The Harris Proposed Economy means 1.7 Trillion ten year deficit. hmmm

- tsmogposted 15 months ago

0

The Committee for a Responsible Federal Budget on Aug 16th released their assessment of the economic proposals by Harris. The bottom line is it would increase the deficit by 1.7 trillion over ten years.

The Kamala Harris Agenda to Lower Costs for American Families by The Committee for a Responsible Federal Budget (Aug 16, 2024)

https://www.crfb.org/blogs/kamala-harri … n-families

Note: Relatively short article getting to the main points. There is a graphic for Summary of the Fiscal Effects of the Harris Agenda to Lower Costs for American Families.

"Much of this agenda is regulatory, including a ban on “price gouging” of food and groceries. The tax and spending elements of the agenda include:

** Expanding the Child Tax Credit by making it fully refundable, increasing the base credit from $2,000 to $3,000, and further increasing the credit to $6,000 for children in their first year of life and $3,600 for other children under six years old.

** Extending the enhanced Affordable Care Act subsidies that reduce premiums paid by households buying health insurance on the exchanges, which expire at the end of 2025.

** Expanding the Earned Income Tax Credit by increasing the credit available to workers who do not have child dependents for tax purposes.

** Establishing a First-Time Homebuyer Tax Credit of up to $25,000 to help cover the cost of a down payment.

** Further supporting affordable housing with tax incentives for building starter homes, an expansion of existing tax credits to support the development of affordable housing, and a $40 billion housing innovation fund.

** Lowering prescription drug costs by capping the cost of insulin, accelerating drug negotiations, and increasing transparency and competition among drug manufacturers.

What is the risk vs reward assessment in your mind?

Is it benefiting the 'right' people? For instance, Gen Z, Millennials, and seniors on social security?

Thoughts, criticisms, accolades, and/or commentary?

For the curious the Committee's assessment of the proposed 2025 Budget

Analysis of the President's FY 2025 Budget by The Committee for a Responsible Federal Budget (Mar 11, 2024)

https://www.crfb.org/papers/analysis-pr … 2025budgetAs I look through her ideas I see:

set price limits of groceries

Give money to individuals for having children

Give money to individuals for health care

Give money to individuals for NOT having children

Give money to individuals to buy a house

Set pricing for drugs

Somewhere we've lost our way when a politician can actually propose simply giving money to everyone in sight without concern for the needs of the nation. We've lost sight when it's about giving money to the "right" people, according to age, sex, race, etc.

I didn't see anything in there about where we were going to find that magic money tree to pay for all this. Do we dismantle our military? End Social Security? Stop welfare? How do we pay for all the giveaways?"** Expanding the Earned Income Tax Credit by increasing the credit available to workers who do not have child dependents for tax purposes."

The EITC is a "refundable" tax credit (what a misnomer!), meaning you do not need to owe taxes to get it. It is simply given out.

I am 74 years old and will never have children again. Is Harris proposing that I get $1500 per year ( or whatever the figure is) because I don't have kids? Will my wife get the same? Underage children? My neighbor, 16 years old, has a child and gets aid - if he did not would he get that expanded EIC (or whatever she will call it)?"I didn't see anything in there about where we were going to find that magic money tree to pay for all this."

From the first paragraph of the article we discover;

"The Harris campaign has said this would be paid for through taxes on corporations and high earners and that they support the revenue raisers in the President’s Fiscal Year (FY) 2025 budget but has not put forward specific offsets as part of their Agenda to Lower Costs for American Families."

You would have to read the complete article to get the specifics as shared by the authors. It is tied to the proposed 2025 budget. A link has been provided at the OP for that.

Ever since the first of the year when I made several posts about our debt and deficit spending I keep a sharp eye on it sharing news from The Committee for a Responsible Federal Budget. They don't hold back and are fair in my mind critical of the present administration and past ones.

There Debt Thermometer is interesting if curious. It shows years 2020 - 2024.

https://www.crfb.org/debt-thermometerYes, I know. Politicians always say they can pay for their programs...and then tax the people to do it. I don't believe Harris is going to raise corporate taxes and taxes on the rich enough to pay for half her wondrous giveaways. If she does it to corporations they will leave, and if she taxes the rich enough they will take their money elsewhere even if they don't leave physically.

That is the way of these things; buy votes with pie in the sky promises and then either back out or force people to pay for what they don't want.~ magnifying glass:

"If she does it to corporations they will leave, and if she taxes the rich enough they will take their money elsewhere even if they don't leave physically." Widerness"I don't believe Harris is going to raise corporate taxes and taxes on the rich enough to pay for half her wondrous giveaways. If she does it to corporations they will leave,

So using the same logic won't corporations leave when tariffs cut into their bottom line? I mean their only choice is to absorb all or some of the tariff cost or pass on all or some to the consumer.... Will they be leaving as you predicted?He predicted that under different circumstances, he inferred that when Biden proposed his great tax hike on the rich and big businesses. Your logic is flawed. Trump cut tons of business stifling regulations. And they will know come out even with Tariffs, making more cash. Leave- you've got to be kidding, they are investing big time. LOL No threat of big Government taxing them to death. Your logic is not plausible. And you presume that the consumer will absorb costs --- we do not indicate that now or in the future.

