Simple Mathematical Proof that Obama was Wrong

- JaxsonRaineposted 13 years ago

0

This is about Obama claiming that Mitt's tax plan can't possibly work, and that it would cost $5 trillion in tax cuts.

The top 1% of Americans pay an effective tax rate of 24%. This is a fact, I have mentioned it many times, it comes directly from the IRS.

The average AGI for someone in the top 1% is $959,000. They have a marginal rate of 35%, but only pay 24%.

Now, let's drop the top marginal rate to 25%, and put a limit on deductions of $25,000, both ideas that Romney threw out in the debate.

So, out of $959,000, they would have to pay taxes on at least $934,000, at 25%. 25% of $934,000 is $233,500. $233,500/$959,000 is 24.3%, slightly more than what they pay now. The more someone makes, the closer to 25% it would be.

Now, as a note, that's not how taxes work exactly, but it's a perfect demonstration of the principle. It is very easy to lower the marginal rate, and reduce deductions/exemptions/credits, to remain revenue neutral. Anyone who says doing so is impossible(Obama) doesn't understand basic math.Assuming this is true which I have not checked but am willing to trust you on for now. It raise sthe question of why bothering to do it at all? if the tax burden remains the same and revenue remains the same what is the purpose?

You should love it. It puts everyone on equal ground. You don't end up with one company with $5 billion in profits that paid 10%, and another that paid 30%. You don't end up with established companies paying 10% because they have organized their business around the tax code, while new businesses that are struggling pay 30%.

So for one, it's more fair.

Another reason... corporate tax rate is 35% on any income over $18.3 million. Individual tax rates is 35% on any income over $200,000-$400,000. Half of small businesses pay on the individual tax rate, so they hit higher rates much sooner. Again, small businesses usually don't have the good accountants and lawyers, or the business practice tailored to get their tax rates as low as possible, so they end up paying higher. Again, it's about fairness, among other things.

But this isn't a fairness for fairness' sake, as Obama is in favor of. This is fairness for health of the economy. Do you think GM should pay a lower tax rate than John's Photography?(Oh, bad example, GM doesn't pay any taxes).

Greetings, Jaxson. Just between you and me, you are one of my favorite posters.

I follow your arithmetic, agree with your numbers, but disagree with your conclusion. You clearly understand the math. However, you clearly do not understand the political realities that trump your calculations. While your numbers prove a possibility, your conclusion is a giant leap in improbability. As is always the case, the devil is in the details.

A common observation from the first presidential debate goes like this: “However, Romney says he wants to pay for the tax cuts by reducing or eliminating tax credits, deductions and exemptions. The goal is a simpler tax code that raises the same amount of money as the current system but does it in a more efficient manner. The knock on Romney's plan, which Obama accurately cited, is that Romney has refused to say which tax breaks he would eliminate to pay for the lower rates.” {1}

…and your reply…I think it is fair to say Ralph sees a problem in the probability and not in the possibility of your math. I am not sure “tens of thousands of deductions, exemptions, and credits” is accurate but it does highlight the biggest flaw in the Romney plan. President Obama may be correct in saying the plan in impossible because, as a sitting president, he knows from experience something the governor has yet to learn. Specifically, just because you are elected president does not mean you will get everything you wish for.

Each one of those “thousands” of tax benefits has a powerful and influential constituency that will fight to preserve their pet deductions. Gov. Romney can not be specific and he can only say all deductions are “on the table” because he really does not know if, in the end, he can eliminate any loopholes to deliver a revenue neutral tax reform. Just look at his party. How many conservative congressmen with a huge religious-minded base will support eliminating charitable deductions? How many conservatives in Congress, whose campaigns are funded by Wall Street bankers, will support eliminating mortgage interest deductions? No American politician will go against the oil giants. As a result, Jaxson, proving Gov. Romney’s revenue neutral tax reform is possible becomes irrelevant when exposed to the glaring sunlight of Washington politics.

