Add your name: Suspend Jared Kushner

Yesterday, House Oversight Committee Chairman Jason Chaffetz confirmed that Trump's former national security adviser, Michael Flynn, may have committed a felony by not properly disclosing payments from Russia when applying for his security clearance.1

And Flynn's not the only member of Trump's inner circle who has been dishonest about his dealings with Russia. Earlier this month, Donald Trump's son-in-law and White House senior adviser, Jared Kushner, failed to report dozens of meetings with foreign agents, including meetings with Russian government agents as recently as December 2016, while completing the same questionnaire as Flynn required for top-secret security clearance.

Will you sign petition to the U.S. Office of Personnel Management and the FBI to demand that Jared Kushner's interim security clearance be suspended immediately?

https://act.moveon.org/go/9755?t=2& … 054.XC24wi

- It's bad enough with the White House Nepotism - this is serious.

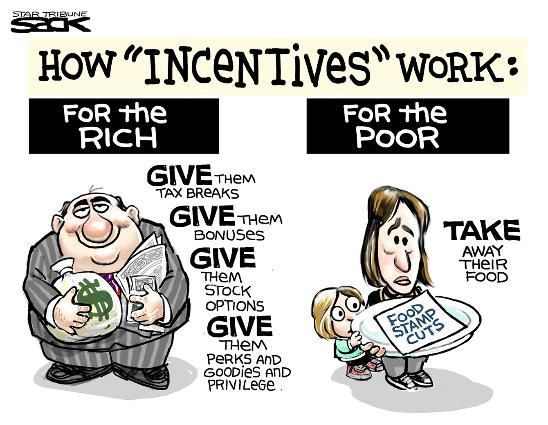

Trump just released his tax plan — proving to us once again where his priorities lie. The super rich and big corporations win, and we lose.

The Trump tax plan will mean that the wealthy will pay even less taxes than they do now. Billionaires will benefit, including Trump himself. The 1% and Wall Street need to pay MORE taxes, not less.

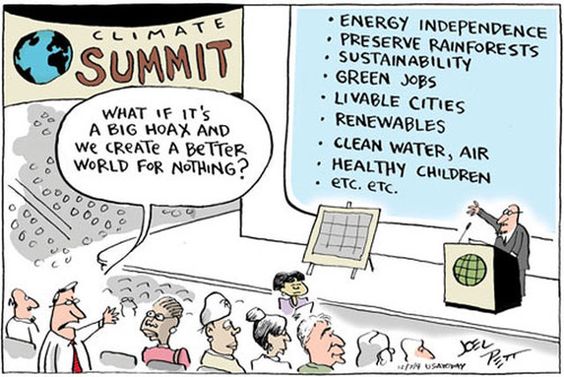

His plan will drain money from our communities, schools, and hospitals in order to give a break to Wall Street billionaires and big corporations.

The tax plan is being promoted by Treasury Secretary Steve Mnuchin and NEC Director Gary Cohn — both former Goldman Sachs executives. It’s no surprise that Wall Street loves it. It will cost us more, while letting billionaires off the hook.

We reject a plan that allows the rich to get richer while our communities are in need of jobs and resources to thrive.

We deserve a plan that invests in our communities, not the 1%. Sign the petition and tell Wall Street to pay what it owes.

http://caf.salsalabs.com/dia/track.jsp? … rq%2Bc6ozD

"The 1% and Wall Street need to pay MORE taxes, not less."

Why? Because paying 1,000 times what you do isn't enough?Whatever, Wilderness - the lack of interest Trump and the GOP have always shown regarding the Russians hacking into our systems has always been suspicious. As long as the Russians didn't use any of the bad information against them that they found, the country is apparently safe and we should all drop it. If they had been a little more concerned about this 'act of war' like the rest of us, things might be different.

Plus, the extent of your brainwashing on behalf of the crooked rich is amazing. (Not all rich are crooks; and its not like they only exist within the GOP to make sure they are taken care of.)

Prior to FDR establishing 'the welfare state' taxes for the rich were far higher than they are now for all kinds of really good reasons. The highest was in 1944-45, “the most progressive tax years in U.S. history,” the 94% rate applied to any income above $200,000.

The shocking thing is that no one is asking the 1% to take this huge of a hit; but a LOT more fairness across the board would be nice - WITHOUT a bunch of loopholes for them to jump through to get out of paying taxes. This is actually one of the reasons why we want to see Trump's tax returns. We'd like to see how many stunts he has pulled to create loopholes for himself.

