Trump, the Art of the Deal, Negotiations 101 & Tariffs

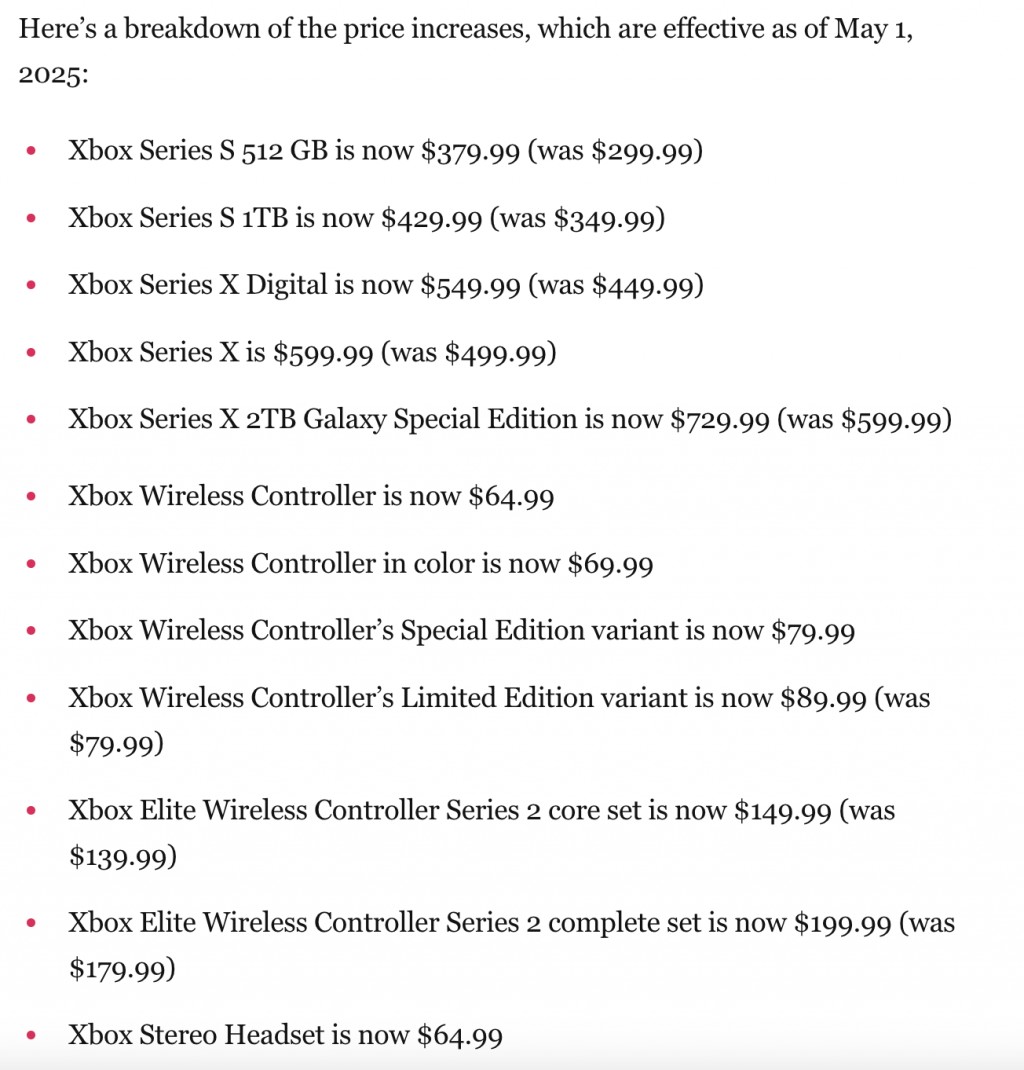

Microsoft just raised X box prices in the United States because of Trump tariffs. ...

Not insignificant hikes...

https://www.polygon.com/news/581992/xbo … ncrease-usIf tariffs are so great, why are so many companies begging for exemptions from them?

If tariffs are so great, why did Trump beg Amazon not to show the impact of the tariffs to consumers?

I don’t understand.... How do tariffs simultaneously bring in so much money to replace the income tax AND bring jobs here (which reduce imports and tariffs)

That's some kind of magic isn't itThis is actually how tariffs work...

https://x.com/RBReich/status/1916935447898689785Apple Inc. Chief Executive Officer Tim Cook said that planned US tariffs on foreign imports will add $900 million in costs in the current period. “We estimate the impact to add $900 million to our costs,” he told analysts on a conference call after releasing quarterly financial results.

Something we should be cheering??Yikes, it would be great to hear the rest of Tim's thoughts ---

"The Company posted quarterly revenue of $95.4 billion, up 5 percent year over year, and quarterly diluted earnings per share of $1.65, up 8 percent year over year. “Today Apple is reporting strong quarterly results, including double-digit growth in Services,” said Tim Cook, Apple's CEO.3 hours ago" https://www.apple.com/newsroom/2025/05/ … e's%20CEO.

Yes, during Apple's second-quarter earnings call on May 1, 2025, CEO Tim Cook stated that the company estimates U.S. tariffs on foreign imports will add approximately $900 million to its costs for the current quarter. He emphasized that this estimate is based on the assumption that existing global tariff rates and policies remain unchanged and that no new tariffs are introduced during the quarter. Cook also cautioned that this figure should not be used to predict future quarters, as there are unique factors benefiting the June quarter.

To mitigate the impact of these tariffs, Apple has been diversifying its supply chain. Most iPhones sold in the U.S. this quarter are being produced in India, while products like iPads, Macs, Apple Watches, and AirPods are primarily manufactured in Vietnam. Despite these shifts, China remains the main source for Apple's international product sales.

DESPITE the anticipated tariff-related costs, Apple reported STRONG financial RESULTS FOR THIS QUARTER, with revenue reaching $95.4 billion—a 5% year-over-year INCREASE—and net income of $24.78 billion. However, the company's stock experienced a decline in after-hours trading, likely due to concerns over the potential impact of tariffs on future earnings.

Plays a bit differently when all the facts are offered up. Im mean context matters.Fantastic for Apple, they are remaining profitable, wonderful for them. That really wasn't the point. Should we celebrate because Apple has shifted their supply chain to avoid tariffs? Doesn't that undercut Trump's scheme of collecting revenue to reduce the debt? Or does it impact his goal of reshoring the jobs lol?? Can't keep up with what the actual goal of this tariff nonsense is...

it’s reason to celebrate that they have moved their iPhone assembly line out of China due to trade war tariffs and instead of moving it to the United States, they are moving it to India to avoid the tariffs?. MAGA were conned again.... Apple is exempt from the tariffs and they're not reassuring those jobs LOL... Yeah a win-win for them

Yikes, it would be great to hear the rest of Tim's thoughts ---

"The Company posted quarterly revenue of $95.4 billion, up 5 percent year over year, and quarterly diluted earnings per share of $1.65, up 8 percent year over year. “Today Apple is reporting strong quarterly results, including double-digit growth in Services,” said Tim Cook, Apple's CEO.3 hours ago" https://www.apple.com/newsroom/2025/05/ … e's%20CEO.

Yes, during Apple's second-quarter earnings call on May 1, 2025, CEO Tim Cook stated that the company estimates U.S. tariffs on foreign imports will add approximately $900 million to its costs for the current quarter. He emphasized that this estimate is based on the assumption that existing global tariff rates and policies remain unchanged and that no new tariffs are introduced during the quarter. Cook also cautioned that this figure should not be used to predict future quarters, as there are unique factors benefiting the June quarter.

To mitigate the impact of these tariffs, Apple has been diversifying its supply chain. Most iPhones sold in the U.S. this quarter are being produced in India, while products like iPads, Macs, Apple Watches, and AirPods are primarily manufactured in Vietnam. Despite these shifts, China remains the main source for Apple's international product sales.

DESPITE the anticipated tariff-related costs, Apple reported STRONG financial RESULTS FOR THIS QUARTER, with revenue reaching $95.4 billion—a 5% year-over-year INCREASE—and net income of $24.78 billion. However, the company's stock experienced a decline in after-hours trading, likely due to concerns over the potential impact of tariffs on future earnings.

Trump is effectively engaged in an economic standoff with several major nations, but none pose as significant a challenge as China. Apple’s decision to shift more of its operations to India and Vietnam is a major development—one that’s bound to get China’s full attention. Tim Cook has turned up the pressure, and it’s a move that gives Trump considerable leverage in trade negotiations. If other companies follow Apple’s lead and pull out of China, we could see a deal materialize sooner rather than later. In many ways, this shift couldn’t come at a better time. Trump’s strategy is clear: hit China hard and fast—forcing them to the table before they lose the massive stream of U.S. business they’ve relied on for years.So we are supposed to applaud the fact that Apple has evaded the purpose of the tariffs? Actually.... What IS the purpose of the tariffs??

I am certainly applauding Cook's move, and here is why. Let me go into great detail to prevent my context from being skewed.

As Apple moves more of its manufacturing operations to Vietnam and India and begins reshoring some production to the United States, the decision may serve as a strong validation of former President Donald Trump’s aggressive tariff strategy against China. While Tim has openly opposed tariffs, arguing they increase costs, disrupt supply chains, and hurt American consumers, the company’s evolving global strategy closely aligns with what the Trump administration aimed to achieve through economic pressure.

