulate the market rather than using tax revenue to quash the market and saturate it with unemployed or under paid workers who do not create demand.So what you want to do is tax someone else therefore reducing their demand?

Other than this blatant fallacy that for some reason you just can't fathom, don't you realise that this policy de-incentiveses making products better and cheaper? If people don't have demand for your product, wouldn't it be better for everyone if you found a way to be more efficient and therefore improve your product? The best way to incentivise that is to let the market compete.

The economy is broken and resources have been misapplied: there is too much money in the financial sector and housing. Stimulus says to the economy: more of the same please. In order to properly fix the economy instead of exacerbating the same problems, we have let resources return to productive avenues.Well, what about deficit spending? That's not taxation, and nobody's money gets "stolen," but you Austrians still complain about it anyway. You think your dollars are being "diluted," even though there is zero evidence of demand-pull inflation.

We complain about it because it's done on the back of our dollars and is impossible to pay back. But I know you guys don't see it as debt at all and would like the government to do it forever.

As far as inflation is concerned, maybe you should look beyond the CPI, and even check your grocery receipt every so often. Here are some basic goods that have been subject to massive inflation since 2002:

Eggs: 73%

Coffee: 90%

Peanut Butter: 40%

Milk: 26%

A Loaf Of White Bread: 39%

Spaghetti And Macaroni: 44%

Orange Juice: 46%

Red Delicious Apples: 43%

Beer: 25%

Wine: 60%

Electricity: 42%

Margarine: 143%

Tomatoes: 22%

Turkey: 56%

Ground Beef: 61%

Chocolate Chip Cookies: 39%

Gasoline: 158%

But more importantly, most of that money is going into government bonds and the stock market, that are both experiencing huge bubbles that have to burst at some point, at which point you will likely blame capitalism.We complain about it because it's done on the back of our dollars and is impossible to pay back. But I know you guys don't see it as debt at all and would like the government to do it forever.

Have you ever considered what would happen if the government didn't deficit spend? Every time I argue against Austrian economics, I come up against the same thing: you guys have a little rule of thumb, like "more dollars = inflation," and you stop there. You don't apply your rule to reality to see if it holds true. And most maddeningly of all, you don't even consider the way things are done in practice. Everything that doesn't fit in is a "distortion." A few posts back, you called the fact that China and Japan save their earned dollars as "a distortion." No, what that is is reality, and your paradigm cannot account for it. People, companies, and other governments actually do sit on their dollars (in the form of bonds).

As far as inflation is concerned,...

Chalk about 100% of that up to the price of oil, which we have no control over. I challenge you to present a correlation between money growth and inflation that doesn't look like two random lines on a graph.

But more importantly, most of that money is going into government bonds and the stock market, that are both experiencing huge bubbles that have to burst at some point, at which point you will likely blame capitalism.

Government bonds are experiencing a bubble? How so? Their exploding interest rates? Do you understand the mechanism of government bonds? Do you understand how the Fed controls the interest rate on them?

But when there is no market for the product . . .

If there is absolutely no market for the product no matter how cheap and good it is, no amount of wealth sharing is going to make a difference.

What, not even if it means that those who couldn't afford the product now could?

The big lesson that this crisis forcibly brought home—one we should have long known—is that economies are not necessarily efficient, stable or self-correcting.

-- Joe Stiglitz

http://blog-imfdirect.imf.org/2013/05/0 … nd-policy/I'm interested to know how anybody could conclude that since the economy has not been allowed to self-correct for decades now.

No rather libertarians like to pretend it has not because otherwise the collapse suggests an issue with a capitalist system, sure there has been regulation and tampering, a lot of it poorly executed but that does not change the basic free market nature of the system. Not to mention we saw markets fail to self regulate, tha thappened until the point where people got sick of it and began to regulate it.

The Fed distorts the market in a such way that it can hardly be called 'free' anymore, and you're claiming that it is a failure of the free-market? Free markets do not often produce ultra-low interest rates, only central banks can.

The Fed has singlehandedly saved the U.S. economy from a double dip recession. Bernanke deserves a presidential medal.

Much less than what we are losing due to continued high unemployment and decaying infrastructure. The FED will begin selling the bonds it has bought when unemployment is lower and the inflation rate shows signs of picking up. The effect of FED purchases of U.S. bonds is quite different from purchases by other countries such as China.

Why don't you tell us? Then, I can explain to you where you have gone wrong. It will be easier that way.

@Ralph

How can one falsify that statement? The economy is in stagnation, extremely high unemployment and the lowest rate of new small business openings. How worse could it possibly get?

We need a good recession to rectify the damage done by the Fed.The inadequacy of the original stimulus package plus the persistence of the recession in Europe is why the U.S. economy is recovering slowly.

Your economic theories are unorthodox, to put it politely.Look around you, we are having a good recession!

Considering how messed up our economy is based on mainstream theories, I consider that a compliment.

Again, there is no way to falsify what you are saying. The stimulus package was the biggest we've ever seen, and QE doesn't look like it's going to end any time soon. When exactly are we supposed to find ourselves in beautiful prosperity?The stimulus was largely misguided. Only a fraction of the stimulus money made it into the hands of people who could spend it, and that wasn't nearly enough to counter what people had lost in the form of lost home equity and lost jobs. Money poured into "recapitalizing" banks was a total waste. QE, too, is misguided, as it adds no money to the economy.

The truth is that the government was (and is) still too influenced by monetarists and deficit hawks, and they did everything they could do hamstring any attempt at a normal Keynesian solution of countercyclical spending. QE and the bank bailouts were, for the most part, asset swaps, and they added nothing to the economy - no demand, and no new jobs. So, don't point to the "stimulus" as evidence that Keynesianism doesn't work, because the Keynesian element that managed to sneak past the deficit hawks worked very well. It just wasn't big enough.

