A Stronger America Through Strategic Rare Mineral Initiatives

President Trump's Strategic Pursuit of Rare Earth Minerals: Securing America's Technological Future

As President of the United States, I have embarked on a comprehensive strategy to ensure that America leads in the acquisition and processing of critical minerals essential for emerging technologies. This initiative is driven by the imperative to reduce dependence on adversarial nations, particularly China, and to position the U.S. as a dominant force in the global technological landscape.

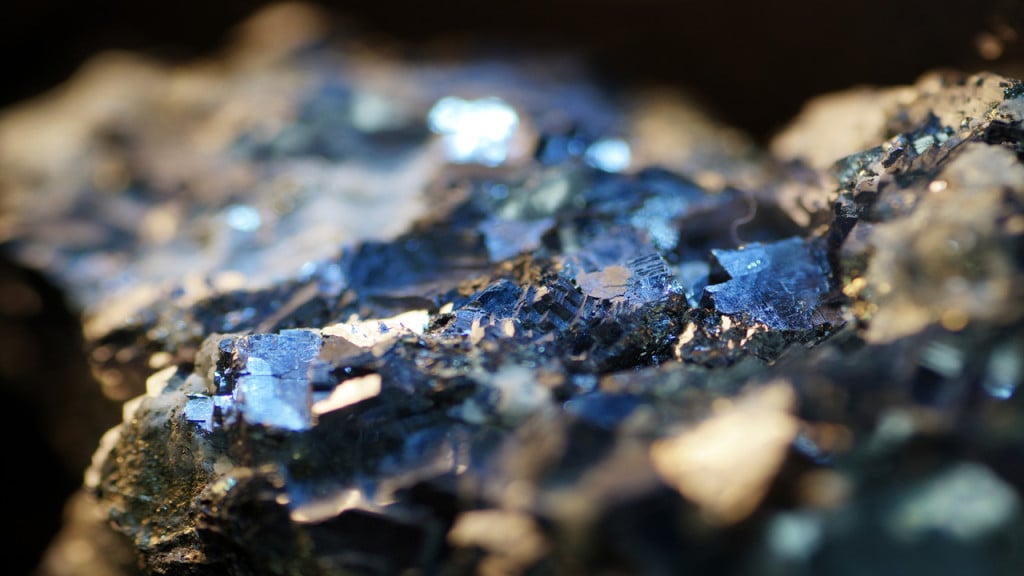

The Imperative for Rare Earth Minerals

Rare earth elements (REEs) and critical minerals are the backbone of modern technology. From semiconductors and electric vehicles to advanced defense systems, these materials are indispensable. Recognizing this, my administration has prioritized the establishment of secure, domestic supply chains to meet the growing demands of the 21st century.

Competing with China: A Strategic Necessity

China currently controls a significant portion of the global supply of REEs, posing potential risks to global supply chains. In response, I have initiated several bilateral agreements and investments aimed at diversifying sources and reducing reliance on Chinese-controlled resources.

Domestic Initiatives

Within the United States, we are focusing on expanding domestic production capabilities. The Mountain Pass mine in California, operated by MP Materials, is a cornerstone of this effort. The Pentagon has become the largest shareholder in MP Materials, investing $400 million and committing to purchase all output from a new magnet factory. This partnership aims to bolster domestic production and processing of REEs, ensuring a steady supply for both civilian and defense applications.

International Partnerships

To further secure the supply of critical minerals, my administration has forged strategic partnerships with key allies and resource-rich nations:

Australia: In October 2025, I signed an $8.5 billion critical minerals agreement with Australian Prime Minister Anthony Albanese. This deal includes $3 billion in joint investments over six months, targeting deposits of critical minerals worth $53 billion. The agreement also involves the U.S. Export-Import Bank issuing Letters of Interest totaling over $2.2 billion to support projects by companies like Arafura Rare Earths, Northern Minerals, and Graphinex. Additionally, we are supporting U.S. aluminum giant Alcoa in developing a gallium plant in Western Australia, expected to supply up to 10% of global gallium needs.

