Is it ethical to have an inheritance tax?

I feel that if we truly lived in a free market society taxes would be extremely low, inheritance tax would be non-existent and there would not be a minimum wage law. I feel that taxes and minimum wage laws hurt the economy as they prevent the accumulation and distribution of capital.

I feel that too many people, who may be great at social adaptation but poor in intellectual growth, desire a world that is socialized, or communist, in nature as too many people desire a free lunch- welfare, free education, the removal of the second amendment, restrictions of the first amendment and security of state controlled monopolies.

Do we Americans live in a free market society (capitalism), a socialist (mixed economy), or under a state controlled economy (communism)?

How does state control of the economy effect your own personal American Dream?I think the inheritance tax is unethical! It's hard enough now for a person to actually acquire property that's paid for when they die. The inheritance tax makes it almost impossible for heirs to afford to obtain the property that's been bequeathed to them. Something's wrong with that law.

Taxes in general, though, are necessary I believe. We do gotta actually support society as a whole, which includes ourselves. But I do know that there's too much fraud and unnecessary spending and wrong application of those taxes by our government.+1,000,000,000,000,000,000,000,000,000,000,000,000

I view the inheritence tax as a disservice to Americans who desire to build and distribute capital and jobs that provide real wages. It is hard enough to maintain a business and equity after the heir's predecessor has passed over, and taxing them on money and equity that was previously taxed is double jeopardy. Inheritence tax is a prime example of how organized crime, or the rule of the mob, is retarding the economic growth of our national, and perhaps international, economies.

I can't believe the inheritence tax survived after the Bush administration- oh how little our officials serve.

I think inheritance tax is fine, the person is receiving that money did not labor for it. Gifts are taxed and inheritances should be too.

We live in a mixed system as does all of the first world, we do because we had a pure capitalist system and we (the people of the first world) as a collective decided that was awful and changed it. All round the world, in every first world country. That is what I call consumer demand, you capitalists should understand it

When my father died, his house sold for about four times what he had paid for it, well above inflation.

My sister and I happily paid inheritance tax and ended up with a large lump of unearned money to boot.And because it was not earned by sweat and hard work (of the new owner, anyway - the first owner DID sweat for it and pay taxes on it already) the rest of the world is entitled to a portion of it.

A very, very different way of thinking from my own.How do you know the first owner sweated for it?

My father did absolutely nothing to earn the money that we received from the sale of his house.Really? He did nothing? Then how did he make the original purchase?

Are you saying that the increase in estate value is bad when it generates incomes and distribution of wealth?

If we are to have taxes at all, maybe they should be based on IQ scores rather than income.

I think we knew we would think about it differently

But since we are doing our little touch of propaganda I'll do mine.

Because the person about to receive the funds did not work for them, did not earn them, I think a portion can be taxed to help others who do not have the fortune of being left something or having people to leave them something.

We should do that so as to not continue a cycle of inherited wealth leading to an inevitable wealthy aristocracy based on bloodline rather than labor and the massive problems associated with precisely that which history has demonstrated so many times.

That money should be used to create opportunity for others so that we may be a land of opportunity rather than the lowest opportunity nation in the first world. Where the born poor die poor and the born rich die rich more than any other state in the first world.LOL Yes, we both knew the thinking would be different, didn't we?

The owner of the money is dead, and to you that means you think you have a claim on it to do with as you wish. In this case, give it to a third party rather than the person who the dead willed it to.

But you don't need fancy reasons to do that. You don't need the rationalizations that it will create opportunities for someone else, that accumulation of wealth from a blood relative is not right or that the intended recipient didn't work for the money and therefore doesn't deserve it.

You simply need the might to enforce your opinion. Coupled with the greed of the person you will give it to, you have that might and might always makes right.As we all know might does not equal right, and society certainly does not do anything it can so no justification is required, you can disagree with the justification if you will but it's not a sinister conspiracy of might vs right.

As I usually cover with this very tired argument. Liberals (in the US anyway) are the greatest supporters of the inheritance tax, statistically liberals are the wealthiest political demographic in this country 7% wealthier than conservatives. So actually rather than it being people imposing might to take from others it's voting to take from themselves to give to others when they pass away.

So I'll say you were factually wrong in that sense and it really wasn't greed.I don't see the money going to rich liberals, although I suppose that it could.

I think the biggest problem is that I simply disagree that specific individuals need to pay more than others (on a percentage basis of income) do. Add in that this money has already been taxed (at least) twice and it simply does not make sense to tax it a third time because the owner died.

No, it is viewed as "free" money by the tax and spend group. Another way to get taxes from a small group of people that do not have the power to fight back. Much like other "specialty" taxes (cigarettes, alcohol, etc.) that are levied on small groups of people that end up paying extra (meaning more than other people) into the general fund simply because they can be forced to do so. They haven't the power to fight back, and the majority (always wanting more money and to lower their own tax bill at the same time) very much takes advantage of it.

Basically, I am unable to cobble together any rational reason that an inheritance should be taxed at all. It is, at the root, no different than a savings account, and IRA or any sum of cash sitting there. It was worked for and Uncle Sam's required portion already given over. That the owner has died and wished it to go to a child, relative or other loved one should not have anything to do with the tax code. It just doesn't turn it into free money to be grabbed for by the legislature. (Of course, I feel the same way about a gift tax.)

A thousand years ago the Norman French invaded my country and divided up the land amongst the aristocracy. Now let's suppose that there was no inheritance tax or redistribution of wealth once the owner has died, the UK would be a country ruled by a handful of super wealthy individuals who had been holding the wealth for a thousand years (that's if peasant revolution hadn't happened in the meantime of course).

Wealth accumulates wealth. A kid born into riches has opportunity to make vast wealth. A kid born into poverty has nothing to invest in the first place, and what gains they could make over an incredibly long time could never rival the rich kids. Without some form of wealth redistribution, all wealth migrates upwards with increase socio-economic stratification. That is not good for any country; history tells us this leads to social unrest, and in many instances revolution. Ever wondered how communism got started?Those Normans were pretty dumb people if your country now belongs to you. I would have put your ancestors to work on farms, mills, and shops. Not only that, I would have only put the land up for very low rent and I never would have sold a thing, other than my managerial services.

The UK ought to belong to France to this day- after all, fifty percent of the English vocabulary belongs to the French. Try learning English with half a dictionary.

You owe France. We all owe France. For starters, they taught us how to dismember kings and queens.

"A kid born into poverty has nothing to invest in the first place, and what gains they could make over an incredibly long time could never rival the rich kids" I used to think that way when I was a poor kid, but somewhere along the line I figured out that I had myself to invest into whatever work I undertook. Soon thereafter the revelation, I began getting noticed for good work and conduct around school and the workplace. I graduated with honors, and I make 40k (USD) a year which is not bad for a single man with zero dependents. As happy as I am with such a salary, I am not allowing myself to be idle in such a state of mild prosperity. I am pursuing larger dreams and I plan on sharing the wealth through distribution of wages and I will avoid taxes as much as possible through the law itself.

Communism got started with taxing the rich to death.

Taxing dead people is only going to lead to a more totalitarian society and is going to continue to destroy the market in the US. A lot of people would like to use their inheritance to start a business, but if you take so much from them, they end up figuring it best to by a home, and settle down with a less inspiring job.

