One percenter businessman warns: 'The pitchforks are coming"

A one percenter from Seattle named Nick Hanauer published a piece in Politico Friday warning his "fellow zillionaires" that a revolution à la France 1789 is coming to the United States if America's wealthiest don't take drastic steps to reduce inequality.

Read more: http://www.upi.com/Top_News/US/2014/06/ … z368WhykKw

The conservatives want this guy silenced. He is everything they despise.

http://www.forbes.com/sites/timworstall … omic-plan/

Good points are made in both pieces.You have opened a very emotion-driven topic, one I bet a lot of folks agree with, including me:

The rate of increase in U.S. income disparity is a problem.

But I think you may have picked the wrong advocate to support it. Nick Hanauer might be putting his voice to the problem, but his solutions, (and personal actions), don't support or solve the problem he discusses, and the Forbes link pretty much proves the shallowness of his proposals.

You did say both links had good points, and you are right, (except for the part about conservatives wanting to silence him).

If your own Forbes link is followed to the articles below it, Hanauer's points are pretty much destroyed by facts. At least that is how I see it.

I happen to agree with the Forbes article, so my examples might seem to be paraphrasing them, but...

I particularly liked this point;

"Costco has sales of $51 billion, 110,000 employees (45% part time, similar to WalMart isn’t it?) and WalMart has sales (in North America) of $191 billion and 1.3 million associates. So Costco has sales of some $465,000 per employee and WalMart $147,000 per employee. That sounds about right to me, it’s been a number of years since I lived in the US but Costco is the place where you drag that 50lb bag of rice to the door yourself, right? WalMart is the one where cheery souls are employed solely to bid you good day as you enter? So, in theory, we could in fact get WalMart to pay the same as Costco by making similarly efficient use of labor: that is, firing between two thirds and three quarters of their staff."

Labor cost is a business cost, just like your utility bill is a living cost. If labor increases and a business has a fixed labor budget, (a reality determined by sales profit), just as your utilities increase and you have a fixed income - something else has to decrease. For businesses it will probably be the number of employees, (or a price increase to customers), for you it will probably be a second tier expense - like gas for the car, so your use of the car is restricted - no more unplanned excursions. Errand consolidation becomes a priority.

As the Forbes article points out, modest minimum wage increases are not the job killer opponents proclaim, but neither are they the solution proponents proclaim.

At the most basic level, increasing the minimum wage is not adding new money to the economy - it is just redistributing it. (ps. I am a minimum wage as a wage floor proponent - but not a living wage advocate)

There have been a lot of threads about this topic, but I have seen none that present facts instead of emotions. Increasing the minimum wage is not the solution.

GAI don't know if a minimum wage increase will have much to do with regards to moving people out of debt but it may spark the economy.

My concern is that corporate America is heading out of the country to escape taxes that they feel are too heavy. Walgreens is considering it even though they were given a 46 million dollar tax credit from Illinois over a ten year period.

http://finance.yahoo.com/news/renouncin … 40207.html

With net gains of 880 million dollars reported for the second fiscal quarter 2014 I have to wonder how much more in tax credits (free money) they need to stay?

http://news.walgreens.com/article_displ … le_id=5856When net gains are a lousy 4% of sales, I'd say all they can get.

On the contrary, with profits in the grocery trade running between 1% and 3% any company making 4% would be over the moon.

Ha! Hijacking your own thread. But it is an interesting topic

Just for conversation's sake, and using really rough ballpark numbers...

$880,000,000 x 4 (quarters) = $3,520,000,000

times a 14% tax saving = $492,800,000

What would you do if you had a choice to save half a billion dollars - per year?

GAI wouldn't expect to carry on business in a country I don't support. You see that is the crux of the matter. Is it legal? Thanks to a bought congress who enjoys the payoffs to make it happen, it is absolutely legal. And we wonder why the middle class taxes have gone up. Because we have to pay the corporations share they vacated.

Can you validate that comment with more than just "feelings" and "talking points" and "sound-bytes?"

With all the deductions, exemptions, credits, and other devices that allow both corporations and individuals/families to decrease their tax liability - simple overviews are probably the most understandable examples to illustrate our current "real" tax burden.

ps. I know we can all find stats and graphs to "prove" whatever point we want to make - but I am comfortable referencing the Center on Budget and Policy Priorities, (cbpp.org)

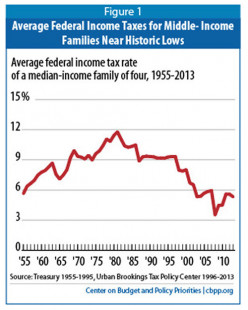

Regarding middleclass taxes, Cbpp.org says this:

Federal Income Taxes on Middle-Income Families Remain Near Historic Lows

"Income taxes: A family of four in the exact middle of the income spectrum filing its taxes for 2013 this filing season paid only 5.3 percent of its 2013 income in federal income taxes, according to estimates from the Urban-Brookings Tax Policy Center (TPC).[3] Average income tax rates for these typical families have been lower during the Bush and Obama Administrations than at any time since the 1950s. (See Figure 1.) As discussed below, 2009 and 2010 were particularly low because of the temporary Making Work Pay Tax Credit."

Source:Cbpp.org

Conversely, setting aside the standard corporate chart tax rate of 35% - after various manipulations, the average U.S. corporation pays a 13% tax bill - still more than double the middleclass tax burden you are lamenting.

So if middleclass income taxes are at historic lows - how can you substantiate your claim they are increasing to pay for the corporation's evil tax dodges?

Also, how do you reach the claim that corporations don't support their home countries if they don't pay the maximum tax burdens?

What situations in your life would you pay more for something than you have to? Are you unpatriotic because you don't strictly "Buy American Made?"

And are all the pensioners in the pension funds that are frequently the major corporate stock holders, and depend on corporate performance to increase the value of the retirement investments, unpatriotic too?

Come on rhamson, I know my examples can be validly debated, but I think your emotional contentions would be much harder to support.

GAA study done on the top Fortune Five Hundred revealed that out of 280 corporations 111 of them paid an effective tax rate of 17%. That's half of the 35% tax rate required under the tax code. This study also finds that through donations to congress many have had the tax code changed to favor their actions. Sure it is a feeling, but one based on experiencing the pitfalls of being a little fish self employed sole ownership business that can't buy a politician to give it a break. I don't know where you think that the mega corporations that are buying up the smaller ones are having a hard time. Sure Walgreens went from around 7500 stores to 7300 stores but that isn't because of taxes. It is a bad business plan that put them there just like Rite Aid did.

http://money.cnn.com/2011/11/03/news/ec … /index.htmI was more generous, the data I found said 13%.

So yes, 13% - 17% is a lot lower than the charted 35%. (52% to 63% lower)

But so is 5.3% a lot lower than the 15%-25% individual charted rate. (65%-79% lower)

(ps. I did not say mega corporations were having a hard time.)

Your original point was that middleclass taxes have gone up to compensate for the less than chart rate taxes corporations are paying. I think I have shown that is not true.

So now your point appears to be a complaint that your business isn't big enough to buy political favors. Hmm... two thoughts occur; either your business isn't eligible for the type of tax breaks "mega" corporations use, or you need a new accountant.

I do understand your feeling, but appearances and rhetoric aren't always supported by facts; no matter how strong the feeling is.

pss. yes, there are crooked corporations out there, (think Enron), but there are also money-laundering, merchandise-fencing, deposit-stealing small businesses out there too. Do you feel their activities and description fit your small business? Or all small businesses?

