What does it mean that 7,000,000+ people signed up for Obamacare?

By the time the dust settles, there will be more than 7 million paying enrollments into the Obamacare program through the Federal, State, and off exchanges. It also appears that the mix of young and old, while not ideal, may not be too bad; although that remains to be seen.

What does it mean that the original CBO projections were exceeded; the scaled back administration projections were blown away, and the sky-is-falling prognostications last November were so much hyperbole?It means that there are 7 million additional people taking from the government coffers to buy something they want but don't want to pay for.

It means that government expenditures have skyrocketed.

It means that there are millions of people out there destined to be sorely disillusioned when they need health insurance and find that what they signed up for is worthless.

It means that the road to US bankruptcy has become a four lane speedway instead of a country road.Wasn't that happening anyway with you paying higher taxes and premiums for their emergency room medical bills?

Also, I bet the diabetic person who was denied insurance because of the pre-existing condition or the cancer patient who was dropped because it cost too much will probably disagree with you.No such thing, the system was fine before. There was ALWAYS free or very low cost heath care before Obama took over with his mandated Obama"care". People weren't denied medical care because they were too poor. Hospitals always provided low cost or free care, even pay as you go care. Obama should have LEFT things ALONE!

the system was fine before

People weren't denied medical care because they were too poor. Hospitals always provided low cost or free care, even pay as you go care.

On what planet?

Not sure what taxes have to do with people using health care they can't pay for. Unless you think hospitals are reimbursed by Uncle Sam for freeloaders?

You really think someone dropped because it cost too much will now say that government costs are not skyrocketing? Or that people aren't being subsidized for health insurance? Why would anyone make such a claim?Who do you think pays for people who go to the emergency room and can't pay for the service? The hospital sure doesn't absorb the cost, the sick person generally does not; they can't afford it or it drives them bankrupt; the insurance companies don't, there was no insurance to start with - that leaves you, through your local, state, and federal taxes as well as higher healthcare costs from the part the hospital's do absorb.as a loss.

Well, until the CBO reverses itself, I don't buy your skyrocketing argument. So far, Medicare costs have actually fallen and at this point in time, healthcare costs have stayed in line with normal inflation.

And those whose insurance was dropped will understand they are part of the reason costs skyrocket because somebody has to absorb the cost of their care since they can't. Who do your think pays for it, the money tree? Or do you think they just become altruistic and die for the better good?One of us needs a little enlightenment. Perhaps it is me, but I have a hunch it is you.

For instance;

"Who do you think pays for people who go to the emergency room and can't pay for the service? The hospital sure doesn't absorb the cost.... that leaves you, through your local, state, and federal taxes as well as higher healthcare costs from the part the hospital's do absorb.as a loss...."

Yes, the hospitals do have to absorb the cost of services they provide to the uninsured.

No, hospitals receive no Fed., State, or local taxes as compensation for unpaid services they have provided to the uninsured. (unless you can stretch the argument from A to G to X, and back)

But yes, you did get the part about it causing healthcare costs for the insured, (and others that actually pay), to rise. I heard two out of three ain't bad, but I don't know about one out of three...

Here is an article from the NC Medical Journal that does a decent job explaining it:

How hospitals deal with the cost of the uninsured...

You went two for two on your costs points.

But...

"And those whose insurance was dropped will understand they are part of the reason costs skyrocket because somebody has to absorb the cost of their care since they can't...."

What? I am part of the reason for the costs skyrocketing? Because Obamacare caused my self-paid coverage to be dropped? So, I was paying for my own coverage, (which I was very pleased with), then Obamacare set new rules that caused my plan to get dropped, (don't make the mistake of trying to educate me that I really only had a substandard junk plan), and now I am part of the problem?

You're going to have to 'splain that one to me.

GA"healthcare costs for the insured, (and others that actually pay)"

Particularly the "others that actually pay". They don't have the ability a 10,000 member insurance consortium does to negotiate fees and consequently generally pay either nearly nothing or double what insured patients do.Yup, there was a reason that Aspirin was billed at $40.00

GA

Don't be a sharpshooter, GA, you know exactly what I meant; if your policy, which I presume didn't meet minimum coverage standards, was dropped you could, and probably did get another. If you were dropped because your cancer care got too expensive, without Obamacare you would be SOL because you couldn't get coverage anymore; which appears to be fine with you, since you can simply pass the cost of your care on to others.

I guess I should have stated the tax thing differently. The most direct way you pay higher taxes is the hospitals pay lower taxes ... due to all those write-offs mentioned in the article you reference. Just like the hospital itself where it must charge higher prices to recover the lost income, so must the taxing authorities, who depend on the taxes from the hospitals, raise taxes to cover their lost revenues. Then there are outreach programs, my sister-in-law was part of one, that all hospitals have that search for ways to help the uninsured pay for their care; often that is getting them qualified for Medicare or Medicaid or some state program that may be available.Oh my! A sharp shooter? For pointing out a very incorrect statement about our taxes reimbursing hospitals for non-insured non-payers? Ok, if that is how you see it.

As for my cancelled plan... I detailed my "experience" in a thread quite a while ago, and I even mentioned to you that it might not be a good idea to respond as you have...

"... if your policy, which I presume didn't meet minimum coverage standards..."

Here is the history of my "substandard" plan;

It covered my families typical medical needs; wellness visits, preventive care, (Pap smears and mammograms for my wife), minor sicknesses, prescriptions, etc. with typical co-pays. We were very happy with it, and suffered no cut-offs or hoops to jump through.

It covered a serious bout of necrophilia faceiitas(sp?), (flesh-eating disease) for me that included 7 surgeries in 15 days in ICU/Shock Trauma, and something like 7 or 8 days "regular" hospital bed days. After my family deductible, ($3500) it paid 100%.

It covered an intensive series of radiation and chemo treatments for a cancer that was discovered during the flesh-eating disease treatments. 100% covered.

It covered treatment for a heart attack and stent surgery - 100%, and I paid only a co-pay for follow-up doctors visits. Which included weekly monitoring for blood-thinner treatment.

This of course covered a several year period. I was never denied any treatment I needed. Never heard anything from my provider about pay-out caps. And never incurred costs beyond my deductible and co-pays.

Doesn't sound substandard to me. Until Obamacare decided that my wife and I, in our 50s at the time, must have pre-natal and maternity coverage.

Oops... My plan did not include that. I did not want that. I also did not want the non-renewal cancellation letter that advised me my plan would no longer be offered - but I could seek coverage on Maryland's Healthcare exchange. (which the news recently reported is being shut down and shifted to a federal exchange enrollment.

My Exchange experience was similar to what we have heard Wilderness vent about - nothing there compared to my previous policy in the same price range.

So your reliance on what the administration tells you about Obamacare, its paper-thin rationalizations that you seem to readily accept, and your determination that from my comments here - I am perfectly willing to allow others to pay for my healthcare, doesn't reflect positively on you.

I was paying for my own healthcare. I did have good healthcare. The ACA changed all that - and in my case, not for the better.

As for you attempt to directly tie higher tax costs to hospital losses - I am not surprised that you could not resist the temptation to "stretch the argument from A to G to X, and back..." Even though there was no implication in your original "tax" point that it was such a convoluted and "esoteric" path to get there.

Hopefully, my forum conversations have been, and are, more substantive and sincere than many of the "usual talking point" rants, and blindly partisan reiterations we find in this forum - it makes for more realistic discussions - in my opinion.

GACouldn't your insurer, to become compliant, simply added those pre-natal overages in as riders? They had plenty of notice, and since there is no risk in your case, your premium shouldn't have been impacted. Why did they not chose to do that, they were well aware of the requirement years in advance.

And the analog between a hospital and a tax authority recovering losses is wrong how?

