More to think about.......

Yea, that doesn't oversimplify it or anything...

I'm sure you would like to complicate it with a bunch of BS .!

Then tell me John in your unbiased way who is at fault for the housing bubble to burst.

You really need him to answer that???????????

Or any other liberal here American or not?????????No........

You are supposed to be one of those with all the answers. It's your turn.....He already has Ralph, it was entirely the fault of the democrats!

Naturally. Bucky's interested in a partisan rant, not an honest, serious discussion. I'm willing to admit that the Democrats were partly at fault. I suspect Clinton wishes he had not signed the bill repealed the Glass-Steagall Act which prohibited banks from playing risky games with deposits insured by the government.

It had a lot to do with personal responsibility in my opinion as well. People wanted to live a life they couldn't afford before they earned it.

+1 Sellers can't sell, and banks can't make a loan, without a willing customer.

And how many people willingly pump substances into their bodies that they know will probably kill them?

I would not estimate over 95% of the population. The numbers of people imbibing cyclamates, nicotine, tar, corn syrup, ethanol, marijuana, opium etc. is high, but not 100%.

Not sure of your point, though...Point is that not everybody is as clued up as we are.

Many people will, if told by the bankers, that of course they can afford a $1000 a month mortgage repayment on an income of $1000 a month will believe them and take it.

And that is not to say that many people are stupid,just not very numerate.Really, People believe they can afford something because someone told them they could? They are oblivious to how much they make and bring home? Ive never actually met anyone that stupid, close, but not that f#@king stupid!

Yes, many people!

I've known people who've refused pay rises because it would move them into a higher tax bracket and they've thought that would result in all their earnings being taxed at the higher rate leaving them worse off than they would be if they didn't accept it.

In the 1980s Labour lost the General Election largely because one of the right wing tabloids ran a scare story about how Labour would increase the tax rate for those earning over £30,000 pa. People who would be pushed to earn that much in a life time were outraged and voted conservative!

I could go on but you won't actually take any notice, so I wont.I really wouldn't take notice of what people do in a country in which I don't live. I have explained what caused the bubble to burst and you are right to a point. The people were not conned into buying something they couldn't afford they just hoped in spite of their fiscal situation they could pay for that house there was certainly greed involved but mostly from the home buyer!

No bankers rubbing their hands in glee at the thought of loads of free money?

It affected us here in the UK as well you know.

And don't forget, your democrats are just as capitalist as your republicans.And that would possibly be the only redeeming quality a democrat has! I'm sure there were greedy bankers who knowing the loan was backed by the Feds were greedy. But I don't think any of those bankers went looking for somebody to loan money to and the buyers were just as greedy.

The implication is that we all need big brother to make our decisions for us.

One which I reject 100%.

If you're incapable of figuring a simple budget, don't buy but with cash. Don't ask big brother to regulate both your and my decisions - just don't make any yourself and the problem is avoided without affecting me.No, we don't need big brother to make decisions for us, we need big brother to butt out and stop doing the banks dirty work for them.

I was a mortgage loan officer in the decade before the "housing bubble" burst. We were concerned that the two largest holders of mortgages in the United States, Fanny Mae and Freddy Mac, were continually lowering, or entirely eliminating, various financial criteria for qualifying for a loan. The influence of these Federally established lenders on the overall mortgage market resulted in an ever increasing risk.

The distortion of risk by Fanny Mae and Freddie Mac resulted in a market where the lowest payment, regardless of all other factors, was the ultimate lure for the borrower and the lender. The result was home values constantly inflated by lenders demanding more value and customers taking loans for homes that they could never have afforded without the aforementioned market distortions. It is Fanny Mae and Freddie Mac that pushed "No Doc/No Ratio/No Income" loans.