Ukraine: In April 2025, I signed a framework agreement with Ukraine to establish a joint investment fund for the reconstruction of Ukraine, capitalized in part by revenues from future natural resource extraction. This agreement aims to strengthen economic cooperation and attract investments for Ukraine's recovery, while securing access to critical minerals.

Democratic Republic of Congo (DRC): Recognizing the DRC's vast reserves of cobalt, copper, and other rare earth elements, my administration is facilitating a peace agreement between the DRC and Rwanda. This agreement is expected to grant the U.S. access to significant mineral rights in the DRC, enhancing our supply of essential materials for technology manufacturing.

Investment in Africa

Beyond individual agreements, my administration is exploring broader strategies to enhance mineral supply chains in Africa. We are considering the establishment of regional processing hubs, which would create jobs and better secure supply chains. This approach aligns with African aspirations outlined in the African Green Minerals Strategy while meeting U.S. strategic needs.

Executive Order on Deep-Sea Mining (April 23, 2025)

In an effort to secure alternative sources of critical minerals, Trump signed an executive order to expedite permits for deep-sea mining in U.S. and international waters. The initiative aimed to access seabed resources rich in metals like nickel and cobalt, essential for battery production. This move faced criticism from environmental groups and legal experts concerned about potential ecological impacts and violations of international law.

The Verge

Investment in Domestic Mining Projects (October 2025)

The administration allocated approximately $35.6 million to develop critical mineral resources in Alaska's Ambler mining district. This investment aimed to enhance domestic production of copper, zinc, and lead, further reducing reliance on foreign sources.

Reuters

Critical Minerals Agreement with Australia (October 20, 2025)

Trump and Australian Prime Minister Anthony Albanese signed an $8.5 billion agreement to strengthen supply chains and counter China's growing restrictions on rare-earth exports. The deal included plans for joint investments in the critical minerals sector, focusing on securing stable prices and supply.

The pursuit of rare earth minerals is not merely an economic endeavor but a strategic imperative. By securing access to these vital resources, we are ensuring that America remains at the forefront of technological innovation and global competitiveness. Through domestic initiatives and international partnerships, my administration is committed to building a resilient and secure supply chain for critical minerals, safeguarding our nation's future in an increasingly complex global landscape.

We finally have a strong, intelligent, and forward-thinking president who looks to the best of the future and is clearly working to make America a leader in innovation, security, and opportunity. By prioritizing critical resources, fostering strategic partnerships, and investing in domestic capabilities, he is ensuring that our nation is prepared to meet the challenges of tomorrow while creating a foundation for sustained economic growth, technological advancement, and global influence. This approach demonstrates a commitment not just to the present, but to a resilient and prosperous America for generations to come.I’ve watched, with growing optimism, as President Trump has moved swiftly to shore up America’s access to the rare and critical minerals that will power our economy, our industries, and our armed forces for decades to come. This isn’t small-time diplomacy or empty talk; it’s a full-throated strategy to end U.S. dependence on unstable or unfriendly supply chains and to put American workers, manufacturers, and innovators back in the driver’s seat of the technology revolution.

The administration has turned trade summits and White House meetings into concrete supply-chain wins. In late October 2025, the United States announced an agreement with Malaysia that explicitly removes the threat of export quotas or bans on critical minerals and rare earth elements to American companies, a practical assurance that manufacturers in the U.S. will have a reliable partner in Southeast Asia for important inputs. This is the kind of predictable access firms need when planning new factories, new battery lines, and new defense production.

The administration has not limited itself to government-to-government agreements. It has used American financing tools to underwrite private projects that directly increase U.S. supply options. A striking example: the U.S. Export-Import Bank issued a letter of interest in mid-2025 for a loan of up to $120 million to support the Tanbreez rare-earths project in Greenland, a move that signals Washington’s willingness to back physical production abroad when it advances U.S. supply security. The same project has committed production to U.S. customers through offtake arrangements, meaning American manufacturers can count on tangible volumes of concentrate in the near term. That pragmatism, combining public finance and private sector expertise, is exactly how you turn strategic intent into delivered supply.