Just sayin'

GAI think you may have forgotten Obamacare in your retort. This article clearly shows that the tax on the middleclass has jumped squarely into their laps. I did not see this in your report.

http://blogs.wsj.com/washwire/2014/06/2 … d%20Policy

As for as the uncommon (for you) snarky remark about my business having some sort of clandestine application I will forgive you as I know you were trying to make an analogy. Whatever graph or chart you come up with will not change that corporate America is abandoning the country in search of ever more escalating profits. The corporations of the sixties and seventies accepted a more realistic compensation knowing that they lived where they worked. This latest trend to vacate the country by large corporations is cashing in on the tax haven drive by the lobbyists to cheat and improve their bottom line at the countries expense.

Trade agreements that were pioneered in the nineties to lower tariffs from foreign imports has greatly inhibited their competitive domestic prowess. The companies that produce the goods want to be foreign based as well as the manufacturers and the only thing that will be produced in-country is the consumers who will pick up the tax burden. It is the complete rape of our economy and way of life.First, my apologies for your misunderstanding of my apparently snarky comment about your business...

"... but there are also money-laundering, merchandise-fencing, deposit-stealing small businesses out there too. Do you feel their activities and description fit your small business? Or all small businesses?"

My intent was actually the very opposite of your interpretation. It was to ask if you wanted your ethical small business to be tainted by the image and actions of other unethical businesses. I was making the point of "... one rotten apple spoils the barrel..."

As for the Obamacare tax increases on the middleclass... I was aware of that, but did not mention it because; 1) I did not want my reply to appear as just Obama-bashing, and 2) those new taxes have nothing to do with corporate tax actions - they are purely the result of a massive government program with massive associated spending.

We are not in the sixties anymore. The world has changed, and globalization opportunities have emerged that were not possible in the sixties. I just can't get on-board the "it ain't patriotic" train relative to corporations relocating for the reasons we have been discussing.

GAI am sorry if you took my meaning to come from a patriotic perspective. I have not been accused of that in some years. My take on the whole thing is the circumventing of the system that worked. There was a time when companies were concerned with profits based on customer strength to purchase the products they offered. Somewhere along the line we have incorporated a model that in some cases could care less for the health and welfare and economic viability of the very people they want to buy their products. Some new industries such as fracking and speed lined drug development are an example of profit by any means. The reason why I hijacked this was to demonstrate where a lot of the blame exists. If business is given a green light to make and in some cases cover up their wrongs any way possible in the name of a profit, many with shareholder pressure for profits go for it.

Obamacare is a weak attempt at making up the difference for those who have been caught in this conundrum. No job or too low wages for health care purchase leaves them with what alternative? Die or go into debt. Of course there are those who game the system but that is a human trait and not just the poor or underemployed. As we make education economically unattainable and jobs especially scarce what will the ones left out wish to do. My friend it may not be pitchforks we will have to worry about as many militias are chomping at the bit to jump in when the time is ripe.

Former Secretary of Labor Robert Reich weighs in on the Walgreens impending move. It is quite simple. Merge with a foreign business in a lower tax bracket and carry on business as usual. As is usual with this type of move a corporation must follow suite to remain competitive. What's wrong with this picture.

http://www.salon.com/2014/07/08/robert_ … socialflow

GA:

"At the most basic level, increasing the minimum wage is not adding new money to the economy - it is just redistributing it."

Of course, but it is redistributing it to the area of the economy where it will do the most good overall. One dollar in the hands of a middle class or lower class person will, on average, do more to stimulate overall growth and prosperity than one dollar in the hands of a top 1% person.Speaking personally as a 1%'er (although nowhere nearly as 1% as Nick Hanauer), I'm curious to know what makes you say something like this.

From what I've seen over the last few years, people seem to think that the wealthy keep their money in large, Scrooge McDuck style vaults.

We don't have these ^^^

The truth is, that dollar (and the rest of them) help build the companies I invest in. That dollar helps fund medical research, build electric cars, grow green energy sources, and, over the last few days, helps build amazing cameras that people use to take breathtaking videos (yes, a shameless GoPro plug, lol). That dollar gets loaned out to people who are buying houses, and cars, and vacations, and computers, and iPads, and all sorts of things.

If you wanted to get technical, due to Fractional Reserve Banking, that money actually has more utility with a "1%'er".Shawn:

So if you think about it, businesses are going to get the money one way or another. If you're a company, there are basically three ways to get capital: sales, investment or loans.

You are talking about investment and loans. I am talking about sales, which is really what a successful business is made of at the end of the day.

"That dollar helps fund medical research, build electric cars, grow green energy sources, ... cameras..."

Each of those examples can be (and are) funded through sales. In fact validation from the market is the real test of a successful business (that is, it is the real test as to whether that electric car or green energy source is something anybody actually wants to buy).

The test is not whether a millionaire thinks it is a great idea. The test is whether customers buy it.

"That dollar gets loaned out to people who are buying houses, and cars, and vacations, and computers, and iPads..."

You are conflating two different things. In every one of these cases, the buyer is rarely getting his loan from a rich individual. Rather he is getting the money from a bank or other financial institution (credit card companies, etc).

"If you wanted to get technical, due to Fractional Reserve Banking, that money actually has more utility with a "1%'er"."

It makes no difference who owns that dollar as long as the dollar is deposited in a bank for FRB to have its effect. It is the bank, not the rich man, who uses the magic of FRB to create wealth.

(You could argue that the very poor/ destitute are less likely to have bank accounts, but I don't think you would argue that's a very significant factor.)But you're talking about it after the fact. The money has already been through that process when it was initially earned, we're talking about what comes next, once the business already has the money.

If you want to make the argument that it's better for that money to go to workers instead of the company because the workers need it more, then that's a different discussion (and one certainly worth having), but the assertion that redistribution has an Economic benefit is simply not accurate.

True, but again, these companies have already been through that process. They grew to a point at which they could no longer grow from sales alone, and so they went public.

It's no different than a farmer who buys a tractor to increase productivity: he already had a successful farm, but he had reached the limits of what he could do with the tools he had at his disposal.

It's not like someone woke up one morning and said: "GoPro is going to be a successful company and have a great IPO" (another shameless plug, I don't know what's wrong with me, lol), there was a successful company there already, before it went public.

I don't see how they're different. The argument was that a dollar has more utility with someone from the middle class than it does with a 1%'er; and I was pointing out that that's hardly ever the case. The marginal utility is different, to be sure, but that's a different argument.

Yes, but it's only with the "rich man" that that dollar is likely to spend any time in a bank account. Again, spending habits and marginal utility come into play.But it's not redistribution, it's circulation which does have a definite economic advantage.

There is no shortage of money at the moment, just a shortage of money in circulation.

And that's part of the problem, businesses don't need money to invest when the market is flat, they'll only do that in a buoyant market. So money in the bank is money not working.

Pass that dollar onto somebody who doesn't have surplus income to invest in banks and they will immediately go out and spend it, supporting others in their community and the workers producing what they have spent their dollar on.You're making the same assumption that I was talking about initially.

Just because the money is in a millionaire's bank account does not mean it's "not in circulation", in fact it's quite the opposite.

That's simply not accurate.

When you say "pass that dollar on" let's be honest about what you're really saying: redistribute that dollar. Whether it's through taxes, or higher mandated wages, you're not adding anything to the Economy, you're simply taking from one individual and giving to another: redistribution is not addition.