Petition signed and thanks for putting it handy up here. I've never liked the idea of Jared being in the position he is in, anyway. Its not like he has anymore experience than Trump and he's wearing an awfully big hat.

What does any of that have to do with charging some of the people more than others, for the same thing? What does it have to do with "fair" taxation? And why the lie that because rates were very high in the 40's that people actually paid them? The rich are paying more today than at any time in the past, regardless of what the top rates were. Ever hear of loopholes or exemptions?

Go watch more BS at Fox News. The rest of us will worry about & actually take care of the country.

Does that mean it has nothing at all to do with unfair taxation? You were just ranting, without anything of value to add?

please do tell us how it all works since you are a CPA {snark}

So you're telling us that .01% paying more taxes via loopholes? I'm sure that's a typo - yes?Can't find a typo - can you be more specific? Maybe with a copy and paste instead of making things up that were never said?

The rich are paying more today than at any time in the past, regardless of what the top rates were. Ever hear of loopholes or exemptions?

you have the word "paying"in italics.Does that me you are mocking yourself ?An effort to point out the difference between what is being insinuated as a result of high rates and what actual figures are. While rates used to be higher, dollar figures were actually lower because nobody paid at the level anyway.

Was it really that hard to pick up on? I'll try to make it clearer in the future - sorry about that."An effort to point out the difference between what is being insinuated as a result of high rates and what actual figures are. While rates used to be higher, dollar figures were actually lower because nobody paid at the level anyway".

If the rich were not paying at the higher rate level back in the forties, what makes you think that they are paying today now that the rates are considerably lower?

Is there any support for your assertion that the Rich did not pay at the higher rates in the past?Because we have eliminated most of the egregious loopholes of the 40's. And because it isn't worth as much effort or cost to avoid a 40% tax as it is to avoid a 90% tax on the same amount of income. Particularly this last is simple common sense, but something liberals countrywide choose not to think about.

There is plenty, but I'm not going to search it out again. It's been shown in these forums several times. You might start by looking at effective tax rates - the percentage of income actually paid out in taxes - as a starting point. What you don't want is any kind of analysis about tax rates over the years, but that's mostly what you'll find.effective tax rates

I'm sure that this chart won't mean diddly-squat to you but here it is anyway....

What happened to the effective rate in 1940? That's the topic of discussion, I thought - the comparison between taxes paid by the ultra rich in 1940 and now.

But you're on the right track - the graph plainly shows how patently unfair it is for some people to pay not only a higher percentage of income, but an even higher dollar amount as that income rises.

Related Discussions

- 99

Why Did GOP Tax Cuts Not Work?

by Scott Belford 7 years ago

The GOP sold gullible Americans on the promise their tax give-a-way to the rich and corporate America would mostly benefit the Middle Class. Why isn't it.They said all of this money staying in corporate coffers would go to investment, more jobs, and higher wages. It has been six months...

- 43

Jared Kushner's Top Secret Clearance

by Mike Russo 6 years ago

During the 1960's I worked for a company that was doing business with the (NSA) National Security Agency. The job that I was on required that I have a secret clearance with crypto access. The job required working with the NSA on many "black box projects" for the Minuteman...

- 342

President Trump Revokes John Brennan's Security Clearance

by Ralph Schwartz 7 years ago

Historically, former heads of intelligence and law enforcement agencies have been allowed to retain their security clearances so they can be called upon to consult with their successors in times of crisis - John Brennan has been accused of using his access to personally profit as a spokesperson on...

- 319

Why does everyone hate the rich?

by Jesusjohn78 6 years ago

Everyone hates the "rich" and I do not understand why. I was always under the impression the American dream was to become successful and stay successful? SO why are we always trying to punish the rich?

- 140

Congress Demands Trump's Taxes !

by Ralph Schwartz 3 years ago

Congress has ramped up efforts to secure the tax returns of President Trump, demanding the IRS hand them over for scrutiny, launching what appears to be a legal battle between the Executive and Legislative branches.There is no existing law which requires the President or any other private citizen...

- 15

What will Donald Trump's taxes reveal?

by Randy Godwin 8 years ago

What will Donald Trump's taxes reveal?It is a sure thing the Special Prosecutor will subpoena Trump's taxes. Will they reveal any monetary ties to the Russians or will they show he isn't as rich as he claims. I realize this is a speculative topic, but I think we'll eventually have the real answers...