It is Fanny Mae and Freddie Mac that constituted a vast secondary market for high risk loans. It is Fanny Mae and Freddie Mac the induced the creation of other high risk loan instruments by private lenders chasing the competition. It is the pressure by other government entities to lend to customers who, in their understandable desire for a better life, would borrow sums far outside their ability to repay. It was these pressure that compelled leaders to seek higher profits to indemnify themselves and their investors from those increasing risks. It is a legitimate desire by investors to mitigate that risk that resulted in the creation of instruments filled with disastrous consequences.

This is not the first such real estate market bubble caused by government interference into the private market place. In The Housing Boom and Bust , Thomas Sowell explains how government involvement in real estate has created several "Booms" and "Busts" throughout American Economic History.

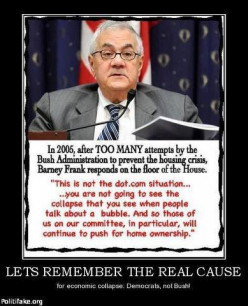

There may be no real villains but there are certainly dupes and doofuses, Barney Frank being among the latter. Ultimately, it is the desire for government to make life all skittles and beer and remove all reasonable effort to acquire a home that precipitated the entire mess. As Pogo said, in a simple statement of universal prescience, "We has met the enemy and he is us."

Not true, Jack. I had a front row seat for the housing/development debacle in Florida, and thus the world. It was the predatory practices of mortgage brokers who lured folks to the "American Dream" and made them believe it was within their reach.

Hey, they still pocketed the commission, what did they have to lose?Outside of naming it as "predatory practices", there isn't a lot of difference between what healthy fitness said and what you said.

People wanted, and bought, far more house than they could afford. It doesn't take a genius to make a home budget, they just didn't bother. Or didn't bother to figure out that when an arm interest rate went up they couldn't afford it.

You can't "lure" suckers that pay attention, and that is the duty of the new homeowner, not the evil banksters.You are obviously as green as goat shit.

As one of those ordinary people, like your insurance agent and appliance store salesman, whose income came from commissions, I can tell you that you are stuffed full of manure if you believe anything that has dribble out of your oral sphincter. Predatory lending is a word invented by those who wish to console the ignorant for their greed.

If not for the desire of greedy borrowers to incur vast sums of debt just to live in a house they knew they could never afford there would never be a housing bubble. If not for the willful distortion of economic information and the steady and deliberate dismantling of time tested lending practices, such as, income to debt ratios, down payments and proof of reliable income, by the FEDERAL government there would have never been a housing bubble.

You want to identify a villain, I have three for you - ignorance, government and liberalism. People who do not understand from where money comes, what it is or how it works are to blame. A government too willing to turn the risks that individuals and businesses take on into a risk that all taxpayers, and the overall economy, must backstop is to blame. Finally, the liberal idea that life is just way too mean and everything should be all rainbows and butterflies is mostly to blame. If not for liberal fantasies of how life is supposed to be people wouldn't be nearly as stupid and greedy as they tend to be once they realize government will protect them from their own bad character.

What caused the "housing bubble" to burst in 2007/2008, the facts are available and all fingers point to the Community Reinvestment Act (CRA) signed by Jimmy Carter (Democrat) in 1977 and strengthened under the Clinton (Democrat) administration. This law was strongly backed by such community organizers like the Association of Community Organizations for Reform Now, or ACORN, who benefited from the CRA and were awarded hundreds of millions of taxpayer dollars in grants to "help" low-income families obtain home loans.

The CRA allowed these community organizers to essentially blackmail banks to make loans to people who would never have qualified were it not for the government's intervention. If a small business owner were forced to conduct business in such a way, they wouldn't last a week, but because of the leftist mandate for "fairness," millions of people were able to buy houses they could not afford. Republicans didn't sponsor the CRA; it was backed by uber-liberals like Barney Frank and Chris Dodd.

