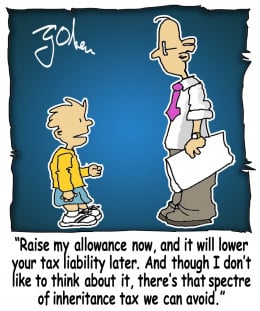

Should it be a parent's goal to leave an inheritance?

Should it be a parent's goal to leave an inheritance?

It is estimated that less than 25% of (adult) children are left an inheritance. So in this economy should parents focus more on saving an inheritance for their adult children or for enjoying their retirement to the fullest?From my upbringing: it should be a parent's goal to teach their children financial responsibility, do as much as possible to facilitate their education, and teach them to be independent so that they won't need an inheritance. That's how my parents did it and that's how Warren Buffett is doing it, and it seems rather effective. Were I to leave an inheritance, though, I would not tell my kids so that it comes as a supplement to what they have (and a nice surprise), not as an excuse to wait around for it.

Inheritance should be what is left over after a full life. If nothing is left over then there should be no inheritance. I would rather give what is left over to my children than anyone else. Donating to the poor is part of my current life. For instance all of my copyrighted work will go to my children. My keepsakes will go to my children. (these kinds of inheritance are seldom reported but are just as important) Real property I own will go to the children.

Adult children will either be responsible or not. One of mine is already richer than I am and another is a vagabond of sorts while another is anti-materialistic and another a minor.

So for me, of course I will leave them what is left over. How long I live will determine how much that is. But I sure as heck am not saving up so that they have my money that I want to spend. And truth be told they would no want me to.

(fun question)My grandmother left me a inheritance of $20k when I was 22 years old. I used it as a down payment to buy my first home. That money started me in a lifetime of making investments. That inheritance along with the example my grandmother gave me for saving & investing changed the course of my life. It is my personal to goal leave my children an inheritance.

I agree that parents should teach their children responsibility. That way if you do leave them an inheritance, they would be less prone to squander it. It is not my goal to leave my children an inheritance, but neither do I intend to leave anything left over from my life to a "charitable" organization to squander. I intend to live a normal life when I retire, and I have enough squirreled away to do so, but I hope there is enough left over to leave to my heirs.

My mother used to worry every time she bought a big ticket item, (sofa, car, etc.). I would encourage her to go places and buy the things she needed, including taking trips, but she would always say that she "was spending our inheritance". I told her that my brother and I were going to be comfortable in our retirements without her money. I don't know where she got the idea of an obligation, but she was a child of the depression. Her parents had no inheritances despite the fact that their parents were comfortable farmers. They always had to scrounge for a living, and she felt poverty of the depression. I don't think we should feel that way.Hi peeples. "Happy New Year" to you and yours. "Inheritance," is a great topic for discussion! Very rarely have I discussed this with a few people who don't all have a different slant/opinion on this. From what I can glean with my own experiences, the various OPINIONS on this is what is definitely "inherited." My own parents it seems, thought leaving your children as much as humanly possible was Number One of the Ten Commandments. Thus, my sister and I pretty much adopted that belief.

However, let's face it. In 2015, the average American family hopes to have enough to get their children from point A to emancipation with a nest egg enough to survive the balance of their own lives.

This is like so much else we could discuss in terms of being proactive or even having a "goal." I'd like to believe that parents should not feel guilty if they don't "leave" much of anything. I like to tell my sons, "Oh, I'm leaving you plenty....it will take you years to clean up my mess!" In some cases, our kids should be grateful we don't leave them a BILL!! LOL. In my particular case, I'm not kidding.

An inheritance is certainly very nice. So is giving and sharing while we are all living and as circumstances present themselves. Really peeples, this is not something that people should be overly concerned with, especially when we know we gave our children the really important things in life.....and this will be obvious to us and them.

In the meantime.....remember Mommy & Daddy are important too!I believe parents should be a blessing to their children and that would include teaching them how to take care of themselves, how to treat other people properly, and how to handle money. I do not have any children but if I did I want to help them as much as possible and teach them at the same time. I would try real hard to save up money / resources to give them a leg up in life if at all possible. On the other hand I want to enjoy my retirement as well. Will I eat dog food so my kids could have a good life? Probably not.

Thank you gmwilliams! Even though I am not wealthy I would want my children to have a leg up in life if I could provide it. I remember how tough it was and would want my children to have it better than me.

