The Idea that Taxes are Theft

I want to get people's views on this.

The thread's inspired by comments I've seen from people in and outside of this forum that suggest taxes are theft.

The idea goes: if the government forces people to pay taxes (under threat of imprisonment) then they are essentially stealing people's money by force.

This view has never made sense to me. I've always seen taxes as part of a social contract. In exchange for the protections, freedoms and opportunities that come with being a part of civilized society, everyone who can afford to, pays something towards the upkeep of that society.

Some argue that taxation can't be justified in this way because you can't opt-out. If someone stops paying their taxes, government will just lock them up.

But it's not true that people can't opt-out. Only US citizens, permanent residents or a green-card holders must report their income to the IRS and pay tax on it. That makes sense, because only citizens enjoy the full benefits of living in US society. So taxation is closely tied to citizenship.

If someone no longer wants to directly pay towards the upkeep of US society, then effectively they are saying they no longer want to be a US citizen. The government can't compel anyone to maintain their citizenship, so it can't stop anyone from opting out of the social contract that requires payment of taxes.

For most ordinary working people, the negative impact of renouncing citizenship (e.g. uprooting and moving to another country) far outweigh the positive impact of not having to pay taxes, but that's not the government's fault. The full benefits of society are conferred only on citizens for obvious reasons.

This all seems logical to me, but some people genuinely hold view that taxation is a type of theft.

What are your thoughts on this?I agree with you that taxes are part of a social contract required to maintain the safety and security of a country.

They also are no different than the goods or services we buy at a shopping center. Taxes pay for goods and services from government.

You can't take something from a store and refuse to pay for it. You can't use roads, bridges, schools, military, etc., without paying for them. If you don't want to pay for them, you can choose to go to another country that doesn't have them.

Taxes are purely capitalistic.Hey promiseem, I think you might want to rethink that "goods from a store" analogy. Of course I must pay for the goods I take from the store. But I didn't take any pampers for the baby down the street, so why do I have to pay for them?

Or, to be less cute, I didn't buy a Trac phone, so why do I have to pay for the one someone else took, (without paying for it)?

GAYour point is well taken. But I think the complexity of our society doesn't allow us to get everyone to pay based on differing levels of use. At least not for the bigger items such as defense.

The exchange of funds and services is a contract between the government as a whole and the citizens as a whole. I saw the following definition online:

A social contract is "an implicit agreement among the members of a society to cooperate for social benefits, for example by sacrificing some individual freedom for state protection."I agree with your comment promisem, but it is extent of that "implicit agreement" that goes to the "legalized theft" point of the OP, and my thoughts about when the changes to that implicit agreement go beyond the commonly viewed basic social functions of government, ie. defense, roads, bridges, etc.

When those "changes" begin to be for the tangible benefit of some citizens, and not all citizens, and when the costs of those benefits are paid for by some citizens, and not all citizens - then I think there is support for some to have the legitimate view of "legalized theft."

You are right in that it is unrealistic to try to proportion taxes based on use - regarding our governments basic and primary functions, (again, that defense, roads, etc. stuff). But I don't think that is the issue of these taxation discussions. I think that, almost without exception, the discussions involve taxing for benefits to segments of society instead of the whole of society.

So it's not proportional taxation based on use, it's legalized theft by vote of the majority.

GAI'm with you on your first paragraph but not quite on the second. It's individual responsibility that makes a difference for me.

An abandoned child can't come up with a way of paying his or her fair share of taxes. So some of our taxes go to the care of that child. The child gains and we lose.

On the other hand, a fully capable adult who doesn't work and figures out a way of getting welfare is someone who gets benefits at our expense. To me, that's a legitimate form of theft.

The fact that our society sometimes succeeds and sometimes fails at dealing with certain segments should not be a reason to look on taxes in general as theft. I believe the real thief is the lazy bum who won't work."I believe the real thief is the lazy bum who won't work."

What about the person that simply wants. as opposed to needs, what they demand? A cell phone. A nice house, with separate bedrooms for all the kids, good food as opposed to marginal. Or the person that intentionally sets up situations where they cannot reasonably support themselves? Or even the person that continues to make bad decisions (maybe the single woman continually getting pregnant or the person building a home next to a river for the third time), counting on society to bail them out?

Thoughts?It goes to the merit part of individual responsibility. Society shouldn't pay for an individual's cell phone, etc. The individual has to earn it.

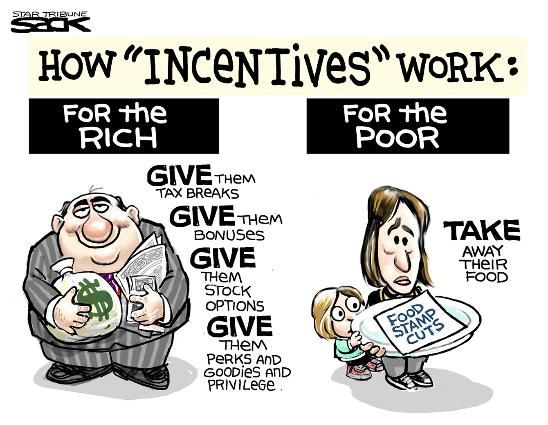

But there are limits to merit. A person doesn't "earn" $1 billion a year in zero-based stock options and no salary as part of a strategy to avoid income and employment taxes that benefits himself and financially harms society. That person also doesn't earn $1 billion by abusing the system to get that money.

I suspect you will like my first paragraph but not my second.

Your first is fine. The second ignores that nearly all these "avoidance" strategies are made possible as a scheme to benefit society. Take the social engineering out of the tax code and there won't be any of those schemes left. It also grossly exaggerates income - never heard of anyone earning a billion in a year. And finally, if a person is smart enough to use the tax code to their advantage (or hire someone to tell them how) then it is most definitely being "earned".

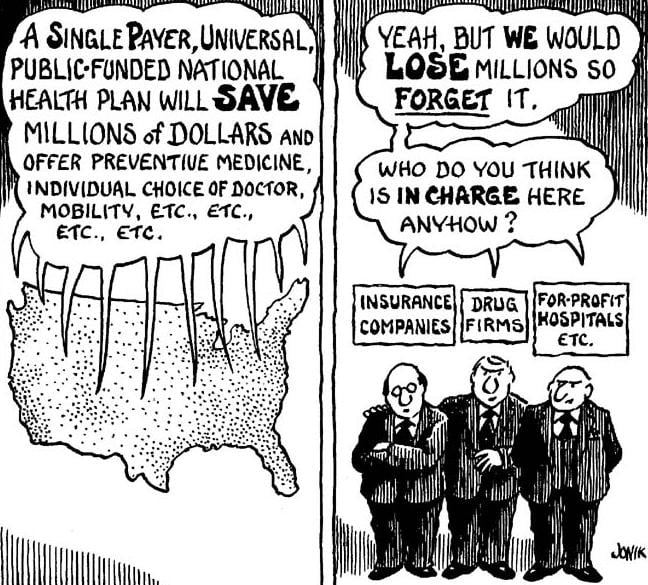

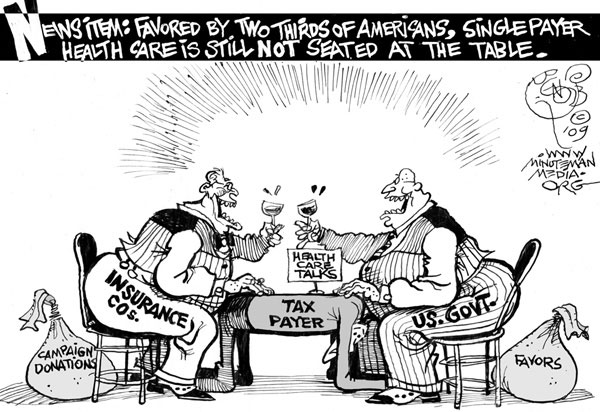

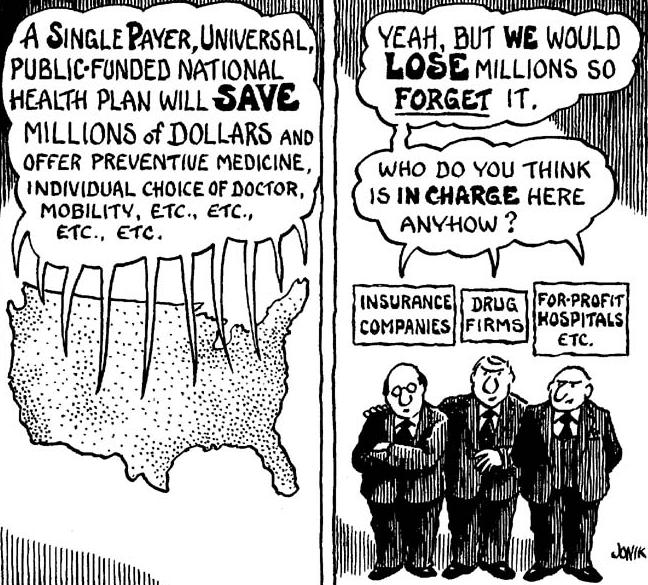

1. Those schemes benefit the individual and not society. They exist because wealthy people use campaign funding to get laws passed in their favor. That's why the top tax rates and corporate taxes have dropped so much over the last 30 years.

2. Earning $1 billion a year is quite common. I can give you plenty of examples if you want starting with the Koch brothers, the Google founders and Larry Ellison, among many others.

3. If a person hires a major law firm to manipulate and outmaneuver lowly paid IRS accountants at the expense of common people, it is not earned. It is an abuse of power.1. It is for what individual to give a tax break to build a business in a slum? I think you'll have to supply examples before I can understand this, along with the reasoning behind the law.

Tax rates have dropped because of tax avoidance schemes? That makes some sense (lower rates means it isn't profitable to search and use many schemes) but I doubt you refer to that.

2. No, no - not a company! An individual earning a billion. Lots of companies net a billion, but after spreading it through a thousand investors it doesn't amount to anything like that.