As to your last paragraph - I couldn't agree more, GA.They could have added it. That they didn't is probably because the plans required by Obamacare have a much higher profit margin - when govt. picks up the tab no one cares what the cost is. Unlimited money, you know...

Think about it, GA, what did Obamacare actually do? It made insurance available to those who couldn't get because 1) they couldn't afford it or 2) insurers refused to insure them. It also set a minimum standard of care for all individuals in order to remove the millions of rip-off policies that claimed to protect them, but did not when push came to shove.

Had legitimate insurers like yours simply complied by, in your case, adding prenatal care, and leaving the premiums alone, you wouldn't have been dropped; it was totally within their power to do so and you could have kept your insurance and your doctors. It wasn't the intention of the ACA law for insurers to treat you the way they did.

There are only four classes of people who need to actually use a state or federal exchange; 1) those who qualify for regular (I think) or extended Medicare, 2) those who can't get regular insurance, 3) those where the exchange offers a better deal than the employer, although the employer meets the rules in all respects (rare, I suspect), and 4) those who can get non-employer provided insurance elsewhere, but the exchange offers a better deal. Everybody else who doesn't have employer provided insurance can get it from off-exchange sources, which many young professionals are doing.

Those people who have insurance which qualifies, such as my employees, got to keep their insurance, their hospitals, and their doctors; it is this scenario which probably 90% of Americans who currently have employer-provided insurance fall under. Me, I am a retired military old fart, so Medicare and Tricare keeps me alive.

The long-term goal of Obamacare, of course, is to have a much healthier, and therefore less costly and more productive America. If America gets healthier, then higher productivity follows which then leads, potentially, to higher growth and a stronger economy. We will never get to that outcome under the way we have been doing business which effectively and demonstrably leads to the opposite results."what did Obamacare actually do"?

It provided extra profits for the insurance companies.

It fooled millions into thinking they have useful insurance, where in fact it is only useful in catastrophic circumstances.

It forced millions to pay for insurance for those that can't or won't afford it.

It forced millions to buy insurance they didn't want - insurance with the price jacked up to "insure" people with known and expected higher health care costs.

It cost millions their insurance and/or choice of doctor.

It hasn't yet, but will bankrupt the country if not changed radically.

It made a complete and total fool out of Pelosi. It made simple fools out of anyone that voted for it without reading and understanding it. It has polarized congress like nothing else ever did. It set the US very deeply into the socialistic, entitlement philosophy that politicians love to see. It extended the grasp of government even deeper into it's citizens.

Do we need to go on?

As far as goals - no, the goal of Obamacare is to extend control over more people, and a more firm control to boot. It is to raise taxes, expanding government even further beyond the ridiculous level it already is. And, as with all socialistic programs, it is to force sharing of the wealth from those that have successfully worked for it to those that have not.ps. I am concerned that my response(s) may sound patronizing or rude, and I hope they do not strike you that way, because that is not my intention at all - but it seems like almost everything you are discussing is an emotional response coming from your heart and ideological leanings, which is great if the facts agreed with you, but... in many of your points that does not seem to be the case.

GA

I believe Wilderness is correct in his "why couldn't they..." explanation. I do not believe insurance companies have to seek out and entice people to become customers any longer. The ACA now provides them with a government mandated pool of customers - and a guaranteed profit margin.

As for you reference to a hospital and tax authority analogy, I am a bit lost. I did not understand it to be an analogy. You said hospitals would recover service cost losses through Fed. State, and local taxes. I disagreed. I don't see any analogy in that discussion.

And as predicted, you are still digging... I'll get you a shovel with a longer handle.

GAThat is the problem with being a Meyers-Briggs INTP, I am a very strong iNtuitor. Based on all that I know and have experienced, It is simply obvious to me that taxes will go up, so I say it; it is just like I know the sun will come up tomorrow, although nobody can prove it. So, when you ask me why I think that, I have to dig down to see what it was that led me to such a conclusion.

So I start with the fundamentals; 1) people without means to pay visit emergency rooms in large numbers. 2) the reason many do not have means is that they do not have jobs or the they are low paying jobs. 3) when people like this get in financial straights, they may go on welfare or take other support from local, state or federal agencies, 4) they may go bankrupt and take other creditors down with them creating more losses, 5) and probably a few more things. Processing all of that, it just makes sense to me, local, state and federal funds are going to be spent as a result of these no-pays at the emergency rooms. Then there is the lost tax revenues, which hadn't crossed my mind until a little bit ago (which also applies to the creditors taken to the cleaners I just mentioned).

All of things have to have an impact on the amount of taxes we pay; I may not know the exact mechanism, but the process makes perfect sense to me; just as the sun coming up tomorrow does.Well, I did not look up that "Meyers-Briggs INTP, I am a very strong iNtuitor..." thing, but I have a feeling it is going to lead back to that taxpayer making-up hospitals losses thing.

So, maybe I misunderstood what you said.

Two days ago you said this;

"Who do you think pays for people who go to the emergency room and can't pay for the service? The hospital sure doesn't absorb the cost, the sick person generally does not; they can't afford it or it drives them bankrupt; the insurance companies don't, there was no insurance to start with - that leaves you, through your local, state, and federal taxes as well as higher healthcare costs from the part the hospital's do absorb.as a loss...."

Now, reading, "the hospitals sure don't absorb the cost...", and in the same statement you continue with; "...that leaves you, through your local, state, and federal taxes..."

That paragraph reads, to me, that you are saying hospitals receive tax money to offset the costs they won't absorb. You told me who wasn't paying it, then you told me who was.

Now you are saying that is not what you meant? You were talking about a vast web of "if... thens" that prove our taxes go up due to uninsured folks visiting emergency rooms.

Well, yeah. And our taxes go up due to unemployed people, and medicaid expansion, and earmarks for social programs designed to help the "less fortunate," and, and, and, and...

I'm not buying it. But if that's your story, and you are sticking to it... it's OK with me. We should move on anyway.

Maybe get back to holding our breath until there is more info on the 7,000,000 paid enrollments you extolled.

GAOK, try this. The hospitals do not absorb the costs because they raise their prices, logic says so, along with with your referenced article. Also, I know for a fact, because my sister-in-law used to do it, some of the costs are shifted to local, state, and federal agencies (funded by the taxpayer) if they can be tapped to pay for the costs. That is one way it raises your taxes. Another way is making up in lower taxes paid by hospitals and anybody else who loses money because the recipient of the care don't pay for it.

So, when the dust settles, over the long-term, who paid for the losses the hospital sustained, not the hospitals, they raised their prices to recoup their loss? You did, through higher taxes and higher healthcare costs; it all circles back to you.It is obvious you intended something other than what I interpreted your statement to mean.

You stand by your position and I stand by mine.

Time to move on.

GA

I have medical insurance and am diabetic. My premiums are a huge portion of income. I pay an even larger amount for copays, deductibles, and prescriptions. At the end of the day, my illnesses and my husband's mean we owe five time our yearly income in medical bills...not including the ones we've already paid. Insurance does what exactly? I'm not condemning/criticizing Obamacare. I'm condemning/criticizing the industry it's gotten into bed with-and then decided that it will charge people for not whoring themselves out as well.

Bingo. Let's lay blame where it belongs. Which is to say, spread it fairly.

It's a game played not only by the insurance companies, but the providers as well. So-called "nonprofit" health care providers (hospitals, doctors groups) are raking it in over and above the amount they supposed agreed to with the insurance companies.

They point fingers at each other.

Example:

As the "insured" I get a bill from the provider for going to my new primary care doctor.

This is the initial office visit to establish myself as a new patient.

I was expecting the visit to cost a $30 copay, which they did not collect at time of visit.

Instead, I get a bill for $150. WTF?

Why?

The provider claims "It's the insurance company's fault. They would only pay $350."