Wealthier parents, upper middle and upper classes, leave their children an inheritance. They want their children to be financially cushioned. They are of the school that their future generations should be provided for and for those descendants to have a financial advantage in life. Wealthier parents, for the most part, tend to leave their children an inheritance in order to provide their children a financial cushion in life so the latter would have more choices in life. They also want their children's and/or grandchildren's future to be secure.

Poorer parents, lower middle class, working class, and lower classes, contend that their children SHOULD make THEIR OWN way. They are of the school that they are not obligated to provide their children with anything beyond the bare rudiments. They assert that if their children want the rudiments, they can WELL provide for themselves. They maintain that it is not their job as parents to provide for and invest in their children's future, the latter CAN do these thingis THEMSELVES.

I believe that if parents are wealthy, they should leave their children an inheritance to give the latter financial secuirty and a financial advantage in life. Parents, if financially able, should invest in and ensure their children's socioeconomic future; not to do otherwise, is selfishness and irresponsibility on the part of the parents. Intelligent, thoughtful, and educated parents look out for their future generations.No, I think the primary goal of a parent to raise independent self-reliant contributing citizens for society. Your "golden years" are for you to spend your money as you wish!

Parents who have property & life insurance or some remaining cash/items of value (left over) at the end of their lives may want to structure some form of division among their children.

If an adult child is (relying) on a inheritance to get ahead in life something went wrong when they were handed the baton to adulthood. Parents spend tons of money providing shelter, clothing, food, entertainment activities, first cars, and college tuition over many years.

Those were their "years of sacrifice".

No retired person should be afraid of indulging them self after 22 years of putting someone else "first". If there is money left over so be it. One man's opinion!

Ideally I would contend it is wise to leave their children an inheritance; however, if one could configure it so this inheritance has the effect of instructing their children on "how to fish" (i. e. How to use the inheritance to make money for them) then the ideal inheritance would indeed be entrenched and the lesson would be priceless...No, it should not be a goal.

It should be a goal to take care of yourself and not leave any debt to your children.

I don't want my children to have the responsibility of paying for my care in my elder years, funeral expenses, or any other debts.

A parents legacy is to leave good memories, examples, life lessons, positive role models and practical education for life. There are a lot of more important things to leave rather than material wealth.

My parents were very wise with all of their assets, practical, spiritual and material.They lived rather modestly, even though they traveled extensively with about 14 major world trips.

What they left me by their example and experience are far more important than their money.Wow, such great answers. I asked this question after a recent discussion with my husband. He was one of those that were left an inheritance. Sadly though it was left to him far too young, with no instruction, and no financial smarts taught. The result was the money was gone in no time, and there was nothing to show for it. I will never get an inheritance and have had to learn how to save money and be financially smart on my own.

Personally I would rather do cool things with my children(even as adults) while I am living. Instead of saving them money outside of the basic life insurance policy I would think it to be better to make sure they have everything they need while I'm alive. I understand savings are important, but as a parent we spend so many years raising and spending our money on our children, I think it seems fair to spend our money frivolously on ourselves after we retire.

I want my children to be cared for when I am gone though so it leaves me torn. Thanks again everyone for all the great answers!

Related Discussions

- 11

How should parents deal with lazy, unemployed, still-live-with-Mom-and-Dad adult

by Hypersapien 11 years ago

How should parents deal with lazy, unemployed, still-live-with-Mom-and-Dad adult children?It's one thing if your child loses his job and has to move back home, but how do you deal with one that won't even look for work, thinks you should still provide for all their needs (clean their room, wash...

- 63

There are parents who have DEEP ISSUES. They do not want their

by Grace Marguerite Williams 19 months ago

adult children to grow. They are the type of parents who subconsciously sabotage their children's career chances and advancements. They seem to be deathly afraid to allow their children to establish their own independent lives. They want their adult children to be NEAR...

- 111

What do you do if your teenager refuses to come home?

by Ken McGonigal 2 years ago

What do you do if your teenager refuses to come home?My son is 16 years old. He does not like our rules. Now he is refusing to come home.

- 130

Dads - Trying to develop a relationship with a older estranged child.

by dje71 15 months ago

There are a lot of discussions in forums by dads desperately wanting to be "dad" to their estranged children. My take on it is different; I used to be one of those dads.The mother of my daughter and I separated a year after my daughter was born. The mother did everything she could to...

- 8

Should parents borrow money from their adult children?

by Shelly McRae 13 years ago

Should parents borrow money from their adult children?

- 16

Do you think it is wrong to discipline your child?

by Kevin J Timothy 13 years ago

Do you think it is wrong to discipline your child?Especially when the bible clearly endorses it in Proverbs 13:24