What should be done about Social Security?

http://www.nytimes.com/2013/03/31/opini … ef=opinion

Social Security, Present and Future

By THE EDITORIAL BOARD

Published: March 30, 2013 6 Comments

"In the fight over the federal budget deficit, Social Security has so far been untouched. That may soon change.

Today's Editorials

"In last year’s “fiscal cliff” debate, President Obama offered to reduce the annual cost-of-living adjustment, or COLA, for Social Security benefits, a spending cut favored by Republicans and scorned by Democrats. Republicans rejected the offer because Mr. Obama wanted tax increases in exchange, while Democrats said it would be too harmful. More recently, Senate Democrats did not include Social Security reforms in their budget and specifically rejected a COLA cut. The House Republican budget also steered clear of explicit cuts to Social Security, a move partly aimed at isolating Mr. Obama.

"The question now is whether Mr. Obama will again propose to cut the COLA when he unveils his budget next week. We think he should not do so. The president might want to seem like he is willing to compromise by renewing his call for a COLA cut. But Republicans already spurned his offer and are unlikely to take him up on it now. They are more likely to paint him as a foe of Social Security, which would be reinforced by Democrats’ opposition to the cut.

"Even if Mr. Obama avoided those pitfalls, a COLA cut is a bad idea, as we will explain in this editorial. It also is a distraction from the real problems of Social Security.

"WHAT IS THE PROBLEM WITH SOCIAL SECURITY? The answer is a long-term shortfall. Social Security plans for solvency over 75 years, but because of demographic pressures and the weak economy, it is currently solvent only until 2033. After that, without reforms, it would pay about 75 percent of promised benefits.

"Meanwhile, the nation is having a retirement crisis. Even before the recession, people had not saved enough to make up for the loss of traditional pensions. The downturn and slow recovery have made things worse. Less than half of households ages 55 to 64 have retirement savings, and of those, half have less than $120,000. Many near-retirees also have lost home equity or a job.

"All that will leave most retirees heavily reliant on Social Security, which currently pays a modest benefit, on average, of $1,265 a month. Already, the majority of retirees — with annual incomes up to $32,600 — get two-thirds to all of their income from Social Security.

"Even at higher incomes, up to $57,960, Social Security is the single biggest source, accounting for almost half. Only the top fifth of seniors, with incomes above $57,960, do not rely on Social Security as their largest source of income; most of them are still working.

"Going forward, there is no escaping the reality that Social Security will be more vital than ever. To save it, we need consensus on direction and principles, among Democrats and across the aisle, along these lines:

"SHOULD IT BE USED FOR DEFICIT REDUCTION? This is part of a larger question about whether any deficit reduction is appropriate when the economy is weak and unemployment high. The short answer to both questions is no. But as long as the deficit occupies center stage, the best approach would be for politicians to debate, and even agree, on spending cuts and tax increases to take effect as the economy strengthens.

"Social Security reforms should be decided separately because the program is not driving the deficit. That distinction goes to chronic revenue shortfalls and rising health costs that propel spending on Medicare and Medicaid. Social Security did not cause today’s deficits, because the payroll taxes that support it have been more than adequate; and it will not contribute to future debt, because it is barred from spending more than it takes in.

"The reason Social Security is wrapped up in the political budget debate is that government deficit projections assume Social Security will always pay promised benefits in full, even though the system is expected to run short in 20 years. That shortfall is reflected in deficit projections, so reducing it would improve the budget outlook.

"The answer is to address Social Security’s problems, not to conflate reforms with the broader deficit reduction efforts.

"HOW SHOULD SOCIAL SECURITY BE REFORMED? The drive to cut the COLA is based on the premise that the inflation gauge used to compute the adjustment overstates the rising cost of living. That is a flawed premise. A good case can be made that the gauge is an inaccurate way to track inflation for working-age people, but there is no empirical evidence that it overstates inflation among retirees, who tend to spend more on health care and other necessities for which there are few, if any, cheaper substitutes.

"To ensure that the system is paying proper COLAs, Congress should instruct the Bureau of Labor Statistics to develop a statistically rigorous index of inflation among retirees. Until that is done, cutting the COLA on grounds that it is too large would be unjustified and disingenuous.

"In the meantime, the debate over reforming Social Security will come down to tax increases versus benefit cuts. With retirements at risk, reducing benefits is dangerous, though trimming benefits for upper-income recipients, who live longer and draw larger benefits, could close about 10 percent of the system’s long-term funding gap.

"Another overdue reform, which would close about a third of the gap, is to raise the level of wages subject to Social Security payroll tax to about $200,000 from the current $113,700. That would bring the taxable wage base in line with rising incomes among top earners.

"A sensible change is to raise the payroll tax rate, currently 6.2 percent for both workers and employers. The rate has not been raised since 1990. A one percentage point increase could be phased in over 20 years and still raise enough revenue to close about half of the funding gap.•

"It is imperative that the frenzy that passes these days for deficit debate not engulf Social Security. There are rational and acceptable fixes to the program that could preserve it for generations to come, if political will can be found to enact them."One thing that bugs me is that we already fixed Social Security under Reagan, and Congress went and spent the money on other stuff. That should be made clear to the American people. I still think my idea of creating personal accounts *not* aimed at Wall Street pockets, but at interest-bearing accounts that can't be taken away by politicians looking to score a political point, is a good one:

How We Can Create a Powerful New Social Security Program

<link removed>Republican's goal has always been to eviscerate Social Security.

WillStarr is wrong, what caused the debt is George W. Bush taking the Social Security surplus to start his private war with Iraq.

We first have to agree that all such social programs must either operate in the black, or be abandoned. Then we have to agree that they cannot be so costly that they affect the free market's ability to prosper.

At the moment, such entitlements absorb 2 out of every 3 dollars of federal spending, so they are the primary reason for our $17 trillion in debt.The stupid wars got our debt out of control NOT the Social Security benefits that we contributed to

Social Security does not contribute to the national debt.

You mean that all those billions "borrowed" from the fund need not be repaid? That the IOU's are worthless?

That's a real shock!

Your reasoning escapes me. You are blaming SS for money borrowed and pissed away in Iraq and Afghanistan?? Get real.

I don't blame Social Security for our debt. As costly as they have been, I do not blame the wars entirely either. I blame runaway spending for the most part. Yes, you can put blame on the wars too, but the vast majority of debt incurred in the past 12 years has been because of stimulus spending and entitlements, either Bush's post 9-11 spending or Obama's post Bush spending.

http://www.reuters.com/article/2011/06/ … 5320110629The inadequate stimulus prevented the tax revenue from falling farther than it did by preventing a deeper recession. Bernanke also helped when it was apparent that the stimulus was insufficient.

The stimulus was massive. We loaned money to businesses. We guaranteed loans. We gave, gave, and then gave money we didn’t have. The economy is still bad.

How much more did we need?I can't put a number on it. The original amount proposed by Obama, if memory serves, was $900 billion, which was dropped to $800 billion to get two GOP votes for it--Olympia Snowe and Susan Collins of Maine.

http://www.policymic.com/articles/8616/ … y-theories

Peter Prime:

"President Barack Obama took office in the midst of a financial crisis that had sent the U.S. economy into a tailspin. The two most pressing tasks of the incoming administration were to stabilize the economy and to restore economic growth. There was an intense debate among economists regarding the best way to deal with the crisis and to put the economy on a path to recovery.

