The Trump Economy...

In the 10 months of the Trump administration, we are seeing hard data that our economy is coming back. The stock market is a leading indicator of things to come. It has crossed over the 23000 mark.

That is an 18% increase since Jan. 1 2017.

For those who doubt this, I like to understand your thinking...

Answer the question honestly.

Has he been a good force for the American people or not? Not the donor class, or the unions or the rich and famous but everyday citizens working and paying taxes...both Republicans and Democrats...

It is estimated 70-80% of the people are invested in the market one way or another either directly through stock ownership or indirectly through their company 401k or 403b plans...

His latest tax proposal is a good one though not the one I prefer. I am a big supporter of the Fair Tax. Still, by all indicators, it will be good for all. A simplified tax structure and lower corp. tax will stimulate the economy. Past history has shown when tax rates are reduced, the country's revenue goes higher.

If some GOP senators don't come on board now, they are missing the boat. I wish some Democrats with conscience will support this president and his agnda. A bipartisan bill on tax reform will go a long way to bridge the gap between the left and the right. Money talks and when everyone benefits, how can one be against it?1. The stock market increased 3X more during the first 6 months of the Obama administration than during Trump's. BTW, Trump's administration began Jan. 20.

goo.gl/z8MYG9

2. The unemployment rate during Obama declined from 10% to 4.7%. Using both the stock market and unemployment, it's hard to see how the economy only now is bouncing back.

3. The market is grossly overvalued at an historical high compared to GDP because of possible tax reform. If reform doesn't pass, and it probably won't, many experts think the market will crash.

4. The Trump tax plan benefits Trump and other billionaires by killing the AMT and estate tax. It has little help for everyone else.

5. Blaming Democrats for Republican inability to pass anything when Republicans control both the House and the Senate is astonishing.

No, he has not been good for the American people for too many reasons to list here.What policies do you support that will benefit the American people?

I pose this as a real question and I want to know your answer.

It is so easy to criticize from the outside but ruling in a democracy is never easy. It was true when Reagan took office in a split Congress and it is not easy now with the likes of RINO on the GOP side.

The fact is Obama had a terrible economic policy that we suffered the worst recovery in modern times and on top of that, he was boasting about a 2% GDP geowrh saying that is the best we can do...

I am sorry but that is not the best and not even close. Reagan had a GDP rate of 6-7%.

The ACA is still the biggest job killer in America. It prevents small companies of expanding and it forces a segment of the working population into P/T work due specifically to the regulations in ACA...I favor a real Republican solution that balances the budget during strong economc times. I don't favor a "greed first" solution that adds debt to the country while putting more money into the pockets of billionaires.

The economy was already in deep recession when Obama took over. All of the declines took place in 2008 (when Bush was president) and the first quarter of 2009.

ACA actually created jobs. A repeal would kill 1 million of them.

http://www.marketwatch.com/story/the-ri … 2017-06-28

The REAL GDP after inflation has grown at a steady pace since World War II except for the 2008 Bush recession.

https://fred.stlouisfed.org/series/GDPC1I agree with you on the balanced budget proposal but I suspect we disagree on how to get there. It is almost criminal for Obama to drive up our debt in recessionary period where he should have been cutting expenses and entitlements. Now we are at $20 trillion.

For democrats, it is never enough taxes to pay for entitlements.

Therefore by definition, we will never have a balanced budget.Let me add this. I track my taxes and it has gone up every year in the Obama Admin. All while the debt keep rising year after year. How come? If we can't reduce our budget in a recession, when will it be reduced? I am tired of being called a heartless conservative when I do pay my share and some and yet some don't pay any and wants more from our government...

The definition of socialism is "sooner or later, you run out of other people's money..." we are not quite there yet but look at Greece and Venezuela...and that is where the US is headed if we continue down that path.Can't go with you here, Jacklee. We have historically spent our way out of recessions, and with borrowed money because there wasn't enough tax receipts to cover the bill. We also spend large sums helping and caring for those people that used to pay taxes but can't after losing their job.

The time to reduce deficits and debt is in good times, not bad. Sure, cut expenses when the money dries up, but to cut them beyond the loss of income isn't reasonable. Instead, increase spending when times are good and tax receipts are up...but not as much as the tax receipts increased.You are making my case. The fact is we had a recovery after the first two years of Obama though much weaker. Then, we had record revenues due to his tax increases...

Then we had more debt added till it reached $20 Trillion in 2017...

So where was the reduction in spending?

