Biden's Spending Has Sunk THe US Economy Yet He Continues To Spend

The Writing Is On The Wall --- America is headed for some real economic problems, with no one at the helm. We have 11.4 million unfilled jobs, with forecasted layoff on the horizon.

A wave of layoffs is sweeping the US. Here are firms that have announced cuts so far, from Carvana to Netflix.

June 1, 2022 https://www.businessinsider.com/layoffs … uts-2022-5

"In the first few months of 2022, a wave of layoffs swept across American business.

The cuts stem from slower business growth, paired with rising labor costs.

The layoffs cut across industries, from mortgage lending to digital-payment processing."

Tech companies lay off workers at the highest rate since 2020 --- Elon Musk Lays off 10% of workers

"Technology companies in May axed employees at the highest rate in two years, as rising interest rates and a stock market selloff squeeze startups and Big Tech firms alike.

Sixty-six tech firms handed out a whopping 16,800 pink slips last month. That’s more than the 13,600 layoffs across 52 companies during the first four months of 2022 combined — and the most employees to get the axe in a single month since May 2020, according to tech jobs tracking site layoffs.fyi. "

https://nypost.com/2022/05/31/tech-layo … ince-2020/

Automobile companies laying have started to cut back, and lay off ---

https://www.autonews.com/topic/layoffs-and-downsizing

https://intellizence.com/insights/layof … s-layoffs/

Americans Keep Spending Even as Inflation Erodes Buying Power

To keep up with rising prices, Americans are saving less, but economists expect expenditures to slow in the months ahead.

https://www.nytimes.com/2022/05/27/busi … april.html

All signs point to big economic problems in the near future.

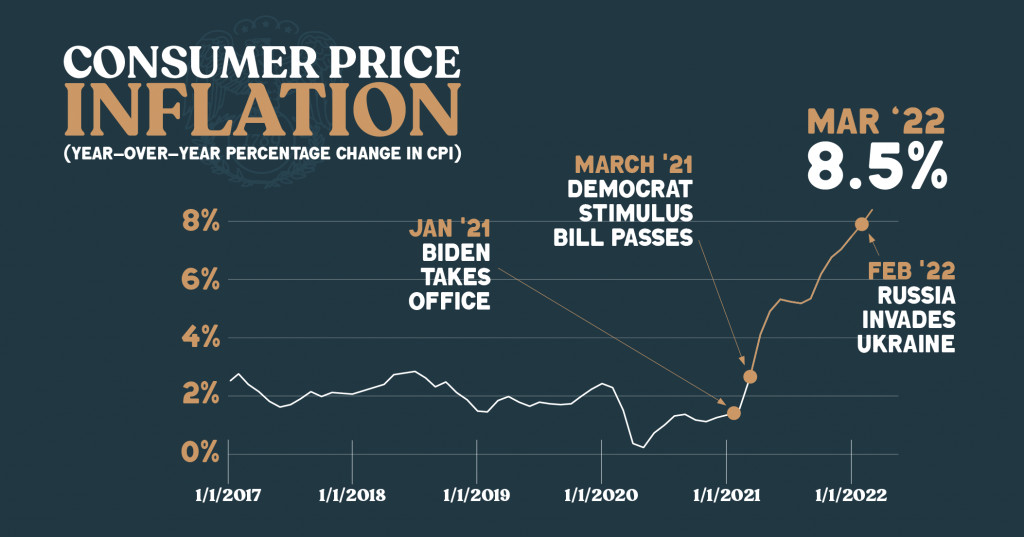

Yet we have a president that does not see the writing on the wall and continues to spend. When he should have seen the problems his huge COVID 1.9 trillion COVID package did to add to inflation...

Biden has now ordered the U.S. Department of Education to cancel about $5.8 billion in outstanding student loans for more than 560,000 borrowers in the largest single loan forgiveness action taken by the government to date.