At the heart of Trump’s trade war was a goal to reduce American corporate dependency on China. By imposing tariffs on hundreds of billions of dollars in Chinese imports, the administration sought to make it more costly for U.S. companies to rely on Chinese manufacturing. Apple’s decision to shift significant production to India and Vietnam is exactly the kind of realignment Trump’s policies were designed to provoke. Every iPhone built outside of China weakens Beijing’s economic leverage over American tech companies.

Even more notably, Apple is also moving some of its manufacturing back into the United States. In partnership with TSMC (Taiwan Semiconductor Manufacturing Company), Apple is investing in chip production facilities in Arizona, bringing high-tech manufacturing jobs to American soil. Apple also continues to rely on U.S.-based suppliers for components like glass and processors, demonstrating a partial reshoring strategy that matches Trump's call to “bring jobs home.”

These moves validate Trump’s broader pressure tactics. Apple, once heavily dependent on China, is proving that it is possible to diversify the supply chain. At the same time, strengthening ties with nations like India and Vietnam supports broader U.S. geopolitical goals in Asia.

Interestingly, despite their differing public stances, Donald Trump and Tim Cook appeared to have developed a good working relationship during Trump’s presidency. Cook was one of the few tech executives who maintained open and productive lines of communication with the White House. Trump often praised Cook for being a “great executive” and credited him with explaining complex tech manufacturing issues in clear terms. That relationship likely helped ease some policy tensions while also fostering practical outcomes, like Apple’s shift in supply chain strategy. (Tim attended Trump's inauguration front and center---)

Though Tim Cook may still prefer a world without tariffs, his actions increasingly align with the strategic goals Donald Trump set in motion. Apple’s evolving production model isn’t just a corporate pivot, it’s a case study in how sustained political pressure can reshape global business decisions in line with national economic interests. In my view, more business CEOs will follow Tim's bold move.

In my view, it won't be long before we see serious negotiations begin with China. Trump's war is about to see casualties.Well the goal of tariffs was to bring manufacturing back to America? Cook is evading that. If bringing jobs to America is the goal, why is he exempting so many corporations from the impacts?

Or are tariffs a negotiating tool? But if they're only a tool then that means they are temporary... Or actually is the goal of tariffs to create revenue (off of American consumers) to pay down the debt? Increase government revenue? That would mean tariffs would be permanent and the revenue would be reliant on imports to continue coming in... I have totally lost the messaging on what these tariffs are supposed to be doing??"Apple CEO Tim Cook appeared virtually at a gathering of business executives this week to celebrate President Trump’s first 100 days in office. “I wanna take a moment to recognize President Trump’s focus on domestic semiconductor manufacturing, and we will continue to work with the administration as we invest in these areas,” Cook said during his pre-recorded comments.

In his commentary, Cook touted Apple’s announcement of a $500 billion investment in the United States over the next four years and the company’s long history of working with domestic suppliers.

The White House shared a video of Cook’s comments on YouTube. Here’s the transcript:

“Hi, everyone. I’m sorry I couldn’t be with you today, but I’m glad to have the chance to speak. I’ve always said that Apple could only have been created in the United States. We are a uniquely American company and we care deeply about our impact on this country. That’s why we recently announced plans to spend five hundred billion dollars here over the next four years. We’re expanding our teams and our facilities in several states, including Michigan, Texas, California, Arizona, Nevada, Iowa, Oregon, North Carolina, and Washington. We’re also establishing a new factory for advanced AI servers in Texas, and we’ll be doubling our US advanced manufacturing fund to help companies expand in America.

We are proud to create millions of jobs here and to make significant investments to catalyze a new era of advanced manufacturing, and we’re proud to support businesses all across the country that help us deliver for our users. All told, we have more than nine thousand suppliers in the US across all fifty states.

We work with American companies to source everything from the components we used for Face ID to the glass used an iPhone. And we expect to source more than nineteen billion chips this year in America from companies across a dozen states. That includes tens of millions of advanced chips being made right now by TSMC in Arizona, where we are the first and largest customer.

I wanna take a moment to recognize President Trump’s focus on domestic semiconductor manufacturing, and we will continue to work with the administration as we invest in these areas. Needless to say, we are excited for the future of American innovation and the incredible opportunities it will create and we are honored to do our part.”

Cook has cozied up to Trump several times since he won reelection in November. In December, the Apple CEO met with Trump at his Mar-a-Lago resort in Florida. He also donated $1 million to Trump’s inauguration fund and subsequently attended the inauguration in January. Additionally, Cook has closely communicated with the Trump administration regarding the ongoing tariff saga and how it could impact Apple.

During Apple’s fiscal Q2 earnings call on Thursday, Cook repeatedly touted Apple’s investment in the United States economy. “Obviously, we’re very engaged on the tariff discussions,” Cook also said to analysts. “We believe in engagement and will continue to engage.”

If you have a debate on Tim's words, take it to Tim---

"In my view, it won't be long before we see serious negotiations begin with China. "

So is the goal of the tariffs a negotiating tactic?

Or

Are they intended to be a long-term source of revenue for the government?

Or

are they intended to drive jobs back to America?

The administration wants the public to believe three different things, all of which are in conflict.

Trump’s rationales for his tariffs are incoherent and contradict each other..

Bring back manufacturing? Raise revenue? Negotiate with every country in the world? Trump can’t have his cake and eat it too....

Which one is it Trump whispers?Interesting info/opinion on the tariff war and its impact on China:

China Is Losing the Tariff War

https://www.youtube.com/watch?v=ENfc_2mAM0E

I tend to agree, China is the exporter nation, it will feel the sting of this much quicker than America and with much more significant impact to its economy.

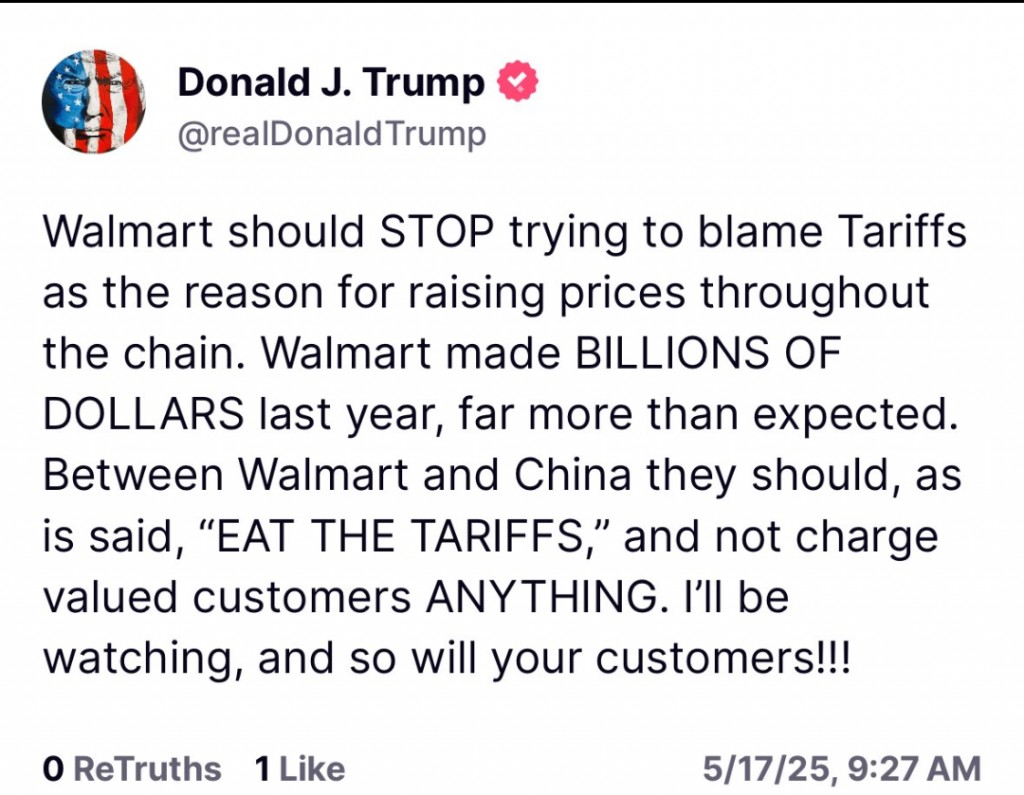

It is a battle that needed to be fought... the propaganda (shows you how much influence China has today in our media outlets) is making it out to be far worse than it is.What sting? China is a dictatorship without democratic elections... The people of China will suffer as much as Xi wants them to and they will do it quietly. In this country? We cry over the shortage of toilet paper...Walmart and Target reportedly told Trump in a meeting last week that shoppers are likely to see empty shelves and higher prices from next month. They also warned that supply shocks could carry on until Christmas.... The very second that Americans go into a store and cannot find what they want is the second that all hell will break loose in this country. You have to be kidding me.

Anyone who supported this tariff nonsense will be held accountable at The ballot box. Trump has us at the mercy of China. LOL 90 trade deals in 90 days, isn't that what he said? Where are the deals? Seems to be that the rest of the world is talking and solidifying relationships while we are sitting here isolated.

What an idiotic statement for him to make, history shows us that trade deals take on average 18 months...

The coming days are bringing higher prices, empty shelves and disrupted supply chains, this time not because of a pandemic or a war, but self-inflicted by trump.

You folks do realize that the last boats without crippling tariffs from China are arriving....Ken, honestly, this is all the Democrats have left: a broken media that nobody trusts, and fewer people even listen to anymore. Have you seen the ratings lately? Total joke — LOL. All they do is spread fear and negativity. And let's be real, it's easy to stir up a crowd when fear and outrage are their main fuel. It’s getting pretty sad, honestly, downright cringeworthy.