Your argument is moving away from the premise. The premise being that folks made an argument against increasing corporate tax rates due to increased costs hurting corporations. The argument was made that an increased corporate tax rate would cause employers to shed workers and even move away. Why don't the increased tariff costs do the same?

The question is simple why don't tariffs have the same effect on the corporations bottom line as a corporate tax increase? Both are an increased cost.

Even if corporate America eats some of the tariffs, the damage is inevitable. Margins shrink, so companies cut back on investment, leading to slower growth, less innovation, and fewer new jobs....

Again, the argument being that we can’t raise taxes on corporations because that means they won’t hire as many people and pay people enough.

But they CAN take on the cost of tariffs (tax) and be fine...."Your argument is moving away from the premise. The premise being that folks made an argument against increasing corporate tax rates due to increased costs hurting corporations. The argument was made that an increased corporate tax rate would cause employers to shed workers and even move away. Why don't the increased tariff costs do the same?

The question is simple why don't tariffs have the same effect on the corporations bottom line as a corporate tax increase? Both are an increased cost." Willow

I thought I gave a good explanation, but let me clarify: Biden’s proposed taxes—combined with his failure to cut regulations and, in fact, adding more—ended up being worse for businesses. His tax proposals were actually more burdensome than the tariffs have turned out to be so far. The concern at the time was that Biden's new taxes, especially because of how high they were, could push businesses to leave the U.S. entirely. That was the main point critics raised when he proposed significant tax hikes on the wealthy and on businesses. Bottom line: the tariffs cost less than what Biden was planning to charge them in taxes.This has nothing to do with Biden. Increased corporate tax rates affect the bottom line and tariffs affect the bottom line. You do realize that the 15% has to come from somewhere and it's not the country of origin... The posts I'm seeing written here seem to be portraying an idea that the 15% tariff just magically disappears into the ether...

Tariffs are taxes paid to uncle sam by US firms that import goods or services. Trump changed the GOP from an anti to a pro tax party. Bigger US firms will raise prices (inflation) to offset tariffs...

It is horrific; she stands there as Queen, promising gifts, if the good subjects will only submit.

Yes. See how many times she refers to herself (I) during her speech.

She has, (will have,) checks and balances.

She acts like she doesn't, (won't.)

... and they say Trump will be a dictator?

Furthermore, she is misleading her supporters in so many ways while offering exactly what they want. So, when/if she gets in, she will give them what she never even mentioned.

~and she did not so well! Such smooth talk I have never heard.

Especially from her!

How did she do it?(remove not

and she did so well ... with her speaking.)

She sounded so convincing and sure of herself, for a change.

Rehearsing MUCH?

After reading the article, I found myself perplexed by how anyone could support such an agenda of spending or by the audacity of a woman who stands at a podium making such promises. Almost all of her proposals, except for negotiating lower drug prices, would require Congress to pass legislation to fund these giveaways.

It is factual that the United States is struggling to maintain the solvency of its primary social programs, including Social Security, Medicare, and Medicaid. Given these financial strains, is it realistic to consider that the nation could take on several additional social programs as proposed by Vice President Kamala Harris?

Typically, my posts are quite long, but I’ll keep this brief. In short, I find Harris's agenda to be completely absurd and leaning towards communism or a significant shift in that direction. Hopefully, Harris will keep sharing more of her ideas, giving Americans a complete view of her grand plan.How quickly history is forgotten. Remember President J. Carter? The days of long lines at the gas pumps? Expensive everything!

https://www.youtube.com/watch?v=rU6PWT1rVUkKathryn --- Absolutely, it's surprising how quickly some of the challenges faced during President Carter's administration seem to fade from memory. Along with the long lines at gas stations due to the energy crisis, there were other significant issues that plagued the country during that time. Inflation was rampant, with the cost of living soaring, making everyday essentials increasingly expensive. Unemployment rates were very high, creating economic uncertainty for many families. The Iranian hostage crisis was another major issue that dominated headlines and contributed to a sense of national frustration, and fear.

These problems collectively painted a bleak picture. One that shaped the political landscape for years to come. What I see today, feels very familiar, with what I witnessed at that time in our history.

Hopefully, we won't stay on this destructive path. We can't afford to continue spending, taking the gamble that more spending could well add to our economic problems. Harris's agenda calls for tons of spending. We need to work on solving problems that are pressing currently, not creating more by adding more spending on free stuff. Makes no sense at all. Hopefully, now that Harris has outed her plans, more Americans will wake up and see what problems could occur with her as president.

Harris' proposals are the finishing steps needed to collapse the current system to allow in full blown central government communism.

Smarter people than me have already recognized this:

https://twitter.com/RobertMSterling/sta … 8008391127Folks, when a country gives away its revenue stream through tax cuts, there are consequences - usually for the people who are least able to cope with them.

Inflation is caused by the Federal government spending more than it earns, because they just print more money to make up the difference.

To solve inflation, reduce wasteful government spending. Your tax dollars should be spent well, not poorly. ~ Elon Musk

I presented you with a few links that explained how the tax cuts and other efforts of the Trump Administration improved revenue and associated areas like personal spending, not so long ago in another thread.

Federal Revenues Hit All-Time Highs Under Trump Tax Cuts

https://www.investors.com/politics/edit … -deficits/

Did the Tax Cuts and Jobs Act Pay for Itself in 2018?

https://www.taxpolicycenter.org/taxvox/ … tself-2018

What occurred, Corporate Taxes went down, other efforts by Trump to strong arm corporations to "stay" in America or "build" in America were successful... corporations had more money... but corporations were also being forced to spend/develop that money IN America/Americans.