3. It is an abuse of power to follow the law? I don't follow that, and if you mean illegal activity, well, that's a totally different matter - using legal loopholes is not a crime and neither are "tax avoidance schemes" as long as they follow the law. Criminals need punished, not those lowering their taxes legally (remember Trump not paying for a couple of years?).

But I think the larger question is where does "help" end and "total support" begin? We could build giant dormitories instead of the section 8 program, for instance. We could give cheap food sufficient to sustain life instead of choosing what one likes. We could require a HMO type health plan instead of medicaid. We could require work for any benefits, even from the disabled.

Related question: Is a phony war a theft of our tax dollars and an abuse of the social contract?

Well now, that would be for another thread wouldn't it? Just as we are discussing what constitutes "legalized theft" here, we could discuss what constitutes a "phony war" there.

Do I need to page peoplepower73 to tell you the importance of staying on topic? ;-)

GA"Is a phony war a theft of our tax dollars..."

I am on topic. If your concept of taxes as theft applies to welfare, it must also apply to war and national defense. It is using our taxes to benefit individuals, i.e., the oil and defense industry executives who profited from the wasteful and unncessary Iraq war.

Have to go with promisem that that taxes are part of a social contract required to maintain the safety and security of a country. They also provide for roads, bridges, schools, etc. - things we all benefit from.

And just like he says, if you choose not to pay for those benefits you are free to choose a different country.

But is your question actually about taxes used to benefit specific individuals, or even small groups of individuals, without providing any benefit to the taxpayer?Actually you were the one who talked about taxes being theft.

I think what you're saying is that if taxes are used to build roads, water, provide schools and hospitals etc, - things the whole population can use - then it's not theft. But if taxes are used to assist a small portion of the population, like the poor, then it is theft.

The trouble with that is, how far do you take it? Is it theft that I pay taxes used to build interstate roads, when I don't own a car and never travel on them? Why should I pay taxes to build schools or pay teachers, when I have no kids? Maybe you own a car and never take public transport, so why should your taxes pay for that?You benefit from roads; your groceries come to you via roads if nothing else. Without the interstate system our economy would die within months. A good road system is absolutely essential to the country as a whole. Same with schools; it is absolutely essential for the country to educate it's children, at least a minimum amount. You live in a country - you are responsible for it's operation.

But it is NOT essential to support specific individuals that contribute little or nothing to the country. And you are NOT responsible for their support. That's not to say that you shouldn't feel a moral responsibility to help out, but that is not a reason for a third party to force you to provide support. It is your money and therefore your decision, not that of the third person.

I see it like this. Bob, Joe and Alice live in the same country, but a thousand miles apart. Bob is rich, Joe is doing well but Alice is poor. She has too many children for her income, chooses to live in a high cost area and refuses to train for a better job.

Joe finds out about Alice and sends her $50 to help out. He doesn't know her, has never met her, but wants to help the needy. Meanwhile, Bob has given $500 to help set up a local job skills bank to improve work skills of the poor in his town. Joe writes Bob, requesting Bob send money to Alice as she is poor as Joe doesn't want to cut into his own standard of living to support Alice; he reasons that Bob has lots of money and should support the needy. Bob refuses; he feels he has contributed enough already and feels no need to give to strangers on the other side of the country. Joe is furious; Bob is obviously cruel, heartless and uncaring. Joe gathers his friends, arms themselves and goes to Bob's house, stripping it of anything of value and doling out the proceeds to Alice to help her out on a weekly basis.

With a weekly income to supplement her meager earnings Alice has no need or desire to improve. She remains poor but lives a reasonable lifestyle, depending on the income from Bob's belongings for her support and the support of her children.

Bob's job bank has, by now, helped 10 people to double their income by improving work skills, and those 10 people have contributed to the job bank as well, allowing it to take in 20 people rather than 10.

You tell me: which person has done "right" and which has overstepped their moral authority by theft? Which has benefited from charity and which is locked into it? Which action (job bank or giving cash) produces the best results?

And finally, tell me if Joe had an ethical or moral right to take from Bob whatever he wanted, to use for purposes JOE defined - purposes which benefit Bob nothing at all.

You don't understand? Perhaps you should crack open a history book. Or maybe read the US Constitution.

From Wikipedia:

In order to help pay for its war effort in the American Civil War, Congress imposed its first personal income tax in 1861. It was part of the Revenue Act of 1861 (3% of all incomes over US $800). This tax was repealed and replaced by another income tax in 1862.

In 1894, Democrats in Congress passed the Wilson-Gorman tariff, which imposed the first peacetime income tax. The rate was 2% on income over $4000, which meant fewer than 10% of households would pay any.

https://en.m.wikipedia.org/wiki/Income_ … ted_StatesHardly anywhere near the kind of taxes that we face today. And they were all intended to be temporary for the cause of freeing the slaves.

Unlike today's congress...

You certainly got that one right - todays taxes are confiscatory, nothing less.

Do you mean confiscatory in the dictionary sense? "The action of taking or seizing someone's property with authority; seizure."

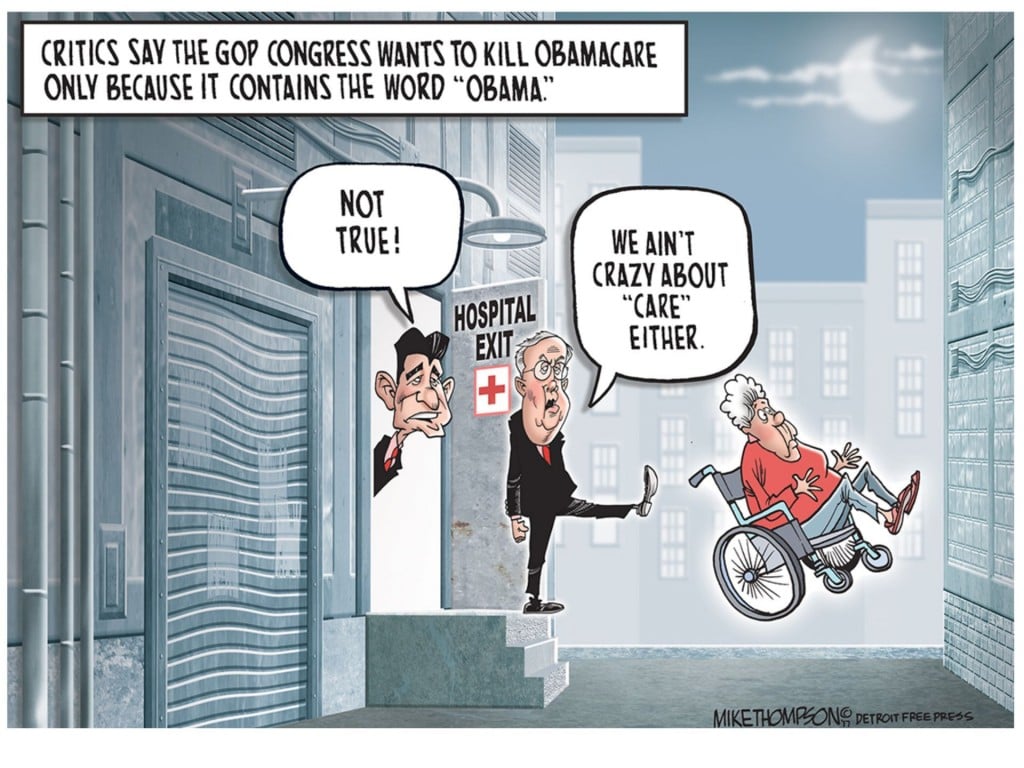

If taxes are part of the social contract, is the payment of them actually seizure if they are part of a social contract?I think the problem has become not so much the taxation but what they do with the taxes. And, how they work to figure out how to add more taxes (think Obamacare) and how they work to take money from anything else they've collected other than taxes (think Social Security). All whilst increasing the debt to record proportions.

Fiscal responsibility would go a long way toward stopping the moaning.Taxes and the proper use of them is a part of the social contract. When those taxes are confiscated (in the dictionary sense) and used for anything but the good of the country, of society, then it becomes something else. Greed, maybe - we want what we can't afford so confiscate the wealth of another to pay for it.

Both GA and Jennifer have explained this in greater detail.Maybe politics is ultimately about the size and shape of the social contract. Taxes and the proper use of them is often in the eye of the beholder.

Yes, and I explained the opposite perspective above - sorry you missed it. The 'proper use of taxes' doesn't happen when one political party imposes their ideals on the opposing side as if THEY are the only minority to be regarded as RIGHT. (I will remind you that Obamacare is the compromise between the two healthcare ideals of 'no healthcare' and '100% free healthcare.)

Really, did you even READ what I wrote above... The proper use of taxes is something to be negotiated or tinkered with, not REMOVED in order to remove programs that our society NEEDS.