Beyond the headline agreements, the administration’s approach contains three practical pillars that together form a durable, long-term strategy. First: diversify supply. By building relationships with multiple nations (Australia, Malaysia, Greenland partners, Ukraine, and others), the U.S. reduces single-point dependence and strengthens negotiating leverage. Second: invest in processing and manufacturing. Deals aren’t just about mines; they are about building refineries, separation plants, and value-added facilities so that raw minerals are turned into American-made components for EVs, wind turbines, and defense systems. Third: move fast on financing and permitting. Whether it’s concentrated public-private financing packages, the use of EXIM and other tools, or expedited regulatory reviews, speed matters when global competitors are racing to lock up resources.

For the U.S. workforce, these moves translate into real jobs and real factories. New mines and downstream processing create employment across mining towns, manufacturing hubs, and transport corridors. But perhaps more importantly, they re-establish secure domestic and allied supply chains for the semiconductors, batteries, electric motors, and guidance systems that define 21st-century industry. That’s economic patriotism: making sure the chips and magnets that power our devices and defense systems come from friendly, reliable partners.

The administration has also been smart about linking mineral access to wider strategic goals: economic partnerships that open markets for U.S. goods, reconstruction funds that stabilize partner nations, and finance lines that encourage Western processing capacity rather than raw exports to adversaries. Those linkages mean minerals policy is not an isolated technical field but a lever of broader national strategy — and President Trump has used his negotiating position to pull that lever decisively.

Looking ahead, the path is clear and action-oriented: accelerate investment in allied source countries, underwrite priority processing capacity in friendly jurisdictions, and pair commercial offtake deals with government support to de-risk projects. The Trump administration has already begun executing on this blueprint — from letters of interest at EXIM for Greenland projects, to rapid investment pledges with Australia, to binding commitments from trade partners in Southeast Asia. Each deal both shores up supply and creates the business certainty U.S. companies need to expand plants and hire.

I believe this is the kind of big, strategic thinking America needed. Instead of waiting for shortages to bite or letting other powers dominate the supply chain for decades, the administration is proactively building alternatives, and doing so at the scale and speed required by modern industry. For readers who want a stronger America in manufacturing, defense, and clean energy technology, these mineral deals are a central piece of the comeback story. They are practical, patriotic, and forward-looking, and they will help ensure that American innovation has the raw materials it needs to thrive.Trump “cut a deal” with China to: buy the soybeans they were already buying before the trade war, but now China gets advanced AI chips too?? Where is the win?

America’s Rare Earth Comeback: Building Independence and Innovation for the Future

The United States is on the verge of a remarkable comeback in the race for rare earth minerals, the essential elements that power our modern world. From electric vehicles and renewable energy systems to advanced defense technologies, rare earths are the backbone of the global economy. And for the first time in decades, the U.S. is not just talking about independence in this area - it’s actively building it.

A Strategic Shift Toward Self-Reliance

Over the past few years, the U.S. government and private sector have worked hand-in-hand to strengthen America’s rare earth supply chain. Companies like MP Materials are leading the charge, with their Nevada mine now supplying key minerals for magnets used in everything from wind turbines to fighter jets. Even more encouraging, the Department of Defense has stepped in with strong financial and strategic backing - recognizing that rare earth minerals aren’t just an industrial need but a matter of national security.

“Mine to Magnet” A Complete American Supply Chain

What’s unfolding is a transformation from the ground up. The U.S. is no longer content to simply dig up ore and ship it overseas for processing. New facilities are being developed to handle every step, from mining to refining to magnet production, right here at home. This “mine to magnet” approach is revitalizing regions once left behind by global outsourcing, creating new jobs and opportunities in technology and manufacturing.