To use a simplistic example:

There are two kids in a classroom: Tom, and Dick. In this classroom there are 10 apples:

Tom has 7 apples.

Dick has 3 apples

You're talking about a system where the teacher takes apples from Tom and gives them to Dick: she redistributes them. There are still only 10 apples in the classroom, nothing was added.

It's the same with wages and the Economy: redistributing wealth doesn't add anything to the Economy because that money was already in the Economy. Again, if you want to have a discussion on the morality of wealth redistribution, then that's a fair point, but the Economics are clear.But money in a bank account is quite patently not in circulation!

As you seem to like analogies let's try a more pertinent one.

Fred has a haulage company. There is not enough work for all his trucks so several sit in the garage unused and not earning. Those trucks haven't ceased to exist because they are not used but they don't earn.

I suppose by that reckoning the whole economic system is based on redistribution. Fred redistributes some of the rental for his trucks to the drivers.

That is so simplistic as to miss the whole point entirely. A much closer one would be a teacher demanding 100 apples a day whilst only paying one apple a day and then demanding a part of that apple back.

I'm afraid when the rich get even richer and everybody gets less well off it is impossible to avoid the moral question. The whole question of a minimum wage is a moral one.Ahh, now we come to the heart of the problem.

First, let me assure you that money in a bank account is most definitely in circulation, and then some. Banks work on a system called Fractional Reserve Banking, and the Schoolhouse Rock version is basically this:

Banks take in deposits. They keep a fraction of those deposits on hand (in "reserve") and they loan out the rest. Those loans turn into new deposits which go through the process again.

Your assertion would only be accurate if banks worked on a 100% reserve system, they don't. To use your analogy:

Fred has a haulage company. There is not enough work for all his trucks so he rents out the trucks he's not using to Jim, who has a delivery company.

No, the drivers provide Fred with a service (they drive) for which they are compensated. Fred wins because he has someone to drive his trucks, and the drivers win because they can trade their skill for money; it's a win-win scenario.

The method of redistribution you're talking about is a lose-win: Fred is losing because you're taking additional money from him, yet providing no benefit. Meanwhile the drivers are winning because you're giving them money without them having to provide additional services.

Again, if you want to have a discussion on the morality of money and who "needs it more", then that's fine, but as it pertains to Economics, the numbers speak for themselves.

Then it appears we're having two different discussions: I'm talking about the Economics of the situation, and you're talking morality, which is fine, but not the topic at hand.Of course I don't think they take in money and sit on it! They lend it out again in the likes of mortgages that take even more money out of circulation and that's before a lot of the mortgages go toxic and bring down the economies of whole countries. Banks are sitting on huge reserves, reluctant to lend.

Except that all other haulage companies have surplus unused trucks!

Not lose win at all, Fred gets a better class/skilled driver who works more efficiently, takes pride in his work, doesn't constantly wreck his truck and generates higher profits for his boss.

Yes numbers speak for themselves. When the UK was in the process of introducing a minimum wage wholesale redundancies were forecast, indeed the collapse of the whole British economy. It just didn't happen.

I'm saying the two are inseparable. There is no situation where one man taking advantage of another is not a moral question.I think you're having an issue with semantics here, because the money isn't going "out of circulation".

Bank reserves are certainly higher than normal, but they're nowhere near 100%.

This was your analogy, not mine. The point is, assets in "storage" still have utility.

I'm sorry John, but that's a ridiculous argument. You're implying that skill at ones job is derived from the amount at which they're paid, which is just silly.

The fact is, the quality of Fred's drivers doesn't change at all. The only thing that changes is the amount that they're being paid.

I also take exception to this notion of "pay them more or they'll be incompetent" (e.g. "constantly wreck his trucks"). If Fred's drivers were honestly that bad, it's doubtful they'd be employed at all.

If someone ties their work ethic and the quality of their performance at their job to the pay they receive (which they agreed upon when they took the job), then that says more about their terrible qualities as a worker. If you're being paid to do a job, then you do that job to the best of your ability, you don't "sandbag" or slack, because you think you're worth more.

Nothing stops you from renegotiating or finding other employment if you feel ill used.

Not being British, I'll take your word for it.

How exactly is Fred taking advantage of his workers by paying them to do a job?OK, you go to the blood bank and donate blood which is stored until needed. Whilst in storage it still exists but it isn't in circulation.

Never heard the expression "pay peanuts, get monkeys"? The fact is that monkeys don't make good drivers!

I'm not suggesting that if drivers were paid more they would suddenly become better drivers, some would, but the company would be able to recruit better drivers.

For examples look at Swift Trucking on google and you tube. Of course they aren't the only ones but they will give you a good idea of how bad bottom of the pit drivers are.

Fine thoughts but a bit lacking in reality. If you are worrying about paying your rent or feeding your family your mind will not be fully on the job.

Fine when there is full employment, not so fine when there are ten or more people chasing every job.

By not paying them enough to live off. By forcing them to throw themselves on taxpayers to subsidise their employers and make up the shortfall in the money they are being paid.

You know you talk a lot about redistribution from the rich to the poor but you never mention redistribution from the middle classes to the rich!

There is a bakery somewhere, I know not where but that doesn't matter. It runs at 50% capacity because that is all its customers can afford to spend on bread.

One day the customers get a pay rise which allows them to increase their bread supply from one small loaf a day to two or more. The bakery goes from 50% of capacity to being over capacity. They have to hire more workers and start another shift.

The money is already in the economy, nothing has been created at below bakery level but demand has been increased and the economy is lifted.There are a few problems with your analogy here:

First, this doesn't really apply to the discussion we've been having on redistribution, since it's not clear that there is any redistribution taking place in this example.

Second, you provided no evidence that this money was "already in the Economy".

And finally, this doesn't pertain to the discussion we've been having on redistribution through higher mandated wages.I assume that you are using "redistribution" as many others do here, as the taking off one to give to another with no exchange.

I'm not.

The relationship between employer and employee is a symbiotic one, one cannot survive without the other.

Without the boss there would be no job and without the worker there would be no profit.

What I am arguing for is a more equitable sharing of those profits.

Right, that's got that out of the way. You'll now see that that makes the first part of your answer redundant, there was no redistribution and that was never even implied.

You'll have to take my word for the money already being in the economy unless you can provide an alternative source for said money.

And it does pertain to the discussion, it demonstrates how higher wages can stimulate the economy.Therein lies the problem, I'm going by the actual definition of the word, silly me.

There is no definition of redistribution that implies a net gain for all parties John, I'm sorry but it just isn't the case. When you redistribute anything, you're "taking off one to give to another with no exchange", if there were an exchange, then we'd call it an exchange, not redistribution.

Symbiotic yes, but in no way equal. What you're describing are partners, or investors, not employees, and that's fine if that's how the business chooses to operate, but not all of them do.

Employment is a transaction, nothing more, nothing less: the worker trades one hour of labor for an agreed upon compensation, that's all. A worker in a factory, or store, or restaurant, or at any job is entitled to their agreed upon compensation and that's it, nothing more. If they want a greater share of the profits of their labor, then they can renegotiate their compensation, or they can go start their own business.

If you hired a contractor to come renovate your bathroom, does that entitle them to come over to your house and take a shower whenever they like?

Then your analogy fails to make any sense.

Higher wages are a product of a growing Economy, not a method for Economic growth; if that were the case, we'd make the minimum wage $100 an hour. Growth has to come first, then higher wages; there is a direct causal relationship here, this isn't a "Chick & Egg" scenario.That is why I am not talking about redistribution but more equatable sharing.