I ask, "Why did you bill them $500 if you knew they would only pay $350? Wasn't $350 the agreed upon reimbursement amount for this visit? My insurance documents say office visits are $30 copay."

"Oh no. This wasn't "just" an office visit. They had to do diagnoses, etc."

I rightly point out, "She didn't have to do any diagnosis. I came in with my full medical records since 2005 and told HER all my diagnoses. She didn't diagnose shit. She didn't even lay a hand on me. No examination."

Well, they somehow coded the visit as some super heavy duty level of medical office visit that in their mind warrants $500. They don't care if insurance doesn't pay it all. If I don't pay the $150 they will put it into collections -- we've lived through that before.

This scenario is not due to Obamacare. This patient in the middle system predates Obamacare.Yeah, I hear you (I didn't know there were in non-profit hospitals left since deregulation put profits ahead of health care). Years ago my wife was put in collections for an anesthesiologists bill she never knew about; the insurer sent it to the wrong address and nobody notified her and she is one of the very few who take paying her bills VERY seriously.

Sounds like you disagree with what the provider thinks the service was worth, nothing else.

Because it isn't the doctor OR the insurance that is responsible for paying the bill. It is you. They will bill the insurance for the entire bill, knowing they won't pay it all, and the rest is your responsibility.I agree, she paid, ONCE she found out about it; all I am talking about is the co-pay that was due. What I am talking about is the ethics of company who never tried to inform her it was due beyond sending a letter to the wrong place and just turned the $25 over to a collection company to ruin her credit. Did I tell you I don't like large corporations.

This is the same ethics of your provider for not complying with the Obamacare regulation which you refer to in a different part of this forum; the one who dumped you for no good reason.

Aw, come on, Wilderness. Your statement does not come close to being true and you probably know this. Not all enrollees who purchased insurance policies on the exchanges receive government subsidies. A full 20% are expected to pay their full premiums out of their own pocket. This group excludes those that purchased coverage directly from insurers outside of an exchange and a roughly equivalent number receiving employment-based coverage also purchased through exchanges. {1}

I know you are not in favor of the program but, Holy Hyperbole, Batman!!!!, such gross distortions undermine your credibility in Gotham City.

I can not believe you said, “It means that government expenditures have skyrocketed.” I would think you would want to be among the well informed rather than just another source of misinformation. The CBO estimates that Exchange Subsidies and Related Spending for the 2014 to 2024 period will be $16B less than last year’s estimate. In addition, since last year, the projected Net Cost of the ACA Coverage Provisions will reduce the Effects on the Cumulative Federal Deficit, 2014 to 2023 by $9B. Translated, this mean costs for subsidies are NOT skyrocketing but turning out to be less than expected. {2}

After 5 years, the ACA remains on track to reduce the federal deficit (and the national debt) and some folks continue to complain about it. Each time the House of Representatives asks the CBO for an analysis of the dozens of bills drafted to repeal the ACA, the Congress is advised that repealing the ACA will increase the governments operating deficits and in turn the national debt. The CBO, in a letter dated July 24, 2012, advised the Honorable John Boehner, “Specifically, we estimate that H.R. 6079 [repeal the Affordable Care Act with the exception of one subsection that has no budgetary effect] would reduce direct spending by $890 billion and reduce revenues by $1 trillion between 2013 and 2022, thus adding $109 billion to federal budget deficits over that period” {3}

According to you, “It means that there are millions of people out there destined to be sorely disillusioned when they need health insurance and find that what they signed up for is worthless.”

I am afraid, Wilderness, when talking about the ACA, irrelevant negativity is misplaced. We are talking about insurance here; i.e. spreading the risk of health related financial disaster over a pool of more than 270 million Americans. Your exaggerations about millions of people buying worthless insurance policies has me begging for some supporting facts. What you consider worthless may mean lifesaving access to a cure to someone else.

“It means that the road to US bankruptcy has become a four lane speedway instead of a country road.

Your posts are always so colorful. Not always pertinent but always colorful.

{1} http://www.cbo.gov/sites/default/files/ … 14_Feb.pdf Table B-3

{2} http://www.cbo.gov/publication/43471 Table 4.

{3} http://www.cbo.gov/publication/43471 What Is the Impact of Repealing the ACA on the Federal Budget?I don't think gross exaggerations (color?) are particularly useful.

"A full 20% are expected to pay their full premiums out of their own pocket. This group excludes those that purchased coverage directly from insurers outside of an exchange and a roughly equivalent number receiving employment-based coverage also purchased through exchanges."

Wow! 20%. Including all those that are buying outside of the main provisions of the plan (employer/private). That means what? That 2% are paying their own way while using the ACA? Now that has to be a real benefit and savings to the country!

Nor does comparing apples to oranges help much.

"The CBO estimates that Exchange Subsidies and Related Spending for the 2014 to 2024 period will be $16B less than last year’s estimate."

And what does the CBO estimate that the spending will be compared to last years spending? Not the estimate for this year, but actual spending? It went up, right? As in up a LOT? Like maybe all the subsidies being paid are an increase in govt. expenditures?

The ACA will decrease govt. deficits? ONLY if it is ignored that the ACA itself is a large tax increase. Tax increases are always promoted as decreasing deficits, but it is hardly reasonable to insinuate that buying insurance for millions of people will decrease our deficit. A little honesty, please.

What I consider worthless is insurance with such high deductibles that after the premium is paid there is no money left for actual care. And that is just what the bronze packages are, and what the rest of it is as well to those without the means to buy decent insurance. Only in catastrophic cases will such insurance have any value, and few people face that.

Speaking of COB projections, it is now projecting that the 10 year cost will be above 2 trillion dollars, up from 850 billion. Sound like a deficit buster to you? Because it does to me, without massive tax increases, producing that four lane road to bankruptcy. You can live in a dream world, where doctors, nurses and hospitals don't need payment to survive on, but reality is a little different. We cannot afford the costs associated with the ACA, whether we "recoup" it by driving citizens to bankruptcy with huge tax increases or let the govt. fail without more taxes.

To complicate matters, when you add in that people are going to find out just how pathetic their policies are, and demand much more, it is going to exacerbate an already untenable situation. Politicians will comply, raising the cost, and widening that superhighway even further. A projection from someone that understands how our entitlement philosophy works today.See my answer to GA, the CBO estimates have changed little since the original one and, at least as of May 2013, is still projecting a NET DECREASE (got to figure out how to do that color thing) in the deficit as a result of the ACA. A good cost analyst focuses on both revenues as well as costs, not just costs as you are doing; and revenues from all sources from all provisions of ACA exceed the costs ... at least according to the CBO. They can't be much clearer than that.

The costs of Obamacare will be over 2 trillion, or about 3 times original "estimates". That means there will be 2 trillion dollars collected in taxes to pay for it in order to maintain the deficit at current levels, more than that if the deficit is to be reduced. We cannot afford another 2 trillion in taxes just to tread water.

But that was not the point; Quill was trying to say that because COB estimates of costs are less than last years estimates that the cost this year was not greater than the cost last year. Two entirely separate and different things - one is an estimate for 2014, one is cost for 2013.And what the CBO is telling you is that their outyear cost predictions are pretty much on track (actually less than their original 2010 estimates if you look at their charts). What that says is while you may be surprised by the numbers, the CBO is not because in the time window we are currently talking about, they predicted the gross cost side of the equation would be about $2 trillion. That said, when you include all revenues, they are still estimating that Obamacare will "end up reducing the deficit."

What is it that makes the CBO hold that opinion, do you think? Keep in mind, you aren't arguing with me on this one, you are arguing with the CBO."On track" does not mean going from 850 billion to 2 trillion. Not in MY mind, anyway - it obviously does to the politicians pushing the crap.

But a question; why don't we simply increase taxes until the entire deficit is wiped out? If that's how we get rid of it, let's do it! We don't need to eat, or pay the mortgage; let's just pay and pay and pay until the deficit is gone.