Here is another example of why I am skeptical about achieving tax reform without increasing taxes for all Americans. “The alternative energy heavy NextEra Energy already had six different firms helping it lobby on tax policy when it brought Akin Gump Straus Hauer and Feld, one of the three biggest lobbying firms in Washington over the past decade, into the fray in the last months of 2010. A tax fight was gearing up and NextEra Energy, along with other companies, sought to preserve newly won tax breaks that have helped to push their tax burdens to among the lowest in the nation.” {3}

So, Jaxson, I am not an expert in these matters. My opinion is not worth a hoot or a holler but that hasn’t stopped me from speaking out in the past. The Romney revenue-neutral tax reform is impossible despite the math in your simplistic model. Unfortunately, if Mitt Romney is elected and he tries to implement his “plan”, the results could be disastrous for the poor and less fortunate in America.

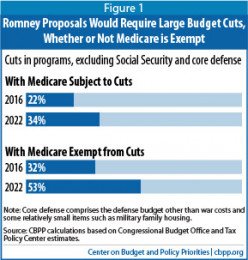

The Center on Budget and Policy Priorities paints a bleak picture of the future. “If policymakers repealed health reform (the Affordable Care Act, or ACA) and exempted Social Security from cuts, as Romney has suggested, and cut Medicare, Medicaid, and all other entitlement and discretionary programs by the same percentage to meet Romney’s overall spending cap and defense spending target, then they would have to cut non-defense programs other than Social Security by 22 percent in 2016 and 34 percent in 2022.”

“If they exempted Medicare from cuts for this period, the cuts in other programs would have to be even more dramatic — 32 percent in 2016 and 53 percent in 2022.” {4} If this happens, Jaxson, the US economy is going to tank so badly, Mrs. Romney may have to give up one of her Cadillacs.

{1} http://www.nydailynews.com/news/politic … -1.1174495

{2} http://taxpolicycenter.org/taxtopics/romney-plan.cfm

{3} http://sunlightfoundation.com/blog/2011 … ve-energy/

{4} http://www.cbpp.org/cms/?fa=view&id=3658

Or they find a work around on the deductions through a trust or charitable donation.

I know which I think is more likely.No, you're not understanding.

If you take away the deductions, there would be no workarounds.Sure there would. You attribute the income differently.

Not likely. Romney didn't mention the carried interest loophole, and he defended big oil's depletion allowance. He didn't explain how he would reduce the deficit. And he changed his tune about pre-existing conditions. His presentation was full of lies and half truths.

There are tens of thousands of deductions, exemptions, and credits. Did you expect him to mention them all?

He said they would all be on the table. Even oil company credits.

He also did explain how he would reduce the deficit, he has done so over his entire campaign. Raise revenues(not by raising taxes, but by getting more people paying taxes by getting them jbos), cut spending.

As for pre-existing conditions... that one I really don't know about. From what he says, it sounds like he wants that to be left up to the states, and I'm fine with that. He doesn't have a problem with covering them, he just doesn't like big federal government.

Do you really want to go over the debate, fact by fact?

Start by admitting that Obama was wrong about Romney's 5 trillion tax cut.No, he wasn't.

Come on Ralph, honest discussion time. Please, please, please, show some integrity and answer the following question.

What tax rate would the wealthiest Americans pay, if we reduced the marginal tax rate on their income to 24%, and didn't give them any deductions, exemptions, credits, etc? What effective tax rate would they pay?

Maybe if I ask three times I'll have a better chance of you answering... What effective rate would they pay?I'll answer that when I hear from you or Romney what programs should be cut and what loopholes closed.

You can't answer it, because it proves Obama was wrong, and by extension, that you were wrong too.

Classic Ralph. If you can't rebut a point, just change the subject, make demands, etc...

But, I know full-well that you are willing to lie to make Romney look bad... you admitted it.

