When will they ever learn?

Over a decade ago we decided that the poor should be able to have a house whether they could afford it or not. The end result of that decision was the recession that spread world wide and caused immense damage to millions of people.

From the Idaho statesman, April 25:

http://www.idahostatesman.com/2013/04/2 … k=misearch

A rather long article, but at the root of it is the problem that the poor cannot afford the down payment on a new home. We need to reduce the requirements for down payments on mortgages in order that poorer people can qualify. The article acknowledges that doing so will inevitably increase the default rate, but...the poor deserve to have a house and it is up to the rest of us to make it happen.

When will they ever learn?

Is there something intrinsically faulty in the minds of people that decide society can afford whatever it wants; that we can buy everyone whatever we decide they are "entitled" to without damaging the economy or individuals that will (and already have) picked up the enormous cost of such stupid decisions? Are such people simply unable to learn from history? Do they not care?

When will they ever learn?I would agree, and I do agree with what will happen.

The thing is it really doesn't generally hurt anybody but the mortgage holder. Banks are not hurt by defaults, in general, because the equity that the owner had in the property is usually well above the legal costs incurred by the banks for foreclosure.

So the bank gets a house for less than they loaned... They may loose "projected" profits but they rarely take a true loss on the deal.If the down payment is, say, zero then the cost to the bank is definitely there. Only when the down payment is higher, enough higher to take care of the normal damage to a re-possessed house plus all court and attorney fees, does the bank break even. There is also the loss of profit to be considered - the "cost of money". That money could have been used to fund another mortgage, with profit, so that missing profit is also a loss.

I would agree... if we are working on the assumption that the home owner defaults the month after taking the mortgage.

Two or three years of payments plus the return of the home more than make up for the legal fees, etc. Generally. Attorney fees aren't nearly as high, as most larger banks have legal personal on staff, not hired out per hour.

Yes, profits could have been used for reinvestment... but loss of projected earnings doesn't lead to business failure. Breaking even doesn't require government bail-outs. Banking on projected earnings as money in hand does.

Totally agree. If a person cannot afford a house, he/she should not buy one but live within his/her means. NOT EVERYONE can afford a house. You cannot have your cake and eat it too!

If one is POOR, do without or get a better job if one wants to live better. Most poor people in America want to live affluently but they are loathe to make the sacrifices in order to live that lifestyle. They live in the immediate. They do not believe in delayed gratification.

Affluent people sacrifice and strategize for their success and they believe in delaying their gratification. Poor people, on the other hand, believe in instant gratificationi. They want to do what they want and when they want, without consideration of the consequences of their actions.Of course they can....until the bubble bursts and millions pay the price for such foolishness.

When will they ever learn?I know a couple who rented a chicken coop when they were first married, which was something like 55 years ago. Now they live in a 5,000 square foot house.

The current working class isn't, generally speaking, willing to work for what they want like people were willing to do in the past. Now, it's like some kind of 'human right' to have a 3 bedroom home in the suburb right out of college.

:*(It wasn't a chicken coop, but my first "apartment" was a bedroom with a bath down the hall shared by 4 other renters. My first home after marriage was a single wide trailer, 2 beds, for a family of 4. We were there for 8 years before we could afford a house.

You're right - everyone is entitled to a 2500 sq ft home anymore, right out of school and with no money and no income. How times change.

If we spent less money on stupid shit, then maybe we'd be able to afford our more altruistic tendencies, but not by lowering the mortgage rate. The same stupid thinking was behind the stimulus. It was ostensibly to help out everyone who was going to be hit by the housing bubble bursting, yet those were the employees of the banks that were failing and the families living in the houses that were eventually foreclosed on. If we had taken all that stimulus money, we could have paid off all those mortgages and given everyone enough money to survive AND get retrained if they needed it to get new jobs. The banks would have failed, but no one would have been hurt TOO bad, and new banks would have taken their place. More importantly, the banks that dies would be an example to those that came later. Those banks would have gotten the message: You screw up, you take your lumps.

We should have protected those who deserved to be protected; the employees that were left jobless, the people who had money in accounts in the banks and the poor families that were duped into taking a deal that backfired on them. NO ONE ELSE. We had enough money to do that.