No dear, consumer demand can only be met by voluntary exchange. Government actions cannot come into this because they are inherently in-voluntary. If society voluntarily decided that they wanted to give some of their inheritance to an institution that would use it to wage war, spy on people and then maybe when they've done with that, feed some children, there would be absolutely no need for it to be enforced.

How do you tell when an action is involuntary? Look for the gun.Yup consumer demand is created by consumer pressure, i.e. what most consumers want, citizens of a nation are the consumers of their governmental system and by democratic means indicate what they want changed and what the want to stay the same.

The difference of course is that in a democratic system everyone gets one vote in a purely monetary one people have more sway based on their available capital.

The people all around the first world, democratically, without a single exception with all sort of variation made it very clear what they didn't want, libertarian policies, indeed what they wanted was a rapid move away from unrestricted capitalism. Never in human history has there been such a global consensus of political movement.

The unfortunate byproduct however is a generation lucky enough to be born in the first world and to be sheltered and protected from the cradle, a generation which has never lived under such a system, has no idea what it is like, some of them are then tempted by the same failed idea.Voting is at best the most outrageously inefficient way of indicating demand there is. Only about 20% of the population of the US voted for Obama in the last election, and you can hardly say they all agreed with every single policy his administration has up to now. Being kind, most of them voted on the basis that they thought Romney would be worse. Yet, according to your theory, Obama enforces the cast-iron will of the populace, and is the accurate representation of what America is and stands for. By every conceivable measure, this is glaringly inaccurate. I just want to point this out, because it seems mind-bogglingly obvious to me that what you do with your dollar every single day is a much better indication of your will than putting an X next to some guy's name who roughly agrees with you, every 4 years or so. How is it even possible that the will of a people, with all of their wonderful and unique lifestyles and views, can be split between 2 or at most 3 groups of people, who are not all that different anyway? It's absurd!

The emperor is not wearing any clothes!

Applying this to the topic: if the whole world largely agrees that giving away a portion of your inheritance is a good thing, why don't they just do it? Cut out the middle-man. The fact that government aggression is necessary proves that it, or the way it is done, is not desirable to the populace. Otherwise, why the need to enforce it?

If you and your friends want to go out to a party, you just go, you don't need to threaten them, take a portion of their money for a 'party fund' and say that they need to vote for a party-arranger every four years to decide where they go.

We need to question these things. I've told you this before, but you seem to be basing your argument on "what is, must be". Government declares that it is the will of the people, so therefore, it is!

What you're saying is that I don't really oppose the drug war and the drone programs - I have a vote so that means I chose for them to happen! Come on. It doesn't stand up to any logical scrutiny.As I have told you before I somewhat agree, our voting system is pretty light on numbers, in Australia voting is compulsory, turnout is 98.5% or some such. Do you prefer that?

As I said dollars are not indicative of as population they are indicative of people with the most dollars. Which means in the US 3% of the population has more sway in such a system than 50% which is a whole lot less representative.

There is no cause for two or three groups that are quite similar you know, you can create a political party, anyone can, hell I voted third party which was actually like 8th party. Voting socialist party int he US is not a winning move The reason two or three dominate is because they represent the cross section of belief that most people in the electorate hold.

The reason two or three dominate is because they represent the cross section of belief that most people in the electorate hold.

Ah there is the rub though, people don't agree that just them giving away a portion of their inheritance is a good thing, they agree (in general) that everyone giving away a portion of their inheritance is a good thing.

No what I am saying is that people have very clearly demonstrated in mass what they want, that can of course change so what is does not have to be at all. Feel free to attempt to change their minds on the issue. Until you mange to change their mind people will continue to vote to administrate the system as they see fit, which is what they have done.

I am arguing that people have a way of seeing and deciding what is good and what is not, particularly for themselves. If people live under a communist system and most hate it and want to change it then it's not a good system. Similarly when the whole world decided it really did not like unrestricted capitalism at all and changed it it's because that was a bad system and like any bad product it is discontinued. Systems of governance are just products and votes are the currency in which they (in democratic systems) compete. But as noted one person one vote, not dependent on who has the most money.I would rather nobody vote at all, but I do expect that if something claims to be the will of the people, it shows at least the majority of the population in agreement as evidence. I'm sure that even in Australia, nobody in the whole country agrees with every single one of Rudd's policies, therefore making the majority in disagreement with one thing or another. What compounds the problem is when politicians don't do what they were elected to do, examples include Gillard, Obama and Cameron/Clegg. 3 heads of super-powerful states elected on less than half of the popular vote, who don't even do what they were elected to do. Power to the people!

Oh yeah, and let's create a government so these super-rich people can buy it and make policy further benefit them. At least in the market, corporations have to find ways to provide goods and services in order to survive. With the guaranteed bail-outs, subsidies, tax-breaks and regulatory favouritism that comes with government, there's less need for all that 'persuasion' business. They just need to make sure they fund two or three parties that won't question it, and pay the media to persuade everyone that voting for anyone else would be a wasted vote. Power to the people!

But let's say for the sake of argument that government is the will of the people, or at least the majority. Its still wrong to steal from people. It may be your opinion that everyone should give a portion of their inheritance away, but if you encountered someone who didn't want to, would putting a gun to their head be justified? If not, why is it OK for the government to do it on your behalf?

I have the right to change your mind about putting a gun to this person's head. It's still wrong. You should not be doing it. I'm not too interested in your fantastical notions of 'consent'. Just because you've declared your sovereign right doesn't make it so, and this person doesn't need to give away anything.

If people have a way of seeing what is good for themselves, why in the world do we need to decide for them?

Since all capitalism is is property rights and voluntary exchange, if the populace decided that they didn't like it, they would simply stop. Let me try and drum this into you one more time: if everyone agrees, violence is not necessary. You only need to exercise a monopoly of force when a large section of the populace would not consent, making government inherently involuntary.Yes but everyone agreeing is unfeasible and running a country on the basis of the tastes of every individual is impossible. So we do it by majority.

Perhaps we should send non-voters to concentration camps after they reach the age of forty. If you are still not voting after age forty you are a waste of space and have no stake in the undertakings of free men and women.

The absence of voting is a vote for tyranny. Vote or pipe down.

The point is that someone did labour for the wealth, and who are we to collectively rob the dead of their right to give the fruits of their labours to whomever they **** please. If we were to be a collective democracy as you have demonstrated in your thoughts then the first rule of such a club would be that the mob rules. Thank god we are not a democratic republic, and their is still time for the federation to repair itself from such unethical laws in which the dead are treated like a the tar that paves the streets. If we were a society of free men we would respect the unadulterated wishes of the dead without the collectives of leeches spawning over the passing on of the legacies and bloodlines that made this nation great, prosperous, free and safe. Simply because we are a democracy does not mean we should be granted, nor should we use, the right to give rise to a Total-Institution in which the state robs the dead and their families. We who live with a love in our heart for a peaceful and free homeland cannot allow the government to blind and tax us for a government apparatus that uses more resources than necessary to solve our private and common desres and problems- which is why we cannot feed into the myth in the infallability of public government. We must first learn to govern ourselves privately free of the burdens of a confused and inefficient public (government). The more they raise the taxes, the more inefficient they will become as they become used to running at the same level of inefficiency. They will continue to waste more cash on needless programs, and they will only pressingly ask for more of our money. If you died, having paid your dues, why would you believe in a system that did not pay its own dues? The system, since its inception has been blessed with the flow of cash charities and taxpayers, and especially blessed with the blood, itself, of patriots. The system will forever remain in debt to such people. So why must the people suffer its unethical and thoughtless taxes?