Meanwhile, Trump is delivering, especially on trade negotiations. Hopefully, in the next week or so, we will see some done deals. He’s doing exactly what he promised, and I see things coming up roses. And you can bet that’s going to send the Democrats into a full-blown meltdown, flailing in every direction with their tired Trump-bashing. Their playbook’s empty. The left's crazy train is running out of track — and fast.

This will be fun to watch, after all the crazy we have had to endure--- time to get some popcorn and sit back and enjoy.

China has way more to lose — they’ll cave. Meanwhile, Vietnam and India are celebrating. Trump knew exactly what he was doing; those countries are more than ready to pick up the slack, leaving China as the odd man out. Both nations are already in trade talks, and odds are they’ll agree to low-friction deals, in my view.. As we rebuild our manufacturing base, we won’t see the kind of shortages people fear. Plus, big business is going to love the lower tariffs from doing business with India and Vietnam instead of relying so heavily on China.

Trump is driving a push hard for stronger, more diversified supply chains as we work to rebuild. And for once, both political parties seem to agree on the importance of bringing some manufacturing back home or shifting it to trusted allies. I think we’ll see some smart, strategic deals made with India and Vietnam, and eventually, even a fair and balanced agreement with China. It’s an exciting time to be watching all this unfold, truly history in the making."Meanwhile, Trump is delivering, especially on trade negotiations."

What trade deals has Trump completed? He hasn't delivered on anything. Literally no one is talking to him.

"Plus, big business is going to love the lower tariffs from doing business with India and Vietnam instead of relying so heavily on China.

What? I thought the goal was to bring these jobs here?? Or was the goal to make our country rich off of collecting tariffs (an increase tax to consumer)... I don't know... what is the actual the goal? It would seem that you believe the goal of these tariffs is to negotiate better trade deals? But Trump hasn't really stated that as his goal...

He has actually stated three separate goals, none of which can occur simultaneously. At this point, I don't even think magas understand what the real point of these tariffs are.

Looks like the US Economy is doing just fine.

"Stock market today: S&P 500 wipes out Trump tariff losses, marks longest winning streak in 20 years as trade war cools"

US stocks jumped on Friday, with the S&P 500 notching its longest winning streak since November 2004 as a solid jobs report and possible thawing in US-China trade tensions boosted spirits on Wall Street.

The S&P 500 (^GSPC) added nearly 1.5% to climb above its closing level on April 2, when President Trump announced a sweeping tariff plan on what he called "Liberation Day." The Dow Jones Industrial Average (^DJI) moved up 1.4%, or over 500 points, notching a ninth winning day in a row. Meanwhile, the tech-heavy Nasdaq Composite (^IXIC) climbed roughly 1.5%."

https://finance.yahoo.com/news/live/sto … 25773.html

"Trump's April tariff revenue topped $17 billion. That dwarfs any haul from his first term.

President Trump's tariffs became very real for importers last month as the government collected more than $17.4 billion in "Customs and Certain Excise Taxes" during April.

That was nearly double March's haul of $9.6 billion, dwarfing the smaller spikes in revenue seen during Trump's first term."

https://finance.yahoo.com/news/trumps-a … 56118.html

"Strong Jobs Report Alleviates Economic Concerns"

The latest report from the Bureau of Labor Statistics showed that the economy added more jobs than expected in April. The strong pace of hiring suggests that the labor market remains resilient despite uncertainties related to tariffs and trade policies.

The strong jobs report, which helped alleviate concerns about the potential for a sustained economic downturn driven by trade tensions, helped boost the outlook for U.S. travel demand. Shares of numerous companies in the travel industry moved higher. United Airlines Holdings (UAL) shares lifted 7.1%, while Delta Air Lines (DAL) shares advanced 6.6%. Shares of cruise operator Norwegian Cruise Line Holdings (NCLH) were up 6.8%."

https://finance.yahoo.com/news/p-500-ga … 40993.htmlBut trump just said the other day that this economy is Biden's .... How does he claim credit for a strong jobs report when he just blamed the GDP on Biden, the two are linked... Can't have it both ways.

“This is Biden’s economy, because we took over on Jan. 20, and I think you have to get us a little bit of time to get moving,” Trump said during remarks at the White House on Wednesday afternoon.Mike--- Absolutely agree, it's great to see some solid signs of stability and growth in the U.S. economy right now. The streak in the S&P 500 is especially encouraging, and the combination of a strong jobs report and easing trade tensions gives some real reasons for optimism. Hey, you know I’m an optimist, and I have faith we’re on the right path. I'm also pleased to see strength in sectors like travel and transportation, Delta, United, and even cruise lines bouncing back shows consumer confidence and pent-up demand. It’s a sign people are ready to spend, move, and live again.

It’s also worth mentioning that small business sentiment is beginning to tick upward. According to the NFIB Small Business Optimism Index, sentiment has been gradually improving since 2023, after hitting multi-year lows in the prior years. Many small business owners have reported a more hopeful outlook on earnings, sales, and hiring, even as concerns about inflation and regulatory pressures still persist. At the same time, key manufacturing indicators, like the ISM Manufacturing PMI, are showing early signs of life. After a prolonged period of contraction in 2023, recent data (as of early 2025) suggests that certain sectors, especially automotive and aerospace, are rebounding, thanks to easing supply chain issues and renewed demand.

Another bright spot is that inflation is cooling without triggering a spike in unemployment-- a difficult balance to strike, especially when you consider how volatile things were in 2022. If the Fed can stay measured and global tensions don’t throw us off course, we might just be on track for that elusive soft landing. All in all, things are looking pretty good, and I’m hopeful we can keep this momentum going.How are tariffs a sign of stability and growth? You realize the consumer is paying that tax? Anything that Trump brought in in tariff revenue is simply because we paid more for those items... And that's a good thing?

A little piece of Mike's article he failed to quote...

"We're going to make a lot of money [from tariffs] and that money's going to be used to reduce taxes," Trump said on April 23. "We're going to get big, big tax breaks."

I thought tariffs were about bringing jobs back? So the scheme is that we will all just pay more for absolutely everything? That's the plan?

And the small business optimism index?

"The NFIB Small Business Optimism Index is currently at 97.4 in March 2025, falling below the 51-year average of 98, indicating a decline in small business sentiment about the economy."

ABA Banking Journal Staff. (2025). NFIB: Small Business Optimism Index fell to 97.4 in March. https://bankingjournal.aba.com/2025/04/ … -in-march/Shar,

The left only has fear mongering left to try and influence voters.

I really had a good laugh when they were saying the stock market crashed and people were losing their 401ks.

Talk about ignorance of the market to extremes. Anybody with any knowledge of the market knew this was said by those who know nothing about the market.

I agree, things are looking good.

I believe the fear mongering of the left will only increase as they have no solutions for anything and can only complain.I really had a good laugh when they were saying the stock market crashed and people were losing their 401ks.

You must not have a 401k or other stock portfolio.... A couple of days market gains do not even begin to wipe away the devastation brought on by trump... The losses are huge and they are very real. Maga owns this.

Trump: “This is Biden’s stock market”

Market rallies for two days: “This is Trump’s stock market”

The kind of logic that only exists in trump world"A couple of days market gains do not even begin to wipe away the devastation brought on by trump... The losses are huge and they are very real."

You REALLY and SERIOUSLY need to take some time and study the stock market. Should you do that you would find ALL of the losses at the beginning of the tariffs have been regained.

I am DEEPLY involved with the stock market. On a daily basis.

So...I know that the left has no idea what they are talking about when it comes to the stock market.

The attempt to portray the utter nonsense about the stock market as something to worry about is more than a bit ridiculous. It's laughable.

Try is with someone who doesn't know anything about the stock market.

You'll have better luck.

November: “The market’s surging because I won. Day one—cheap prices, best economy ever.”

February: “Jobs report is great, market’s booming—my agenda is already working!”

March: “The market’s fantastic. Look what I’ve done!”

Early April: Announces tariffs—market tanks. “The stock market doesn’t matter. Not a real indicator.”

MAGA: “Only rich boomers care about the market anyway.”

Trump pauses tariffs: Market rallies. “Boom! My stock market. You’re welcome.”

Late April – May: Trade war escalates, market plunges again, first time of negative GDP growth since 2022. “This is Biden’s stock market.”

Two-day rebound: “It’s mine again. Look how amazing I am.”

You can’t even call it spin anymore...it’s just whiplash gaslighting.The impact of this tariff nonsense is about to hit...

https://x.com/SpencerHakimian/status/19 … 3807532439What an Everest size mountain of bullshit this is.

Apple shifts their iPhone production to India and that is a win for America?

Who did not get the business? America.

Who will still pay more for the iPhone?

Americans.

