What are fair taxes? How progressive should the U.S. tax system be?

What are fair taxes? How progressive should the U.S. tax system be?

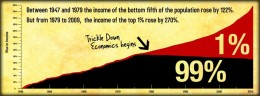

A progressive tax increases as the taxable amount increases. The tax burden incurred includes roads I do not travel on, so why is there a division of 'us' versus 'them', taxpayers vs freeloaders?. Isn't slashing domestic programs that feed children 'a bridge too far'? Trickle down economics is exactly what it sounds like. What do you consider to be a fair tax scheme?

- Sri Tposted 8 years ago

0

No taxes are needed. The government owns all the money already. The system is designed to remove a portion of the income of the people to control them. If they really needed money they could invest the money they already have and it would multiply beyond human comprehension.

I don't understand, if all money is fiat, & it's printed out based by the banks, then why banks what "more" more what?

An extreme example. Most fines are designed to take away money from people. To take away money in their eyes is punishment because the person has less cash or freedom. So money represents freedom. If they take away money, people have less freedom.

ptosis

Either the country believes in the 14th amendment across the board, or they don't. All the social issues were adjudicated using the 14th am, and yet when it applies to non social issues, it is not used, and there is NO Equal Protection, and there is Discrimination.

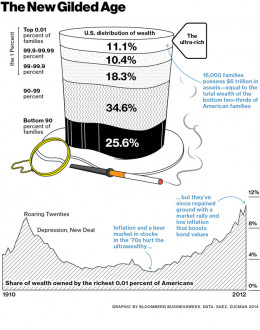

Consider that the progressive tax system has never worked, and the proof is the 1% of wealth equaling or bettering the 99%.

Since 2008, most of the billionaires and especially Bill Gates have more than doubled their wealth. And they did it because of the Internal Rev Code which favors the poor and the rich. The poor don't pay taxes, but can get earned credits, and other benefits. While the rich can use a lot of it. As for the middle class they can only use a few that were not cut from 1986 TRA.

In addition, look what Congress did in 2013 to the medical deduction threshold. They raised it from 7.5% to 10%, and based on the hype from ACA they should have lowered it to 2%.

A National Sales tax would be non discriminatory and give equal protection to everyone. Not a Flat Tax because it still involves the Internal Rev Code.

The NST could be brought in to 10 or 12%, and it would mirror existing state sales tax. The FICA would still come out of wages but not be in the NST.

The federal govt also needs to recede and relinquish back to the states, on things like your food programs. The locals know best how to take care of their own.

Your don't go into the specifics for these cuts to food programs etc. If these people had jobs, the proverbial fishing pole, they could catch their own fish. Previous administrations have focused mostly on the fish, instead of the fishing pole.

There is a lot of fraud in these programs, and they have been used by generations of people. 46 million people on SNAP that is about 1 out of every 5 families. How does continuing to support the fraud and throw them fish help either them or the country?

Fair taxes are equal taxes. and 10% of $100 is equal to 10% of $100 million. They already pay this in state sales tax, so any argument against it has already lost at that level.

So $10 is fair to the lower income, and $10 million fair to the upper income.

There is no equality in progression. And it doesn't really work out that way because of the loopholes in the Internal Rev Code.

Related Discussions

- 17

What Is A "Fair Share" Relative To Taxes?

by ga anderson 9 years ago

Much is heard of a demand that corporations and the wealthy pay their "fair share" of taxes, but I have heard little of what that share should be.With only a single restriction; that the discussion is about legal tax actions, what should that "fair share" be?One could say that...

- 54

A "Fair Tax' System vs. Our, (U.S.), Progressive Income Tax Structure

by ga anderson 8 years ago

First, a little housekeeping;Recent comments by Wilderness and Live to Learn prompted me to refer to an old thread by My Esoteric.The motivating comments related to what a "Fair" taxation structure should be.I now believe that out current 'progressive' income tax structure is one that at...

- 69

Is it time to replace the IRS with a true fair tax system?

by taburkett 6 years ago

Is it time to replace the IRS with a true fair tax system?Is it time to replace the IRS and current disproportionate tax system with a 1% charge on every commercial monetary transaction that creates equal contribution for all?

- 15

What makes some people believe in entitlement programs, handouts,

by Grace Marguerite Williams 11 years ago

income redistribution and having a rescue me mentality? What makes so many people extremely hesitant to accept self-responsibility and self-accountability? Don't they realize that many people are in dire life and socioeconomic circumstances because of poor decision making and life choices on their...

- 53

What Does It Mean for The Wealthy to Pay Their Fair Share of Taxes?

by Scott Belford 3 months ago

This topic has come up recently across several forums, so I though I would start on specifically for this subject.The question comes up when mainly Democrats and some Independents complain that the wealthy do not pay their fair share in taxes. The rebuttal ranges from they already do to why should...

- 24

Can someone define what their, or anyone else's "fair share" is?

by Ralph Schwartz 8 years ago

Can someone define what their, or anyone else's "fair share" is?Each day I hear complaints about rich people not paying their "fair share" of taxes - someone define "fair share" for me.