Hi Wilderness. I am sorry you are having difficulty understanding the dynamics of the ACA. I am not here to defend the ACA or to change your opinions about it. I do not really care if you like the ACA or not. I only provide available facts when I come across statements that are untrue. Then I leave the rest up to you.

I see why you are having trouble. I said about 20% of individual enrollees are self payers “excluding coverage purchased outside of exchanges” and you reply “Wow! 20%. Including all those that are buying outside.” [Bold font added] That is followed by an imaginary, non-factual “2% are paying their own way while using the ACA” The “2%” is false, misleading, and absolutely meaningless.

Here again are the facts. Forecasts from CBO say 182 million people {1} will have healthcare insurance in 2014, 6-7 million {2} will have purchased policies on ACA exchanges, and about 5 million {3} of the 7 million will receive subsidies. In other words, about 97% of all those insured will NOT, repeat will NOT, receive any subsidies from the ACA. Ultimately, about 20% of individual purchasers on the exchanges will pay their premiums out of pocket. If you think I misstated, miscalculated, or misrepresent the CBO report just let me know. I will be happy to correct any errors.

{1} http://www.cbo.gov/sites/default/files/ … 14_Feb.pdf Table B-2

{2} Ibid.

{3} Ibid. Table B-3Might I add, that most of 97% who do not receive subsidies from the government via ACA do receive non-taxed subsidies, often more generous than ACA, from their employers. The non-taxes aspect of it, of course, means the government has been subsidizing peoples health insurance for decades, long before ACA was the apple of Obama's eye.

To be consistent, Wilderness, I am assuming you also think there should not be a tax break for the employer or employee for employer subsidized health insurance and that employers can't deduct them as a business expense (because in doing so, that means the government is once more subsidizing an individuals health care)?The government does not subsidize anything by taking less money from someone.

And yes, a legitimate business cost is always deductible. Including perks and "bennies" as well as salaries; where in the world did you come up with the idea I thought differently?

I WILL say, however, that if an employer/employee gets a tax break for the cost of insurance, then anyone buying privately, whether subsidized or not, should also get it, and that doesn't happen. Another case of the small, politically powerless group paying to support the larger group.Au contraire, my friend. The baseline is the person who pays the full-freight for their own insurance. Any person doesn't pay their own full freight, by definition, is being subsidized, no different than those who qualify for it on the exchanges.

In the case of an employer's 125 plans, it is a direct subsidy by the taxpayer equal to the amount of the employee's contribution times the employees highest marginal tax rate.

In the case of the employer's portion of an employee's health insurance, that is a direct subsidy to the employee as far as he or she is concerned; effectively, it is free insurance; it doesn't make any difference why or how they get it, it is free relative the baseline. But who actually pays for it?

Again, it is the taxpayer, either in terms of higher taxes or higher prices. Higher taxes because companies pay lower taxes so the difference needs to be made up somehow. Higher prices because the companies have to recover the costs of the insurance subsidies minus what they were able to recover from lower taxes.

The reason any government subsidizes anything is to produce some desired outcome; in America that is normally for some social good; in this case to get as many Americans with health insurance as possible; It is simply the right thing to do for the individual citizens and the country as a whole. It would be nice if everyone could afford insurance without help, but obviously that is impossible, yet it is in the nations best interest that people be as healthy as possible.Very highly disagree, though mostly through semantics.

Govt. does not subsidize by requiring less taxes. Govt. subsidizes by giving cash to recipients. And if companies pay less taxes from legitimate business deductions (salaries+benefits) then you can extend that to every thing they do. They are subsidized for buying raw materials, labor, electric bills - every cost they have.

Occasionally govt. subsidizes something to gain a specific result but more often it is simply to buy votes. To give someone else's money away to show how wonderful that politician is.

And no, requiring person A to pay for person B is not the "right thing to do". It is unethical, it is immoral and should very, very seldom be tolerated, but it most definitely is not only tolerated we have become a nation of entitlements because of that mindset. That someone else should buy me what I want because I can't or won't pay for it myself.

My apologies - I did misread the "exclude/include" in spite of quoting. I plead old age and senility.

But when you quote ME, it would be nice to quote in such a way that it does not change the meaning. "That means what? That 2% are paying their own way while using the ACA? " is just a little different than “2% are paying their own way while using the ACA” - one is an obvious guess, the other a statement of fact. A little more care, please.

But NONE of that has anything to do with comparing usage projections with costs. The two are apples and oranges, or maybe apples and horses or something. Completely and totally unrelated.I am sorry Wilderness, I thought I had the market on old age and senility; I don't mind sharing though, it is nice to know you aren't alone in the world..

Are you really comfortable standing behind the "...7 million paying enrollments..." statement?

Without going on a bash Obama and Obamacare rant, I would simply point out that there is no evidence that statement is true - other than the administration's claim that it is.

At last check;

The administration was not able to provide the number of the 7.1 million enrolled that have actually paid anything. So do they have coverage if they haven't paid?

Nor have they been able to determine how many of those enrollments were previously insured-but-cancelled enrollments. Likewise they aren't saying how many of that 7.1 million are new medicaid enrollments, (remember the "paying" part of your statement?). So the trumpeting of 7.1 million newly enrolled paying citizens apparently has a few caveats.

As for the young/old mix - a guessitmate that pops up frequently is that approx. 25% of the enrollments are the young age group they need to make the system work - but the plan's viability was based on that number being 40%. Of course it must be noted, as you pointed out, there really isn't any firm data on that yet. Still, it might be a little early for proclamations and champagne corks.

Finally, I know this sounds a bit conspiratorial, and another commenter has mentioned it, but after all the delays, excuses, fixes, previous sub-goal enrollment numbers, and final, final, and really final enrollment deadlines - can't you see it being just a little bit curious that their final number was their originally projected number? Is reality that coincidental?

I must admit I am a bit skeptical, and you have more courage than I to post such an enthusiastic proclamation of success.

ps. since you brought up CBO projections... have you seen their latest one on the now-projected cost of Obamacare? From $848 Billion, (over 10 years), when it was passed to more than $2 Trillion now

Yep, I would hold off on the champagne for a few more weeks.

GAInteresting article in our paper today, with headlines along the lines the OP states.

Except that neither the headline nor anywhere in the article was there indication that Obama said there were 7 million paying insured. Just insured, which means the government is picking up the lions share of the insurance. The insurance, including a nice profit for the insurance companies - surely a good use of our tax money.Speaking of interesting stories... and insurance company profits...

I heard an interesting one last night from a talk radio show host I trust, (he takes on both parties and Fox news), Jerry Doyle. I really recommend you search him and listen to some of his broadcasts. You can do it online.

Anyway, I haven't checked this, but according to Jerry, the part of Obamacare that guarantees insurance companies that participate in the exchanges a profit* gets the money from a fund funded by the insurance companies that do make a profit - in essence taking from a successful business to support an unsuccessful one. Hmm... that sounds familiar. I wonder how long that can go on.

GA

*Part of the ACA guarantees participating companies a pre-agreed upon profit level. If they don't reach that level the gov'ment kicks in a lump sum payment to get them there.Judging by the costs and benefits of the pitiful piece of trash I ended up with, insurance companies will have no trouble at all making phenomenal profits. With a 12,600 deductible I am extremely unlikely to ever use it, which means that the $800 per month Uncle Sam is paying Blue Cross is almost all pure profit.

Premiums are based on the risk assessment made by insurers and competition in each market. I guess in some markets for a family policy, the gov't share of premiums are that high, in other markets, they are not.