Please note that I am not anti-tax, I am against theft under the guise of the right. If it were right it would not be a rule of the mob.

Inheritence taxes are robbing the middle class of the chance to continue to develop all american, local, companies in all industries.Could you please paragraph that a bit? It's a bit hard to read in it's current format.

I do not want a simple or direct democracy as you claim, I firmly believe in constitutional limitation. On the other hand we simply disagree on where those limitations should be.

Me, I just prefer systems that work best and I DO believe in the right of a populace to dictate how it is to be governed to a greater extent than you do.

Many tyrants have said they were taking away democratic rights for the good of individual freedom, they were all liars.To wage war on poverty you first have to wage war

That might have worked if I had said war on poverty

Here look I'll say it now so your "witty" one liner works.

War on poverty.

Well now it's the wrong way round but still. I do what I can

YES, COMRADE JOSAK! YOUR AVATAR SAYS IT ALL!

It wasn't meant to be a witty one liner however if you see it that way so be it.

If you think you can defeat poverty by the pen then go ahead but defeating the ruling classes and all they have to lose will be difficult with a few strokes of your Biro.

Attitudes will not change just because you think they should, the only way to change things is to rid the world of those who seek to exploit others, would you be prepared to rise up and fight? Or more importantly would the poor?

Taxation isn't the answer when only a small amount is used for the purpose of assisting those who have nothing. There will always be a refuge for the rich somewhere, some country that doesn't like your thinking or some dictator who thinks your wealth will aid their power.

So to aid a war on poverty you must first start a war."Attitudes will not change just because you think they should, the only way to change things is to rid the world of those who seek to exploit others, would you be prepared to rise up and fight? Or more importantly would the poor?"

Ja, mein Führer. Wie kann ich Ihnen dienen? Heil dem Führer!

"If you think you can defeat poverty by the pen then go ahead but defeating the ruling classes and all they have to lose will be difficult with a few strokes of your Biro."

What made this nation a free nation started by what the pen bled onto the pages that became our law- the Constitution, the Bill of Rights, the Emancipation Proclamation, and the Patriot Act... maybe not the Patriot Act, but you know what I mean.

"Taxation isn't the answer when only a small amount is used for the purpose of assisting those who have nothing."

Taxes ought to used as public sector industry start up money. Any politician who says otherwise is wearing his ass as a hat. Period.

"to aid a war on poverty you must first start a war." To end poverty you need a productive public sector that produces goods to be bought and sold on the free market. Such is the way of a mixed economy. Called it whatever you want- I guarantee that it will work to lower taxes and unemployment.

I think that the free market is the ultimate way to decide upon how one is governed. But I believe that one of the most effective ways to drive out corruption is to create a public sector that produces goods and services that will cause taxes to lower and unemployment to reach zero.

Unemployment would never be allowed to reach zero because that is not good for the economy. Zero unemployment implies that workers would be free to walk of of their jobs to another employer. What government or corporation would ever tolerate that? As long as there are unemployed, then the threat of unemployment is real which keeps workers obedient and hard working, and enables said corporations to depress salaries.

The government couldn't prevent 0% unemployment, even if it were possible on more than just a theoretical level. Incidentally, unemployment is what prevents companies form depressing wages and salaries, since workers have the option of finding new jobs if they don't like their compensation; full employment would remove this option, essentially trapping people in their current job.

The reason 100% employment would be a bad thing is because it would completely freeze the workforce. There would be no new businesses, existing businesses wouldn't be able to expand, and anyone leaving the workforce (illness, injury, retirement, or death) would seriously disrupt the ability of their company to function.

As a practical matter, full employment is impossible due to new workers entering the workforce everyday.

You are succinctly correct. There are many people who decry wealth, ambition, and success. These are the same people who glorify the poor, feeling that these people are such through no fault of their own. Yes, there are those in this society who want handouts because they refuse to take responsibility for their individual lives. They live in a world of self-gratification without thoughts of their future. These are the same people who unthinking act upon their baser desires. Need I say more!

I definitely beieve that it is EGREGIOUSLY UNETHICIAL to have an inheritance tax. Why should people pay taxes on what their parents and/or grandparents worked and saved for. There is an entitlement mentality among many poor people in this society. THEY want to live the good life but they are UNWILLING to sacrifice and work for it. THEY would rather indulge in their self-gratifications and present moments than to assess and plan for their futures. I agree with your premise that welfare needs to be scrapped, except for the mentally, emotionally, physically, and psychologically handicapped and the elderly. All who are ABLE-BODIED should be mandated to work. If they DON'T work, well.......too ------------ bad! Tough love is needed to reform welfare.Whoa! Tough talk and without a care for being PC - wish I'd said it.

For you've got it right, right down the line. (except, of course, for the "UNETHIIAL" part... )

)

Sure it's ethical to have an inheritance tax.

Here's another question:

Is it ethical for capitalist pigs to be allowed to accumulate gross amount of wealth while millions starve?When has taxing the capitalist pigs ever stopped millions starving?

Its been tried many times but the leaders of the starving millions are to busy buying themselves expensive presents out of it.

What do you do with such corrupted power?

Perhaps we ought to go back to paying the churches- times were better than, no?

I agree. Taxes do not feed people, but wages do.

I think he was talking about the real starving John.

You'll have to run that past me again!

What people without food are not starving?Around thirteen to eighteen million men, women and children per year from starvation.(not including malnutrition). Every 3.6 seconds someone dies of starvation. In Asia, Africa and Latin countries it is said that 500 million people live in absolute poverty. One third of the world is well fed, one third of the world is underfed and, one third of the world are starving.

No, his statement was "Taxes do not feed people, but wages do."

The fact that there aren't millions starving to death in the western world is because they are fed by taxes, not wages.janesix wrote:

Sure it's ethical to have an inheritance tax.

Here's another question:

Is it ethical for capitalist pigs to be allowed to accumulate gross amount of wealth while millions starve?

This is the post I first replied to John and I stick by my statement.

"When has taxing the capitalist pigs ever stopped millions starving?"Look around you. Compare today with the past when many of our own people starved to death, and that in recent history.

Here are some of my progressive views and opinions:

Personally I enjoy the sound of pigs being sent off to the slaughter house. But let us be rational for a moment by rephrasing your question:

Is it ethical for capitalist people to be allowed to accumulate a gross income while millions starve?

First off, where and who are these starving millions that you speak of? Surely no one in the USA is starving. Not even homeless people are starving in the USA- I would know so, because at one point before I began making 40k a year I endured such poverty and met with all too many homeless people to discover that they were all well fed and well rested.

Is it okay for people to starve in foreign nations? No, but nor is it wise to procreate in countries that have low educational standards, malnutrition, and rampant disease. Which is precisely what international free enterprise is fighting when it is providing livable wages to a growing global middle class. How do I know that there is a growing global middle class? Because part of my investment portfolio is dedicated toward business that are generating a middle class in South Korea, China, Brazil, Thailand, etcetera... not only is free market capitalism a means to provide for the general welfare of mankind by distribution of livable wages and accumulation of capital; but it is also a means to break down learning barriers and spread the wealth of the primary languages spoken in the world (ie: English, Spanish, Mandarin) Thereby actuating and progressing the world to a unified world of civil, social, and economic order.