But the essential point about a symbiotic relationship is that one part can not exist without the other. Without slavery no business can escape that symbiotic relationship, they may pretend it doesn't exist but as soon as there is no one left to earn them their profits there are no more profits.

Maybe that would be possible in an ideal world but the majority have no say in their own remuneration.

What does that have to do with anything? They would tell you how much they wanted for the job and if you did not agree you would have to look for somebody else to do your bathroom. Which is the exact opposite of what happens in the employer/employee relationship.

Which did come first, the chicken or the egg?

Sure, with out growth there are no higher wages but then without higher wages there is no growth. Stimulate growth by paying higher wages, that has been proven to work time and time again. What does not work, though it doesn't stop some from trying, is to depress wages, that does not stimulate growth.Which is fine, but again, not all businesses are willing to share the profits, and at the end of the day, it's their business and their money to do with as they please.

Workers are essential yes, but no individual worker is essential. When I was in High School, I was a lifeguard at a water park here in Orlando. All they needed was someone watching the wave pool in case someone got into trouble, they didn't specifically need me.

Of course they do. First of all, they have the option of saying no and not taking the job, no one is putting a gun to their head and forcing them to work for "XYZ Corporation".

But more importantly they have the ability, through hard work, to learn more skills and increase their value in the marketplace which will allow them to command higher wages in the future.

You mean like how an employer says "We offer 'X' per hour for this job" and the employee has the option of agreeing or looking for other work? It's the same exact principal.

I'll settle for one example where there has ever been long term Economic success from increasing wages before there was Economic Growth to support it.Meaning what? The new deal paid many to work when there was no work to be had, it avoided them having to claim social security.

Remind me, where does the business get their profit from, and how did they get that business in the first place?

The whole point is that they needed somebody, it doesn't matter who, but without somebody there would be no lifeguard would there!

I just love people who are divorced from reality. Of course one can say no to a job and then sit back and watch their car go, and then their house. There are after all plenty of cardboard boxes available.

That's not really an option many would take and why there will always be people who let themselves be exploited-the alternative is much worse.

No, what would be the exact same principal would be 20 workmen queueing up to do the job, the first saying $100, the next $80 and so on down the line until the man offers to do the job for less than it will cost him to do hoping that he may find a way of getting a crust out of it.Remind me again who assumed the risk of starting the business? Who's on the hook if it goes under? Who's responsible for making sure the business actually stays afloat? If the business fails, the employee simply walks away and finds another job, meanwhile the owner is still on the hook.

Which was exactly my point. You're confusing the relationship between Industry and Labor (which is symbiotic), with the employer/employee relationship which is more of a "marriage of convenience".

John, I hate to break this to you, but this isn't the 1890's. Opportunity here in the States, is everywhere for those willing to work for it.

You're making too many assumptions for this analogy to make any sense at all.You mean like Fred Goodwin, CEO of RBS bank which under Goodwins control lost £24.1 billion. To cut a long story short Goodwin went, disappeared into oblivion, totally penniless and unemployable - no wait, that's wrong, he left with his pension pot, worth £25 million intact are protest his drawings from RBS (after he'd gone) were reduced to £342.500 a year. Oh, and unlike many of his ex employees he walked away to another job.

Plenty more like that, the "boss walks away without loss, whilst his ex employees are left on the scrapheap.

No, it is still a symbiotic relationship even if the employers treat it as a marriage of convenience. No workers, no profits.

I see, the masses of unemployed are just lazy and prefer to live in poverty! That's a cop out and a refusal to face up to facts. Do you really believe that when the economy tanks millions suddenly become lazy?So you're telling me that Fred Goodwin is the one that took the risk of founding RBS? That would mean he's close to 300 years old. It's an old trick: "answer the question you want to answer, not the one you were asked", but it doesn't change the underlying fact.

Which is true theoretically, but unrealistic in practice: there will always be workers. We will never have 0% unemployment, so there will always be someone else to fill the position. The wages they earn will be determined (like everything else) by the law of Supply & Demand.

First, a lack of ambition doesn't always necessitate laziness, some people might not be interested in being their own boss, and that's fine. Some people are honestly content with what they have, and so for them, the fact that they don't want to advance any further doesn't mean their "lazy". As for the people who protest for a $15 minimum wage, yes, I do believe a lot of them are lazy.

This is where the disconnect comes from between Progressives, and moderate Democrats like myself:

~Democrats are interested in finding ways to move people out of poverty, Progressives want to make poverty more comfortable.

~Democrats want Education reform so that everyone can learn the skills they need to be of value in the marketplace, Progressives want a $22 Minimum Wage.

~Democrats believe President Clinton was right when he said: "There is nothing wrong with America that cannot be cured by what is right with America", Progressives believe that America is the problem.Excellent comment, and great points. (quoted above) But where are those Democrats? I have not seen the Democrat you describe for a long time.

What you have described is not today's Democrats - it is the Purples, (my new party).

Come join us. I almost have Credence2 convinced. (he just has a few more "Progressive" pounds to shed)

GABelieve me, no one hates what's happened to the party more than I do. We've gone from being the party of "Ask not what your country can do for you..." to being the party of cradle to grave welfare.

I'm not ready to abandon the party to the Progressives just yet, however if something doesn't happen soon, I'm afraid there won't be much a party left. Until we can get rid of people like Reid, Pelosi, Warren, and Obama (who are the heart of the Progressive movement, which is essentially the Tea Party of the Left), there is not much hope.+1,000,000,000,000,000,000! The Democratic Party of yesterday has become radicalized. It should be called for what it is, the Radical Leftist Socialist Party! The Democrat Party has lost THEIR minds or what is left of their minds! While the Republican Party has gone to the right, the Democratic Party has gone to ......THE LEFT!

Just my opinion, but I think the Republicans have gone off the rails, to the far right, just as badly as the Democrats have to the left.

GAYou jokin'? Our Democratic party isn't "far left." On the contrary, if you compare the Democratic party to political parties all over the world, our "far left" Democrats are more slightly-center-right. They're not even on the left side, let alone the far end of it.

A serious question occurred to me after making my above reply.

Do you vote your party if you don't agree with it's candidate, but you agree with the Republican candidate even less?

I took the easy road and am registered Independent, so I feel no party loyalty at all. I will also refrain from voting for an office if I don't like either of the candidates. I will not vote for the "lesser of two evils."

GA

Ah forgive me, I did not realise that after a certain time it was all right to shaft the company and the workers you were in charge of. How long is this period and is it defined by statute or custom?

As that example was too subtle for you, try this one. My ex partner worked for a small software development company set up by two blokes and financed with their pension money from the RAF. To cut a short story even shorter. They didn't make it, the company folded with the loss of 20+ jobs. Some off the 20+ got jobs within a month or two, others took much longer. All lost money, some less able to carry the debt than the others.

What about the two owners left carrying the can after their ex employees had "just walked away" Oh yes, they sold the companies product to a competitor and came away with a profit!!

The law of supply and demand is not the same as "take it or leave it" which is the law that applies to most employment.

To quote you " It's an old trick: "answer the question you want to answer, not the one you were asked", but it doesn't change the underlying fact."

Now do you think all the millions put out of work by the failed economy are suddenly lazy, or perhaps lost their ambition?

"No, what would be the exact same principal would be 20 workmen queuing up to do the job, the first saying $100, the next $80 and so on down the line until the man offers to do the job for less than it will cost him to do hoping that he may find a way of getting a crust out of it."

