The World, Upside Down

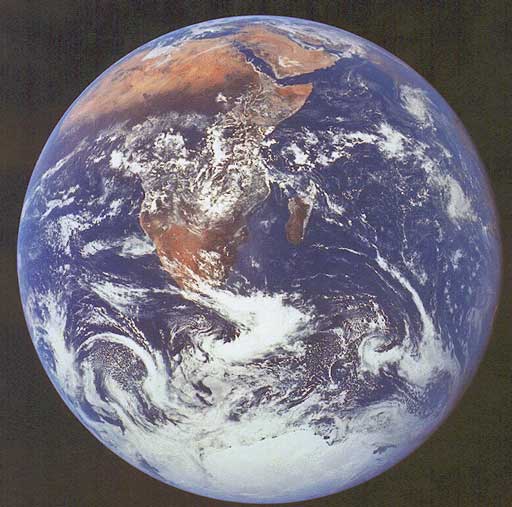

The World

Amazing

I am sometimes amazed at how the World has become: Upside down.

It has become upside down mainly because how we the people, have allowed the banks and bankers, to control every aspect of our lives.

Each of us as human beings is born free. Free to make choices of our own, for the reasons we choose and for the purposes that we choose.

Of course, over the thousands of years of our existence, it has become clear that there have to be rules that we as free people must comply with. These obviously include not killing others, not cheating others and the safe nurturing of our children.

It has only been in the last century though, that the “norm” seems to only apply to the lower financial classes and now separate rules, if any, apply to the wealthy. It is amazing that even through thousands of years of evolution; these rules for the rich have no consideration for the well being of others in the species.

Leading Banks

Banks

First we must consider what banks produce: Nothing.

What do banks grow: Nothing?

What do banks manufacture: Nothing?

What do banks mine: Nothing?

It is said, yes they produce wealth. Perhaps this is true but wealth for whom, other than them only.

So, from nothing they produce wealth for themselves.

How do they do this and how come no one else can?

It is said that they provide a service, what service and for whom?

So this is it. If some body requires money to build a company that will provide goods or services for the people and employ workers, they get a loan from a bank. I get that but whose money do the banks give them: ours not theirs.

- Who Owns Your Money?

Do you own your money? If not then who does and how much influence do they have over you?

How it Works

Big banks have been allowed over the years by greedy or mis-guided politicians, to create a set of rules that only benefit themselves but have to be accepted by the rest of us.

If we go to a bank to borrow money, remembering that it is by us borrowing that the banks make their money, we must answer an enumerable amount of questions.

These questions may include but not be restricted to: how much do we earn, how do we spend it, where do we work, for how long, are we married, how many kids, where do we live, who are our parents, how old are they, are we sick, have we ever been, do we intend to get sick, what do we want the money for, how do we intend to pay back, who can vouch for us and most important of all, do we have collateral?

Why all these questions?

If we have collateral, they will hold it or at least the papers for it and so no questions need be asked, the choice should be ours.

What should happen is: We should be told how much money they have, how much does their CEO make, how much does the owner have, does he pay taxes, what do they intend to do with the profit they make from us?

They should be competing for our business.

In the United States, it has become law that you are not allowed to “hoard” more than a certain amount of currency. We therefore have to use the banks and are forced to comply with their rules.

Even if an independent bank was now to open, they are automatically required to comply with the rules of the larger bank “syndication”.

- 40 Million Empty Houses in the US

why are there homeless? Why do we pay so much? Why are we in debt? All of this whilst 40 million houses stand empty and not wanted.

A Loan

So after answering all the questions we get a loan, perhaps to buy a house.

The bank holds the house paper. This means that if we default on the loan agreement, they get to keep the house. We pay interest. No objection, that’s how they make their money. Then though, WE have to pay insurance. The insurance companies are owned by the banks, this is double payment.

If we miss an insurance payment, the insurance becomes invalid. We miss another couple of mortgage payments, the bank takes the house. We have nothing.

When does an insurance company pay the bank, to stop the bank taking back the house?

So we come on hard times. We lose the money we have already paid on the house, whether it be deposit or regular payments. We lose the money we paid for as interest on the loan. We lose the money we paid as insurance payments.

The bank has all the money paid them. The bank has all the interest payments. The bank also now has the house that they can resell, probably at a higher rate than what was first borrowed for the initial purchase.

The insurance company, probably owned by the same bank, has all the insurance payments made on that house.

We have nothing, except perhaps extra questions and a higher interest rate to pay when we next go to a bank to get a loan for something to cover our heads.

Just Another Puppet?

Conclusion

OK, we made a free choice to go to the bank for a loan.

If we had collateral, we lost it. If, perhaps in the case of a house, the house is the collateral, we lost it.

What is amazing is this: in either case, the bank never lost anything.

This begs the question:

How can a bank lose so much money that it has to ask the Government to bail them out with OUR money?

The answer has to be that although WE were required to play by the rules they set, they had no rules by which they must play by.

In their greed for yet more wealth and power, they loaned their fellow “colleagues” money to “gamble” without collateral and so must pay for their error of judgment.

We may have to suffer the consequences of those choices we make but we should not have to endure, let alone be forced to endure, the consequences created by others choices.

There have to be rules and laws but those rules and laws must be equally followed and enforced by all.

These rules must equally apply to the rich as well as the poor, perhaps even more so as usually the poor’s choices only affect themselves, whereby the rich man’s choice all too often affects many.

At this time of an approaching Presidential Election, the people should be asking only one question of the candidates.

Do you too Sir, intend to be yet another pawn to the bankers?

- Where's the Fort Knox Gold

A recent mystery seems to be as to whether there is any gold in Fort Knox or not. Is there? If not, where has it gone and who knows about it? - Debt, a Word of the Past

The word debt seems to have been replaced with deficit. No matter how often you change the word, the meaning is still the same. - A Century of Scam

Is it a scam that has been going on for nearly a century? Is fluoride really good for us? Why are they insisting on putting it in our water? - What New World Order?

There is a lot of talk about a New World Order. Is it just talk or is it not enough talk? - War and the US Dollar

The elitists of the United States want war, but why? They would even like a cold war but both would be better. Why?