So you don't think that's because the western world has had, historically, the most liberalised economy, no?

Would you mind proving that, statement, I think it's quite the opposite, the first world was the first part of the world to introduce large scale social regulation.

The industrial revolution occurred in the West through technological innovation that came from free-markets. The rest of the world was still operating under a mercantilist system at that time.

That doesn't show that we had a liberalised economy, quite the reverse in fact when some lived like lords and the many lived like pigs.

The 'liberalised' I'm talking about here is the classical liberal meaning, that is: freer markets. Not the modern understanding of the word 'liberal'.

Actually the industrial revolution was just the culmination of massive resources concentrated on a small area, those resources taken by force, conquest and colonizations all around the world.

As any historian will tell you the accumulation of wealth will lead to progress, ie. the renaissance began in the maritime states of Italy because they were ridiculously wealthy.

The accumulation of wealth allows the sponsorship of great minds and allows more people to focus on creating and inventing rather than simply feeding themselves. That lead to the technical innovations that created the industrial revolution, the free market wasn't the driver there it was that England owned more than third of the planet and raped much of it ruthlessly for tremendous amounts of wealth using government force to take it in the first place.

So no, not at all, laughably not.And it is the freer markets, the globalisation that has led to the decline of your county's industrialisation, the auto industry in Detroit for example which led ultimately the bankruptcy of the city itself. Be very careful what you wish for.

We need to live in a globalized society- furthermore we need to live in a globalized society with fewer language and cultural barriers. It is all a part of the process of branching out into the final frontier.

@ AS.

By fewer language and cultural barriers I guess you mean as long as what remains is American English and American Culture. Seeing as America is in its descendancy and Brazil, China, India and the Middle East on the ascendancy, perhaps your Education system needs to start teaching Portuguese, Arabic and Mandarin, and your culture should migrate its systems and values to theirs.

Undoubtedly America does affirm to some socialist policies (ie Social Security, welfare, jobs for vets, etc) however social regulations date back to the times of king and queens- serfs, knights, indentured servants, farms owned by royalty with portions leased to the peasants, etcetera. There is nothing new under the sun, other than the arrangement and orientation of the policies we Americans exhibit. To state that America is the inventor of socialism or communism is preposterous. Furthermore what do you mean by your usage of the dead phrase "first world?"

Having the most libertarian economy would explain why there is enough food for everyone in America. It would also explain why we have enough facilities for everyone to access in America as opposed to regions of India where there is one toilet for every 1700 people.

This may come as a shock to you but America is not the entirety of the western world, just a part of it and America is not the wealthiest nation in the world per capita, if America is successful because it's more libertarian policies are good then Norway as the most per capita successful and wealthy nation on earth proves that socialism is the best system. Right?

Anything but agreement proves you a hypocrite.Norway

Tax rate up to 47%+.

From a nation that is oil rich I think that is pretty disgusting

.http://mylittlenorway.com/2010/04/do-you-really-want-to-live-in-norway/Yeah, socialism works like snake venom. Josak, continue to live in your socialist utopia. Utopia is so grand to those who REFUSE to accept reality! la la la la la la la!

This is the WORLD that Josak wants:

Yup and yet Norwegians have 25% more disposable income than UK citizens and 19% more than American citizens so obviously the tax isn't too bad. Also Norway is less minerally and naturally rich per capita than either the US or the UK. Yes it has oil but it lacks the massive amounts of other minerals and it's cold climate is an impediment to year round farming etc.

The global natural wealth scale actually puts it quite low, one of the lowest in the first world.

I know you guys struggle with the facts and all but there they are.

They will of course be ignored in favor of more ALL CAPS insults or "witty" one liners.I agree. Perhaps if the nation's government produced anything and extracted the oil itself, then taxes and unemployment would be closer to zero. Who charges someone prior to services rendered but a tyrant or mob boss?

Such a luxury is reserved only for tyrants and mobs.

There are many varieties of socialism. I am all for a public sector that produces goods and reasonable services, however I am not for the statist totalities that come with the common socialist package.

In order to have a healthy economy I believe we need to have production in both the public (government) and private (individual enterprise) sectors. To say that Norway is better simply because they are socialist, seems to be an error in that the person making such a statement is missing the shift in economic trends that brought work to socialist Norway in the first place.

Name a product produced by a socialist nation such as Norway and I will provide a detail on how such work/labor/capital/interest developed or transitioned there that proves that libertarian values still hold up and are the driving force behind the shape of the world.

Indeed it did, and if it did not there would only be one toilet for every 1700 people in the US like parts of India, which has a less laissez-faire economy.

Which clearly tells you that unrestrained capitalism without some redistribution of wealth doesn't actually work for the benefit of humanity.

That depends on what your definition of humanity is. Some people are content with living as borderline beasts that make lower wages overseas.

Oh sorry, humanity is only made up of those that support the American socio-economic system. Everyone else can just f-off and die.

Perhaps society would be better if the unwaged found jobs or starved to death. I have run across a lot of unwaged citizens in America who I felt sorry for until I realized how much more of an animal than a person they were/are. Some people are just naturally bred to be losers and there is no saving such beasts. It is sad, but if you interact with people on a daily basis you will eventually find a beast in human clothing here and there. Perhaps it is genetic or perhaps such people are broken.

The complaints about the economy are typically coming from non college graduates or non science majors. The world we live in is becoming more technocratic every day and eventually the only way to prevail in the economy will be to have a fundamental understanding of the technology surrounding and effecting us. This is why it is so important for people to go to college for science degrees. Well paying labor careers have, for the most part, left this nation to stimulate the rising middle class throughout the rest of the world. This is unlikely to reverse and from the perspective of the American labor proletariat it will always be like this until they decide to go back to college for a degree that is pertinent to our current economic needs.If unchecked, taxes also prevent middle class business owners from providing decent wages.

The unwaged are unwaged because they failed too many tests and continue to fail to start up an enterprise.

Continuously, we have millions of people fed of taxes in this country. You certainly had many people starving in England during the industrial revolution etc. I notice you don't now.

But the capitalist pigs don't pay the most taxes, the workers do.

Well first off that is not true, but even if it were that would be fine, everyone has a duty to contribute what they can to the country and society that in turn helps them. That is most certainly not restricted to the rich.

Capitalist pigs? If I were to own capital would that make me a bourgeois capitalist pig? Or would I simply be a freeman with invested interests?

We needed the industrial revolution to get to where we are now, and whether or not people were really starving during the acculamtion of capital which brought about the I.R. is debateable. You cannot believe everything that your parents tell you about how hard their lives were; it's often hyperinflated dialogue to keep you on the straight and narrow with a job and home... not that having such an inventory is a bad thing.

The industrial revolution was a good thing, the conditions during it were not. It's not a matter of stories from people there but raw statistical fact. Children dying in factories at age 9, work houses just to have somewhere to put the masses of indigent, 18 hour work days seven days a week, reduced life expectancies etc. etc. it's all a matter of public record.

I have worked 7-18's before; it is not something that can be sustained by the human body for more than a few days. Don't believe everything you read.

I have done similar 6 days a week when I was a teen. It kills you slowly but it can be done. Hence the reduced life expectancy. This is not something I just saw somewhere it's part of the sworn testimony of thousands of workers and church leaders which lead to introduction of the first maximum work hour day in the UK which I believe was 15 hours. 14 for children under 12.