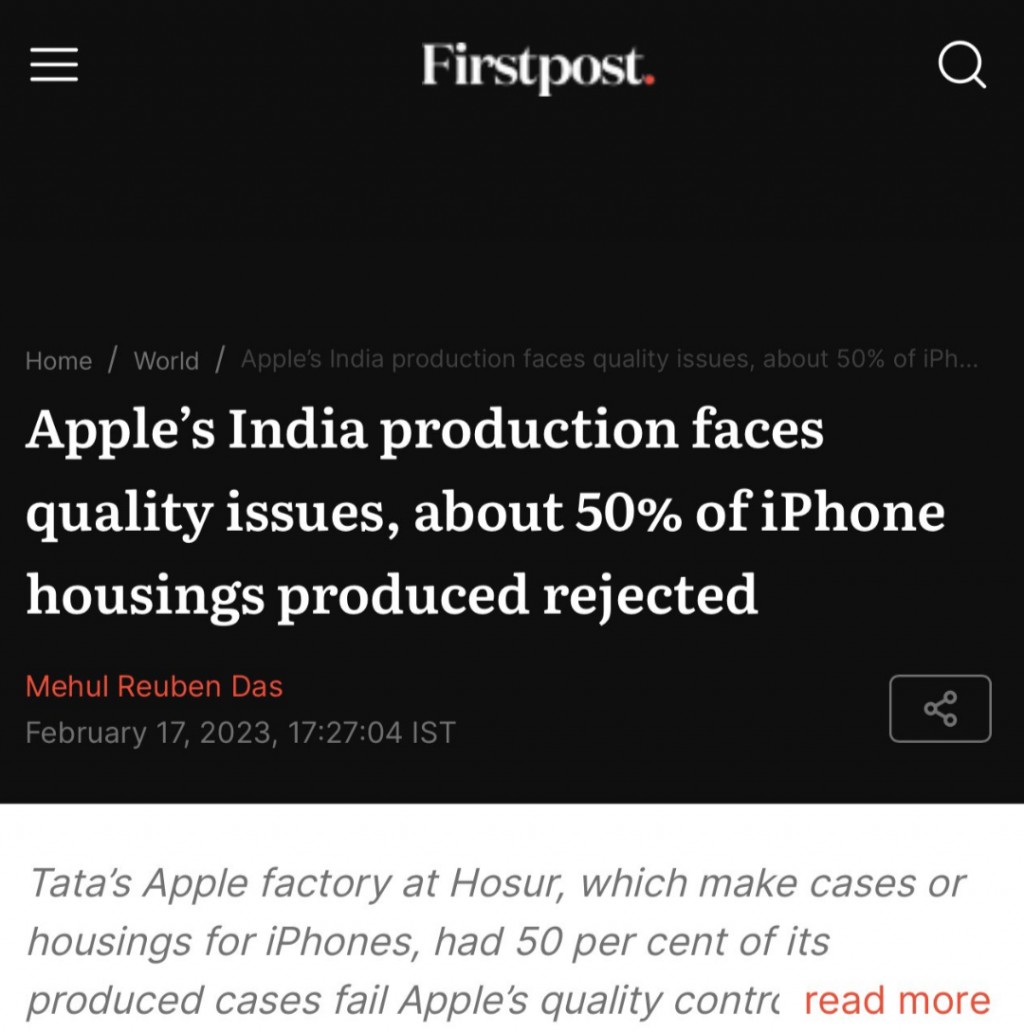

Apple tried it with lesser models. The flaws made them abandon the idea & bring back production to China.

This time around, Apple is forced to move production of all US bound iPhones to India.

What has changed in a few years (2 years at most) that will make India suitable NOW?

Apple is demonstrating a commitment not only to maintaining the company’s solvency and delivering value to investors but also to strategically bringing more manufacturing back to the U.S. in a sustainable way. By shifting business from China to other countries with lower tariffs, while simultaneously increasing domestic production, Apple is working to balance global and local needs. This process will take time, but under Tim Cook’s leadership, the company is positioning itself well as it navigates the disruptions caused by Trump’s efforts to bring China into fairer trade practices. It's clear Tim Cook is on board with an "America First" approach, in my view. And you should offer a link to your post; it needs to be open for others to determine its content and context.

Apple is not bringing any manufacturing to America.

I thought that was the goal of tariffs? Or is it revenue? Or is it a negotiation tactic? I don't know what is the goal?

https://ig.ft.com/us-iphone/I posted a link to Tim Cook's speech to investures where he laid out his plans. I have nothing more to say on this subject-- I just have no intention of ruminating on this subject any longer.

Just to set the record straight and add clarification to Tim Cook's intentions:

Apple is making significant shifts in its manufacturing strategy, particularly by moving much of its iPhone production to **India**. This transition is largely driven by **tariff concerns** and **geopolitical tensions** between the U.S. and China. By 2026, Apple plans for **most iPhones sold in the U.S.** to be manufactured in India, reducing reliance on Chinese production.

Additionally, Apple is increasing its **U.S. chip sourcing**, with plans to obtain **19 billion chips** from domestic suppliers in 2025. This aligns with Apple's broader strategy to diversify its supply chain while maintaining high-tech manufacturing capabilities.

Sources:

https://www.msn.com/en-us/news/technolo … r-AA1DCfD3

https://www.devdiscourse.com/article/te … t-to-india

https://finance.yahoo.com/news/apple-so … 35800.htmlI've shared everything you've posted throughout this thread, though much of it has become buried in the back-and-forth. Still, thank you for your contribution. If you come across anything new, send me a heads-up. Hard to keep up.

Here's a great link you might want to check out.

I think Tim Cook is making a smart move by shifting business to India and Vietnam. Hopefully, more companies will follow suit. This could pressure China into negotiating fairer tariffs. Let’s be honest, China is Trump’s real target. He's likely to strike more reasonable, reciprocal tariff deals with countries like India and Vietnam. That would help companies like Apple avoid the full brunt of manufacturing changes while U.S. production ramps up. Of course, none of this can happen overnight, but Trump could definitely work toward securing fair trade terms with nations like Japan, India, and Vietnam in the meantime. Hopefully, we will hear some news on some finished deals soon. Otherwise, we may start seeing prices rise.

Apple CEO Tim Cook appeared virtually at a gathering of business executives this week to celebrate President Trump’s first 100 days in office. https://9to5mac.com/2025/05/02/tim-cook … tment-lol/

“I wanna take a moment to recognize President Trump’s focus on domestic semiconductor manufacturing, and we will continue to work with the administration as we invest in these areas.”

"Hi, everyone. I’m sorry I couldn’t be with you today, but I’m glad to have the chance to speak. I’ve always said that Apple could only have been created in the United States. We are a uniquely American company and we care deeply about our impact on this country. That’s why we recently announced plans to spend five hundred billion dollars here over the next four years. We’re expanding our teams and our facilities in several states, including Michigan, Texas, California, Arizona, Nevada, Iowa, Oregon, North Carolina, and Washington. We’re also establishing a new factory for advanced AI servers in Texas, and we’ll be doubling our US advanced manufacturing fund to help companies expand in America.

We are proud to create millions of jobs here and to make significant investments to catalyze a new era of advanced manufacturing, and we’re proud to support businesses all across the country that help us deliver for our users. All told, we have more than nine thousand suppliers in the US across all fifty states.

We work with American companies to source everything from the components we used for Face ID to the glass used an iPhone. And we expect to source more than nineteen billion chips this year in America from companies across a dozen states. That includes tens of millions of advanced chips being made right now by TSMC in Arizona, where we are the first and largest customer.

I wanna take a moment to recognize President Trump’s focus on domestic semiconductor manufacturing, and we will continue to work with the administration as we invest in these areas. Needless to say, we are excited for the future of American innovation and the incredible opportunities it will create, and we are honored to do our part.” Tim CookTrump...

"We’re going to make a lot of money [from tariffs] and that money's going to be used to reduce taxes,"

You can't make a lot of money on tariffs unless you have a lot of imports...You are diverting from the subject of the conversation. Not interested in changing up the conversation I am having with PeoplePower. I think there is a lot to unpack regarding Apple and Tim Cook's plans.

What I posted is not exactly the same as Tim Cook's address. It says this:

" Additionally, Apple is increasing its **U.S. chip sourcing**, with plans to obtain **19 billion chips** from domestic suppliers in 2025. This aligns with Apple's broader strategy to diversify its supply chain while maintaining high-tech manufacturing capabilities."

That could be construed to mean increasing manufacturing, but the key words here are obtain and maintaining. These domestic suppliers might already have the capability to produce 19 billion chips. It doesn't say increasing manufacturing. We will have to wait and see how this plays out.Yes, I’m well aware, I closely monitor everything related to Apple. I included Tim’s clip to share his direct, up-to-date insights. Of course, such a shift won’t happen overnight, but it’s exciting to see a major company like Apple making strides toward producing more in the U.S. Building that kind of independence is essential for our future. And honestly, Apple's $500 billion investment is huge, yet it seems some people fail to truly understand the magnitude of that commitment. It’s such a positive step forward, yet I still see negative comments on social media about Apple’s dedication, almost as if there’s a hope that, somehow, Apple will betray the U.S. in the process. It’s a strange perspective, in my view. Me--- I am saying yay! for Apple's commitment.

I’m also very pleased with the Ukraine rare mineral deal, for obvious reasons. It’s a major step forward in securing the resources we’ll need to manufacture key technologies here at home, including semiconductors, electric vehicle components, and advanced electronics. This move strengthens our supply chain and reduces reliance on adversarial nations. It’s likely a big reason why Tim Cook seemed so pleased last week: he sees the groundwork being laid for a more resilient, U.S.-based tech manufacturing ecosystem.

I believe that, in the end, Trump will leave behind a stronger America when his time in office comes to a close. This is an exciting chapter, in my view. I tend to focus less on the noise at the edges and more on the positive developments that are unfolding."Apple's $500 billion investment is huge, yet it seems some people fail to truly understand the magnitude of that commitment.