Innovation Leads the Way

Equally inspiring is the innovation driving this resurgence. American scientists are finding creative ways to recover rare earth minerals from existing mining waste and tailings, dramatically cutting costs and environmental impact. This breakthrough means we can reclaim valuable materials that were once discarded, turning yesterday’s waste into tomorrow’s energy and technology.

Global Leadership Through Smart Partnerships

While the U.S. builds its domestic foundation, it’s also forming smart partnerships with trusted allies to secure additional sources of critical minerals. This cooperative approach strengthens not only our national supply but also the collective resilience of democratic nations that value stability and transparency in trade.

A Future Fueled by Determination

What’s happening across the rare earth industry is about more than materials - it’s about mindset. America is rediscovering its drive for independence, innovation, and leadership in critical technology sectors. The progress being made today lays the foundation for a future where our nation controls its own destiny, powers its own industries, and safeguards its own defense.

Every new investment, every research breakthrough, every processing facility built, these are signs of a nation on the move. The groundwork is being laid for an American rare earth renaissance, and it’s happening faster than most expected. WE have the right guy in the White House at the right time...

The bottom line: the U.S. is no longer playing catch-up. It’s paving the way.Dec 5, 2025

The Democratic Republic of Congo has agreed to give US buyers preferential treatment for minerals sold by its state-owned mining companies, just one day after Washington brokered a fragile peace treaty between the country and neighbouring Rwanda.

The US government and Swiss trader Mercuria on Friday each announced up to $1bn in fresh funding for minerals ventures in the DR Congo, the world’s biggest producer of cobalt and second-biggest producer of copper.

Washington and Kinshasa signed an extensive critical minerals, economic and security agreement on the heels of Thursday’s treaty, which paves the way for greater US access to the DR Congo’s wealth of minerals.

The DR Congo’s president Felix Tshisekedi has sought US security support to halt the deadly war raging in the east of the country in exchange for access to its minerals, which include gold, tin and copper.

The US International Development Finance Corporation (DFC) said it intends to provide up to $1bn in finance for the Lobito Railway, which connects copper-producing regions to Western customers through a port on the Atlantic Ocean.

The DFC will also support a new marketing joint venture between state-owned miner Gécamines and Mercuria, that will sell Gécamines’ copper and cobalt — and give American companies a right of first refusal for its metals.

“We’ll be involved with sending some of our biggest and greatest companies over to these two countries,” US President Donald Trump said on Thursday at the signing ceremony. “Everybody is going to make a lot of money.”

Ben Black, chief executive of DFC, said the projects would “help to secure vital supply chains, expand private-sector opportunity and strengthen America’s global competitiveness”.

Mercuria will invest up to $1bn in the joint venture through pre-financing arrangements and credit lines, and provide logistical support such as warehousing and transportation for the minerals, the company said.

Guy Robert Lukama, chair of Gécamines, said the deal with Mercuria gives it the ability to “strategically direct” its minerals to “end-user markets that align with our vision of strong and sustainable growth”.

Gécamines holds minority stakes in mines that entitle it to receive a portion of the minerals produced, including its 20 per cent stake in the giant Tenke Fungurume copper-cobalt mine run by China’s CMOC.

The Congolese mining group controls an estimated 500,000 tonnes of copper production through these stakes, roughly 2 per cent of global annual production, according to analysts.

Kostas Bintas, head of metals at Mercuria, said the deal with Kinshasa would give the country more choice over how and to whom it sells its minerals.

“There is a broader trend, countries around the world with mineral resources are trying to get more control of their resources, particularly in assets where they themselves are shareholders,” said Bintas.

Chinese companies are by far the biggest producers of copper and cobalt in the DR Congo.

The US-DR Congo critical minerals agreement, signed Thursday, lays out ways the two countries will work together, including by creating a strategic mineral reserve that will “ensure predictable and durable supply of critical minerals . . . for the United States”.

It also indicates US support for infrastructure projects, including the Grand Inga Dam and the Lobito project.