There also seems to be a conflict of interest: the IMF's livelihood depends on it, and other central banks' ability to inflate and manipulate the economy. You think they're going to come out with an essay concluding that they were wrong and the hard-money people were correct?

"Do you think businesses cut back on labour just because they get the willies? For whatever reason, these businesses do not have the means to hire the workers, and they're not going to be able to until they are more productive, efficient and therefore making more money."

Businesses cut back on labor for one reason only - because that labor is costing more than they are bringing in. The usual reason is because demand is down, and they aren't selling as much as before. But sometimes, it comes from increases in worker productivity - if fewer workers can produce the same amount of goods, businesses can increase their margin that way, too. But no business on the face of the earth - including the Mises Institute, if they sold anything - cuts their labor force when demand is high and those workers are making the company money.Which is exactly what I've been saying: the business can't afford the workers. But if there are fundamental problems in the economy, increasing the demand through stimulus won't fix it. Again, there is too much money in financial services and not enough being put into making stuff that people might actually want.

There's not enough money being put into making stuff that people want???? When is the last time you wanted to buy something and it wasn't available?

But what is the point of making stuff that people want if they can't afford it?

Not sure what Europe should do; we should spend some money on repairing infrastructure and building a high-speed rail system; long-term, we need an economy that doesn't rise and fall with Wall Street.

We need an interest rate that encourages savings, which in turn will make money available to local economies and lessen the push to put money into the stock market.

We should expand Medicare so that individuals of any age and small businesses can buy into it. This infusion of cash would rescue Medicare and create the public option that should have been created in the first place; this will help drive down health care costs.

We should change zoning laws and building codes in a way that would protect the environment and ensure housing safety while allowing the building and locating of tiny/small homes. This could allow homeowners to build without the need for a mortgage. In some instances, a relatively short-term loan, such as for five years, could be used to fund the tiny house and could treated as a simple-interest consumer loan rather than a mortgage loan.

We need to take a look at the economy from the bottom up rather than the top down so that it works for everyone.Or this factory in Bangladesh

http://www.cbc.ca/news/world/story/2013 … l?cmp=fbtlWow, it's like you are completely ignoring what I'm saying!

Try reading it again, more slowly.You said "Let's create an environment where businesses aren't crushed by regulations, laws, and taxes... and, and, AND! assurances that they aren't going to face huge regulations, laws, and taxes"

It was precisely because businesses weren't "crushed" by regulation that caused the disaster at West and the building collapse in Bangladesh.Nope. There are regulations that are useful for protecting the free market and the freedoms of everyone. Then there are regulations that are not, and are only burdens.

I didn't say get rid of all regulations, now did I?Regulations to protect the free market!!

That isn't a free market then is it? It's a regulated market.Free markets require regulation just like a free country requires laws.

The laws and regulations should exist solely to protect the freedoms of others. No more.+1

Yes. Free markets need regulation too, just less of it.Countries need regulations for a variety of valid reasons. Here are a few-

To keep the bankers from screwing their customers as in the case of no doc loans and toxic mortgages.

To try to prevent insider trading.

To prohibit false advertising.

To assure that drugs are safe and efficacious.

To protect the environment.

To prevent discrimination in employment.

To assure airline safety.

To prohibit Ponzi schemes

To try to assure save and healthful work places.

And so forth.Many of those are debatable. The government shouldn't have to warn people about everything, it should only prevent direct harm without the consent of the individual.

If I agree to let some stranger invest my money, it should only be regulated by the stipulations in our contract. The government shouldn't be sitting there trying to control everything.

Governments are inherently bureaucratic and inefficient. Government regulation can be a good thing. However, in general, government regulation is more problematic than free-market regulation. Problems arise whether or not there is government oversight. That's life. The market is almost always more efficient than the government, so deregulated industries are usually more efficient.

John, before you say that I need to provide sources to prove this, I'll preemptively say that you need to provide sources to show this is wrong. I'm still waiting for any source that says that socialism results in a smaller government. Guess I'll have a long wait?I'm actually capable of reading and understanding a post without lots of backup to prove your point.

I'll make the same point to you that I made to Jaxson - a market is not free if it is regulated, there is no such thing as free market regulation.

I'm sorry you didn't find the links that I posted sufficient proof, how many would it take to prove to you that socialism isn't about big government?Socialism is about big government. Your links are weak.

As you are so insistent then it is up to you to prove it.

Nope. You never have provided sources that say that socialism is about smaller government. Nice try. You're the one who loves socialism. If you wan't to prove it, prove it. I'm not going to do your job for you.

But the thing is that I know socialism isn't about big government. I know this from many years of experience. There is no one (acceptable to you) document that states socialism isn't about big government. Therefore, you do your work and find an acceptable source that says socialism really is about big government.

While you are at it, find me a source that says all western large governments are purely the work of socialists, even big government in the US..No, I accept reputable sources. You never provided a source that actually says that socialist governments are smaller. You even said so much when you said that the sources you were providing weren't what I was looking for.

Oh come on! You show me a reputable source that states, and proves, that socialists are all for big government.

You can no more do that than I can do the opposite.http://www.huppi.com/kangaroo/L-socialism.htm

Of course you'll find fault with this one as well! I wonder what it will be, written by a socialist perhaps?I've never heard of your source and can't find any information about it.

Your obscure site is just that. Your cohort, Josak, has questioned the value of some of my sources and is doing so right now. He questions Homeland Security, Arizona Department of Corrections, and CBS when it comes to giving information about why people are incarcerated. Go figure. I consider these to be better sources than your source, one I have never heard of before.

By the way, I must have missed where your site says that socialist governments have smaller governments. I'll go back and look. I'm sure you wouldn't post unless it said that somewhere.But still no sources from you!

