Are you a freeloader or a taxpayer?

Only half of all Americans are paying their taxes because they are still employed. The unemployment rate isn't going down any time soon as much as the media wants to spin it so it looks like the taxpayer half will slowly reduce their numbers as Obama proposes more ways to spend money in the hopes of reducing the deficit. Huh? Yeah, I know, but that's how he looks at it.

I don't know what it's like in the US, but in the UK the only way of getting out of paying any taxes is not to spend any money.

Apparently in the UK if you're an immigrant they give you stuff. All you have to do in the US is not get a job and if you're a woman, have illegitimate children, then you get a check and don't pay taxes.

The unemployment rate is not "half".

Those not paying have no money to pay for whatever reason.

But I don't see how half can be paying "no" tax as you pay tax every time you buy something.

What is that figure based on? Income tax alone? There are lots of other kinds of tax. Sales, saving, inheritance, dividend etc.Yes its figured on income tax. But don't pull the sales tax ploy, these people are getting money back that they never earned and certainly didn't pay in sales tax throughout the year. Half of America is supporting the other half.

If you include all taxes, even the bottom 20% pays an average of 18.7% of their income in taxes:

Thank you for saving me time and typing, kerryg.

Cassie - I'm in the upper half and come April 15th I'll probably be forking over more. I reckon I've paid my "fair share" since 50% pay not a skinny penny.

The FrogNot sure how they manage that. Never buying anything?

Frog knows not of which he speaks, psyche. He imagines that tax on earned income is the only federal tax, and if you end up getting all of your withholdings back at tax time, you pay no taxes at all.

******

They're speaking of income tax (Money you earn) not tax for buying things

Wake up and smell the coffee. You can receive "Welfare" but you are taxed.

Cassie, The reason the other half are not paying taxes is because there isn't any jobs for many Americans. Be thankful you have a job, many Americans still do not and it will be a long-time for many Americans to bounce back. I wouldn't call them freeloaders they are Americans who gave there blood and sweat for our Country and its about time they get something back. I don't care if those who are unemployed get Food Stamps or Public Assistance our Country owes millions of people something since they chose to take it all away.

"our Country owes millions of people something since they chose to take it all away."

Yes! And I'll go further: those who got all the breaks can give it back!The breaks are always going to the wealthy not the middle class or the poor. I live in a middle class neighbor and see my neighbors still beating the streets for work. I see them with a Food Stamp card in there hand and I do not care. These were the same people who were thriving citizens and were taxpayers that are still getting food from the Food Banks. Our Country is not recovering, but it is election time so the Media will tell all of us anything to gain a vote. I agree they who receive tax breaks need to give it all back!

In 2009, the top 1% had an average <b>effective</b> tax rate of 24.01%.

The bottom 50% had an average effective tax rate of 1.85%.

The rich are paying much more than their fair share in taxes. If this report went into the bottom 25%, you would see taxpayers paying a negative percentage. The poor have a much more favorable tax situation than the rich.

http://www.taxfoundation.org/news/show/250.htmlNonsense. You're ignoring excise taxes, which hit the low-income folks a lot harder than the wealthy.

Hit harder?

Do the poor pay a higher percentage?

Do the poor pay a higher total amount?

The more you spend, the more you pay in taxes. The rich spend a lot more money than the poor, so they pay more taxes.Actually, the opposite--the rich generally spend a smaller proportion of their income than the poor. The rich save a greater proportion of their income, and those savings go into investments and whatnot, which are taxed at a much lower rate than income tax. This is one of many ways the system favors the rich.

Yes, the poor or middle class often do pay a higher percentage of their income than the rich or super rich.

You can't look at absolute figures; the rich will always pay more in absolute terms. You have to look at the percentages.1 - Capital gains are taxed at a higher rate than anyone in the bottom 90% pays in income tax. So that's just untrue.

2 - The point was, as far as sales tax goes, everyone pays the same percentage.

Only if they spend a higher percentage. Are you calling for a progressive sales tax system?

And the rich pay higher percentages in all income taxes, up to 22% higher.Capital gains--so what? It's income, so it should be taxed like all other income at that bracket.

Sure, everyone pays the same sales tax percentage.

No, income taxes are levied regardless of spending. I said the poor or middle class often do pay a higher percentage of their income than the rich or super rich.

The stated tax rates are progressive, but after deductions, exemptions, loopholes and other fun stuff, the rich often pay a smaller percentage. Thus the system is often regressive.

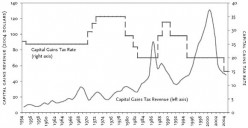

That neat little tax table is one thing, what people actually pay is quite another.I already showed why higher capital gains taxes are a bad thing. When capital gains taxes have been lowered, the IRS has pulled in MORE total c.g. tax revenue than when they were higher. There is no benefit to raising that tax.

Not higher income tax.

As far as other taxes... that's case by case. There are many people in the top 1% who spend the vast majority of their income every year. For a lot of them, most of their wealth is in the form of assets.

I have been showing, over and over, the EFFECTIVE tax rates that each group pays. You are correct in that EVERYONE pays a lower percentage than the marginal tax rate. Americans who make in the 10k to 25k range, with children, can actually pay a negative income tax rate.

But, after all the deductions and 'loopholes', the rich still pay higher than the poor. Much higher.

That is what people actually pay. It's the effective tax rate for each group.Capital gains--income is income. The ridiculous idea that some income is not really "income" is part and parcel of the flawed mentality that has created this horrendously complex morass of a tax code.

But that aside, the cap gains correlation in your chart below is pretty weak. Yes, I see it, but still weak. The chart shows that revenue was the same in the mid 2000s as it was in the late 1980s/ early 90s. Yet the rate was 15% in the mid 2000s, and 30-35% (double) in the late 80s.

Moreover, revenue seems to have tripled from the 1950s to the late 1970s, although the rate never went down--in fact rose from roughly 25% to 35%.

There's obviously a number of other factors in play.

For an interesting chart, plot US GDP growth since the 1940s against marginal income tax rates for the same period. You will see there is no negative correlation between income tax rates and economic growth.

Effectively, the rich pay higher on average, yes. But that is a mathematical average. Not necessarily "typical." I read an article recently about a rich real estate guy who paid a whopping 101% tax rate! That kind of thing really brings up the average, because of the nature of a mathematical average. But there is a huge number of millionaires and billionaires that pay 10 or 15% for example, and that is billions upon billions lost to the treasury. Meanwhile many middle class or upper middle class people (earning, say, $200,000 to $400,000) pay 20, 30% or more.

The contrasts are especially important between the middle class and the upper class. And between small/ medium sized business (many sole proprietors), and big business.This is what I have been saying, if you go to a government website find some chart that they have so graciously provided for you, and believe it to be factual, you are just following in the sheep foot prints that they have laid out for you. I research far beyond what the Government stats give me and have never found that their numbers even come close the reality of what is really going on.

Nobody is saying that capital gains aren't income, they are just a different type. Again, I showed why higher c.g. taxes is a bad thing. The IRS gets LESS total revenue with higher c.g. taxes, so how does that help anyone?

Yeah, so the revenue was the same with half the tax rate. That means there was DOUBLE the investment. When taxes are lowered, there is more investment, and therefore, more receipts. The fact that the revenue is that high during a major recession shows how the lower taxes help both sides of the party.

Once the rate went up, the revenue started stagnating. It fluctuated some, but there wasn't the same growth it had seen under the lower rates. It never rose above the peak before rates went up until after the rates were lowered again in the early 80s.

GDP isn't a good measure to look at the state of the economy in this way. For instance, GDP can be very high during times of war, even when standards of living are very low.

No, typical is average. The average tax situation is the typical tax situation. When you find articles about individuals, those are not, by definition, typical.