It's also why the sequester is stupid. It's a 2% cut in the INCREASE in spending... So why did we LOSE stuff? We did it because they way they balance the books is to cut high-profile projects so that they can make a point of telling us that it's the oppositions fault in the next election. They cut each others high-profile projects because they know it will hurt them in the next election. What they DON'T cut is everything that NEEDS to be cut, like independent health-care for Congress, but isn't talked about because the people in office know that we'd say "Well that's ridiculous... Get rid of it."Well, THEY'RE learning now that their houses are being foreclosed and they are left out in the streets.

Nope, it was all down to the bankers "nobody is too poor to help us make money".

As they were forced into making substandard loans. Sure - it was all the evil bankers, not the stupid lawmakers and not the stupid homeowners buying what they know they can't afford.

It's easy, isn't it, to declare a group to be evil and then lay all the stupidity of others at their feet.On the other hand, the bankers discovered another money making tool.

How much did the bankers spend lobbying government to allow them to set up toxic loans?

Proper regulation of the banks would have avoided it all.

You're about the same age as me Wilderness, remember when you were convinced you could afford a mortgage but the banks said "no, your limit is 3.5 times your annual salary"?The tool that drove them to bankruptcy and the hope that the feds would bail them out. Great tool it was, also nearly driving the country under and freezing them out of millions of future mortgages.

Did you check the lobbying efforts? Where the banks repeatedly told the lawmakers it was dangerous and should not be done? Or have you carefully glossed over that?

Yes, proper regulation would have avoided it. Unfortunately the regulation required banks to make increasing numbers of substandard loans - loans that everyone but the lawmakers knew would fail in large numbers.

No - I had a birthday 4 days ago and was only 29. Far less than you .

.

Banks here were more concerned about the percentage of disposable income, after debt payments were made. I forget what it was (40%?), but it was set in stone and no bank would ignore it. And it still is, it's just the the figure was raised beyond what any reasonable, thinking person would consider acceptable. Combine that with ARM's that would soon increase to more than the entire disposable income and the loan WILL fail.

Mostly because stupid politicians bought votes with mortgages the new owners were destined to default on. It made lots of people happy...for a handful of years. Then the bubble burst and the world fell.

The housing market is among the most corrupt systems to have ever been devised. Millions and millions of unused homes, but the notion of low-cost housing for the poor and even free housing for the homeless is unthinkable.

/facepalmThere Ain't No Such Thing As A Free Lunch. How many of those unusued homes, belonging to someone else, have you purchased to give to the poor?

If you don't have enough, go borrow some more and pass the debt to your kids. Or steal it from someone that does have more.

It's what govt. does - doesn't that automatically make it right and ethical?

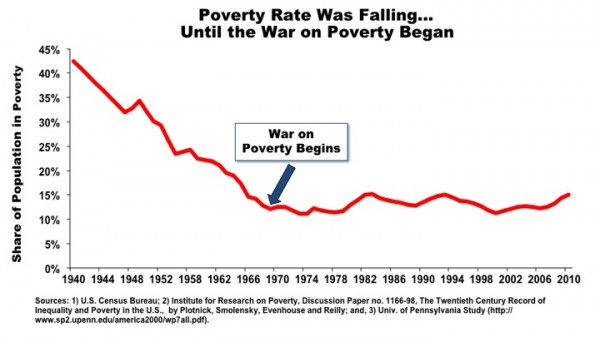

Records are incomplete until 1958 and not used in any attempt at accuracy, poverty fell about six percent in the decade after the war on poverty and has since stayed down at a low rate since rather than spiking upwards as it had repeatedly before it.

Really the problem is our sample size is too small, just one nation, if only we could look at what poverty is like in nations with lots of poverty reduction plans and compare it to those with fewer.... wait we can? and their poverty is really low comparatively?

Well that answers that doesn't it.Now that's a real shocker. Things were getting better until the politicians meddled with the program.

It almost indicates that govt. interference is a failure; that our esteemed leaders haven't a clue how to do anything right. Unbelievable that such a thing could be.