What is clear is that premiums are much higher than they would have been because of the Republican effort to kill ACA as well as the lack of participation and/or active resistance by most States. The combination of those insurgent activities did two things, 1) kept enrollments lower than they would have been and 2) kept insurers out of the market that might have otherwise come in had the state environment been friendly instead of hostile.Sorry, keeping enrollments down, with the number of people enrolling, will not affect premiums. It is already a good statistical universe.

You'll have a hard time showing that any insurer stayed out of a specific state because they were "hostile". Unless you really mean "didn't subsidize the company" instead of "hostile"?It is the nature of insurance pools that the smaller the pool, the higher the premiums, it is simple freshman-year statistics. Similarly, the more sicker people in a pool, the higher the premiums. Consequently, small pools with mostly sick people, what Republicans were striving to achieve, are the most expensive.

And if I am insurance company in a state who is opposed to Obamacare, what incentive do I have to take a chance of providing insurance to an exchange the State would rather see fail; that doesn't make much business sense.You need to go back to freshman year math. The difference in a pool of 1 million and 100,000 will result in zero difference in premium price. No one is talking about a "small" pool of anything, and especially one party was not striving to achieve a small pool of sick people. Or can you provide proof in the form of emails or other data to support that ridiculous statement?

The incentive is profit. The state does not determine the requirements of the plans - Obama did. No state has the power to make an insurance company following federal guidelines fail.

Yep, knew about that a couple of years ago. It was a temporary provision (3 years, I think) that was to put in by the practical minded who understood that with so many variables, including the full-court press by the Republicans to make this law fail, that the initial pool size and mix may not be what is needed for profitability. It was a perfectly pragmatic thing to do for those who don't have an agenda.

Damn, lost my reply when I clicked on your $2 Trillion link before submitting.

So, I will start there. At the beginning of the 2009 CBO report that contains the $848 billion number you reference are these words:

- "CBO and JCT estimate that, on balance, the direct spending and revenue effects of enacting the Patient Protection and Affordable Care Act would yield a "net reduction in federal deficits" of $130 billion over the 2010-2019 period (see Table 1)"

That is a bit different message than the $848 billion cost you reference.

Each year, the CBO reestablishes its baseline and moves another year out in its 10-year look. This link show a chart of each of those baselines; http://www.cbo.gov/publication/44176

As you can see and read, they have not changed very much over the intervening years. In fact, this May 2013 report contains the following statement

- "Those amounts do not reflect the total budgetary impact of the ACA. That legislation includes many other provisions that, 'on net, will reduce' budget deficits."

Medicaid is not part of the 7 million.

Your figures on the young/old mix sound familiar, but it is reports I have heard in the last two weeks that suggest the mix is coming closer to what it needs to be when you include off-exchanges where the number of young people is much higher and the higher number of young people supposedly in the deadline surge. Only time will tell if it was enough, or even if it was true.

Unfortunately, it will probably be impossible to differentiate the number of policies canceled as a normal course of business and the additional cancellations that were not reviewed in one fashion or another due to not meeting the requirements of Obamacare. Only the insurance companies can provide that information, assuming they have it in the first place. So, at this point in time, beyond anecdotal stories, it is a bit pointless to speculate what percentage of total permanent cancellations were due to Obamacare.

Finally, industry estimates that between 80 and 90% of enrollments finally pay-up. So, depending on where in that range the real percentage is, that means between 7.7 million (probably achievable by time everything is counted) and 8.7 million (probably not) to get to 7 million paid up. Also, it doesn't matter, I don't think, if these are newly insured or previously insured. All the insurers care about is the size of the pool and what percentage of young people are in it.Yup, it is an apples and oranges comparison. The Forbes' article I referenced did not discuss net budgetary impact - so perhaps a little more digging is needed.

"...Medicaid is not part of the 7 million."

Seems like this may be a grey area. Several reports have indicated Medicaid/Chip enrollments through the exchanges are counted. Including this one from HHS ASPE Issue Brief which stated:

Number of Persons who have had a Medicaid/CHIP Determination or Assessment through the Marketplaces:

4.4 million (does not include individuals applying through State Medicaid/CHIP agencies.)

So are they included or not? It does look as if they are. Maybe I will dig a little deeper, or maybe not.

As for the number of cancelled policy enrollments...

I am feeling lazy this morning, so I must qualify this with, "as I remember...", but I think it was the insurance industry that already published the information that the 5 million or so, policies were dropped specifically related to the new Obamacare coverage requirements. So perhaps it is possible to determine that number?

Regarding your "how many will pay" estimates....

As before, your optimism and trust in the administrations claims exceeds mine. I am very skeptical of these quoted estimates. Time will tell

But this...

Also, it doesn't matter, I don't think, if these are newly insured or previously insured. All the insurers care about is the size of the pool and what percentage of young people are in it.

Really? It doesn't matter? OMG! The possible replies are staggering. What was the purpose of the ACA - get insurance for the uninsured? Like your doctor you can keep him? etc. etc. etc. And now you imply it's what the insurers care about that matters? The enrollment numbers are all that matter?

Geez Louise...

GA

Hello GA.

It is always enlightening to read your even handed, middle of the road commentaries. I hope they continue.

Since you introduced this link to the dialog, I will address this reply to you. However, it really applies to anyone who bought into this false claim without verifying its validity.

The article “CBO: Obamacare’s 10-Year Costs Will Now Eclipse $2 Trillion” is cleverly misleading.

The statement, “From $848 Billion, (over 10 years), when it was passed to more than $2 Trillion now” perpetuates the illusion. Reading these words, without actually examining the latest CBO report, might cause someone to think that the costs of the ACA have gone from $848B then to “more than $2T now. Doing the math, that is an increase of 136% ((2T-848B)/848B), right? Readers who believe the costs of the ACA have risen suddenly and unexpectedly by more than 136% have bought the illusion without first delving into the facts actually reported by the CBO.

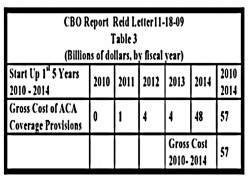

Start Up...

Interim...

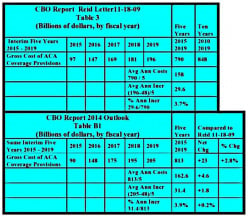

Looking at the CBO report delivered to Sen. Harry Reid in 2009, the total gross costs in the five years ending 2019 add up to $790B (848B-57

+B). {1}

Compare the same five years ending 2019 in latest CBO report (Feb. 2014) to the Reid report of 2009. The latest estimate has risen from $790B to $813B, i.e. +$23B or 2.8%. That 2.8% is a long way from a 136% increase! {2}

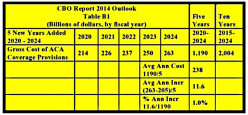

Newly Added...

Looking again at the same CBO report (Feb. 2014), five new years have been added and the total gross costs over these new five years add up to $1,190B, i.e. $377B or 46% ((1,190-813)/813) greater than the previous five years (2015 - 2019) . That 46% is a long way from a 136% increase!

There is no 136% increase. It is an illusion created by comparing two unrelated numbers that represent two unrelated five year periods. The 46% may seems to be high and rather sudden. The truth is that the 46% is neither.

Look on page 14 of the CBO document delivered to Sen. Reid in 2009 to see that the annual gross costs were predicted to increase 8% per year in the decade following 2019. “Those provisions have an estimated cost of $196 billion in 2019, and that cost is growing at about 8 percent per year toward the end of the 10-year budget window. As a rough approximation, CBO assumes continued growth at about that rate during the following decade.” {3}

A linear projection of 8% annual increases over the next five years would result in an estimated annual gross cost in FY2024 of $274B ($196B x 1.4). However, the estimated gross cost in FY2024 turns out to be $263B, less than, yet totally consistent with, CBO projections from 2009.