The benefit... the incentive for corporations to flee to other nations went down because they were no longer getting taxed at the higher rate... it actually made financial sense for them to stay in America.

Alright, well, I'm not going to go deep into the bushes on this one... but those tax cuts put MORE money into American's pockets... and they spent it ... those tax cuts put MORE money into Corporation's pockets in one hand and they were getting strong-armed into "staying" in America ... more jobs, higher salaries that are all taxed... and people have more money to spend.

What the government has done the last three years is spend. spend. spend. spend. spend. spend. spend. raise taxes. add regulations. pass new laws requiring more restrictions on energy production. pay for wars. and more wars. and more wars.

And when Harris becomes President we are really going to see the screws turned on... spend. regulate. restrict. spend. confiscate. criminalize. spend. spend. spend.

https://twitter.com/CilComLFC/status/18 … 3302953442

Collapse.

Communism.

You do know who Harris' father was right?

This clip is an example of the mindset she was taught/believes:

https://twitter.com/ChuckCallesto/statu … 2558823557When this country thinks that the wealth of the people belongs to the politicians there are consequences. And we are at that point.

One can also assume that the people who are filthy rich (Donor class) and the Institutions (BlackRock) that literally pay for the elections and allow the political class to live in the luxurious way that they do... want to take as much power and wealth from the lower classes as possible.

They want to control the masses and impose their will more than the politicians in DC do... the likes of Cuban and Soros can't stay out of sticking their noses into the remake of society, of the world.What better way to control than to keep the masses destitute and ignorant? And they are doing both.

The term, survival of the fittest, comes to mind.

Wasn't it a Republican, Dick Cheney, who said "Deficits don't matter?"

"So Cheney was mainly right, subject to two provisos: first, that the deficits are not the source of inflation; and, second, investors continue to have confidence that they will get repaid. Unless and until another country can rival the US economy and emulate its relative political stability, deficits will indeed not matter very much."

Arnold J Clift

Brattleboro, VT, US

Deputy Secretary, World Bank, 1993-96And yet the interest payments are either the second or third largest item in our budget. What could we do with that money had we not shoved our costs onto the future, all those years ago?

I don't think Cheney was right at all. It is fine and good to borrow, for example, war time costs, but we do it for everyday expenses that will continue indefinitely into the future. We want it, we just don't want to pay for it, so force someone else (our kids) to pay it for us. They will have to do without just to make the interest payments, let alone the principle.

https://www.washingtonpost.com/politics … kes-28000/

"Trump cites “government” numbers, but economists say the math makes no sense."The portion of tariffs absorbed by firms squeezes margins.

The portion of tariffs passed on to end consumers increases prices and shrinks real income.

Are these not just corporate income taxes by another name?? Yes, yes they are.

Tariffs are a tax on American corporations... The largest in recent history.The big difference? tariff taxes are charged and payable regardless of whether the company is making a profit, breaking even, or taking a loss. Corporate taxes are only paid if/when a company makes a profit, and only on that profit. Tariffs can put a company breaking even or with a slight profit out of business in a way that corporate taxes can’t since they scale with profit....

I strongly disagree with the idea that tariffs are just like a tax increase on businesses, because they are fundamentally very different in how they function, who they target, and the economic dynamics they create. Tariffs are imposed on imported goods, not on profits, and their purpose is often to protect domestic industries from unfair foreign competition or to incentivize domestic production. Yes, tariffs are paid regardless of profit margin, but so are many costs businesses face, like raw materials, transportation, or rent. A tariff is a strategic tool, and unlike a corporate tax, it can be navigated. For instance, a business owner can choose to purchase from a country with lower or no tariffs, creating a level of pricing competition that can offset or even eliminate the added cost of the tariff. This flexibility allows businesses to adjust supply chains in ways that corporate taxes simply don’t permit.

Corporate taxes, on the other hand, are unavoidable if you’re making a profit; they’re a direct penalty on success. They cut into reinvestment, innovation, and hiring, and they’re applied regardless of whether your inputs are foreign or domestic. Tariffs, by contrast, can encourage domestic sourcing and manufacturing, leading to long-term economic resilience. Saying tariffs are worse because they apply even during a loss ignores the reality that every business already deals with fixed and variable costs that don’t scale with profit. Tariffs are one of many costs a business can manage through smarter sourcing, while corporate taxes are rigid and inescapable. So, no, they're not the same at all, and to conflate the two is to ignore the entire strategic rationale behind trade policy.

This is a complex issue with many layers, but unfortunately, most discussions on social media reduce it to a simplistic talking point like “Tariffs will be passed on to the consumer.” While that can happen, it is by no means a universal outcome, and much more needs to be considered.It's really very simple, tariffs are an increased business cost.

Let's remember..Multiple peer-reviewed studies by the American Economic Association, the Federal Reserve, NBER and the Tax Foundation all confirm one thing: U.S. businesses and consumers bore almost the entire cost of the China tariffs.

This isn’t politics, it’s economics.