I agree that people should live within their means, and a house is not something that everyone is entitled to have, only something that someone can have after they have worked hard to come up with the money, and have an income that will be able to keep up with the payments. Otherwise they are setting themselves up for failure. It's not even that poor people don't "deserve" it, it's just that no one should try to own something they can't possibly afford. The idea of having a house is nice, but there are plenty of apartments that are rented out affordably that provide a roof over ones head, and a comfortable place to live in.

I would rather put hard work into saving up for something first, and feel like I earned it (and can afford it), than to get a house before I can afford it, and have it either eat up all of my money, or else lose it.

I'm always amazed at the "House Hunter" shows that portray really young people buying a house. I mean, if they can afford it, okay, but I don't know many people in their early 20's that have really settled down enough for the responsibilities of home ownership.It's not that the poor "deserve" to be able to afford a house, but in reality, houses shouldn't cost nearly as much as they do. The "popping" of the housing bubble didn't bring houses down to anything close to reasonable prices, never mind how far they did drop. My parents bought their house for $30K just after they were married. Today, the assessed value is $650K.... a little less than $1M before the bubble. Even adjusted for inflation, $30K would be worth only around $200K today. It doesn't take a financial expert to see that something is very wrong with the housing market. The idea of buying a house and spending your entire life paying it off has been a staple of financial planning for a LONG time and no one thinks anything is wrong with it, even today. If you've never carried debt in your whole life, you can't get a loan and credit card companies won't touch you because you are a "risk" What kind of financial logic is that? When the government was talking about this "recovery" we're supposedly in, they weren't talking about getting rid of debt and making the country productive again. They were talking about the need to get the banks lending again and keeping the country's credit from deteriorating and making its citizens SPEND money This is what is "recovery" in their world. In a normal world, debt is something to avoid and saving money is a virtue. During their so-called recovery, unemployment rose higher and stayed higher than government projections for what would happen with OR WITHOUT the stimulus. Inflation is still high, and banks still won't increase interest rates on their bank accounts.. but damnit... they'll lend money again. By ANY sensible yardstick, this is no "recovery", yet the government says so and we're buying it. Today, saving money means putting it in a bank where it earns interest below inflation, so it is LOSING value in the bank. You want to use hard work and save your money? That's nice, but the government says that is slowing recovery. People hanging on to their money so they can actually afford things means money isn't changing hands, and the government only makes money when money changes hands.... so get spending again, citizen... and if you can use someone else's money by taking a loan out, that will be even better.

Everything is backwards in the financial world. Poor people have a ton of advantages yet they still don't have any money. It takes credit to qualify for credit and it's considered financially savvy to carry crushing debt. If everyone who had a credit card was responsible, they wouldn't carry a balance on their card. Credit card companies wouldn't make any money off the interest on balances and they'd go out of business. Credit card companies survive off of people who are bad with money, and you're considered "weird" if you don't have one. More financial logic.

The economy (and the government) is considered "healthy" when it's citizens pile on as much debt as they can possibly handle and never save a dime. This is "fiscal responsibility" It's been like this since at least the 20's after we "recovered" from the Great Depression.That is a great comment! Houses are expensive, and the whole "credit" system is a mess. I completely agree that credit card companies make a lot of money off of those who are bad with money. I had a couple of small credit cards for only 3 years during my early 20's, when I didn't make much money. I spent years paying them off (ended up owing more than double the amount I used), and it messed up my credit for quite a long time. On the bright side, I haven't messed around with credit cards for about 10 years.

It's sad, but if this is a "recovery", it sure isn't a full recovery.

I think there's blame on both sides of the transaction.

People who never would have thought themselves eligible to qualify for a home loan

were encouraged (duped?) into believing they qualified.

Should they have been skeptical of $0 down and 2 percent ARM terms?

Of course!

If it sounds too good to be true, it is.

But we are living in an age of credit cards and financial illiteracy. Not a good combination.

People are more than used to living beyond their means.

And you don't have to be poor to want instant gratification.

I know plenty of middle class homeowners (more like former homeowners) who grossly miscalculated what an ADJUSTABLE rate mortgate means.

But let's not forget the people who were making their house payments just fine -- while they had a job. The housing crash and economy crash are intertwined.- JaxsonRaineposted 12 years ago

0

That's why we need the government to stop protecting people so much. People have the feeling that they can sign anything, because surely the government wouldn't let the bank/insertotherentityhere give them a contract that could hurt them in the end.