Everybody involved in the process sought ways to make money and reduce risk, which resulted in home mortgages being bundled and sold so many times that eventually, there were no buyers left willing to purchase these mortgages that were clearly going to go to default, and the bubble burst. The Democrat sponsored CRA caused the housing crisis, not "Republicans voting against good policies the president wants to pass,"And the banks of course were totally blameless!

Amazing. You have to be one of just 3 or 4 hubbers to have understood the roots of the housing bubble.

It wasn't the bankers; it was the do-gooder politicians that decided everyone should have a house. Coupled, of course, with people that believed them even when they obviously could not pay for it.Again, far too simple.

There were so many factors that went into this more than just people had access to homes.

The banks were offering "no doc" loans because they were so desperate to loan to anyone because they could make money off of the deal.

Homeowners were seeing the value of their homes skyrocket. Why wouldn't they want to take advantage of this investment opportunity?

To simply blame this on Clinton and Carter is not seeing the full picture. You have to also factor in the fall of the economy at large as another reason why the housing bubble burst.I don't blame Clinton and Carter alone, no, Barney Frank/Chris Dodd/Maxine Waters and a whole host of scumbag democrats are just as guilty!

Go back, read and understand why no doc loans were being offered.

Banks didn't offer those loans " because they were so desperate to loan to anyone because they could make money off of the deal" - there was little to no money to be made from them.

They offered those loans primarily because they were being pressured to do so.The banks get to charge more interest on those types of loans. I fail to see how they aren't making a higher profit from that.

And btw, none of my line of thinking here is to dismiss the fact that making lending requirements looser didn't have a role to play in this.

All I'm arguing is that it wasn't the one and only culprit as some seem to suggest.Outside of a interest cap in general, I'm unaware of any limits on mortgage interest. Certainly I've paid from under 4 to double digits, and my son took one last year at 10%. The man I bought my first house from was paying 18% with a VA loan.

It's hard to make a real profit when the projected (and actual) result of a mortgage is default, no matter what the interest rate is.

By their shareholders?

I think it is rather naive to think the banks were blameless, who actually forced them to pollute the worlds banking systems by selling these toxic loans?No by politicians, democrat politicians.

So democrats forced the bankers to sell toxic loans!

Really.No, they were pressured to offer the loans to begin with. Selling bad notes to someone willing to buy them just makes sense.

They were encouraged to make bad loans by the central banks' manipulation of interest rates.

Indeed, they couldn't resist though, could they?

Why would they? I think it is the fault of aggressive intervention in the economy as opposed to 'lassiez-faire capitalism'. However, I believe in free will and lay equal blame to the banks for buying into the Fed and the BoE's policies (with the knowledge that if things go jippy they can get bailed out).

But deciding on the most appropriate economic policy to make is an entirely different thing. The obvious answer is to stop manipulating interest rates - they serve a very valuable market function that encourages banks to be more discerning about who they loan to and encourages creditors to be more careful about what they do with their scarce resources. Lowering interest rates for the purposes of 'stimulus' only serves to mislead consumers into thinking they can afford more than they actually can. No stimulus policy, no housing bubble; so what would be the purpose of aggressing on the market further?

"all fingers point to the Community Reinvestment Act (CRA) signed by Jimmy Carter (Democrat) in 1977 and strengthened under the Clinton (Democrat) administration."

That may have been one of many factors that contributed to the bubble and crash. The proximate cause of the crash however was the practice by the NY banks of packaging and selling bundles of subprime mortgage derivatives which had been greatly over-rated by the bond rating firms to unsuspecting investors all over the world and in some cases betting against the bundles of mortgages sold to their customers. Mortgage brokers sold "no doc" loans based on lying appraisals. There is plenty of blame to go around. Your comment is a gross over-simplification, Bucky.Sorry, already tried that line of thinking......apparently its all the democrats fault.

It is only over-simplified because it shows who is at fault! If you are willing to accept that Clinton is partially responsible then that shows you know that the democrats are solely responsible.

Your powers of reasoning are miniscule or non-existent. Bye, Bye.