- tsmogposted 4 months ago

0

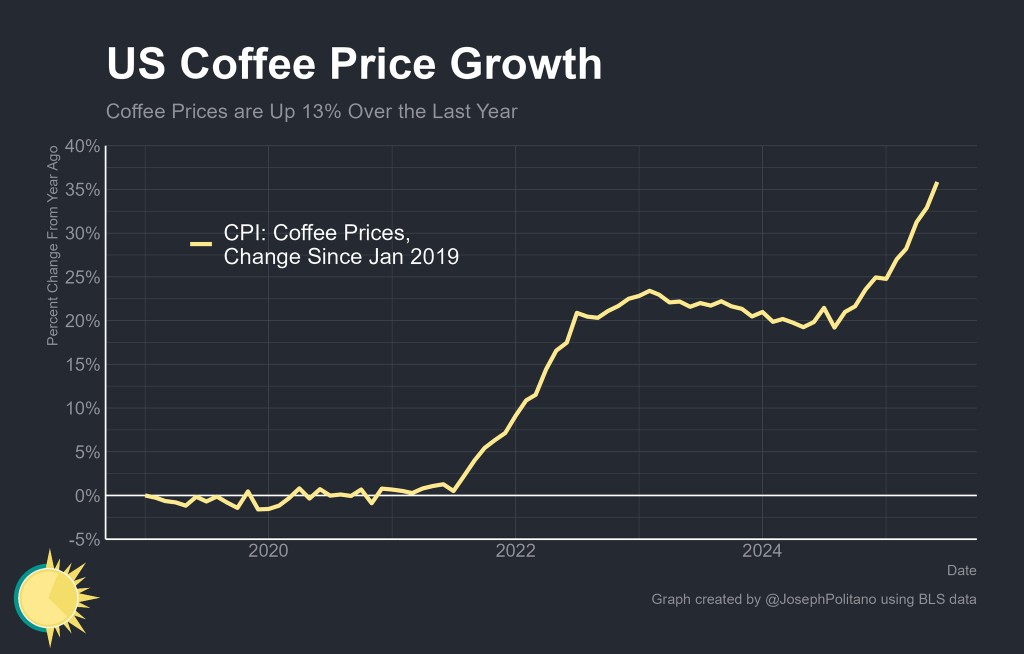

As an aside, all I know is it costs me more to make my omelettes. Roma tomatoes, onions, and green peppers have 'jumped' in price in the market. So, it appears tariffs have affected my life. I took a hit with coffee too. A few dollars as a matter for fact. Yikes! Not coffee!

Coffee! Can someone remind me why it was a good idea to put tariffs on goods that don't grow in America again?

Let me remind you --- the cost went sky high under Biden, as your chart indicates. Now higher under Trump due to a trade war. Guess we will need to wait and see what shakes out after all is said and done. I hope to hell prices will fall back to what they were in 2020 -- I mean thanks for the chart.

Common sense probably should tell Trump that you don't tariff a product that we cannot make in our own country...

He blanketed all nations. Trump’s trade team introduced a “reciprocal tariffs” approach, charging baseline duties of 10% on all imports, plus higher country‑specific rates (up to 50%) for nations deemed to have unfair trade barriers. The idea: punish trade imbalances and encourage trading partners to negotiate one-on-one deals.

Pretty dumb. Coffee will never be produced to the level we consume in this country... Common sense

You might want to wait until all the trade deals are finalized to see where tariffs on coffee actually land. I have no idea what kind of tariff Trump might apply to coffee specifically. Keep in mind, tariffs aren’t usually applied as a blanket measure; they’re broken down by individual commodities. It sounds like you may want to brush up on how tariffs work and how they’re categorized. I mean, coffee could go back to zero tariffs as most was they were before the trade war. It's up now because of the Trade war. Hopefully, Trump will impose zero tariffs on coffee. Why would we produce coffee hear when we can buy it from other nations very cheaply? We do not have the right environment to grow coffee beans. And we are a nation that likes coffee, hence the zero tariffs placed on it.

There are commodities we can not produce here. Common sense tells one that when Trump says build and produce in America, one would not include any products we cannot produce do to the environment, or environmental regulations that are in place by law.Well common sense tells me that there would be a zero tariff on coffee coming into this country at this very minute yet there is not.... I believe it is 10% currently with Brazil actually being significantly higher... Guess who is paying that extra cost? Hey at least we're adding to the government coffers though right?

I don't agree. One of Trump's promises was a tariff war. We are smack in the middle of one. Yes, we are adding to our coffers. Our coffers pay for tons of things that Congress feels we need. Hopefully, when a deal is made with Brazil, coffee will return to being duty-free. Thus far not too bad...

U.S. Average Retail Coffee Prices per Pound (Ground Roast Coffee)

Month Price per Pound Notes

Jan 2023 $6.06 Slight increase from 2022

July 2023 $6.38 Summer increase due to drought impacts

Dec 2023 $6.72 Year-end inflation, supply chain strain

Jan 2024 $6.79 Starting 2024 with stable upward trend

July 2024 $7.10 Strong price pressure from global markets

Dec 2024 $7.44 Anticipation of trade tensions, tariffs

Jan 2025 $7.54 New tariffs proposed, futures rising

April 2025 $7.93 Immediate surge in wholesale import costs

June 2025 $8.13 Highest price on record (as of mid-2025)

Not sure if we will ever see prices we saw in 2019 before COVID

Year Month Average Price Notes

2019 Jan $4.39 Pre-COVID, stable market

Something to keep an eye on.Who should bear the brunt of adding to the coffers by force? The corporations or the consumer?