Trust me it can be done when it is that or starve.Trust me, 7-18's canNOT be maintained. There wasn't a single person in our 50+ man crew that managed to make even 6 weeks of it without time off. Lunch time (1/2 hour) always saw multiple people not coming back after a week or so - good intentions, but asleep in their car. I know - it happened to me.

6 hours per day to eat, sleep, commute and take care of daily necessities cannot be done for more than a couple of weeks or so. If starvation is the result, then people will starve. No one can maintain a work schedule of 126 hours per week plus living necessities at home.Look I have done it but I can't prove I have, there is plenty of sworn testimony from hundreds of people and community/church leaders but I guess it's possible they are all lying, they do have some cause to since they are pushing for a 14 hour limit.

The human body is capable of a whole lot of things one can't imagine it is when it needs to be.

I can't imagine there is any value to arguing it further if no one can prove their point.OK. I didn't video tape anyone asleep in their car, I don't have pay stubs for everyone during the period, and if I did I did not record that boss asking for 18 hour days.

Have it your way. Although I note you claimed to work 6 days, not 7. That, I think could be done.Oh OK I see...

I have done such for six days out of seven, I know that is possible.

There are plenty of sworn statements to such for seven but I concede there is some possibility of dishonesty.

Is that an agreeable compromise ?

As I said I can't think of any way to prove either claim correct or incorrect. I do however question the comparison between people working to make something extra to take home and someone working to not starve and to keep their family alive.

I don;t think that is having it my way

Wilderness, you are talking logic to a person who is-----------. Best to ignore! Man is living in Utopia and NOT in real society! Leave it at that.

Perhaps those starving millions should have worn condoms. Perhaps they should have had to earn a license to breed.

Regardless as to whether or not I have a soul- those millions of others who you referred to brought on themselves.

Prey tell, if the starving millions can't afford food, how would they afford condoms?

There are plenty of groups out there who give away condoms for free to the developing and undeveloped world. the problem is that the belief systems- the religions and other superstitions condemn the use of condoms because religions such as Islam and Hinduism in such regions believe that such practices of safe sex create female promiscuity. Also, what are poor people doing having sex in the first place? Sex should be regarded as a luxury reserved only for those with wealth. If we need to add to the (overpopulated) labor force any time soon we could always make the perfect genetic specimen for intensive labor provided by the miracles of science.

I am 100 percent sure that they did. If their lives ever meant anything to anyone, especially themselves, they would fight for a change.

And please don't add countries like Egypt, Iran, or Greece to the mix- they are already developed nations and they are demonstrating themselves the way freemen ought to demonstrate themselves in the face, and behind the back, of tyrants.

No really they did not in the slightest, particularly and most simply (you should be able to grasp this) the children.

If a child is not able to spot something as out of place as starvation then there is absolutely no hope that the child will become an able bodied revolutionary force in future democratic actions involving altruism. Evil exists in the world not simply because good people stand by while evil people run amok, but also because sometimes good people fail to pull the plug on neutral and evil people.

Inheritance tax, like all taxes, is legalised theft and nothing more. Just as you wouldn't personally point a gun at someone demanding that they share their inheritance with the poor, you should not vote for a politician to do it instead.

Well put- most politicians are nothing more than thugs behind bullet proof glass here to scare and shake the masses down. I bet that if the government disappeared, politically, for four years America would still be running herself- perhaps even more efficiently.

The inheritance tax works out well for the fascist "corporate race" that controls the government. Being immortal, the "corporate race" never needs to take part in this taxation!

If it's too small to read:

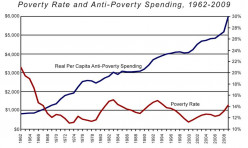

It seems as though government spending on welfare programs has done very little to lift people out of poverty.Yeah my guess is you are using the woeful American welfare system, probably the most right wing first world nation, how about you have a look at the first world nations with the biggest welfare states and a list of nations with fewest people under the poverty line and you will see remarkable "coincidence".

Also try economic mobility and generational mobility.The disparity between the efficiency of each nation's social programming probably has something to with the mentality of certain employees. Unfortunately there are too many lazy or dumb people.

Unfortunately euthanasia of such individuals is not yet legal.Ah eugenics. Perhaps you should look up what happened the last time a group decided that euthenising such people for the same reasons was a good idea. The dumb, the lazy, the criminal, the disabled, people with learning disabilities...

Hint it happened in Germany circa 1940s.One word for you, "SPARTA." Think about it.

Nazis also had sex and marriage- I do not see anyone condemning those acts. Just because the NAZIs did it, does not mean it was bad.Yeah Sparta was probably the first fascist state. I honestly doubt you would like to live in such a system.

Massed forced military service, no freedom of speech no personal property. How would you feel about the compulsory homosexuality btw? Popular culture often ignores that titbit

To state that Sparta was fascist would imply that there was a marriage between the Spartan state and corporations- there were no such corporations married to the state, thus your choice of the word fascism is skewed and one can only presume that you were using the word fascism in a derogatory fashion.

Fascism has only worked or been implemented, to my recollection, once in recorded history- Italy under the rule of Mussolini.

Was city-state, Sparta, a Total Institution? The answer maybe a "perhaps." Then again, it may have been warranted to be so, as it existed during hard times when Sparta was constantly threatened by the imperial conquest of powers such as the Ancient Persians.Have you forgotten Hitler? The worst fascist of them all!

My friend, hitler was not a fascist- although he did ally himself with fascists. The last time I checked the abbreviation, Na.Zi., stood for what translates into Nation Socialist. Hitler lived and died as a NAZI. A major difference between the two ideologies is that all, or most, enterprises or industries become owned by the state under a national socialist regime, whereas all, or most, government work is outsourced to private contractors under fascism.

Oh boy!

Hitler wasn't a fascist!

Here's one definition of fascist -

"A system of government marked by centralization of authority under a dictator, stringent socioeconomic controls, suppression of the opposition through terror and censorship, and typically a policy of belligerent nationalism and racism."

Care to point out where Hitler diverged from that?

Don't be fooled by names, anybody can call themselves whatever they like, or use the name of any political party they take control of, using that name doesn't make them so though.

As for all or most enterprises being owned by the state, that didn't occur under Nazism, most work was indeed outsourced to private contractors.Your definition for fascism, as bad as it may be, is inaccurate.

Fascism is nothing more than a government bought and paid for by powerful private monopolies.

Nazi Germany was without private monopolies as nearly every industry was owned by the state after their banking system collapsed (prior to the onset of the Second World War). Hitler wore a swashtika which became the official emblem of the NaZi party. He did not wear the column/pillar that became the official emblem of the Italian fascist party. Nazism and fascism are too completely different forms of economics- and it is a surprise, when looking back, that the two parties were allies at. The only explanation for the pact between Mussolini (leader of the fascist party) and Hitler (leader of the National Socialist Party) is that Mussolini needed someone to protect him for crimes against humanity carried out against his own people. What better choice is there than to either a) discontinue crimes against humanity, or b) join the ranks of one of history's most inhumane leaders? I cannot believe I am having this discussion- there are no other correlations between National Socialism and Fascism other than the pact between the Italian Fascist Party and the Deutsche National Socialist party.

You are using the term, fascism, incorrectly. Nazi Germany would have had monopolies running the government if it had been fascist, however it did not. Corporations did not own the airways, the trains, the automobile industry- the state, for the most part did.