"Many economists argue that a stimulus would be the surefire way to ensure that the economy would regain its footing. Paul Krugman was an early and prominent advocate for a stimulus. He forcefully argued for a big stimulus. Other economists, particularly those of the conservative persuasion, criticized the idea of a big stimulus because they said that it would lead to inflation, hinder rather than facilitate economic recovery, and would spook the bond market, thereby making it more expensive for the U.S. to borrow money. They favored austerity as the best remedy for the ailing economy. Three years later, the verdict is in: Krugman, the Nobel Prize-winning economist, has been vindicated and the critics of the stimulus have been wronged, as none of their predictions had come to fruition

"After the Obama administration passed the stimulus bill, many critics argued that the bill not only would fail to revive the economy but would cause inflation. Although Krugman supported the notion of a stimulus bill, he made the case that the bill needed to be much bigger not only to jump-start the economy but to provide the economic boost that would be needed to recoup the tremendous job losses that occurred as a result of the Great Recession. In other words, the bill needed to match the scale and the severity of the crisis.

"The financial collapse resulted in a $3 trillion hole in the economy. Because of the fierce opposition of the Republicans in Congress against the stimulus bill, the Obama administration managed to shepherd only $767 billion- worth out of Congress for the stimulus. Thus, the bill didn't match the $3 trillion crisis. It was insufficient to fully plug the economic hole.

"The financial crisis triggered an explosion in home foreclosures and mass unemployment. As a result, many states have seen their revenues plummeted. In the beginning of the crisis, the stimulus money helped many states to deal with their budget shortfalls. As the money began to run out, many states resorted to mass layoffs of teachers, firefighters, police officers, and other states employees. With a much bigger stimulus, the administration would have been able to provide more financial aid to the states, which in turn would not have to engage in such layoffs to try to balance their budgets. Therefore, many states were forced to adopt policies that have mitigated instead of strengthening the impact of the stimulus.

"Inflation has not been an issue that affected the economy. Hence, those who postulated that the stimulus would cause inflation to rear its ugly head have been wrong. The stimulus has helped the economy recover, evident in 23 consecutive months of job creation. As predicted by Krugman, however, the recovery has not been as robust as it could have been because a smaller stimulus bill has prevented the administration from providing many still-cash-strapped states with the needed financial help. Therefore, the huge spike in government job losses has been a major drag on the economy. Without those job losses, it has been estimated that the unemployment rate would be 7.1%.

"Moreover, the fear that the bond market would become skittish as a result of the stimulus bill has not materialized. Even Larry Summer, economic adviser of president Obama, was concerned that the market might be alarmed by the passing of a bigger stimulus. Krugman has been on the opposite side of the argument. Its borrowing cost is so low that the U.S. is practically being paid by many investors to borrow their money. Such development is another indication that Krugman made the right call.

"While Krugman has been an ardent critic of austerity since the beginning of the crisis, many critics of the stimulus have been pushed for austerity measures as the most effective way to revitalize the economy.

'But, as has been shown in Europe, austerity has been put to the test. And after many years of implementation, there has been resounding evidence that austerity has failed miserably. A number of European countries that embraced this policy are mired in high unemployment and anemic economic growth. Once again, Krugman has been correct in his diagnosis.

"Although Republicans do not support providing more financial aid to the states, which would allow them to keep more government employees in their job, they have conveniently forgotten that under Ronald Reagan, the government did not engage in massive layoffs. In fact, the government went on a hiring spree. The rank of the public sector was swelled by more than 1 million people in 1985 alone. This sharp uptick in government jobs played an important role in bolstering the economic recovery during the presidency of Reagan. Now, when a Democrat occupies the White House, the GOP claims that the government does not create jobs.

'Many have criticized Krugman for being partisan or reflexively liberal in his political outlook. As Stephen Colbert aptly put it: 'reality has a well-known liberal bias.'

"Krugman has been vindicated time and time again by either events or accumulated evidence. In fact, a study that gauged the predictive ability of many commentators as well as some politicians revealed that Krugman has been the most accurate in his predictions.

"There is a tendency among some economists to remain within the confines of economic models and lose sight of the human dimension when they discuss the economy. In many of his writings, particularly those pieces that deal with the Great Recession, Krugman has gone beyond the numbers or economic models to shine the spotlight on how economic policies are impacting people and evaluating whether those policies would allow many of them to realize their potential or cause their dreams to be deferred. Moreover, Krugman has used his perch at the New York Times to help many of his readers, especially those with no background in economics to have a better understanding of the economic issues that face the country. Unlike many other journalists or political commentators, his analysis tends to be under-girded by empirical data, which help to explain why he has been so eerily prescient in his forecasts. Since he does not have to cultivate sources for his columns, he is not afraid to speak truth to power. That is why his voice has been so indispensable in our political debate."

[Of course many economists don't agree completely with Krugman. However, nearly all orthodox economists agree that stimulus, not austerity, is needed to pull the economy out of a recession. Stimulus can take several forms--public works spending on infrastructure, tax cuts, extended unemployment benefits, etc. A certain amount of stimulus is automatic as a result of deficits which result from reduced tax receipts due to the recession.]

No, no. SS administration doesn't borrow the money - our vaunted politicians do. To put it into the general fund and spend for the pork their constituents want and demand - the pork that keeps them in a job.

The word "entitlement" is annoying; I've been paying into Social Security and Medicare since I was 14; damn right I'm entitled! It's not the people who have supported these programs over the years and now want what they've paid for to be available, it's the politicians who have used Social Security as a piggy bank to pay for other stuff who are the problem. Too bad we can't sue 'em.

AMEN! Social Security should be increased, not cut.

True, and that doesn't make this Obama supporter happy!

I'm not happy, either, but I'm not convinced that extending the payments for Social Security past the current limit (103,000) is that great, either, particularly for freelancers; the income tax rate shoots up at about the same time, and with the Social Security and Medicare added on, freelancers could be paying 50 percent or more for relatively low income in comparison with people at the top of the income scale. What's the point of working?

I suspect that some day you'll be happy you have Social Security.

Here is willstarr professing to who wants to listen to his pseudo lessons in economics. How come a nobody in economics can with such pretention be so certain whereas all the masters in economics lamentably failed? Enlighten us!

60 cents of every federal dollar spent is on entitlements and the interest. Only 18.74% is spent on military:

http://en.wikipedia.org/wiki/File:Fy201 … tegory.jpg95% + of which goes to the disabled, the elderly, working families and veterans.

have you ever heard of the FICA tax, that is what goes into Social Security fund to pay our benefits.

There's a reason these programs are called 'entitlements;' - people were forced to pay into them under the pretense they would get the benefits years later. Welfare, food stamps, Medicaid, etc. are not entitlement programs - but Medicare and Social Security are. What part of being FORCED to pay into a program with a 'guarantee' of later benefits doesn't 'entitle' you to that money?

I'd be happy to not face Medicare in my future; I worked in a setting that offers me health insurance for the rest of my life. Unfortunately, even with that benefit, people are FORCED to go on Medicare when they reach eligibility age. Otherwise, it voids their other insurance.

When SS was begun, most people stayed married to the same person for years, and more marriages were dissolved through death than divorce. Non-working or under-employed spouses were able to collect based on their deceased spouse.

Guess what - even if you're divorced from someone, if you were married for 10 or more years, you can collect based on their SS history (provided you are not married to someone else). Not only that, our pattern of divorces has put an interesting spin on it.

Suppose a man, over his adult life, has three wives, each for more than 10 years. Then he dies. If all three women are not currently married (even if they remarried & later divorced), they can collect on the FULL amount of his SS. Prior to his death, they also could collect 1/2 of that amount. Say his SS is $1,000 while alive (easy number), and he has a wife & two ex's who are old enough for SS and want to collect on his amount. The government pays out $2,500 - $1,000 to him, and $500 each to three spouses or ex-wives. When he dies, they pay $3,000 a month - the full amount times three - because all three woman are eligible for his full benefit. This is one reason why many elderly couples now live together rather than marrying - if she's widowed, they get more money.