What has happen after the CBO delivered the first report to Sen. Reid should be noted. The first five budget years (2010 – 2014) have been removed from the forecast window. The estimated total gross cost of $57B in that start up period have no meaningful affect on the over all fiscal performance of the ACA. The interim budget years (2015 – 2019) were tweaked in 2014 to raise the total gross cost 2.8% from $790B to $813B. The year to year increases in the annual gross costs are expected to be closer to 7% than to 8% per year.

The article linked in the statement above is a sham.

Since the $848B estimate is already included as part of the $2,004B estimate it is illogical to compare them as thought they were separate independent entities. It necessary to separate these joined components from each other before they can be compared. The process flows like this:

Total costs 2010-2014: = $57B [removed/not considered]

Costs 5-yrs 2015-2019: (848B-57+B)= 790B [later revised]

Latest costs 5-yrs 2015-2019: (790B + 23B)= 813B [compare this]

Costs 5-yrs 2020-2024: (2,004-813)= 1,190B [to this]

Naturally, the article does not reveal this fact because it would spoil the illusion. Readers have to dig for themselves to know the truth. Any attempt to directly compare $848B and $2,004B is flawed reasoning, unjustifiable and grossly inaccurate.

The data from the CBO show no sudden and unexpected increases in the anticipated total gross costs of the ACA. In the Budget and Economic Outlook: 2014 to 2024, the CBO reports the insurance coverage provisions in the ACA are largely still on the predicted fiscal track envisioned by the CBO in 2009.

{1} http://www.cbo.gov/sites/default/files/ … _18_09.pdf Table 3.

{2} http://www.cbo.gov/sites/default/files/ … 14_Feb.pdf Table B-1

{3} CBO, Ried Letter, Page 14.Quill, as always, I do look forward to and enjoy your participation in these forums, but you sure make a fella work for his integrity don't you. *chuckle

So, after reading your response, (to which you obviously dedicated substantial thought and effort), I thought, wait a minute, The weekly Standard, even if a generally conservative publication, is usually fairly reliable - have they misled me this time?

So, I go to check, and alas one of their referenced links no longer works - the one I needed!

But I found it. It was the CBO's 2/14 Updated estimate.

Since I don't have your penchant for crunching the numbers, I hope you will understand if I just respond with the numbers as described in the link I posted that prompted your reply - the Gross numbers.

The numbers stated in the linked articles were the CBO's Gross numbers.

From their, (and your), linked 11/19/09 CBO letter to the Mssrs., the gross cost of the ACA was estimated to be $848 Billion for 10 years, (2009 - 2019) - as noted in their, (and your) referenced Table 3.

The 2/14 CBO report, (table B-1) did in fact state the projected direct costs to be $2.004 Trillion - which does appear to be a 136% increase - per the CBO numbers.

But, that is a conclusion the article does not state. And the article does not say it is an adjusted estimate of the original 10-year forecast. The facts in the article are true* as stated, "CBO: Obamacare’s 10-Year Costs Will Now Eclipse $2 Trillion" relative to the true estimated gross costs of an ACA-implemented 10-year forecast period, (2014 - 2024).

*picky, picky, they should have subtracted your first-5-year $57 Billion and called it "Almost $2 Trillion, ($1.947 Trillion)

However, you are correct that it could be misleading when presented to the casual public that may interpret it as proclaiming a 136% cost increase. (which it did not)

But, and it is a very big but...

Who misled, or is misleading who?

The Democrats present, and emphasize to the public, a 10-year estimate that only includes 5 years of primary costs. "Hey Mr./Ms. Public over 10 years our plan will only cost..."

Why? Could it be that if they presented a true 10-year cost estimate as the 2014 -2024 estimate is, the public would not have accepted their healthcare plan?

If this were an apples to apples comparison, which as you point out it is not, then both reports should have been presented as 5 year projections. But since the Dems set the estimate parameters at 10 years - can they really cry foul when the next estimate is also for 1o years?

Is it misleading to compare 10 year gross costs if the only thing that makes it misleading is that the original projection was misleading? Did the Democrats tell the public to be sure to look at the fine print to see the included caveats? Like the fact that it is really only a 5-year cost estimate, or the apparently predictable 8% annual increase? (which I think is very optimistic)

The net result is that you are right, I should have dug deeper before completely trusting that link. It would have been much safer for me to have included a caveat to "look at the fine print too."

The net-net result is that I think it is a fair comparison to present to the public as a tactic already used in the arena by the Democrats. Live by the sword - Die by the sword.

As judged by the Curmudgeon himself - yes, the article could be deemed cleverly misleading to some. (+1 Quill) Yes, the article is factually true as written, *forgiving the little $57 billion forgetfulness (+1 GA)

The verdict: A Draw!

GAGA,

If I were to splash across the Weekly Standard's headline in 100 point font that "GA IS A LIAR", forgetting the trillion times you told the truth, it would be (+1 ME) because at some point in your life, the probability is infinitely high that an instance of you lying can be found, making the statement true.

It is a given the Weekly Standard's headline is a sensationalism and, unfortunately, that seems to be ubiquitous in media (except maybe POTUS on Sirius/XM). What sets a partisan publication apart from unbiased publications is that the biased (Left or Right) continues to propagate the false impression in their article (by focusing only on your single lie in your lifetime) while the unbiased news will also bring up the trillion times you told the truth.

What the Weekly Standard, you, and Quill failed to mention is the CBO's estimate of the ultimate bottom line effect of Obamacare when the Total Ownership Cost (that was my job in the Air Force and OSD) of a system is considered.

- in 2010, the CBO said - "CBO and JCT estimate that, on balance, the direct spending and revenue effects of enacting the Patient Protection and Affordable Care Act would yield a "net reduction in federal deficits" of $130 billion over the 2010-2019 period (see Table 1)"

- in a May 2013 report, the CBO is still projecting a net decrease in federal deficits due to the Patient Protection and Affordable Care Acts.

GA - how does that square with the Weekly Standards hyperbole?Your first point is taken, and well explained, but, in the context of the political canvas on which the national discussion takes place, I stubbornly hold to my quoted explanation.

As for the projected revenues and deficit reductions - of course I am hopeful they pan out, but...

... and as in too many political explanations, it is a very big but,

Even as an inexperienced political layman I found myself questioning and doubting many of the revenue forecasts.

For instance; the stream from Medicare reform savings - even the CBO supplied statements that some of the proposed changes would probably not stand the test of time relative to legislative actions. But since the CBO is mandated to provide estimates based on the details and parameters given to them - not ones they research and determine themselves - they provided the results as requested.

Another questionable revenue projection might be the tax and mandate income streams - since those parameters have already changed; ie. the delayed individual and business mandate implementation, the apparent substantial amount of waivers to the "Cadillac plan" tax, etc.

So, you are right, it is +1 ME, but because the story was about the gross costs estimates of Obanacare - "that's my story, and I'm sticking to it"

GAYour points are well taken, GA, and I am not naive enough to think Obamacare will, in the end, reduce the deficit; Congress, in its infinite wisdom, will make sure it doesn't.

But, what I do expect is a much healthier America, which, in and of itself, has intrinsic value. I also am confident that health care costs will come down, after discounting for inflation, in the long run.

Toward that end, the doctors and hospitals lost a big fight yesterday when Medicare released usage data, by doctor/hospital, for the first time. Once I get it uploaded into Access I will be in hog heaven for awhile. The intended effect of this Obamacare initiative is to reduce fraud, waste, and abuse by exposing it to the light of day.You have surprised me again. With your military/government background I would have expected you to be a bit more skeptical of their proclamations.

But it appeared I was wrong with your earlier supportive Obamacare proclamations, including your defense of the CBO numbers, ie.

"... when the Total Ownership Cost (that was my job in the Air Force and OSD) of a system is considered.

- in 2010, the CBO said - "CBO and JCT estimate that, on balance, the direct spending and revenue effects of enacting the Patient Protection and Affordable Care Act would yield a "net reduction in federal deficits" of $130 billion over the 2010-2019 period (see Table 1)"

Now I sense that skepticism I had expected from your experience.