I have to prove everything I say beyond all dispute but we have to accept what you say at face value!

Typical.You said socialism resluts in smaller government. I asked you to prove that. You have failed to do so. You've done a good job proving my point for me. Now, you believe that government should create jobs for people, because the private sector has failed to do so? That's just another example of how you want greater government intrusion.

No, I just offered a contradictory opinion, not a plea for larger government.

You still have offered me no proof that socialism s about larger government. Under socialism there would be no need for the government to create employment.BTW, we don't have a socialist government, I was answering what current right wing governments should do.

Obviously with socialism there would be no private sector.I never said you had socialism. Now, are you saying conservatives are right-wing government? Conservatives are right-wing. Conservatives do not relish the idea of creating jobs for people. They get out of the way ot the private sector, so it can create jobs.

Er, there are plenty on the left who aren't socialist!

And no they don't get out of the way so that the private sector can create jobs - they are quite happy to allow them to destroy jobs.It's obvious that many of the left are not socialists. I never indicated otherwise.

Conservatives, by definition, do not like government intrusion and strive to minimize it. Whether or not the private sector creates or destroys jobs is another debate topic. Whether or not conservatives want the government to get out of the way of the private sector is not; it is a conservative belief.It seems that you and I not only have a totally different idea of what socialism is, it now appears that we have conflicting views on conservatism as well!

Wikipedia:

"The meaning of 'conservatism' in America has little in common with the way the word is used elsewhere."

In America (Wikipedia):

"Economic conservatives and libertarians favor small government, low taxes, limited regulation, and free enterprise."

"Other modern conservative beliefs include opposition to a world government and skepticism about the importance or validity of various environmental issues."I am elsewhere.

There is probably a similarly worded explanation of socialism.

Again, you're evading the point.

It's about quality links that actually agree with what you are saying rather than quantity. Again, where's your source that clearly shows that socialism results in smaller government?OK, where's your source that clearly shows that socialism leads to big government?

It does indeed. Socialism is a scab. The government is a sore. Without a sore, there is no scab.

But that is only ill-informed opinion, not fact.

The "free market" is only good for two things: making some people money, and putting things on the shelves that people want to buy. It does not employ everybody, it does not take care of the environment, it does not keep people in line, it does not build roads and bridges. It certainly does not "self-regulate." And as far as your belief in efficiency goes, the market is only efficient because of government regulations. Otherwise, business trends toward monopolies and cartels.

Everybody MUST be employed and kept in line? I don't want that kind of government. People make a country great, not a government.

Unemployed people make a country a little less great, and lots of unemployed people make a country a lot less great. EA, for a guy who demands a lot of links and proof, you offer up precious little evidence yourself. All you are doing is beating the "government is bad" drum.

It's a big drum.

Yes, I know unemployed people make a country less great. Look at America as an example of that. I find it disturbing that your government would force people to work and keep them in line. Those are your words. That sounds like a scary world.

I favor a country that works towards allowing businesses to flourish; entrepreneurs produce jobs that are then available for people to better their lives. I do not favor a government that forces people to work and keeps a close eye on them.A guaranteed job does not force anyone to work. If people don't want to work, they don't have to. And "keeping people in line" just means enforcing laws, which the private sector does not do on its own. You are being a bit paranoid here.

Agreed - "The "free market" is only good for two things: making some people money, and putting things on the shelves that people want to buy. It does not employ everybody, it does not take care of the environment, it does not keep people in line, it does not build roads and bridges. It certainly does not "self-regulate." And as far as your belief in efficiency goes, the market is only efficient because of government regulations. Otherwise, business trends toward monopolies and cartels."\

Until mankind progresses (consciously not economically) the world will remain in a mess. When 300 Billionaire families earned collectively more than 4.5 Billion of the worlds poor.... the injustice / imbalance is simply an example of how little mankind has progressed since the cave man days. We have the technology and the means to make earth a safe clean place to live for all, plus the technology and skills needed to begin to explore the universe.

Until mankind progresses and learns to realize it is the love of life and the love of living that is truly important we are stuck. It is time mankind realizes that building character is more important than building things. it is time we built a new man from the inside out.

All the talk and bantering between left and right thinking individuals is nothing more than a display of bull sh*t and proof that "we need progress in consciousness" not money and material gain.

Mankind acts like they are still in kindergarten. it is simply "wrong" that 300 billionaire families can continue to earn so much when people die of starvation. It is simply "wrong" BP can slither away from the disaster that STILL plagues the Gulf. It is simply wrong to believe a debate between left and right thinking will solve any of these problems.

Mankind needs to go back to zero and start over.... or at least be willing to leave kindergarten and make a try at grade one!

Yeah, free markets have regulation too, because there is no such thing as a completetly free market.

Name one completey free market. You won't be able to do it, because even the markets that enjoy the most freedom have some regulations. That's reality, not philosophy.

A solution? I have none.

A prediction? I have a lovely one.

The corporations are going to keep doing what they are doing. The politicians are going to keep doing what they are doing. And sooner or later, it will all come crashing down. And there is not a darn thing that We The People can do about it......except to use the system as it is to prepare for self sustaining ability for when it all does collapse

...only those that have prepared will survive and rebuild a better more intelligent and less ego, selfish, greedy society

...I for one don't want a total collapse, I prefer to visualize a gradual transition to a better society, but sadly, the biggest greedy egos will use up the less in every manner at their disposal and ability to manipulate the money and labor from the lessor...its a lose-lose situation for all...we've seen it before, when will they all learn to do it differently...???