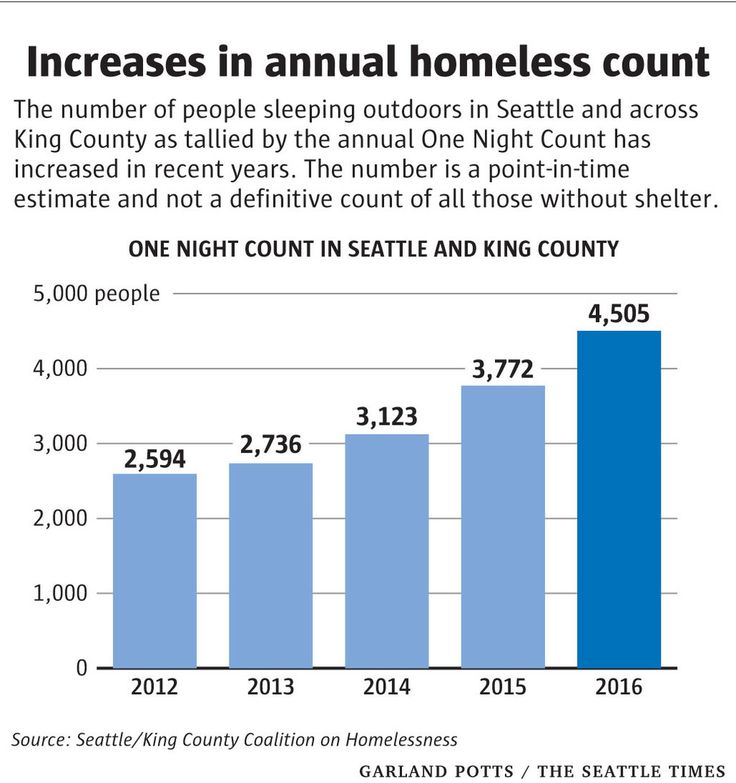

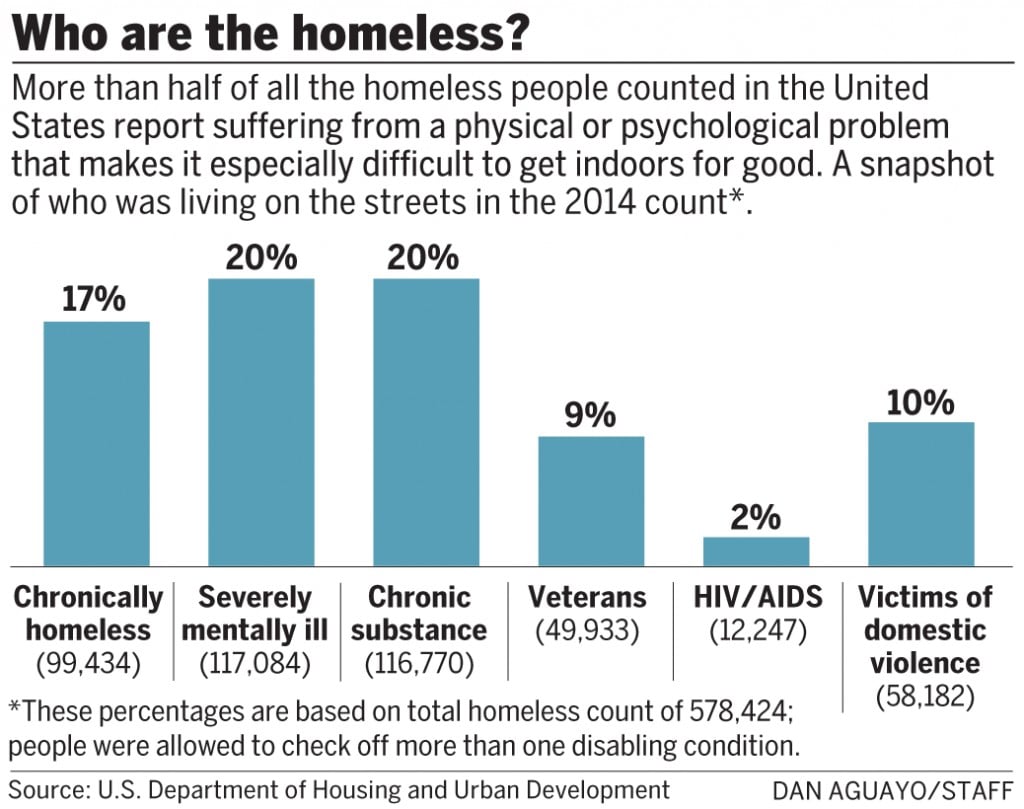

Our country has done a LOT to help create this homeless mess-hole; and one of the ways we've done that is by sending our soldiers across the pond for multiple 'tours' to save money, I guess. They finally return with mental battlescars, are released with an honorable discharge, then promptly kicked to the curb after their physical wounds have healed. Many of our homeless veterans are still young men under the age of 30 and we treat them like garbage!!

We created the homeless situation with the way we barely trickle funds needed into organizations that can help them. We created the situation by not adjusting things in our society that needed to be adjusted as they were happening with regards to things like education & jobs. The amount of people who fall between the cracks of 'not having enough money' because they have a low-paying job (I've told you before that MANY homeless people HAVE JOBS); and falling out of low-to-middle incomes by losing their job for whatever reason - and needing HELP to crawl back out of those traps is significant.

Also, depression is a HUGE contributor to our country's homeless problem; and our society is competitive, not inclusive. When have you EVER seen anyone continue to be immature or lazy or mooch off of others when they are HAPPY, capable and content within themselves to stand on their own 2 feet? Not nearly as much, anyway - and yet, healing mental wounds we can't see in the mind is not something you view as being necessary.

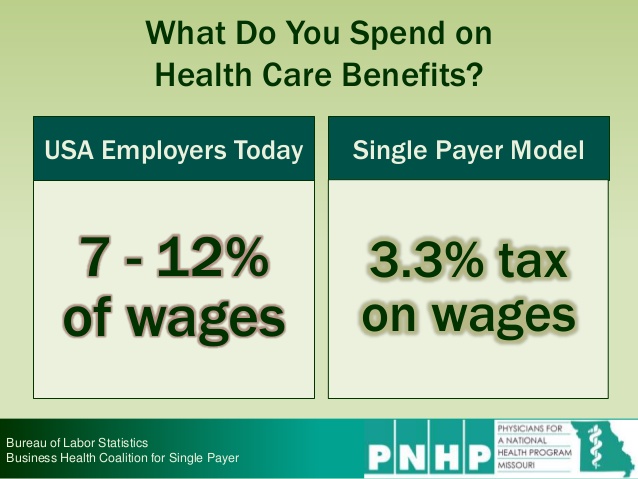

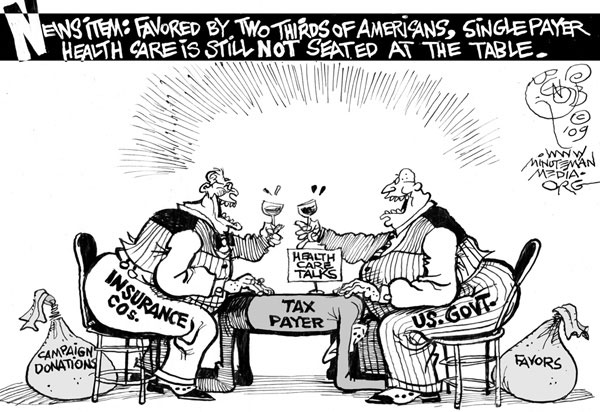

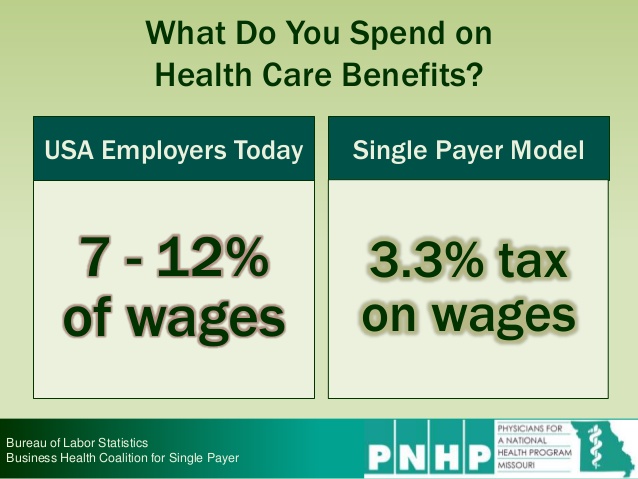

But, you consider any taxes witheld from you to be confiscated? Like I said, single-payer is becoming more & more of a scream since Trump has been in office. Get ready to be really ripped off in a few years when we implement that or something similar. I, for one, will be celebrating with the masses; and your complaints will be music to my ears when that happens. I'm really looking forward to saying, "I told you so."

Not the first or only time this has happened: chants of 'single-payer!' kept interrupting this Hostile Town Hall For Congressman Who Helped Save GOP Health Care Bill

http://www.npr.org/2017/05/11/527895032 … ealth-care

Why people hark back to the primitive and poverty-stricken past as some kind of utopia is beyond me.

And what is that nonsense about slaves? You think taxes are some kind of conspiracy perpetrated by black people?I just wish the Government was more efficient with our money. Why cant 600 million dollars worth of paychecks for deceased Federal employees build Spikes For The Homeless? They get paid, why cant they do something as productive as building spikes or other sharp objects for homeless people. This is something I could get on board with.

We should definitely go back to like it was in 1913. Strip voting rights away from blacks and women and make 8-year-olds work 18 hour days.

Exactly. If the Government can't spend 10 trillion dollars in the next 5 years, children with be forced back into the mines and women will not be allowed to vote. No other options that I can see.

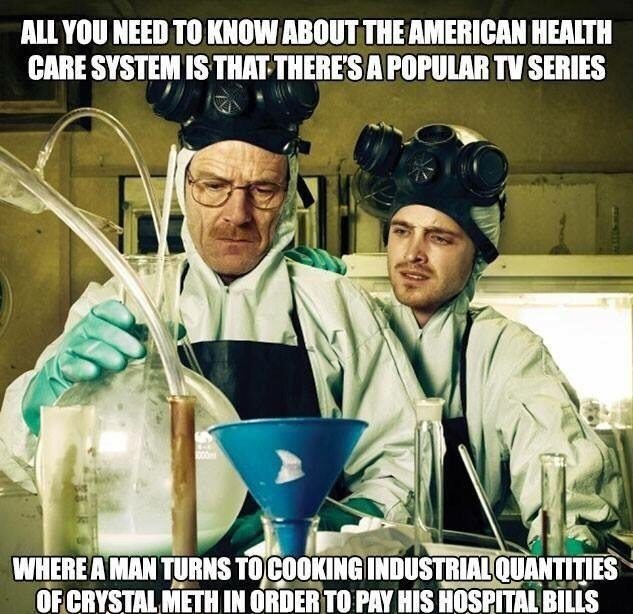

If you employed someone or a group of people and it cost you 600 million in wages, do you think you might just possibly notice when they picked up their paycheck and cashed them, that they were in fact dead?To your point, Warren Buffett pointed out the other day that health care expenses are far more damaging to U.S. businesses than corporate tax rates.

https://www.nytimes.com/2017/05/08/busi … ffett.html

The United States imposed income taxes briefly during the Civil War and the 1890s, and on a permanent basis from 1913.

So I am guessing that is where your '1913' came from.

Before that the US collected taxes on imports, whiskey, and (for a while) on glass windows. States and localities collected poll taxes on voters and property taxes on land and commercial buildings.