That would have to happen a lot to bring up the average. Do you have a reference for that story? The average is calculated on total money made and total money paid, so one person's story, in the top 1%, will not be able to make any noticeable change.

Hold on. First, those rich that pay 10-15% are paying capital gains. On their income, they are paying between 20-24%.

Middle class people aren't paying 20-30%(btw, the top 1% starts in the $340,000 range).

Ok, $200,000 income, mother, father, child.

3 exemptions at $3,700 each = $11,100. Standard deduction(this is being generous, as this bracket usually itemizes) is $11,600, so taxable income is brought down by $22,700 to 177,300. Using the tax worksheet, that tax comes out to $37,713 or about 18%

Let's itemize. Average itemized deduction for $200,000-$250,000 is $63,000. That brings taxable income down to $137,000. Tax on that is $26,500 or about 13%. Interestingly enough, those rates are right in line with what I've been quoting all along. $200,000 falls around the 5% range.

http://www.taxfoundation.org/news/show/250.html

What contrast? Top 1% pays 24%. 5-1% pays 16%. 10-5% pays 11%. Where is the discrepancy?

Yes, I agree that taxes suck for small proprietors. They are too high.

But, our taxes are too high for big businesses too. We have one of the highest effective tax rates in the world(4th I believe). If high taxes are bad for small businesses, maybe they are bad for big businesses too?According to the Krugman column linked below Sweden has one of the most productive economies, high taxes and superior social services.

http://www.nytimes.com/2012/02/27/opini … aulkrugmanThey have a government that is being responsible with money.

Ours isn't. You can't compare the two.

Additionally, Sweden started doing better when they lowered taxes and lowered welfare benefits.Sweden's taxes and social welfare benefits are still much higher than ours. As I recall parents get a one year paid child berth leave. They don't just preach family values. They actually practice them. I agree it's not especially valid to compare Sweden with the U.S. because it's smaller than several of our states. Nevertheless, as Krugman points out high taxes and high social welfare programs aren't incompatible with high economic performance. Of course the people have to vote for the taxes. I suspect one doesn't see as many McMansions and Bentleys in Sweden. The gap between the haves and have nots is much smaller there than here. I doubt that Sweden's first lady drives two Cadillacs.

No, it's not incompatible, but it's much more difficult.

If Sweden, with a high tax rate, can do better by lowering them, the lesson is that too high of taxes can hurt an economy.

And yes, it is much different there than here... we are major consumers, while they are more producers.

That being said, I still prefer lower taxes and free markets over governmental intercession.

"Nobody is saying that capital gains aren't income, they are just a different type."

Let me clarify: all the money a person makes from every source should be taxed at the same rate for their bracket. Why can't we keep it simple.

"The IRS gets LESS total revenue with higher c.g. taxes, so how does that help anyone?"

Again, your chart shows that for decades higher cap gains tax rate did NOT result in lower cap gains revenues. To the contrary, higher rate coincided with higher revenues. And from the 1980s on, the relationship is choppy. It's all there in the chart, you just have to look at it. Bottom line: your own chart contradicts your claim that a lower rate causes higher revenue. Sometimes yes, sometimes no.

"Once the rate went up, the revenue started stagnating... It never rose above the peak before rates went up until after the rates were lowered again in the early 80s."

This all indicates that the relationship is not so simple as your blanket claim. The same rate can lead to different levels of revenue; a lower rate can lead to higher or lower revenue; etc.

Well, adjustments can be made to GDP, we can use GNP instead, etc. You should offer another measure of total material prosperity that can give a broad and comprehensive view if you don't like GDP. Otherwise, this seems like a silly argument. The claim of anti-tax conservatives and activists is always that economic growth is negatively affected by tax increases. This is quite simply false.

"No, typical is average."

The median is always a better measure of what is "typical" as anyone with a basic background in statistics or quantitative analysis knows. Imagine a working class bar with 10 guys in it. Average income might be $20,000 or $30,000. Now imagine Bill Gates walks in. Now there are 11 people, but the average income of those patrons just skyrocketed to millions of dollars. Is a million dollar salary typical in this situation? No, 90% of this bar's population makes far less than that. Thus, the mathematical average is useful, but not a sufficient measure. By the way it is calculated, it is easily swayed by the outliers. That is why the median is better.

Here's the guy I was talking about, actually 102%: http://www.nytimes.com/2012/02/04/busin … sense.html

"Those rich that pay 10-15% are paying capital gains. On their income, they are paying between 20-24%."

No, this is what you are missing. After all the adjustments, the actual tax on their INCOME can be 10-15%. It depends on the person. The rich and super rich have access to the highest-priced tax accountants and attorneys that the middle class and poor don't, and are thus able to take advantage of many hidden loopholes, as well as more common exemptions and deductions. It's just a fact.

"Middle class people aren't paying 20-30%"

Not all, but many. Depends also what you mean by "middle class." Here in New York where I live, it takes six figures for a family to reach middle class status. A middle class sole proprietor most certainly might pay that kind of tax. This is a very large and complex country, it's not as simple as you want to make it out.

"But, our taxes are too high for big businesses too. We have one of the highest effective tax rates in the world (4th I believe). If high taxes are bad for small businesses, maybe they are bad for big businesses too?"

We have one of the highest stated corporate tax rates, I don't know about effective. This NY Times article on GE from last year made waves: http://www.nytimes.com/2011/03/25/busin … 25tax.html

They were able to make lots of money, and pay nothing to the IRS.

Big businesses, like the very rich, have the resources and the political connections to minimize their tax burden. Again, the system is far more complex, with more exceptions, gaps, holes and inconsistencies than you seem to think.What are you talking about? 1950-1970 it was at 25%. There was slow, but steady growth. 1970-1980 the rate went up to 35%, and revenues never went above the the 1968-1969 peak. The rate fell to 20% in the 1980s, and revenues tripled. Late 80s the rate went up, and revenues dropped 30%. Rates dropped in the mid 90s, and revenues rose again.

If you look at each time period, the revenues grew on average through low rates, and fell on average through high rates.

But it's clear that lower rates have lead to growth. Cut the revenue up into time periods and you'll see it grew when taxes were low.

There aren't any measures, that I know of, that accurately reflect what you want. The economy can technically do well, while people struggle.

That's why the rates are split into income brackets. FYI, the ONLY measure we have of 'median' effective tax rates is to look at the averages, as the IRS only publishes total figures for each bracket. You don't like the average, so you say it's no good. Your analogy to Bill Gates in a bar is irrelevant to effective tax rates, as he wouldn't be counted with the other patrons.

That's not talking about his effective tax rate, that's his tax in relation to his taxable income. If you read further in, his total tax rate, as a percentage of his adjusted gross income, was 20%. Exactly in line with what I have been saying.

So yes, he pays 100% taxes on 20% of his income. In other words, a 20% tax rate.

Nobody calculates their tax rate by dividing tax owed into taxable income. You calculate it by dividing tax owed into total income. 20%, not 102%.

Can be, but the average is 20-24%. If you take all of the income reported(gross income) on the top 1% of returns, and divide into that the total taxes paid, it's 24%. You're talking about exceptions, not the rule.

Some are, but you would be surprised. Most of the loopholes involve other processes. The IRS gets its money, but there are many means of changing what year money gets taxed in. That's what happens with GE.

Don't compare business tax to personal income tax. The average middle class, as you defined it, is in the top 1-2% of the nation, and I showed that they don't pay 30%. 11-20% is what we came up with.

That NY Times article had so many problems, and had several corrections and apologies. The author got his 'tax' number from a number that has nothing to do with taxes.

The effective corporate tax rate is easy to find:

http://taxfoundation.org/news/show/27609.html

Around 27% right now, and that doesn't include anything but federal. Last I checked, the total tax rate was ~39%.