Yes, the system is broken. And part of it is a sociological issue. But it's also true that people who pay into SS are indeed entitled to benefits.Can you imagine if Social Security had been privatized as the republicans have tried to do since its inception. Had it been privatized and the beneficiaries had the monies in their/our hands and invested it before the Stock Market crash. Where would you/I be.

I wrote about this in my hub why republicans hate food stamps, Social Security and Medicare.The market is already higher than it was before the crash.

If everyone had been using privatized accounts from the beginning, they would enjoy upwards of three times the retirement benefits.not if they lost everything in the crash!

They wouldn't lose it in the crash. Stocks don't just disappear.

The stock market is high because a lot of companies are overcapitalized, and the stock market is responding. This isn't a measure of productivity; it's a measure of a malfunctioning economy. Having the stock market at an all-time high while worker pay is flatlined and the unemployment rate is still high is not necessarily a good thing.

They can do whatever they want with their 401ks and IRAs. SS is not an investment program. It's an insurance program. Investing in individual stocks and most mutual funds is a loser's game for ordinary people. The crooks on Wall Street are salivating to get their hands on Social Security tax money. Privatizing Social Security would be a huge mistake.

I'm retired and quite happy to be getting Social Security and Medicare benefits. Some day you may glad to have these programs.

Ralph, I'm a little over 3 years away from Medicare and 8 from Social Security if I max out the retirement age to get the most money, and I despair of ever seeing either. I haven't been to a doctor in over 12 years, and the way things are going, I may never see one again. I kill myself to pay self-employment tax every year, and may never benefit.

My husband's grandfather paid into SS for maybe five years. I heard one of his sons estimate he paid in about $400 He drew benefits for forty years. There would have been plenty of money if congress would have left the principle of social security alone, but they didn't nor are they willing to start. It is politicians that have got us here. Not Republicans or Democrats but politicians that like power and are not held accountable. The media doesn't hold them accountable, the people don't know which end is up and don't care. We need someone who can figure out that you need to cut spending, Fraud waste and abuse,would be an excellent place to start cutting. If you have ever worked for the US government you know how much time and money is wasted, because you have to do X, Y and Z the government way. It doesn't make logical sense, but the government way is the best way.

My girlfriend is married to an American and has known him for about 8 years and been married to him for 1 1/2 years and she still hasn't gotten a visa to come to the US. Her mother-in-law died last week, but her visa wasn't in order yet so she is still in Ireland. Yet if you are illegally in California, you can get a college scholarship. Out government is screwy. Social Security isn't the problem. The problem is the royalty that rules the country. Some of the royalty has been in congress for a mighty long time.Americans overwhelmingly want Social Security as a program.

The statistics on retirement savings (or lack thereof) are staggering. The so-called three-legged stool

is down to only 1 leg -- SS.

The savings number look like Americans are short-sighted. But...

how many in that number were

a) counting on owning their home in retirement, but lost it through foreclosure, or are now underwater on it and lost their equity?

b) saw their 401(k) plans decimated in the market downturn?

c) lost their job in the downturn and have not been able to find a comparable one that offers retirement benefits at all?

Forgive me, but it seems to me the free market has, to large degree, hurt Social Security more than the reverse.

As a humanitarian matter, if Social Security is defunded or disbanded, what happens to those people

with no other resources to live on?We get a little hungry, we get a little cold.

And we die off sooner, leaving our contributions (what little wasn't stolen by politicians for their pet projects) in the system.

As an alternative to defunding SS, why don't we do a little recalculating? Add up what was paid in be the individual, add 10% interest each year (a reasonable long term return) and give it back via payments figured from actuarial tables?

The individual put it in, the govt. used it for decades; it's time to give it back with interest. My own monthly payment should go from $1400 to somewhere around $7,000 - costly but equitable considering that it was my money being "borrowed".

I like your thinking, wilderness.

I do often wonder where the actuaries have been hiding. Or where they have been hiding the actuaries.

A while back I took the report from SS on my past income and contributions. Put it all in a spread sheet and played with interest rates and payout amounts. Using actuarial tables for my age, had I received 10% interest all the years I paid in I would be a multi millionaire by now, being paid thousands each month. Even then, the principle would continue to grow every year.

I should be "earning" far more from those monies collected than I ever did by working - several times more and then double that for the Medicare part. I should not need any insurance at all; the millions in "my" SS account would pay for anything I needed.

It's what compounding interest for 40+ years does, at least if interest rates are reasonable and not those "paid" by Uncle Sam for the "use" of my funds.SS is a social insurance program. I heard on NPR this morning that the first recipient of SS had contributed only $20-odd dollars when she reached retirement age and lived until her nineties, collecting many thousands of SS dollars. Some people drop dead the day after they retire and get nothing. Others live to 100 and get a spectacular return.

True, it is an insurance program. A whole life insurance program, so to speak, where cash value is paid out before death.

That some die early and some later is why actuarial tables are used; you are "betting" that you will be more out than you put in and it all balances out in the end as far as the "insurance company" - the US govt. - is concerned.

But it didn't work that way. Instead of holding it in trust, with a reasonable rate of return, but govt. has "borrowed" it at ridiculous interest rates which has left it nearly empty even as payments are set extremely low.Don't you know who raided the Social Security trust fund????

And took the surplus to wage his private war with Iraq!Do you know how the Social Security trust fund works?

Indeed! Tell me where to get 10 percent interest on anything and I'll be there. I think it's a crime that you can't get 5 percent on savings these days; to make any money for retirement people are pretty much forced into the stock market, which isn't necessarily where they'd want to be if they had an alternative. Once again, the powers that be are making decisions for people at the top, rather than the ones at the bottom. Republicans aren't the only ones who practice the trickle-down theory (or "tinkle down," as Archie Bunker used to say).

All the banks are paying is a tenth of one percent. And soon the banks will want us to pay them for holding our money.

All the banks are paying is a tenth of one percent. And soon the banks will want us to pay them for holding our money.

Ten percent is a reasonable rate of return, long term, from stock market investments. Actually a bit on the low side, but still reasonable when you look at the past 30 or 40 years.

To come up with it now, paying the interest that should have been earned in the past, is the trick of course. Let the same organization solve the problem it created; the government (and the people of the US) that benefited from the use of those funds.

It shouldn't take more than a 15-20% tax increase to return the monies...

The fact of the matter is that Washington has been spending the money taken into the Social Security revenue stream since LBJ envisioned his Great Society and wrangled use of the funds rather than borrowing. Instead the revenue was replaced by "IOU's" from the federal government to future receipts while elected officials spoke of the funds as if they were there, guarded, and protected for those citizens reaching retirement age who included that expectation in their planning. The financial crisis of 2008 did not route the funds...they were long gone before that happened. Now, we speak of those who have spent up to three and four decades paying into this system with an expectation of payback only to find a bunch of vultures sitting on power lines contemplating how they can do away with the burden it has become financially for the nation. Never mind thinking about the thieves who stole it right from under our noses....some of which still sit in high office today. Because of these passed actions on the part of flim-flam politicians, the SS program will not be solvent for as long as it could have been had the money been invested and secured from their sticky little fingers. Certainly there should be some effort at downstream reform which will stem the bleeding...there will be no choice there. At the same time, those who participated in this Ponzi Scheme theft owe those who have reached the age of retirement and those benefits should be paid. ~WB

I haven't seen any proposals from the Dems or Republicans that the SS funds not be repaid in full. That would be political suicide. Of course the Republicans have proposed privatizing SS, but found that it was a political non-starter.