"The 1 Percent's Solution" Krugman

"Economic debates rarely end with a T.K.O. But the great policy debate of recent years between Keynesians, who advocate sustaining and, indeed, increasing government spending in a depression, and austerians, who demand immediate spending cuts, comes close — at least in the world of ideas. At this point, the austerian position has imploded; not only have its predictions about the real world failed completely, but the academic research invoked to support that position has turned out to be riddled with errors, omissions and dubious statistics...."

http://www.nytimes.com/2013/04/26/opini … n&_r=0

"Debt, Growth and the Austerity Debate" Reinhart and Rogoff'

"IN May 2010, we published an academic paper, “Growth in a Time of Debt.” Its main finding, drawing on data from 44 countries over 200 years, was that in both rich and developing countries, high levels of government debt — specifically, gross public debt equaling 90 percent or more of the nation’s annual economic output — was associated with notably lower rates of growth...."

http://www.nytimes.com/2013/04/26/opini … ef=opinionThere are socialists and liberals in this forum who constantly say Europe is the shining example for all. Just look in some of the forums about healthcare for plenty of proof about that. Maybe the European way isn't as great as some think it is.

There are 24 million workers in the UK 5.5 million work for the government thus 18.5 million pay taxes to pay for the other 5.5 million so the higher the government workforce the higher the taxes for the real taxpayers.

Basing economic growth on borrowing and government job creation has led us into the situation we are in now. In Greece for instance train conductors were earning around €40000 a year while the railways were losing €400million a year, this is the way governments work. Of you continue to increase debt you will be 1) leaving a large debt for you children and their children to pay off and 2) making the banks even richer as they are in the end the lenders.

Each country should concentrate on what they produce or what resources that have instead of how much debt they can rack up for future generations to pay back.

Bit simplistic I know but economists an politicians have tried the complex rediculiousness of borrowing from Peter to pay Peter back.I agree with your statement about debt. The POTUS made big claims about reducing our deficit when he was elected. That hasn't happened.

Deficit of 2009 (last Bush budget): 1.413 Trillion, Deficit for 2013 Budget: 901 Billion. More than a half a trillion dollar reduction is obviously nothing happening...

10 trillion in debt 4.5 years ago. . .17 trillion now

It took us over 200 years to build up to 10 trillion. Obama spent another 7 trillion in four short years. you're right, a lot did happen. Tax and spend. Borrow and spend. Print and spend. Spend, spend, spend!!!

You keep spinning while the POTUS keeps spending. This is an accurate stat. It comes from the government.You said deficit, you know what a deficit is right? It's not debt.

The deficit has been significantly reduced.Josak,

Stop the arrogant, pompous, know-it-all rhetoric. Enough! Yes, I know what it is. I also know when somebody is deflecting and when somebody manipulates data.

The deficit and the debt are linked. They are not the same, but they are connected, and everybody knows that. Do I have to literally walk you through everything, so I don’t get some kind of pretentious statement that assumes you know more than everybody? Enough!If you say deficit then expect to talk about the deficit, you said: "The POTUS made big claims about reducing our deficit when he was elected. That hasn't happened." but actually yes it has.

Then you changed the discussion because you were wrong to one about the debt.

Then you pretended to be offended to disguise the fact you were wrong.

Yes the debt has grown, the rate of growth has decreased significantly, by more than a third actually, which I believe is the biggest deficit reduction in one term in US history. Reducing the debt happens by reducing the deficit and that is exactly what Obama had done, unlike you know those awesome fiscal conservatives that created a huge deficit. In 2000 revenue was greater than expenditure, by the time they were done the deficit was 1.4 Trillion.He cites facts and you come up with b.s. opinions.

The problem with most atheists who are socialists is the FACT that they think they know everything. I also knew someone else just like Josak. Everything he thought he said was correct. He thought he knew everything. He even knew God didn't exist either.

This is why I don't like socialists that much. They think that they know everything when they are nothing more than idiots.Unlike you who is sure you know everything?

No it really doesn't come from the government here is the treasury site:

http://www.treasurydirect.gov/govt/repo … histo5.htm

Deficit was just under 11 trillion when Obama took power it is now 16.It's a fact. Why don't you look it up yourself?

If you don't like Wikipedia as a source follow the links from it:

Here is 2009:

http://en.wikipedia.org/wiki/2009_Unite … ral_budget

Deficit 1.413 Trillion

This is 2013:

http://en.wikipedia.org/wiki/2013_Unite … ral_budget

Deficit 901 Billion

I think you can do the math on the difference.

This is double speak. Who pays employees of the Treasury Department? Taxpayers. It is part of the government, which is reflected in their .gov site. Wow.

Our exact debt is 16,758,107,082,298.63 right now. It is not 16 trillion and much closer to 17 trillion. Again, you are wrong.

The debt, when Obama took office was exactly 10,626,877,048,913.08. The 16.7 trillion dollar debt is a staggering increase from this number. Tax and spend. Borrow and spend. Print and spend. It's the Obama way.

http://www.publicdebt.treas.gov/

http://www.cbsnews.com/8301-250_162-575 … ok-office/So wait your argument here is a conspiracy theory that the US treasury department is fudging figures for Obama... excellent. Conversation over.

NO. I trust their numbers. I don't trust your numbers.

Despite the fact I quoted their numbers and linked them...

You said 10 to 7 trillion

Which would put the debt incurred at 7 Trillion

The actual debt incurred is just over 6 that is what I was pointing out. 15%+ exaggeration.I quoted their EXACT numbers and linked to them too. The additional debt is massive and in a short period of time.

"10 trillion in debt 4.5 years ago. . .17 trillion now

It took us over 200 years to build up to 10 trillion. Obama spent another 7 trillion in four short years"Obviously, you missed another one of my posts. Keep looking.

That was the post I was responding too. You know, the wrong one.