The fact is, governments collected taxes in biblical times, churches collected tithes.

Armies were often self financing, of course. Looting and a-pillaging.

Could cut back on taxes and go back to the looting. I suppose.The US Government paid 600 Million Dollars to deceased Federal employees. How do you think those folks will survive without our taxes to support them?

Hello Don W.,

Here are my thoughts, (since you asked).

As your question is posed - requiring payment of taxes as part of a social contract to be part of a society, I think your view is entirely correct. It is a legitimate demand. But...

...your question leaves out an important consideration regarding discussions about taxes - the application.

If all citizens paid the same tax, (or even the same rate of tax), then your view still holds, and there are no grounds for the "legalized theft" arguments. But that is not the case. From the very start, the Constitution's authors held the idea that selective, or progressive taxation was the only 'fair' way to finance our government. So, from the beginning our taxation has been based on moral judgement. And that does open the door for the "legalized theft" argument.

Then our income tax was initiated as a progressive tax. The more you could afford - the more that was demanded. Again, a moral decision. Albeit one that was accepted as the most "fair" method of supporting our government's needs.

And there is your legalized theft argument. Why should someone be required to pay more than others for the same services - just because they can afford to?

As a society we initially accepted this legalized theft via the progressive tax structure because behind its apparent "fairness" was the realization that it was also the only method that could finance our government without impoverishing our non-rich citizens.

Once we accepted that little bit of, (valid?), legalized theft as a necessary price for our society, for the basic government functions, as defined by the constitution, we started tumbling down that slippery slope of morally justified taxes, instead of equitably imposed taxes.

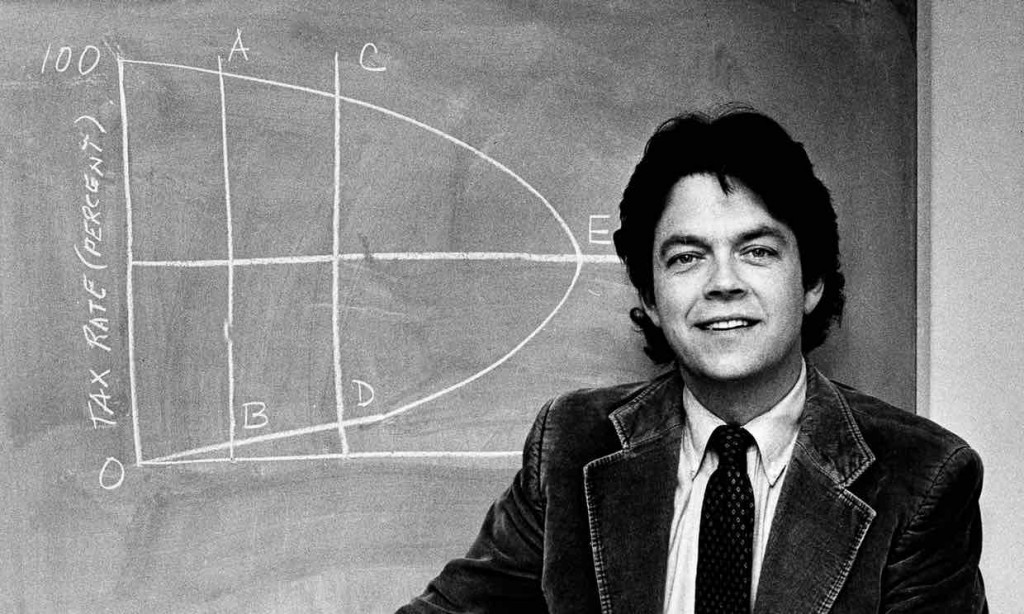

I think we have all heard of the time when the top income tax rate was 94%. That sounds like legalized theft to me - even if our government was in dire straits just to cover the basics.

Then we entered our more modern era when government went beyond its basic functions needs to its social support functions needs. As described by one of our more active forum members as; "cradle to grave entitlement" This is the era when our citizens discovered they could vote themselves all the "bread and circuses" they wanted. And this is also the era when our system of taxation became more a system of "legalized theft."

Those "cradle to grave entitlements" and those new "bread and circuses" demands weren't part of the basic social contract. And taxing 'some' citizens - not all citizens, to pay for them is legalized theft. The thoughts you mentioned encountering are just arguments regarding the degrees of acceptable theft.

... at least that's the way I see it.

GAThe numbers suggest that progressive taxation is pragmatic rather than moral.

U.S. federal budget: $3.65 trillion

U.S. population: 321 million

Federal budget per person: $11,371

Median household income: $56,500

Median household size: 2.6 people

If everyone paid the exact same amount of taxes, the median household would pay $30,000 a year just in federal taxes or 53% of their gross income.Of course it's pragmatic - there is nothing moral about charging different prices for different people, all for the same product.

But it becomes theft when those taxes are used to benefit individuals rather than society. We hollered and complained about bank bailouts (rightly so) but no one seems to be bothered when it is individuals rather than a group of people that profit.

(But you forgot about the myriad of other taxes that will lower the flat amounts to people. Not that it changes the basic equation; we cannot afford to all pay the same, even for basic govt. services.)I was addressing his comments about the moral basis of progressive taxing.

It is not theft when it benefits people incapable of caring for themselves, unless we are willing to let them die in the streets.

It is theft when we spend trillions of tax dollars on unnecessary wars to the benefit of defense companies.So was I. A case might be made for it being impossible to maintain the country, and therefore the "victim" is benefiting according to the social contract, but it's shaky.

Whether an action is theft or not does not depend on the use of whatever is stolen. Nor does it depend on whether the thief wishes a certain outcome over another. Neither one changes the morality of the theft. It might give a reason, and I might even consider it an excuse, but the morality has not changed because of either of those.

True. Now all you have to do is define "unnecessary wars" and prove it was for the benefit of defense companies. Your unsupported opinion is insufficient.

You are right promisem. I 'jumped the gun'.

In my example of the origins of the progressive tax structure - it was a pragmatic decision. But in later years when the rational became; "...it's only fair that the rich pay more," it did become a moral justification.

Your modern day numbers are the proof of that. We spent more than we had to provide the "bread and circuses" the public demanded.

GA

I've been reading the exchanges with interest.

From your comment, and others, it seems the issue is not the principle of taxation as part of a social contract per se, but the application of it; mainly the difference in how much people pay.

In your comment you see progressive tax as essentially a "moral judgement" which opens the door to the "legalized theft" argument.

But theft is essentially taking without consent or legal right, so to determine if something can be considered theft we need to consider how it relates to consent and legal right, not perceived fairness/ unfairness.

Let me offer an analogy:

Someone is a member of a gym, paying monthly dues in exchange for the benefits of being a member. The facts about the gym are as follows:

1. The gym has a legal right to determine the terms and conditions of membership, including its price structure, concessions and discounts.

2. The gym charges Alice $50 per month, but offers concessions for low-income earners. So Bob, a low-income earner, is charged $25 per month.

3. If someone doesn't like the terms and conditions of membership, they can cancel their membership and join a different gym. The gym has no legal right to prevent someone cancelling their membership.

4. If people maintain their membership, they must abide by the terms and conditions of membership.

Can Alice reasonably claim the gym is stealing from her? I would argue she can't.

Alice may believe it's unfair Bob pays less than her, and she is free to express that, and even lobby the gym's board to change it (although others can counter that by doing the same!) But by remaining a member, she is consenting to the T&Cs of membership, which the gym has the legal right to set. So she can't reasonably claim the gym is stealing from her, i.e. taking from her without consent or legal right. The fact of her continued membership provides both.Hi Don, I fully agree with your analogy. In respect of a county, whether it is the USA, the UK or any other democracy, the people make their choices on tax policies by which Governments they put in power through democratic elections.

In the case of British politics:-

• The Conservatives (Republicans) philosophy is lower direct taxes and higher indirect taxes.

• The Liberal Democrats (Democrats) policy in their election manifesto has always been to add 1% or 2% to everyone’s income tax. Yet in spite of this 25% of the British population usually vote for them; but they win fewer seats than this because General Elections for Members of Parliament are on the basis of first past the post for each ‘constituency’ (seat).

• The Labour Party and Greens (Socialism) is to increase income tax on the rich.

So at the end of the day, the people do give their consent to the taxation they get by which party they elect to power. Therefore, as you indicated the question of moral judgement or perceived fairness becomes more of an academic question until the next Election. And the same, I would have thought, would apply to America.Hello Don,

I would offer that the issue is not so much about someone having to pay more, but about why they have to pay more. As in what they are paying more for.

I think your gym analogy needs a few more details to be applicable;

First, it is the only gym in town, and Alice must attend a gym. Then, Alice's entire life; work, home, social life, are all tied to that town. So her choice is to attend that gym, or leave town.

Second, Alice understands the reduced dues for low-income Bob, and has no problem with it. So she signs-up.

But then, the gym owner sees that Bob, (and the other low-income members), doesn't have proper workout clothes. So he bumps Alice's, (and other full-price dues members), monthly dues by $5 so he can provide proper work-out clothes to those that need them. Alice can see the logic of this, and is ok with this too.

After work-outs, most members go to the beverage bar for refreshments to replace lost fluids but it is a cash bar, not free. Bob can't afford those refreshments, but the gym owner thinks Bob needs to replace his lost fluids too. So he bumps Alice's, (and other full-price dues members), monthly dues by $5 so he can provide refreshments for Bob, (and the other low-income members),

Alice winces, but says ok, Bob needs to drink too.

The gym also offers Zumba exercise classes - also at an additional cost. Yes, the gym owner thinks Bob, (and the other low-income members), should be able to take Zumba classes too. So he bumps Alice's, (and other full-price dues members), monthly dues by another $5 .

This gets raised eyebrows from Alice, but she holds her tongue and pays-up.

Another offering from the gym are massages - at an extra cost of course, and Alice frequently finishes her gym day with a massage. Sure thing, the gym owner thinks Bob, (and the other low-income members), should be able to get massages too. So he bumps Alice's, (and other full-price dues members), monthly dues by another $10.