Again, that simply wasn't true. The 'tax refund' that NYT claimed GE was getting was essentially the total of their itemized deductions in the business world. They paid estimated tax all year, and still had a tax liability. That article was one of the most widespread lies I've seen in years."What are you talking about? 1950-1970 it was at 25%. There was slow, but steady growth."

Exactly. It's complicated. Why did revenues rise if there was no decline in the tax rate? This is the first indication your blanket claim is insufficient.

"1970-1980 the rate went up to 35%, and revenues never went above the the 1968-1969 peak."

No but it came pretty damn close around 1978/79. I am looking at the general periods, not a quarter-by-quarter breakdown, which would not be useful anyway. Revenue was declining from what looks like 1968 to 1970 (can't exactly tell because of the chart; just eyeballing it). Yet the rate still had not risen. What gives? Perhaps revenue is not entirely caused by the rate? That would make sense, since total revenue was the same in 2004 as it was 20 years earlier, even with a totally different rate. And since a massive decline (what looks like from about 130 to 50, or over 60%!) occurred in the mid 2000s, even with the lowest rate ever, and the decline continued even after the rate was lowered further!

Overall, if we were to do a regression analysis of this data, we would indeed probably see a slight negative correlation between rate and revenue (as one goes up, the other goes down). But it's nowhere near the absolute rule you asserted. I will reiterate: it's complicated.

"There aren't any measures, that I know of, that accurately reflect what you want."

It's not what I want. You said you didn't want to use GDP. I'm perfectly happy with GDP, as long as it's adjusted and reasonably calculated.

"That's why the rates are split into income brackets."

You were citing averages within each bracket. Average, as I said, is a useful but incomplete measure. Not the whole story.

"FYI, the ONLY measure we have of 'median' effective tax rates is to look at the averages, as the IRS only publishes total figures for each bracket."

I know that. I'm saying it's flawed. The Bill Gates analogy was just an explanation of the concept of average versus median, and sensitivity to outliers.

"Can be, but the average is 20-24%. If you take all of the income reported(gross income) on the top 1% of returns, and divide into that the total taxes paid, it's 24%. You're talking about exceptions, not the rule."

Let me try to make this even clearer. Suppose there are 100 millionaires. They each derive their income in different ways, and so are subject to different deductions and exemptions. Suppose 80 pay a 15% tax, and 20 pay a 50% tax. What is the average tax paid? 22%. Do you see how the mathematical average for this group can easily be different from the typical person? Especially when we have so many other sources telling us that so many rich people pay relatively low rates.

"Don't compare business tax to personal income tax."

Why not? A working person is a working person whether they are classified by some bureaucracy as an independent contractor, sole proprietor, wage-earner, investor or whatever.

"The average middle class, as you defined it, is in the top 1-2% of the nation..."

I didn't define it. I just made the point that it's complicated, and also varies from place to place.

Corporate taxes are certainly hard on the typical business (which is a small/ medium business, between zero and 100 employees). But the Fortune 1000 (less than 1% of all firms) get theirs, rest assured. And that is many billions of dollars in revenue.

"They paid estimated tax all year, and still had a tax liability."

Lol, ok, estimated tax on what exactly? On, say, $10,000 in supposed "taxable income" or something? GE's primary tool is moving money offshore. I don't see any corrections mentioned in the current, final version of this article.

Anyway, you can have the last word if you want. Bottom line is that it's all extremely complicated with lots of loopholes, exemptions, gaps, holes and wrinkles. Which makes it unfair. Even if the majority of the rich paid more than their fair share in taxes, a sizable minority paying much less creates an unfair system, stiffing the typical taxpayer.

And any reasonable person would expect the rich and well-connected (both individuals as well as big business) to use their resources and connections to minimize their tax burden, legally and semi-legally. Something the typical business or middle class person (to say nothing of the working poor) can't do.

Thanks for an interesting discussion.

A lot of people do have jobs but still don't pay income taxes. Exemptions, deductions, EIC and child tax credits can give more money to a family in a year as a refund than they made(gross) for the entire year.

People complain that the rich don't pay enough taxes, even though they pay much higher percentage rates. People complain the rich use 'tax loopholes', but it's ok for the poor to use 'tax loopholes'(all deductions/credits/exemptions are 'tax loopholes').You heard Buffet....his secretary pays a higher percentage rate than him. Leona Helmsley said only little people pay taxes.

Our infrastructure is in shambles, but places with a concentration of wealth are doing mahvelously.

The tax policies from 2000-2008 were put in place to make it so.

They need to be reversed, and we can have a country again.No, his secretary pays a higher income tax rate than his capital gains tax rate. His secretary also pays a higher income tax rate than EVERYONE's capital gains tax rate. It's comparing apples to oranges. Everyone pays the same capital gains rate, and the rich pay higher income tax rates.

We don't need to increase taxes to fix the country, we need to reduce spending. We're over budget by over a trillion dollars every year, there is no taxing your way out of that. If the economy grows by 1-3% every year, and the federal budget grows by 3-5% every year, there is a problem with the budget.When were the cap gains taxes lowered? That was done as a favor to the wealthy, so they could keep more of their money.

Same as the Bush breaks...favor to the wealthy.

When that money was taken out, our economic downfall began.

Not to mention the outright theft that occurred by Wall Street, who pay at 15%...isn't that right? As it's investment $$,and not actually earned by hard work.

I have plenty of places I would cut, and dmop has a great idea...we should vote!

But, if we want a decent, high-grade society, well--you get what you pay for!Lower capital gains tax rates stimulate investment, which helps stimulate the economy.

Look at this chart:

Source: http://www.econlib.org/library/Enc/Capi … Taxes.html

When the rates were lowered in the 80's, what happened to the total tax receipts? They went up. When they were raised in the late 80's/early 90's, receipts went down. When rates were lowered again, receipts went up.

When tax rates are lower, it's easier to invest and make a profit. More people invest. More companies have capital to work with. More expansion is possible.

Raising taxes wouldn't solve our problems, and would only make them worse. The average effective corporate tax rate is at 22% right now, and in 2009 the IRS collected $225 billion from corporate taxes. We also had a deficit of $1,412 billion in 2009. So, let's raise tax rates on corporations to 50% effective. That would give us an additional $286 billion in tax receipts!(It would also bankrupt most companies in the country). Ok, now the deficit would have only been $1,126 billion. Individuals paid an average effective tax rate of 11%, and receipts were $1,175 billion. So all we have to do is double everyone's effective tax rates, and we would have a balanced budget! Of course, the bottom 50% of American's wouldn't care too much about doubling their ENORMOUS tax rate of 1.85%(because that's fair, right? Half of Americans pay under 2% and the other half pay over 20%)

But... then you have the slight problem of businesses going bankrupt, jobs being lost, incomes lost, less spending, recession, even less spending, less jobs because of less spending, depression..."When tax rates are lower, it's easier to invest and make a profit."

If this were actually the case, the economy woudn't have been in the toilet for the past ten years or so, since tax rates are at historic lows.

"Raising taxes wouldn't solve our problems, and would only make them worse. "

If there were any truth to that at all, the postwar economic boom could never have happened, since taxes were much, much higher in the 40s, 50s and 60s.

There is no causal relationship between tax rates and economic growth. Your post is full of fail.If you read what I wrote, I was talking about the relationship between capital gains tax rates and capital gains tax receipts. Just because there are more capital gains tax receipts doesn't mean the economy does better, but it means there is more activity in the markets.

Capital gains are less than 3% of the total tax revenue for the government. So even if it does extremely well, it won't offset general problems in the economy.

They weren't as high as most people think, and tax rates weren't the reason for the economic growth in that time period. The amazing thing is that there was as much growth as there was, in spite of the higher tax rates.