Here's a copy of part of my post, the one that gave exact numbers:

Our exact debt is 16,758,107,082,298.63 right now. It is not 16 trillion and much closer to 17 trillion. Again, you are wrong.

The debt, when Obama took office was exactly 10,626,877,048,913.08.

The only thing that is wrong is your "thinking" on this subject.

Face it, Obama incurred roughly 35% or our entire debt in his short term as president. Be honest.Yup despite Obama reducing the deficit faster than any president in US history inevitably quite a bit of debt was incurred.

I don't really like Obama but his debt handling has been impeccable, really, deficit reduction has been incredible, Reagan more than quadrupled spending to get out of his crisis.Impeccable? Nothing about Obama rings as impeccable. We do both agree on Obama though. I don't really like him either.

Debt is basically accumulated deficits. We accumulated a lot of debt in the last 4.5 years. By the way, CNN Money doesn't really agree with your analysis of Obama's deficit reduction either:

http://money.cnn.com/2013/04/09/news/ec … index.htmlThat article does not even criticize the plan it just notes (correctly) that it still leaves the debt high because that is largely inevitable for some time and that this is slightly precarious in the case of a war. It actually calls it a big cut.

You know a cut where the last two conservative presidents have just massively increased deficits and spending.

Pure crap. Bush handed Obama with a deep recession which reduced tax receipts, two needless wars, a big tax cut for the rich and an unfunded Medicare drug plan written by pharmaceutical company lobbyists. Cutting spending is not the way to get out of a recession.

The quality of this discussion sucks.Where would you get the money from to spend?

The federal government has two sources--tax receipts and sale of U.S. government bonds.

Your country's great economist Maynard Keynes advocated increased government spending during a recession when there is insufficient demand from private consumption and investment to encourage economic growth. This is standard economic theory today. Unfortunately, economic illiteracy is rampant among European and American Tea Party politicians. (and among several participants in this forum)So either way the taxpayer bears the brunt of economic failure of professional economists and politicians.

No, the people who bear the brunt of politicians' mistakes are the millions of unemployed workers, people who have no health insurance; mal-nourished children; and people who are driving every day over unsafe bridges and roads.

Sorry Ralph i should have stated that i am in the UK and as of this moment the only ones suffering badly are the workers on average or lower wages.

Well, I'm in Detroit where there are plenty of people suffering.

Hasn't Detroit been in the same sort of situation for many years? (genuinely interested)

That's because the leadership in Detroit is horrible.

I think the same of your statement. The majority of the war costs were incurred under Bush. That's a fact. Obama needs to own the fact that the recovery is way too anemic. He may not have started the recession. Bush owns that. He does own the anemic recovery. Leadership is taking responsibility. Time for leadership. Spending your way into bankruptcy isn't the way to get out of a recession. At best, it results in short-term economic recovery and eventual collapse.

I'm not sure why you are complaining about Bush when Obama has spent more in half the time. His policies have not helped and in fact are detrimental, Obama has continued Bush policies and have put them in overdrive.

That's a very simplistic comment. The fact is Bush handed Obama a huge bucket of shxx and the Tea Party morons in Congress have done everything they could to sabotage Obama's efforts to deal with Bush's legacy.

A simplistic answer is always best when it is the truth. Obama has had more than four years to solve the problem left to him and hasn't. Reagan was able to counteract carters mess in four years why Can't Obama? The answer is obvious but I doubt you will answer it.

Check simplistic in your dictionary: "The tendency to oversimplify an issue or a problem by ignoring complexities or complications. Simple is good; simplistic is for simpletons.

Your answer is about as far from the truth as you could possibly get. Bush's mess was much worse than Carter's.Reagan's recession was a fraction of the recession that this one is AND just as importantly it was a local recession so the US economy could be propped up on export of consumer goods, this is a global recession so that demand does not exist.

That is why.

Not to mention that Reagan increase spending massively to stimulate the economy where as Obama has as covered reduced the deficit.Carter's mess wasn't that much of a mess. Reagan was able to come in and - with the cooperation of Congress - increase spending like mad. Emphasis on "with the cooperation of Congress." Reagan inherited some oil-related inflation and high interest rates. OPEC loosened up, and the Fed lowered the interest rates, and those problems went away. That's not to say that I agree with the Bush/Obama bank bailouts, but I'm tired of hearing conservatives complain about the slow recovery while their Congressmen do everything in their power to make sure Obama's efforts don't work.

This is the difference between a Left-leaning and right -leaning president. Reagan loved America. Obama makes excuses and hides his hate for America. Reagan came from a generation who were patriots and not cowards. Obama came from a generation of cowards, many of them being draft dodgers and hippies.

The tail end of the Baby-boomer generation has done nothing but harm America. The following generations are no better.Cheney dodged the draft multiple times. Dubya famously dodged active service. Reagan was in the military, but he made movies there, too, and never left the comfy confines of the U.S. of A. The only recent presidents with any active service were Bush 1, Carter, and JFK.

Reagan was a nice enough man, but by the end of his term he was a doddering old man that should not have been left in a position of power. Loving America is not enough when it comes to the presidency.

So government employees pay no taxes in your world! Amazing.

Government workers do not add to the revenue pot however as individuals they pay tax on their earnings and anything else that is taxed that they buy.

And government workers are less likely to be low paid workers dependent on the state for enough money to pay their rent.

Well it does seem a little nuts when a taxpayer is paying towards someone's salary that is much much more than his for in some circumstances to do the same job.

Here in the UK it has come near to breaking point with some government workers earning hundreds of thousands of pounds and retiring on huge pensions while those who pay towards them are in some cases left destitute by the decisions these people make.Very few government employees earn hundreds of thousands of pounds, most are on comparatively low wages. Those that they earn more than generally pay no work related taxes.

