Accounting Jobs in India

Accounting jobs

With the recent globalization of world economy, accounting jobs India have assumed great importance – particularly in the corporate sector. Accounting jobs in India are available aplenty as every small and medium business as well as large corporate houses is continually on the hunt to employ efficient accountants. If you have the required qualifications accounting jobs are there for the asking.

Aspirants wishing to enter the accounting profession must obtain a bachelors degree in commerce with specialization in either accountancy or finance. A postgraduate degree will be an added plus at least at the time of interview and selection. Computer literacy is absolutely indispensable for chalking out a career in accounts.

Are you looking for a job in the Accounting sector?

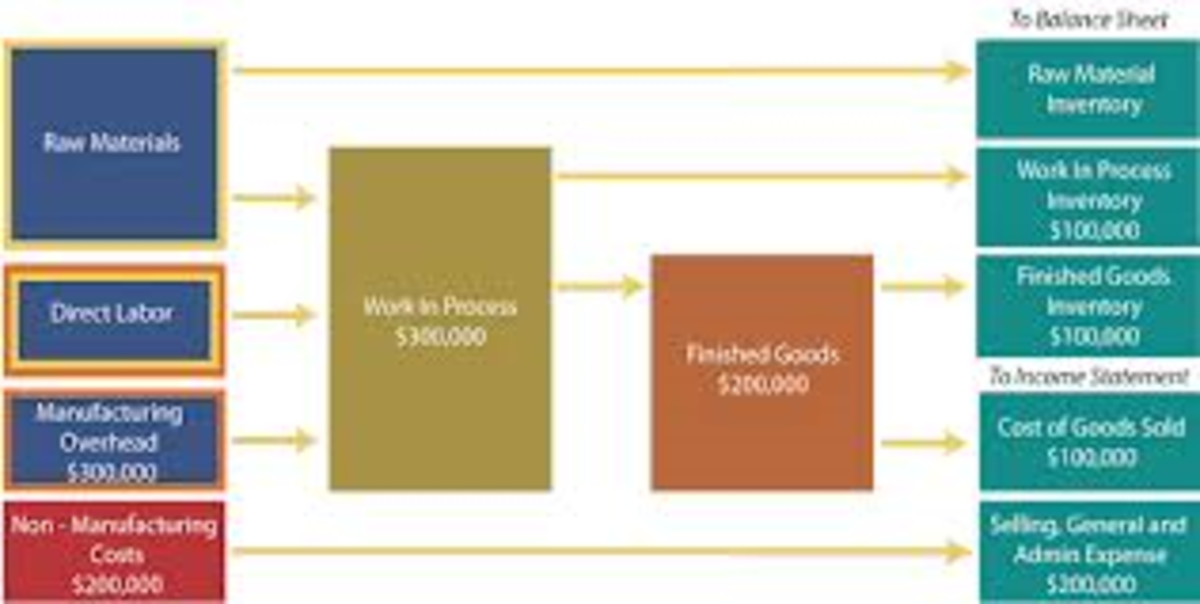

An accounting job in the private companies invariably constitute maintaining the day-to-day accounts, preparing accounts statements, cash flow statements, monthly payroll, book-keeping, arranging the annual audit, filing the annual tax return of the company etc. Companies have openings for accounts jobs at various levels – ranging from an Accounts Assistant to Accounts Executive to Accounts Manager. Fresh graduates/ post graduate in commerce can reasonably expect a staring salary of Rs 7000 to Rs 10000 depending on the size of the organization.

Recruiting candidates for entry level jobs in accounting is done by most companies through press advertisement or providing information on their websites. However, individuals who are desirous of making it big in the corporate accounting or corporate finance spheres must necessarily acquire professional qualifications – either as a Cost Accountant or as a Chartered Accountant.

The Job of an Accountant

Cost Accountant

It is a fact that in today's corporate world, though the practice of conventional accounting and auditing still remains, accountants are more expected to contribute towards the management of scarce resources like funds, machinery, land and labor. This shift in emphasis has opened up tremendous job opportunities for Cost and Works Accountants. The Cost Accountant examination is conducted by the Institute of Cost & Works Accountants of India (ICWAI) in three phases – Foundation, Intermediate and Final.

The minimum qualification to appear for the Foundation exam is a pass in the Senior Secondary Examination under the 10+2 scheme of any recognized Board and the minimum age limit is 17 years. Those aspiring to directly appear for Intermediate exam must be not less than 18 years of age and passed Degree Examination of any recognized University. Students can visit: http://www.icwai.org/icwai/institute-cwa.asp for further details.

Overseas job opportunities

- Find the Best High Paying Hot Overseas Jobs

- Best Paying Hot Jobs in Canada

- Best Paying Hot Jobs in South Africa

- Best Paying Health Care Jobs in the USA

- Best Paying Hot Jobs in New Zealand

- Best Paying Hot Jobs in Dubai

- Top Paying Hot Jobs in UK

- Top Paying Hot Jobs in Malaysia

- Best Paying Hot Jobs in Australia

- Top 10 Hot Jobs in Singapore

- Top Paying Hot Jobs in Philippines

- High Paying Hot Jobs in Japan

- Best Paying Hot Jobs in Norway

Qualified Cost Accountants have a promising career ahead and most Cost Accountants have come to occupy senior positions like Chief Accountant, Cost Controller, Finance Manager, General Manager, Finance Director, Chief Executive, etc. in many Public and Private sectors organizations. These apart - qualified Cost Accountants are also self-employed and practice in areas such as Mandatory Cost Audit under Section 233 (B) of the Companies Act, 1956, Certification assignments under Export & Import Policy, Excise Audit under Section 14A of the Central Excise Act etc.

Qualified Cost accountants can easily expect a starting salary upwards of Rs, 20000 and end up his/her career on a fabulous salary depending upon career progression.

Chartered Accountants

With the rapid growth in Indian economy and multinationals setting up operations in India, careers in finance and accounts look extremely promising. For aspirants who truly want to make it big in the world of accounts and finance must qualify as Chartered Accountants. Chartered Accountancy is a stressful, challenging and yet highly rewarding profession.

The Institute of Chartered Accountants of India (ICAI) is both an examining and a licensing body. The institute conducts the Chartered Accountancy exam. The course involves a blend of theoretical education and practical training with an established auditor which run concurrently for a period of three years. This combination of theory and practice endows a student with the required knowledge and skills to function as a professional accountant and finance head post qualification.

CA course has three phases - Competency Professional Test (CPT), Professional Competency Examination (PCE) and Final examination. The registration for CPT and PCE is open throughout the year. After passing the Professional Competency Examination (PCE) candidates are eligible for registration as articled clerks/audit clerks for practical training.

A candidate aspiring to become a Chartered Accountant must have passed the Senior Secondary Examination (10+2) before registering for the course. ICAI has nearly fifteen branches spread all over the country. A Chartered Accountant (CA) becomes an expert in accounting, auditing and taxation. According to the Company Act only a qualified CA in professional practice is allowed to be appointed as auditors for limited companies in India.

Qualified Chartered Accountants can expect a starting salary upwards of Rs. 20000 and can aspire to earn astronomical sums as they progress in their career o reach the top levels. Career in CA provides you a high pedestal for employment with big corporate houses. As a matter of fact, the chances of ascending the corporate ladder to reach top corporate positions are much better for a Chartered Accountant than even a Cost Accountant. Qualified Chartered Accountants are in great demand as the percentage of passes in this tough exam is very low. Thus Chartered Accountants are an enviable lot as they leave jobs frequently due to continued better prospects.