The cancellation applies to all those who attended schools operated by the now-defunct Corinthian Colleges, one of the largest for-profit education companies that filed for Chapter 11 bankruptcy in 2015.

I don't want my tax dollar to be spent to bail out student loans, especially at this time, when our economy is so fragile. It is very clear to me that we are in a recession that may get worse in the year to come. Is it feasible for this president to add to inflation by dumping more money into a very frail economy?Facts speak louder than wordy media spin.

FACT: The Administration has failed to address inflation for the past year and continues to ignore it.

Before the crisis in Ukraine, the Administration dismissed inflation as “transitory”.

Then, when it became obvious higher prices were here to stay, the Biden Administration attempted to pass the buck onto everyone but themselves – from American businesses and industries like meatpackers.

The Administration also falsely claimed that inflation is part of a global trend – which has been debunked by the San Francisco Federal Reserve Bank.

And reminder: Biden claimed that inflation peaked in December, but it has continued to rise every month afterwards.

(More: Fact Check: It’s Bidenflation, Not Putinflation)

FACT: President Biden’s tax hikes and spending bill would worsen inflation.

Even Mark Zandi, the White House’s preferred economic forecaster, says the Build Back Better bill will worsen inflation:

“None of these ideas so far will help to a meaningful degree, and could do some harm because they could juice up demand at a time supply is constrained by the pandemic and worsen inflation.”

(More: Biden’s Favorite Economic Forecaster: Bidenflation “Only Set to Get Worse”)

CLAIM: “The President’s plan will lower the cost of childcare, elder care, and the cost of prescription drugs.”

FACT: Americans prefer Republicans’ approach that lowers costs over Democrats’ approach of simply centralizing more power.

According to a liberal study, Democrats’ new child care entitlement plan could raise child care costs by $13,000 a year for middle class families making $65,000 or more depending on the state. (More: Top 5 Reasons to Oppose Democrats’ Toddler Tax)

A recent poll found that voters prefer Republicans’ plan to lower costs for medicines delivered in a doctor’s office, cap out of pocket drug spending for seniors, and allow Americans with high deductible plans to pay less for certain services and prescriptions.

Fewer voters support Democrats’ plan to allow the federal government to negotiate drug prices for Medicare.

CLAIM: “The President’s “fix” of the “family glitch” has given more Americans access to health care.”

FACT: Democrats’ partisanship on health care has driven higher prices and families losing coverage and access to their doctors.

Since the Affordable Care Act became law, the average price paid for health insurance (“premiums”) jumped by 143 percent between 2013 and 2019. Over 10 years, spending on health care per person increased by 28.7 percent.

At the same time that premiums more than doubled in the individual market, deductibles for ACA-compliant coverage also increased by an average of 35 percent — over $1,700 for individuals and $3,600 for families.

Democrats will make these price increases even worse with Washington price controls that will kill 342 lifesaving cures and result in less innovation, while letting countries like China take the lead.

(More: Fact Check: Health Care Prices Soared Under Democrats’ Broken Health Care Law)

CLAIM: “Corporations and the wealthiest Americans don’t pay their fair share.”

FACT: Corporate tax revenue is shattering records under Republican tax reform.

Corporate tax revenue is coming in 22 percent higher than last year’s record level, according to the CBO’s most recent monthly budget review.

Corporate tax revenue is set to hit a new record of $454 billion. CBO had predicted in June 2017 that corporate tax revenue would only hit $389 billion in 2022.

As a share of GDP, corporate tax revenue is on track to reach its highest level since 2015 (1.9 percent of GDP).

(More: Fact Check: Higher Corporate Tax Revenue After GOP Tax Reform Debunks Another Democrat Myth)

CLAIM: “Democrats will build energy independence and invest in the strongest ever fuel economy standards.”

FACT: Families are faced with higher gas prices – more than $4 per gallon on average – up nearly 50 percent from last year – because of Democrats’ refusal to support expanding our energy supply and promoting energy independence.

President Biden’s first executive order killed the Keystone XL Pipeline, contributing to the massive spike in energy prices.