Now Alice is getting steamed. And she lets the owner know it. But, it is the only gym in town, and Alice must go to a gym, and she doesn't really want to leave town. So... she bites the bullet and pays-up.

Then the gym offers a new service - a personal concierge to bring members fresh sweat towels, and fetch their refreshment bar orders, and layout their Zumba class gear, and schedule their massages. Bob, (and the other low-income members), tells the gym owner he deserve this service too. So it's another dues increase for Alice's, (and other full-price dues members).

For Alice, this is more than she bargained for in her original gym contract, but, the gym owner insists, and Alice has only two choices pay-up, or turn her life upside down and move out of town.

Do you think Alice might have reached a point yet where she considered the dues increases as "legalized theft," because her alternative was too life-disrupting? Or would it take a few more freebie services cost increases to push her over the edge?

.A final point. Of course Alice has the option of petitioning the Board members, but now there are more board members representing the Bobs, than the Alices. So changing the Board's mind isn't really a realistic option.

I guess I did like your analogy after all. It encompasses the concept of a social contract, the point that a progressive cost schedule, (taxes), is acceptable to most reasonable folks, (Alice was a reasonable person), the illustration that most reasonable folks accept some flexibility in the terms of that social contract, and that there is a point where the terms of an original agreement become too distorted to still be considered the same original agreement.

GAYou're right, some more details are needed to improve the analogy:

5. All gym members automatically become shareholders, with an equal share in the gym.

6. Each director on the gym's board represents a group of shareholders.

7. The members/shareholders of the gym elect the "president" of the board and its directors, who operate the gym on behalf of the shareholders.

What does that change?

The "owner" of the gym is in fact Alice and Bob, along with all the other members of the gym.

The programme to help provide workout clothes to those on low incomes, could only have been implemented if it was either recommended to the board by gym members, or was suggested by a director, and then approved by gym members.

If Alice disapproves of the programme, or any other concessions offered, then her recourse is to persuade other members/shareholders of her point of view so the board (acting on behalf of shareholders) changes gym policy.

She can also try to get elected to the board by outlining what she believes are the best policies for the gym, and hoping enough like minded members support her. Or she can cancel her gym membership altogether.

While we can all sympathize with the fact Alice "doesn't really want to leave town". It does not justify her claim that the gym is committing theft. Considering something theft does not make it actual theft.

In addition, Alice's view does not entitle her to try to reduce Bob's influence with the board by, for example, making it harder for him to participate in shareholder votes. That is contrary to the board's constitution.

In short, none of the additional details you provided change the fact that Alice is participating in a contract, which she is free to cancel should she feel the terms are unacceptable.When the majority, using it's size and guns, takes more and more from a minority, saying all the while "Either gimmee what you have or leave your life behind you on the way out" when does it become theft? Never, because the ones with the most guns is always right? Never, because if the price of total life upheaval is paid (leave the gym) then the financial end is not due?

What gives Bob (and the rest of the majority) the ethical right to put Alice in that situation of paying one price or the other, simply because he wants what she has and possesses the force to take it at will?Wilderness, what gives Bob and the rest of the majority the ethical right is ‘Democracy’. Unlike defining Morals (which is an individual belief) ethics is something that by definition is decided by society.

Unfortunately the analogy breaks down at that point, for the US is NOT a "democracy", it is a "republic". Most of our constitution is devoted to protecting the minority from the excesses of the majority - something this hypothetical gym has failed to do.

Both morals and ethics are defined by society. But that society does not, and cannot, define those ethics or morals for individuals - there are always people that think differently there, and when the societies morals or ethics become intolerable either revolt or leave. We already see the money leaving our country - those that own it will follow if it becomes too onerous.Wilderness: I've been out of the net for 2 weeks and I'm just now reading this thread with interest and respect for the civility of the discussion. You finally made the salient point: we are a republic. We select people to determine how these taxes are to be used. That is where we need to pay close attention to what decisions they make, why they are making them, and who they intend to benefit from those decisions. The societal contract is being administered by our elected officials. It is our responsibility to hold their feet to the fire and be accountable to their responsibilities.

... and consider that pure democracy is nothing more than mob rule. In the case of nations - it is just larger mobs.

GA

The "right" to govern the gym a certain way was established during the gym's formation, by its founders, and approved by the original members/shareholders.

The rights of membership and how the gym is governed are laid out in the board's constitution. The underlying principle is that decisions are made through agreement and compromise, with no one person or group among members, or the governing body, able to exert too much power.

Alice has every right to use all the appropriate governance mechanisms to influence what concessions and discounts the gym offers.

Because of the way the gym is governed though, it is very unlikely Alice will get everything she wants implemented (or if she does, that it won't be reversed at some point in the future). Therefore ideally, her proposal for the gym's concession policy will consider the views of members who disagree with her, and a compromise reached. The same is true for Bob.

In this way, stable progress and improvements are made to the gym, in an iterative way, over time.

Members consent to this governance framework not only because it is a fundamental part of the whole enterprise, but also because it can work well.

The only time it doesn't work well is when members believe getting everything they want in the short-term, is more important than compromising to achieve steady progress in the long term. If Alice rejects the gym's governance framework in favor of the latter, then she is not just rejecting a policy, she is essentially rejecting the principles on which the whole enterprise was founded.

She has every right to do that, but if she decides canceling her membership and joining a different gym is too disruptive, that's a personal decision based on her individual circumstances. The gym is not responsible for it.If gym membership costs are going up, doubling, tripling or more, for one group while another is paying less and less, I have to doubt that anyone in their right mind would join without being forced to (or they think they will the "takers" rather than the "givers").

Which means that the original charter never envisioned one group getting the power to force such payments from it's constituency. Nor is there any "compromise" being reached; Alice's payments just keep rising in order to pay for those that don't pay their share. Nothing she can do will stop that as the power has shifted to one side; the side that wants and requires the other side to foot all the bills.

What improvements are you talking about? So far Alice's payments aren't going to maintain or improve the gym; they are going to Bob to give him what he won't pay for himself! Nothing at all is going to Alice - not new gym equipment, new running track, new towels or more classes. It's all going for Bob's personal wants, and benefiting ONLY Bob.

And that's the whole point of this exercise - to recognize that Alice's increasing payments aren't benefiting her. Not by choice, either - she can't use Bob's new shoes. She can't wear the clothes her money bought Bob, she can't drink his refreshments her money bought, she can't even use the massage her money bought for Bob.

And finally, she can't get on the board (if there is one) because the percentage of the membership demanding others to pay for them is too large - they get all the spots simply from sheer numbers. The gym has become a charity instead of a gym, and most certainly IS responsible for that."Alice's payments just keep rising in order to pay for those that don't pay their share. Nothing she can do will stop that as the power has shifted to one side; the side that wants and requires the other side to foot all the bills."

If the current president of the board is someone who agrees with Alice and is in the process of trying to implement the price reduction she wants, she can't reasonably claim the above is true. In fact the above would be be more true for Bob than Alice.

But before Alice gets too excited about the new president of the board, she needs to consider that if the current president tries to implement everything she wants in the short term, and ignores the views of the majority who wanted someone else to be president, then when power shifts back (as it inevitably will) those changes will likely be undone, Alice will be back to square one, and the whole debate will start again with no real progress made.

Real progress can only be made when the group within the governing body that currently wields most power, comprises. So when another group is in that position, they don't immediately set about reversing what the last group did. But for that to happen members and directors need to understand they can't operate the gym exclusively according to everything Alice wants. They also need to consider the needs of Bob, and those who support Bob.

For example: Bob's supporters might agree for a service Alice objects to being cut, in exchange for Alice agreeing to continue a service Bob's supporters genuinely believe contributes to the gym's overall success.

In this way, no one gets everything, but everyone gets something.

The gym is not a dictatorship (yet), and there is some way before it comes to that. So it's unreasonable for Alice to claim it is, just because the last president of the board, and the majority of members disagreed with her views.

But I'm getting off topic in my own thread, which is about the idea of taxation as theft. Based on what's been said, Alice's argument seems to be: If I don't like what the gym's revenue is being spent on, then I should be able to refuse to pay the membership fee. If the duly appointed governing body enforces the gym's membership rules by demanding payment, then it's theft because even though I am not being forced to remain a member, I don't want to cancel my membership.

Again, unless I'm missing a key feature of the argument, I don't think anyone would reasonably say that Alice's argument stands up under scrutiny."They also need to consider the needs of Bob, and those who support Bob."

Why? When Bob contributes nothing to gym operation, why consider his needs? Why not just kick him out until he can pay his own way instead of requiring Alice to pay it FOR him?

But you keep ignoring that it isn't about gym equipment, classes, etc. It's 100% about Alice paying for what Bob wants, so Bob can visit they gym for free, not even supplying his own clothing. This benefits Alice nothing at all - she is required to either pay what is demanded or pay a different coin to leave - while getting nothing for either the (excess) price to stay or the price to leave.

So yes, you're missing a key ingredient. It isn't about Alice paying for maintenance of the gym; it's about Alice paying for maintenance of Bob. Bob is the ONLY beneficiary of those increases in price - ONLY Bob gets the shoes, free use of property, drinks, etc. At Alice's cost.Bob does not contribute nothing. Remember, he is a low-earner, so which means he qualifies for a concession and pays less for membership than Alice.

But Bob also buys certain goods from the market within the gym (it's a big place!) As the sellers in the market all pay a % of their profits to the gym, this adds to the gym's revenue. That revenue goes towards the cost of maintaining the gym, which benefits everyone who uses the gym including Alice.

Forcing Bob into poverty by making him pay the same as Alice (which is more costly to him in relative terms) reduces his ability to maintain his source of income. Changing Bob from someone on a low-income, to someone with no income, is not in anyone's interest.

In addition, Alice earns her income through the gym's market. Her financial success is owed, in part, to the fact she is a member of this particular gym (as opposed to another less well-organized gym). So she is not doing the gym a favor by paying her membership fee. Her financial success is tied to the success of the gym, and Bob who is one of her customers.

In addition to that, Bob may one day own a stall in the market and become a high earner like Alice, then it will be his turn to pay full membership. Likewise Alice could find herself in the situation Bob is in now, in which case she will benefit from the concessions and discounts.