Only some republicans have supported this.

Repaid maybe, but without any interest. Considering that the govt. has used those funds for decades it hardly seems equitable.

And now Obama is proposing that the calculation for SS increases from inflation be redone in a different manner, lowering any future increases. It was already artificially low, never making up for increased costs, and he wants to lower it further.

Tell me again how no politician would accept never paying it back to the real owners?Obama is wrong on Social Security:

Ralph Deeds · Top Commenter · 108 years old

Social Security does not contribute to the deficit, and President Obama should not have allowed it to become part of the deficit negotiations. Moreover, Social Security does not face an immediate crisis. Social Security fixes should be discussed independently of deficit negotiations, giving consideration to ALL alternatives including raising the earnings cap, increasing the FICA tax rate, reducing early retirement benefits, raising the age for full benefits and so forth. A time when defined benefit pensions are disappearing and under-funded, most people's retirement savings are inadequate, many face bankruptcy and foreclosure due to unemployment and/or medical expenses is hardly the time to cut Social Security benefits. If anything, benefits should be increased. Social Security should be discussed along with changes in 401k and IRA regulations designed to increase participation and reduce excessive administrative and trading costs. President Obama does not have my support on his ill-conceived Social Security proposal supported by ill-informed deficit hawks like Simpson, Bowles, Rattner, Peterson, et al.But SS most certainly does contribute to the deficit.

Money is going out, more than is coming in. That means that the principle is due on all those myriad of IOU's written to the fund. The fund that is empty except for IOU's.

And that in turn means that the general fund must supply those funds if payments are to be made; the deficit increases. To claim that SS does not affect the deficit is just spin and lies - an attempt to cover up and sweep under the rug past actions that are now coming home to roost.

But you're right that SS should be increased. The amount of FICA tax paid is far more than sufficient to maintain a very comfortable lifestyle, but only if it is invested wisely. That congress is unable to produce or use that wisdom is no reason to penalize the people that paid for their retirement, and paid well."But SS most certainly does contribute to the deficit."

Only in the sense that the government borrows from SS funds for other expenditures--military, etc.I refer more to the fact that it has already "borrowed" those funds and now have to borrow more to repay them. That increases the deficit.

Social Security hasn't borrowed anything. The money was "borrowed" by Bush and the Congress as a result of a huge tax cut for the richest Americans, to pay for an unfunded Medicare drug program written by the pharmaceutical companies and to finance two very long, costly, unnecessary wars. Enough FICA taxes were collected to pay SS benefits without borrowing anything. Eventually, because of the growing number of retirees relative to the number of workers, SS taxes won't be enough to pay the benefits unless steps are taken to insure financing is sufficient. This can be done in a several ways or a combination of ways: raising the earnings cap, increasing the FICA tax, cutting benefits in event of early retirement, or, as Obama and the Republicans have proposed, changing the COLA adjustment formula to reduce the rate of increases based on the Consumer Price Index, so called "chained CPI." The deficit hawks have jumped on chained CPI and convinced Obama to propose it. This makes no sense because personal retirement savings are inadequate and fewer each year are covered by traditional pension plans. If anything SS benefits should be increased, not cut, in my opinion.

Ralph, could you post a reputable link backing up your claim that Bush used monies earmarked for the SS trust fund to pay for those things?

Money is fungible. Deficits under Bush were huge. He most certainly borrowed from the SS trust fund to finance them. The quote below from Wikipedia may help:

"Some in our country think that Social Security is a trust fund – in other words, there's a pile of money being accumulated. That's just simply not true. The money – payroll taxes going into the Social Security are spent. They're spent on benefits and they're spent on government programs. There is no trust.[16]

These comments were criticized as "lay[ing] the groundwork for defaulting on almost two trillion dollars worth of US Treasury bonds".[17]

However, even right-leaning politicians have been inconsistent with the language they use when referencing Social Security. For example, Bush has referred to the system going "broke" in 2042. That date arises from the anticipated depletion of the Trust Fund, so Bush's language "seem[s] to suggest that there's something there that goes away in 2042."[18] Specifically, in 2042 and for many decades thereafter, the Social Security system can continue to pay benefits, but benefit payments will be constrained by the revenue base from the 12.4% FICA (Social Security payroll) tax on wages. According to the Social Security trustees, continuing payroll tax revenues at the rate of 12.4% will enable Social Security to pay about 74% of promised benefits during the 2040s, with this ratio falling to about 70% by the end of the forecast period in 2080.[19]"

Here's another link that explains how SS works:

http://www.justfacts.com/socialsecurity.asp

Social Security is an insurance program managed by the government. Not an investment bank. When you pay premiums to the insurance companies they don't save that money for you and pay you interest, not one cent.

All the more the more reason to get rid of it, and create a real retirement account that actually belongs to us and can be passed on to heirs.

Have you heard of 401ks and IRAs? SS is analogous, in some respects, to car insurance. What you collect doesn't correspond to how much you put in. Some live long and get much more than they contribute. Others die the day after they become eligible and get nothing. Some become totally and permanently disabled and collect a lot. There is a benefit for orphaned children which is paid for in part by contributors who have no children or who don't die before their children grow up. SS is a highly successful and important program.

Bush tried to "get rid of it" (privatize it), but he didn't get very far.Apparently there's a new documentary coming up on PBS that exposes the scam behind 401K plans; appears they're a rip-off, as well. There's got to be a bottom-up way of providing financial security for people rather than designing everything for the benefit of those at the top, with people below them getting crumbs. If you don't think Democratic politicians support a form of "trickle down," think again.

John Bogle, inventor of the index fund on 401k plan defects:

So if I do your average, what percentage of my net growth is going to fees in a 401(k) plan?

Well, it's awesome. Let me give you a little longer-term example. The example I use in my book is an individual who is 20 years old today starting to accumulate for retirement. That person has about 45 years to go before retirement -- 20 to 65 -- and then, if you believe the actuarial tables, another 20 years to go before death mercifully brings his or her life to a close. So that's 65 years of investing. If you invest $1,000 at the beginning of that time and earn 8 percent, that $1,000 will grow in that 65-year period to around $140,000.

Now, the financial system -- the mutual fund system in this case -- will take about two and a half percentage points out of that return, so you will have a gross return of 8 percent, a net return of 5.5 percent, and your $1,000 will grow to approximately $30,000. One hundred ten thousand dollars goes to the financial system and $30,000 to you, the investor. Think about that. That means the financial system put up zero percent of the capital and took zero percent of the risk and got almost 80 percent of the return, and you, the investor in this long time period, an investment lifetime, put up 100 percent of the capital, took 100 percent of the risk, and got only a little bit over 20 percent of the return. That is a financial system that is failing investors because of those costs of financial advice and brokerage, some hidden, some out in plain sight, that investors face today. So the system has to be fixed.

Editor's Note: For details on this example, see this table.

I've got to unscramble what you just said. You said that in the case of the $1,000 invested for 65 years, the financial system is taking 80 percent of the money. But most of us aren't doing that. In the first place, at 20 we're out spending it; we're not putting it away. But set that aside. We're really talking about people who are probably saving from 35 or 40 or 45 at best for retirement at 55, 60 or 65. and they are plunking the money away into 401(k)s. I'm just asking you, in that system, roughly what chunk of it are people getting back themselves out of their gains, and what chunk of that is going to go to the financial system for managing their money?