The interesting thing is, if the government lowers tax rates, it generally ends up pulling in as much, or more, total tax revenue. More money in taxpayers' pockets = more spending = more growth = more taxes. It's amazing how it works.

Let me ask you a question. How many goods would you buy if the government took 100% of your money? How many goods would you buy if the government took 0% of your money?

There is a correlation, I just proved it."There is a correlation, I just proved it."

You sure proved something, but it's not what you think.

I'm not sure who gets a free ride, but I've taken the liberty to do some research and share it for those who are interested. A person who makes 30,000 a year on average pays 3,900 out of their check before they even see it. If they spend that money they will pay an average of 2,250 in sales tax. The average property tax is 1,132. Those combined equal 7,282, while the average return for a 30,000 a year income is 2,290, which is an increase of 5% from last year. That leaves that person paying 4,992. That's about 17% of that persons income, which hardly seems like a free ride to me.

Gasoline tax, sales tax....Yeah like John Holdren said, only if the person spends no money at all is that even possible.

I don't see how we can be in such a huge debt when about everyone pays taxes in one form or another makes no sense.

Yeah, that's our government (federal, state, and local) for you.

We shouldn't have a government all it does is create problems more than anything else.

Where would we be with out government. I think we need government as people we all need rules to govern our lives and to unify us. What we don't need is a government body, no people, just documents that spell out the laws of the land. Perhaps there could be a committee to address issues as they arise, but otherwise just documents. In this day and age with all of the technology we could have votes from all citizens before any changes or amendments could be made.

I think Cassie means income tax, which now only half of Americans are paying. I'm a tax payer. 49.5% of Americans pay no income tax. I'm not talking about SS/Medicare/property taxes/sales tax.

The question is vague

Freeloader could mean government employer or politician.So, those unemployed by no choice of their own are now all freeloaders?

Fair point, as I know of many people that aren't working by no fault of their own, and they are not freeloaders. They are really careful with their money, and try to make more however they can.

When you signup for unemployment benefits you are asked right on the form if you want your taxes deducted weekly or not. Unemployment benefits are subject to income tax. Unless that's changed from the last time my ex-husband filed for unemployment.

Wow,now there's a really inverted uninformed title and subject.I wonder why it is our economy is in the situation it is in now?Hmmmmm.........yes,it's because of the common man putting in an honest days work.I would bet my freeloading inheritance that those who fall in the bottom half would gladly exchange places with you,and never piss and moan at all.The percentage of illegals and actual freeloaders are matched by fraudulent misrepresentations of income of wealthy Americans.There are tons of issues weighing in on this and to say that everyone that gets earned income credit or owes no taxes are freeloaders is just ridiculous and juvenile.

Some of you are confusing the different types of taxes. Please re-read my above post. In 2009, 46.9% paid no income tax:

http://www.taxpolicycenter.org/Uploaded … o_pays.pdf

Also, if you work, you can get Earned Income Tax Credit and get back more from the IRS than what you paid in.Understood Habee, but there is no mention of income tax in the title, just taxpayers.

And nobody escapes taxes.Really? Rent an apartment (no real property taxes) in Oregon (no sales tax) and do without a car (no gas tax). If you also go without a phone, no tax there, either. Utilities included in rent - no taxes on electricity. Welfare as only income - no income tax, no FICA.

It could probably be done. It is done, and frequently, if you ignore the small things like phone tax. Even states with sales tax can collect only monies given by Uncle Sam if you have no income."Rent an apartment (no real property taxes)"

Do you seriously think that the landlord doesn't figure in his property tax expenses into your rent?

"do without a car (no gas tax)"

You can do that in big cities with decent public transit, but good luck keeping a job anywhere else with no car (no dependable way to get to and from work).

"Utilities included in rent - no taxes on electricity."

Again with the assumption that the landlord doesn't pass on his tax expense.

"It could probably be done. It is done, "

It can, but doesn't get done nearly as often as you imagine.Renters are paying property taxes indirectly with their rent payments.

Where do these stats come from? (working versus unemployed)?

You can't get earned income credit without earned income... just saying. Technically, only those families that are working are eligible... which kinda blows the freeloader definition to hell.

Only in your world, if you make 11,000 for the year and get back 8000, something is way wrong. I know, I know you disagree. You're probably the other half.

Wow I'd like to know where that happens...

Especially since the highest EIC for 11000 with three children (the most that can be claimed) is 4961. (The max is 5751 btw, so NO ONE is getting back 8k in EIC alone)

And damn skippy I claim it. It ALMOST made up for the amount that I had to pay in "business" taxes for being an independent contractor.LMAO!

Are you uhhuhing about your apparent ignorance of the tax system in general or about you lack of knowledge of how many taxes are charged on 25000 dollars a year in freelance writing?

Or should I feel guilty about taking advantage of a tax credit?

Jealous much?I am completely jealous of you, I wish I could earn as you do. You're my new hero.

Jealous? Hold on, here it comes

Jealous that you don't get the credit. If you got it, you wouldn't be whining about it.

Whining? I have never whined about paying a tax that you somehow seem to escape. Look, I don't believe you come close to making the money you claim with your writing prowess, I don't care that you want to make that kind of stuff up. It takes all kinds to make this world go round, it just takes a few of us to fund it, thats sad.

Wow. You have no idea about the actual business side of freelance writing do you? 25k is a low number for freelance writers and I could be making twice that easily if I wasn't doing it part-time.

Here's a clue: It's not poetry and revenue share sites.Here's a real clue, I DON'T CARE WHAT YOU MAKE, REALLY!!

Apparently you cared enough to accuse me of lying about it. And enough now to use all caps. Poor thing... so excitable. Have a coke and a smile

Me not believing you and accusing you of lying are two different things. I would expect a writer of your pedigree to know that.

I know... if I could just learn how to write about fixing a hole in a wall maybe I would be as good as you. It's something to aspire to I guess.

You looked, you really do care, I'm thankful a Pulitzer prize wannabe such as yourself would take the time, well, not really.

Gawwwwwwwd, its just too easy.

Gawwwwwwwd, its just too easy.

Melissa, trolls are for entertainment purposes only. Stop playing with the guy and using words of more than two syllables. He's responding with words as well as emocions.

Its typical passive-aggressiveness caused by a deep dissatisfaction in my life. I have latent abrasive negativity tendencies caused by a failure to form meaningful relationships with males and thus have never formed appropriate coping mechanisms to deal effectively with men who try to assert themselves in positions of authority. As such, I use sarcasm to avoid meaningful discourse on topics that I find emotionally threatening.

Or... I could just be bored and feel like f***ing with someone for amusement.

Don't be too sure about making that much freelance writing.

I've seen an adsense report showing $3000 for about 20 hubs for one month. That was completely residual income, and the owner had far more going than just HubPages. Worked at as a full time job (or more) $25,000 is definitely possible.I have never felt the need to point out my income and it has been my experience that those who do are not being honest. But, who knows, and better yet who cares?

I was pointing out that for my income EIC doesn't cover the taxes. There was a purpose other than to "show off" which 25k a year really doesn't deserve "showing off".

No shit, but you felt the need to put it out there!

Aww do you need a hug? So angry. I understand, good jobs are hard to find. I care. I really really care.

I don't have a good job I provide them, jealous much?

Of you? Yep. I desperately want to know how to replace a light socket.

Jealousy consumes me. I bet you even have a pick up!Yes, I do, one I can afford. Not a GM vehicle. And I don't even need the EIC.

Well damn... I guess some can aspire to be Hemingway... and then there are those who aspire to be Bob the Builder. I guess your goal is more attainable then mine anyway.

Is it a white pickup? Does it have an NRA sticker? Is there a magnetic sticker on the side with your cell phone number?I know that you are the type to boast of making the amazing sum of 25,000, I also see you make fun of others writing topics, you must be very unhappy in your life.