Who should pay the cost of the tariff in this case? The consumer should simply pay more for coffee because Trump says so? Or the corporate coffee folks should absorb all or some of the cost??? Someone has to pay it, who should it be?

Who should pay the cost of the tariff in this case? The consumer should simply pay more for coffee because Trump says so? Or the corporate coffee folks should absorb all or some of the cost??? Someone has to pay it, who should it be?" Willow

You do realize we’ve had global tariffs in place for decades, right? They’re nothing new. What seems to be overlooked is that many variables determine whether a business chooses to pass the cost of a tariff on to consumers. I’ve already addressed several of these factors in my previous replies.

No, consumers shouldn’t be expected to pay more simply because a president suggests businesses raise prices, which he has no authority to enforce. Pricing decisions fall entirely on the business owner, and they’re based on a range of factors unique to their operations.

You also seem to be ignoring the fact that many of the trade deals Trump has pursued are reciprocal and fair. Some have yet to be finalized, but those that are show a clear “we’ll do this if you do that” structure, aiming for mutual benefit. From the beginning, he’s said he wants fair deals, not to damage other nations.

So, to answer your question: Who should pay? That’s always been up to the business. What Trump has done is offer tax cuts and roll back burdensome regulations in hopes that businesses will keep prices stable. This is a strategy no other president has seriously tried in modern times.

Will it work? I believe it’s showing promising signs, but it’s still too early to make a final judgment.

I might add, this is a bold and courageous agenda, one that we Democrats from the ’70s would have debated passionately and thoroughly. That was the spirit of the party back then: open dialogue, strong ideas, and a willingness to challenge the norm. Oddly enough, it’s the new Republican who's embracing that same approach today, pushing boundaries, challenging the status quo, and actually inviting debate. Meanwhile, the modern Democratic Party seems more focused on clinging to a stagnant narrative, wringing hands, and predicting a bleak future. It’s just not an appealing mindset anymore.Who should pay the increased tariff on coffee? Corporate or consumer?

As I said, I have no idea if or what tariffs might be charged on coffee. The only facts I have are that it was at zero before the trade war. I will wait and see what plays out.

There is already a tariff on nations from which we import coffee.

Do you feel that the corporations should shoulder the complete burden? Or pass it on, at least on part to the end consumer? Right now they seem to be passing on most of the increased cost of importing beans onto the consumer as we all know that coffee prices have risen...

Just in...

"Trump on Wednesday signed an executive order raising tariffs on imports from Brazil to 50 percent, escalating his fight with the largest South American economy"

So it looks like coffee is going to get a lot more expensive.

Should the corporations suck up the cost or pass it on to the consumer? And by the way, we get most of our coffee from BrazilI understand that we have different perspectives on the trade war. Our mindset is quite different. I fully support Trump’s tariff strategy because I believe it plays a crucial role in protecting American industries and jobs, especially in manufacturing and agriculture. Tariffs serve as a powerful negotiation tool to pressure countries like China and Brazil into making fairer trade deals that prioritize U.S. economic interests. Beyond economics, I see tariffs as a way to strengthen national security by reducing our dependence on foreign supply chains.

I’m even willing to pay more for goods if necessary because I believe standing up for American workers and restoring fairness in global trade is worth it. Ultimately, by encouraging the purchase of American-made products, tariffs help boost our domestic economy and promote innovation. While some view tariffs negatively, I believe they are necessary to defend American workers and the future of our country.Where can I buy that American grown coffee??? And do they have enough supply for approximately 300 million people? Lol

As I said, and I can only speak for myself --- again maybe thisntime it will sink in ---

I’m even willing to pay more for goods if necessary because I believe standing up for American workers and restoring fairness in global trade is worth it. Ultimately, by encouraging the purchase of American-made products, tariffs help boost our domestic economy and promote innovation. While some view tariffs negatively, I believe they are necessary to defend American workers and the future of our country.How will a tariff on coffee lead to coffee production in our country? Asking for coffee drinkers everywhere...

They won’t, since we don’t grow coffee beans here because of our unsuitable climate. Trump was very clear that there will always be certain products we have to import due to production limitations. It seems illogical not to recognize that fact. And Trump certainly understood it. His goal is to bring back manufacturing that left the country and to encourage new industries moving toward all the products we’ll need for the future, such as advanced technology, renewable energy equipment, medical supplies, and essential consumer goods, alongside the existing ones.

He is working to make sure that America leads in the manufacturing of all the mentioned. Not satisfied to let China lead."since we don’t grow coffee beans here because of our unsuitable climate. Trump was very clear that there will always be certain products we have to import due to production limitations."

Why would coffee be tariffed then?

And yes, there is currently a tariff on coffee... Why?I’m aware of the tariffs on coffee and honestly feel the tariff conversation has been exhausted—it’s starting to feel like beating a dead horse. You can be assured I’ve followed the details of the deals; most of them follow a similar pattern. I’m satisfied with the agreements that have been made so far and am waiting to see the outcome of the rest. That said, it’s clear we view these new tariffs through very different lenses. I think you’d have a more productive conversation with someone who shares your perspective, since our interpretations and expectations of what these deals will ultimately deliver for the country are quite far apart.