So the relationship between the members of the gym is symbiotic.

Slashing the cost of membership for Alice, at the expense of services helping Bob, doesn't help Alice or the gym in the long run. Likewise, making Alice so unhappy that she does cancel her membership and find a new gym, doesn't help Bob or the gym in the long run either.

A relatively small number of members earn no income at all, for various reasons. They are not all happy having no income for obvious reasons. Many are trying to change that.

An even smaller number of members seem to have no intention of paying their membership fee. However, it is not in Alice or Bob's interest to dismantle the gym because of that. Reducing this number as much as reasonably practicable in a way that doesn't negatively affect those who are trying to change their circumstances (to be the Alice of tomorrow) is more useful to the gym and all its members in the long run.

Again, because of the gym's governance framework, it's impossible for Alice or Bob to get everything they want in terms of how the gym is run. But it is possible for both of them to get something they want. But it takes compromise and finding common cause.Sorry. We're both wrong in that the original scenario doesn't specify if Bob pays anything or not.

There is zero indication that Bob buys anything from the gym, outside of a possible membership...discounted in your view, which means he doesn't even contribute his share of gym maintenance and operation.

No one forces Bob into poverty - he does that himself by wanting what he can't afford.

There is zero indication that Bob may one day pay full membership, but that also has zero bearing on what Alice should pay towards Bob's needs.

No, the relationship between gym members is not symbiotic; at this point in time the only relationship we know of is parasitic, not symbiotic. Bob contributes nothing to benefit Alice at all, while Alice provides total gym support for Bob. That's called parasitic.

Of course removing the costs for Bob from Alice's contribution benefits her; she can now afford to buy a car instead of walking to the gym.

Of course reducing the number of non-paying members benefits the gym; it allows paying members to continue to use the services offered instead of leaving.

There is no compromise any more than there is a symbiotic relationship. The only "compromise" is that Alice pays all of Bob's needs, and that is no compromise at all.

Bottom line: Alice could pay for all these things for Bob that she is being forced to purchase. But she doesn't like Bob; he ogles her and makes rude comments while she works out. She doesn't want to pay for Bob's shoes, clothes and luxury drinks, but she is forced to. Either that or pay a huge price to leave the gym and her life.You must have missed it. Bob's status was given in the original outline of the analogy: "2. The gym charges Alice $50 per month, but offers concessions for low-income earners. So Bob, a low-income earner, is charged $25 per month. "

http://hubpages.com/forum/post/2889546

Regardless, I think we're now pushing what was a simple, illustrative analogy to the point of absurdity. If you really want the analogy to reflect the real-world, you'd have to say all Bob's personal shopping is done within the gym's market, because the gym represents the country/ society and the market represents the US economic market.

But even though that does push the analogy to the bounds of absurdity, the point remains valid. Anyone who benefits from being part of an organization/society, is benefitted by any revenue that contributes to the maintenance of that organization/society. So whatever Bob adds to the gym's revenue, does benefit Alice and all other members.

If Bob currently has zero disposable income, then increasing his tax bill will push him into poverty.

That's the whole point of a progressive tax system. People pay what they can afford to pay.

There is lots of evidence that indicates people from modest backgrounds can become financially successful. It's certainly not guaranteed, but to suggest there is no indication it can happen is, frankly, bizarre.

Alice does not live in isolation from Bob (economically and politically). She can't because they live in the same society. Her success is tied to his, and their success is tied to the success of society. Having a large impoverished underclass is a cost to society and is in no one's interest. impoverished people can't buy the goods Alice sells. Having a large, financially stable middle-class is very good for society. It adds revenue, and generates the high-earners of tomorrow. And for Alice that means more customers. Alice does not benefit from people being impoverished. She benefits from people having a disposable income.

You're right, there is no compromise, and that is exactly my point. Alice wants society to be governed exclusively according to the way she thinks it should be. Likewise, some of Bob's supporters want the same. Neither of those can happen, because the governing framework won't allow it. That's why I said, politically speaking: no one can get everything, but everyone can get something.

The cost of giving up membership is relative. For some it would be a huge cost, for others it wouldn't. It depends on personal circumstances. Either way, it does not change the fact that no one can be compelled to remain a member. Alice can complain about the terms of her membership as much as she wants, but she still can't reasonably say the gym is stealing anything from her.Dang! And I went back and re-read that post rather than depend on a failing memory. Senility, no doubt - I apologize for the error.

So Bob can pay for half of what he "uses" in the way of requiring maintenance, repairs, new towels, etc. Can't see that it changes anything - Alice is still paying for half of what is required because Bob is there. Plus all the other things that are specifically and only for Bob. Bottom line is that Bob does not contribute what it costs to have him there, and nothing that benefits other people.

But, as I understand it, the discussion is not the progressive tax system we use. It is taxing Alice more in order to directly and specifically benefit Bob. The extra taxes gain Alice exactly nothing in return; her earnings and work go ONLY to Bob. Her success is assured, at the gym or country, but Bob's depends on taking Alice's work and profiting from it to the detriment of Alice.

And that's what makes it wrong. You say that if Alice does this, Bob may (may!) contribute one day, but that's unlikely under our system of chaining people to charity for life - we are (IMO) carefully designed to keep people on the largesse of politicians once they have been reduced to that from whatever causes.

Example: Children that need help in the form of parents. We pay others to fulfill that role, supporting that child from the tax base. But over half of foster kids will never graduate high school. Do we recognize that and change the system? Heck no - we continue to pour money into it, knowing we are producing another generation that will require life-long subsidies!

Another: Mary is a single mother with kids. She goes to school and holds a part time job to pay the bills. When she runs short (and she will) do we help her with a few dollars for the electrical bill? No, we do not - instead we tell her that if she quits her job we will cover ALL her costs, from school to housing to food to utilities. We train her to depend on us, and if she ever does get a job she will find that our "help" falls faster than her income rises. This is called "helping"; in truth it is but forging chains - chains both financial and mental.

Well Don, that gym owner of your first description of the analogy must have been busting at the seams to have contained all the shareholders and directors that your analogy now contains./

And I suppose the illustration of the initial social contract that Alice agreed to must have had a few un-noted pages also.

So by your reckoning the gym is now controlled by the democratic efforts of the majority. A "my way or the highway situation. It seems to me your analogy now more closely represents a picture of tyranny of the masses. Alice's only choice is to determine when enough is enough - and move out of town.

Who will pick up the additional cost of her lost revenue in order to keep the gym running?

I suppose that if the gym owner had stopped at just the discounted membership, then Alice would still be around, because that was the contract she agreed to. Beyond that point, her ever increasing costs could easily be seen as legalized theft - at least by Alice, and at least until the extortion becomes more than she is willing to pay.

As for swinging votes her way - that would mean convincing people to give-up their freebies, and we have seen how well that works. Bob won't give up his concierge or pay more money - because he knows he can make Alice pay more - for now.

GA

Alice recently learned that the gym spent $975,000.00 dollars to ship an aspirin from the local store to the spotter in the free weights division. Alice also learned the gym is subsidizing some study investigating the libido of the cockroaches in the gyms lunchroom. Furthermore, Alice became visibly upset when she also learned that her gym fees were being used to furnish said cockroaches with crack cocaine.

Once again Alice feels the gym is in breach of a so called social contract. Alice is adamantly convinced that her fees are being eroded away faster than sandy beaches can be nourished and decides to take the advice of something she read on the interwebz, of opting out.

Then the gym demanded a tax for her to leave ie expat tax.I'm guessing that the same people who think taxation is theft also walk on sidewalks, drive on public roads, and send their kids to public school.

So if they think taxes are theft, they need to sell their vehicle, homeschool their kids, and not use the sidewalk. Or paved roads. And never let their kids enter a library. Also not take any medicine whose creation has been funded by government research.

Let them pay personally for all those things at will, and see if they still think tax is theft.Be specific about your point. Vague one liners with zero intellectual contribution, along with the insinuation that someone is uneducated is about as worthless as public discussion gets. Please try harder.

Roads and bridges are paid for by gas tax. Property tax pays for schools. Homeless people that dont own a car should not be allowed on the roads or have kids in school. Someone has taxes taken out of their check. They go to the store and buy smokes with money they earned that was taxed. They pay a city or sales tax on the pack o smokes. They turn the pack over and thete is a tax stamp. Government has a negative 500 star rating on Charity Nav.

Read the tenth amendment first , every point in your last post is a locally or state tax based , legislated and directed as well by local voting and funding our health care HAS historically been paid for at free will , by contractual agreement between customer and company , created and sustained by free market competition and not by lobbied for corporate money paid to congress members and then dictated conveniently by the same congress , The tenth amendment protections are to guard AGAINST tyrannical taxation of central government for hardly any purpose .

Vermont , a few short years ago , developed a plan for single payer hearth care and like many states they did so unfunded . Recent studies show it will triple our yearly state budget from two billion to six billion . That is never going to happen here without severe taxation or legislated federal subsidizing . Anyone that suggests that doubling our taxes in my state would probably be hung from a lamp post .

No where but in liberal dreams is free health care guaranteed by either local , state or federal government .

You will have to try harder.I don't think you tried hard enough, but that was an intelligent answer that at least deserved a thank you. Educational!

I read that taxes have doubled since JFK...and that he fought against higher taxes. He may have been an insider but he was a President that I respected for that and more, not so much on the affair.

Classified documents on JFK's death can be released to the public in 2017 at the discretion of the President. I hope that Trump will make known who killed JFK. (Evidently, the Russians had released the findings of their investigation and named LBJ.)

Would you like President Trump to declassify the death of JFK?There, see how easy that was? And I was talking about all taxes, including state and local ones. tje thread had developed beyond that, but I was responding to the original. As far as free National Healthcare is concerned, I disagree and the alternative has been devastating. You're speaking of an instance of one state, which does not apply on a national scale. But congrats on being intellectual this time.