Not many friends either huh? Do you have one of those cyber published books? Could I get an autograph?

Not many friends either huh? Do you have one of those cyber published books? Could I get an autograph?

LOL!

And you like to insult people's writing talent when the pinnacle of your work involves fixing a hole. I am actually exceptionally happy in my life. Great husband, great kids, big supportive family. I don't have an ebook, haven't had time to write one. I think the people who write them are damn intelligent though. Look up Scott Nicholson one day... He could buy and sell you from his little "ebook" hobby.

And by the way, I could fix a hole and change a socket all by myself and have. It doesn't require a genius IQ. I guess it's great if that's what you want to do with your life but it doesn't exactly put you in a position to judge others. Hammer your nails Bob Villa. I'm sure you went to some school to learn how to do it. I went to college to learn how to write. I'm sure your nails are very impressed by you. My clients are very impressed by me as well.Lets do the math my friends: the average American makes 29 000 before tax and pays about 2200 tax a year after returns, that leaves 26 800 the average American pays almost 1500 a month on mortgage payments so 26 800 minus 18000 leaves 8800 dollars a year discount food average $4000 a year, fuel is 1600 a year services and costs (electricity ($1200), Internet , city bills, clothes, education costs, house maintenance etc.) and there is nothing left, you say that half the population does not pay enough tax, I pose to you that half the population has NO MONEY left over and thus can't pay more tax, can't argue with the facts my friends.

OK, do the math, but start with reasonable figures.

Median family income in 2006 was $50,263. Can you then start over, showing how that $50,000 can't pay the bills?http://en.wikipedia.org/wiki/Median_household_income

according to this its 31 000 in 2007 but offcourse that has dropped significantly with the crisis so yeah same numbers also remember the value of the American has dropped significantly since then and cost of living has gone up so yeah I stand by the same figures.

I would also remind you that even if it is more be aware that it means HALF of Americas population will be worse off than this...

According to Congressional Budget Office estimates, [6] the lowest earning 20% of Americans (24.1 million households earning an average of $15,900 in 2005) paid an "effective" federal tax rate of 3.9%, when taking into account income tax, social insurance tax, and excise tax.

I just like adding facts. Even the bottom 20% after everything they get back still pay 4% tax.

OH I just realised you are doing family income and I am doing per person income so double the mortgage and the electricity some of the other stuff is calculated to a family but the difference is not significant especially considering the sharp detereoration of the economic system since the time when these figures were taken.

Even more worrying remember that people generally want to save a little bit when they are working full time (or in your familial median when often both people are working full time).

I have never insulted anybodies writing talents, I just think its funny that you seem very impressed by yours. I'm not signed up to earn income from this site, I have no interest in being cyber-published or have all the odd accolades that come from it. You seem to be very angry and that usually stems from insecurity about ones own talent. As far as my choice of topics I only wrote what I know about, if it doesn't help you in anyway that's ok, it may help someone.

It may come as a surprise to you but I'm not impressed with the wealth of some obscure writer, I'm not concerned in the least about what it would take to impress you. I'm very happy being a nobody in this world filled with nobodies. It doesn't seem like you can stand being just another face on a computer screen, good luck on your quest to be somebody.

I know what I'm good at. Why does my confidence bother you?

Obviously.

Oh? Did they teach psychology in nail gun school? Actually, I'm not insecure at all. I think it's hilarious that you accuse me of being both insecure and overconfident in the same paragraph. Grasping at straws much?

Which would explain why you only have two hubs.

Actually, I think you are. You seem to put a lot of emphasis on how much YOU make. I think you want to prove your superiority and it bothers the hell out of you to know that nothing about you impresses me. To me you're just another redneck with a tool belt. It's not a skill set I particularly value... unless my toilet breaks.

Actually, you aren't a nobody. And I am (with no hint of sarcasm) truly sorry you feel that way about yourself.

I write because it is what I am good at, because it puts money in the bank, and because I can do it while being at home with my kids. If I had a desire to be famous, I WOULD be writing fiction. I would likely be very good at it.

If I wanted to earn six digits a year, I likely could do that as well. I have the education to do it easily.

However I am quite happy to stay at home and be a mommy. If I get them all to 18 healthy, happy and ready to face the world then that's all the "somebody" that I need to be.

On a personal note: In the last two days you have accused me of having an unhappy home life and of being insecure and angry. Here's my bit of armchair psychiatry... You are projecting. You assume that if YOU feel something that everyone else does as well. Sorry, I am ridiculously happy and perfectly secure in my life.

Don't mistake my sarcasm and bluntness for anything but disagreement with everything that you have shown on these forums to believe in. It doesn't say anything about me except I think you are wrong.

Finally, since you seem to equate getting the last word in with somehow proving you are right... and since that seems to be terribly fundamentally important to you... go ahead and take it. If winning an argument on an internet forum is all you got, it would be cruel to take it away from you.Not gonna waste my time, you need a new hobby.

Don't forget the offline stuff... (WV Prices- the lowest around)

If you develop a working relationship with a funeral home, obits can run between 150 to 300 dollars for a couple hours of work (including a couple phone interviews plus writing time)

Advertising copy can pay between .75 and 1.50 a word (product descriptions and info fliers) Website copy is about the same thing.

Newsletters for churches and charity groups up to 200 weekly.

And the odd government brochure for a tourist attraction (1500-2500 for a week of work)

There are a million other quickie jobs that take maybe an hour or two that can net 75-100 easy.

****

I might add too that anyone with children pays out so much in daycare that it's almost not worth working.

Who can live off $11,000. You don't care about the children?

Only a bigot would fight this.

I don't know how it's done, but I personally know a family earning around $25,000 per year, paying 0 income tax all year, and getting "back" $9,000 from federal.

Then they must be getting paid under the table. Nobody who gets a paycheck pays 0 income taxes all year. Even if you make little enough to get everything back at tax time, it still gets withheld.

That's blatantly untrue. I had $7 withheld in a year I made $18,000, and that was only from one paycheck with a lot of overtime. It all has to do with your withholding that you claim at work. You can claim exempt and no money will be taken out.

Here's a fun tidbit of information. Mother/Father with 3 kids that makes 25,000.

5 people, $3,700 per exemption = $18,500 off of your taxable income. Married filing jointly standard deduction is $11,600, so that's $30,100 off of your taxable income. So, you can make, with three kids, at least $30k and not owe any federal income taxes.

But, back to the family. $25,000 income with three kids gets you $5,065 in earned income credit. EIC this year maxes out at $5700, but then you can get additional refunds as well, like additional child tax credit. It's possible for a family to make more money from their tax return than from their annual salary."You can claim exempt and no money will be taken out."

That's true. Very few people do this, however.You are saying a family can get $25,000 in tax refund?

well, that almost matches up to what all these R's want to give back to Sheldon Adelson....not quite, but almost.

ps: I don't believe that.I'm saying(and I clearly proved) that a family can get 'free money' from their tax return.

The largest I have ever personally seen was a return of approximately $15,000, and only about $1,000 of that was refunding actual tax withheld. I imagine 25k would be possible, but you would need a lot of dependents.

Melissa is correct - if you make 11,000 a year, then you are contributing 11,000 worth of labor to society.

You may not be contributing to the government, but you are contributing to society as a whole.I like you, I have no idea what that means, but ok.

You mow lawns for a living, making 11,000 per year. You are not freeloading as you provide a service society wants. Uncle Sam may (and does) provide you with more income (including WIC, food stamps, etc.) than you earned, but you did contribute something to society.

I'm not going to debate the need for social assistance, some need it, too many take advantage of it. If you can't agree with that then you are no more better that that other person.

Oh I agree with you here 100%. You said it perfectly - some need it, too many take advantage of it and it has become a way of life for far too many. The third generation welfare mama spitting out babies on a regular schedule comes to mind.