Other DR Congo state-owned enterprises will also offer a first right of refusal on minerals being exported from certain projects to US buyers, such as Entreprise Générale du Cobalt, which buys the mineral from informal mines.

Industry sources say a range of mining projects — including the Rubaya coltan mine, the Western Forelands copper exploration project, the Manono lithium deposit and the Mutoshi copper-cobalt mine — could also benefit from the new US tie-ups.

“This peace agreement is a huge step forward and it does help unlock these mineral resources,” said Rob Strayer, president of the Critical Minerals Forum, a Darpa-funded consortium of miners and consumers.

He added that, “the success or failure of the joint partnership is going to depend on the private sector being involved”.

But the surge of funding and deals comes amid signs of the fragility of the peace deal, the ratification of which coincided with a surge in fighting that forced hundreds of Congolese refugees across the border into Rwanda.

Rwanda-allied M23 rebels and the Congolese army have accused each other of violating an earlier ceasefire, which never fully came into effect.

https://www.ft.com/content/982d40c8-61f … hatgpt.comAustralia On October 21, 2025, Trump and PM Anthony Albanese signed a framework agreement on rare earths & critical minerals; joint investment commitment of ≈ US$3 billion over several months.

Japan On October 27, 2025, a “U.S.–Japan Framework for Securing the Supply of Critical Minerals and Rare Earths” was signed — aiming to coordinate mining, processing, stockpiling, supply-chain resilience.

The White House

Malaysia On Oct 26, 2025, the U.S. signed a memorandum of understanding (MOU) with Malaysia on critical minerals supply-chain cooperation.

Reuters

Thailand Also on Oct 26, 2025, a similar MOU was signed with Thailand on critical minerals cooperation (mining, processing, supply-chain access) under the U.S. administration.

Reuters

Cambodia During the same set of Southeast-Asia negotiations, a trade/critical-minerals deal was signed including Cambodia (though the public text suggests broad trade + supply-chain cooperation rather than a firm mineral-rights contract).

Reuters

Ukraine On April 30, 2025, the U.S. and Ukraine signed the Ukraine–United States Mineral Resources Agreement — establishing a Reconstruction Investment Fund intended to leverage Ukraine’s natural resources (including critical/rare minerals) as part of reconstruction and economic cooperation.

Democratic Republic of the Congo (DRC) In late 2025, as part of a U.S.-brokered peace and economic deal with Rwanda, the DRC agreed to give U.S. companies “preferential access” to critical minerals (e.g. cobalt, copper, gold, tin).

Axios

Domestic / U.S. initiatives Trump also signed executive orders in 2025 to boost domestic mineral production, streamline permitting, and support deep-seabed mineral exploration under the Deep Seabed Hard Mineral Resources Act.

The White HouseTrump just might save us from those trying to destroy us from within.

Worth the watch:

Trump and Putin just SHOCKED the world, and NATO and EU globalists are furious

https://www.youtube.com/watch?v=Z7qOSpl5CEEVery interesting. I did hear about the new 33-page document Trump released late last week, and I managed to find it, but I’ve only had time to skim it. Even that quick look stopped me in my tracks. There’s some truly shocking material in there. And I can’t imagine it won’t blow up publicly this week. Honestly, where on earth are the real journalists?

The document is titled 2025 U.S. National Security Strategy it consists of 33 pages. I found information that German chemical companies (or “German chemical interests”) are “building large processing plants in China” and continue using Russian gas resources that they can “no longer get at home.

This is a must-read, Ken--- I will be diving into it tomorrow.

https://www.whitehouse.gov/wp-content/u … rategy.pdf

I mean, some info in that document is genuinely alarming, and the lack of reporting on it is even more concerning. Real journalism should dig into things like this, not look the other way. It also offers his plan to set America back on track.

I was not going to add it here on HP's forum, I mean, this is some deep sh--t. But your clip made mention of some of what I uncovered in the document.

Yeah, it seems Trump is on the mark, and ready to roll up his sleeves...The 33-pages ended abruptly, as if there were more to the document. ... "shrug*

It reads like a smart plan to me.