Local government here is just as bad, our local council pays the unelected council CRO £180000 a year plus bonuses and pension contributions, his PA received £77000 plus bonuses and pension contributions. This council is already in £3 billion worth of debt and their only answer is to increase local taxes and reduce services.

Directly employed refuse collectors earn an average of £30000 and can retire after 30yrs service whilst contracted

refuse collectors earn £20000 and receive no pension entitlement.

Here in the UK it's a well know that working for the local or national government is like finding the goose that lays the golden egg.

.

I still don't understand why economists are the ones to save what they praised. Who advised governments of austere policies if not them? Why the main protagonists of the crisis are not gathered around the table? Why is it them and not us? They damaged enough the economies.

Federal Cuts Are Concern in Modest First-Quarter Growth

"...In the first quarter of this year, government spending fell at an annual rate of 8.4 percent, after a decrease of 14.8 percent in the fourth quarter of 2012 — with the cuts driven by sharp declines in military spending. Both declines happened largely before the bulk of Congress’s across-the-board spending cuts took place. The so-called sequester is scheduled to strip $85 billion out of federal spending before Oct. 1, cuts that will have secondary effects throughout the private sector. Furloughed federal workers, for example, will spend less money at local businesses....

"The pace of economic activity may have already begun to slow, given recent disappointing reports about economic indicators in March. Hiring slowed sharply last month, for example, and orders for durable goods like aircraft and metals fell more than analysts had expected....

"... Justin Wolfers, an economics professor at the University of Michigan, said the government’s fiscal policy was a drag on the economy. He suggested that the Fed might also not be doing enough to bolster employment, given that inflation rates are still below official targets.

“The bigger picture is that we have a fledgling recovery which needs help but isn’t getting it,” he said. .."

http://www.nytimes.com/2013/04/27/busin … s&_r=0...what is important to look at is that governments/corporations/private individuals have not used economic systems ethically while they have increased financially

HEADING THE WRONG WAY--NYTimes Editorial 4-28-13

"...Underneath it all is the fiscal drag from ill-advised and ill-timed austerity measures. With the expiration this year of the payroll tax break, personal income declined sharply last quarter, forcing consumers to draw on their savings to support their spending. That is unsustainable, presaging weaker consumption in the months to come and, with it, weaker overall growth....

"...The real danger in the Fed’s efforts to revive the economy is not that its actions will cause inflation — of which there is no evidence — but that they will fail to revive the economy by any meaningful measure, denting investor confidence and, in the process, the stock market.

"That is not to blame the Fed. For years, Congress and the Obama administration have been working at cross-purposes to the Fed, as strategies to cut the budget have taken priority over strategies to increase growth, jobs and pay. Republicans have insisted on austerity for ideological and political reasons...."

http://www.nytimes.com/2013/04/28/opini … s&_r=0Check this out: "The Retirement Gamble," on PBS: talks about the astonishing fees that decimate people's 401 (k) plans: http://www.pbs.org/wgbh/pages/frontline … nt-gamble/

I can speak for my country, but I presume the situation is similar worldwide.

1. cut down the social support. I have nothing against pensions and helping people who REALLY need help. But there are MANY people who could work and get wellfare. I can't understand why, but it happens. At least in my country, from around 18 million people we have 4 million entrepreneurs and people who are hired in the private sector and over 8 million people who are either working for the State or getting pensions and support. There have been many cases when people who are currently retired from health reasons are HEALTHY. but they bribed whoever they needed. Help the disabled, help the old people, but those who are still young and strong should work.

2. cut down the taxes. As long as I am working as 3-4 other people combined and the State is taking most of my money (we have some insane taxes, the VTA is 24% etc.), it won't work properly. Many people are starting to 'hide' money and use offshore companies to keep some of their money. Have some normal taxes and everyone will pay, since it's easier than to make all other arrangements.

With these 2 I think we could move on properly. All people should work for their money and not receive help unless they REALLY need it. Our medical system is down, the population is either poor or sick of paying all this garbage, the tax evasion is probably close to 70% or more.Here's what Nobel Prize economist, Paul Krugman, had to say in this morning's paper.

"... So what could we do to reduce unemployment? The answer is, this is a time for above-normal government spending, to sustain the economy until the private sector is willing to spend again. The crucial point is that under current conditions, the government is not, repeat not, in competition with the private sector. Government spending doesn’t divert resources away from private uses; it puts unemployed resources to work. Government borrowing doesn’t crowd out private investment; it mobilizes funds that would otherwise go unused.

"Now, just to be clear, this is not a case for more government spending and larger budget deficits under all circumstances — and the claim that people like me always want bigger deficits is just false. For the economy isn’t always like this — in fact, situations like the one we’re in are fairly rare. By all means let’s try to reduce deficits and bring down government indebtedness once normal conditions return and the economy is no longer depressed. But right now we’re still dealing with the aftermath of a once-in-three-generations financial crisis. This is no time for austerity...."

http://www.nytimes.com/2013/04/29/opini … n&_r=0Surely it's not the government who should be creating jobs, it should be the government who are creating the conditions for more employment.

If the private sector fails to produce more jobs then who else but the government is it up to?

Depends on why the private sector failed. Mostly it's due to the roadblocks that govt. sets up. Well meaning roadblocks, to be sure, but nonetheless roadblocks.

Yet statistically speaking the less well regulated your economy is the higher your unemployment, not to mention that you have lower wages anyway thus reducing the value of being employed

My comment is reference to workplace and business regulations, not regulations for the economy as a whole. Under that topic, there is no way I would believe that additional restrictions on workers will increase productive employment.

It might, and likely will, increase employment for useless paperwork and make work, but eventually the loss of per person productivity will hurt, and hurt badly. Whether every company has the same thing to fight or just one.