Romney defended the depletion allowance, saying that it had been in effect for 100 years and that it benefited mainly small drillers, not Exxon. Not true. He didn't give a single clue, as I recall, on what loopholes he would attempt to close. Saying they are all on the table isn't very helpful.

He also said it would be on the table, and probably wouldn't survive to get rates down to 25%.

He didn't defend it as in 'I'm going to keep it'.

Do we need to look at that figure and see how it is distributed?Ten biggest Romney lies debunked here:

http://www.alternet.org/news-amp-politi … s-debunked

Romney's five biggest lies here:

http://www.rollingstone.com/politics/ne … s-20121004Hey Ralph.

1 - Can you admit that Obama's claim is factually incorrect?

2 - Can you admit that Romney said oil subsidies would be on the table?

3 - (this is a long shot) do you want to actually talk about things, or just post links to articles?Romney didn't specify a single loophole that he would advocate closing. And he said he would eliminate the estate tax.

I must have missed that about big oil companies being on the table. Didn't mittens say that they employed (or rather big business) employed one quarter of all US employees. Didn't mittens say that they've been claiming these (outrageous) tax deductions for decades, and wasn't it Obama who said it's time that that ended?

I already quoted Romney saying it would be on the table. He said that all deductions would be on the table.

He also said that 3% of businesses employ 25% of all workers. Not sure on that figure.

Also, would you care to venture a guess what would happen if we took away deductions from oil companies? I'll give you a hint: it has to do with prices.

Romney was specific on one thing: eliminating the estate tax which would benefit his own family.

Did he?

http://www.nytimes.com/2012/10/03/us/po … wanted=all

Quote please.

Not to mention, you ignored the simple fact that Obama's claim that there aren't enough deductions, exemptions, and credits to offset a reduction in marginal rates, simply isn't true.

Why do you think the top 1% only pay 24%? Because of deductions, exemptions, and credits.

Romney won the debate because Obama failed to effectively challenge his lies.

www.google.com/url?sa=t&rct=j&q … W2ph9cWijQWell, at least you have proven, once again, that you aren't interested in having an honest discussion.

Romney refused to specify what loopholes he would close and what government programs he would cut, except for PBS and Amtrak neither of which would make a detectable dent in the deficit, especially when the huge defense budget INCREASES he's advocating are considered. Romney's budget math doesn't even come close to adding up.

You wouldn't recognize an honest discussion if it bit you in the ass.

Really?

You, who won't answer a single question.

You, who won't back up your claims.

You, who won't admit that your own claims are wrong. when I quote a part of the debate that proves them wrong.

You, who openly admitted you will lie about Romney to make him look bad.

That's choice Ralph, really. Go look at how I debate with people. I address their points. I number my points to facilitate structured discussion. I use facts with primary sources(not just opinion pieces in newspapers).

So tell me Ralph, how is this an honest discussion, if you won't actually address any of my points, rebuttals, or questions?I just want to point out, this is the typical fanboy behavior. It happens on both sides.

Step 1 - Ignore anything the other person says.

Step 2 - Post so many arguments (usually by simply linking to articles) that your opponent can't possibly address them all.

Step 3 - Change the subject, move the goalposts.

Step 4 - Personal insult."Step 4 - Personal insult."

"Why do you have to be so dishonest? Does it really make you feel better or something?"

"You, who openly admitted you will lie about Romney to make him look bad."

"Before we go into anything else Ralph, let's see a little honesty."Not trying to insult you. You are being dishonest. That's a fact. You said Romney didn't say X. I show that he said X. You say Romney said Y, he didn't say Y.

I honestly don't know why you act the way you do.That's not a personal attack either. It's a statement of fact.