We've understood that commitment from them for decades now...Apple has consistently made significant investments in the U.S. economy over multiple presidential administrations, demonstrating a long-term commitment...good on them."Apple's $500 billion investment is huge, yet it seems some people fail to truly understand the magnitude of that commitment." Willow

Once again, you’ve pulled a single sentence out of context—a habit the media seems to have adopted more and more in recent years—and run with it. You completely skipped over the full picture of what I was saying. Honestly, I’m getting tired of dealing with that approach.

Here’s the full thought I was trying to convey:

“And honestly, Apple’s $500 billion investment is huge, yet it seems some people fail to truly understand the magnitude of that commitment. It’s such a positive step forward, yet I still see negative comments on social media about Apple’s dedication—almost as if there’s a hope that, somehow, Apple will betray the U.S. in the process. It’s a strange perspective, in my view. Me? I’m saying yay! to Apple’s commitment.”

See how the words before and after create a complete, nuanced thought?

You may very well understand the commitment—but let’s be clear: you can’t speak for everyone, especially when it comes to what people are saying on social media. I was simply sharing my personal takeaway based on what I’ve seen online.

You could have just rephrased your statement to read--- I understand that commitment from them for decades now...Apple has consistently made significant investments in the U.S. economy over multiple presidential administrations, demonstrating a long-term commitment...good on them.

It appears you were speaking for a group, a segment of our population. Do you feel you can do that?

Here’s the bottom line: context matters. One sentence rarely tells the full story, especially when it’s pulled from a paragraph.

A balanced reply... which is the truth of the matter... yes there will be more investments, especially regarding chip manufacturing, in American Made.

And yes, business will leave China and find somewhere else to go other than America.

Increased investment in production here in America.

And

Increased movement of business out of China to other places like India.It’s understandable that China would seek to diversify its trade partners, but replacing the United States as a primary export destination is no simple task. In 2023 alone, the U.S. imported $427 billion worth of Chinese goods, over 12% of China’s total exports. Losing access to such a massive, high-spending consumer market would leave a significant economic gap that few countries could fill. China has also long benefited from a highly favorable trade imbalance with the U.S., posting a $279 billion trade surplus in 2023. Deals this one-sided are unlikely to be replicated elsewhere, as other nations tend to demand more balanced terms. Realistically, China most likely realizes it will need to come back to the table, especially with its economy faltering and reports of unrest among its people. President Trump has consistently said he is not looking to punish China, but rather to secure a fair trade deal, something that benefits both nations. Given current pressures, I believe we’ll see movement soon. Ken, in the end, I think trade deals are going to start rolling in, and I truly believe that Trump has already laid the groundwork for major investments that will strengthen American jobs and build a more resilient economy.

China is dealing with its own problems... the world is not great and wonderful for China outside of its bickering with America...

Iran being targeted, its main port being bombed, is causing serious issues for China... 90% of everything Iran exports goes to China... and almost as much is imported to Iran from China.

North Korea's new alliance with Russia, and the inter-dependency between those two nations that is growing, is a problem for China.

China will be hurt more economically because of this trade war... America will just shift where it gets its cheaply produced products from... while re-developing the ability to make all high end (critical) products here in America.

If this battle is not fought now... China will definitely become the de-facto power globally as well as within our own politics and propaganda outlets.

China has wormed its way into politicians long holding power in Congress, most media outlets, corporations, the WTO, the WHO, etc. ... and now it is time to work it out of our system, or else, we become another beholden nation enslaved to its whims because we were to weak as a society to stand up for our own interests.You make several strong points, China has absolutely gained a disturbing amount of influence in global institutions and even within some corners of our political and corporate systems. The long game they’ve been playing is no secret anymore. And you're right: if we don’t start standing up for our interests now, we risk slipping further into dependency. That said, while America can and should shift its supply chains and rebuild critical industries, that process will take time, investment, and a serious cultural shift in how we value domestic production. China will feel pain from the trade war, hopefully, ours is less and short-term. Still, the bigger picture matters; this isn’t just about cheap goods, it’s about long-term sovereignty and keeping foreign influence in check. North Korea is a useful reminder too: they have nothing to offer but military support, which is exactly why they’re backing Russia. China, with its economic power, is the real challenge, but one that needs to be addressed now, not later. Trump is hell bent on chipping away at China.

Regarding Iran, Iran exports large quantities to China, but will Trump apply pressure on Iran to the point where they’re forced to reduce exports due to increased domestic needs?

President Trump reimposed broad sanctions on Iran as part of his renewed "maximum pressure" campaign, not just threatening action but implementing direct measures. In February, his administration targeted Iranian oil networks by sanctioning firms like Sepehr Energy, which was linked to Iran's military leadership. By April, the U.S. also sanctioned individuals and companies in Iran, the UAE, and China for helping procure components for Iran’s drone and missile programs. Then on May 1, Trump announced secondary sanctions against any nation importing Iranian oil or petrochemical products, aimed especially at China, Iran’s biggest oil customer. It is being reported that these moves were designed to pressure Iran into returning to nuclear negotiations and to curb its regional military activities.

https://www.politico.com/news/2025/05/0 … a-00322292

Trump seems to be adding pressure on China wherever he can."Iran being targeted, its main port being bombed, is causing serious issues for China... 90% of everything Iran exports goes to China.."

Various data sources report that approximately 30% of Iran’s total exports are sent to China...

Iran (IRN) Exports, Imports, and Trade Partners - OEC World. (2025). https://oec.world/en/profile/country/irn

Apple has done this once in its history already though? Moved some of its manufacturing to India and after poor quality outcomes, moved back to China. LOL why would this time be any different

Maga's are masters at avoidance of trumps really weird and particularly egregious acts...no one has been able to answer a very simple question... What is the end goal of these tariffs? Jobs or revenue? We've heard both simultaneously.... We all know that these two things cannot exist at once.

Surely there is an obtainable, clear goal, right?yes, the goal is corruption and control.

As Trump can easily make tariff exceptions for some companies under certain conditions....those companies have to pay with his crypto coin that is not traceable.

Not sure why maga followers can't define the goals of these tariffs...

Trump's tariffs purportedly aim to serve multiple goals...protecting domestic industry, raising government revenue, and leveraging trade negotiations...which inherently conflict with each other.Trump...

"We’re going to make a lot of money [from tariffs] and that money's going to be used to reduce taxes,"

You can't make a lot of money on tariffs unless you have a lot of imports...

How does this work? His goals and rhetoric are at odds with each other.Warren Buffett this weekend.. his simplicity says it best...

“We should be looking to trade with the rest of the world, and we should do what we do best and they should do what they do best . Trade should not be a weapon"

He is making a clear reference to the economic principle of "comparative advantage"

Explained Simply:

Each country should specialize in producing goods and services it can make most efficiently,and trade for the rest. This makes everyone better off.

Example:

India is great at producing software and providing services.

Brazil is great at growing coffee.

If India tries to grow coffee, it might be less efficient. If Brazil tries to develop software at scale, it might lag behind.

So:

* India exports software

* Brazil exports coffee.

* Both countries trade and benefit.

Analogy:

Think of two friends:

* Alice is great at cooking.

* Bob is great at fixing things.

If they both try to do everything, they waste time and do a poorer job.

But if Alice cooks and Bob fixes, and they help each other... both eat well and live in a well-maintained house.

Buffett’s Philosophy:

*Global prosperity comes from collaboration.

* Trade should not be used as a weapon or political tool

* Countries trying to "win" trade wars by isolating others end up hurting global growth...It's a great philosophy. All it needs is countries that believe it and follow it. That do not take the stance of "I do better at making nick nacks so you should buy all that from me. But I do not want your products, whatever it is that you do best at, because it takes jobs from my own people.

Pretty rare, for nearly all countries care more about their own citizenry than they do about ours, and are quite happy to sell Americans all kinds of things...but don't want to buy what Americans make for then they can't make it themselves.As I have said... China is not in a position to win this war... they are the EXPORTER to America... where else can they sell 40% of their exports?

I don't think Mexico or Canada is going to pick up that slack.

A situation made worse for China because of the war on Iran... 90% of energy resources exported by Iran goes to China... well, that is being disrupted substantially."they are the EXPORTER to America... where else can they sell 40% of their exports?

This has been fact checked previously.. but here we are again:

In 2024, China exported approximately 14.7% of its total exports to the United States. This figure has been decreasing in recent years, reaching its lowest level in a decade...

https://www.statista.com/statistics/160 … %20decade.

Do you know anything about Buffet? I really must laugh at this point. You pick up a blurb and run with it. His history is long, and he never hides his views on anything, literally.

Warren Buffett has long been a strong proponent of globalization and open trade, a position that aligns closely with the global scale of his investments and the reach of Berkshire Hathaway, the company he leads. Many of Berkshire’s most important holdings, such as Apple and Coca-Cola, generate significant portions of their revenue from international markets. Apple, for instance, earns more than half of its income from outside the United States, while Coca-Cola operates in more than 200 countries. Buffett’s commitment to global trade isn’t just philosophical; it’s woven into the business model of the companies he backs. His investments reflect a firm belief in the concept of comparative advantage, the idea that countries benefit most when they focus on producing what they do best and trade for the rest.

At the same time, Buffett has not always turned a blind eye to the risks of imbalanced trade. He has criticized America’s long-standing trade deficits, warning in a 2003 article that the country was “selling itself out” by relying too heavily on imports. Yet even in that critique, he did not call for punitive tariffs or protectionist policies. Instead, he proposed mechanisms like “import certificates” to bring trade into better balance, ideas designed to encourage fair trade, not isolate the U.S. from global commerce. In this way, Buffett’s views overlap in principle with Donald Trump’s call for “fair trade,” though the two men differ significantly in how they propose achieving it. While Trump emphasizes tariffs and bilateral deals to protect U.S. industries and close trade gaps, Buffett focuses on long-term cooperation and mutual prosperity through open markets.