You know, that's exactly how the bid process for construction jobs is working in my area. Contractors take the jobs for under cost, hoping against hope that they can keep their cash flow up and dredge up a tiny profit from extras on the job. The businessman always seems to get the shaft, don't they?Well who is doing the shafting? It isn't the workers who are expected to prop up the uneconomic business is it? It is the bigger businesses who treat the contractors in exactly the same way as they treat their employees.

It works really well, too....until the price increase of flour (because those employees are being paid more now) goes up. And sugar and pastries and electricity to run the ovens.

Then the price the bakery charges must go up too, and business falls right back to where it was. It's what always happens with forced pay raises, pay raises not accompanied with increased production. The unions and idiot politicians always wanting more and more have made that very clear over the years.Except the bakery is buying more flour and can negotiate better discounts, as with sugar (and why would a bakery want to buy pastries?)

The ovens are producing more bread so the unit cost of electricity drops and what ever price increases they suffer can be offset from the much higher profits they make. Remember the bakery was working at 50% capacity.Wait, wait. The baker can negotiate better discounts from a flour mill that has had their labor costs go through the roof? I rather doubt that - you're living in that dream world again. Same with the sugar and pastry cups (sorry about that). And if there is more production from the ovens it is because the ovens are running longer and using more power. Power that has ALSO gone up in price because the labor costs have gone up.

So only the fixed costs such as rent and property taxes have remained static. Everything else has gone up, and that always - ALWAYS - means a price increase. It's called inflation, John, and it comes from raising wages more than anything else. After all, at the root, everything outside of royalties for such things as oil or mines has only labor as a root cost.So by your reckoning a bakery working at 50% capacity is more efficient and more cost effective than one running at 100%! So lets make it even more efficient and cost effective and reduce capacity to what, 25% 10%, 1% !

Let's see. YOU said more people were hired to produce that extra, leaving the efficiency untouched. Same "cakes per man hour" or whatever. As I said, fixed costs per cake will go down, but fixed costs are not that big a percentage of total costs anyway.

But labor IS a huge part of the cost of a cake, and it went up. Same cakes per man hour, but cost per man hour went up. So did the cost of a cake.

How about if we cut labor costs per man hour by 10%, costing 5% of the business instead of raising it? Now total profits go up, injecting more money into the bakers pocket and allowing hiring of more people. Efficiency really IS up, instead of just saying increased costs make cost per item less, and business booms.No, you assume that the bakers are on a minimum wage and therefore labour costs went up. That wasn't my assumption. Likewise the millers.

OK - the pay raise went only to the baker's vendors.

Same result, just a tick better because the bakers wages remained constant. Or did you mean that only people that produce nothing and thus won't cause a price increase followed by inflation got a pay raise?Where is your evidence that a wage rise will cause inflation?

Seems like common sense to me; raise wages either the owner earns less or prices rise. Owners don't like to earn less and won't do so if they can help it; that means prices rise. Prices rise = inflation.

But why do prices have to rise? They are just as likely to go down.

Of course! Everyone knows that increasing the cost of a product means the seller should cut the price when they sell it! A basic business principle...to the socialist that figures the government owns everything and everything is thus free. To the rest of the world it becomes insanity unless productivity increases at least as much as wages did, and we already said that didn't happen.

But I didn't say productivity didn't increase, in fact I said that because of increased demand it did!

Why would production per man hour go up just because of a raise? Because the employees feel good about themselves and now do a better job? Productivity is generally used to mean production rate (per labor hour, not per day or other time period), not total production.

You're getting confused here. Wages have gone elsewhere, not in the industry affected. This increase in wages has increased demand.

And we were talking about production rather than productivity.

You asked where is there evidence that inflation would result. It's called wage push inflation.

http://www.investopedia.com/terms/w/wag … lation.asp

http://www.highprogrammer.com/alan/rant … /graph.pngBut that isn't evidence that inflation will result, just that it might. The Invertopedia entry is purely an attempt to keep wages down without any other consideration.

That provides direct evidence that inflation will result. Here, I give you the name for it and then provide you with direct graphical evidence. Why the hell do you think that after the adjusted inflationary spike occurs after the minimum wage is raised, we always and invariably see the adjusted for inflation line immediately fall back down?

It does no such thing, in fact it provides direct evidence that increased production will have the opposite affect.

But you are so convinced that all the worlds problems would be solved if the worker would just stop demanding a wage that he could live off that there seems little point in debating with you.http://www.youtube.com/watch?v=0DhDp2PF … detailpage

This video explains what was going on in the minimum wage graph that had an line showing the real wage adjusted for inflation. Initially, the adjusted dollars spiked and then as that equilibrium was hit the real value in adjusted dollars decreased. How freaking dishonest are you?He states "when wages go too high" without indicating what "too high" is. Too low wages will equally result in a drop in demand and a rise in inflation.

How freaking dishonest are you?

"Too high" means anything that pushes the system out of equilibrium in an upward direction. For instance, the government stepping in and setting the price of labor with an increased minimum wage would have that effect.

All other things being equal, any time costs are increased the aggregate supply is going to shift to the left, driving prices upward. The amount of the increase in the price depends upon how much costs increased. Higher wage increases means higher inflation, while lower wage increases means lower inflation.

If you reduce costs or cut wages, then the aggregate supply line shifts to the right, meaning supply increases which will result in prices falling, due to the lack of demand. Therefore, theoretically you will see deflation not inflation.

The problem we have in our society today is that there are too many people who are not making an honest living. They are perping, trolling, and shilling for dollars, or using welfare to subsidize their standard of living (same thing in my opinion), which keeps prices artificially high with fiat that is distributed in an inequitable manner, making it unlivable for people who are working for a living. If you want to end that problem, then the government should quit funding people to toe the party line and instead require them to get real jobs.If wages were the only driver of inflation here in the UK we should be seeing deflation, not inflation, as real wages have dropped over the last five years while inflation has been running over target.

I would like to know where all these real jobs are that you think people should take! Remember, both our governments tried to tackle inflation by abandoning the goal of full employment.

Lack of demand will drive prices up just as surely as increased demand will drive prices down.+1,000,000,000,000,000,000,000,000,000,000,000!!!!

You want to drive wages up, then create more jobs.

Then pay me more wages to spend and I will create more jobs.

If you want higher wages, then quit advocating for government intrusion in the market, as it is clearly artificial and interfering with the prices of goods, services, and labor in ways that are detrimental to those whom the power elite consider to be working slobs. If you make the marketplace more competitive and quit protecting political favorites, while making the atmosphere more amenable to business, then you will see job growth, and as a result higher wages. Artificially elevate the minimum wage and you will see inflation and the reduction in "real wages" despite the attempts to pander to a political base that is being exploited for votes during election cycles, and otherwise completely f*cked over by the political class that is favoring businesses that lobby and support there elections with real money.

Who's advocating for more government intrusion?

The government in the UK has driven wages down, taxes up and, by policy, driven industry out of the country.

They have striven to make the market place less competitive but have made it more attractive for large foriegn corporations to move in and avoid paying tax.

That doesn't alter the basic premise that jobs are created by people spending money, give them more money and more jobs will be created, less money and you will have less jobs.Pardon my intrusion into your conversation with John but this statement as a stand alone offering is overlooking what has already been done to create the problem in the first place.

....If you want higher wages, then quit advocating for government intrusion in the market, as it is clearly artificial and interfering with the prices of goods, services, and labor in ways that are detrimental to those whom the power elite consider to be working slobs.