Well, in the long run, it's 80 percent to the financial system, 20 percent to you. In a given year, it's about 80 percent to you and 20 percent to the financial system, so if you look at 10 years or 15 years, you're probably talking about 60 percent to you and 40 percent to the financial system maybe over 20 years, something like that. But the longer the period, the greater the impact of that tyranny of compounding costs is.

How do you get costs out of the system? Aren't you stuck? You are in a 401(k), and you've got only 11 options or 28 options from your company, and they are all through Vanguard, Fidelity, T. Rowe Price, somebody else. Can you get the costs out?

Easy. You own [a market index fund]: the entire U.S. stock market or maybe 25 percent international, the entire U.S. bond market, or just simply go to government intermediate-term bonds and don't pay anybody for those services. The costs are going to be about 10 basis points or 15 basis points instead of 2.5 percent a year, that 10 or 15 basis points meaning a tenth of 1 percent or a little bit more. It is all you need to pay to own the market.

And do most company 401(k) plans give you that option, buying a market index, or are you given the portfolio that comes with the mutual fund company that the company has signed up with?

The index fund is an increasingly popular option with corporations, and not all of them, but I think some of them, are kind of expensive. Some are charging half of 1 percent. But even that is better. The regular mutual funds which are selling regular equity funds are charging you, as far as you can tell, somewhere between 1 percent and 1.5 percent a year in costs and have hidden portfolio turnover costs: They are turning over their portfolios at 50, 60, 70, 80, 100 percent a year, and there's a hidden cost that you don't even know about that gets paid to the financial system by all that active management.

So I'm a complete believer in capturing the market return through an index fund rather than taking probably about a 5 percent chance over an investment lifetime of beating the market after all those costs. ...

But one of the ideas behind the 401(k) was, "you can do it!" You own it; you run it. And you've got millions of people out there saying, "I can beat the averages." What do you say to that?

I say, don't kid yourself, pal. Look, it's so simple. We're not like the kids out in Lake Wobegon. As investors, we are all average, and as investors, we all share the stock market's return. It's going to turn out to be 8 percent return, we're all going to share 8 percent return, but only before costs are deducted. We all share the market's return less the cost of the financial system. All those management fees and brokerage commissions and sales loads and God knows what else is thrown in there -- the advertising that you see.

So if investors would just use index funds, and particularly the cheapest ones, they would, by definition, capture the market return, or almost all of it -- 98 percent, 99 percent of it. ...

The evidence is profound that mutual fund investors make terrible errors in terms of timing. They want to pour money into the stock market when it's high, and they want to pull it out when the market is low. They make terrible errors on fund selection. They want to buy funds that have done the best, and then when they do the worst they want to switch out of them and get into something else that is then doing the best. All that shuffling around is a tale told by an idiot, full of sound and fury, signifying nothing but losses for the investor.

... Then another place we have really gone awry is we now offer people basically a nice little shotgun by which they can commit suicide: We have given them brokerage accounts, and you can run a brokerage account in your 401(k) plan. So you can then buy individual stocks and go back and forth and do all the insane things that so many investors do all the time.

So we have taken a system that should be simple -- own the stock market and hold it forever; if you like bonds a little more as you get older, have more in bonds, and hold it forever -- [and] now it's pick and choose and select and move money back and forth, even to the point of where you can pick individual stocks and pick your company's stock, which is a big part of the 401(k) problem, and issue; you can do that, too. It's a system that really needs to be fixed, and badly.

You keep coming back to this idea that buying your own company's stock is a bum idea for people in 401(k)s.

Working for company X and having a substantial portion of your retirement plan in company X is simply exposing yourself to too much risk, because the company is both your employer and the source of your retirement income. So if something goes wrong, you lose both your job and your retirement plan.

Or, since employees seem to have a yen to invest where they know a little bit about the company, limit [that investment]. Ten percent in company stock is not the end of the world. But people got greatly overexposed, partly because companies pushed them into it, and partly because in a wave of enthusiasm -- Enron's stock goes way up, people of their own volition put more in that stock than they had to under the company rules, and the tragedy followed. There are plenty of them out there; it's not just Enron.

Looking at the mutual fund industry as a whole, how important was advertising in getting 401(k)s to be the rage of the country?

Well, the industry did not really advertise 401(k), is my recollection, in any big way. It's just too amorphous or inchoate a market to try and reach all the employees out there when you can target yourself right to the corporation itself and say, "We, Vanguard, or we, Fidelity, or we, Capital Group, are the best choice for you to offer to your employees in your 401(k) plan."

I think a good hunk of the responsibility for what's going wrong here in our 401(k) system is that targeting has basically been to the human resources department of these corporations, not to the financial department. I think the financial vice president might have made much more sophisticated choices about how to go about accumulating money for the long term as compared to the human resource departments.

The corporations should have taken a more important role in disciplining the number of choices that are offered to corporate employees -- maybe 12, 15, 20, 30 choices. How do you pick among 30 choices? I would say they should have given a stock fund and a stock index fund, a bond index fund or perhaps a money market fund for security, and let them change.

Today we're trying to creep up on that system with these target retirement funds, where you target your age, and you have more in stocks when you begin. Say you're going to retire 25 years from now. You might be 80 percent in stocks and 20 percent in bonds, and by the time you are retirement age or it gets 10 years away, you're maybe 90 percent in bonds and 10 percent in stocks. The target fund does that for you. But now people are going to probably choose that as one of half a dozen options when if you put your whole plan in it, it will work fine.

I mentioned before allowing employees to use brokerage accounts in their 401(k) plans. They think they can beat the market. How idle a chance, how idle a threat, how idle an opportunity is trading stocks back and forth and thinking you can win beat the system. You can't do it. Maybe one can out of 1,000, one out of 10,000. Maybe it's only one out of 100,000. The odds are terrible.

How did the mutual fund industry get so complicated? Today you're looking at a family of funds that's got 50, 60, 70 different funds, maybe hundreds of different funds.

That's a long story. Let me just give you a couple of ideas. When I came into this business, there were relatively small privately held companies run by the people that ran the management companies, and these companies were run by investment professionals.

Today that has changed in every single respect. These are giant companies. They are not privately held anymore. They are owned by giant financial conglomerates, whether it's Deutsche Bank or Marsh & McLennan [Companies] or Sun Life of Canada. Basically, the largest portion of mutual fund assets are run by financial conglomerates, and they are in business to earn a return on their capital in the business and the amount they have paid to buy into the business, and not the return on your capital as a fund investor. Corporations demand a return on their capital, and that comes at your expense as a fund shareholder. Of course the money managers are running the funds, but the corporate giants who run them don't have a professional bone in their body.

When I came into it, it was a profession with elements of business. Now it's become a business with elements of profession, and not nearly enough elements of a profession in it. We've become a marketing business, and that's where you get all these choices. If the world wants something -- new toothpaste, new beer, better bread -- we give it to them in our consumer society. That's not the right way to run a business concerned with other people's money. That's a sacred trust; it's not a marketing game.

So when you are talking about the individual investor winding up with 30 percent less of their gains over the short run or 60 percent less of their gains over the long run, the folks who are picking up that 30 percent or 60 percent are these giant financial conglomerates, the JPMorgans of the world?

Well, not necessarily JPMorgan, but any large financial conglomerate that is in this business is responsible for a big portion of that gain. But another big portion is the brokerage business itself, because these mutual funds today trade like they are in an Arabian rug market. It's back and forth with Wall Street turning over their portfolios at 100 percent a year, meaning the average fund holds the average stock for one year of time.

So the big financial conglomerate is both picking up the mutual fund fees and picking up the brokerage fees the mutual fund has generated by trading its stock.