She doesn't exist. She's a chimaera conjured by the right to demonize anyone who accepts public assistance and to justify the destruction of same.

It doesn't have to be mowing lawns either... A full time minimum wage earner only earns between 13195 and 15080 dollars a year. If that is all that can be found by a worker, I fail to see how that can be considered freeloading.

No, of course it doesn't have to be mowing lawns (there are several successful companies in my area that do nothing but that in the summer).

Any work that produced income means that a person isn't freeloading. Although a welfare recipient receiving full support while working "under the table" for illegal and unreported income might be...Touched a nerve with me there.

Hubbys is worth more than minimum wage ,purely based on experience etc,but thats all he can find!

Freeloading,dont know,and dont care. Like he says ,it feels like work to his aching back every night!

As far as receiving mega tax back, well heres the crazy thing, to me (who is not used to the tax system here in the states) I see it as money you should have been making all along, its just a bit late getting to us-

Damn skippy it's work. A job is a job. I'm not sure where the line is that you have to cross to not be considered a drain on society.

I've ran across the whole "having kids just to collect more EIC" argument too. Yep, an extra 2k in tax breaks a year is SO worth labor, delivery, and round-the-clock parenting. Would you adopt a kid for an extra 160 or so bucks a month?

If you are having kids for that reason you are doing it wrong.

I have seen returns of families that made around 15k that got more in refunds than they made all year.

Not trying to be stereotypical, but most of those families lived in trailers and had new Mustangs.***

No one making $11,000 a year gets back $8,000 unless they have a lot of children. If so, they deserve it.

Freeloader: politicians and the beneficiaries of bailouts/spending.

Suckers: everyone else.I notice that certain people only have eyes for certain other people's money. But they are blind to the corporate and republican freeloaders who do even less to earn their keep.

But the most despicable right wing act so far: Chicken Hawk right wingers attempting to call veteran's benefits "welfare".Wow! I'm amazed to read this and see so little mention of large corporations that get major tax breaks, commit massive fraud and use that money to lobby the government - and now to buy elections. Not to mention the huge industrial-military complex that awards billions to individual companies for weapons that are often shelved before they're ever used.

I also see no mention at all of the massive medicare fraud that's happening in so-called well respected medical clinics and hospitals.

Yes, there is abuse and fraud at the bottom. However, I think it would pale considerably if we looked in more detail at the top wage earners. They are freeloading as only the very rich can. Do we not look at that, purely because too many of us secretly aspire to being rich ourselves one day?

I also consider it freeloading for CEO's to make millions each year while the workers in the same company are losing their benefits and are being made to work twice as hard for the same salary as they take on the workloads of their coworkers who have been laid off. You know, those 'freeloading' people who are now on unemployment?

As someone who's reaching retirement age, I am particularly offended that I will be considered a freeloader when I accept the social security payments that I have paid into all of my working life.

Wake up and stop looking down your noses. I think if you looked up, you'd find the real freeloaders.Yes! Best line of the day!: "Wake up and stop looking down your noses. I think if you looked up, you'd find the real freeloaders."

So true. And they must be laughing that people scape-goat the poor.

we pay so much tax, we are almost homeless, it is a struggle to find the rent...... not meaning to be bitter, but we work very hard to keep a lot of people in the life they are used to........

Youre not wrong Joy, what most here won't tell you is that the real freeloaders are the CEO's and owners of big companies who make 30 or 40 times the money off your work that they pay you, and who even when fired recieve extraordinary sums of money beyond what the vast majority of people will ever make and they freeload eneough to cover plenty of people on welfare.

I am definitely a taxpayer. Paid my share when I was working-it seems that I am paying even more taxes since I have retired. Looking for more ways to earn monies!

Income Tax was not part of the Constitution.

Like Social Security it was the brilliant scheme of the Democrat Presidents.

Income Tax invades privacy to collect a tax.

Income Tax is discriminatory as it is progressive, and progressive is not equality.

Income Tax has too many loopholes for the very rich so even though the tiered tax bracket would have them pay more than the not so rich, they use the loopholes to pay their CPAs and Atty to minimize their taxes.

Income Tax should be eliminated and Replaced with a National Sales Tax and it would use the same existing mechanism as State Sales Tax.

It would eliminate or severely reduce the problems of the Income Tax System.

The Internal Revenue Code could be shelved, and when people buy something they pay their fair share with a minimal of exposing their privacy.

A ten percent NST would bring in $10 for a $100 purchase, and $10,000 for a $100,000 purchase. Simple math shows that $10,000 is more than $100.No tax system will work if the government spends more than they collect.

It can't happen, for if it did Congress would not be able to promote their pet projects and friends via tax deductions. Any and all social engineering by Congress would have to be up front cash payments instead of subsidies via the tax code.

This in turn makes it quite transparent and anyone can see where the money actually goes. Not acceptable."Income Tax was not part of the Constitution."

Amendment 16: The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

Try reading the document before making assertions about what it says.

That so many people pay so little tax is an indication that so many people are working poor, working for very low wages. Many full time jobs offer so little that a person can be working full time and still be living in poverty. Why are people angry at the working poor?

Why are the working poor angry at the rich?

Probably because the working poor have an inkling of what the very rich are getting away with. All of those categories and deductions on the complicated tax returns we have to wade through these days were not put there for the working poor. They were added to accommodate the very rich, and to make sure they don't have to pay the taxes that the rest of us do.

I am hearing more anger directed at the working poor. They are called freeloaders, even if they work hard at low paying jobs.

@melissa.

Its typical passive-aggressiveness caused by a deep dissatisfaction in my life. I have latent abrasive negativity tendencies caused by a failure to form meaningful relationships with males and thus have never formed appropriate coping mechanisms to deal effectively with men who try to assert themselves in positions of authority. As such, I use sarcasm to avoid meaningful discourse on topics that I find emotionally threatening.

Or... I could just be bored and feel like f***ing with someone for amusement.

Yeah, yeah. LMAO. Unlike some who get paid 50cents per post per forum! But in their other life they are wealthy and employ people! Jeez, Melissa, we're in the wrong job honey. I mean, we scratch around looking for a fight, for less than a dollar, we have to pretend to be someone we're not......I hear ya both there!!

P.S How can you tell whose a troll or not ?( I know, I dont get out much) lolThey write two hubs, scratch around for an argument with those who have differing political views, never find consensus and support those with radical, unsubstantiated views. Oh yes, and when they are challenged reply with emocions. They are often not the most articulate of posters.

- Onusonusposted 13 years ago

0

The money has to be distributed equally to everyone so that everything is fair. Then everybody will be happy. Socialism doesn't work.

“The democracy will cease to exist when you take away from those who are willing to work and give to those who would not.” JeffersonThe money has to be distributed equally to everyone so that everything is fair. Then everybody will be happy. Socialism doesn't work.

Tell that to the trolls, earning 50c per post. They're about to rebel. Viva la revolucion.There is a difference between fairly and equally.

Fuel tax credit

In February 2006 Time Magazine described a synthetic-fuel tax-credit amendment that Santorum added to a larger bill as "a multibillion-dollar scam" that benefited "a small group of the politically well connected".

What do you think....free-loaders? Yeah, me too.Either way it's stealing from one group to give to another.

http://www.youtube.com/watch?v=9jK2_trRPRkWhich is different to stealing from one group to give to another, how?

And if that's too obscure for you, the capitalists who free-load off the workers are OK in your book?Freeload off the workers? Did the workers create the job? Did the workers create the company that was hired to do the work? Did the workers supply the money to market the company that was hired to do the work? No, they were hired to do the work and agreed to be paid what they were.

So that gives the wealthy the right to free-load off the poor! Hm.