The problem is that governments have already been meddling in the mix at the behest of corporate pressure and lobbying. NAFTA and the TPP agreements effectively shipped the jobs to third world labor pools in order to collect the difference in profits from the lower wages paid. That is where the disconnect came about. In the process the domestic labor market plummeted into unemployment or under employment and the comeback has been mostly part time jobs in the wake of it. The manufacturing jobs coming back are increasingly filled with robotic labor. The problem lies in the lack of livable wage jobs and therefore either going into debt or doing without are the options presented in buying anything. Reducing taxes or labor costs will only further line the pockets of corporations as no change is necessary for them. They are already recording profits with the situation as it stands. In another stupid move the government has set up a healthcare plan that is to help those left in the increasing lurch by the demise of the jobs.

So leaving things the way they are is great for corporations and their whining to lower taxes to "create more jobs" is just a ruse to line their pockets even more.

That has largely been the crux of the argument, if you drive wages up without increasing productivity then you will only dilute the currency by causing inflation. Wage increases should happen naturally, without someone the government messing with supply and demand. If businesses choose to pay employees more to obtain higher quality employees, then that is a good thing, but if government force the hand of all businesses, including those that are struggling, then it will cost jobs and dilute the currency.

But if you sell two consumables were once you sold one productivity automatically follows.The best way of ensuring that you sell two is to make sure that those in the market can afford two consumables rather than one.

The most effective way of doing this is targeting the low paid and letting them earn more money.

"If businesses choose to pay employees more" and there in lies the rub. Without compulsion many businesses will choose to pay employees less until they can compete with third world economies. At which point we become just another third world economy dragging everybody down with us.

If a business is struggling and dependent on paying slave like wages to survive doesn't the beloved free market say they should go to the wall rather than use their workers to prop them up?

After all, the concept of free surely applies to all, not just the bosses.

Poverty is not just an economics exercise, it is a real life problem that affects us all. It increases crime and therefore insurance rates. It affects education and it affects the ability to work making the worker less productive and more inclined to accidents.

The benefits of lifting people out of poverty are immeasurable and unlike low wages not just of benefit to the rich.

"If wages were the only driver of inflation here in the UK we should be seeing deflation, not inflation, as real wages have dropped over the last five years while inflation has been running over target."

Obviously, there are a number of different factors that drive inflation. Increasing the cost of providing goods and services, by increasing wages, is one of them.

There are several costs that businesses incur in order to operate.

What do you mean by real wages? If you are talking about wages adjusted for inflation, they have dropped due to inflation, most likely cause by heavy-handed government intrusion into the marketplace that drives up costs, as well as irresponsible monetary policy and the printing of money that increases money supply.

"I would like to know where all these real jobs are that you think people should take! Remember, both our governments tried to tackle inflation by abandoning the goal of full employment."

Without the burden of over-regulation, the effect of which is to push businesses out of the U.K. or the United States, in favor of business climates that are more conducive and cheaper to operate within, in terms of costs, then there would be more incentive to produce in the UK and the U.S. This means that there would be a higher supply of jobs, which would drive wages up because the businesses that were offering positions in the U.K. would have to be more competitive, in terms of compensation, in order to attract workers. However, since demand is high for the limited supply of jobs that exist, businesses can get away with paying less to employees. Therefore, like I said, if you want to drive wages up, then you must make the business climate in the U.K. or the U.S. more favorable to businesses, which would have the effect of creating more jobs, thereby, driving wages up.

"Lack of demand will drive prices up just as surely as increased demand will drive prices down." Initially, you stated, "[t]oo low wages will equally result in a drop in demand and a rise in inflation."

What the hell are you talking about? It is clear that you don't know what the hell you are talking about. Lack of demand in terms of people willing to take the job would drive the price up for the position, because the employer would have to pay more to attract someone willing to work there for a compensation that entices them to quit what they are doing and go there. However, if you are saying that if wages are too low this somehow would increase the price of the goods, then you are making a fundamental error and are confusing the idea of demand decreasing with increased price, which is meant to reflect the idea that when a firm charges more for a good, the demand for it drops, with a shift in the demand. When wages are depressed this would be something that shifts the demand line down, thereby lowering the prices of good.

It appears to me that you are confusing demand with quantity demanded. Quantity demanded will decrease with increasing prices, while demand (or where the demand line sits) depends on a number of variables, including wages, preferences, taste, price of related goods, market expectations, etc.

Increasing, the price of the goods to a point that is higher on the demand curve means that there will be less people willing to buy them at that price, while depressing wages will result in the shift in the demand curve down, meaning that in order to sell that same amount of product the price must be lowered. Hence, you are wrong again. Obviously, depressing wages would shift the demand line downward. In order to sell products to a population whose wages are depressed, means you'd be looking at a different demand line.

Although I think there is something to the idea that it is possible to depress the wages of those who are manufacturing the goods, while artificially keeping the demand for such goods high by handing out money through irresponsible monetary policy and a welfare state, whereby it makes it difficult for the people who are actually working to keep up, because the prices of good are not reflecting the what the would naturally, because producers are still able to sell their goods for the higher prices. This is why government intervention in the markets is bad. It allows for a two-tiered system, whereby those who are playing the government's game are benefiting, while those who do not and try to do things correctly by working for an honest living, instead of gaming the system that has been created by corruption, find themselves worse off and hurt by the artificial demand lines that are created by reckless government spending and political favoritism.

Shawn:

Let's make sure we're talking about the same thing. My original statement was that $1 on average will do more for the economy in the hands of a lower class person than a rich person.

IOW you shut down the economy for an hour, everybody freezes, nobody does anything, and you have one dollar to give. Do you give it to the poor guy or the rich guy? I say give to the poor guy. The biggest reason is what I mentioned to GA--the poor spend a higher percentage of their income than the rich. So the money is more likely to be moving through the economy if it's in the hands of the poor than the rich.

Now you argue that the rich man can either invest that dollar in a company, or park it in a bank where it will be lent out to the company, but in reality those are both minor contributions to businesses. (And bank lending is irrelevant again because the poor guy puts the dollar in a bank too--so it's six-in-one.)

Sales are much more important. Why? Because (a) businesses ultimately only survive on sales, and (b) the rich guy, if he invests, will probably only invest in large established companies. This is exactly where the majority of economic activity and the majority of jobs do NOT happen.

Most econ. activity and most jobs exist in the small and medium businesses, not the big businesses. A rich guy will invest in an IPO or a startup, but as a rule that is not where the jobs are, and that's not where the growth is. The growth and jobs are in the millions of tiny businesses in local communities around the country. Exactly where the poor guy is likely to spend his dollar.

(We are also assuming a closed system, which is NOT a safe assumption. In reality, the rich guy is far more likely to send that dollar to Switzerland or Aruba, whereas the poor guy is almost guaranteed to spend that dollar in the domestic economy.)

"True, but again, these companies have already been through that process."

(The process of market validation.) I don't agree. A business is constantly going through that process. Every month, every year, you need to adapt to changing market conditions and serve the customer. There is never an "end" to it.

An investor only invests if he thinks there is future in the market. He doesn't say, "Wow, that was a great sales run, let me give them my money so they can close their doors" haha. He invests because he thinks, in his infinite wisdom, that future customers will buy more stuff. It always goes back to sales.

"I don't see how they're different."

Please re-read it again. You spoke about housing loans (to take just one). Housing loans basically only come from banks (banks which have the deposits of everybody, rich or poor). They do not come from rich people as individuals.