Under a fascist regime all government officials cater to the will of monopolies. Whereas, under a national socialist regime, all corporations cater to the will of the state.

Lastly, these two systems are forms of socioeconomic theories. They are not official state government theories. Examples of state theories include: republicanism, federalism, monarchy, theocracy, confederacy, democracy, etcetera. Technically NaZi Germany and Fascist Italy were democracies that voted away their rights, which can expand on another point of mine- democracies ultimately fail as societies on behalf of losing laissez-faire and the rights of all free men. In true democracies, direct democracies, the ultimate rule is that of the mob, regardless of how well informed the mob is. Four examples of democractic powers that have failed are: Sparta, Nazi Germany, People's Republic of China, and North Korea.

An example of a power that is as close to democracy as any land can ever permit itself to become is the Federal republic of these United States of America.

Feel free to brush up on an objectivist education of economics, government, and history.

Bottom line: if you cannot correctly identify a target by its true classification then you should not be firing the shots.

Fascism and NaZism, as similar as they may have seemed during World War Two are very far apart in their actualizations. Both of them began with democratic virtues and principles however Hitler and his brutes (the state) took the rights away. Mussolini, in the invested interest of securing a monopoly of capital enterprise, via state funded corporate entities, took the rights of men away.

One is rule by the state, the other is rule by the company. Neither of the two practice(d) true laissez faire. It's dangerous to confuse socialism with fascism for many reasons, one being that if you see them as one and the same you confuse the way in which they rise to power and the means to safely and effectively dismantle them from power. For example if you lived in a fascist society, but you thought it was national socialist, corporations would not hire you if you had an arrest record for protesting the government because they may see you as a type of rebel rouser in favor of idealisms in the likeness of unions and welfare. If you lived in a NaZi society, and you were to protest against what you thought to be a fascist society, they would likely kill you or use you to become a spy against the threat of communism, fascism, and any other party not favorable to the power's that be. Likely you would not have any rights such as a right to an attorney, a right to trial by peers, a right to assembly, nor a right to any of those other rights you may have voted away during the days of democracy. While they both may exhibit totalitarian aspects they exist on two seperate sides of the spectrum. One is for overly centralized business and the other is for overly centralized government.

The only way you could maintain such a hybrid system that is both overly centralized in government and business is to have a very large conspiracy of very powerful and wealthy men in which the elections are entirely rigged, candidates are carefully groomed, a society of workers who are over taxed, constant states of warfare to acquisition resources and cheap labor from regions abroad, a constant state of fear perpetuated by monopoly and government owned news media, large amounts of prisons, inadequate education institutions, a very powerful centralized banking system free of investigations by the state powers, secret court systems that do not grant constitutional and/or human rights in the likeness of our Bill of Rights, secret articles that violate some type of constitutional legislation, the entire legislature would have to be bought out, and those men in uniform would have to have little IQs if they actually believed that they were in service to some type of constitutional power that grants all of Mankind their inalienable freedoms.

Also, you may have to cook the history books for such a collusion of big government and big monopoly powers to survive in an apparatus under the guise of a democracy or republic.

I think that both parties are bad for the security and liberty of Mankind, however it is important understand that they are different and what makes them different if you want to prevent an entire nation from becoming such a tyranny.I heartily agree. First brush up on your education and then you will not fall into the trap of incorrectly identifying your target.

You are full of so many incorrect ideas that even starting to correct you fills me with weariness.

If we had a federal government that was run in accordance with it's Constitutional limits, including, but not limited to, the 10th amendment, then we would not need to have punitive taxes including the"death" tax. I also agree, and have written on, the need to abolish the minimum wage. Well posed question, Andrew.

The best scenario, and one I think was envisioned by the founders, would be the Constitutional Republic they set up and one that embraces Capitalism, not to be confused, as often is, with Corporatism.Thank you. I agree for the most part, but I am not sure if corporations in general are bad as not all corporations are as massive as their stigma causes the masses to believe. I know of plenty of small corporations. It is important to note that not all corporations pave the road to tyrannies in the likeness of fascism, but that all fascisms put the corporations to work paving the roads of tyranny.

I am content with mixed economics that permit the growth of capital through the means of laissez faire, so long as everyone has an equal opportunity to become an educated individual within society. While we may need taxes for certain things to work, I feel it is time that the government lowered taxes, relinquished a couple more of its duties to private institutions under careful regulations, and did away with arbitrary laws regarding minimum wage limits which are preventing many small businesses from accumulating enough capital to provide for their workers and the desires of consumers. Of course some minimum wages would be too low at first, however as the accumulation of capital continued the businesses would be able to provide more for the consumers and higher wages. And of course people have a right to assembly and peaceful protest which would cause unions to naturally form among men and women to boost wages if need be. However, I believe that unions should only last as temporary entities that fade out once the needs of the worker are matched. Unions, like any other power become corrupted with the transitioning of power, which is why workers should amass and disperse- unionize and then settle for what they feel they have earned. Power tends to concentrate as it matures if you allow it to stagnate- eventually you end up with a pool of bloodthirsty insects if the pool is not distributed among the garden in a reasonable amount of time.

Inheritance tax is for the ultra-rich, to make sure they don't amass empires to hold in their family and pass down generation to generation (which is what they're trying to do now . . . and can by our new laws that some of them passed, while in office recently). The tax doesn't apply to people who have small holdings. Even the majority of farmers in the grain belt of our country have said they don't apply to the land they hold. And some of the ultra-rich say we SHOULD have estate taxes (i.e. inheritance/death taxes) - Bill Gates and Warren Buffett, for example.

People should be allowed to be as wealthy as they want. What have we become in the days that we assemble together to take a share of the weath from men and women who earned it? What are we other than a mob when we rob the graves of dead men for their buried and invested treasures? What are we but a covenant of vampires siphening off the wealth of bloodlines that are accumulating capital within our homeland? What crime is there in passing the flame on to the next generation and the people that you trust to continue pumping cash through the arteries of our economy?

The inheritence tax hurts the middle class and impoverished class just as much as it hurts the wealthy. It stifles the growth of local, state and national capital, as it trusts statist bureaucrats moreso than the libertarian free thinking men and women who give this nation its tenacity and innovation.Are we really supposed to believe that somebody paying tax of 40% on an estate of $5 million + is going to suffer! And in case you miss that, $5 million and then 40% of everything over $5 million.

I'm sure that somebody inheriting only $5 million is really going to be impoverished!

Hurting the impoverished class! You're having a laugh.40% of any man or woman's income is more absurd than the kind of taxes that were imposed upon the colonies of Brittain. When any man is threatened with having 40 cents on the dollar taken away from him you live under the rule of the collective mob. Who am I to tell someone that they cannot inherit a legacy that was already taxed onto the death of the previous owner? Whether it is is five thousand or five billion dollars, taking forty percent away- taking one per cent away- from previously taxed dollars is robbery no matter how you frame it. You cannot allow the collective to rob the individual of his grave and legacy after said individual already did his part and shared his income with the collective, via living taxes while he lived and worked.

Death taxes are as absurd as serfdoms and monarchies in that they rob people from a decent chance to stimulate the economy of the living.

Let sleeping corpses rest in peace tax free.

Obviously such idealism is an absurdity in the mind of the statist who operates on blind faith to failing bureaucracies that rob all classes of their security and liberty.But an inheritance is not somebodies income, it's a gift.

And what is all this about being taxed to the death of the previous owner!