You can't have it both ways...if he created the recovery then he should have reduced the debt but he did neither...Wilderness and I don't agree often, but we do this time. Obama signed tax CUT bills that were passed by a Republic Congress to stimulate the economy during the worst economic downturn since the Great Depression.

http://www.latimes.com/nation/politics/ … story.html

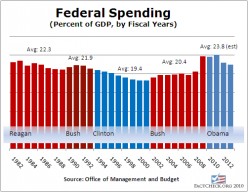

Federal spending as a percentage of GDP has been in decline since 2012. See the attached chart.

You can't drive down debt by cutting taxes. So I assume you are opposed to the Trump tax plan because it will add massive debt to the U.S. economy.On the contrary, i support tax cut to stimulate economy and increase revenue to the treasury. It happened under Kennedy and Reagan administration. The trick is not to spend more than we take in...that is why we need a balanced budget amendment.

"The trick is not to spend more than we take in"

A trick indeed. Let a liberal even smell money and he'll spend twice what is there. To a lesser extent, so will the GOP; the end result is that without very firm action from the people (amendment) it will never change (until the supply of loan money runs out, anyway).We keep cutting taxes but the debt keeps going up.

You increase tax rates when the economy is stronger to pay down the debt. You decrease tax rates when the economy is weak to stimulate it.

What you don't do is cut taxes when rates already are at historical lows and the country is carrying $18 trillion in debt.And yet, the reports I see indicate that the rich are paying more dollars, and a higher percentage of their income, than ever before. Regardless of what top rates are or were, actual payments are up.

Guess it all depends on whose spin you want to accept as factual, doesn't it?

Your chart ends at 2012; it hardly shows a decrease in spending after that date...

You are reading it incorrectly. The 2012 is angled to show two years before the end. It goes through 2014.

Hard to see, even on my large screen. I would have said 2013 at best.

But considering that your statement was that it has decreased every year since 2012 it doesn't work very well either way, does it?

President Trump is doing a wonderful job bringing back our economy. Hopefully he can lower the huge debt that occurred over the Obama years. Jobs numbers are great, and his progressive agenda is working wonderful to encourage spending as well as investing.

Jack: You like most people are confusing the national debt with the national budget. They are not the same thing. The national debt was created to pay for the Revolutionary War. Every president since then has inherited the national debt of the previous president. It has risen and fallen since then, but its trend has always been upward. Today it stands at around 20 trillion. Trump inherited that debt from Obama, and Obama inherited it from Bush, and every president since then.

The national budget is not the same as the national debt and is based on how we pay for the debt incurred the previous fiscal year. If there is more revenue than outgo it is deemed a surplus. If there is less revenue than outgo, it is deemed a deficit. It they are equal, the budget is balanced. When there is a deficit, the interest is added to the national debt. Clinton was the only president since 1970 to have a surplus for three straight years and it was done under a republican controlled congress.

I don't see anyway that Trump can balance the budget, based on how he is going to pay for all the natural disasters we have had while in office. That money will have to be charged to the "budget credit card."

When there is not enough revenue to pay for the last fiscal years expenditures, they have to raise the budget ceiling to pay for what has already been spent the previous fiscal year. This is where congress plays the game of shutting the government down until they get their proposed legislation passed. If we don't pay our debt from the previous year, we get our treasury bond rating downgraded to a lower rating. This happened on April 18, 2011 when congress shut the government down for a long period of time.

The United State is a debtor nation and probably will be for the foreseeable future. China and Japan hold a big chunk of our debt in the form of treasury bonds. Here is the national debt clock in real time.

http://www.usdebtclock.org/I know exactly what you are talking about and I am not confused by the two.

You fail to mention that despite of record revenue intake, we were spending more than we take in.

That was what drove the debt from 10 trilion to 20 trillion in 8 years of Obama.

There is a way for Trump to reduce the debt while cutting taxes. It is called fiscal respinsibility. He can cut some fat in the federal budget...which you and I know there are plenty...

He can cut the taxes to stimulate economy and thereby increase the revenue to the IRS...it is not a fixed pie. The economy can grow if allowed to...

As the pie gets larger, everyone wins...that is capitalism.

I am glad you raised the issue of these natural disasters. They occur periodically like clock work in the past 100 years. That is why we have insurance... most of the burden will be taken care of by the insurance company though it will take years. Some are still recovering from hurricane Sandy here in the Northeast.

The federal budget is to pay for defense and infrastructure and entitlements and social security and medicare... we have allowed the government to grow unchecked year after year even when the private economy was shrinking during recessions...that was the imbalance.