So whether that dollar is owned by a rich or poor person makes no difference, as long as it is deposited in a bank. The bank will lend it out regardless.

"Yes, but it's only with the "rich man" that that dollar is likely to spend any time in a bank account. Again, spending habits and marginal utility come into play."

Why do you say that? All money is pretty much constantly in someone's bank account. You're implying that the poor person will withdraw cash and the money is lost to the financial system forever. To the contrary, he takes that cash and spends it at the liquor store, and then the liquor store puts that money in a bank account. So the FRB is (almost) always in effect regardless.

It doesn't matter who owns the money, rich or poor. As long as the money is in a bank account somewhere (which I concede is slightly more likely to be the case among the rich), FRB will be in effect. It basically has nothing to do with spending habits.See, we weren't actually talking about the same thing. What you're talking about is Marginal Utility and that's a different (though related) concept altogether from what I was discussing, which was Total Utility (i.e. "A dollar is a dollar, is a dollar")..

I don't accept your premise.

To a company in need of financing, there is nothing "minor" about it. A guy selling 100 Widgets a week want's to expand but can't, so he goes public to raise money, which allows him to:

Buy a new factory (which has to be built, creating jobs for construction workers),

Buy new machinery (creating business for the Widget machine maker).

Hire more sales and support staff.

Hire drivers and buy trucks to deliver the product.

And all this allows hit to now sell 1,000 Widgets a week.

And since when do small businesses not need financing? Sure, they might not be traded on the NYSE or the NASDAQ, but they still have investors. Even if it's in the form of loans from the bank, the money to loan has to come from somewhere.

Granted, but I don't see the correlation. Yes, I spend money outside my local market, but there are a great number of people from outside my local market who bring their money in.

(Not really a fair example in my case, I live 10 minutes from Disney World, Universal, and Sea World, lol)

It can also be argued that the wealthy person provided fair value for the money when it was earned, so the net for the economy is still a positive.

True, but I don't see how that relates to our conversation.

Which reinforces my initial point that money in a bank account still has a great deal of utility.

Again, that was the point I was making initially: that savings have a great deal of utility and that money in a bank account is not "out of circulation", it's still being used."To a company in need of financing, there is nothing "minor" about it."

I meant minor in the sense of the total contribution to the economy/ businesses.

I wrote a hub called "The Rich Do Not Create Jobs" a while back. There I give a chart showing that investment as a percentage of GDP in the US declined gradually from 1980 to 2011. This is despite the meteoric rise in the number of millionaires and billionaires, and their concentration of total income, during this time period.

More rich people did not lead to more investment.

"And since when do small businesses not need financing?"

I never said that. Financing/ investment is a relatively minor part of the success of businesses, in the aggregate.

Sales are the main factor. Everything is oriented towards sales. Investment is done for the sake of sales. Borrowing is done for the sake of sales. And, crucially, the investment or the loan only makes mathematical sense if the ultimate sales that result from it are greater than the investment/ loan itself.

I think you missed the reference. By Switzerland and Aruba I was referring to offshore banking and tax havens, which only the rich take part in, and which siphons dollars out of the domestic economy. In other words, Scrooge McDuck is alive and well.

"Which reinforces my initial point that money in a bank account still has a great deal of utility."

I never said otherwise. But that is irrelevant to the topic of rich people, which was your argument.

"...money in a bank account is not "out of circulation", it's still being used."

Again, you are arguing against something that I never said. The issue is not whether it's being used, the issue is what specific use it is being put towards.

The bottom line is that the stats simply do not support your side. We have more rich than ever, a higher concentration of income in very few hands than ever, and yet we see no effect (or a detrimental effect) on Unemployment and growth in the overall economy.

I understand it makes a certain kind of sense in theory. But reality does not bear it out. In other industrialized nations with very high tax rates on the rich where disposable income among the upper classes is much lower, we often see unemployment and growth rates just as good if not better than in the US.First, let me apologize for taking so long to respond; I missed your reply initially, and yesterday I was busy burn-- I mean cooking for the 4th.

I think we're talking about two different things here again. The chart you show on your Hub tracking Investment as a part of GDP, is tracking Gross Private Domestic Investment, not personal investments (stocks, bonds, etc.), the two are different. "Investment" in GDP terms, is essentially spending by businesses, and isn't at all related to the number of millionaires and billionaires in the country.

I think you and I are actually arguing the same point in different ways on this one.

That's true, but you can't then discount the foreign money that's injected into the Domestic Economy.

This is another one where I think we're actually on the same side, just in different ways.

Like John, I think we're having two different arguments here: you're talking morality, I'm talking Economics.

If the money was legally obtained, then how much, and what it's spent on is irrelevant.

The question is: "Is the system fair?", and the answer is, unquestionably, "yes".

The current Economic climate isn't a failure of the system, it's the natural byproduct of the Government attempting to manipulate that system; this goes back to the discussion we were having on my article about whether or not the Government can actually "fix" the Economy. Well we're living with the results of the Government attempting to "fix" things.

The Government should behave like an NFL Referee: It should be separate, impartial, and there only to enforce the rules, not to try to pick winners and losers. When the Government gets into the business of trying to decide who succeeds and who fails, it inevitably makes thing worse.

The two are unrelated. The Economy isn't a Zero-Sum game; the success of one person doesn't require the failure of others.

The current employment and Economic Growth (or lack thereof) numbers have nothing to do with the "concentration of wealth", and anyone who tells you they do is selling something.

Wages are low because unemployment is high, creating a surplus of labor. Unemployment is high because small businesses are scared to spend money due to the current uncertainty surrounding certain Government policies.

The GDP has more to do with the terrible weather in Q4 2013, and Q1 2014, and bad Fed Policy than anything else. Call me an optimist, but I'm still fairly confident that things will be much better the rest of the year (pending anymore shenanigans from Nature).No problem.

"...tracking Gross Private Domestic Investment"

Could be. I'm going to have to concede that point for now because I don't have time to go back and check it.

"That's true, but you can't then discount the foreign money that's injected into the Domestic Economy."

Yes I can, because that is not something subject to domestic policy. The money injected from foreigners is at their discretion, not ours or our government's. If all foreigners stopped investing in the US tomorrow, that would not have any effect on rich Americans storing cash in foreign banks.

"...you're talking morality, I'm talking Economics. If the money was legally obtained, then how much, and what it's spent on is irrelevant."

I assure you it's not about morality. What the money is spent on does have an effect, and it is most certainly relevant. In the aggregate, and on average, a business needs sales more than it needs investment.

The economy grows because people buy stuff from businesses, not because businesses get investments.

"Well we're living with the results of the Government attempting to "fix" things. "

This is a whole separate topic that we can discuss another time. But there are many examples in history and the present, of governments (including in the US) successfully "fixing" economies.

"The two are unrelated."

I assume the two you're referring to are (a) the rich/ concentration of wealth and (b) growth, right? Just to make sure.

That would contradict what you said earlier, and what your contention has been all along, which is that $1 in the hands of a rich man will do more for the economy than $1 in the hands of a poor man. If a rich man's dollar is more valuable, then of course the two are related. With more rich people, we would expect more growth. But that is not what we see.

Unfortunately once again you are arguing a straw man. I never said the economy is a zero-sum game.

My point was that if the rich contributed to growth, then with more rich people, and more money in their hands, we should have more growth. A simple prediction based on the orthodoxy we are fed. Yet that is not what reality shows us.