Which roadblocks specifically? Folks like to talk about too many regulations, but seldom are any specific regulations mentioned or the negative effects of those regulations discussed.

Start with ridiculous ADA requirements, requirements that are necessary whether there is a handicapped person working or even could work there.

Move on to reams and reams of paperwork that does nothing for the company or anyone else except the paper clip counters in Washington.

Finish it up with OSHA regulations that have gone far beyond worker safety to nothing more than providing income to expand the workload of inspectors.

In between you will find more hundreds of stupid and deleterious regulations should you care to look.Not seeing anything specific here. These are generalized statements, not specific regulations.

You are going to need to back those statements.

The reams of paperwork comment is just a generalized statement, not to mention that the federal paperwork burden has been reduced significantly under Obama.

And in a country with a pretty poor safety record where several expert studies have concluded that up to 75% of our truck drivers and pilots are made to work too many hours for safety. Where we still have around 5500 lives lost yearly in workplace accidents I would disagree that regulation on the matter is excessive.

Per capita Australia for example is more than four times safer in number of workplace fatalities even though it has a massive concentration on high danger industries like mining, fishing and trucking.I worked for General Motors, before and after OSHA, and OSHA brought about substantive safety improvements in plant facilities, practices and record keeping. Some of the requirements were on the Mickey Mouse side, but for the most part they made sense. Some of the most significant requirements had to do with exposures to toxic substances and fumes.

Noise exposure regulations were significant also.OSHA has indeed caused significant gains in workplace safety. However, when you have to have an MSDS for tap water, it's going too far. Or for common motor oil. Or for window cleaner purchased at Safeway. The list is endless.

When you are fined $500 for leaving a company pickup turned off, take the key and leave it park, but don't set the hand brake on Texas desert that's as flat as a pancake, it's going too far.

When you are told not to stand on the second step of a ladder, that you must instead use a ladder too wide to fit and thus lean out several feet from that ladder, that's going too far.

When "partnering with OSHA" requires a full time person to fill out the paperwork in a 10 person location, that's going too far.

When you are fined for protecting a safety horn from weather, without affecting the sound intensity, that's going too far.

When two different locations in the same worldwide company gets the same citation and the resultant fine goes from $200 to $10,000 for multiple violations that's going too far.

All from personal experience, and I could go on all night. I was safety director for 22 years for that 10 person location.

As is the case with nearly everything govt. does, OSHA does not (and cannot) use common sense and it is killing American businesses.OSHA "it is killing American businesses."

A bit of an overstatement, don't you think?

In terms of man hours, how much time do you think it takes just to maintain data to file taxes with? How about to fill out OSHA records? 100% non-productive work, but it has to be paid for. I've done too much company paperwork designed to do nothing but inform government of what's going to think there isn't far too much.

Workplace fatality rate in the US is in line with that in the EU at around 3-4 per 100,000 workers. In reality, the rate per manhour worked will be less as the typical work week is considerably longer in the US. I can't say what Australia is - can you provide numbers to back up your claim that Australia is 1/4 that of either the EU or the US?

If you think US workplace accidents are far too high, consider that you are far safer (from accidents) to be working than not, I'd say our jobsites are pretty safe.The UK had 175 deaths in 2011 compared to 5500+ in the US the UK's population is almost 63 million.

Their death's are 0.6 per hundred thousand compared to our what 4? so 7.5 time safer in the UK? that is outright terrible. When we are looking at the EU we are being compared to some pretty terrible countries in eastern Europe etc which are not first world so that is inaccurate

http://www.hse.gov.uk/statistics/fatals.htm

Australia which has a very high risk workplace focus due to it's primary industry, mining, trucking and fishing in still only has 1 out 100 000

http://www.abs.gov.au/ausstats/abs@.nsf … 20jun+2011

So yes ours is APPALLING and yet you want to decrease the protections...Not according to:

http://www.hse.gov.uk/statistics/european/

While better than the US (per 100,000 workers) it is nowhere what you're showing. Plus, if you could look at indicents per million man hours worked they would be much closer as the work week is considerably longer in the US.

Just realized, too - we've both used the same source, hse.gov.uk/statistics , but they're showing quite a difference in rates. Wonder why?The link you posted just now shows 0.59 "the rate of fatalities for UK workers in 2009 (0.59 per 100 000)" compared to our 3.6.

I really don't know what you are looking at but 7 times the difference is not explainable by the extra tiny number of hours done more by US workers.

http://stats.oecd.org/Index.aspx?DatasetCode=ANHRS

US workers only work about 150 hours more per year about 10% more yet suffer 700% more fatalities...

Mind you the fact we work more hours is a big part of why these accidents occur because our overwork legislation is terrible with many professions having people working under extreme exhaustion (truck driver, pilot etc.).

http://en.wikipedia.org/wiki/File:Selec … y_rate.png

While fishing is very high on the list of danger, truck driving is way down there and mining isn't even listed. Maybe the Aussies need to come to the US and learn how to do it right?

And no, I don't want to decrease protections. I want to decrease the number of stupid rules and fines designed solely to collect money and can (and do) sometimes increase risk. OSHA (and MSHA) are great ideas, but have veered from their goal of protecting workers to making money. That and keeping inspectors busy.

That's an argument for larger government in your system? If the government has to create jobs, that's certainly larger government.

Take the UK for instance there are 2.7 million unemployed so how many worthless government jobs paid for by the already hard pressed taxpayer would they have to create before there would be an economic up turn?

If you are talking about the government investing in infrastructure projects that will be taken up by private companies who will increase there workforce to complete the projects then I would be all for it.

Projects for building new bridges, railways, roads, prisons, schools etc etc should always take president over creating jobs for 100000 penpushers and paperwork jockeys.Which is still government producing more jobs, whether they are infrastructural or not, and I agree they should be.