".......Congrats on being intellectual this time ......... as compared to what , your intellect ? That was far too easy . As matters of fact , most taxes are voluntarily self inflicted . Been to a school board budget meeting lately ? Lower attendance voter apathy , attending education union members , school board manipulations , the worst taxes are basically local education taxes , town ,city , county , state taxes are the higher and the least monitored by the lack of vigilance by tax payers .

As your education has no doubt enlightened you - the "big bad wolf" federal tax man is actually the lower $ entities of almost all tax collections . Your enemy , if you dislike taxes , are the higher local and state taxes , Are taxes constitutional ? No , or rather on only certain levels of federalism , the people you elect at all levels of government are not your friends . The more you entrust to them , the better their financial future becomes. Voted for more , bigger ,more expensive government lately ?Intellectual as opposed to your vague one liner from before, of course.

Deleted

Intellect , often requires only one liners ? No B.S. , ask Will Rogers you know ?

Not in your case, unfortunately. You eventually elaborated though, so yay.

Indeed they are; my paycheck reminds me biweekly. I don't mind paying these state and local taxes at all, so there's no issue unless it's spent on some frivolity. And I'm not stupid enough to think that the government is not corrupt. Also, I'm not sure what you could understand about my intellect, given that my post was directed to the OP and did not address the issue you apparently thought I was addressing, but whatever floats your boat.

Hi Ashtonfirefly, if you go back and peruse the thread you will see that the thought was not that paying taxes was in itself considered theft, it was that there comes a point when increased taxation is considered by some to equate to "legalized theft" because one must pay, or face force and possible imprisonment for not paying. Or, leave the country.

The thread notes plenty of examples to clarify what the opposing opinions meant by the description of "legalized theft."

ps. I do appreciate that my taxes helped pay for the sidewalks, roads, and schools, but I do balk at increasing my taxes to pay for "Bob's workout clothes."

GAAhaaa, well I was responding to the original post. I was not aware how far it had evolved.

If taxation is theft , then so must be the use of any and all public accommodations. So, sure, keep up the notion that taxes are theft, just don't ever in your life use public roads, breathe air whose pollution is regulated by the federal government, send your kids to public schools, do business in a market protected by law enforcement, hire workers educated with public funds...

You all have forgotten or never learned US founding history , Constitutional taxation is and was for minimal taxation . America actually became a nation because of tyrannical taxation and yet , now over taxation is by voluntarily submitting it ?

What happened ?

"America the Beautiful" became "America the Nanny State "I agree that America was hardly a legitimate nation before we formed a civil society of self governance funded by communal taxation. Again, never use a public road or send your kids to public school or collect a social security check in your life if you actually believe the nonsense you about taxes...

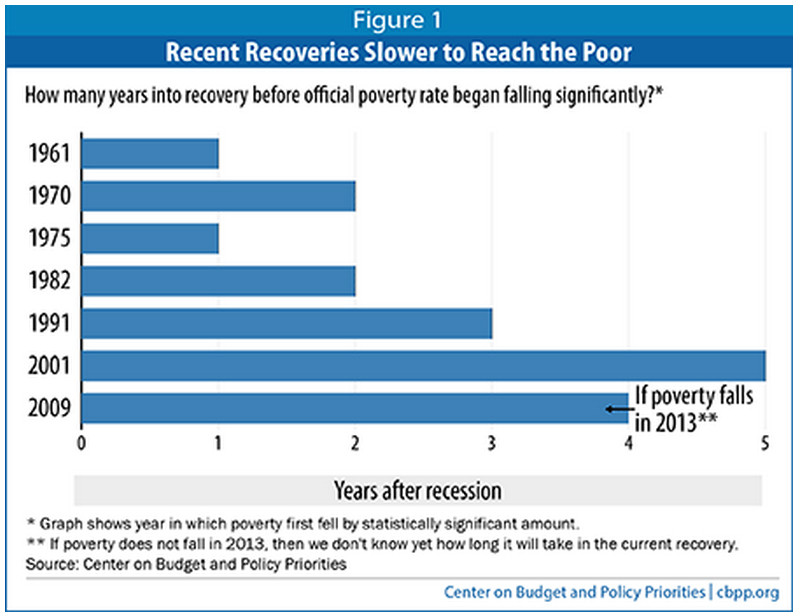

The biggest problem we have as a nation is that the wealthy have bribed politicians in order to skirt their taxes. The wealthiest Americans were taxed between 70-94% from the mid 1930 through the 1970s. Reagan destroyed the Middle class and the American Dream when we redistributed the wealth of the nation from the people to the crony capitalists, resulting in going on 40 years of wage stagnation, and the lowest social mobility of any developed nation. Congrats for destroying the American Dream, anti-tax loons...I think you're missing the main thrust here - we all pay taxes, and all receive something for it. Roads and other infrastructure, military protection, research producing the products we enjoy, etc. We don't always agree on the usefulness of what we get, but that's life.

But when we take from one to give to another, without any compensation of any kind (roads, etc.) it becomes another matter, and becomes simple theft. The vast entitlement programs of the US have crossed that line; simply a method of redistributing wealth, with the "givers" receiving nothing in return. The idea that we actually own what others have earned - that it is ours for the taking - such as that 94% confiscation rate even though no one paid it is beyond comprehension. How did we become a nation of thieves, taking what others have and returning nothing?For one, taxation does not become theft simply because you somehow think that you can forever avoid using public roads, using the sewer system, breathing air with government mandated pollution regulations, attending public schools, hiring workers educated at public schools, utilizing currency made by the US government...

Second, that would be an impossible task.

The top tax rate was 94% when unemployment rate was 2% and the American Dream was constructed via public policy of taxing corporattions and the wealthy. You want to talk effective tax rates? The effective corporate tax rate in the US is the lowest in the industrial world; corporations used to account for a third of US tax revenue, now just a tenth. That is why our deficit is a high as it is - because we've used the tax code to redistribute the wealth of the nation to corporations and the wealthy by refusing to make them pay their fair share like they did when we used those funds to build a strong middle class that was the envy of the world (though Japan's debt/gdp is double ours, and they're doing just fine, even without the virtue of the petrodollar...)Suggest you re-read the post you replied to. It delineates the difference between public projects and entitlements...and the morality of taxing just to give it away without zero benefit to the one being taxed which is what is being termed "theft".

Effective tax rates...how about looking up what the effective tax rate was when the top rate was 94%. You will find that it was less than it is today. Which in turn means it is a red herring to even bring that obscene rate up.Oh gawd! Not another "fair share" argument. Justin, it's good to see a new voice in the forums, but, follow the thread. You will see you are a bit off-base.

GA

So if you dont smoke marlboros, buy gas, own your own car or own your own home, your kids should not be going to school. In a bus. On a road.

400 billion a year on interest on 20 trillion in future taxes. Interest and taxes were invented by the greedy too lazy to steal. Instead of being their cheerleader they need an audit, then some restitution.

Here's how I understand it.

The government has certain legitimate functions that come within its proper sphere of authority, and which only the government is equipped to provide for citizens. On the national level, this would be things like national defense, national highways, regulating interstate trade, and little else, really. On the local level, this would include things like city roads, parks, water, and police force.

These are things that citizens would find it very hard to provide for themselves, and they come under the natural sphere of the national or local government's authority. Taxing for such things is legitimate. It is, as you describe, part of the social contract.

The problem comes when people think this legitimate function can be extended until, basically, the government can take it into their own hands administrate, tax for, and even have a monopoly on, *anything that someone decides they ought to.*

The 'someone' could be the federal gov itself, a government agency, an activist body, or even a plurality of citizens. It doesn't matter. If someone decides the the government ought to be the entity to provide something, and has a right to tax in order to do so, does that make it the gov's legitimate role? Answer: No, it does not.

For a lot of reasons. One, it is unjust to usurp a role that ought to be filled by someone else. Two, such usurpation is really a form of abuse of power. Three, government (not surprisingly) tends to be really, really bad at performing functions outside of its natural sphere. Whether it's education, art, or health care (to name just the obv ones), once it become the govn't's job, it immediately starts to become more expensive, bureaucratic, slow, and generally inane.

The other big problem with this is cases where the taxes are, basically, being levied on one group of citizens and then handed over to another. For example, I tax Peter to pay for Paul's college education. If Peter says, "That's not fair!," my response is, "You have the money, he doesn't. It's for the common good." To take by force from those who "can afford it" just because they can afford it and someone else needs it is to trample on basic property rights. It's in cases like this that taxation is basically theft with the power of the state behind it.This also goes along with wilderness and other people who believe that there is no benefit to the taxpayer in the government administering, facilitating or regulating things they view to not to be within the government's responsibilities.

1) This isn't 1913 or any year prior to it. Our population is much larger, we've got more issues to deal with as a larger society. How many school shootings were there back then? How much different (or similar) is the subject of race? The way jobs are spread out is different - and some are obsolete. Back in 1913, subjects like education were a much smaller thing. Like it or not, the government of this country needs to become more involved. Why?

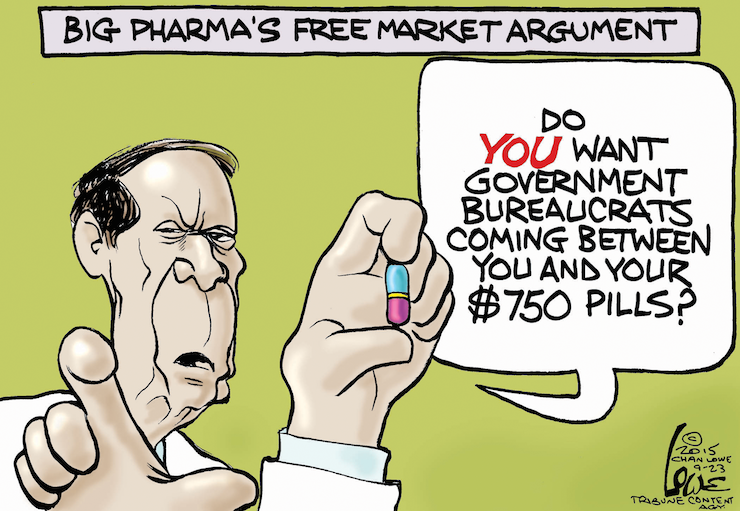

2) Because we can't trust businesses to regulate themselves. Even if industries began to create their own oversite system to regulate themselves, we'd still need someone 'neutral' we could trust to make sure they are following whatever protocols they should be following. Look what has happened to our economy in the past because of excessive greed by corporations. And what the HELL is going on with the outrageous cost of some drugs? How anyone can think we should just go back to letting them all do their own thing is amazing to me.