The more you coddle people, the less they learn, and the less they think for themselves. Intelligent people will look at a mortgage and say 'Hmm, when this rate goes up, that will be hard to pay. And if either my wife or I get sick/fired and can't work, we won't be able to make it on one income'.

I don't blame the lenders. I blame idiots who refuse to think for themselves. Before you think about going half a million in debt, you should at least make sure that you could service that debt for more than, oh I don't know, a month if you lose your job. Actually, it is not that the poor deserve to have a house and we have to make it happen. It's that the greedy lenders convince one person that they can afford it and before you know it; it spirals out of control, mean while the greedy bankers have made tons on the interest of these loans and the poor fools who were convinced to go over their heads financially are shit out of luck and usually out in the street.

People need to learn not to buy stuff they can't afford. It's really a simple concept.

So the blame lies on a bank somewhere rather than the idiot signing a mortgage with payments more than they can afford?

I have a hard time with that - yes we're training Americans that nothing is their fault, that they have no responsibility for their decisions, but it's a lie. Everyone is responsible for their own choices, including the choice to take on a mortgage they can't afford. Outside of the mentally incapable, we're all quite competent to make decisions, we just don't the responsibility that comes with it and would rather put the blame on someone else when it turns out to be a poor decision.No, you can't blame the people who are signing an offered contract. They can't be expected to make decisions for themselves.

Go watch any episode of HouseHunters, ever, with a young couple(30s or younger), or better yet, Property Virgins.

It's always the same "Yeah, we don't really want to go that high, it's going to be really tight, but we both have jobs so we should be able to make it"... with no thought to:

What if one of you gets sick at some point in the next 30 YEARS while you have a mortgage?

What if one of you loses your job at some point in the next 30 YEARS while you have a mortgage?

What if one of you gets a pay cut?

What if we have bad inflation and everything ends up costing twice as much in a 5 year period?

But no, we need to blame the people who are lending money, never the people who are accepting it.Interesting datum: there is a higher percentage of two earner couples losing their home than single earner families.

They depend on 2 jobs to make the payment, but that also doubles the chance that one job or the other will be lost. With a one earner couple the chance of job loss is cut in half, but then you also have 2 people capable of looking for work and replacing that lost job.

But you're right - always, always put the blame on somebody else. Never, ever admit that you screwed up. It's the banks fault that your mother gave birth to an idiot, incapable of thinking past the wants of today to the needs of tomorrow.

Related Discussions

- 620

Is giving money the only way to help poor people?

by Goodpal 11 months ago

Is giving money the only way to help poor people?You can't get rid of poverty by giving people money. - P. J. O'Rourke. What do you think?

- 84

Conservatives, Do YOU Feel That Many Poor People Make Excuses ?

by Grace Marguerite Williams 10 years ago

Disclaimer: Not addressing the hard working poor who are trying to better lives for their families; the underemployed; the unemployed; the needy elderly; the physically, mentally, emotionally, and psychologically handicapped who CAN'T help themselves; and, those who fell temporarily upon hard...

- 45

What is the root cause of poverty in the world?

by Christian L Perry 7 years ago

What is the root cause of poverty in the world?

- 73

The K.I.S.S. Factor-It is VERY SIMPLE Really! Yes, Really!!

by Grace Marguerite Williams 4 years ago

How can we REDUCE, if not ELIMINATE poverty in America? Let's get TRUTHFUL, even RAW here, no SOFTSOAPING here! Let's TELL IT LIKE IT IS!

- 40

Home Ownership!! What to do, What to do? The American Dream?

by tsmog 23 months ago

American dream of owning a home is dead, majority of renters sayNote: All of the referenced have plenty of graphics for a skim.by The Guardian (Mar 12, 2024)https://www.theguardian.com/society/202 … GTUS_email"The American dream of owning your own home is dead, according to the majority...

- 78

Are the poor useful for the society in any way?

by Goodpal 8 years ago

Are the poor useful for the society in any way?Is it that Poverty and the Poor are mere burden on the society? Do they serve any meaningful purpose?