I have no reason to defend what I truly believe in.Gotcha. You are obviously content with tariffs on coffee that raise the prices for the rest of us ..

"Gotcha. You are obviously content with tariffs on coffee that raise the prices for the rest of us .." willow

I'm being clear about how I feel on this issue; I’m not concerned with how others may view it. Just as you're entitled to your perspective, I have mine. I don't know what coffee will cost, and frankly, I don't care what you or anyone else pays for it. I'm aligned with what I believe will make America stronger and bring back jobs.

I've said repeatedly: I'm willing to pay more for goods if it means building a better, more self-reliant nation. How many times does that need to be repeated before it sticks?

I've followed the details of these trade deals closely. Most follow a clear and consistent pattern. I'm satisfied with what's been negotiated so far, and I'm watching the rest unfold. I support Trump on this; I appreciate that he's following through on his promises regarding tariffs.How is that jobs thing working out? The experts consistently predict, especially as more data comes in, that Trump will cost America almost a million jobs by the end of 2025.

"I think you’d have a more productive conversation with someone who shares your perspective, since our interpretations and expectations of what these deals will ultimately deliver for the country are quite far apart." - WHAT is the point of having any discussion at all if one is only going to talk to those who share the same views? If that is the case, it isn't a discussion at all, just patting each other on the back for being so smart.

If you are seriously asking this question and not just looking for another reason to say things about Trump I will try to explain from a Brazilian perspective. Our duly elected president, who wanted to import and do more trade deals with the US, lost the last election in part due to interference from Biden. The current president and his ilk is trying to shift all of our trade to China. Trump chose to inflict tarrifs on coffee and many other Brazilian goods in an attempt to fight that. The majority of people here do not support that as it is causing more hardship and lack of jobs here. Other people point out that Trump is trying to get rid of the head of our Supreme court, who has done thing like fabricate charges against the former president, place him under house arrest with an ankle monitor, tried to force X to give up names of Brazilians that made any negative comments on the socialiast government, and made sure that there were no paper ballots so that he could control the results of the election. If anyone did these things in the US the other governments of the world would be in an uproar and would stop trade with a government elected through fraud.

So was a tariff on coffee a good thing? Probably not. Is Trump trying to do something against a government that is not in favor of the US? Definitely.I don't care about the politics of Brazil...not our business over here.... You know we have this thing called America first LOL. The masses want reasonably priced coffee...that's it.

Yes, I understand you only care about yourself. You did ask though, my mistake if I thought you were being sincere and wanted to know.

You might be interested to know that one of his points in doing all this is that the BRICS countries are trying to switch to using the yuan as a trade currency instead of the US dollar. That does have a lot to do with your economy since if the dollar is no longer the worldwide currency its value is going to go down.The ONLY point Trump is messing with your internal governance is that he is pissed a fellow dictator is being brought to justice in Brazil, something we can't seem to do here.

Trump is trying to do the best for your own country. His actions are not in the best interest of Brazil, which I can understand. What amazes me is people on the left that do not want things to get any better for the US.

Of course we do, that is why we voted for Harris. Unfortunately, we got Trump and will be forced to go through four years of Hell until it can get better again.

Here are the metrics I look at to see if Trump is making things better or worse.

* Whether Debt is exploding or not: With the One Big Ugly Bill, it is exploding by at least $3.4 trillion, the threat of which is already driving investors in America away.

* What is the Dollar doing, getting weaker, stronger, or staying the same? It has LOST 8% since Trump took over.

* What are investors doing, putting money into treasuries or taking it out? A total of $125 Billion has flowed out of America

* What is inflation (PCE) doing, going to the Fed's 2% mark, remaining constant, or increasing again? It is increasing again.

* How is our labor market doing, strengthening, remaining the same, or getting weaker? Up until July, it appeared to be holding its own or not deteriorating too fast. In July, with the May and June updates, the bottom fell out of the labor market

* How is the GDP doing, going up, staying the same, getting weaker? It is getting weaker. From Feb through June, the GDP has grown at a very weak 1.24% on an annualized basis.

* How is manufacturing doing? Major manufacturers have lost in excess of $7.5 Billion dollars so far this year (that is a minimum)

That is just a few of the ways to measure how Trump is doing. As far as I know, there are not any positive ones. It is clear Trump is Making America Worse Again - MAWA

Therefore, since conservatives want Trump to keep on doing what he is doing, it seems to me the correct thing to be "amazed" about is how badly those on the Right want America to do.

Doc. Thank you for laying out your perspective so clearly. There’s a lot of truth and important context in what you said. From a U.S. standpoint, I do support Trump being involved in Brazil’s politics, not to meddle in sovereignty, but to protect long-term American interests, especially as they relate to trade, the global influence of the dollar, and the fight against authoritarian socialism that could harm both our nations.

Let’s start with trade. Brazil is one of the largest economies in Latin America and plays a strategic role in global agricultural and mineral exports. When its government shifts alliances toward China, that doesn’t just hurt U.S. exporters and consumers; it weakens the influence of the U.S. dollar in global transactions. China has made it clear it wants to reduce reliance on the dollar and expand its sphere of influence through trade and currency agreements. If Brazil, a key regional player, aligns its trade and financial systems more closely with China, that’s a direct challenge to the U.S. economically and geopolitically. Trump understands this and is attempting to push back using the tools at his disposal, mainly tariffs and diplomacy.