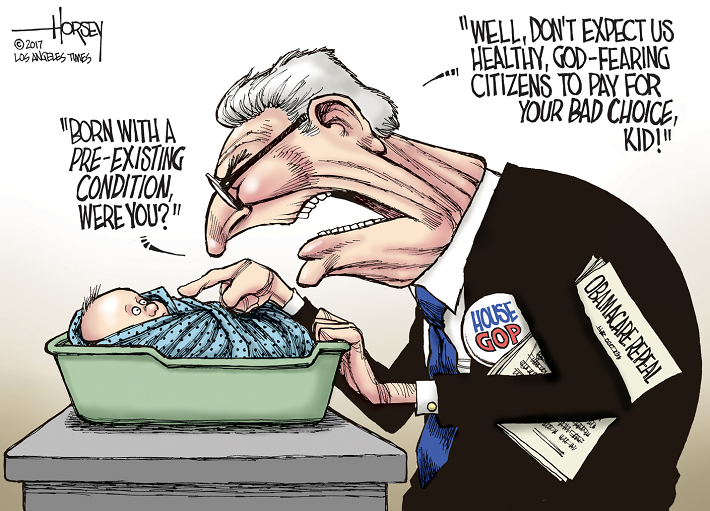

3) Things like healthcare & food stamps are so screwed up beyond this erroneous notion that 'those people are all lazy'; and no matter what, anyone and everyone should be able to pay medical expenses out of their own pockets with the outrageous cost that they are - is seriously closed off from reality. What about pre-existing conditions? What if you have a handicapped child - a child that pro-lifers INSIST that you have to have despite that many of them refuse to help you take care of it after its born - whether you were raped, or not. What a hornets nest.

This is an article that just came out about Amazon including a homeless shelter in one of their new highrises being built in Seattle - and they've been hosting a homeless shelter for a while, now. http://www.npr.org/sections/thetwo-way/ … ss-shelter

Our homeless situation in Seattle is so bad that it was declared a state of emergency a couple years ago. There are heroine needles absolutely everywhere; and they keep having to clear out homeless camps. Crime keeps getting worse...

But, one person & one family at a time (there are SO MANY veterans & little kids) we do what we can to get them back on their feet through job training or substance abuse therapy or whatever it is they need to help get them back on their feet. I was reading in another article last week that the biggest problem we have is that there are almost TWICE as many evictions happening than we can get people through the systems in any given month. If we could catch them at the point before they get evicted, we would be able to stay on top of things, better. On top of that, our mild climate & blue-state generosity draws homeless from all over - almost 20% are from other states.

And of course, the systems (there are several) are understaffed, overworked and underpaid because people and the government fight over who should pay for these lazy good-for-nothing bums.

What would I get out of it? Cleaner streets, safer neighborhoods, more of my follow citizens actually working instead of being homeless... Yeah, we get stuff out of it. Especially when you are one of the people looking them in the eye and giving them what they need - whether its from the government or directly out of your pocket, it makes no difference.

I keep hearing more and more about a single-payer healthcare system - and that wasn't something I even considered to be a possiblity for this country before Trump came along. But that man is a unifying force for those who oppose his 'extremes'. I would not be surprised if that's what we end up having within a decade - maybe even less.

Enjoy your tax breaks now. I don't think they are going to last very long.

The UK is going the same way, although the stats are not quite as bleak, yet. We never needed food banks in the past, but now they are common. And homelessness is constantly rising.

Makes a mockery of all those years of increasing GDP and productivity. Wealth is just systematically siphoned off by the already wealthy.

They know what they are doing though, they keep enough of the population onside with a comfortable life and blame the lowest forty percent for all the social ills.

That really is the tyranny of the majority, one of the great ills that democracy is prone to.

I am not a doctor. I have never attended some school of medicine. I have never driven an ambulance or had occasion to give cpr. I just dont have much confidence in paying alot of taxes to an entity that cannot tell if the employees it pays, to the tune of 600 million, are dead. But I am no doctor.

Brilliant. I never said - ever - that Ocare is perfect the way it is and that it didn't need some serious tinkering. My point was, throwing it all completely away is not the answer for the reasons I said within my long dissertations above.

Also, it is the reason why the single-payer system - that three-quartersish of the American public favor - is still yet to come. Trump, his party and his supporters are making sure of that. I won't be voting for the 'middle of the road' candidate next time. I'll be voting for Bernie, assuming he runs. I would never have said that last year around this same time.

Congratulations - Trump really is changing our country for the better. I was completely wrong. Its just not all happening 'now'.

I'm not sure how many deceased Federal employees were covered under Obamacare, but Id guess there were some. My heart really goes out to them and I do consider the everyday challenges of just getting out of bed and picking up their Government checks, considering their affliction. My only concern is I believe my tax money would be better used if the deceased restricted themselves to self employment as opposed to working for the Government and my taxes.

The ACA was never defined as perfect. How much closer would we be to perfecting it if seven years ago, instead of just voting to end it, we'd worked together to improve it? In the long run, it's purpose was to reduce costs by solving the problem of healthcare for the nation as a whole. If we all saw it that way we would be well on the way to providing care for all our citizens at a reduced cost.

That may be true but I saw Obamacare as a first attempt, destined to fail, simply because it approached the problem 'business as usual'. Protect corporations and their profits while allowing pork barrel politics to lumber on; all the while ignoring the needs of the American people. It was a lip service attempt at health care.

I think the Republicans will also fail. It will take a few failures for them to come to grips with the fact that a health care system which does, truly, look to the needs of the American people will have to put them first.Well said, and one of the biggest problems with the whole concept. It was an attempt to work within the then current system while making it do what it could not, and still cannot do.

Kathleen, the "purpose" of the ACA was never to reduce health care costs for the nation. Only to shift those costs to someone else while increasing national costs beyond what we can pay. There is zero doubt that it was presented to save costs for everyone, but there is also zero doubt that those pushing for it either didn't know what it was ("vote for it and THEN read it") or knew very well it was unworkable from the start.

Generally, from a British perspective, the question wouldn’t even arise simply because the British cultural and social attitudes are so different to the way many Americans seem to think.

From a British perspective, paying taxes for healthcare (NHS), Education, State Pensions and the welfare state (which is what some Americans object to) is generally considered by British people more of an insurance rather than a tax e.g. we all need education, we all need healthcare and we all benefit from the State Pension in old age. Plus the welfare state is there in the event of falling on hard times e.g. through redundancy or long term illness; it then provides security while you need it.

I know one of the objections from some Americans is that the rich pay more than the poor for benefits that most benefit the poor. If I understand the American tax system correctly then income is taxed using just a single ‘progressive’ tax e.g. where the percentage increases with the more you earn.

FYI, in Britain two forms of taxes are used together on income. The main tax (called income tax), is used to collect Government Revenue to pay for those things that affects everyone e.g. Defence; and it is a stepped progressive tax. The other tax on income, specifically designed to collect Government Revenue for Healthcare, Education, State pensions and welfare is called ‘National Insurance Contributions’ and it’s not a progressive tax. The National Insurance paid on income is:-

• 12% on income earned from £8,160 ($10,500) per year, but

• Only 2% on all income above £45,000 ($58,000) per year.

So although everyone in Britain, including the super-rich benefit from free healthcare for all at the point of use, free Education (under 19) and State Pension (from 66). The National Insurance form of income tax helps to ensure that those who most use the welfare system, and most need the other benefits, pay a greater proportion of their income tax than a progressive tax system would.

So although I’m sure some will disagree, and still argue that its theft from the rich, I think the British system of having a progressive tax on income to cover general government expenditure, and a flat rate tax that drops down for high earners, does at least try to make the tax system more equitable for all.

History leading to the introduction of National Insurance in the UK in 1948: https://youtu.be/U6mOiYXq1BkOddly, the main reason why Americans are afraid of a similar system is based on hysterical Christian dogma (although we've got a few know-it-all atheists in the mix, like wilderness): ie., if we set our country up to collectively support each other in this way; that would somehow mean that we are coelesing into a scary communist or socialist government instead of emphasizing individual freedom to the max.

This is scary not only because they believe both systems are literally EVIL (yeah, in the literal kind of way complete with demons) - but they are considered to be so because that is supposedly a step toward a 'one world government' with the anti-christ being able to take over the world.

Scary stuff, if you believe your eternal soul - and everyone else's - is on the line. Anyone who believes that probably needs to read my 1st spotlight article.

We're dealing with a really weird mix of religious superstitions, lack of education and plain 'ol lack of logic or empathy. I walk among the homeless in Seattle almost every day; and I've worked with agencies that deal with them in several different ways on several occassions through marketing/organizing & participating in charity events.

The most heartbreaking thing for me, is that most of these people really ARE capable of working, have dreams and WANT to work and support themselves. Do you really think our young veteran men are HAPPY becoming the 'addicted outcasts' they have become? You're sorely mistaken if you believe that. Many of them are in serious freakin PAIN and can barely pick their heads up. You've heard of the alarming increase in suicides among our military, right?

Go ahead, keep ignoring them. I refuse to. Maybe its because I look them directly in the eye more often.You know, saying this kind of thing is about like saying that anyone wanting decent health care for all is a communist at heart, wanting a complete equalization of wealth according to needs. Value of work is to be ignored in favor of being given whatever is needed to live a luxurious life. And they are too stupid to figure out we don't have the resources to give everybody whatever they want.

Both are obviously false, both are obnoxious, and neither makes any attempt to understand the viewpoint of the other. Don't you agree?I'm always impressed with the fact that you are willing to engage in conversation with people too prejudiced to think rationally.

What about the 1.7 Billion dollar ransom obama gave to Iran in the middle of the night? I dont drive on the roads in Tehran. 1.7 Billion could have kept deceased Federal employees in walking around money for 3 years.