Sure. Merrill Lynch would be a better example than JPMorgan, and any of the other giant brokerage firms are doing it. They're selling their own funds to the public, a little bit to a lesser extent now. But they are also getting a lot of money if, for example, Merrill Lynch sells the Capital Group fund to the public, the Capital Group gives them a lot of their brokerage business, and of course they say it's not a quid pro quo, and who am I to say that it is, but I'm not sure it matters. They get the money when they sell shares of the fund.

When I asked you earlier about the whole retirement system, you used the phrase a "perfect storm." To a certain extent, when you look at the retirement situation in America, are you saying a storm is brewing?

It's a generational storm that is coming in large measure because capitalism has gone astray. We have had what I describe in my book as a pathological mutation from traditional owners of capitalism, where the owners put up the capital and got the lion's share of the rewards, to a new form of managers' capitalism, where the managers, often aided by accountants and the financial system and the marketing system, are putting their own interest in front of the interests of the last-line owners, whether it's the direct owners -- the stockholders of America -- or the indirect owners -- the pension beneficiaries, mutual fund shareholders and the like. They simply aren't getting a fair shake.

Now play it out in terms of the retirement system. How does what you call managerial capitalism affect the defined benefit part of our retirement system, pensions?

... Well, on the corporate side, our CEOs and other highly placed executives in the company are basically getting paid for keeping the stock price rising. And the way you do that, if you can't earn money the hard way -- be more efficient, develop new markets, do a lot of innovation -- you start to manufacture earnings the financial way, changing the financial assumptions. Here, one of the big changes is raising the assumptions on your pension plan beyond reason, which means you make a nice profit that year; you know, you are paid basically on your profitability. But you as an executive are putting that impossibly high return on your pension plan, and those pensioners will eventually have to pay the price, or the corporation will have to.

So to use Lincoln's phrase, you're saying that a system run by and for the managers is going to make pension assumptions that make the corporation look good but also underfund the pension, and employees are going to pay in the end.

That's correct, although it could be at least theoretically possible that the next managers who come along after these CEOs will be in a position to pay that price. They're not going to be able to do it quite so easily. ... They will be a little bit like buying a pig in a poke.

http://www.pbs.org/wgbh/pages/frontline … bogle.html

Those who stole the money promise to make it right by using their taxing power to force the victims of the theft to pay themselves back.

For some reason, they think that is 'fair'.

It would appear that the problem stems not from Social Security but rather from management which governs the country. I daresay if by some miracle America can stop waging war especially the war on terrorism which implies warning forever money could be saved.

The idea that profit can only be made by large numbers flies in the face of at least one company we know of whom has been around for years still making a profit even though it's product is extremely expensive-who might that company be? That company would be Rolls Royce.

The the years I have read about government funding projects which I believe some are absolutely ridiculous such as studying bubbles similar to the ones we used to play with as children that's right the ones we use the stick that little plastic stem into the bottle pull it out and blow bubbles and the government is paying for this so-called research can anyone see money being lost here?

There are a number of ways to improve the economy in America rather than reaching for money that was never allocated to be used in such a way.What should be done? We should issue a full refund to anyone who has paid in then tell everyone to be responsible for their own money instead of relying on the government.

Without that refund including a reasonable interest, it isn't worth much. It's the 40 years of interest accumulation that makes those payments into something livable.

You mean government should be limited and not even involved in this sort of thing? What a novel idea!

Actually just stop running a system that depends on mass unemployment. Provide enough work for those who want to work and the net result will be a smaller SS budget and a larger tax pool.

Oh, and stop blaming the victims for the crimes committed against them."THE NATION" ON SOCIAL SECURITY: On the very day that a bleak jobs report exposed the feebleness of the recovery, the White House announced that the president will propose cuts in Social Security. This was designed to get Republicans to agree to negotiate a grand bargain on deficit reduction—or prove that they are obstructing a budget deal. House Speaker John Boehner's reaction immediately revealed the folly of Obama's ploy: "If the president believes these modest entitlement savings are needed to help shore up these programs, there's no reason they should be held hostage for more tax hikes."

The exchange has Republicans salivating. Cutting Social Security has now become Obama's choice, not something extorted by the GOP. This could imperil Democrats running for re-election in 2014; those who support Obama's proposal will face the wrath of seniors and a flood of Republican ads accusing them of wanting to cut Social Security. If Nancy Pelosi and Harry Reid have any sense, they will organize their caucuses and pledge to oppose any deal that cuts a dime from this popular New Deal legacy.

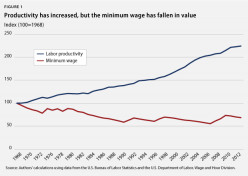

The economics of the president's proposal are even worse than the politics. The crisis we face isn't that Social Security benefits are too generous; it is that more and more Americans lack the means for a secure retirement. Only about 15 percent of employees have traditional defined-benefit pensions at their workplace, and 55 percent have no retirement plan at all. Decades of wage stagnation and the corporate rollback of pensions have sapped worker savings.

The Wall Street wilding that produced the Great Recession and the housing collapse savaged what little wealth workers had stored in their homes, as well as their 401(k)s and IRAs. And many families are racked by job losses or medical crises that upend their finances, forcing them to pay penalties to tap into retirement accounts.

Sixty percent of Americans receive at least two-thirds of their retirement income from Social Security, but the meager payments replace only 40 percent of earnings, on average. Most experts argue that retirees need about 70 percent to maintain living standards.

Yes, we need to reform Social Security, but the reform should increase—not cut—this crucial income support that millions rely on. In a sensible proposal released by the New America Foundation, Michael Lind, Steven Hill, Robert Hiltonsmith and Joshua Freedman call for adding a supplement to Social Security that would guarantee all retirees about 60 percent of their average wage in retirement (similar to that of most other developed nations).They would pay for the expanded benefit not by increasing the payroll tax rate, but by raising the payroll tax cap and eliminating top-end tax breaks, particularly those now offered to private retirement plans that disproportionately benefit the wealthy.

The authors argue that under their plan, we would end up spending about the same percentage of GDP on the nation's retirement system, but with a much fairer distribution of support. This would also stabilize the overall economy, since the elderly will spend those extra dollars, giving a boost to aggregate demand.

The greatest power of a president is the power to set the agenda. Barack Obama should be rallying Americans to protect and strengthen our already inadequate Social Security system. Instead, he's pushing for cuts. For most Americans, that's a lousy deal, not a grand bargain.

http://www.thenation.com/article/173773 … mailNationThe Nation? Could you possibly have used a more biased, far left source?

If you disagree with the facts or opinions in the article please explain why or provide a more accurate source.

Kenneth Bergman

Ashland, OR

NYT Pick

"I wouldn't be surprised to hear Republicans saying "Obama wants to cut Social Security for the elderly" when the next election cycle rolls around. And well they should. The Chained CPI is a very bad idea, and our President should hang his head in shame over pushing for it.

"The (faulty) concept behind the Chained CPI is that when people can't afford more expensive cuts of meat because of inflation, they will buy cheaper ones. Therefore, according to this convoluted logic, their rate of personal inflation doesn't go up as much because they are buying cheaper substitutes. But if you pursue this thinking to the limit, we'll all be eating dogfood or catfood someday.

"The Chained CPI concept has been floating around Washington for many years, but the Simpson-Bowles Commission (aka the "Catfood Commission") put it back on the table when they recommended it as a cost-cutting step. Although he has ignored most of the Commission's recommendations, Obama has latched onto the Chained CPI as part of his effort to seek a "grand bargain" with the Republicans in Congress. Of course, Boehmer and other Republicans have just spit in his face, but they'll be all too willing to use it in the 2014 Congressional campaign, just as they used "Obama wants to cut Medicare" in 2010 in an effort to scare seniors into voting Republican.