"small businesses are scared to spend money due to the current uncertainty surrounding certain Government policies."

I know plenty of business people who don't give a rat's ass about Obamacare or whatever. They're too busy trying to make sales and pay the bills.

Federal politics are far less important to small business people (which is where most of the jobs are) than the pundits would have you believe.

(Those are the same pundits who will say with a straight face that just seeing Obama's face on the TV screen is enough to send the stock market down by 2% for the day.)

State/ local policies, laws and regulations are far more relevant to businesses.

Here's another way to think about it, very simplified:

Imagine 2 economies. In the first, everybody spends everything, and nobody saves or invests anything. In the second, everybody saves/ invests everything, but nobody spends anything.

Which economy would be more appealing to a business owner? The one where it is known that nobody will spend anything nor buy anything you produce, but where you will get lots of support from investors, or the one where you will get zero investment or financing, but where people just love to spend?

The choice is obvious. (Indeed, the second economy is not even possible because an economy could not exist in the first place if nobody was buying anything from anybody. And workers would have nothing to save if businesses had no revenue to pay them.)

This helps to explain why America is such an attractive market to companies around the world, domestic or foreign. Americans love to spend, spend, spend (too much of course). We have a strong consumer culture here that is often lacking in other places. It often goes too far, but it has been a powerful force in our prosperity.

Are you sure you meant to include the Middleclass in that statement? Do you think they are minimum wage earners?

Most sources I have seen put the median hourly wage, (the one middleclass earners would be getting), at around $16.71 p/hr.

But lets look at your contention that it would boost the economy. And lets look at it from an easy to describe small business perspective. A design shop, retail store, franchise eatery, etc. Because I don't think this issue has anything to do with the top 1%

Every dollar redistributed to a minimum wage earner is a dollar less the businessman has.

I read somewhere that many businesses are moving to a part-time model of 29 hrs. instead of a full-time 40 hrs. Lets split the difference say a work week of 34 hrs. Or $34 more per week. But, reduce that by taxes, say 16.5% (6.5% Fica + 10% Fed. Inc.), so now it's $28 extra bucks.

Where do you think the majority of those workers might spend that windfall?

I would guess that the majority are responsible folks, and might buy some needed items like shoes and clothing, etc. but would mostly spend it buying some more food or paying some past due bills. Of course the smaller number of these workers that are irresponsible will spend it on nights out and trendy stuff, which would boost the economy while doing nothing to improve their condition - but how much economic power would that group exert?

So now take the businessman, who has $36 less per worker, and pick a small random number of say 10 workers. So now they have $360 less per week. What will that loss take from the economy?

Maybe some new equipment purchase? An advertising budget cut? The expense of a new product line? Or, *gasp* a canceled new hire or even a layoff, etc. etc. - all of which has a very direct economic effect.

It appears to me that it is a sure thing that each dollar lost to the businessman would directly impact the economy, whereas it is an iffy maybe/maybe not thing with the minimum wage worker.

With that said, I am not against a minimum wage as a floor wage. I think there are too many unscrupulous people and too many desperate workers to let the market have free rein. History shows us plenty of examples.

But I am not convinced your scenario, or anyone's scenario, that increasing the minimum wage is a magic bullet to boost the poor out of poverty and boost the economy out of recessionary conditions.

Minimum wage jobs are, generally speaking, such because that is what the work is worth. Minimum wage workers, again generally speaking, are more likely to be such, (of course our current economic conditions provide a lot of exceptions to this), because they are either new to the work work, unskilled, or just not productive enough to warrant higher wages.

Minimum wage increases will help folks of course, but they are probably not the economic cure proponents claim.

GAGA:

Clarifying, the lower class is the main beneficiary of the min. wage. My point was that the lower class and the middle class together have more consumer power than the rich (which is Hanauer's main argument throughout).

"Every dollar redistributed to a minimum wage earner is a dollar less the businessman has."

Not exactly. Every dollar given to a MW earner will in turn be spent on another business. So ultimately, "business" in the aggregate gets the money anyway.

What they spend their extra wage on, whether we approve of it or not, of course makes no difference. It's all going back through the economy one way or another. But mostly it does help their own quality of life.

"...but how much economic power would that group exert?"

A significant amount, for two reasons: (a) there are many more of them than the rich or the businessmen, and (b) studies have consistently shown that the poor spend a much higher percentage of their income than the rich.

How many people are making $20k per year? Millions. So that group accounts for literally tens of billions of dollars (if not more) of potential spending power. Now how many people are making $1 million per year? Far, far fewer. Probably in the tens of thousands, if that.

We all know about someone like Warren Buffet or Bill Gates. No doubt they are, individually, spending more than the typical low-wage worker individually, in a given year. But there are only a couple of those guys, and their total spend will never compare to the armies upon armies of low-wage workers.

"So now they have $360 less per week. What will that loss take from the economy? Maybe some new equipment purchase? An advertising budget cut?"

But you said yourself earlier that this is all just moving money from one pocket to the other, remember? It's not like that money is disappearing from the economy. It will just go to other businesses instead, in the form of sales.

"It appears to me that it is a sure thing that each dollar lost to the businessman would directly impact the economy, whereas it is an iffy maybe/maybe not thing with the minimum wage worker."

Again, that worker will spend almost everything he earns. That much is clear. So if anything, giving money to the worker is the sure thing, very likely to stimulate the economy, and allowing the businessman to keep it is "iffy": he may decide to sit on his cash because he's afraid of market conditions in the next 6-12 months for instance. In which case he will not hire or purchase anything.

Now I never said minimum wages were a magic bullet. But they can and do contribute to less poverty and more growth.

"Minimum wage jobs are, generally speaking, such because that is what the work is worth."

But the "value" of the work is itself determined by a negotiating process in the market. If one side (i.e. the worker) is significantly handicapped in their negotiating ability (this is their only option, they are desperate for work, etc), then we actually have a skewed system. Not a situation where free private parties are mutually agreeing on a price.With your more detailed response, I think we may be just quibbling about the details. I agree with the point about the consumer power of the lower and middleclass in the economy.

It also appears we agree that a minimum wage is a redistribution, although we have different perspectives of the utility, (thanks Shawn), of that redistribution.

And on this point...

"But the "value" of the work is itself determined by a negotiating process in the market. If one side (i.e. the worker) is significantly handicapped in their negotiating ability (this is their only option, they are desperate for work, etc), then we actually have a skewed system. Not a situation where free private parties are mutually agreeing on a price"

I completely agree. This is why I support a minimum wage as a wage floor, but strongly oppose the concept of it as a "living" wage.

GAThere is a number (and forgive me, I don't have the data right in front of me) at which you can increase the minimum wage in relation the the National Median Wage, and it will have zero negative impact on the Economy. It's around the neighborhood of 45%, again, I'm working from memory here, so don't set this in stone.

The most recent final report on the Median Wage I could find, puts it at about $16.90 an hour. This means that you could raise the minimum wage to $7.60, and there would be no measurable negative effects. That's around a 5% increase from the current Federal Minimum Wage. It's not Earth shattering, but it's not nothing.I have seen similar data. The way some economists explain it is that modest incremental increases in the minimum wage rate, up to the point that it would equal 40%-45% of the median wage - would produce negligible impact on the rest of the labor market. So your recollection is the same as what I have seen.

But... and it is a big but, those same economists also said that once minimum wage approaches 50% of the median wage, a dangerous ripple effect would be that every wage level would then need to increase proportionally to maintain the value of the median wage earner's productivity.