Buffett’s lifelong embrace of globalization has played a major role in making him one of the richest individuals in the world. He sees global trade not as a threat but as a pathway to peace, stability, and shared economic growth. While critics often bristle at Trump’s aggressive trade rhetoric, it’s worth noting that both he and Buffett ultimately share a desire for fair, mutually beneficial trade; only their methods differ.

Keep in mind, unfair trade made him one of the wealthiest men in the world. As they have done for the majority of the most wealthy.

Globalization has significantly enriched the wealthiest individuals and multinational corporations by expanding their access to resources, markets, and investment opportunities. One of the biggest drivers of wealth creation has been the ability to shift manufacturing and services to countries with cheaper labor and materials, dramatically reducing costs and increasing profit margins. These savings flowed directly to top executives, shareholders, and company founders. At the same time, globalization opened vast new consumer markets, allowing companies like Amazon, Apple, and Tesla to sell products across the world and scale their businesses far beyond what domestic demand could support. Wealthy investors also benefited from globally integrated financial markets, which offered high-return opportunities and diversified portfolios.

Additionally, globalization rewarded ownership of intellectual property and branding, assets typically controlled by the richest individuals and companies. Tech billionaires, for instance, amassed enormous fortunes by licensing software and digital services that could be easily scaled worldwide. The global nature of commerce also made it easier for the wealthy to exploit tax loopholes and offshore havens, minimizing their tax burdens in ways not available to average workers. Tariffs, often negotiated as part of complex trade deals, also played a role in globalization and the accumulation of wealth at the top. In some cases, tariffs protected key domestic industries while allowing powerful multinational firms to dominate international markets by leveraging government influence. In other instances, uneven or poorly enforced tariffs created environments where large corporations could navigate and manipulate trade frameworks better than smaller competitors, entrenching their market dominance and deepening their profits.

As international business became central to national economies, the ultra-wealthy gained disproportionate political influence, often helping shape trade and tax policies that further entrenched their economic power. While globalization has lifted millions out of poverty globally, especially in developing nations, it has also contributed to widening inequality in wealthier countries, where income growth for the middle and working classes has lagged far behind the capital gains enjoyed by the elite.

Globalists often favor the status quo when it comes to tariffs because they benefit from unfair trade practices that line their pockets. I’ve always been upfront about being a capitalist, capitalism rewards those who are productive and can create wealth. But I’ve also come to realize that these unfair tariffs primarily benefit the wealthy, while everyday Americans don't see the same gains. Fair trade, on the other hand, has the potential to benefit a broader group of Americans, ensuring that more people share in the economic prosperity.He is making a case for comparative advantage. Something that has been completely ignored. It's a very valid point. I'm guessing you don't subscribe to the principle of comparative advantage?

Tariffs and Globalization worked hand and hand to drain us of trillions over the years. The Guys that Biden hoped to tax as Trump would say "bigly"--- guys like Buffet, Tim, Jeff, Elon, and so many more that flourished due to unfair trade.

I think a problem has occurred due to some not understanding what Trump has proposed, and shared regarding tariffs. You bring up comparative advantage.

Trump’s trade ideologies relate to the concept of comparative advantage in selective and strategic ways. He often acknowledges that the United States should focus more on industries where it has natural strengths, such as technology, energy, and advanced manufacturing. In doing so, he aligns with the idea that countries benefit from specializing in what they do best.

Trump frequently argues that other nations, particularly China, gain trade advantages through manipulation—such as currency devaluation, low labor standards, and heavy subsidies—which he views as distortions of true comparative advantage. To counter this, he uses tariffs and trade barriers not just to protect American industries but to correct what he sees as an uneven playing field. Additionally, Trump prioritizes national security and economic independence, especially in critical sectors like steel, pharmaceuticals, and semiconductors, even if domestic production in those areas is less efficient. This runs contrary to the principle of comparative advantage, but reflects his broader view that efficiency should not come at the cost of vulnerability. Overall, Trump’s trade philosophy selectively incorporates comparative advantage when it benefits U.S. interests, but rejects it when he believes it undermines fairness, leverage, or national strength.

He also suggests that some industries, such as steel, pharmaceuticals, and semiconductors, are too important to rely on foreign production, regardless of efficiency, because they are tied to national security and economic independence. In this way, Trump doesn’t necessarily reject the theory of comparative advantage, but he challenges whether free trade always allows the U.S. to trade from a position of strength. His trade policies reflect a belief that protecting certain industries and correcting perceived imbalances is sometimes worth more than the efficiency gains that come from global specialization.

I’m always surprised by the reaction to renegotiating tariffs. Politicians and everyday citizens alike have been voicing concerns about unfair trade for decades, and with good reason. I think the response might have been different if a Democrat or a different Republican had taken these steps years ago. It appears Trump will take many kicking and screaming into fair trade. A Tariff war can cause turmoil. This is most likely why no one took it on. Many promised to address it, but never did much to tackle unfair trade."Trump’s trade ideologies relate to the concept of comparative advantage in selective and strategic ways. He often acknowledges that the United States should focus more on industries where it has natural strengths, such as technology, energy, and advanced manufacturing.

But he's offered exemptions?! exempting these sectors selectively from tariffs while imposing tariffs on other sectors creates unbalanced trade conditions that contradict the mutual gains expected from comparative advantage-based trade... This country hasn't been "drained of trillions". We've benefited from lower cost items that can be produced more efficiently elsewhere.

The principle of comparative advantage explains that countries specialize in producing goods where they have lower opportunity costs relative to others, enabling more efficient production through specialization and mutually beneficial trade. Trade deficits and surpluses naturally arise from these differences in specialization and efficiency, not necessarily from unfair trade barriers.

Trump's tariffs do not encompass the principles of comparative advantage at all.

As of yet, Maga has not even been able to identify what Trump's ultimate goal of these tariffs are?

Trump...

"We’re going to make a lot of money [from tariffs] and that money's going to be used to reduce taxes,"

You can't make a lot of money on tariffs unless you have a lot of imports...and Americans paying that tariff tax.

So how does this work? His goals and rhetoric are at odds with each other.

Really seems like the goal is to just make Americans pay more for absolutely everything... I think that's crystal clear in the language lately that we should as a country become accustomed to less things and having to pay more for those items.It has become very evident that you do not understand the concept of tariffs, that the US has long had a serious imbalance, and you clearly don't understand what strategies Trump is using to fight a complicated trade war. I feel I am wasting too much energy on the subject. As I said, this is a very complicated subject. Too complicated for a chat.

Hey Shar, perhaps a different voice, a different approach!?

Not sure where this guy hangs his hat, but he does a good job of laying it all out:

https://www.facebook.com/share/p/16D675 … tid=oFDknkWhat is Trump's goal of his tariff program? Is it to reshore jobs? Is it a negotiation tactic? Or is it to be considered a permanent revenue stream? He has stated all three and all three are contradictory.

Also, trade imbalances are not inherently bad.What do you view as a long term "good" from a large, long term (negative) imbalance?

Not just "good" today, but for years or decades to come?I just want to know what the current goal actually is...oddly, no one seems to be able to answer that question.

I've come to the conclusion that Trump and MAGA live in an alternate reality. His goal is to reduce the national debt, the budget deficit, and remove income taxes.

He thinks by shutting off imports from China and the other countries that are on his rip-off list, he can increase manufacturing here and create jobs and income.

He also thinks by laying off federal workers, it will reduce the payroll and create more income. In addition, he thinks by deporting all immigrant manual labor, it will create more jobs and thus create more income.

Thus he will achieve his goal of reducing the national debt and budget deficit and we will no longer have to pay income taxes ever again.

It's all very simple in his brain. He is reducing expenses and increasing income, but in reality, I don't think he has a clue as to what he is doing. The scary part is he actual believes what he is doing will work.But you can't increase revenue and bring back jobs at the same time? To increase revenue in order to remove income tax would mean that tariffs would have to be permanent. Which would mean relying on a steady stream of imports.

"Ford puts a number on its tariff hit and halts guidance

‘Substantial’ risks lead carmaker to pull outlook for the year amid a $1.5 billion hit from tariffs"

Yikes. It's about to get real. When a legacy automaker like Ford can’t see 12 months ahead, the storm isn’t coming..it’s already here

This whole trade war will go down as the biggest act of political suicide in history...

https://www.marketwatch.com/story/ford- … e-a171d656

So we're at, at least a dozen companies in the S&P100 saying they have no forward guidance due to tariffs.Trump changes his tune on the economy

President Trump is changing his tune on the economy, suggesting that Americans should buy less and will probably pay more and bear the brunt of an uncertain economic landscape as his wide-ranging tariff policy takes effect.

Trump and his economic team have for weeks said the tariffs would result in only short-term pain and that the tumult in the stock market would eventually level out.

But the White House’s messaging has evolved from Trump on the campaign trail promising to lower prices and make America “wealthy” again to Trump suggesting that the U.S. needs a cultural shift on consumer spending while accepting that his tariff plan will raise prices.

Trump was asked Sunday by NBC’s Kristen Welker if he would acknowledge that his tariff plan will result in higher prices.