GAAgreed...

Ten times better than the previous Administration's desire to start WWIII and give away the country to foreigners.It describes one of your "Big Picture" scenarios. This one seems so logically right that I added an extra 'bias' filter before replying.

As the bones of a concept, I liked it all. This one's worth following.

GA

Yeah, I noticed the abrupt ending too - it almost feels like they trimmed it down or pulled out some sections before release. But honestly, even with the way it ends, the tone and direction are crystal clear. I walked away thinking it reads like an intelligent, focused plan. It finally puts our priorities back in order and lays out a strategy that actually benefits the American people.

Shar

Appreciate the link.

No more Global police officer... Monroe Doctrine revival.

Orwells 1984... The three global powers in endless conflict against one another.

Predicting the complete irrelevance of the EU.... If there is any government totally out of touch with reality (like the Leftists in our own country) that delude the themselves....it is the EU.

Don't expect our media to give it much coverage...unless it is to denigrate it.So much to unpack. I actually think the new National Security Strategy is exactly the kind of bold shift we’ve needed for a long time. When I read through it, I felt like, for the first time in years, America is finally acting like a sovereign nation again instead of a global babysitter. It puts our interests first, it brings the focus back to the Western Hemisphere, and it makes it clear that we’re done footing the bill for countries that won’t even defend themselves. To me, that’s not isolationism, it's common sense.

I also like that it’s honest about the cultural and economic decline we’ve watched unfold in Europe and refuses to pretend everything is fine just to keep certain people comfortable. The strategy treats our security the way it should be treated: through realism, strength, and smart prioritization, not endless idealistic missions or global “projects” that never actually protect Americans. And I appreciate that we’re not chasing utopian climate agendas or social-engineering plans overseas. We’re finally focusing on hard power, economic leverage, secure borders, and rebuilding our own national confidence. That’s America First, plain and simple.

And honestly, what surprises me most is how little coverage this document has gotten. It feels like the left hasn’t quite grasped what’s actually in it yet. But if they ever really dig into it, I think they’ll be furious. The plan rejects almost every pillar of their worldview—globalism, climate dogma, open-ended foreign commitments, and the idea that America should constantly defer to international institutions. It also calls out hard truths about migration, cultural instability, and Europe’s political failures. So if the left ever gets wind of how sharply the country has changed course, I don’t think they’ll take it well at all.

SharYes, as I have tried to bring to light for years... Our politicians... both sides, but the majority of the Democrats, sold out America the Nation and it's citizens.

Trump is the embodiment of the American Citizens standing up and taking back their country.

F the One World globalist agenda that sacrifices America the Nation... F letting in tens of millions of migrants... We need to do like Poland ...put a wall up and let the world know, cross our borders illegally and you'll be shot... Not showered with Social services and support.

Migration problem solved... Nonstop flow of drugs into the country solved... Sex trafficking solved.

Poland has a cohesive society that knows exactly what communism has to offer... unfortunately America doesn't... So we need to defeat the enemy within as well.

This one will raise an eyebrow:

https://youtu.be/Brs4aXOvdxg?si=sDU1EwOCYrM3Kb74

Ken

And so it begins---- Get a load of this

Congress is trying to make sure the Pentagon can’t suddenly pull U.S. troops out of Europe or South Korea, and they’re doing it in a way that’s meant to reassure America’s allies. The 2026 National Defense Authorization Act (NDAA), finalized by House and Senate negotiators, basically locks troop levels near where they are now: at least 76,000 in Europe and 28,500 in South Korea. Any reduction below those numbers would require a detailed assessment, consultation with allies, and a clear explanation of how it wouldn’t hurt U.S. or NATO security.