As for the Brazilian Supreme Court and the political situation, many Americans are unaware of what’s really happening. The actions you described—targeting political dissent, censoring free speech, using the justice system to suppress opposition- would be considered outrageous if they occurred in a Western democracy. Yet because it’s happening under a left-wing regime that certain global actors favor, it’s largely ignored. Trump’s stance isn’t just about protecting trade, it’s about signaling that the U.S. won’t quietly tolerate authoritarian behavior from governments that suppress freedom while turning toward America’s adversaries.

The coffee tariff may not be ideal on the surface, but it’s a piece of a broader strategy. Trump is drawing attention to a shifting alliance in South America that could damage American workers, limit our exports, and embolden regimes that don’t respect liberty. And while some in Brazil understandably feel the economic squeeze, it’s worth recognizing that Trump is not acting against Brazil’s people, but against a political direction that undermines shared values and U.S. interests.

When the U.S. imposes tariffs on Brazilian goods like coffee, it raises the cost for American importers. In response, those businesses naturally start seeking alternatives, often turning to nations like Colombia, Vietnam, Ethiopia, or Central American countries that are still open to strong trade relationships with the U.S. That redirection of demand gradually reduces Brazil’s share of the U.S. market, especially in high-volume goods like coffee.

So yes, Trump is involved, and for good reason. The survival of U.S. influence in the Western Hemisphere and the future of the U.S. dollar as the world’s reserve currency are very much on the line.

July 29 --- In a CNBC “Squawk Box” interview (late July 2025), Lutnick stated that natural resources not produced in the U.S., such as coffee and cocoa, could qualify for zero tariffs in trade agreements with countries like Indonesia and the EU

Reuters

He elaborated: “If a country produces something we don’t grow, it can enter at zero [tariffs]… coffee and cocoa would be other examples of natural resources.” Though coffee is included conceptually, these exemptions apply only to countries with finalized trade deals, and Lutnick did not name Brazil or guarantee its inclusion.

"Trump was very clear that there will always be certain products we have to import due to production limitations." - THAT being true, then what is the justification of putting tariffs, especially high ones on such products?

You seem very concerned about the "fairness" or lack thereof in global trade, so much so that you are willing to pay higher prices to "fix" it.

Are you just taking Trump's word for that or do you have a set of data that leads you to that conclusion?

When I asked ChatGPT, other than China, it could find but a very few examples, most of which were being resolved in other ways.

Oh yes...."punishing" Brazil by making Americans pay more for coffee....

The deal with Brazil has not been negotiated. I feel, and just my view, coffee will go back to zero or maybe a small tariff placed. Are you not reading in the worst yet again? Do you ever look at the other possible outcomes that could result from the new tariffs?

Elaborate on the good of increased costs due to tariffs. Increased cost to corporations, consumers or both. Some did not want to see corporate tax rates go up due to the impact they would have, the cost. Yet the same folks are cheering for corporations to absorb all the extra cost of tariffs. Do you believe that the corporation should absorb all of these costs?

"Nevertheless, President Biden does deserve praise for putting forward a comprehensive budget proposal that not only offsets new spending and tax breaks but would also reduce budget deficits by $3.3 trillion through 2034. These savings are less than half of what is needed to stabilize federal debt over the next decade, but they represent an important step forward and offer an opportunity to build on the savings from the Fiscal Responsibility Act.

We hope Congress and the President will come together on a plan to save at least the $3.3 trillion called for in this budget, responsibly extend expiring policies, and avoid Social Security insolvency – and do so in a fair, pro-growth, and ideally bipartisan manner."QUESTION...

Who should shoulder the cost of these tariffs? The corporations should solely absorb the extra cost? The consumer should absorb the extra cost? Or a mixture of both?It’s important to approach this question with a dose of common sense and a look at basic economics. First off, it’s still too early to predict with certainty how businesses will react to the newly imposed or proposed tariffs under Trump’s policies. However, what we do know is that many corporations would likely prefer paying targeted tariffs over facing the blanket high taxes and increasing regulations proposed by Biden. Tariffs are specific, measurable, and sometimes temporary; taxes are sweeping, ongoing burdens that hit the bottom line every quarter. Many business leaders would likely rather deal with trade barriers than massive hikes in corporate tax rates or the red tape that comes with ever-expanding federal oversight.

Simple math begins to hint at the answer here. Under Biden, we possibly would have seen higher taxes and more regulations, an approach that stifles growth. And had he won in 2024, Biden made it clear that the wealthiest Americans and large corporations would face a very steep rise in taxes. He pitched it as a way to make the rich “pay their fair share,” but in reality, those costs always find their way back to workers, investors, and consumers. Contrast that with Trump’s economic strategy, where sweeping tax cuts and incentives have already become law through what he calls “The Big Beautiful Bill.” Trump’s renewed promise to slash burdensome regulations and keep taxes low means companies will retain more earnings, expand faster, and compete harder. With more investment pouring in, both from domestic and foreign sources, we’re likely to see a level of competition we haven’t experienced in decades. That kind of competitive pressure forces companies to keep prices down and improve quality just to survive.