At first, the president suggested tariffs will “make us rich” — similar to sentiments he’s expressed when it comes to touting his economic policy. But in the next turn, he suggested that American children, for example, do not need as many toys and that Americans do not need to spend as much money on “junk we don’t need.”

“I’m just saying they don’t need to have 30 dolls. They can have three. They don’t need to have 250 pencils. They can have five,” Trump said, acknowledging that the prices of such items could also go up.

That’s in stark contrast with candidate Trump, who spent much of 2024 railing against inflation under former President Biden and promising to lower costs if elected. In an ABC News interview last week, Trump said his economic policy is what voters signed up for.

Trump has in recent weeks acknowledged “a little disturbance” in the economy that emerged when his tariff plan was rolled out. When he was campaigning, Trump spoke frequently of tariffs on China, the European Union, Canada and Mexico, but his policy ultimately imposed tariffs on nearly every country in the world, sending the U.S. and foreign stock and bond markets into chaos.

Douglas Holtz-Eakin, president of the center-right American Action Forum, called Trump’s messaging “pivoting” on an unpopular policy.

“This feels tone-deaf to me. This is, ‘You’re too materialistic. You don’t need as many dollars as you think.’ And he’s a very strange messenger for that message, and I don’t think it’s going to sell,” Holtz-Eakin said.

Marc Short, who was a top aide to former Vice President Mike Pence during Trump’s first administration, warned that Trump risks alienating people if he keeps talking about dolls, calling it a “damaging message” that “suggests a little bit of an elitism perspective.”

High tariffs on China and other key trading partners will have the most impact on Americans who rely on less-expensive goods, not those who can buy 30 toys, argued Daniel Hornung, National Economic Council deputy director in the Biden administration.

“Saying low- and middle-income people should just buy less or buy more expensive stuff misses an important point,” Hornung said. “We have large swaths of the country that don’t make enough money to afford to buy expensive things, and it’s very important to them whether or not something costs 5 percent or 10 percent or 20 percent or 100 percent more.”

Using tariffs as a negotiation tool while Trump is also asking Americans to get used to buying less goods are opposing ideas, argued Kathryn Anne Edwards, a labor economist and policy consultant.

“They’re in complete conflict with each other because if it’s just a negotiating ploy, you don’t try to bring domestic production home at all. You’re just trying to get a better price for your consumers here,” she said. “If it’s actually about domestic production, negotiation’s off the table because I don’t care what you offer me, this is about jobs at home.”

Also contributing to economic anxieties are some projections from Wall Street that see a potential recession on the horizon.

When NBC’s Welker asked Trump whether he was OK with the prospect of a recession, at least in the short term, he replied: “Look, yeah. Everything’s OK. What we are — I said this is a transition period.”

Edwards said that the possibility of the U.S. heading toward a recession could actually prevent companies from opening manufacturing plants in the U.S., going against one of Trump’s own intentions.

“What would prevent a business right now from saying, ‘Hey, if there’s a tariff, I’m going to start manufacturing something at home.’… Well, they can’t do it because if there’s a recession, it’s not an easy time to start a high-scale manufacturing business, especially if orders are down, stores are closing and consumption is down,” she said.

The policies are also losing some support from the public. Almost 6 in 10 U.S. adults said Trump’s policies are making the economy worse..."

So what IS the goal of the tariff terror?

https://thehill.com/homenews/administra … s-economy/Trump’s latest move proves his manufacturing Golden Age is just fools’ gold

Contrary to popular belief, American exporters have enjoyed a manufacturing renaissance. Since 1994, American exports have nearly tripled, even after you adjust for inflation.

Oh but please tell me more about how the world is taking advantage of us? How we're "losing" trillions?

American goods exported exceeded $2 trillion last year. America’s aerospace industry now exports nearly $100 billion a year. The American automotive sector exports more than $160 billion annually, nearly doubling in inflation-adjusted terms since 1994. American soybean farmers supply livestock around the globe with feed. Each of these export-intensive sectors stands to lose jobs due to these tariffs.

First, don’t expect an overall gain in American manufacturing jobs. Certainly, individual companies may benefit. A tariff on steel might save a few jobs at a specific steel mill. But the cost for every American manufacturer using this higher-priced domestic steel will also increase.

Numerous American companies have already begun laying off American workers in response to the tariffs, including at five Stellantis plants. Currently, up to 30% of North American auto production may be temporarily halted due to the tariff uncertainty. These headlines will become routine if the trade war continues.

Second, the limited tariff-created manufacturing jobs will not be better paid jobs. Good-paying jobs are contingent on productivity. Higher tariffs lower labor productivity as less efficient businesses are protected from competition.

Thanks largely to the innovation and efficiencies from free trade, our jobs market has diversified away from a concentration of jobs in a lower-paying, physically demanding industry. The burgeoning sectors have supplied tens of millions of Americans with opportunities in safer professions.

Productivity overall of workers doubled in just the past 40 years. It’s not just investors or managers who benefit as resources yield more output. Workers share in this abundance of affordable, available and diverse goods.

Our so-called "trade deficit" has largely enabled this boom in newer, more productive jobs. The surplus dollars overseas generated by us importing more than we export flow back to the United States often in the form of foreign direct investment (FDI) in businesses here — exploding more than 500% compared to thirty years ago to more than $330 billion last year. If the president succeeds at eliminating this trade deficit, workers employed in these new jobs will suffer as foreign direct dries up.

Economic distortion caused by tariffs will shift jobs and resources to industries in which we lack a comparative economic advantage. As government policies deploy resources to less efficient businesses, more individuals will be forced to take these less desirable jobs.

The overall decline in business output translates not only to less profit; it yields less take-home pay and consumption for middle-class families. Workers will be harmed by this shift to lower-paying jobs.

We now export far more of these services than we import. For this reason, the typical American family enjoys an annual income $26,000 greater than just one generation ago. A record percentage of young adults are participating in our stronger economy.

Tariffs are a roadblock to prosperity, not a highway.

We’ve been here before: Look at the Smoot-Hawley Tariff of 1930. It was meant to protect American industry, but it prolonged the Great Depression by choking global trade. The layoffs, price hikes, financial carnage and cratering approval ratings caused by this historic tax increase may cajole the president into soon relenting.

If not, the promised manufacturing jobs will come at the expense of jobs elsewhere and be far fewer in number than promised. We will produce less, consume less and earn less. The Golden Age will deliver nothing but fools’ gold: Politically caused scarcity in an age of abundance."

https://www.foxnews.com/opinion/trumps- … fools-goldAre you sure you are not equating "exports" with "manufacturing"? One need not be a manufacturer, with large factories and employment, to export. Oil and food come immediately to mind.

An article from some years ago comes to mind, where a man did a major remodel of his home, determined to buy American for everything. He was a complete failure, as America did not make the things he needed. Kitchen appliances from toasters to refrigerators, household items from central air conditioning to a new vacuum cleaner; nothing was made in America. Even personal items, from hair brushes to the clothes on our backs are made elsewhere. We simply do NOT manufacture things at nearly the pace and variety we used to.

But you are absolutely correct that we will never have the employment numbers we used to have in manufacturing. Robotics and automation have seen to that, and the genie will never return to the bottle.

Trump: 'We're going to become so rich, you're not going to know where to spend all that money'

AND

Trump: "Well, maybe the children will have two dolls instead of 30 dolls. So maybe the two dolls will cost a couple bucks more than they would normally.”.Trump: "Everyone says, 'When, when, when are you gonna sign deals?' We don't have to sign deals ... they have to sign deals with us. We don't care about their market ... they'll either say, 'Great,' and they'll start shopping, or they'll say, 'Not good.' That's okay. You don't have to shop."

Adds, “Not trading with China — we’re losing nothing.”

Are you freaking kidding me.

So we have a shift in goal now? I think his statement shows his hand doesn't it? No one is coming to make any deals are they?

https://x.com/atrupar/status/1919791248388268265

Bessent: “We’ll get trade deals this week.”

Trump, hours later: “We don’t have to sign deals"

What?And this is incredible, Bessent as questioned earlier by Mark Pocan and couldn’t answer the most basic question: who actually pays the tariffs? Absolutely stammering and fumbling...

https://x.com/CalltoActivism/status/1919775484440666304I can't resist piping in. That clip brought an evening chuckle.

He really made himself look bad. Your choice of "incredible" covers it. But, it was the thought that came next that brought the chuckle.

I don't remember the names, but surely you remember the senior-level female VIP who, in a televised Congressional hearing, couldn't define a woman? That was the thought.

Wait. That's not 'whataboutism, or defense of Besset or criticism of the woman. It's the 'SMH' chuckle about politicians' low opinion of the public.

Time after time we see it. In times like your clip, they rub our faces in it. Half the time we swallow it, and half the time we spit it out. Then we argue about our choice of action.

GA

Can anyone answer, what did the Ukraine get out of the minerals deal with Trump? Did Trump guarantee the Ukraine's territorial integrity in return? I don't recall Trump making that guarantee, how is that going to stop Putin and his offensive?