"The facts are that Social Security has been running a surplus until now, and it can be made solvent until 2100 by increasing the FICA tax cap. Say NO to Chained CPI! "Ralph Deeds

Birmingham, Michigan

Even though the economists may be correct in their view that the current CPI overstates living cost increases for many seniors, their Chained CPI recommendation ignores the facts that retirement savings are inadequate, fewer are covered by defined benefit pensions, many are unemployed, real wages have declined, and many have had their homes foreclosed and/or been bankrupted by uninsured medical costs. It would seem that these circumstances would lead a reasonable person to conclude that SS benefits should be increased not reduced..

April 14, 2013 at 12:36 p.m.

Reply

Recommend6It amazes me that the politicians and pundits on the right blame people for their own predicament -- including not saving enough for retirement -- when local and regional lenders and Wall Street wrecked the housing industry, wiped out 401(k)s, and pushed millions into foreclosure.

I agree. Too many Wall Street banksters have too much influence on both parties.

The Democrats should never have allowed the word "entitlements" to be used to describe programs we have all paid into all our working lives, to provide for money in our elder years. I want to scream every time I hear that word used in an innapropriate way.

That word has been used for quite a while - unfortunately. It's been given bad connotations, and many people think it means having an inappropriate sense of entitlement (as a narcissist would have), rather than meaning people have a right to the benefits of the program.

Hi Marcy,

I know the word has been used in the wrong way for a long time, but when the President saw he was facing people who were going to fight him about every little thing, I wish he would have had the sense to speak up about it. Many of my friends in their late 50's have been paying into Social Security since they went to work at 17 and 18. So they are entitled to get something back, that was the agreement. They aren't people who ever collected unemployment, and many never had time off work unless they had surgeries, Moms had babies, or worked for a company for over 10-15 years like we have to in the U.S. to get our precious 3 weeks of vacation time, not nearly enough. And much of that gets used to take care of sick family members, even though Bill Clinton authorized the Family Leave Act, you still don't get paid. I guess I'm sick of hearing good, hardworking people characteized as lay abouts and lazy non workers.

I am inclined to agree with you Jean Bakula.

As I see if the problem is not Social Security nor has it ever been. The real problem is the mismanaging of the United States. We FORCE people to pay into the program and after years of complying then when the cost of mismanaging and the funds are tight we now say we are GOING TO FORCE YOU to give up the money We Promised you when you started paying into the system.

Apparently mismanaging is an acceptable practice as we need only look back at these corporations who mismanaged their business only to be bailed out by our government for no other reason than incompetence.

How Much Does It Cost to Be the Police of the World?"Budget Negotiating Chip Has Big Downside for Old and Poor.

http://www.nytimes.com/2013/04/20/your- … l&_r=0

"...Social Security, which is self-financed through payroll taxes, does not contribute to the deficit. Yet it is being lassoed into the broader debate. ...while some lawmakers insist that we can’t ask the wealthiest Americans and large corporations to pay a penny more in taxes....

"...The Obama administration proposes to water down one of Social Security’s strongest features: the inflation adjustment, which enables retirees to maintain their purchasing power over long periods....the rate of slower growth would still compound over time and would ultimately cost many older people thousands of dollars over the course of their retirement....

"...The switch to a different measure of inflation — known as the “chained C.P.I.-U” — would resolve about 20 percent of the program’s current shortfall, according to Social Security’s actuaries..."

"...The “three-legged stool” of retirement — that is, pensions, savings and Social Security — has already become more of a lopsided two-legged stool, because pensions have been waning for years. And the Social Security leg is providing most of the support for many retirees: about 43 percent of single people and 22 percent of married couples rely on the benefits for more than 90 percent of their income, the Social Security Administration says. More than half of couples and 73 percent of singles draw more than half their income from the program...."

"...Social Security advocates say there are a variety of other ways to strengthen the program that would not be as burdensome to retirees. Currently, employees and employers each pay 6.2 percent on the first $113,700 of earnings (self-employed people must pay the entire 12.4 percent). Eliminating the cap on which earnings are taxed would eliminate about 88 percent of the current shortfall, according to the Social Security Administration....""Have you heard of 401ks and IRAs? SS is analogous, in some respects, to car insurance."

I understand it perfectly, Ralph, but do you understand the concept of freedom? Americans are being forced by a tyrannical government to buy their 'insurance' plan, and now, we are also about to be forced to participate in another 'insurance' plan called Obamacare.

What about freedom and liberty, Ralph? What about those of us who prefer to make our own way on life?Under your concept of "liberty" we would be tripping over beggars on the sidewalks in every city like Bangladesh. "Community" is important as well as liberty. We are a rich enough country that children and adults who can't find a job should not be starving, begging or not getting medical care. Some day you may be glad you are getting SS and Medicare.

But where does it stop? People used to survive and live by dint of their own efforts. The a few decades ago we began feeding them. Then housing them. Then clothing them, and picking up their other bills such as electric and water bills and school lunches (including a take home dinner). We added such niceties as cell phones and now will provide all medical care for them.

Does it only end when everyone has an "equal" amount? When we've degraded our economy to the point of third world countries by removing any and all incentive to work will the socialist liberals finally be happy?"Does it only end when everyone has an "equal" amount?"

In case you haven't noticed income and wealth disparity has been going the other way, big time for the past 40 years or so. The rich are getting richer and the gap between them and the middle class and the poor has grown considerably. Republicans whine about "redistribution" but fail to recognize that the redistribution has been going from the middle class to the rich in this country.

Fortunately, I've had no personal experience with welfare. However, my understanding is that Clinton and Gingrich added a work requirement, and I read somewhere recently that most of the current beneficiaries are children. Moreover, thanks to misguided economic policies there are plenty of people with families working part-time at minimum wage jobs or unable to find any job. Here's what Paul Krugman had to say about this today in his OP-Ed "The Jobless Trap":

http://www.nytimes.com/2013/04/22/opini … n&_r=0Nice. More emotional arguments to sustain and, I presume, expand the system.

Does that mean that you agree it should not stop until we're all back to scratching out a living from straw huts while trying to feed 10 more besides ourselves?""Does it only end when everyone has an equal amount?"

I'm not aware of anybody who has suggested that "everybody should have an equal amount."Don't know - every year it seems we take more from the "haves" and give it to the "have nots". It's to the point already that the "haves" are paying taxes to the point that the "have nots" are ending up with more than some of the "haves" that are supporting them.

Where does it end? Is the next freebie a new car? Free internet (already done in some towns) or free cable TV? Where does it stop?You mean like this?

A small but growing number of American corporations, operating in businesses as diverse as private prisons, billboards and casinos, are making an aggressive move to reduce — or even eliminate — their federal tax bills.

They are declaring that they are not ordinary corporations at all. Instead, they say, they are something else: special trusts that are typically exempt from paying federal taxes.

The trust structure has been around for years but, until recently, it was generally used only by funds holding real estate. Now, the likes of the Corrections Corporation of America, which owns and operates 44 prisons and detention centers across the nation, have quietly received permission from the Internal Revenue Service to put on new corporate clothes and, as a result, save many millions on taxes.

The Corrections Corporation, which is making the switch, expects to save $70 million in 2013. Penn National Gaming, which operates 22 casinos, including the M Resort Spa Casino in Las Vegas, recently won approval to change its tax designation, too.