The bill also cements the U.S. hold on NATO’s top military spot, the Supreme Allied Commander Europe (SACEUR), a role traditionally held by an American general. This move comes after reports that the Pentagon had considered trimming forces or even giving up SACEUR, though recent signals suggested Washington was already stepping back from such plans even before Congress got involved. U.S. officials also told European leaders that by 2027, Europe will need to shoulder a bigger share of NATO’s defense responsibilities, while the U.S. maintains key posts and keeps troop levels stable for the near term.

On top of that, the NDAA authorizes $400 million for Ukraine’s security over the next two years and sets strict rules for when the Pentagon can reclaim equipment already purchased for Ukraine. This reflects Congress keeping a close eye on strategic priorities abroad and trying to ensure the U.S. can respond to emergencies without disrupting ongoing support for allies.

Now, here’s where it ties directly to Trump’s recently released 33-page document. His plan emphasizes rebuilding America’s military in a smart way, bringing in new industries, and making sure U.S. allies are strong partners, but without leaving Americans vulnerable or overcommitted overseas. A big part of his strategy is redeploying troops and reducing permanent U.S. footprints in Europe, something the NDAA 2026 would actually restrict. That means if Trump were to follow his own plan, signing this bill as-is would directly conflict with his vision.

Despite what the media might be suggesting, this isn’t a done deal. While the NDAA has passed both the House and Senate, the House on September 10, 2025, the Senate on October 9, 2025, and the final “conference” version released on December 8, 2025—it still needs the President’s signature to become law. Based on Trump’s stated priorities, it’s very possible he won’t sign it, which keeps the conversation about U.S. troop deployments and NATO commitments very much alive.

Bottom line: Congress is trying to lock in current troop levels and NATO commitments, but Trump’s plan takes a different approach, emphasizing flexibility, strategic redeployments, and stronger incentives for allies. Until the President acts, this story is far from settled, and it’s a perfect example of why media reports framing the NDAA as a done deal are missing the bigger picture.It is worth watching... Trump and his Administration represent the Citizens of America.

Congress not so much... for decades they have been the enemy of Americans, sell outs to corporations and countries like China.

Nancy Pelosi ...Chuck Schumer ...two of the biggest sell outs still there.

Related Discussions

- 3840

Trump’s Day One: A Bold Agenda to Reclaim America

by Sharlee 15 hours ago

My post is a summary of an article I came across on Fox News. He is coming out running! Day one, President-elect Trump is set to sign over 200 executive actions, marking a major shift in U.S. policy across a range of areas, from border security to energy to cutting costs for...

- 39

Do On To Others Not Us --- We Just Care About A Green Planet Not Kids

by Sharlee 3 years ago

Look here not there...Biden turns to country with documented child labor issues for green energy mineral supplies: 'It's egregious'The Biden administration opened the door to financing mining projects in the Democratic Republic of the Congo (DRC) and Zambia to bolster the global green energy supply...

- 15

President Donald Trump Keeps Winning for the United States

by Readmikenow 7 months ago

President Trump secured the border in unprecedented fashion.Illegal border crossings have declined to the lowest level ever recorded — down 94% from last February and down 96% from the all-time high of the Biden Administration. In one sector, illegal border crossings are down 99% over 2023.Fox News...

- 15

Economic Boom by 2027

by Ken Burgess 2 months ago

Regardless of what either the Biden or Trump Administration has said... we have been in a recession for the last 3 years.Thanks to the changes in taxation made by the Republicans/Trump-Administration, America is about to become the global haven for corporations looking to invest in new...

- 14

How China won the Cultural Revolution in America

by Ken Burgess 22 months ago

For a generation some of the most well-regarded minds in the West (IE – Henry Kissinger) believed that robust economic engagement with China would lead the Chinese Communist Party (CCP) to open its economy and financial markets and in turn to liberalize its political system and abide by the rule of...

- 43

America should Invest Heavily in Africa, or China will beat you to It

by AdsenseStrategies 15 years ago

Even though there is a perception that the United States gives large amounts of aid to Africa, the fact is that the Chinese and the Arabs are licking their lips at all of that mineral resource wealth that Africa holds, and are in the process of filling the gap left by the West's lack of interest in...