Or, do you now deny that you said you will knowingly lie about Romney?I don't recall saying that. Remind me when and where and in what context.

http://hubpages.com/forum/topic/101694#post2170448

The context was that you were lying about what Romney said about firing people. You admitted you will do it to make him look bad. Your justification is that it is an election year. Election year makes lying ok to you, but not to me.As I said, I don't recall saying I would lie about Romney. Anyway I don't think I even quoted Romney out of context. Romney is a chameleon which changes color depending on what he thinks will please his audience. In the debate last night he tried to portray himself as a moderate. Nobody knows what he really is.

I quoted you. You admitted it. Taking his quotes out of context to paint a false picture is lying. That, I believe, was in regard to 'Romney likes to fire people'.

It's a very clear lie, and very clearly out of context. Sorry Ralph, you can't change what you have said in the past by saying you said something else.

Obama knows that he doesn't have to challenge his lies. Every right thinking individual who reads widely and has some grasp of economics and the US situation knows what Mittens is all about.

Obama has not changed, he's a signpost not a weather cock. Mittens on the other hand, changes like the weather. He's inconsistent, inexperienced and unbelievably naive if he hasn't yet realised that everything he said last night isn't going to revisit him, when he least expects it.Hollie, did Obama lie when he said Mitt's plan is impossible, even though I just proved that it's possible?

You didn't prove anything, except in your own mind.

Coward. Answer my question then.

If the marginal rate for the top 1% is set to 25%, and they aren't allowed any deductions, exemptions, or credits, then what effective tax rate will they pay?

You continue to say I haven't proven it, even though I very plainly have. The answer is 25%, by the way, and it proves that you could LOWER tax rates, and even INCREASE effective rates, if you wanted.You've called me a liar and a coward. End of discussion as far as I'm concerned. Piss off!

When I said you lied, I proved it.

Sorry, I'll probably get banned for it, but you are being a coward. You continue to make the claim that I haven't proven what I have very clearly proven, without responding to any of my specific points or questions. That is intellectual dishonesty at it's finest.

If you want to prove that you're the better man, and that you are right and I am wrong, answer my question and show me why the answer isn't 25%.

MEDICARE: Romney made numerous false claims about Medicare, but two stand out:

The oft-repeated false allegation that Obama harmed seniors by cutting $716 BILLION from Medicare. As we’ve often discussed in this space, the savings Obamacare achieves through cracking down on fraud and abuse and ending overpayments to insurance companies and providers has no impact on beneficiaries. Indeed, Obamacare provides Medicare beneficiaries with new no-cost preventive care, is already saving seniors billions on prescription drugs, and will eventually completely close the notorious prescription drug donut hole. Finally, the savings achieved by Obamacare actually extend the solvency of Medicare by 8 years, while Romney’s plan to put the waste back in will actually bring the date of the Medicare trust fund’s insolvency ahead to 2016 — just four years from now.

Romney also claimed that his plan to end the Medicare guarantee and turn it into a voucher plan would not hurt current seniors. A senior who is age 64 today would face increased costs of at least $11,100 and, eventually, traditional Medicare would collapse entirely and force all seniors into the hands of private insurance companies.

PRE-EXISTING CONDITIONS: In one of the more outrageous distortions of his own policy positions, Romney claimed that “preexisting conditions are covered under my plan.” This too is completely untrue. Romney’s actual position, as his own top strategist admitted immediately after the debate, is that only people with continuous insurance coverage would be guaranteed insurance if they have a pre-existing condition. It’s worth nothing that this isn’t even an improvement from the status quo, it’s been the law since 1996. So in reality Romney’s plan would continue to allow insurance companies to deny coverage to millions of Americans with preexisting conditions.

Romney’s misinformation throughout the debate was so prolific that even his own campaign admitted to reporters that he said things that were completely untrue.

For a more thorough accounting of Mitt’s mendacity about Wall Street reform and numerous other topics, check out the compilation put together this morning by ThinkProgress.- JaxsonRaineposted 13 years ago

0

Good for you Ralph. You can copy/paste from ThinkProgress.