I tell you what, if as you say the workers play no part then let somebody set up a company with no workers and let's see how far they get!The workers do their part just as I described, they work!! They work because the employer by whatever means supplied the capital to create a job for them. They did nothing other than what they were paid to do, and for the sum that they agreed to work for.

I'm amused by the number of people who think a fait accompli is an agreement.

I am amused that someone doesn't understand that agreeing to work for a sum is an agreement.

Capitalism has proven time and again to create an environment that supports the most individual freedom, whereas socialism has proven time and again that it does the exact opposite.

Really!

Freedom for the few, slavery for the many.The many also have the freedom to start a company and maybe become the few.

Really, so I could go to the bank with the ass hanging out of my trousers and get a million dollar loan to set up a business!

Sounds good to me.I started a company with money I earned, no bank, no assistance from anyone. Sorry that you don't have the work ethic it takes.

No but do you have a multi million dollar business?

Absolutely not, what difference does that make? We are talking about starting a business and ANYONE who has the drive can do so. How big that business becomes is completely up to them and the market.

It does stand in the way, but we thrive in spite of them. Unlike you we choose not to be dependent upon government.

But I thought that you were a capitalist! And we all know how dependent on government they are.

I think you will find that politicians give money to those that will return it back to them, who is dependent upon whom?

I don't find that at all. How many CEOs with big tax breaks return money to the government?

I said them! Them being the corrupt politicians, follow along a little better.

Riiiiiight. Every single road you drive on or piece of mail you send out or computer you use or telephone or television or tv to advertise on is given to you thanks to the achievement of gvt...of which you depend on more than I, since I am not a business-owner.

And once again--we see a Republican unable to respond without a personal smear and lie.Yeah? Where did government get the money Sunshine? I drive on toll roads built by private corporations in 1/3 the time it has taken government to repair 40 miles of highway. You once again are wrong.

And the banks, and who they know. You think you're free - slave.

Sorry, I'm a woman, i wasn't paid enough to be able to save money due to unfair wages

But, but, but, you're free and agreed to work for the wages offered.

Why didn't you just tell your boss how much you wanted?Because she was paid what she agreed to work for, whose fault is that?

Some choice, work for what we'll pay you or don't work!

Amazingly enough they were not the only employer, she only has herself to blame.

You obviously know far more about the circumstances than I do, all I know is that in the UK women are still paid less than men for doing the same work,and I bet it is exactly the same in the US.

Women are paid less because they leave the workforce earlier and more often than men.

Really, there are no jobs for life any more. Men are just as likely to leave employment as women.

Men will stay in the workforce longer than women on average, no I will not search for statistics for you.

Don't bother,we both know it's a lame excuse.

Are you really trying to tell me that if two people, one man one woman, start a job at the same time you think the woman should be paid less because she might not stay as long!I didn't say that. If I have a woman and a man who have the same experience they will both be paid the same. If one proves to be better than the other then that person will be paid more.

Well bully for you,shame the rest don't share your feelings.

Most companies do share my feelings, the unfortunate fact is men are usually more productive for longer periods of time.

But even when they aren't they still earn more than women.

Same applies. Men do not leave the workforce earlier or more often, so they will be paid more. If they do not produce they will not be employed.

Sigh. But even if they do leave the workforce early or often,they still earn more.

Yes, because the opposite is still true, what don't you understand about that?

That women will not stay working as long as men.

But with the same experience and the same start date, who is to know who will stay longer? The company might go bust in six months!

History will know, and for the last time history has shown women will leave the workforce earlier and more often than men.

It might be smart business, if smart business is getting cheap labour, but it's still a lame excuse.

Not all of the labor will be cheap, just the labor that has a history of leaving employment earlier and more often. You really don't get this do you?

To be quite honest, I don't get it at all.

You have to pay a man more because he might not leave the job as soon as a woman, even though that woman is the main bread winner and the guy is just a house husband seeking pin money.

Is that it, have I got it now?I understand you don't get it and you never will. We do not live in your perfect world because no such world exists, I would suggest you quit worrying about things that will never change no matter how much you stick your fingers in your ears and scream La La La La because you don't want to hear it.

I rather think you are the one already sticking your fingers in you ears and screaming La la La La.

The age of women as second class citizens should be passed by now.They are not second class citizens, some women will earn more than ten men, but that is a case by case basis. If women want the same money as men then history will have to be changed, that means they will need to work up to the day they have a baby (some actually do)they will have to miss work less due to kids being sick. A host of things will have to change.

Listen to women who've made it talk. Talk about glass ceilings and how they have to do everything, not as well as a man, but ten times better than a man to get the same credit.

Oh well, it seems those that came before them screwed them.

All that is needed is state or business sponsored day care.

Like they have in those socialist countries.

Women who work outside the home should be considered the norm now, not the exception.

And schools could come up to date as well...we just got throught with the week of "winter break"....after X-mas and thanksgiving....and next is Easter.....please: give a parent a break!If having children is a burden, one should have thought of that before getting pregnant.

No--society should not MAKE it a burden!

Did you ever see that movie 9 to 5?

That idea of a day-care center in the building...that's the ticket.

Or state day cares....no one likes leaving their kids all day, but you have to!

200 a week and up for daycare is hard to handle.

And--what's with you? Aren't you going to give me kudos for not aborting?

Or is your point the usual judgemental one: You shouldn't have had sex.

I did some research for you:

From this article http://news.stanford.edu/pr/98/981104wagegap.html

"The more educated women were no more likely than men to leave jobs for nonemployment, and they were slightly more likely than men to stay in a job than to change to a new job, she said. Their job-to-job turnover was about 1 to 2 percentage points less than for men.

The study is not sufficient to prove that the wage gap for educated women is mostly attributable to employer gender discrimination, she said, although that is a clearer possibility. "There is definitely evidence against higher turnover being the root cause of the wage gap for more highly educated workers, at least at these younger ages," she said."

Women are paid less because of predjudice, nothing more.

I tell my boss--who is male, that I used to manage a retail store, so am entitled to higher-pay due to experience. He says

"Oh, that's just an over-rated cashier."

Kid comes from Nepal, says he helped his father at home, so he knows how to fix things.

Makes 2 dollars an hour more than I do.

I have 3 kids to support. He's free as a bird.

Predjudice.Is this for the same job? If so, your experience being equal should pay the same, but if he has experience in maintenance as well then it ain't equal. Deal with it.

Thats too bad, blame all those women before you.

John - you get that million dollars, set up the company, and give yourself a huge bonus! Put your bonus money in an off shore account, then trash the business!

What, about a million dollar bonus by any chance

I'm really speechless at the ignorance that both of you have just exhibited.

Really?

There was a group of guys who bought a British Motor manufacturer for £10 and then proceeded to break it up and sell it off for millions.

Yes,I suppose we are ignorant, we only joke about doing such things, we don't go out and do them for real.

I wasn't actually.

Haven't the capitalists done a good job on you?They have done a great job for me actually. But unfortunately the government keeps taking money from me and lining their pockets with it. Just for social security they take about $190.00 per check and put it into an anemic fund that won't be around when it comes time for me to collect. if I were to take that money and put it into savings or invest it into a retirement fund I would be a millionaire by the time I retire. But instead the politicians get to be millionaires, and I and the people who I could have been charitable to get the shaft.

Not forgetting all the money that they give to your capitalist buddies when they've screwed things up(again).

Not seeing how they could possibly do worse than the federal government is doing right now. They are doing a good job following in the foot steps of Greece. Socialism at it's finest. Take from the money earners and give to the unproductive. What could possibly go wrong? LOL!

"Half of all quotes on the internet are made up."

--Mark Twain

If a person is born rich, and never had to worry about where the money to pay his bills comes from, the Republicans admire him, but if a person works their entire life 60 hours a week, and is laid off from their job, Mr. Republican calls him a freeloader if he collects unemployment.