Here is the proof of what I am saying..

https://www.cnsnews.com/commentary/tere … nfold-1941Jack: I was just replying to your statement: "Then we had more debt added till it reached $20 Trillion in 2017...So where was the reduction in spending?"

To me, it sounds as if you are calling the national debt the national budget. I don't just comment for you. I comment so others can understand the difference as well.I did not confuse the two. The deficit and debt are related. In any given year, our government operate with a deficit. That deficit is added to the debt which is cumulative. If any year, our government has a surplus, then the extra money can be used to service the debt to reduce it. I hope that is clear to you and to all. This is basic economics.

There is going to be a giant outgo for FEMA to aid in paying for the natural disasters. They wont't even come close to making those whole who lost everything and have no insurance. FEMA is still paying for people who were involved in prior natural disasters.

Our economy has been coming back since late 2010/early 2011. There was a record consecutive months of job growth that just ended. Trump inherited a good economy. Trump has record low job approval.

I heard that Trump is looking to replace Yellen. I was advocating for that months ago (in 2016) before Trump won the election fair and square.

Added: But, the coup goes on. I posted about that months ago.How is cutting taxes going to create enough revenue to balance the budget?

Mike, you should know that cutting taxes stimulate economy and thereby create jobs and lead to more people paying taxes, revenue increases...

It will not balance the budget but with fiscal restraints can lead to a reduction of deficits.

This is not rocket science...

On the other hand, if we continue with what we have been doing, raising taxes while spending even more on entitlements, we increase the deficits and adds to the national debt.

How'd this tax cutting thing work out in Kansas? Or for Bush Jr.?

Jack: How much was spent on entitlements as a percentage of the total budget last year?

How about answering one of my question. Does your family increase your budget every year for the past 40 years?

Why do we need a federal budget that goes up year after year...during boom and recession...and more importantly, did they do any good? Are people being helped? Or is mostly wasted?

Jack: Yes, 40 years ago, what did you pay for a loaf of bread compared to today? It goes back to income versus outgo. If a family's income was way more than there outgo, there probably was no need for a budget. But if they were living on the edge, a budget would help. The federal budget goes up every year because of the cost of goods and services continue to increase.

According to the CBO, in fiscal year 2016 our spending was 3.9 trillion and our revenue was 3.3 trillion. That is a difference of .6 trillion. That is what it would take to balance the budget. So the question is adding new jobs, and cutting taxes, and entitlements needs to generate .6 trillion to balance the budget. Do you think that will happen?

By the way, how are entitlements defined in the budget? In all the charts you linked, I could not find a category for entitlements.

Related Discussions

- 21

The GOP House of Representatives, Shutting Down the Government

by Mike Russo 5 months ago

The new House of Representatives is ready to shut down the government because they don’t want to pay for the countries bills that were accrued in the last fiscal year. So they want to hold the country hostage until they get what they want, which is to lower spending for the next fiscal year. ...

- 211

Trump Economy In Doomed Irreparable Chaos And Disarray

by JAKE Earthshine 6 years ago

Unprecedented instability, we’ve never experienced anything as chaotic and destructive as this: Greatest stock market crash in history, Unilateral trade wars with our allies instigated recklessly by Mr. Trump which is killing jobs for his own voters and everyone else, Americans dropping out of the...

- 132

Debt? Whose to blame? What to do, What to do?

by tsmog 20 months ago

From Riches to Rags: Causes of Fiscal Deterioration Since 2001 by Committee for a Responsible Federal Budget (Jan 10, 2024) says;https://www.crfb.org/papers/riches-rags … ation-2001 [Who in the hell are those people. There about page is at the next link.]https://www.crfb.org/staff-members“In...

- 20

Trump Rally Continues...

by Jack Lee 8 years ago

The DOW is near 22,000, a 20% jump since November 2016. For those who invested in the market, that is a huge return...Those who question the wisdom of electing Trump as President, do you have anything to say?Despite the inaction of the new GOP congress, the change in business outlook is...

- 17

what constitutes growth in our economy?

by freddykrueger 15 years ago

Is it like bush losing 750,000 jobs a month or creating 290,000 jobs a month under obama.I understand it's taking a long time but nothing comes fast it all takes time.I remember during the campaign everyone said we needed a change yet now they disagree.It was the measures this president took that...

- 107

My Criticism of the Trump administration

by Jack Lee 7 years ago

As most of you know, I support many of Trump’s initiatives and I defend him here on hubpages when he is unfairly criticized by the media and others.You may also know I did not vote for Trump or Hillary in the 2016 election.Now, after over one year in office, and the signing of the latest Omnibus...