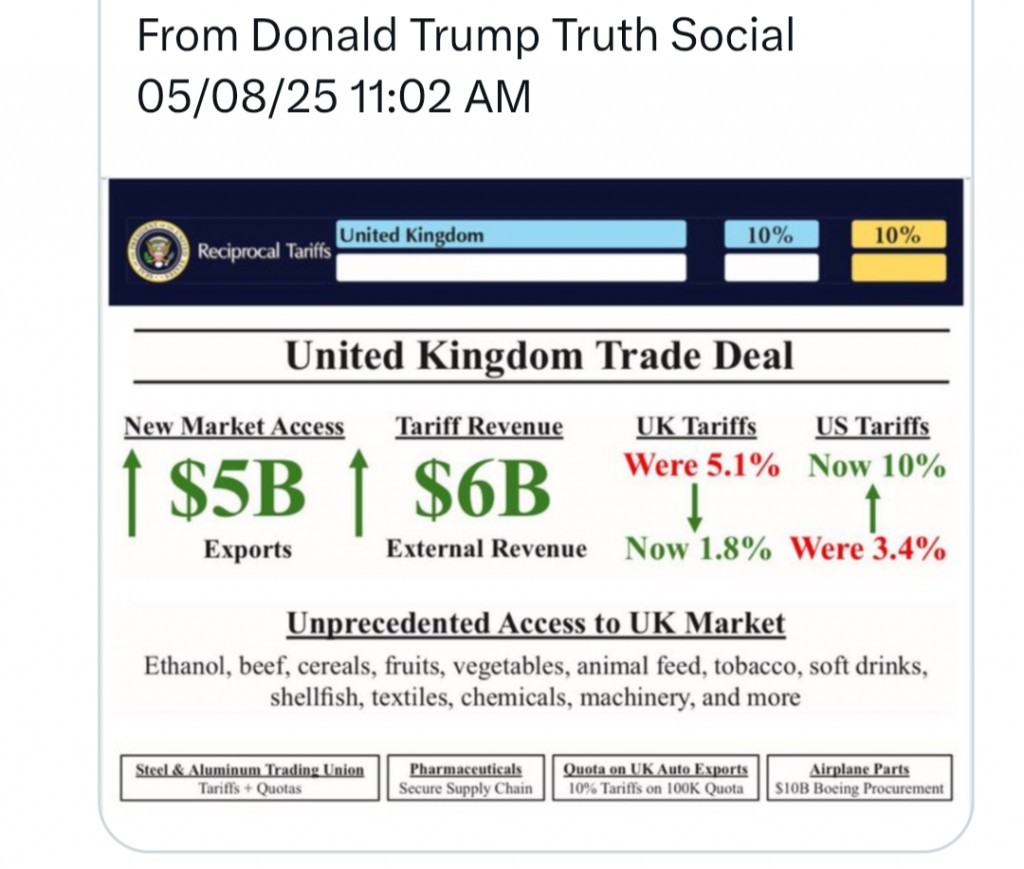

Britain and India clinched a long-coveted free trade pact on Tuesday after tariff turmoil sparked by U.S. President Donald Trump forced the two sides to hasten efforts to increase their trade in whisky, cars and food....

The agreement between India and Britain is expected to boost bilateral trade between the world's fifth and sixth largest economies by 25.5 billion pounds ($34.13 billion) a year from 2040, Britain said.

Meanwhile in our country...ZERO deals.

https://www.reuters.com/world/uk/whats- … 025-05-06/On May 6, 2025, the United Kingdom and India finalized a landmark Free Trade Agreement (FTA) after THREE YEARS of negotiations. This deal significantly reduces tariffs on a range of goods and is expected to deepen economic ties between the two countries. Notably, India has agreed to lower tariffs on 90% of British exports, including reducing the whisky tariff from 150% to 40% over the next decade and cutting car tariffs from over 100% to 10%. In return, 99% of Indian exports, such as textiles, food products, and jewelry, will enter the UK duty-free. Economically, the agreement is projected to boost bilateral trade by £25.5 billion (approximately $34 billion) annually by 2040 and raise the UK’s GDP by £4.8 billion each year in the long term.

While the FTA does not explicitly target China, it could still have indirect consequences for the Chinese economy. As India and the UK strengthen their trade relationship, both countries may become less reliant on Chinese imports and exports, gradually shifting global trade patterns. Additionally, increased trade between India and the UK may intensify competition for Chinese exporters, particularly in industries like textiles and automotive parts, where India is becoming increasingly competitive. The agreement also reflects a broader trend of nations diversifying their trade partnerships in response to geopolitical tensions, which could lessen China’s global economic influence over time. Moreover, as companies seek to mitigate risks exposed by recent global supply chain disruptions, India may emerge as a more attractive manufacturing and sourcing alternative to China. Though the FTA is not designed to counter China, its long-term effects may contribute to reducing China’s dominance in certain sectors of the global economy.

So, could this work out well for the US in the ongoing Tariff war? Maybe

Did anyone catch the treasury secretary Bessent today being questioned by oversight?

"We have not engaged in trade negotiations with China as of yet"

Well gee.. what does that mean?

Another lie from Trump.

China has been dreaming of humiliating the US for many years. The MAGA amateurs have come at just the right time.

https://x.com/RpsAgainstTrump/status/19 … 8666465476I’ve been seeing a lot of chatter about the tariff war over the past month, and what I’m picking up is that tariffs are still pretty misunderstood, mostly because the topic is complex. The media doesn’t help either; they’re all over the negative aspects of a tariff war, but no one’s really talking about the other side of the coin: why fair trade actually matters and why now is the time to negotiate a more level playing field.

I’ve been thinking a lot about the whole idea of “free trade,” especially when it comes to China, and honestly, it’s never been very free or fair for the U.S. For decades, we’ve operated under this belief that open trade would benefit everyone, but the numbers just don’t back that up. While we’ve been letting Chinese goods pour into our markets, our own businesses have been stuck jumping through hoops to even compete abroad. It’s no wonder our trade deficit with China hit $295 billion in 2024.

Here’s the kicker: the U.S. was charging a 20.8% average tariff on Chinese imports, but China was slapping our goods with tariffs between 67% and 84%. How is that anything close to fair? That kind of imbalance crushes American manufacturers and hands Chinese companies a major advantage. If we flipped the script and made tariffs reciprocal, say, both countries charging the same 20.8%,we wouldn’t see prices rise here at all. But our exporters would finally get a fair shot, and that revenue could go right back into American infrastructure, jobs, and industry.

Even better, fair trade could spark a manufacturing comeback here at home. Imagine more companies choosing to build in the U.S. just to avoid foreign tariffs. Picture a German carmaker opening a plant in Tennessee instead of China, or a tech company building phones in Texas rather than Vietnam. Leveling the playing field makes America a more attractive place to do business, which means more jobs, better wages, and a stronger economy.

Fair trade doesn’t mean isolation; it means standing on equal ground. If we just match the treatment we’re already giving, we’re not hurting anyone, we’re simply making trade work for us again. It’s really just about looking at the stats and understanding how much we stand to gain if we hold our ground. If Trump can scale this kind of fair trade policy, we might actually see real growth and opportunity back on our shores."but China was slapping our goods with tariffs between 67% and 84%."

' According to WTO data, in 2023 (the latest available data), China’s simple average Most-Favored-Nation (MFN) applied tariff rate was 7.5 percent, with a trade-weighted average of 3 percent. In comparison, the US maintained a lower MFN applied rate of 3.3 percent and a trade-weighted average of 2.2 percent. Breaking it down further, China’s MFN applied tariff rate in 2023 averaged 14 percent for agricultural products and 6.4 percent for non-agricultural products, while the US imposed lower rates of 5 percent and 3.1 percent, respectively."

Historical average tariffs imposed by China on US goods have stayed below the 30% range.

https://www.china-briefing.com/news/tru … 20percent.

US-China Trade War Tariffs: An Up-to-Date Chart | PIIE. https://www.piie.com/research/piie-char … date-chart

Let's examine this "full and comprehensive" trade "deal" with the UK:

-The 10% tariffs on goods from the UK into the US remains (so no relief for taxpayers)

-It DOES include lower tariff quotas for UK steel and car exports. Note the use of the word "quotas", so essentially it changes nothing because the quotas have never been met.

-It puts an end to the THREATENED BUT NOT IMPLEMENTED 25% tariffs Trump threatened on steel and car imports

-It's so "full and comprehensive" that it doesn't cover pharmaceuticals

So, the "full and comprehensive" trade agreement with the UK is missing all sorts of points and resulted in *checks notes* ABSOLUTELY NOTHING for the US.

Meaning that our trade war with the UK was settled for ZERO, and Trump is just proclaiming victory even though there's been no change. The only thing this "deal" provided was pending but not yet implemented tariff relief for US citizens on British goods.

Also worth noting that the effective tariff rate in the UK for US goods was 0.5%....

More theater with no substance. There's no trade deficit with the UK. He basically is announcing renewing the same deal that was already in existence.

Very little change since UK had a surplus, basically the US REDUCES steel and auto tariffs on UK.

So far UK has no concessions, unclear if they keep the 10% tariff.

Literal nothing-burger.Trump on US port traffic slowing down:

“It’s a good thing-not a bad thing.” “That means we lose less money.”

Makes sense?

Truck drivers don't think so...There are no ships from China sailing to the West coast on 5/10/2025. When will they start laying off dock workers and truckers in California, Oregon, and Washington?

This situation is concerning. I’m hoping that negotiations go smoothly, and that we don’t end up feeling the impact of shortages and rising costs. I’m holding on to the belief that a fair deal can be reached. Both leaders are fully aware of the severe consequences if this isn’t resolved quickly. They’re both in politically vulnerable positions. While I’m not one to make predictions, I have a sense that a fair deal will come together quickly to avoid too much fallout. I’m giving it a couple of weeks.

From what I have read, it is now a forgone conclusion there will disruptions because the supply chain now officially broken. The question is for how long will this go on.