We are middle class and have always paid taxes. However, we now can't afford anything extra because we are taxed so high. Taxes are the biggest chunk out of our paycheck. It is hard to work and work and pay all the money in and you see other people getting their children's college and everything paid for while you worry to death about how on earth you're going to afford to send your child to school. The money just is not there to do it.

I do think the tax system is not fair the way it is currently set up. I am for a flat sales tax, because then everyone would have to pay based on what they spend and people who get paid cash under the table would also be taxed.The problem with that is that it hits the lower paid harder than the higher paid.

If you are barely scraping by a 10% sales tax is a considerable chunk of your income.

"Kid comes from Nepal, syas he helped his father at home, so he knows how to fix things." It is very clear he has no experience in retail but fix-it only.

It is? I asked if it was for the same job, maintenance will always pay more than a cashier.

It's not a cashier, it's a manager.

I had experience as a manager. You know: running a store. And my boss said "Oh that's just a glorified cashier"...which it isn't.

And this kid got the maintenance job at a higher pay because he helped his dad around ther house?

No--it's cause he's a guy.

And had he had kids, I'm sure he would have been offered more.

It's a mind-set that has to change. Same mind set that thinks it owns my body.Maintenance is more important than an over glorified cashier, sorry about your luck. You should seek employment elsewhere, what will be your excuse for not doing so?

Unless of course that over glorified cashier just happens to be a man . . .

Man, some people are dense.

Would you call a hardware store manager a glorified cashier?

Only if it was a woman, eh?

The job is m a n a g e r.

You have no clue what this worlds is like outside of your cocoon.

Racism and sexism still exists. Obama is fighting both. Forward, not back: see ya on the bus.I have seen smarter stop signs than hardware store managers, I will not be seeing you on any bus.

OH, repairguy outsmarted by a woman! How will he ever live it down?

So--you think running a store is nothing?

Well, if running it is nothing, owning it must be like a kid in diapers. And these you put on a pedestal!

I'll wave to you on your magical bus back to 1950. I'll be standing in the future.I absolutely think running a store is something! Something a 12 year old could do with the proper training.

Obviously, it's something you've never done.

And it's only when the owners were managers first do they have an inkling of what goes on.I have done it, it ain't that hard at least it wasn't for me. But we are not all created equal, are we?

No we weren't some of us were "created" (if you swing that way) decent people with a sense of ethics, justice and decorum and unfurtunately some were created like you. repair guy: a man who fixes walls for a living but is convinced he is a genius...

Don't bother LMC, he's a man and obviously far superior to you, even if he is stuck in the nineteenth century.

I don't think any of us are in any doubt of the following two things:

1 Repair guy is the proud owner of some hairy family jewels.

2 Repair guy has an inflated opinion of himself.Certainly the second.

As for the first, he's probably living his capitalist dream in a cardboard box hooked up to a telephone line.

Just curious John....anyone who says a manager is a glorified clerk has either not done it, or not done it well!

I certainly don't agree with much of what Repairguy47 has been saying, but I must agree with some of it. There are legitimate reasons why the average woman makes less than the average man, but those reasons are exaggerated and much of the problem still stems from discrimination. The reason I reply here rather than on one of the other posts is that it's true that owners who haven't managed don't know what it takes. You can even go back a step further and say owners and managers who have never done the actual job don't know what it takes either. As a person who has been in all three positions, I'll say that the worker is the real commodity in the equation. I have found as an owner that if you train, pay and treat your workers right; you don't really need managers. Back to the original post; it is the big corporations and politicians that are getting the free ride, not the poor, and certainly not the middle class. The small business owners are the one's who are really getting the short end of the stick however. Even if you show a loss for the quarter you will still pay self-employment tax, and EIC doesn't cover your losses even with seven kids. Even after deductions for an electric car, approved home improvements, charitable donations, and too many itemized deductions to list you will still pay taxes as a self employed individual. Not to mention all the taxes you pay on all the things you must buy to run your business.

The kid doesn't even have experience in maintenance. He helped his father around the house? Sounds pretty bent to me.

If the kid doesn't work well do you think he will keep his job? There is no conspiracy to keep women down other than the one fabricated in the minds of those who think all things should be equal. Woman will leave the workforce earlier and more often than men, that fact alone is why they are paid less on average.

"The age of women as second class citizens should be passed by now."

We're getting a crash course, right now. It's not over by a long shot.Everyone should pay taxes that I agree, but as a tax payer I which I knew where my money was going.

I am a tax payer because I own my business and have employees, therefore I pay a lot of taxes.

If your adjusted gross income is less than $32,000 you are a freeloader. If you are unemployed and getting unemployment, you are being taxed, see first sentence to determine whether you are a freeloader or a taxpayer.

"Freedom in capitalist society always remains about the same as it was in ancient Greek republics: Freedom for slave owners." ~Vladimir Lenin

Warren Buffet says that the rich paying high taxes is a myth. That's not what is stifling growth, they are waiting for a better deal, IMO.

They truly want to have their cake and eat it too, and now they see an opening. Edit: now they HAVE an opening, thanks to the elections of 2010.

We are actually BLAMING the corporate/uber-rich heist of wealth on the poor!

As if poor people are sucking all the money out of the system!

Unions are being decimated, and wages have been stagnant since the 1970's.

We actually PAID companies to leave this country and set up shop overseas.

Rich got a huge bonus under Bush....that is why the income disaprity is so glaring. THAT is what made the "Huge sucking sound" that Texas Tea talked about.

Loss of jobs: theft of wealth: lessening of money into the pool.

It has long been a goal of theirs: starve the beast. But what they are doing is starving humanity.

Let me tell you something...if you want to try and live in this capitalist orgy-land on less than $45,000 a year....go right ahead.

Do you not make the connection?

If income tax is levied according to income, then if you are not paying it, it's because YOU HAVE NO INCOME!

Cost of living is too high...do something about that.

Raise wages...that would help.

But to keep demonizing the poor is a losing game: We are on to that one!

The quarter mil that Bachmann got would help thousands of welfare families!!!!

Ditto for Rick Perry, who got $80,000. AND who just cut all funding for Planned Parenthood in Texas......yet the corporate tax rate is too high?

We in America have totally different value systems operating.You can look, up tax rates yourself. The top 1% pay around 24% effective. The bottom 50% pay under 2% effective. There is no myth about it.

We've driven companies away by having one of the highest corporate tax rates in the world.

Let's say you run a business, and you make $100,000 in sales. You pay all your expenses, and you've got $20,000 left. Good for you! Now you can afford the $15,000 in new equipment/maintenance/etc that you need, and still have money for a rainy day.

Then the government steps in. Federal taxes take an average effective 22%. When you factor in all taxes, it's 34%.

So now, you only have $13,200. Sorry, you can only get some of the equipment you need, and you won't have any money for a rainy day.

The average tax rate of OECD countries is 18%, and you realize you would have kept $3,200 more if you were based in one of those countries. For this company, the higher tax rates are forcing it to operate at a 3.2% higher profit margin than in OECD countries.

What's 3.2%? Big oil operates at around a 6% profit margin. Most new companies operate(if they manage to succeed, that is) on 1-2%. 3.2% is a big burden on a business.

I've lived with a wife and child on $18,000 in recent years. That has changed now, but we did it. Let me tell you something... expectations in this country are ridiculous. People complain they can't live off of $45,000, but they drive new cars, have all the new gadgets, eat out, run up credit(and spend a lot of money on interest, which is nothing but wasting money), and still have better living conditions than most any other country.

$45,000? That's so easy to live off of.

Cutting corporate rates allows companies to spend their money on themselves. Upgrades/expansion/hiring/benefits/bonuses.