Changing from a standard corporation to a real estate investment trust, or REIT — a designation signed into law by President Dwight D. Eisenhower — has suddenly become a hot corporate trend. One Wall Street analyst has characterized the label as a “golden ticket” for corporations.

“I’ve been in this business for 30 years, and I’ve never seen the interest in REIT conversions as high as it is today,” said Robert O’Brien, the head of the real estate practice at Deloitte & Touche, the big accounting firm.

At a time when deficits and taxes loom large in Washington, some question whether the new real estate investment trusts deserve their privileged position.

When they were created in 1960, they were meant to be passive investment vehicles, like mutual funds, that buy up a broad portfolio of real estate — whether shopping malls, warehouses, hospitals or even timberland — and derive almost all of their income from those holdings.

One of the bedrock principles — and the reason for the tax exemption — was that the trusts do not do any business other than owning real estate.

[Romney used some kind of an accounting trick like this to get $20 million into his IRA.]

http://www.nytimes.com/2013/04/22/busin … taxes.html

"...Don't know,every year it seems we take more from the "haves" and give it to the "have nots"

It may seem that way, but the numbers don't bear it out. The rich are getting richer, and the middle class and the poor are going backwards.*shrug* What do you expect? When those with enough money to fight back against the constant onslaught of taxes, taking what they have earned to give it to someone else, they will do so.

And absolutely the numbers DO bear it out. A typical family of four on welfare of all kinds will take home more in spending ability than I've earned in any but a handful of years. While I helped to give it to them through taxes I paid. You're talking $50,000 per year in buying power, between food, housing, medical, straight welfare and all the rest. I seldom earned that much with two people working and paying taxes.Can you prove that with real figures based on real examples? Can you put names to these mythical families? Looking at food stamps alone, according to figures from the state of Massachusetts, a four-member family can get a maximum of $668 a month, and that goes down with any income at all. Most people other than the elderly and children are not living off welfare, but are working low-income jobs, often more than one, and use various forms of welfare to supplement their income. Many forms of welfare are not even available to two-parent families. Any marginal increase in income and recipients are quickly booted off any welfare they have, and they typically have to report to whatever agency is overseeing their program monthly. Nobody in this country who is legally receiving assistance is living a life of comfort and ease by being on welfare.

I guess that depends on what you call comfort and ease. To me a family of four can get along nicely on $40,000 per year; my wife and I do on little over $30,000.

Such a family, with no income, will get food stamps, subsidized housing (at next to no cost to them), and free medical care. They can get education assistance - college at little to no cost. Subsidized or free electricity. Free school lunches, often with a take home dinner. As much as $1,000 per month in cash is available in some states. And out of all that, they will owe zero in income taxes, while I will pay 10-15% of my $30,000 to help provide for those maxing out their welfare status. Now add in the EIC that is often available as well - that can amount to nearly $400 per month.I don't have the exact figures off the top of my head, but a family of four can earn just as much in welfare +wages with the father working part-time at minimum wage, than if the father took a full time job earning $65k per year.

I've seen that figure, too - just can't remember where.

Which doesn't say that benefits are too high but that pay is too low.

But that is 100% a matter of opinion. In my 40+ years of working (usually with 2 children to support) I think I earned $65,000 just once and with 2 earners. A great year, and one that made me feel rich. Able to do and buy nearly anything I wanted even as my taxes drug others along with me.

No, John, jobs paying $65,000 aren't too low as a matter of course, and there is no possible reason to give stolen money in that amount to a family of four to provide for their needs. At least there isn't unless one is a socialist, demanding that everyone have equal wealth whether they produce it or not. I don't subscribe to that quaint notion and so find it quite objectionable when some else surpasses my earnings ability primarily by way of charity handouts using what I produced to do so.How many years ago did your earnings beat $65,000?

Socialists don't demand equal wealth, they demand equal opportunity. That extends to the equal opportunity for everybody to be able to go out and earn sufficient for their needs, not to be thrown on the unwanted pile or the too low paid to exist pile .

This doesn't take into account the fact that people are generally on assistance for limited amounts of time, and not all families will be eligible for all programs. The average length of time a person is on food stamps is 8 to 10 months; this is reasonable, considering how long it takes someone who lost a job to replace it these days. Some programs have specific time limits, after which people get kicked off no matter what their financial situation is.

Want to trade your work life for welfare? Go ahead. You'll find it full of bureaucrats dictating your life, rummaging through your personal and financial information, and waiting to find reasons to boot you off whatever program you're on. It's no way to live. I was forced to take advantage of some programs -- food stamps, fuel assistance, and local rental assistance -- for a brief period a few years ago when the bastards on Wall Street managed to take down the publishing industry with it; I got off the programs as soon as possible, built my life from scratch, and swore I would never put myself through that again. When I had to replace my car a couple years ago I bought a van so that if things went to hell again I'd have a place to live. I'd rather live under a bridge than go through that experience again.

Want to live off welfare? Go ahead; make my day.

"constant onslaught of taxes,"

Taxes have been going down. Apparently you haven't noticed.No, I haven't noticed. In fact, I pay more taxes. In January, my taxes increased.

You apparently don't have enough effective lobbyists working on you behalf in Washington and your state capitol or a smart enough tax preparer making sure you get the advantage of every loophole as was the case of Romney whose tax return was reportedly the size of a NY City phone book.

Here's a link to a history of U.S. individual income tax rates:

http://taxfoundation.org/sites/taxfound … 2013_0.pdf

"What about freedom and liberty, Ralph? What about those of us who prefer to make our own way on life?"

I value freedom and liberty just as much as you do. But you are speaking in empty generalities. The difference between us and between you and most Americans is that we hold community values as well.

Does your state require liability insurance on your car? Does the bank that holds the mortgage on your house require fire and casualty insurance? There are good reasons for those requirements just as there's are good reasons for Social Security and for paying other taxes established by our state and federal representatives. You need a time machine to take you back a couple of hundred years to the Northwest Territory or Alaska.Voluntary community values, Ralph?

Or community values by force?Voluntary community values are admirable, but they often aren't sufficient. Laws passed by our elected officials aren't equivalent to "by force." You should work to oppose or repeal laws with which you disagree. It's called democracy.

- JaxsonRaineposted 12 years ago

0

Ralph, that post is hogwash. They didn't take 110,000 away from you. You can't count the future return someone might make off of some money as part of the cost.

That's like saying that if I buy a car for $20,000 at age 20, that I paid the car company 2.9 million for the car, because that's what $20k would be worth after 65 years of 8% returns.

Complete nonsense.Many if not most 401k providers are ripping participants off. I would only participate in order to get a match from my employer. Without a 401k match a Roth or Regular IRA would offer a significantly better return.

I'm just talking about the asinine extrapolation of a cost to its potential 65-year investment growth.

Have you heard of John Bogle? He's on the side of investors, not Wall Street. I'm sure his calculations are 100% accurate and that many 401k plans are lousy investments unless there is a substantial employer match. Why do you think his 65 year extrapolation is assinine? Please explain. A 401k plan is a long-term investment for many people. I benefited from a savings stock purchase plan under which my employer put in 50 cents for every dollar that I put in up to a max of 10%. That meant that for 34 years saved 15% of my salary. The company contribution went into my employer's stock with a requirement that I couldn't sell it for three years. I sold it on the three-year anniversary every year and invested the proceeds into more diversified investments (GICs when interest rates were quite high and mutual funds, later.) As a result, my income is higher since I retired than it was before I retired. That's what I good 401k plan could do if Wall Street didn't rip the participants off.

Ralph, I already explained it. But, let's try again.