Following similar reasoning to Wilderness' response... I am curious exactly what the mechanisms are for the $1596 billion ACA-related revenue that would result in a $109 Billion deficit reduction. ($1487 net cost + $109 Billion deficit reduction)

Given your penchant for number crunching, (not sarcasm), maybe that would be a project you could tackle, a la your doctor/hospital data intentions?

For example; How many hundreds of billions of savings from medicare/medicaid fraud and abuse reform are they including in their projections? When other Presidents have also tackled this issue, and Congress has a noted history of sidestepping or delaying such reforms - what is different this time that would lend credibility to their claims?

There are tons of other such credibility-challenged projections - their increased taxable wages revenue for instance, that could use a little 'splaining.

I have tried, but remain unconvinced. Maybe I just need a syllabus to get me going.

GAI try hard, GA, never to pay attention to proclamations by anybody. For example, was I surprised by the failure of the web-site roll out in Oct, not really; although I have to admit I was surprised by the magnitude of it. Do I understand what went on behind the scenes that led up to such a debacle? Yes I do, I had a birds-eye view of it several times from my perch in the upper echelons of resource allocation (cost and economic analysis, readiness analysis, operations and support analysis, etc) functions in both the AF and OSD.

The worst I have seen was during the Clinton administration around 1994 - 1998 was the creation and dismantlement of the Joint Logistics Supply Center (JLSC). I was part of the team responsible for making sure their estimated costs to build the IT infrastructure was reasonable and was in an office that reported directly to the OSD Army 2-star responsible for the success of the program, he was an Assistant Under Secretary or something. Anyway, the long and short of it was, we kept having to readjust their cost estimates upward but ran into problems with, guess who, the 2-star. In the end, it turned out he mismanaged the program so badly as did the people he put in place at JLSC to run it, that $4 billion went up in smoke when GAO reports and Congressional inquires forced the end to the effort. Did the Secretary of Defence or his Under Secretary for Supply and Logistics have a clue? Not on your life, the 2-star did a fantastic job of hiding the problems until it was too late.

I suspect the same thing happened to the Secretary of HHS. Program managers are like gods and have immense control over information flow out of their programs. This is the reason my jobs were created, to give independent insight into these programs; but guess who is the first to get laid off with budget cuts.I agree with your example, and it sounds like a logical explanation of what might have happened.

But, there has to be a desk somewhere that is the final destination for the buck. And if the HHS debacle fits the scenario you painted - there should have been several desks falling like dominoes before the final one, which I think should have been the Secretary's.

I haven't heard of any, and this issue is/was important enough to have warranted a fallen Secretary if accountability was what it should be.

GASibelius has paid the final price with her resignation under a cloud when it should have been in bright sunshine, but that is not how the real world works. What is most unfortunate, however, is the way Democrats turned their backs on her.

At least from my side of the fence, she has been successful on several fronts, including Obamacare. Because I am not a politician or part of the opposition and I have experience in the IT field, I can overlook the kick-off fumble and applaud a successful end game.

This is going to be ironic, because while they are running way from Obamacare, it is my estimation that by November, Democrats will be benefiting from ACA's success.

Question: if the tax and other income streams of the ACA were allowed to remain (except of course the cost of individual premiums) while all costs were cut completely (primarily subsidies, but anything else as well), what would happen to the deficit? Go up, go down, remain constant? I would surmise go far down from what it is now, meaning that bragging about raising taxes to reduce the deficit probably isn't a good selling point for the ACA. Particularly as only a tiny portion of that raise is actually going to lowering the deficit - the rest goes to the latest, and biggest, entitlement program.

The 7 million paying enrollees is an interesting assertion not born out by facts. It also means that of the approximately 35 million uninsured, for whom this monumental new entitlement, massive new regulatory system, incredible distortion of the market place and catastrophic disruption of the medical industry was enacted - 28 millions still remain uninsured. What a GREAT success!! What is next? OBAMAFOOD in which the the millions of hungry remain hungry and even have their numbers swell while destroying agriculture? Or How about OBAMAMONEY in which the millions of poor are increased while the value of the dollar is eroded by inflation and over spending - OOOPS!! too late on this one.

What a rousing success leftist social engineering is, Darwin would be so proud.I assume your feelings about social security, Medicare, and Medicaid are the same?

BTW, why are the insurance companies starting to like it?I wonder if that is true. The insurance companies signed on early to OBAMACARE because it promised forced consumption of their products, isn't that the dream? Buy this product or else, what a free country we live in. There is a myth among lefties that business is all about the price regulated market place, when the reality is that businesses are just as selfish and lazy as people. They want the most benefit for the least effort, it is an evolutionary imperative. Why wouldn't a widget maker love the government forcing everyone to buy widgets? Government is force, business is not, unless paired with government.

"Most benefit for the least effort"; I would agree there, that is the fundamental precept of capitalism.

And yes, government is force, when needed, for societal good when parts of society or the mechanism of society (like capitalism) prevents large numbers of the same society from receiving Locke's inalienable rights of Life, health, Liberty, and Property which Jefferson codified as Life, Liberty, and the Pursuit of Happiness.If Locke is guaranteeing life, health, etc. then Locke needs to make sure we have it. He can pay the price, in other words; a faux "guarantee" of an "inalienable right" without the means to actually accomplish it isn't worth much.

*cough cough car insurance cough cough*

Sorry. Had something in my throat.*slaps back* A luigi, no doubt; a worthless piece of garbage, coming from the depths of the body to be discarded as quietly as possible. Much like some thoughts.

Car insurance is available for purchase across state lines, the price is not set by the government, what is covered is not set by the government, the insurance companies that provide auto insurance are not determined by the government, the government only requires those who wish to operate their car to have insurance, operating an auto mobile puts others at risk, auto insurance required by the government does not cover ordinary maintenance, the ownership of a car is optional, the operation of a car is optional.... What a ridiculous analogy.

A human is not a car. When the government determines all aspects of medical care it determines the disposition of human health. It isn't a ridiculous analogy, it is a stupid, dangerous and destructive one.Well, it sort of is. I get my auto insurance from USAA, but it is USAA doing business in VA and then when I moved to FL, it was transferred to that office and my policy changed to fit Florida law.

Exactly what aspects of human health is the government determining beyond setting a minimum standard of care, which is the duty of government in the first place. Try to pick something the insurance companies didn't already control.

I will tell you what Obamacare did do, it stopped insurance companies from effectively committing manslaughter in those cases where they denied insurance or dropped insurance and the person died as a result. It stopped insurance companies from maiming those people who didn't die.On the contrary, this has been exacerbated and promises to get much worse.

Did the State of Florida require that you own an automobile? Did they tell you what insurance companies you could buy from? Was the price set by the state or by the market place? Were you told which mechanics could work on your car?

From the online legal dictionary:

"n. the unlawful killing of another person without premeditation or so-called "malice aforethought" (an evil intent prior to the killing). It is distinguished from murder (which brings greater penalties) by lack of any prior intention to kill anyone or create a deadly situation. There are two levels of manslaughter: voluntary and involuntary. Voluntary manslaughter includes killing in heat of passion or while committing a felony. Involuntary manslaughter occurs when a death is caused by a violation of a non-felony, such as reckless driving (called "vehicular manslaughter")."

You will notice that manslaughter requires that an action was taken, resulting in the unlawful death of a person. Can you describe the illegal action taken by an insurance company, that caused the death of a person? Ever?

Can you describe a known, proven case where an insurance company maimed a person? By hiring a hit man, perhaps, as a paper corporation obviously cannot carry out physical actions itself...First, let's parse your words. First you say "...notice that manslaughter requires that an action was taken ..." then you say "... Can you describe the illegal action taken ..." Why did you insert the word "illegal"? It is not necessary that the action be illegal to be considered involuntary manslaughter so long as the outcome is a foreseeable possible consequence of the action.