More money in the hands of the otherwise unemployed means more demand that can be exercised. There should be no argument about that. Where people are mistaken is believing that this is all paid for with taxes, and therefore it is a zero-sum game. In reality, much of this is paid for with deficit spending. And when you have a fiat currency, like the U.S. and the U.K. do, this costs the government nothing. (remember that the interest on bonds is also paid for with freely-created fiat currency.)

Remembering that EXCESSIVE use of that non value coefficient currency manipulation creates inflation.

And remembering that whenever debt is never paid back the carrying charges on that borrowing will eventually be greater than any benefit received from borrowing.

As the US has to borrow simply to cover interest, let alone principle, we are already far beyond that point.

But this government is cutting the building of new roads and bridges, tramways and all sorts of stuff that would give the economy a boost.

Until mankind progresses (consciously not economically) the world will remain in a mess. When 300 Billionaire families earned collectively more than 4.5 Billion of the worlds poor (collectively).... the injustice / imbalance is simply an example of how little mankind has progressed since the cave man days. We have the technology and the means to make earth a safe clean place to live for all, plus the technology and skills needed to begin to explore the universe.

Until mankind progresses and learns to realize it is the love of life and the love of living that is truly important we are stuck. It is time mankind realizes that building character is more important than building things. it is time we built a new man from the inside out.

All the talk and bantering between left and right thinking individuals is nothing more than a display of bull sh*t and proof that "we need progress in consciousness" not money, political or material gain.

Mankind acts like they are still in kindergarten. it is simply "WRONG" that 300 billionaire families can continue to earn so much when people die of starvation. It is simply "WRONG" BP can slither away from the disaster that STILL plagues the Gulf.

It is simply "WRONG" to believe a debate between left and right thinking will solve ANY of these problems.

Mankind needs to go back to zero and start over.... or at least be willing to leave kindergarten and make a try at grade one!Right Wing thinking is better at solving problems. Left Wing helps create problems.

Like the problems they solved by invading Iraq and Afghanistan?

"They" = the majority of Congress, both republican and democrat, and George Bush. . .It also included the majority of America and numerous foreign nations, . . .but apparently not you

What would your solution have been, ask them to be nice? More sanctions? Ignoring them? Telling them that sticks and stones may break your bones, but words will never hurt you? Would you apologize?

Liberals are all over Iraq and Afghanistan, yet they largely voted for these actions at the time. Now, they blame republicans or say that Bush lied. Well, Congress was getting the same intelligence.The majority of Congress were duped into backing president Cheney on Iraq because they were lied to. Colin Powell and his once-honorable reputation sat there and regurgitated false intel to the U.N. and the rest of the world to justify the invasion. Most of the rest of the world, happily, saw through that. Remember how we didn't have all those allies marching with us in Iraq? And Bush's misguided policy of widespread payola in Afghanistan has worked out well, too. And all because Reagan took a little-known militant named Osama Bin Laden and made him a star, just for being a thorn in the side of the U.S.S.R. Awesome track record you guys are sporting there in the Middle East.

If you bothered to look into it, Rumsfeld and Cheney marginalized the intel that didn't justify invading Iraq, and championed the little bit that did. The biggest movers in the Bush administration were the ones fudging the intel, and they were the ones who led us into a long, fruitless war. But at least we neutralized all those weapons of mass destruction, eh?Congress had the same intelligence. Your statement is an excuse. What's more, a lot of those democrats who voted for war still stand by their votes, so this is just an excuse. Let's start with John Kerry and Tom Daschle standing by their vote for war. I can find a lot more too. So. . . .your argument is poor, because a lot of those democrats would still vote the same way today, with the benefit of a lot more intelligence.

http://www.cnn.com/2004/ALLPOLITICS/08/09/kerry.iraq/

http://www.democraticunderground.com/di … 102x479336

Lyndon Baines Johnson help keep America in Vietnam. Mention that please. He was on the Left. Roosevelt made sure America was involved in WW2. As a matter of fact, America was illegally supporting England with goods and services. Roosevelt was a Democrat.

So do not play that Bull with me. Not to mention the Democrats started the American Civil War. I have a long history of stuff on them.I don't agree with our involvement in Vietman, either. But if you are going to compare our involvement in WWII to our second go-around in Iraq, I'm going to have to (virtually) laugh in your face. And the civil war? Seriously? My sides are splitting now.

The only thing that's not completely hilarious about your positions is that you are probably still allowed to vote.I was just making a case there. You see Democrats are not immune from making huge blunders.

Over 200,000 Americans lost their lives in WW2.. And very few of them were draft dodgers like the cowards (Bill Clinton ect...Left Wing hippies). You can laugh as hard as you like. At least during that time people knew a thing or two about responsibility unlike today. What does me having to vote have anything to do with anything? That is not even the point.

My comment is neither right nor left - as far as I am concerned they both ultimately create the exact same problems.... time for progress in mankind means eliminate all the systems we have used to date to get man to where he is today.... same as when you leave grade school and enter middle school you throw away the flash cards and the building blocks.... All existing political and economic systems have had their purpose... key word "HAD". We need something new. A resource based economy - a system that honors and builds character... and respects the earth we live on.

Again - my comment has sweet F*#K all to do with left and right politics.

I just finished a class on Macroeconomics. It is surprising to see how many are losing jobs. I wrote a paper on this topic, about white collar jobs moving off shore. I think that majority of layoffs and terminations are due to the moving of white collar jobs off shore.

- stop OMamma care and get the government out of the way.

Socialism: no incentive, no value, no worth...these are the CORRECT words for socialism.

'Deficit Hawk' CEOs Pocket Hundreds of Millions with Tax Loopholes

Executives behind austerity group 'Fix the Debt' make millions off the backs of those whose benefits they want to slash