By banning new oil and gas leasing on federal land at the behest of Green New Deal enthusiasts, President Biden attacked blue-collar workers and their families by making energy less affordable.

Democrats’ want to give away $550 billion in green welfare subsidies to special interests and the wealthy – literally sending government checks to the Top 1 percent and the biggest corporations.

Wealthy individuals with up to $500,000 in income would enjoy their own green welfare, including a $12,500 check to buy a luxury electric vehicle.

(More: Fact Check: The Real Reason Behind High Energy Costs)

CLAIM: “We’re seeing record job growth and low unemployment.”

FACT: The April Jobs Report revealed that the economy lost 353,000 workers and the labor force shrunk, creating more pressure for higher prices while hammering small businesses whose optimism is plummeting.

A majority of small businesses fear Bidenflation will close down their business.

Our labor force is shrinking, and President Biden is failing to deliver on his jobs promises. (More: EXPERT: Biden “Hasn’t Added One Single Job from 2019 High Watermark”)

According to Ways and Means analysis of the Bureau of Labor Statistics’ data, real wages have decreased by over 3 percent since President Biden took office. (More: Fact Check: American Workers See Largest Decline in Real Wages Since Data Began Being Reported)

Meanwhile, American families’ view of the U.S. economy under President Biden is now the worst it’s been in a decade, according to a new CNN poll.

President Biden’s policies raised recession risks and held back a return to work. (More: Fact Check: Dems’ War on Work Raised Recession Risks & Held Back Returning to Work)

CLAIM: “Inflation is part of a global trend.”

Fact: A new analysis from the San Francisco Federal Reserve finds that U.S. core inflation is higher than other nations – and attributes a part of it to President Biden’s decision to continue unemployment bonuses and government stimulus after the pandemic receded. (More: San Francisco Federal Reserve Analysis Debunks White House Excuses on Inflation)

Despite the end of the pandemic, the Biden Administration continued to send monthly “stimulus” checks and unemployment bonuses, which increased inflation by about 3 percentage points by the fourth quarter of 2021.

Former Obama-Biden economic adviser Larry Summers himself warned that President Biden’s so-called “stimulus” would trigger inflation.

But President Biden and Democrats have ignored inflation, denied it, dismissed it as “transitory,” and are even trying to pass the blame for rising costs onto American businesses and industries like meatpackers and energy suppliers. (More: Fact Check: Biden Budget Director is Wrong — American Inflation Isn’t Just Part of a Global Trend)Here's the link where Sharlee got her information, for those that want to see its origins:

https://gop-waysandmeans.house.gov/fact … on-denial/There is little that any individual government can do about global trends. Trump couldn't do it, and Biden can't do t. Unfortunately, the United States is no longer in charge of its own destiny.

Better get used to it.So goes the US so goes the world. Get ready for an even bumpier ride. Biden continues to spend and will pour another bucket of free cash into our economy. It will surely send us and most of the world into a deeper recession.

And yet he does not learn his lesson... One bad decision after another. With failing polls, Biden is desperately trying to gain favor. We see one political ploy after another, one proposed bandaid after another. Instead of solving the problem, he makes them worse by trying to buy votes. In my view, this man is a pure politician, a politician with little ability to do the job of president.

Biden floats gas tax holiday, but analysis shows it could worsen inflation --- White House considering pausing 18.4-cents per gallon tax on gasoline

Under mounting pressure to ease rising consumer prices, President Biden is exploring a temporary suspension of the federal gas tax – but the move may only exacerbate record-high inflation.

"I hope I have a decision based on the data I’m looking for by the end of the week," the president told reporters in Delaware on Monday.

The gas tax holiday – which would require action by Congress – would temporarily eliminate the federal gas tax of 18.4 cents per gallon. It is intended to help consumers cope with higher prices at the pump amid a record surge in the cost of fuel.