Denying or cancelling somebody's insurance who has a life-threatening condition is an action that has the foreseeable possible outcome of death. All you need to do is dig through newspaper stories to find plenty of examples, why would you think there is such a brouhaha about it. I have read several myself, although I did neglect to file them away for this conversation.I guess it is hard for me to imagine a legal action that would result in a death. Certainly such things as reckless driving, or DUI, are illegal. Even relatively innocuous actions that result in a death are illegal when performed in such a way as to cause death.

Denying an insurance policy causes bacteria to reproduce and grow? Or a cancerous tumor to increase in size? Can you give the methodology showing that a signature on a piece of paper directly affects bacteria in human being?

Because I really don't think the courts will agree that signing a piece of paper denying a contract (of ANY sort) constitutes "manslaughter" as you claim.

Let's start with this:

"[Approximately 18.1 million Americans per year between 18 and 64 years of age experience a problem with their health plan that results in a denial or delay of medical care. [Families USA, 6/21/01]"

then follow-up with this:

"The Harvard study found that people without health insurance had a 40 percent higher risk of death than those with private health insurance -- as a result of being unable to obtain necessary medical care. "

and finish with this:

"Deamonte Driver, a 12-year-old homeless child, died Sunday in a District hospital after an infection from a molar spread to his brain.

At the time he fell ill, his family's Medicaid coverage had lapsed. Even on the state plan, his mother said, the children lacked regular dental care and she had great difficulty finding a dentist. [The Washington Post, 3/3/07]"

As to Maim, I wonder what shape this lady ended up in:

"In June 2003, Shirley Loewe went to Good Shepherd Medical Center here with a softball-size lump in her breast and was diagnosed with a rare form of breast cancer. She didn't know it, but she had just made a big mistake.

Ms. Loewe was uninsured. Under federal law, she could have gotten Medicaid coverage -- and saved herself a lot of hardship -- if she'd gone to a different clinic less than a half-mile away. But by walking through Good Shepherd's doors, Ms. Loewe unwittingly let that opportunity slip and embarked on a four-year journey through the Byzantine U.S. health-care system.

It was an odyssey that would take her to five hospitals, two clinics, two charitable organizations and two nursing homes in two states. She was denied assistance or care at least six times along the way, for reasons that ranged from not being poor enough to not being sick enough.

Ms. Loewe eventually got treatment, but at personal cost and great aggravation. [The Wall Street Journal, 9/13/07]"Are you still trying to claim that not having insurance makes bacteria grow? Or breaks bones, or causes infections? It is an obvious fallacy, you know. That Diamonte's parents made too much money for public support of their child did not put that cavity there.

As far as Ms Loewe - how horrible that she had to pay for treatment like the rest of us do.you forgot to add... "and didn't have enough money to pay for treatment that the insurance would have"

Your own comments indicate that Loewe got her treatment, and without the public dole. Just like the rest of us do. If you wish to help Ms Loewe with her bills you are freed to do so, legally and morally. What you are NOT free to do, morally, is steal from a third party to pay her bills. The liberals of the country seem to frequently "forget" that rather important rule, but then they also forget that they some kind of god, defining morals for everyone.

Yes, she did, but at what cost of personal pain, suffering, and dollars that she should not have had to pay absent an unethical and immoral private health care system. If she qualified for Medicaid, that meant she was at or below poverty level; but given your comment, I am guess it was better that she traded in her rent, food, transportation to work, utility, and other essentials for living money to pay for a hugely expensive operation "just so she could stay off the dole." That is the American way, isn't it; it is better to die than have the gov't give you money; which, btw, could have been Mrs. Lowes outcome ... soft-ball sized lumps in ones breast tend to do that you know.

First, according to you she lost her medicaid, presumably because she earned too much.

Second, wherever do you get the quaint notion that she, or anyone else, should not have to pay for something they want? How in the world do you come up with the idea that it is moral or ethical to force someone else to pay for it?

So yes, absent your unwarranted and irrelevant comment about trading car or other goods for her life, it is HER responsibility to cover the costs of her own care. Not yours, not mine, not anyone but hers. Again, if you wish to help her pay her bills you are certainly able to do so, but you have no right whatsoever to force anyone else to do so.You say "... wherever do you get the quaint notion that she, or anyone else, should not have to pay for something they want?" OK, let's take that statement to its logical conclusion. If she wants to live and can't pay for it and will die if she can't, your position is she should die. Do I have that right?

If I don't, how do you propose she live without paying for it?Wrong question. The one you need to be asking is what gives you the right to take my possessions for use as you see fit, and do I have the same right to do it to you?

Actually, yes you do, in a society built on the belief in Life, Liberty, and the Pursuit of Happyness where the charge to the government by the People is to 1) form a more perfect Union, 2) establish Justice, 3) insure domestic Tranquility, 4) provide for the common defense, 5) promote the general Welfare, and, 6) secure the Blessing of Liberty.

Embodied in those American ideals is the belief that society should not let someone die simply because they cannot afford to pay for the ability to keep themselves alive. Based on that belief, society has charged the government to raise money from members of that society, even from those who don't care about their fellow Americans, to provide the funds to save the lives of those who cannot afford to do it themselves.

I understand that is not the kind of society you wish to live in, but that is the kind of society envisioned by those who created the Constitution which provides the framework for such humanitarian actions by the government to happen."Embodied in those American ideals is the belief that society should not let someone die simply because they cannot afford to pay for the ability to keep themselves alive."

Bearing in mind that 5) refers to the welfare of the country, not individuals, which of the 6 embodies the belief that belongings may be taken from one person to be given to another?

"society has charged the government to raise money from members of that society" An excellent example of "might makes right", but of course that society has done so does NOT mean that it has the ethical or moral right to take such action. It does not.

And no, those that created our constitution absolutely did not envision a country where government paid for the health care of it's citizens. Those authors, in fact, did not order (or even specifically authorize) our government to give anything to individual citizens; not food, not money, not health care, not housing, not cell phones. They never intended our great country to become a socialist paradise where "share the wealth" was the rule of the day, and they were correct in that assessment. We did not get to where we are by following that losing strategy.

Personally, I have no objection to helping out the less fortunate, but I also feel that we long ago crossed any reasonable line in that pursuit and turned our citizenry into a "gimmee" crowd, more than happy to live off the charity of others and that it will cost us, if not changed, all that we have gained in our two centuries of growth. And along those lines I will say that I specifically do not believe this country can afford to provide all citizens with the health care they think they "deserve" somehow. Not and keep even half of our standard of living intact - we simply do not have the resources to do so.To your "belongings" question, that would be Section 8, Article 1, which gives Congress the authority to enact laws to implement the charge the Preamble gives to the government. Give Locke a read for the moral and ethical right for a government to provide for the common good. Also, the writers did not specifically prohibit those things you mention; instead they gave Congress the authority to do what is needed, especially as it pertains to the common defence and general Welfare, to carry out the duties laid out in the Preamble.as time moves on into the future. They knew they didn't know it all; they knew they hadn't covered 100% of the possible needs the future may bring so they wrote a somewhat open-ended document flexible enough to allow for future developments but limited by the tension between 1) the three branches of gov't, 2) the two Houses of Congress, and 3) the rights of the States vs the rights of the federal government within the context that they were all part of the same Union and not separate and unique entities.

Where do you get the idea that 1) general Welfare applies "only" to the country and not individuals as well and 2) that individual don't make up the country; I think the term is People? Also, when has the government written a "welfare" law that applied to a single individual? Haven't all of the laws been aimed at large segments of society that ultimately provides general Welfare to all of society by raising the economic average of the whole?