As for who should bear the cost of these tariffs, the reality is that it’s hard to predict. We don’t yet know how much of the cost will be absorbed by corporations or passed on to consumers; it will likely vary across industries, business models, and supply chains. What Trump has put in motion is complex. He didn’t rely on one simple fix, he used many moving parts to try to reset the economy. Some of these pieces are bold, even unprecedented, and they’re all coming into play at once. Because of that, there’s no clear formula or past example to draw from. What is clear, however, is that under Biden, prices rose sharply due to a mix of poor decisions, energy restrictions, reckless government spending, and neglect of supply chain issues. Since then, prices have mostly leveled off, and in some areas have even declined slightly, not because of a successful policy, but because the market is trying to correct itself.

So while she may worry about tariffs, I’d remind her that Trump’s approach isn’t business as usual, it’s a bold and multifaceted effort to restore balance and growth to the economy. Biden’s plan, by contrast, was based on redistribution, tax hikes, and tighter control, policies that tend to choke innovation and limit opportunity. When you step back and weigh the costs, Trump’s model may not be easy to predict, but in principle, it’s built to empower growth rather than suppress it.

I see it this way: some people are stuck using outdated variables when trying to predict the outcome of these new trade deals. In my view, they’re not fully considering that Trump has put multiple strategies into motion all at once, bold, overlapping actions that are designed to work together. It’s not just tariffs or tax cuts alone; it’s a broader reset aimed at driving a strong economic comeback. He’s also working to bring in investment from foreign nations and negotiating with other countries to establish fair, reciprocal trade agreements. The goal isn’t isolation; it’s to open up a truly fair global trading system where American businesses are no longer taken advantage of. Ignoring that full picture leads to shallow or incomplete conclusions.Tariffs are a cost... Who do you believe should pay the cost?

The corporation at 100%? The consumer at 100%? Or a mix of both?

Who's bottom line should it impact the most, the corporation or the consumer?Yes, tariffs are a cost, but my point is that we can’t automatically assume, as in the past, that those costs will be passed on to consumers in the same way. My earlier comment outlines why I believe it’s difficult to predict the outcome using traditional models. So far, there’s no solid, conclusive evidence that the tariff measures have significantly driven up consumer prices. I understand that your concern is rooted in historical precedent, that tariffs usually lead to price increases, but I’d argue that Trump’s approach involves a very different and complex set of economic actions that don’t mirror past conditions. Because of that, I’m not convinced we can draw a straight line from tariffs to consumer price hikes in this case. So no, I don’t believe it’s conclusive that consumers will end up shouldering the burden.

My mindset is a bit different; I don’t rely solely on past examples without also considering the unique circumstances we’re facing now. I take current differences into account before drawing conclusions. I think Trump’s economic agenda is unique, and in the end, it may work out very well. I hope that helps clarify where I’m coming from.The question is....Who should pay the cost? Some entity must pay the cost.

Not interested in repeating myself. Stepping away from your comments for a bit. They are repetitive. That does not make for intelligent conversation.

The question was never answered... Are you satisfied with corporations absorbing tariff costs and therefore affecting their bottom line and potentially staffing or should more of the tariff cost be passed on to the consumer? Or should we see some combination of the two?

- tsmogposted 4 months ago

0

MAGA tariffs:

Beef: more expensive

Coffee: more expensive

Amazon: raises prices by 5.2% on low cost items since tariffs announced

GM: takes a $1.1B hit

Stellantis: $1.7B loss

Is America great yet?BTW, back to the starting point - Don't you now wish Harris' $1.7 trillion add to the debt had materialized? Now we have a $3.2 trillion increase and a million more people who will lose their insurance. Great job, Trump.

Related Discussions

- 15

Trump vs. Harris . . . economic plan, deficit, and debt.

by tsmog 14 months ago

How the Plans of Kamala Harris and Donald Trump Could Affect the Deficit by Investopedia (Sept 17, 2024)https://www.investopedia.com/trump-harr … on-8710401The bottom line . . ."According to separate analyses by nonpartisan think tank the Committee for a Responsible Federal Budget and...

- 13

the 2011 federal budget

by JON EWALL 14 years ago

Will the US Government be forced to shut down because President Obama and the previous Democrat controlled Congress failed to approve a 2011 budget?

- 75

With record revenues, we are still running a deficit...

by Jack Lee 7 years ago

The GOP controlled house is a disgrace. They deserve to loose their majority. After a great booming economy...and record revenue coming into the treasury...you would think we could finally reduce our debt.Instead, they kept spending and increased our deficit for years to come.Why did they think we...

- 119

One Big Beautiful Bill or a Ball of BS?

by Willowarbor 5 months ago

On Tuesday, Trump lauded a House budget blueprint that may enable Congress to pass much of his legislative agenda in what he called “ONE BIG BEAUTIFUL BILL.” That budget, which passed a committee vote and could hit the House floor as soon as next week, lays out targets for legislation that would...

- 28

After dealing with the wall and immigration, what is next?

by Jack Lee 6 years ago

Trump must deal with the looming debt.This is a solvable problem. It is a spending problem, not taxation.We are raising record revenue at the IRS. Yet, we are still spending more than we take in.That needs to stop.Trump must tackle this because Democrats wont and Repulbicans wont either.Only an...

- 21

The GOP House of Representatives, Shutting Down the Government

by Mike Russo 5 months ago

The new House of Representatives is ready to shut down the government because they don’t want to pay for the countries bills that were accrued in the last fiscal year. So they want to hold the country hostage until they get what they want, which is to lower spending for the next fiscal year. ...