When my father died he left quite a few pounds, We happily paid inheritance tax and still had a big lump of money that we had done nothing to earn. The lump that we received was mostly made up of the proceeds from the sale of his house and a good 75% of that was made up from property inflation, he didn't work for it and had paid no taxes on it.

And why does that tax not stimulate the economy? It isn't taken out of circulation burnt or any thing like that. It is spent and spending stimulates the economy, unlike money sitting in somebodies bank account.A gift? Please.

If it were okay to tax gifts half of all presents handed out around the menorah or Christmas tree would be confiscated by the Feds each year and distributed throughout the ghettos of America.

Giving away 40 percent of your families' estates is an injustice if I have ever heard of an injustice. Americans have the constitutional right to not quarter soldiers, so why do we quarter bureaucrats?

That 40 percent is not stopping the growth of poverty, it is lining the pockets of politicians who have invested political interests which feed off of the fear of their base- the lower castes. It is not the government's place to regulate not stimulate an economy. If it were, we would all have began speaking German after the last world war.

Private property does not belong to the state simply because the owner passed over. It belongs to his legacy- his heirs.Nobody gives away 40% of an estate. Remember, the first $5 million is free of tax.

Is anyone paying attention to the shenanigans so many ultra-rich play in order to get that money in the first place? Seldom are they above-board. They set up nominal headquarters in other countries, so they can avoid their fair share of income taxes. They pay big bucks for accountants to go through the tax code for every loophole they can possibly take advantage of, whether or not it was intended to apply in their situation - and most weren't. They even reorganize their companies to avoid paying taxes. Yet they consume more of the services provided by those taxes than any of the millions of people in the middle or lower classes. So who's paying for the public services they use? This is some of what the estate tax is attempting to recover.

I would venture to say, actually, that those ultra-rich who support the estate tax, seeing it's value to society and themselves using their money to benefit society, are people who played fewer shenanigans than the ones who pay politicians to eliminate estate taxes. Think of Bill Gates. What? You laugh? He played shenanigans, didn't he? The others play many more, but keep them well hidden.First of all, the top 1% of wage earners in this country pay for 30% of this country. Just something to think about the next time you want to start accusing people of "not paying their fair share".

Second, the bottom 20% of wage earners in this country actually have a negative tax burden. That means that they receive more from the Federal Government than they pay in.

It sure is popular to criticize the wealthy, these days isn't it? As a business owner, and member of the 1% myself, I've gotten used to it, it sorta comes with the territory. Perhaps though- just perhaps, if more people spent less time vilifying others for being successful, and a little more time working on becoming successful, then perhaps there wouldn't be such huge disparity in income levels.

But hey, what do I know, I'm one of those "evil 1%'ers".

Sources: The Tax Policy CenterI figured you were. So do you pay social security taxes? No? You must earn more than $87,000 per year? That's when the social security taxes are no longer required. So anyone earning more than that doesn't have to give money away to the government. They get to invest it themselves and earn income from it. And social security taxes have been going up since 1983 for those who earn less than $87,000 per year.

So you say that the upper 1% pays 30% taxes? Are you talking income taxes? After business deductions, right? Which decreases their income to almost nothing, the way they arrange things. 30% of that, then?

With estate taxes (back to the original topic) according to what I understand, the actual rate paid is more like 4.9% for the upper 1%, whereas the statutory rate is 35-55%. Who covers for these missing taxes? The middle class.

Then there's all the income top executives defer, so they don't have to pay taxes on it. They invest it instead or, in most cases, take it in stocks options, rather than salary. That's a permanent tax deferral, for those who can afford to get paid lower salaries, while they meanwhile are "earning" interest on their tax free investment. So are those the estate taxes the upper crust is trying to avoid paying?

Source: Perfectly LegalYou're confused on how Social Security taxes work. Everyone pays Social Security taxes (even us evil 1%'ers

) on the first $114k of income. I also have to pay Medicare tax on everything.

) on the first $114k of income. I also have to pay Medicare tax on everything.

The top 1% pays 30% of all Income Tax in this country. (Source cited in previous comment).

I'm not sure who's teaching you economics, but you need to fire them immediately if they're telling you that stocks are a "permanent tax deferral".

There is a simple reason why the wealthy hire accountants and lawyers to handle their taxes, at least for me there is: I'm a fairly well educated man, I have degrees in Marketing and Economics from the University of Florida (go Gators!), and if you held a gun to my head, I still wouldn't be able to do my taxes by myself.

I hire people to do my taxes, not because I'm looking to dodge paying (although believe me, I don't want to pay a penny more than I have to), but because that shit reads like something out of Star Trek. And the IRS isn't exactly known for being the most understanding branch of the Federal Government when it comes to mistakes (just ask Willie Nelson and Wesley Snipes).You're right. I miswrote. Everyone has to pay SS on the lowest portion of their income . . . which is almost nothing to the ultra-rich, but can make the difference in survival for many of the lower income families. And as I said before, they've been going higher, even as politicians claimed they were lowering taxes for the middle class. Now, between those and the alternate tax (stealth tax) that nearly everyone is paying now, taxes are actually much higher for the middle and lower classes than Bush (and other "leaders") led us to believe they would be in his campaign "promises."

To put it into an overall perspective, the Bureau of Labor Statistics' annual consumer expenditure survey for 2001 showed that those making over $116,666 (top 20%) paid 19% total taxes that year (state, local, federal, income, etc), whereas those in the bottom 20% paid 18%. Essentially, when you count all taxes put together, Americans are paying a flat tax across the board . . . which kills the lower majority, who can barely afford food and housing, and is nothing to the upper crust with all the advantages.

And don't tell me someone starting a business who is scrambling for food has equal opportunity with someone whose folks have boucoup bucks they're willing to lend and a mansion for their children to live in until they get going on their own (not to mention higher level college degrees like you and I).

I have done. I was an economist promoting international trade before switching to environmental writing a few years ago. I didn't have deductions beyond your basic business and some inheritance moneys, so it wasn't too difficult, but I totally agree about the mess the tax code is in. I actually think we need to start from scratch and devise a whole new system.I don't get where you get the idea that opportunities need be equal. If someone has parents that can provide for their child a comfortable lifestyle, and they choose to do so, what business is it of anyone else? I don't know how this notion got so ingrained in everyone's mind, that success is somehow a Zero-Sum game. Just because someone has a better situation that you, doesn't diminish your opportunities. I went to school with kids whose parents were extremely rich. it didn't prevent me from getting an education.

And I know I may get a visit from the ghost of Christmas past, but I didn't bust my ass in college to provide a comfortable living for the poor. I didn't work 90+ hour weeks, when I would sometimes go days without even seeing my kids, just to make sure that someone else's kids could go to a good college. I worked hard for my degrees and built my business to provide for my family, if others were either unwilling or unable to do so, then that's sad, but it's not my problem.

You ask why I use tax shelters and keep as much of my income out of government hands as possible, it's because I work to provide for my family, not yours or anyone else's. I have no problem with paying income taxes, as Oliver Wendell Holmes said: "taxes are the price we pay to live in a civilized society", but expecting me to pay above and beyond just because I've been successful and can afford to, is delusional to the point of absurdity.

As for the tax code, I completely agree, we need to scrap it and come up with something that people can at least understand.See, the thing is, Shawn, and this is where I think people are getting confused (not necessarily you), the estate tax is not a "death tax," i.e. it's not a tax on the person who died. It's an income tax on those who receive the inheritance unearned by themselves. It's like, everybody is required to pay income tax, no matter where the income comes from.