A gallon of gas, on average, cost $4.96 nationwide on Tuesday, according to AAA. While that's down just slightly from the previous high of $5.01, it's a stunning 61% jump from just one year ago, when the average price was just $3.07 per gallon. Gas prices are expected to climb higher as the country enters peak travel season and as the Russian war in Ukraine threatens to further rattle the market.

But the Committee for a Responsible Federal Budget, a non-partisan group that advocates for reducing the federal budget, previously argued that suspending the tax for a 10-month period could actually increase demand for gasoline and other goods and services when the economy is already confronting high consumer demand and pandemic-induced supply chain disruptions.

While the gas tax holiday may reduce prices at the pump, it will further increase demand for gasoline and other goods and services at a time when the economy has little capacity to absorb it," the blog post said. "The result could be even higher rates of inflation in 2023."

Suspending the gas tax for 10 months would also reduce revenue by about $20 billion, according to the CRFB.

Money from the tax is used to pay for the Highway Trust Fund, which covers expenses like highway construction and public transit. More than $42 billion is expected to flow into the Highway Trust Fund this year – more than three-fifths of which stems from the gas tax, according to the CRFB. A tax holiday would "significantly decrease" that revenue.

For months, the prices of all kinds of energy – gasoline, diesel fuel, natural gas, oil and more – have been a major driver behind inflation, which surged 7% in December, the highest level since 1982. Energy costs have climbed more than 29% over the past year, in part due to lopsided supply and demand. Consumers are traveling more, but the supply side has not kept up with the demand.

The rising prices are eating away at the strong wage gains Americans saw last year and are hitting the lowest-income households the hardest. An analysis from the University of Pennsylvania's Penn Wharton Budget Model shows that higher energy prices cost the average American an additional $1,200 last year. The lowest-income households spent about 11% of total expenditures on energy in 2021, up from 8% in 2020.

Related Discussions

- 28

Biden’s Band-Aid Is Falling Off—And Now Trump Takes the Heat?

by Sharlee 4 months ago

Blaming Trump for a Bidden Band-Aid Falling Off Misses the PointIn recent weeks, headlines have warned that Obamacare premiums are set to spike in 2026, and predictably, fingers are being pointed at Donald Trump. But let’s take a step back and look at the full timeline of events before buying into...

- 34

Don't Give Trump Credit for the Success of the Biden Economy

by Willowarbor 11 months ago

Trump will inherit "the strongest economy in modern history," "an economy primed for growth," "booming markets and solid growth," an economy that is "pretty damn good," and investments "flowing" to "rural and manufacturing communities."In...

- 8177

What are the Great Things President Joe Biden Has Done While President

by Scott Belford 10 months ago

This is, of course, an open question since he has just started his four years, but since the RINO Party is already saying defeating Covid and growing the economy is a disaster, I thought I would start a thread that proves them wrong.I just listed two things he has done:- Got America well on its way...

- 20

Bidenomics

by Sharlee 4 months ago

Biden called out for 'factual error' once again -- this time in 'Bidenomics' tweet, after boasting about wage levels.President Biden was previously fact-checked when he claimed to slash the deficit by $1.7T WAPO fact-checked and found to be MISLEADING and earned Biden bottomless...

- 41

Biden Proposed Tax Hikes for 2025

by Ken Burgess 4 months ago

Details and Analysis of President Biden’s Fiscal Year 2025 Budget Proposalhttps://taxfoundation.org/research/all/ … proposals/The Biden Tax Hike Will Likely Exceed $7 Trillion https://gop-waysandmeans.house.gov/the- … -trillion/Biden Tax Resource...

- 68

Tonight, June 27th is the debate Trump vs. Biden. A blockbuster?

by tsmog 17 months ago

Tonight Trump and Biden go head to head offering observers perspective of this and that. A lot 'may' be learned. The rules have changed, but purpose hasn't. Are you going to watch? Any particular topic of prime importance? Where Biden and Trump stand on key 2024 issues heading into the 1st debate...