Still not going to answer my question? - JaxsonRaineposted 13 years ago

0

Quill, I respect your posts, you keep me in line sometimes

First, I just wanted to show that the people saying Romney's plan is impossible, are wrong. It's not impossible at all.

Second, it's late and I don't want to look at any new numbers, so that stuff you posted will have to wait.

However, I do think that Romney is the guy who could get it done. He's worked with a 'hostile' legislature in the past, and gotten the tough decisions made. He's show a willingness to compromise.

I don't think people will be so adverse to giving up their deductions, or limiting their deductions, if it is coupled with a tax decrease that means their effective rate won't change. If we are most worried about the middle class, we could simply limit deductions to $100,000... that would probably not affect a single middle-class family out there.

For businesses, they won't care if they can't deduct certain things if it means their rate stays the same. It will help new/smaller businesses because their initial rate won't be so high. It will help everyone because the code won't be so difficult. It will make the fairness people happy because GE won't be paying 'too low' of a tax rate anymore(they pay about 20%, where the average in the nation is about 25%).

I'm glad to see Romney say that he is willing to work at the problem from any angle he can. He's not saying "I want to look at this and this and this". He's saying "I want to look at everything, and do anything that we can all agree on. If that doesn't work, we can approach it from another angle, or another angle."

Look at Obamacare... that was my way or the highway. That was we won't even give you time to read it before you vote on it, we have to pass it to find out what's in it.

That's not what Romney is proposing, and I"m glad.You make very optimistic assertions about Romney and his ability to get things done but the only flaw in your logic is the trust we need to have in him. Romney feeds this distrust with his lack of detailing how he will get it done. He does that because as he has said himself the critics will tear the plans to shreds thus rendering the details unsubstantial. With his current record of reversal of statements and policy in conjunction with what he has reversed himelf in the past how can any level headed thinking person agree that Romney will do the right things based on his history?

Romney is digging himself in further even today with reversing his statements about the 47% in an effort to lie his way out of that fiasco. Maybe Obama is not getting the recovery done in a fast enough timeframe but how can we trust that Romney won't sell us all out if given the reigns?

Related Discussions

- 184

Obama to seek a new tax rate for wealthy

by Stacie L 14 years ago

WASHINGTON (AP) — President Barack Obama is expected to seek a new base tax rate for the wealthy to ensure that millionaires pay at least at the same percentage as middle income taxpayers.A White House official said the proposal would be included in the president's proposal for long term deficit...

- 66

13.9% and more in tithes to the Mormon Church than in taxes

by warden76 14 years ago

So, Mitt's taxes came out today...paying 13.9% this year. Oddly, he ended up paying more to the Mormon Church than he paid in taxes. Does it seem odd that somebody who has not paid into Social Security for years can comment on ending it? So...thoughts? Is this guy one of you? Do you still support...

- 37

Romney Debate Tactic: There's a name for that!

by Susan Reid 13 years ago

The Gish Gallup. Who knew?http://www.dailykos.com/story/2012/10/0 … ish-Gallop

- 68

About those 7,000 millionaires in the 47%

by Susan Reid 13 years ago

Wow. 500,000 households making more than $100K per year and 7,000 millionaires paid no income tax in 2011.Do they consider themselves "victims" do we suppose?Are they lost causes who will never "take personal responsibility and care for their lives"Excerpt followed by...

- 27

Mitt Admits Companies are Dodging Taxes

by Sooner28 13 years ago

"I'm going to champion small business. We've got to make it easier for small businesses. Big business is doing fine in many places -– they get the loans they need, they can deal with all the regulation. They know how to find ways to get through the tax code, save money by putting various...

- 19

Romney's plan to Increasing taxes through the back door

by Petra Vlah 13 years ago

At the very specific question “what would you cut in terms of deductions like home mortgages, child allocation and charity contribution in order to reform the tax system and reduce the deficit”, Romney’s response was something like that: “ I will help the middle class by giving them a $25.000...