Some say it's money that's already been taxed, but that's not the point. The money I get as a salary from employment has already been taxed from somebody too. Probably all money, except that newly minted, has been taxed from somebody.

The point is that any person receiving money from any source is supposed to pay income on that money. (Little gifts from parent to child don't need to be taxed, but substantial income, yes.) The estate tax is an income tax being taken from those inheriting the money.Therein lies the problem. That was not supposed to be the case. We need to repeal 1913...IRS, The Fed and all things related to it. The tax code as expanded exponentially over the years to coincide with the federal government and it's unConstitutional expansion and associated spending. If the federal government was restricted by the Constitution we wouldn't need this absurd amount of confiscated funds in the first place. The federal government's refusal to be limited by the specific enumerated powers put forth in the Constitution and the further limits of the 10 Amendment are at the core of the tax and spend issues we face,

The problem with that theory is that the money is still part of the same estate. Under your premise, if we are to assume that the money is actually "income", then only the portion withdrawn form the estate should be taxed, and only at the appropriate bracket rate.

The fact that the money has already been taxed is precisely the point. And yes, the money that you receive from an employer may or may not have already been taxed, but that's irrelevant because your employer isn't paying an additional tax. Any applicable taxes have already been collected, and that transaction is complete.

When you earn income, you are being taxed on what is essentially "new money". Inheritance is not "new money", it's already part of an existing estate, it's simply coming under the control of a new individual.

The estate tax is simply the government taking a "second bite at the apple", since the only person who would have standing to challenge it, is dead.There's no "simply" about it. That's exactly what's happening. It's income to a new person or set of people and should be taxed. You're treating the "estate" as though it's a living entity that's bigger than any individual. It isn't. It's an inanimate thing that acts as income for a new set of people that should be taxed.

This is one point on which we're simply going to have to agree to disagree. Economists, politicians, scholars, and philosophers have been debating this issue for thousands of years, so I doubt you and I will finally be the ones to "crack the secret".

Why do the captains of free enterprise need to be above board all the time when they have people they pay handsomely to do the work?

Fair share of taxes? Please. Taxes should not have to exist in the first place; unless the there exist state and federal emergencies. The public sector should be generating its own income to curb unemployment and lower taxes.

Loop holes exist for a very good reason, they serve to make the fabric of society all the more impermeable.

The estate tax is unjust because it steals land, money and other assets of possession from the dead. The dead paid their fair share while they were living and it is nothing more than robbery by the rule of the mob when an enterprise is commandeered by an organized mob that preaches that its actions are on behalf of the people.

Stop the estate tax, lower all taxes, create a self-sustaining public sector, and then maybe I wont consider taking my enterprise with decent salaries overseas.

You used the term, ultra-rich, as if it were derogatory- as if it were bad to be someone with great wealth.

I too am calling shenanigans against you and all people who are in your likeness. Shenanigans to the people who want the government to be propped up like a cane for the lazy and weak.

I was lazy once, but I woke up when I heard the alarm.

I too was weak once, until I worked out my mind and body, then I joined the US department of defense which made me stronger. At the end of my term, I enrolled in a college where I strengthened my mind- my soul.

I am above this pseudo-Christ mentality that the rich do not deserve wealth and happiness like everyone else. If ever a prophet in the likeness of Sustainable Sue turned me away at the Pearly Gates because I made some worth out of my life on Earth, I would drag them all the down to the fiery pits to where they unjustly condemn me.

Do you want the private sector to consume less services from the public sector? Then start up a free enterprise to provide such services to other such private enterprises.

Do you want the federal or state government to lower taxes? Then open public tax free commissaries that have goods produced in the US, more importantly: by government employees itself.

The solution is never to go to some distant neighbor's estate (ie Mr Gates) and take forty percent of his belongings and income (dead or alive). When you follow down that path you may as well be wearing a swastika or ski mask on a warm summer night.

Would you strip a cadaver of their clothing and other possessions simply to add to your wardrobe? Would you dig up a cemetery to loot the treasuries of the dead? How long do you think such a practice would last?

I would rather have all of my estate burnt to ash than allow one penny to go to support a non-productive and inefficient system that feeds itself by taking a portion of the freeman's earnings. When you pay off a debt to society, you do not have to continue paying for it after you died. When you do a service to society by leading a productive enterprise that generated livable wages, you should not bear the punishment of having to pay into a pyramid scheme.

Make the public sector produce goods. Have drive competition in the market. This is how a mixed economy is supposed to function. Taxes are only this high when you live under a totalitarian regime in the likeness of fascism (welfare of the corporations) or socialism (welfare of the people).

John, you stated the "We happily paid inheritance tax", which is basically a non sequitur, as you had no choice but to pay it. Now if you had been given the opportunity to keep it all or give some or all of it to the government, then your statement would have weight.

Secondly, regardless of how you father earned it, whether through the sweat of his brow, ingenuity or simple "good fortune" by way of making a good real estate transaction, it was HIS money to give to who HE decided.

Finally, the money that is taken by way of confiscatory means does not have the same economic (in real economics) effect as those dollars spent and invested by individuals and businesses. Bureaucracy eats up to much and it is usually misspent as well.Happily as in we didn't have to squawk about how unfair it was and how it was really our money, even though we had no hand in the acquiring of it.

My father consistently made bad real estate transactions. House inflation was right outside his remit.

In what way does money spent by a bureaucrat behave any differently to money spent by a none bureaucrat?SO, if I give you a birthday present, you should pay tax on that? What difference does the "event" or size matter? You say he did nothing to earn the money (except invest)...what did the government do to earn it???

If you take a dollar from someone who earns it and send it to Washington (or fill in any central government) it must be whittled away to pay for those in power to administer it. The salaries, expenses etc of the bureaucracy all go towards reducing each dollar that is confiscated before it is spend. Add to that the utter mismanagement of most, if not all, government spending and you have your answer. If you, on the other hand, as the one who earned the dollar spend it yourself, then the entire dollar goes directly into the marketplace. It is simply economics 101.

John, at point does your money become yours and not the property of the State?The salaries, expenses etc of the bureaucracy are spent in the market place and stimulate it.

I don't get this idea that (a) spending money stimulates the economy but (b) spending exactly the same amount of money doesn't stimulate anything!

In many parts of this country if you die intestate the Crown takes 100% of your estate however large or small. That is bad.When did I say it was an all or nothing? I did not say that the confiscated fund do not effect the economy, just not to the extent that the same dollar, without the cost of bureaucracy, would have. Because it is NOT the same amount of money.

Again, take the dollar, then take out the costs associated with administering it though a government bureaucracy, and you are left with less money to invest in Product A or Service B in the private sector. If spend $100 at Store A, the government would have to confiscate more than that from me to spend the same amount in Store A.

And again, what right does the government have to take your money to give it to someone else? Regardless of efficiency, it is a matter of understanding the right of ownership. What % of YOUR money should you be allowed to keep? Give me an actual %... Federal expenditure, here in the States and according to the Constitution, it was supposed to be limited and only for things that affected the Common good, meaning something that was for everyone. Such things as common defense etc. It was never meant to spent the way it is now, nor was it meant to go up to the federal level and then fought to be brought back to individual States.How can a $100 not be a $100?