Partially = solely!

Some reasoning there!

Is English your native language?Comprehension is a good thing.

I wont explain it to you this time.You should try it some time. If you can get the meaning "solely" out of the word "partially" then it is you, I am afraid, that lacks comprehension.

Didn't do that John, why is it so hard for you to read and comprehend?

You said

"If you are willing to accept that Clinton is partially responsible then that shows you know that the democrats are solely responsible"

It of course does no such thing.Then I give up! You'll just have to explain to me how Partially = solely.

Good heavens! I even quoted your post where you said it, but now you deny saying it!

Here it is again and in full this time -

"It is only over-simplified because it shows who is at fault! If you are willing to accept that Clinton is partially responsible then that shows you know that the democrats are solely responsible."I am aware of what I said and what I didn't say. Too bad you can't figure it out.

Yeah partially and solely are different things, obviously admitting one does not equate the other.

You two discuss it and I'll see if I care enough to get back to you, don't hold your breath.

I can figure it out and have done. Pity you can't figure out what you actually wrote!"

You conservatives are going to be consistently at sea until you start talking about the Federal Reserve.

One Hydra at a time. The tentacles of government created agencies distorting the market place are numerous, invidious, insidious and so deeply rooted their extraction all at once risks killing the "organism" - that would be the government liberated market.

The Fed is the Hydra's heart - it is what gives the government its power to extend itself into every aspect of our lives. What could be more powerful than to be able to control the very unit of exchange people use every day? If we trust the market at all we have to know that the less government in it the better it will be in the long term, so there is nothing to be scared of by shoving a spear through the government's heart.

I'm an abolitionist - central banking is immoral and therefore must go yesterday. It is absolutely no use skirting round shaving bits of the government here and there whilst the mother brain expands regardless. We don't need Mitt Romneys, we need Ron Pauls.No better proof exists than the Great Cyprus Bank Robbery.

I always notice...no matter what the incident or topic....

the left is never ever ever ever ever at fault. Even when it''s their responsibility. It's Bush....or something.....always and forever.

Best way in the world to indoctrinate is to tell the lie over and over and over and over and over and over and over and over and over...........And the right does that so well too. Or don't you like the competition?

Related Discussions

- 175

What Democrats Have Taught Me About Losing an Election

by Readmikenow 4 years ago

I have been confused as to exactly how to handle a Biden presidency. I consider him a babbling old fool who got rich selling out the United States and his vice president as a female who is a socialist/communist and had to sleep her way into a career. My opinion of both is extremely...

- 9

Do you contend that in 2016 that Americans will put a Republican president in of

by Grace Marguerite Williams 10 years ago

Do you contend that in 2016 that Americans will put a Republican president in office? Why? Why not?

- 77

Why is the left okay with racial slurs against Senator Tim Scott?

by Readmikenow 4 years ago

It is an example of the hypocrisy of the left. They believe they protect black people, except for black conservatives. I know black conservatives who have been lectured by white, female, liberals about being black. If a white liberal says anything racist about a black...

- 19

What will happen in the 2026 midterms?

by Scott Belford 8 weeks ago

If history is any guide, it will be a Democratic romp. Probably the best predictor is what is happening in the special elections in 2025. They have been devastating to Republicans. Republicans in trying to save face claim that there is nothing to see there because Democrats are winning in already...

- 22

Obama now & before the election

by Harvey Stelman 14 years ago

While on the campaign trail a video shows Obama saying the following.1- George Bush has run our debt to over $4 trillion, I will reduce it. I don't think that happened.2- My budget will straighten everything out. What budget!

- 112

Republicans are determined to keep ex-felons from voting in Florida?

by Credence2 5 years ago

Here in Florida was passed a ballot initiative allowing ex felons who have served their time and were not convicted of specific crimes to be allowed to vote. The ballot measure was passed in 2016.But aware of the ever present treachery of the Republican Party, this many people now having access to...